The Weekly Bottom Line

Our summary of recent economic events and what to expect in the weeks ahead.

Date Published: June 6, 2025

- Category:

- Canada

Canadian Highlights

- The Bank of Canada held its policy rate at 2.75% for the second consecutive meeting, citing a “softer but not sharply weaker” economy and firmer-than-expected core inflation.

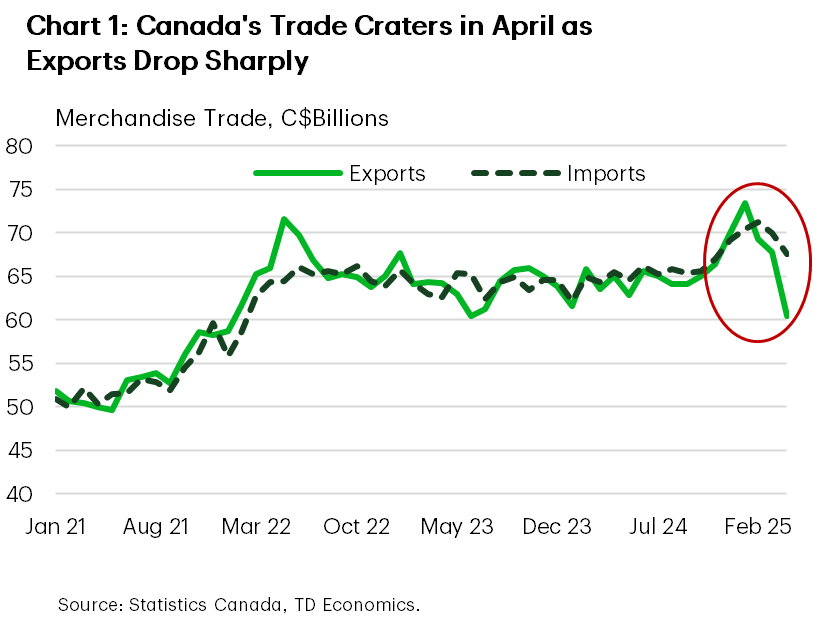

- But signs of real-side weakness are mounting. Merchandise trade cratered in April, with both imports and exports declining.

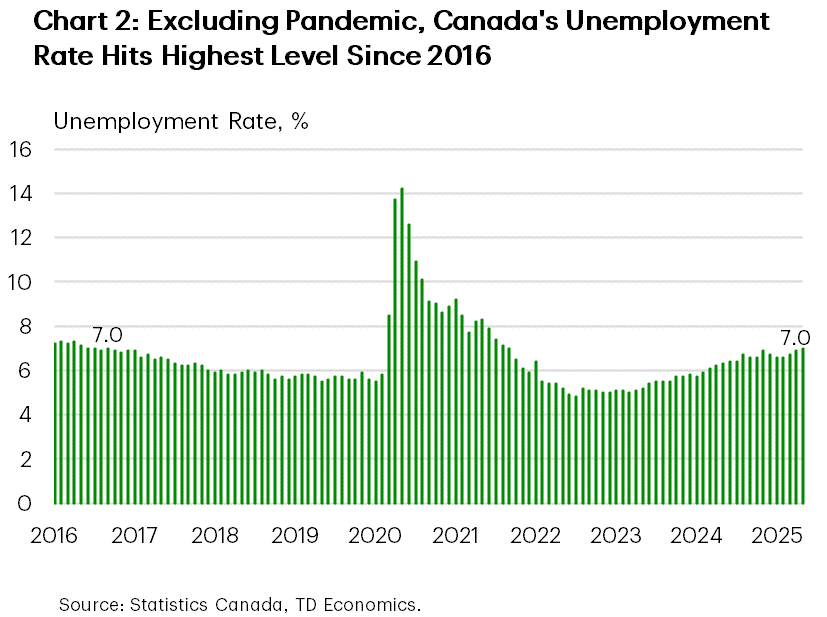

- May employment was essentially flat while the unemployment rate rose to 7.0% – its highest level since 2016, outside of the pandemic.

U.S. Highlights

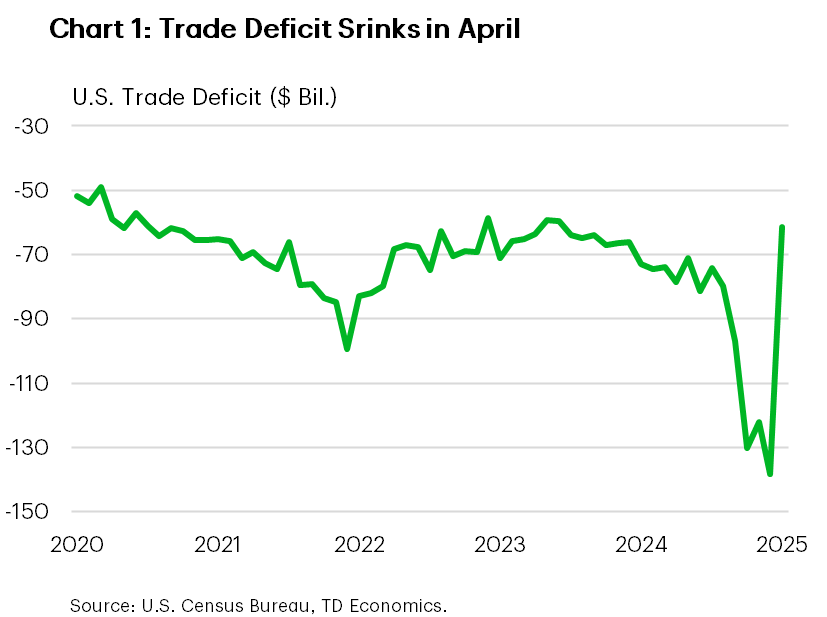

- After swelling in the previous three months, the trade deficit narrowed by 55% as pre-emptive inventory building ahead of tariffs appears to have run its course.

- Front-loading behaviour by consumers is also normalizing, with vehicle sales falling 9.3% month-over-month in May.

- Despite the large swings in other data, the labour market’s performance remained steady-as-she-goes. The economy added 139k new jobs in May, only a touch lower than 144k average over the past 12 months.

This week, the Bank of Canada held its policy rate at 2.75% for the second consecutive meeting, citing a “softer but not sharply weaker” economy and firmer-than-expected core inflation. The Canadian dollar climbed past 73 cents U.S., but lost steam following Friday’s jobs report. Longer term yields were little changed at first, with markets interpreting the hold as marginally hawkish, but had edged higher at the time of writing.

April’s trade data provided very clear evidence of how the U.S. tariffs are affecting Canadian trade. Merchandise trade cratered, with both imports and exports down – but exports more sharply, which will create a notable drag from net trade in the second quarter (Chart 1). Unsurprisingly, the biggest hit came from auto exports, which are now cooling after several months of gains as companies front-loaded shipments. Motor vehicle and parts imports also fell, signalling weaker domestic demand. Beyond autos, trade in consumer goods and industrial machinery & equipment also slumped, shrinking Canada’s merchandise trade surplus with the United States to its lowest level since end-2020. Trade with non-U.S. partners rose, but not enough to offset the losses. Given the trade’s heavy weight in GDP, we expect net exports to push Canada’s economy into contraction in the second quarter.

If the trade report set the melancholy tone, the jobs report drove it home. May employment was essentially flat, with a gain just under 9k. Since U.S. tariffs were first imposed in March, employment is down 16k – a stark reversal from more than a 100k gain in the preceding three months, when optimism due to lower interest rates grew. Manufacturing employment has been particularly hit, marking a fourth consecutive monthly decline, with cumulative losses now amounting to 55k. The unemployment rate rose to 7.0% – the highest since 2016, excluding the pandemic (Chart 2). Since February, the rate has climbed 0.4 percentage points and we expect it to continue rising into the second half of the year, weighing further on real activity.

Arguably, the case for easing existed even before Wednesday’s decision, especially when factoring in collapsing sentiment indicators, which in Canada tend to lead real activity. So why didn’t the Bank cut? The wrinkle is inflation. While headline CPI eased in April thanks to lower oil prices and elimination of the carbon tax, the Bank’s preferred core measures ticked above 3.0%. With tariff-driven price pressures looming, policymakers appear unwilling to risk reigniting inflation or de-anchoring expectations. Indeed, one-year-ahead inflation expectations jumped a full percentage point, while longer-term measures edged up modestly.

This week’s trade and employment data provided more evidence of the very real weakness unfolding in the economy. We expect the Bank will eventually be convinced that further interest rate cuts are needed, with two more cuts likely this year.

Maria Solovieva, CFA, Economist | 416-380-1195

The impact of tariffs continues to distort the economic data, contributing to significant volatility—a trend that was evident this week. Trade flows are a prime example. The trade deficit swelled to an all-time high over the past three months as companies rushed to stockpile goods ahead of anticipated tariffs. However, this pre-emptive inventory build-up now appears to have run its course. April’s trade data showed the deficit narrowed by 55%, as imports of consumer goods and industrial supplies declined to pre-tariff levels (Chart 1).

Consumer spending patterns also appear to be normalizing. Overall spending growth moderated in April, with a slight decline in spending on goods. New vehicles—a major category—are showing signs of stabilization following the pre-emptive shopping sprees seen in March and April. This week’s data suggests that this front-loading behavior has ended, with vehicle sales falling 9.3% month-over-month in May.

Looking ahead, car prices are likely to rise as automakers and dealers pass on at least part of the higher costs to consumers, which will weigh on sales. As noted in our recent report, if tariffs remain in place for the full year, we expect auto sales to decline by 4.0% on a Q4-over-Q4 basis. Financing costs also remain elevated. According to data from Edmunds, the average financing rate on new cars in May was 7.3%—0.7 percentage points higher than in December. A reprieve seems unlikely in the near term, as persistent trade and fiscal policy uncertainty, coupled with a still-resilient labor market, are expected to keep the Federal Reserve on hold. Interest rate futures currently price in just 20 basis points of policy easing by September and only two quarter-point cuts by year-end.

Indeed, today’s payroll report showed that the labor market remained resilient in May. The U.S. economy added 139,000 jobs, slightly above the consensus forecast of 125,000. Smoothing through the monthly volatility, job growth averaged 135,000 over the past three months—just slightly below the 144,000 average over the past year. The unemployment rate remained low, holding steady at 4.2%, while wages continued to rise.

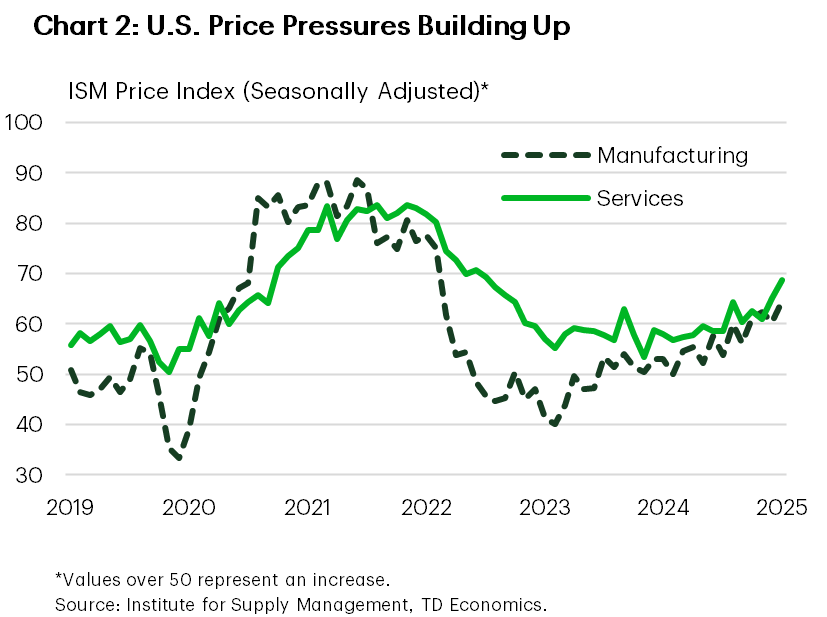

Overall, the large swings in data since the start of the year have made it challenging to assess the underlying health of the U.S. economy. Hard data indicators such as employment and inflation remain resilient. In contrast, soft indicators—including the Beige Book and ISM indexes—suggest the economy is beginning to feel the effects of trade uncertainty. Both the manufacturing and services ISM indexes are now in contractionary territory, while the price subcomponents of both have been trending higher, indicating rising inflationary pressures (Chart 2). This week’s Beige Book also noted that economic activity has declined slightly since the previous report, and that contacts expect prices and costs to rise at a faster pace going forward. Layoffs were mentioned 15 times, up from 10 in March and 6 in January. We continue to expect policy uncertainty to exact a toll on the real economy, but rate cuts are looking further away.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: