Peeling Back the Layers to the Florida Condo Market Weakness

Admir Kolaj, Economist | 416-944-6318

Date Published: May 29, 2025

- Category:

- US

- Real Estate

- State & Local Analysis

Highlights

- Following an exceptionally strong run in the post-pandemic period, the tables have turned for Florida’s condo market, with sales and prices trailing down for some time now.

- While several common headwinds are blowing against the sector – chief among them elevated interest rates and reduced domestic migration inflows – part of the weakness has to do with the implementation of stricter rules regarding the inspection and repair of condo buildings. This has accentuated the pain for older condos.

- A growing inventory glut points to additional weakness ahead. Condos play an outsize role in Florida, and the sector’s weakness will take some moderate wind out of the state economy’s sails.

- The fog over the Florida’s condo market will take time to dissipate. We expect the tough backdrop that developed in late 2024 to last about two years. Assuming that several pieces fall into place – i.e., mortgage rates trend lower and the state economy continues to outperform the U.S. average, albeit by a more moderate margin than in the recent past – we see scope for Florida’s condo market to begin finding firmer footing by late 2026.

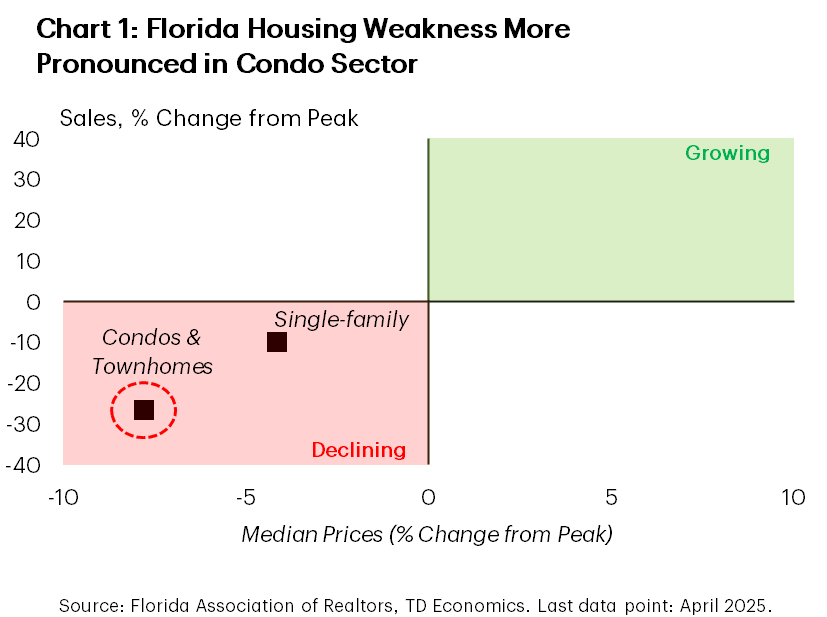

Florida’s housing market had a strong run in the years following the pandemic and its condominium sector was no exception. But this positive narrative has seen a dramatic shift over the last few quarters. While the overall housing market has softened, in tune with national trends, Florida’s condo sector remains on much weaker footing with both sales and prices down considerably from their recent peaks (Chart 1). Part of the weakness is tied to recent policy changes, with stricter regulation as related to building repair and maintenance accentuating the pain for older condos. A buildup in condo inventories suggests that the weakness has further to run. Nonetheless, we note several factors that could set the stage for a gradual recovery in the sector by late 2026, marking an end to the pronounced roughly 2-year downcycle.

Florida Condo Weakness Likely to Deepen First

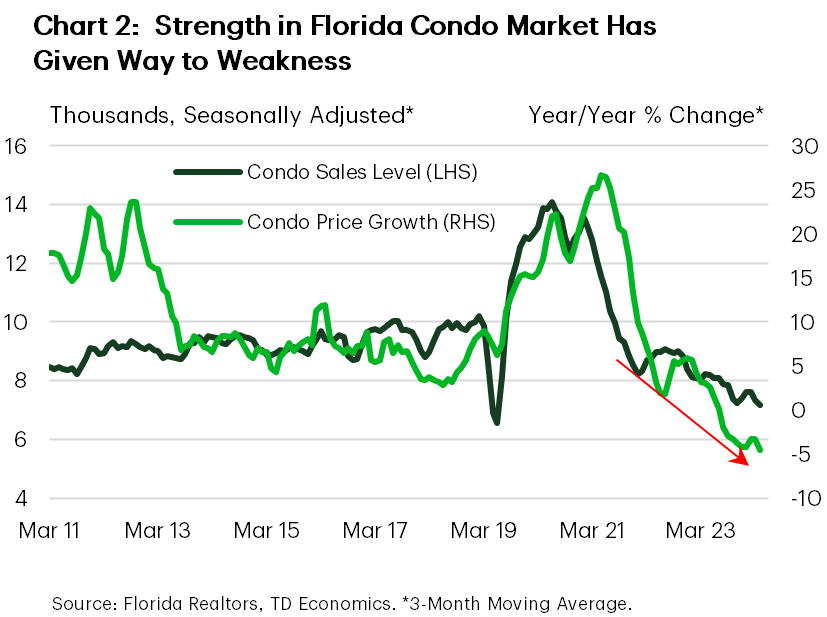

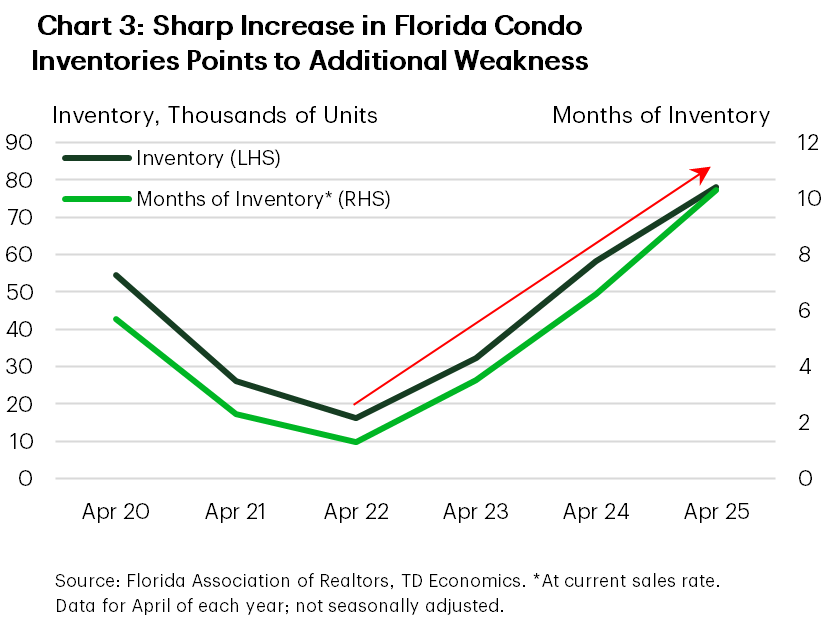

In the years preceding the pandemic, condo and townhome sales in Florida averaged close to 10,000 a month, while price growth for the sector hovered near 6% year-on-year (y/y). Following a strong surge in sales and prices in the post-pandemic period, both metrics have weakened considerably over the last several quarters. Condo sales in the state are now down by more than a quarter from their 2018-19 level (or -13% y/y over the last three months), while median prices also continue to trail lower, having fallen about 8% from their peak (-4.5% y/y) (Chart 1 and 2). In fact, when it comes to prices, the segment is faring much worse when compared to both the Florida single-family segment (-2% y/y) and the overall U.S. condo segment (+2% y/y). In the meantime, inventories are building up. There are now close to 80,000 condos and townhomes for sale across the state – a number that’s up by about 20,000 or 35% from a year ago (Chart 3). Benchmarked against sales, inventories now make up over 10 months’ worth of supply, marking a sharp increase from the level of recent years and much higher than 5.6 months for the single-family market – indicating that the state’s condo sector is deep in buyer’s territory.

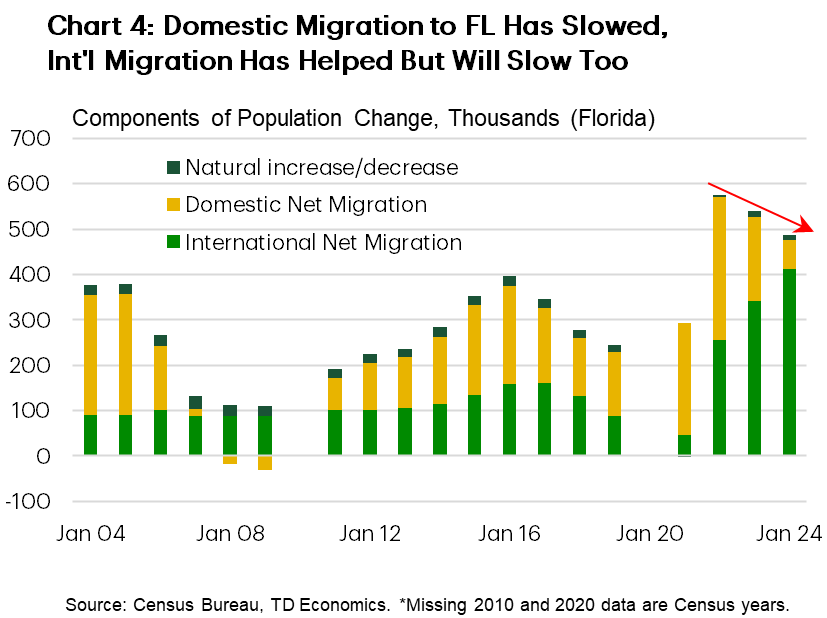

There are several common factors weighing on Florida’s housing market, including the single-family sector. These include elevated interest rates and elevated trade uncertainty (which is contributing to buyer hesitancy), and a sharp slowdown in domestic migration inflows. To this end, consider that mortgage rates are still hovering near 7%, while domestic migration inflows to the state fell to the lowest level since the Great Financial Crisis (GFC) last year (Chart 4). Fast-rising home insurance premiums are also a headwind. The state’s home insurance crisis continues to fester, and Florida remains the most expensive state for homeowners’ insurance, with overall premiums estimated at more than triple the national rate, while condo-specific premiums are at least double the national average.

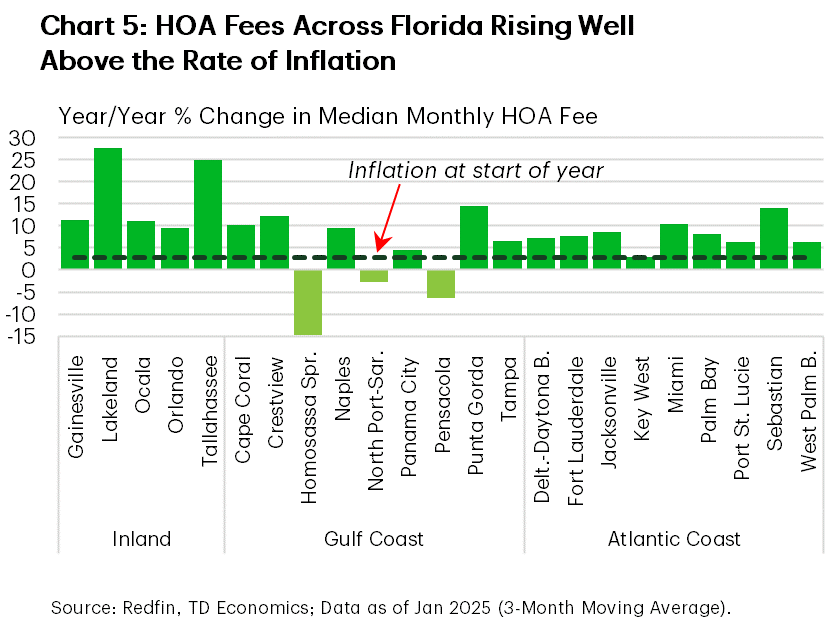

The condo sector has the added burden of fast-rising homeowner association (HOA) fees. While HOA fees have been rising at a fast rate in the post-pandemic period, reflecting in part general inflationary pressures from labor and material costs, more recently there is the risk of additional substantial costs to condo owners. This pertains to new stricter regulation with respect to condo inspections and repairs. Legislative changes implemented not long ago require buildings in the state older than 30 years – that are 3 stories or higher – to undergo milestone inspections, and for condo associations to fund the necessary repairs. Following the introduction of the law, the inspections were to have been completed by the end of 2024, but estimates from earlier this year showed only a partial uptake. As inspections tend to uncover underlying issues, this has contributed to a sharp increase in HOA fees, resulted in steep ‘special assessments’ in some cases, or a combination of the two. In fact, at the start of this year, HOA fees were rising far above the rate of inflation in all but a few large metro areas across Florida (Chart 5). There’s likely more pressure to go on this front, as more inspections are completed and uncover underlying issues. Given all the headwinds that the condo sector faces, it is no wonder that many owners are choosing to list their units for sale, growing the glut in an already-flooded market. The process of inspection and repair can also indirectly affect insurance premiums. Speaking of insurance, inadequate coverage is one of the more common reasons why some condo associations are placed on Fannie Mae’s confidential ‘blacklist’, which deters many lenders from issuing mortgages on these properties and ultimately severely restricts the pool of buyers – further perpetuating a negative feedback loop.

Textbox 1: The Offloading of U.S. Properties by Foreign Owners Could Be Contributing to Uptick in Inventories

Many of the aforementioned factors are weighing on foreign owners of U.S. homes too. While foreign U.S. homebuyers tend to favor cash purchases – some 50% paid in cash last year vs. 28% for all existing-home buyers – and may be more insulated from an interest rate perspective, there’s no escaping the increase in HOA fees. Florida is the top destination for foreign buyers of U.S. homes, accounting for 20% of all foreign home purchases in the U.S. last year. The top buyers for Florida homes are those from Latin America (35% last year) and Canada (27%).1 Media reports suggest that a significant share of Canadian snowbirds (those that tend to spend winters in the Sunshine State) are looking to offload their Florida properties – a factor that could be contributing to the increase in for-sale condo inventories at the margin. A weak Canadian dollar (down about 15% from its two-decade average), coupled with elevated trade tensions, and more cumbersome travel requirements, are likely added factors contributing to this sentiment.

Condos Play an Outsized Role in Florida’s Housing Market

Condos and townhomes are quite a bit more popular in the Sunshine State than nationwide. Florida is home to about 1.5 million condo units, which make up a fifth of all the nation’s condos. Additionally, condos in the state make up around 15% of the total housing stock – more than double the national equivalent share. The strong tilt toward condos is also visible in sales. In recent years, this segment has accounted for more than a quarter of all homes sales in Florida – much higher compared to roughly 10% country-wide.

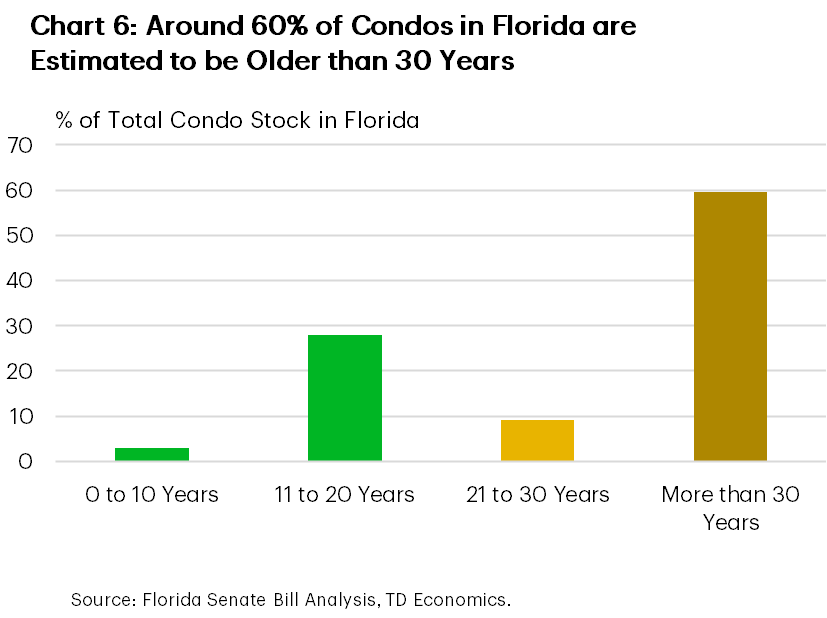

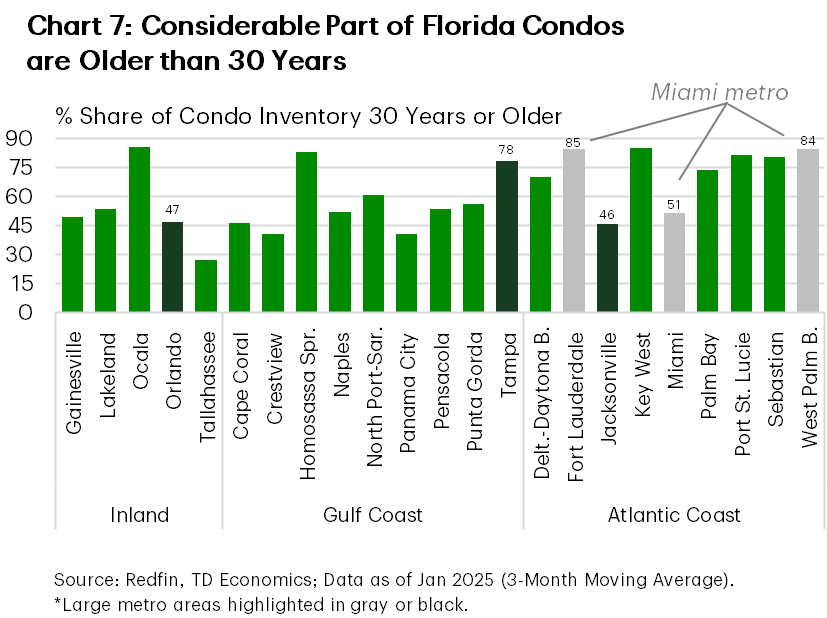

Florida’s condo stock tends to be older. Recent estimates suggests that more than half of all condo units in the state – some 900 thousand units out of 1.5 million, scattered across 16,000 condo associations – are older than 30 years.2 This means close to two-thirds of all condo units in the state could be affected by the stricter regulation on inspections and repairs (Chart 6). The share may be slightly higher because the age threshold for condos affected by recent regulation also includes buildings that are 25 years and older located within 3 miles of the shore. Additionally, while the share of older condos varies by location, most of the large metro areas in Florida have a substantial share of older condos, with some, such as Fort Lauderdale and West Palm Beach, as high as 85% (chart 7).

Negative Impact for Sunshine State Economy, But There Are Mitigating Factors Too

The older buildings affected by the new regulation and their unit owners will feel the financial sting to varying degrees. This will depend on the repairs needed for each building and the financial status of the condo association (i.e., their reserve fund balance). Older buildings that have been diligently maintained over the years may very well see little-to-no impact besides the added cost of the inspection service. But, these may be few and far between. Recent reporting has highlighted several examples where inspections have uncovered major repairs, leading to special assessment fees of several thousand dollars. While conditions will vary from building to building, it is reasonable to assume that a considerable share of these older structures will require some repairs, with the bill to be passed down to the respective owners. Some of these owners may have to dip into their savings to fund the repairs or may need to forego other expenses. The impact will be harder for those on fixed incomes. Overall, this will weigh on consumer spending, and take some moderate wind out of the sails of economic growth for Florida.

Properties more at risk are those that have been blacklisted by mortgage backers, with these either requiring major repairs, having inadequate reserve funds, inadequate insurance coverage, or a combination of these factors. According to recent reporting, Fannie Mae’s Florida blacklist has grown to over 1,400 condo associations, with about half of these located in the Miami metro area. This indicates that condo owners in roughly 6% of condo associations statewide will likely have to bear substantial financial costs, and will struggle to sell their units owing to an extremely restricted buyer pool.3

Mitigating some of the impact for the Florida economy is the fact that some parts of the state already had similar milestone inspections in place for years. This included the counties of Miami-Dade and Broward, albeit the local regulation was less stringent with building recertification mandated at the 40-year mark (instead of 25-to-30 years) and every 10 years thereafter. Additionally, there will be some offsets on economic activity too. For instance, the urgency around repairing aging structures will lend a hand to construction and related sectors. At the same time, given an already flooded for-sale condo market, some of the condo inventory is likely to end up on the rental market, which may yield some benefits for renters.

Scope For Conditions to Improve Over the Medium Term

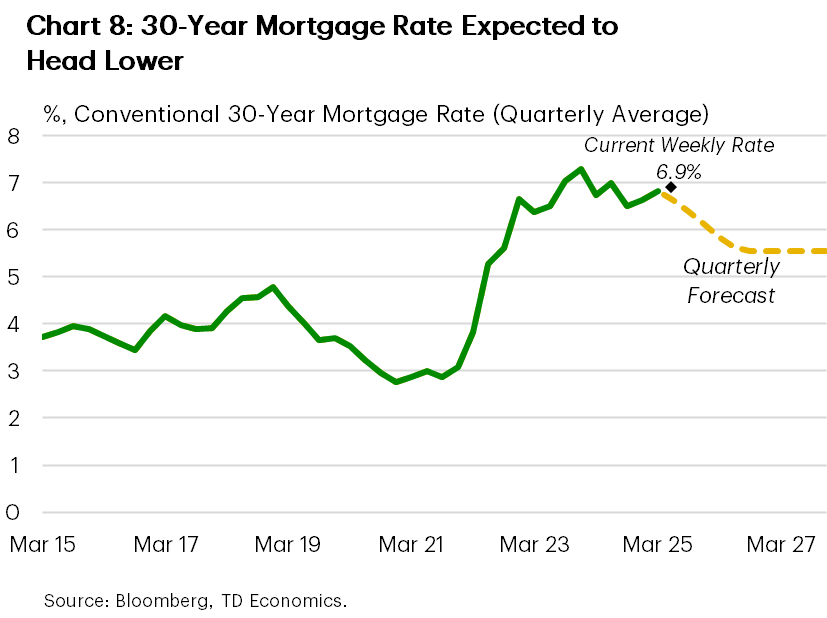

While conditions in Florida’s condo market are likely to remain weak over the next several quarters, we believe that an improvement in a few underlying factors could help the sector to begin regaining traction by late 2026. For starters, many of the common factors weighing on the broader housing market should ease over time. This includes expectations for lower interest rates ahead. Assuming more clarity is provided around U.S. tariff policies – including a rollback in tariff rates as trade deals are reached – the Federal Reserve is expected to resume trimming the fed funds rate in the second half of 2025. In tune with this narrative, by the end of next year, we anticipate mortgage rates will fall within the 5.5-6.0% range – roughly 90-140 basis points lower compared to the current weekly rate of 6.9% (Chart 8). This improving interest rate tide will help lift all housing boats, with benefits to extend to Florida’s condo sector.

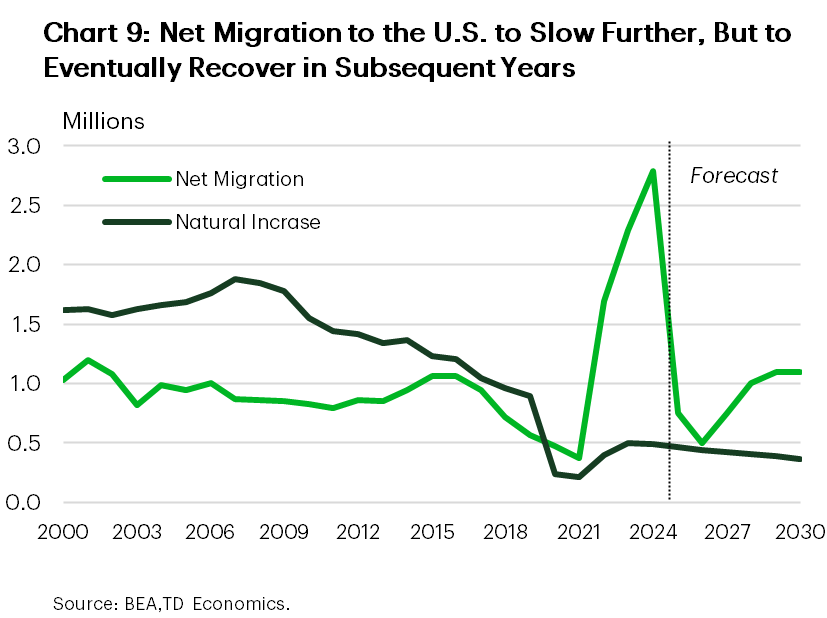

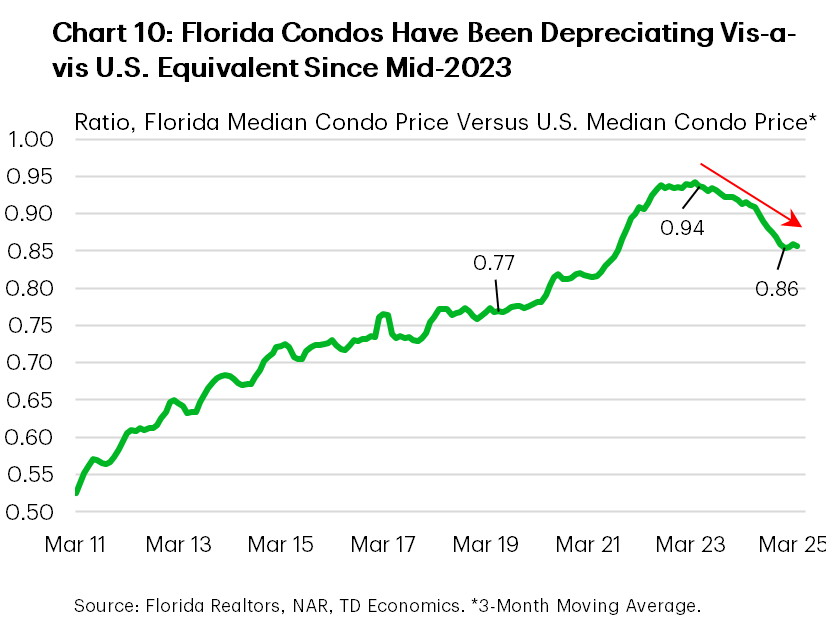

Additionally, while nationwide international migration inflows are poised to ease over the next several quarters, the trend is expected to eventually firm up again in about two years (Chart 9). This is based on the assumption that the American employment engine will continue to require additional fuel, and immigration will help satiate a part of that demand. With the current administration tightening regulation and enforcement as related to undocumented immigration, it is fair to assume that documented (i.e., employment-based) immigration could play a larger role in the future. These trends will be mirrored in the Sunshine State, an important landing pad for immigrants coming to America. Domestic migration inflows remain harder to read. But, given the expectation for the dynamic Florida economy to continue outperforming the nation over the next several years, it is expected that the inflow of domestic migrants will begin to dial up once again too. Indeed, while job growth in the Sunshine State has slowed over the past year, it retains a moderate edge over the nation, and its unemployment rate (3.7%) remains comfortably below the national average (4.2%) – trends that we don’t anticipate will reverse course over the medium term. An underperformance in home prices vis-à-vis their U.S. equivalent, could also lend a modest hand to migration inflows down the road (Chart 10).

Last but certainly not least, a recent softening of the law that accentuated the pain for older condos could help ease some of the pressures for the segment. Governor Ron DeSantis has stated his intention to sign HB 913 into law. This will result in several important changes, including the extension of the deadline for structural integrity studies by one year. Additionally, condo associations will be allowed to use lines of credits or loans to cover reserve obligations and may take a two-year pause in reserve funding immediately following milestone inspections. All these measures should help make repair costs more manageable over the near-term. Still, the amendments are no panacea. For instance, while condo associations can now dip into debt to meet reserve obligations, the added costs will ultimately still have to be passed down to the unit holders. Additionally, the amendments give the law a bit more teeth too, as condo associations that do not meet the deadline for the structural integrity studies could now lose state-backed Citizens Property Insurance – something that would drive them into the more expensive private insurance market.

Bottom Line

Peeling back the many layers to the Florida condo market weakness reveals a nuanced story. More stringent building inspection and repair requirements have certainly accentuated the pain for older condos, which can be found in abundance in the Sunshine State. That said, headwinds posed by other factors, such as reduced domestic migration inflows and the more common elevated mortgage rates, cannot be overlooked. Tacked on to this list are also signs of reduced interest from international buyers and owners.

Over the near-term, the growth arrow for Florida’s condo sector is still pointing down, with a growing glut of for-sale condo inventories reinforcing this point. Still, a pending softening to the regulation that perpetuated the pain for older condos should help ease some of the negative pressures for the segment in the near-term. Building on this, we see scope for the condo market to begin regaining some footing by the end of 2026 – a narrative that will require cooperation from interest rates and migration inflows, with the former expected to head lower and latter to stage an eventual recovery down the road. Florida’s expected moderate economic growth outperformance in the years ahead vis-à-vis the nation, is also expected to lend a hand in this regard.

End Notes

- NAR report, page 17. https://www.nar.realtor/sites/default/files/documents/2024-international-transactions-in-us-residential-real-estatereport-07-17-2024.pdf

- UF, https://news.ufl.edu/2024/10/condo-conversation

- Blacklisted condo associations estimated at 1,440 (link). Registered condo associations in the state estimated at around 25,000.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: