North American Auto Outlook 2025

Trade Headwinds to Stall Industry

Andrew Foran, Economist | 416-350-8927

Date Published: May 28, 2025

- Category:

- U.S.

- Trade

- Commodities & Industry

Highlights

- The U.S. has implemented 25% tariffs on automotive imports, with partial exemptions granted to Canada, Mexico, and now the U.K.

- If the tariffs are left in place for the full year, we would expect to see sales fall by 4.0% in the U.S. and 7.5% in Canada on a fourth-quarter-over-fourth-quarter basis in 2025.

- Given the uncertainty surrounding current U.S. trade policies and the financial costs associated with domestic reshoring, tariffs are likely to only result in a gradual reallocation of production towards the U.S. over the coming years.

At the start of 2025, the automotive industry was looking forward to another year of healthy sales growth, aided by affordability improvements from lower financing costs and continued solid gains in real household income. However, less than halfway through the year we have seen several aggressive trade policies announced by the new U.S. administration which are expected to weigh on the outlook over the coming years.

The rationale for the U.S. tariffs on automobiles appears to be that they are a tool to reshore manufacturing capacity to the U.S. The North American automotive industry, as one of the most interconnected in the world, will be significantly impacted by these tariffs should they remain in effect indefinitely. Higher vehicle costs and slower economic growth from the U.S. administration’s reciprocal tariff policy are expected to result in a decline in sales of 4.0% in the U.S. and 7.5% in Canada on a fourth-quarter-over-fourth-quarter basis this year, with limited upside next year as expected price increases will far exceed growth in real income, putting further strain on buyer affordability.

Assuming the administration leaves its current tariff policies in place, we will likely see a protracted decoupling of the North American automotive industry. This will result in higher costs for consumers in the near-term from the direct effects of the tariffs and the long-term as manufacturers seek to recoup the costs of multi-billion-dollar investments in new manufacturing capacity. Optimal production schedules will vary by manufacturer, but tariffs will likely have a significant distortionary effect on North American production in 2025 and beyond.

Tariffs in Play as of May 2025

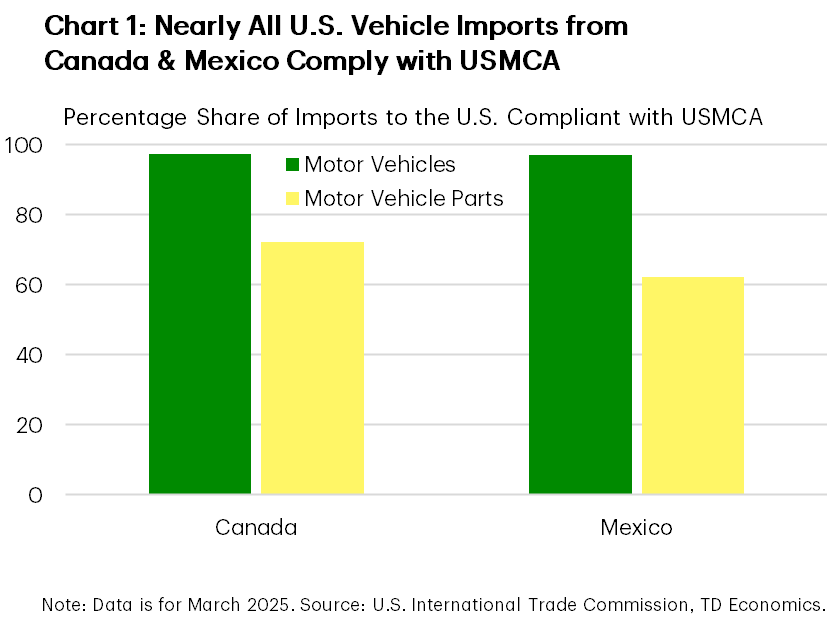

Over the course of the past few months, we have seen several trade policies implemented by the U.S., which have been met by retaliatory measures from Canada. Initially on April 3rd, the U.S. imposed tariffs of 25% on all imported automobiles. For vehicles imported from Canada and Mexico that are compliant with the United States-Mexico-Canada Agreement (USMCA), the levy would only apply to the content value of the vehicle that is produced outside of the U.S. As of March 2025, over 97% of vehicles imported from Canada and Mexico were complaint with the USMCA (Chart 1).

The U.S. also imposed a 25% tariff on automobile parts imports on May 3rd with exemptions for USMCA-compliant parts. For the first year, the U.S. is providing an offset to domestic vehicle manufacturers for the automobile parts tariffs equal to 3.75% of the mean suggested retail price of U.S. vehicles. After one year, the offset falls to 2.5% before being eliminated entirely after two years. This is likely to provide a material offset to the auto parts tariffs in 2025, but only if USMCA parts remain exempt indefinitely.

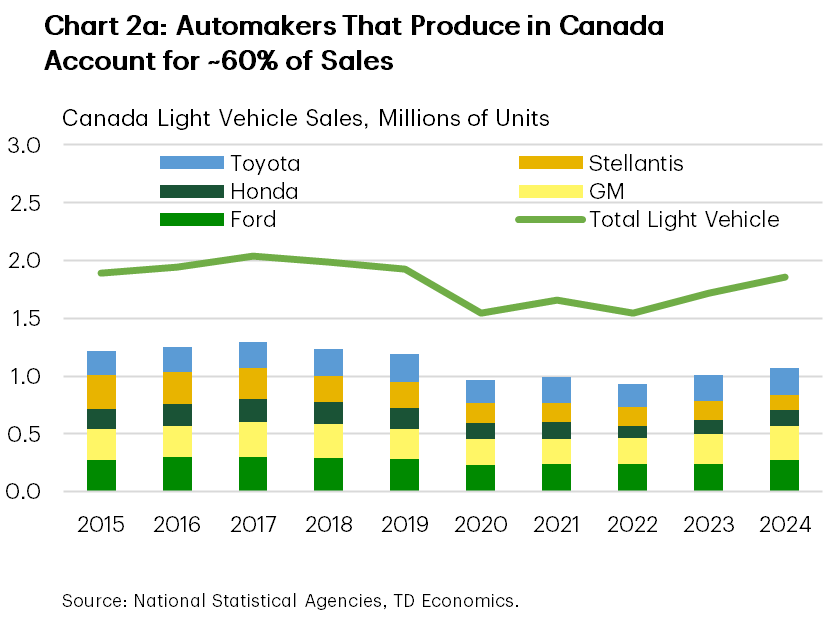

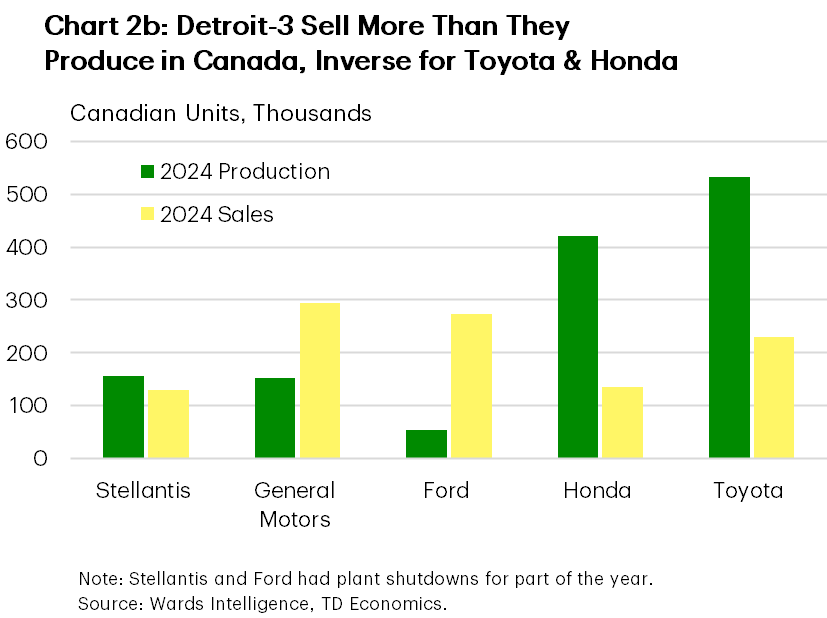

In response to the April 3rd tariffs on automobiles, Canada implemented retaliatory tariffs of 25% on vehicles imported from the U.S., with the tariff only applying to the content value sourced outside of Canada and Mexico. The government’s default assumption for the Canadian and Mexican share is 15%, meaning imported vehicles would face a roughly 21% effective tariff rate (25% x 85% = 21%). However, the Canadian government has also announced that it will be offering a tariff offset for manufacturers that produce in Canada, which includes General Motors, Ford, Stellantis, Honda, and Toyota. The offset will be quota-based and subject to the condition that manufacturers continue to produce in Canada and/or maintain their existing investments. While we have not received full details on how the offset framework will be applied, the automakers that produce in Canada accounted for just under 60% of all vehicle sales in 2024 (Chart 2a), meaning that the provided offset will likely be material for the overall market. In addition, if the quota is directly tied to domestic production, then Toyota and Honda would likely be in a better position relative to the Detroit-3 (Chart 2b).

Interestingly, the U.S. and Canada are targeting a similar share of their vehicle market with tariffs. Roughly half of vehicles sold in the U.S. are imported, while roughly half of the vehicles sold in Canada are imported from the U.S. The tariff offsets provided by both countries will help to partially mitigate the impact on the market, but headwinds are expected to remain pervasive for the foreseeable future.

The Future of North American Auto Production

It would be unwise to speak with a high degree of confidence regarding the geographic distribution of North American auto production over the next few years. The new administration has enacted a series of trade policies over the past few months, with several subsequently altered or withdrawn shortly after being announced. We therefore are confronted with a myriad of possible scenarios related to the duration, magnitude, and composition of the tariffs. This applies both to the direct effects of the auto tariffs as well as the indirect effects of the other tariff policies affecting auto supply chains and the broader economy.

Let’s start with the scenario in which the current tariffs in effect are left in place through the coming four years. Will this result in the U.S. becoming self-sufficient in automotive production and eliminating all imports of autos? This outcome seems highly unlikely given the elevated financial costs associated with shifting production abroad to the U.S., with most of this theoretical reallocation requiring new production facilities – dozens of them if replacing all imports is the goal. Additional hurdles would be faced in attempting to establish holistically domestic supply chains, with those hurdles becoming mountains if USMCA-compliant auto parts are eventually targeted. Even if we lay these considerations to the side for a moment, automakers will still face challenges producing the same model variety that they currently sell domestically. Vehicle production is high volume, low variety, with only a few models being produced at any given facility. Most of the vehicle models sold in the U.S. are not currently produced domestically, meaning that consumers would likely see less variety if all production came from within the U.S. All while vehicles prices would be rising by thousands of dollars, in the near-term due to the tariffs and in the long-term as the costs of reshoring are passed on through higher output prices.

The seismic nature of the full reshoring scenario is why it is more likely we instead see a moderate shift in production towards the U.S. The U.S. currently has roughly 1.6 million annual units’ worth of unused production capacity. This is where automakers can likely expand the most efficiently in the near-term. Building new production facilities is a far costlier endeavor, with operational timelines likely to coincide closely with the 2028 elections, whose outcome could negate the very trade policies that the automakers would be going to such great lengths to avoid. This is a key constraint holding back significant investment activity in the current economic environment, even for those who are convinced that the current administration will not alter course over the next four years. Still, businesses can’t sit on their hands for four years, so companies are likely to gradually increase investments in the U.S. over the coming year if the current tariffs are left in place.

Canadian and Mexican production is likely to decline moving forward as the vast majority of vehicles produced in each country are exported to the U.S. Some of this production will likely shift to the U.S., as we have already seen in some cases, while some of it could also be maintained if shifted towards domestic or other foreign markets. The design of the Canadian retaliatory tariffs on imported vehicles from the U.S. also incentivize automakers that produce domestically in Canada to maintain their current production/investment levels. However, if automakers seek to offset the cost effects of the tariffs while minimizing disruptions to existing supply chains, lower relative labor compensation rates in Mexico would likely put Canada at a disadvantage. An example of this was General Motors’ recent decision to cut a shift at its Oshawa, Ontario plant while boosting production at its Fort Wayne, Indiana plant and leaving its production levels at its Silao, Guanajuato plant unchanged. These three plants produce nearly all of the light-duty Chevrolet Silverados sold in North America.

At this point in time, drawing broad conclusions from the anecdotes available in recent months would be speculative at best. Over the coming years production trends are likely to see moderately higher U.S. output, but feasibility constraints, in addition to elevated uncertainty regarding the duration and composition of the tariffs, will hinder a broader structural reallocation within North America. For 2025, production levels are expected to fall as tariff uncertainty weighs on the U.S. economy, and the broader North American economy as well. This will work to slow sales volumes, necessitating a commensurate adjustment to production.

Table 1. Automobile Tariffs in Effect As of May 2025

| U.S. | Canada | |

| Automobiles | 25% tariff, USMCA-compliant vehicles only charged for non-U.S. content value. | 25% tariff, USMCA-complaint vehicles only charged for non-Canadian/non-Mexican content value. Firms that produce domestically elgible for quota offset. |

| Automobile Parts | 25% tariff on non-USMCA parts. Offset equal to 3.75% of MSRP of average U.S. vehicle provided until May 2026 when percentage falls to 2.5% until it is eliminated in May 2027. | N/A |

Vehicle Sales Expected to Bear Brunt of Tariff Impact

After spending the past five years contending with the pandemic, high inflation, and high interest rates, vehicle sales in 2025 were on track for the first normal year since 2019. However, we have now entered a new paradigm when it comes to U.S. trade policy, which is likely to have significant influence on the North American automotive industry in 2025 and beyond.

Multiple factors, primarily stemming from the trade policies, will all play interconnected roles when it comes to vehicle sales in 2025. The first is the direct effect of automotive tariffs, which will likely increase the average vehicle price in the U.S. by thousands of dollars. The second is the indirect effects of the full complement of trade policies implemented by the U.S. administration, which are likely to weigh on the economy as a whole this year. Our current expectation is for real U.S. GDP growth to fall to 1.5% this year, roughly half the pace seen in 2024.

For 2025, we expect U.S. vehicles sales to decline by 4.0% on a fourth-quarter-over-fourth-quarter basis under the assumption that auto tariffs remain in effect through the year while reciprocal tariff policies gradually settle at a global average of 10%, with a higher 30% tariff on China. This estimate should be considered a baseline, with current risks skewed towards the upside after negotiations led to a partial exemption for U.K. auto exports to the U.S. and a temporary suspension of additional tariffs on China. If we see continued progress on this front, particularly in relation to auto tariff exemptions, then we would expect to see moderately higher vehicle sales this year. In the near-term, vehicle sales are expected to follow an abnormal up-down trend between the first half of the year and the second, as tariffs led to frontloading consumer behavior through April which is likely to be followed by some level of reversion as tariffs begin to filter through more materially to prices.

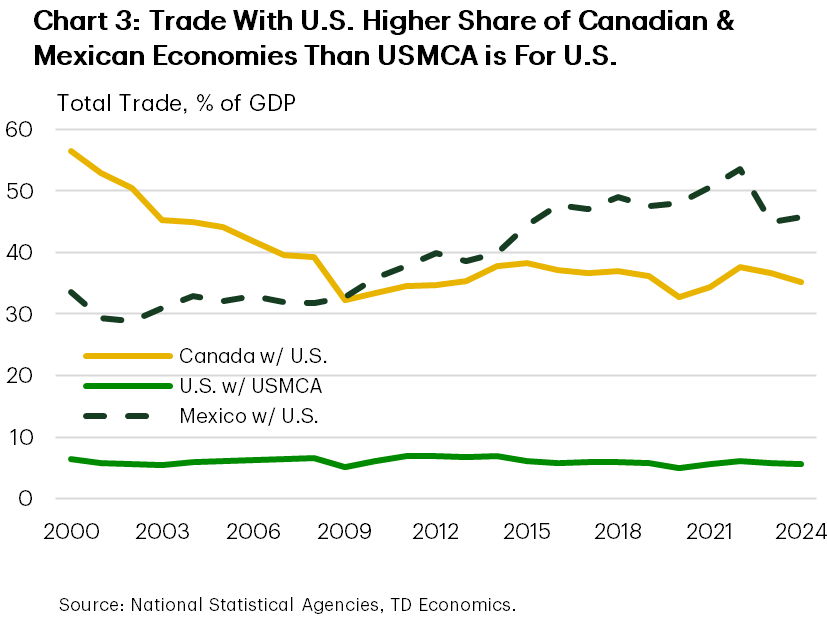

North of the border, Canadian vehicle sales are expected to fall by 7.5% on a fourth-quarter-over-fourth-quarter basis in 2025. However, this precludes the Canadian government’s remission framework, which will likely provide material upside support to the sales forecast once finalized. The structure of Canada’s retaliatory tariffs is expected to have less of an impact on domestic sales relative to the more broad-based U.S. tariffs. Canada’s economic performance is expected to be impacted to a greater degree owing to the fact that its economy is far more reliant on trade with the U.S. than vice versa (Chart 3). With economic growth expected to fall below 1% this year, this will likely act as an additional headwind to the sales outlook.

An important caveat to keep in mind is that the first deal struck under the U.S. reciprocal trade policy with the U.K. included a quota exemption for automotive vehicles, granting a partial reprieve from the auto tariffs. While there are no guarantees other nations will obtain the same terms, the USMCA already includes a non-binding quota exemption from auto tariffs that the U.S. is presently ignoring. This means Canada and Mexico could receive a similar arrangement, with more aggressive terms for non-compliant vehicles. However, as seen over the past few months, the trajectory of U.S. trade policy remains highly uncertain, with the automotive industry and many others subject to the associated economic consequences.

Bottom Line

Economic uncertainty has returned to levels not seen since the pandemic on the back of volatile U.S. trade policy. The administration’s full complement of auto related tariffs includes a 25% levy on imported vehicles & parts to the U.S., with partial exemptions granted to Canada, Mexico, and the U.K. Absent clear guidance from the administration, uncertainty is likely to remain elevated through 2025 as negotiated trade deals continue to alter the composition of U.S. tariffs. However, if the automotive tariffs are left in place for a prolonged period of time, we would expect to see a contraction in sales in the U.S. and Canada by year-end, with a gradual re-orientation of production towards the U.S. over the coming years.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: