The Weekly Bottom Line

Our summary of recent economic events and what to expect in the weeks ahead.

Date Published: May 17, 2024

- Category:

- Canada

U.S. Highlights

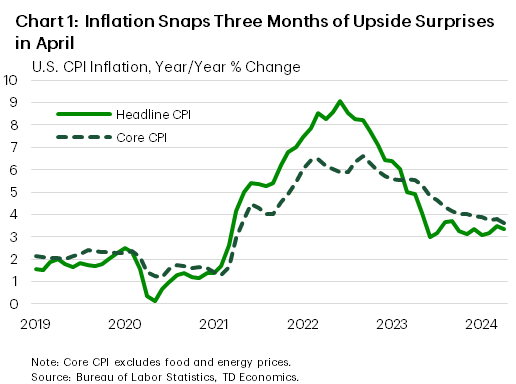

- After three consecutive months of hotter-than-expected inflation, consumer prices in the U.S. finally broke the heat streak in April, with headline and core inflation decelerating.

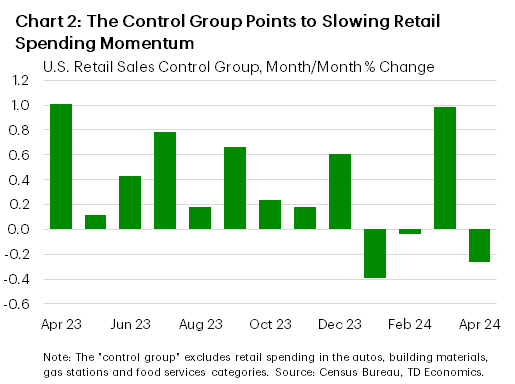

- Retail sales also lost momentum in April, with spending coming in flat for the month.

- With the data showing some slowing in economic activity, markets are hopeful that the Federal Reserve will deliver on rate cuts this year. However, Fed Governors are touting that holding rates higher for longer is still on the table, while they wait for more convincing data.

Canadian Highlights

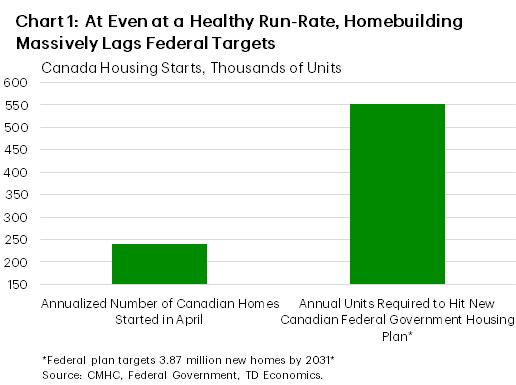

- Housing starts were firm in April, although nowhere near levels required to hit federal targets under their new plan or restore affordability to solid levels, per CMHC’s analysis.

- The weak spring selling season for existing homes continued in April, with sales down month-on-month and benchmark prices flat. However, softness now could set the stage for a rebound later.

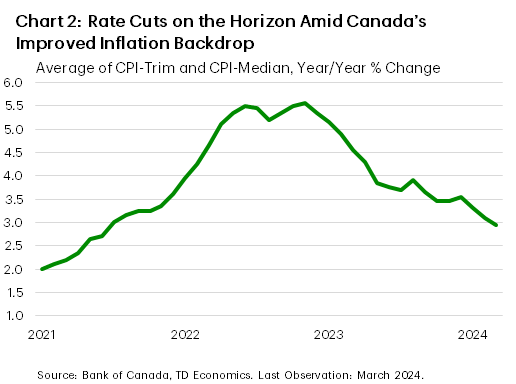

- Next week brings the release of the April inflation report, and expectations are that cooler trends will prevail in the Bank of Canada’s preferred metrics.

A combination of data releases this week pointed to a cooling U.S. economy. Retail sales were weak, and inflation slowed, which revived hopes of a Fed rate cut sooner rather than later. Markets responded to the news with the S&P 500 edging higher (up 1.4% relative to last Friday’s close) and 10-year Treasury yield easing (down 9 basis points), at the time of writing.

The April Consumer Price Index was much anticipated after a string of disappointing readings. Markets hoped the report would snap the string of three consecutive months of hotter-than-expected inflation. Good news – it did (Chart 1). Relative to March, headline inflation in April decelerated on both an annual and monthly basis. The same was true for core inflation. While the reprieve from the string of upside surprises was welcomed, the out turn on its own is not enough to undo the elevated numbers in Q1. Further adding to the price picture, were higher-than-expected readings for producer prices in April, even as March’s figures were revised lower. Given the mixed bag, the central bank is likely to remain on the sidelines awaiting more information before taking any policy action (see here).

This was the position articulated by both Fed Chair Powell and Fed Governor Mester this week. Chair Powell reiterated that the central bank is likely to hold rates at their current level until more compelling data shows that inflation has resumed its downward trek. Governor Mester highlighted that she believes rates are high enough to slow economic activity and bring inflation down. As such, holding rates steady is appropriate.

Data showing that consumers pumped the brakes on retail spending, seemed to support Mester’s position. Retail sales were flat in April, with data for March revised lower. Of note, the “control group” which feeds into the calculation of personal consumption expenditure in GDP, outright declined in April, marking its third decline in four months (Chart 2). The out turn is pointing to slowing consumer momentum, which is a key ingredient to achieving the Fed’s 2% inflation target.

A combination of data releases this week pointed to a cooling U.S. economy. Retail sales were weak, and inflation slowed, which revived hopes of a Fed rate cut sooner rather than later. Markets responded to the news with the S&P 500 edging higher (up 1.4% relative to last Friday’s close) and 10-year Treasury yield easing (down 9 basis points), at the time of writing.

The outlook among small businesses was a bit better in April with the NFIB small business optimism index increasing. Despite the marginal increase, the index remains well below its historical average. Business owners continued to be concerned about inflation and quality of labor issues. Additionally, concerns about sales are rising among small business owners, with fewer of them having raised or planning to raise prices.

Turning to the housing market, signals were mixed. Housing starts rose, while building permits fell in April. The overall tally was boosted by multi-family starts, as single-family starts declined slightly. April’s uptick did not completely undo the decline in March and suggests that builders remain wary as higher home prices and interest rates weigh on buyer demand.

The Fed had much to digest this week as they ponder their next policy move. While the break in inflation’s heat streak is a welcome development, it’s still too early to breathe a sigh of relief. As is stands, markets (and us) expect any rate cut to materialize closer to the end of the year.

Shernette McLeod, Economist | 416-415-0413

Probably the most significant development for Canadian financial markets this week flowed from south of the border. Weaker-than-expected data sent U.S. bond yields lower, with Canadian yields following suit. Indeed, the benchmark Canadian 10-year yield was down around 10 bps on the week (at time of writing). Otherwise, housing was the name of the economic game this week, with April pulse-checks on new home construction and the state of Canada’s resale market.

Housing starts dipped a tad last month, but the underlying trend remained healthy. There are a few things to note here. First, the trend in starts was about 15% above the pre-pandemic run-rate. Second, this trend has been supported by condo units and purpose-built rental housing. Current condo starts reflect gains in pre-sales several years ago when borrowing costs were lower, while purpose-built rental construction is being supported by steep increases in rents and government programs. Meanwhile, construction of other units, like detached housing, remains at low levels.

Third, even though the trend in starts is healthy, it’s clearly on the decline. This is consistent with our view that starts will fall in 2024, as borrowing and construction costs remain high, and demand for new homes has been notably weak in markets like Toronto recently. Fourth, even this robust pace of homebuilding comes nowhere near levels required to hit the federal government’s target under its new housing plan, or to restore affordability to solid levels, per CMHC’s analysis (Chart 1).

As for the resale market, April was a subdued month. Home sales declined month-on-month while benchmark prices were flat. We were expecting a soft spring market to unfold given stretched affordability conditions and our view that buyers and sellers would wait for more clarity on rates from the Bank of Canada. However, home sales are on track to disappoint even our modest expectations in the second quarter. The upshot of this weaker performance is that pent-up demand continues to build, waiting to be unleashed in the second half of this year and 2025, when rates should be moving lower (see report).

This anticipated rise in home sales will push home prices higher, although strained affordability in key markets will limit the gain. Rising home prices would imply upward pressure on consumer inflation via the shelter component, although this will likely be more of a second half story. In the here and now, we eagerly await next week’s CPI report for April. The consensus expects that the average of the Bank’s preferred core inflation measures (CPI-trim and CPI-median) decelerated from March, continuing the improvements we’ve seen since the beginning of the year (Chart 2). Both we and the markets anticipate that July will be the start of the Bank of Canada’s rate cutting campaign. After all, waiting until July will give the Bank an opportunity to see two more inflation and jobs reports, along with a Business Outlook Survey. However, a significant downside surprise in next week’s report could revive expectations for a June move.

Rishi Sondhi, Economist | 416-983-8806

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Print Version

Share this: