Federal Budget 2025 – Competitiveness focused, but few surprises

Date Published: November 4, 2025

- Category:

- Canada

- Government Finance & Policy

The Carney government released its first budget, drawing a line in the sand relative to the previous Liberal government. Gone are the hundreds of income measures sprinkled across different sectors and populations in the Canadian economy. Instead, a new focus on government efficiency and reducing operational costs to fund big spending initiatives on infrastructure, defense and housing, all with the aim of re-orienting Canada’s economy east-to-west, diversifying trade across all three oceans, and supporting business investment to “supercharge” growth and productivity.

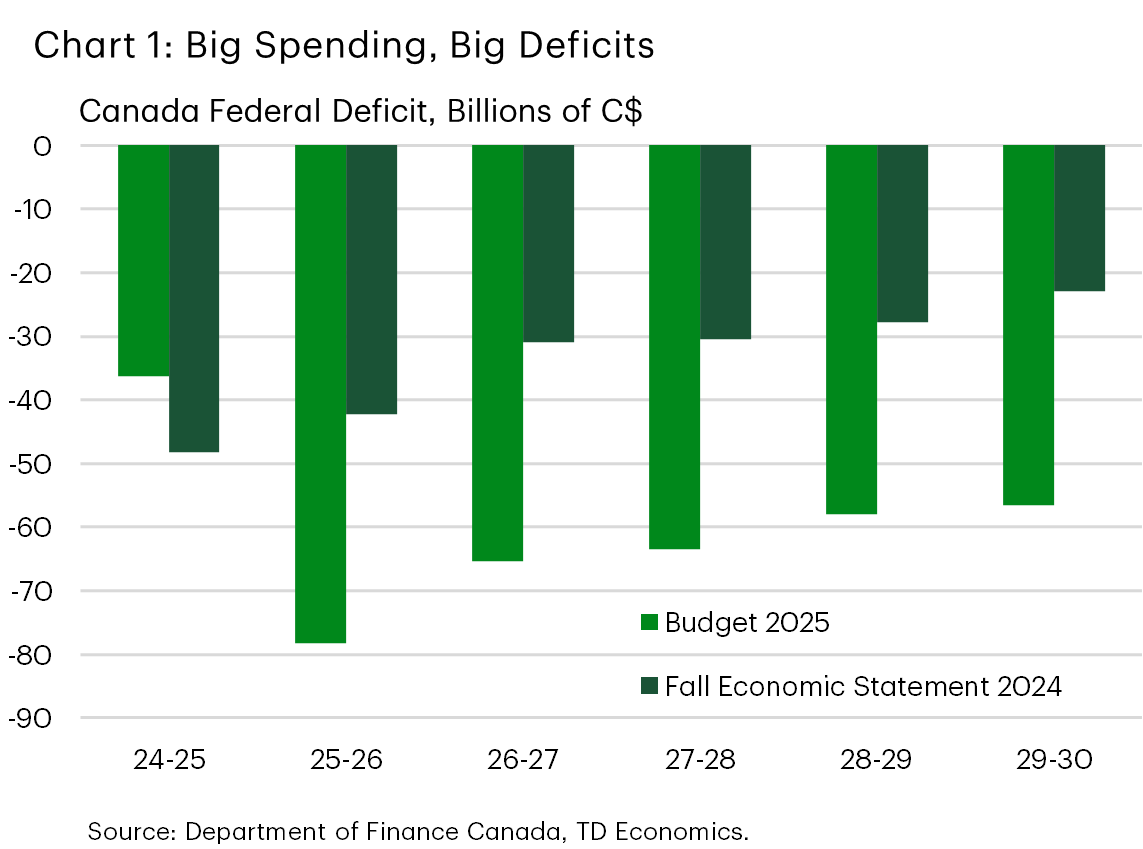

This is hard-nosed budget aimed at incenting private investment and defense with big spending and deficit to back it up. The budget deficit swells to -$78.3 billion this fiscal year from -$42.2 billion in the 2024 Fall Economic Statement. The deficit remains significantly elevated through the 5-year forecast horizon, falling to only -$56.6 billion by 2029-30. The federal government also abandoned its prior fiscal anchor, electing instead to target:

- Introducing a new day-to-day operating spending line item and balancing that with budgetary and capital revenues by 2028-29

- A declining deficit-to-GDP ratio through the forecast horizon

At 2.5% of GDP, the deficit this year will be the highest since 1995-96 outside of recessionary periods, such as 2008-09 and during the COVID-19 pandemic. All said, Budget 2025 adds or has added $140.9 billion in net new spending across four main areas, including defense, infrastructure, the already-implemented tax cut to the lowest income bracket, and the new Build Canada Homes program. As an offset, the government’s comprehensive expenditure review identified nearly $60 billion in cost savings over 5 years. This is comprised of reduced departmental budgets, reflecting a 10% cut in federal public employees and other operational savings. The accumulated deficit rises by 2 percentage points of GDP relative to fiscal 2024-25 to 43.3% but remains stable through the remainder of the forecast horizon.

Big numbers were also thrown around for infrastructure measures, including a new $51 billion Build Communities Strong Fund. While the program is new, the funding is not. The majority was reallocation from other areas. In other words, the net budgetary impact for this program is only $9 billion over 5 years. This re-allocation technique was a general theme across the budget.

Of the $140.9 billion in new spending, $103.1 billion is accounted for by higher defense ($62.9 billion through 2029-30) and the already announced and implemented personal income tax cut ($27.2 billion) and funding for the Build Canada Homes initiative ($13 billion). Those big infrastructure spends and business investment incentives were, in fact, either already previously announced and funded, but unimplemented, or reflect reallocations of other funding the previous government had already passed.

Economic and Fiscal Updates since Fall 2024

The deterioration in the fiscal outlook can be partially chalked up to significant deterioration in the economic backdrop. Real GDP growth in 2025 and 2026 was downgraded by 0.8 and 0.9 percentage points, respectively. Thereafter, growth recovers quicker than we anticipate with government projecting the economy expands by 2.0% in 2027 vs. our 1.7% expectation. Moreover, the near-term underperformance is never recouped, resulting in an economy that is 1.8% smaller by 2029 relative to the 2024 Fall Economic Statement (FES). In dollar terms, nominal GDP is expected to be $52 billion smaller by 2029 than had previously been expected.

This budget comes with a substantial starting-point shock. The FES had forecast a deficit of 1.3% of GDP in FY2025-26. However, the unexpected trade war has dented revenue and forced a shift in economic priorities. The budget puts the cumulative effect of the “trade actions” at $7 billion over the projection horizon relative to FES 2024.

Ultimately, the restated 2025-26 deficit at 2.5% of GDP is now the highest outside of a recession since 1995-96. From here, spending cranks up on defense and housing, a previously announced tax cut for households, and tax incentives for corporates. Budgetary shortfalls at the end of the forecast horizon level off at 1.5% of GDP, more than double the FES estimate of 0.6%.

Looking into the breakdown of economic and fiscal developments since FES 2024, income tax revenues are expected to be better than initially anticipated under resilient personal and corporate incomes. The biggest line items are the rise in direct program expenses, adding $65 billion to the deficit over the next 5 years, $16.8 billion in 2025-26 alone. This reflects the government updating how contingent liabilities are being accounted for noting the budget, “increases the projection of expenses for contingent liabilities across the forecast horizon, with a larger increase in 2025-26 where there is more information on specific negotiations, cases and claims”, referring mostly to Indigenous claims against the crown.

Total program expenses from FY25-26 are expected to be 16.5% of GDP and fall to 15.4% by 2029-2030. This is essentially in line with the FES 2024 plan of 15.3% of GDP in FY29-30. That said, it is an elevated trajectory, especially with near-term outlays roughly 0.6, 0.3 and 0.4 ppt of GDP higher over the next three fiscal years.

Higher interest rates and wider deficits are set to drive public debt charges higher than in FES 2024. Debt chargers are expected to register $55.6 billion this fiscal year (1.8% of GDP) and ultimately rise to $76.1 billion by FY29-30 (2.1% of GDP). These would bring debt charges back to 2007 levels, coincidentally the last time interest rates were this high.

Table 1: Federal Budget 2025 Fiscal Summary

[ Billions of C$ Unless Otherwise Noted ]

| Fiscal Year | 24-25 | 25-26 | 26-27 | 27-28 | 28-29 | 29-30 |

| Budgetary Revenues | 511.0 | 507.5 | 523.2 | 541.3 | 560.2 | 583.3 |

| Program Expenses | 489.9 | 525.2 | 528.4 | 537.9 | 549.7 | 568.3 |

| Public Debt Charges | 53.4 | 55.6 | 60.0 | 66.2 | 71.4 | 76.1 |

| Net Actuarial Losses (Gains) | 4.0 | 5.0 | 0.2 | 0.7 | -0.3 | -4.5 |

| Total Expenses | 547.3 | 585.9 | 588.5 | 604.8 | 620.9 | 639.9 |

| Budget Balance | -36.3 | -78.3 | -65.4 | -63.5 | -57.9 | -56.6 |

| Federal Debt | 1,266.5 | 1,347.0 | 1,412.4 | 1,476.0 | 1,533.9 | 1,590.5 |

| Per Cent of GDP | ||||||

| Budgetary Revenues | 16.6 | 16.0 | 16.0 | 15.9 | 15.8 | 15.8 |

| Program Expenses | 15.9 | 16.5 | 16.1 | 15.8 | 15.5 | 15.4 |

| Public Debt Charges | 1.7 | 1.8 | 1.8 | 1.9 | 2.0 | 2.1 |

| Budget Balance | -1.2 | -2.5 | -2.0 | -1.9 | -1.6 | -1.5 |

| Federal Debt | 41.2 | 42.4 | 43.1 | 43.3 | 43.3 | 43.1 |

New programs in Budget 2025

Competitiveness and Tax

- The government is focused on catalyzing private sector investment in the economy. There are a bevy of initiatives, headlined by the Productivity Super-Deduction, the Major Projects Office, a Trade Diversification Strategy and a Generational Investments in Infrastructure.

- Limited additional information on the Major Projects office was offered beyond what we already know. The next tranche of projects are due to be formally announced in the coming weeks.

- Budget 2025 made a seemingly big splash on the competitiveness front, announcing a newly named “productivity super-deduction” and enhancing the scientific research & experimental development (SR&ED) credit. Despite the fancy name, the super-deduction is not new in concept. It was introduced and funded in the FES 2024 but not legislated or made available to corporations. The new name, however, does reflect expanded eligibility of projects to include manufacturing & processing facilities and some LNG facilities. It includes immediate 100% expensing for manufacturing equipment, clean technology investments, and data network infrastructure (e.g. AI-related investments).

- In addition, changes are being made to the Scientific Research & Experimental Development (SR&ED) credit to also expand eligibility by raising capital phase-out thresholds, raising annual expenditure limits, and expanding eligibility among firms. This too was a FES 2024 measure, that will now be implemented.

- As a result, these initiatives add only $1.5 billion to the fiscal. Immediate expensing was costed at $17 billion at the time, while the enhanced SR&ED credit had a $1.9 billion price tag.

- These measures do put Canada on somewhat more even footing relative to the U.S. since the passing of the One Big Beautiful Bill (OBBB), which also introduced immediate 100% expensing for business investment. The OBBB aligns on being available for certain classes of non-residential buildings, including manufacturing, but was more general on equipment.

Defense

- The biggest new line item in Budget 2025 is the increase in defense expenditures. The new budget anticipates $58.7 billion in net-new outlays dedicated to the military. The figure actually understates the total spending expected over the next five years. On a cash basis, $82 billion dollars are expected flow from government coffers to fund defense initiatives – including $20 billion for CAF compensation and healthcare, $19 billion to repair and sustain CAF capabilities and defense infrastructure investment, $10.9 billion for upgrades to defense digital infrastructure, $17.9 billion to expand the military’s capabilities, and $6.6 billion for the Defense Industrial. Importantly, a new Defense Investment Agency is supposed to oversee the defense procurement and speed up procurement timelines.

- The $82 billion represents roughly 2.5% of 2025 GDP, or roughly 0.5% of GDP per year. Starting from 2.0% of GDP this year, it remains to be seen how the government will continue to sustain even greater expenditures on hard defense spending in the coming year.

Operational Efficiencies

- To offset the deficit agenda, the government is banking on roughly $52 billion in savings over the life of the budget. This is driven by the results of the Comprehensive Expenditure Review, reducing planned direct program expenses by 4.9% in 2028-2029. Together with CRA initiatives and new revenues, cumulative savings of roughly $34.5 over the same time frame as expected (this increases to roughly $48 billion through 29-30 with another $12.5 in “Ongoing” savings).

- Workforce reductions are expected in the coming years. Many (not all) departments are facing a savings target roughly 15 per cent over three years and public sector employment is targeted to fall by roughly 40k positions (10%) relative to its 2023-24 peak.

Climate Policy

- Budget 2025 was a bit lacking on the climate policy front.

- Although many keyed in to the removal of the emissions cap, this came with many conditions. It’s conditional on leveraging CCUS alongside implementing methane reduction regulations that Canada has already committed to.

- After cancelling the federal fuel charge and not extending many consumer rebates for clean technologies such as home heat pumps or zero-emissions vehicles, a big question going into this budget was how Carney (former UN Special Envoy on Climate Finance) was going to reenvision Canada’s climate strategy. As it turns out, the answer is that he simply will not.

- Budget 2025 was limited to extending and expanding eligibility for existing tax credits around clean technology, clean electricity generation, clean hydrogen production, carbon capture, etc, and maintaining Canada’s commitment to reduce methane emissions. A reallocation of existing funding to critical minerals infrastructure will now be used to fund a new $2 billion critical minerals sovereign fund aimed at providing early-stage financing for mining companies.

- Notably, the budget referenced leveraging the industrial carbon pricing system as the main tool to address economy-wide emissions by providing a carbon price trajectory beyond 2030. However, little-to-no detail was provided as to how the output-based pricing system would replace policies lost on the consumer side. Canada’s industrial carbon price applies to only some industries, meaning the large proportion of Canada’s greenhouse gas emissions will go unpriced. In addition, no detail was provided on how the industrial system’s binding constraints would evolve over time to push impacted industries to reduce their emissions; simply that price certainty past 2030 would be provided.

Immigration

- Budget 2025 made a brief reference to a significant change to the immigration target. Permanent resident numbers will be maintained relative to 2026 at 380,000 through 2028. However, non-permanent resident (NPR) targets are expected to fall significantly. The previous 2025-27 target had NPR numbers falling from 673,650 in 2025 to between 520,000-550,000 in 2026/27 – the new target for 2026/27 is now 370,000, less than 5% of the population. International student numbers will be halved to 150,000 through 2027 and 2028 providing most of the decrease.

What does it all mean? What’s missing?

This budget aims to do something no previous government has been able to – re-orient the Canadian economy from north-south to east-west and across oceans. But its success hinges on “build it and they will come”. Big infrastructure spending and tax incentives to invest do change the calculus for some firms to invest, pursue or expand on non-US trading relationships or focus on expanding domestically. But given ongoing trade and economic uncertainty, this budget alone may not be enough to get firms immediately off the sidelines.

More clarity is needed on how government can work more closely with industry to address that uncertainty. Prime Minister Carney can continue moving the needle by addressing the majority of firms that cite tax and regulatory compliance barriers as fundamental challenges to Canada’s competitiveness. Though government is quick to note that Canada’s marginal effective tax rate on new investment leads many of our advanced trading partners, the country’s dismal investment and productivity numbers underscore the need for action here.

All said, this budget does put Canada on better footing with a renewed focus – future budgets will likely build on these foundations. However, the U.S. is heavily focused on supporting AI and data center industries, and business investment has surged as a result. In Canada, the budget has some reference but limited dollars in these initiatives and remains heavily tilted to more traditional industries. This represents a risk in keeping in step with the future economy. And, given that deficits are the size of the mid-90s, outside of recession, there is also a risk that you build it, and they don’t come.

Table 2: Economic Assumptions

[ Annual % Change Unless Otherwise Noted ]

| Calendar Year | 2025 | 2026 | 2027 | 2028 | 2029 |

| Real GDP | |||||

| 2024 Fall Economic Statement | 1.9 | 2.1 | 2.1 | 2.0 | 2.0 |

| Budget 2025 | 1.1 | 1.2 | 2.0 | 1.9 | 2.0 |

| TD Economics Forecast | 1.2 | 1.1 | 1.7 | 1.8 | 1.7 |

| Nominal GDP | |||||

| 2024 Fall Economic Statement | 3.9 | 4.2 | 4.1 | 4.0 | 4.0 |

| Budget 2025 | 3.5 | 3.0 | 4.1 | 4.0 | 4.0 |

| TD Economics Forecast | 3.6 | 3.4 | 3.9 | 3.8 | 3.8 |

| Consumer Price Index Inflation | |||||

| 2024 Fall Economic Statement | 2.0 | 2.0 | 2.0 | 2.0 | 2.0 |

| Budget 2025 | 2.1 | 2.0 | 2.0 | 2.0 | 2.0 |

| TD Economics Forecast | 2.0 | 2.1 | 2.0 | 2.0 | 2.0 |

| Unemployment Rate (%) | |||||

| 2024 Fall Economic Statement | 6.7 | 6.2 | 6.0 | 5.8 | 5.7 |

| Budget 2025 | 7.0 | 6.8 | 6.4 | 6.1 | 6.0 |

| TD Economics Forecast | 7.0 | 6.9 | 6.3 | 6.0 | 5.9 |

| 3-Month Treasury Bill Rate (%) | |||||

| 2024 Fall Economic Statement | 2.9 | 2.6 | 2.8 | 2.8 | 2.8 |

| Budget 2025 | 2.6 | 2.3 | 2.5 | 2.6 | 2.6 |

| TD Economics Forecast | 2.6 | 2.3 | 2.3 | 2.3 | 2.3 |

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: