The New Normal:

2026 Canadian Automotive Outlook

Andrew Foran, Economist | 416-350-8927

Date Published: February 19, 2026

- Category:

- Canada

- Commodities & Industry

Highlights

- Tariffs have led to a partial reorganization of North American automotive production, with Canadian production last year falling 5.4% year-on-year – more than that seen in the U.S. and Mexico.

- A reversal of this trend through agreements with other nations is theoretically feasible, but will likely necessitate a broader trade diversification strategy in the wake of the now tariffed access to the U.S. market.

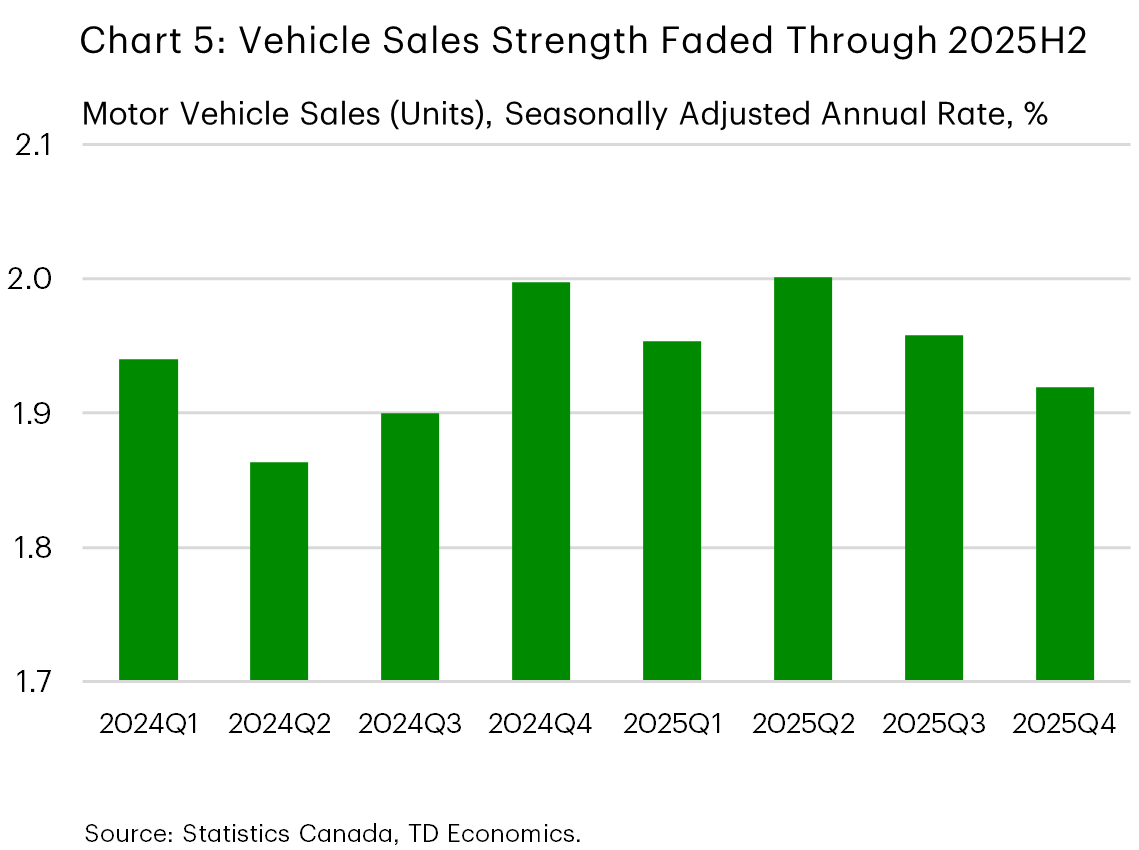

- Canadian vehicle sales in 2025 hit a 6-year high, but tariffs have dampened demand in recent months.

- As trade headwinds remain and support from past easing in financial conditions wanes, we expect vehicle sales to fall by 4.3% in 2026.

The Canadian automotive industry faced considerable headwinds in 2025 as tariffs imposed by and against the nation’s largest trading partner disrupted supply chains within the industry and the broader economy. However, Canadian vehicle sales still managed to notch a post-pandemic high in volumes on the year – a byproduct of easing financial conditions, pent-up demand, and significant front-loading ahead of the implementation of tariffs.

Looking to 2026, elevated trade uncertainty is likely to continue to weigh on the industry as the first review of CUSMA takes place. The process promises to be extensive, with the U.S. likely to seek material revisions to be made within or as an accessory to the agreement. Losing CUSMA would have significant consequences for Canada and the North American auto industry, but the prospect of extended negotiations could also yield improved trade relations as well.

On balance, we expect new vehicle sales to fall 4.3% to 1.9 million units in 2026, as the impact of tariffs on supply chains wanes gradually but remains a headwind on aggregate.

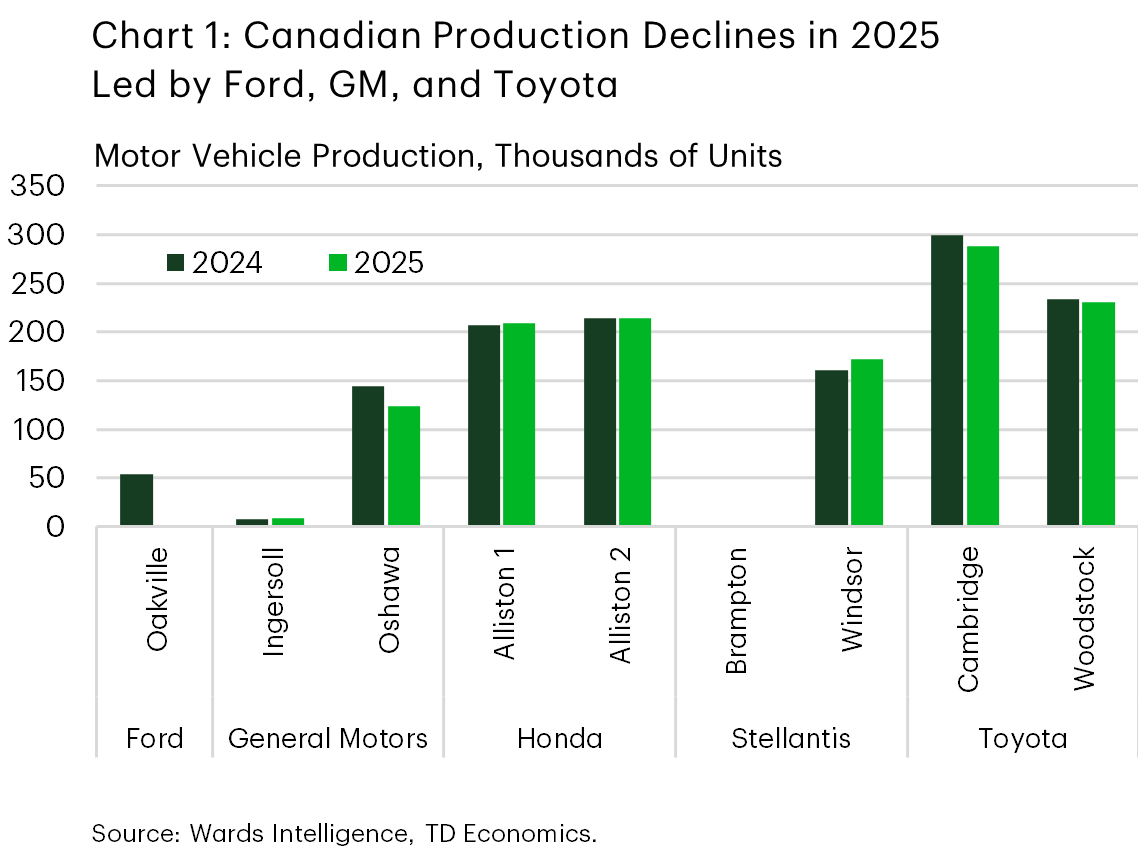

North American Production, Adaptation Amid Trade Uncertainty

Over 15 million vehicles were produced in North America in 2025, roughly 3% less than the year prior. Production fell in all three North American nations, with the largest decline (-5.4%) recorded in Canada. Part of this decline was accounted for by the retooling of Ford’s Oakville plant, but declines were also recorded at General Motors’ Oshawa plant – which will fall further in 2026 after the plant cut a shift in January – and Toyota’s plants in Cambridge and Woodstock (Chart 1). Stellantis’ Brampton facility was also scheduled to begin operations last year after undergoing retooling but has been idled indefinitely by the automaker amid tariff pressures. However, the addition of a third shift at Stellantis’ Windsor facility - originally announced during the 2023 union negotiations but subseqently delayed - will provide a modest boost to production in 2026.

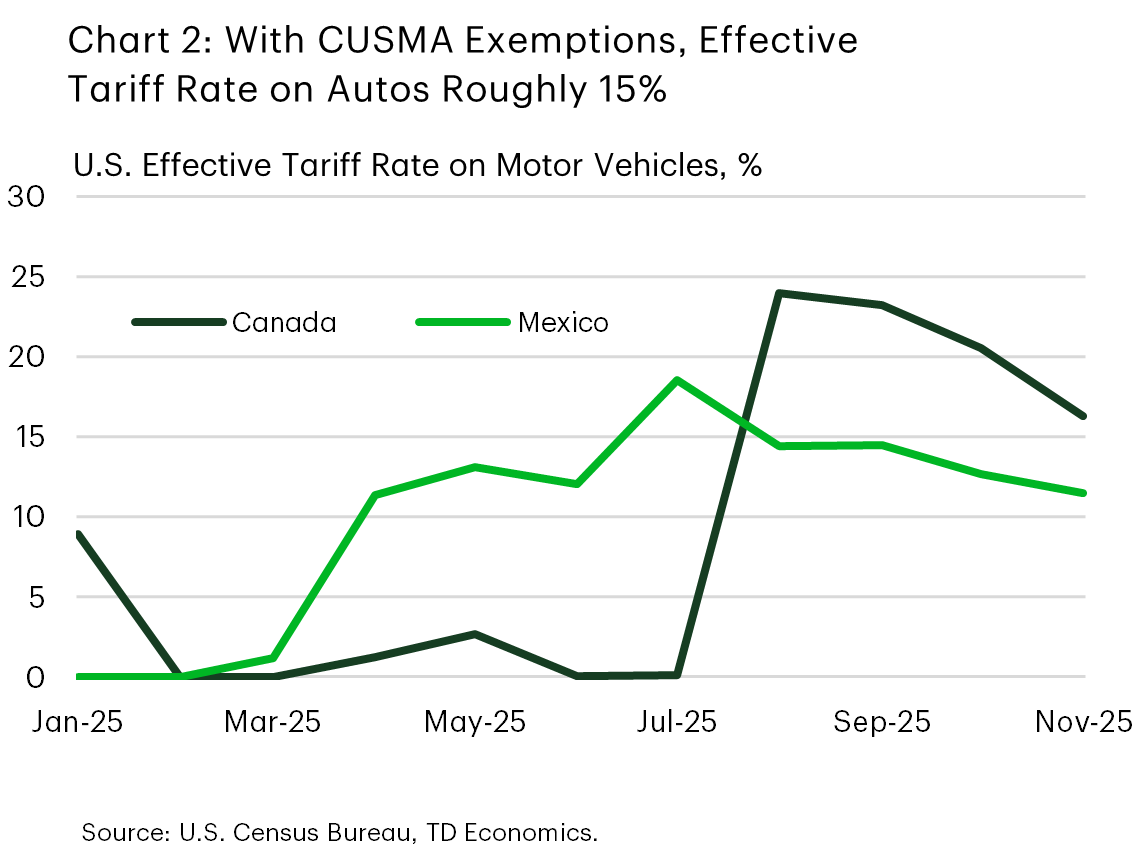

For context, Canada’s production of automobiles is primarily exported to the U.S., with roughly 90% shipped south of the border in any given year. As a result, domestic production was materially impacted by the implementation of 25% tariffs by the U.S. last March. For CUSMA-compliant motor vehicle exports – which cover 99% of the total Canadian motor vehicle exports to the U.S. – the tariff only applies to the share of the vehicle’s content sourced from outside the U.S. This puts the effective U.S. tariff on Canadian produced automobiles in the 15-20% range (Chart 2). Of note, this is slightly higher than the tariff rate the U.S. currently charges on other major automobile export nations, including the E.U., Japan, and South Korea, which all face a 15% tariff. This has been a point of contention between the U.S. administration and North American automotive industry since the trade deals with the lower tariffs were announced last summer.

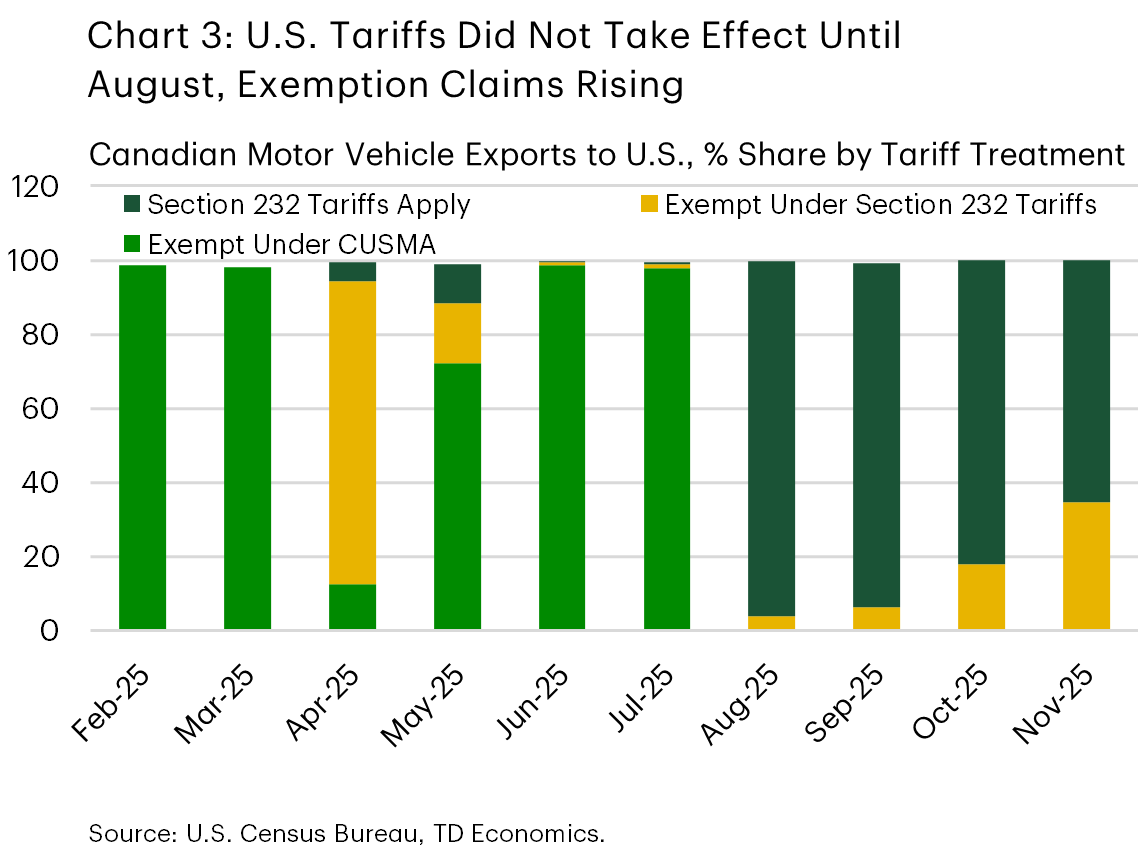

The impacts of U.S. tariffs on Canadian exports have only begun to show up in the past few months. Although the levies started to take effect last March, it took until August for the U.S. to fully implement them as specified (Chart 3), which is why the effective tariff rate shot higher at that time. By the latter portion of the year, it appears exemption claims for the share of vehicles accounted for by U.S. content began to rise. Note that U.S. auto tariffs on Mexico took effect immediately in March, with the reasoning for the lag in application for Canada likely owing to the difficulty in delineating between U.S. and Canadian content given the magnitude of integration between the two countries. Before 2025, Canada and the U.S. had traded freely in automobiles for nearly 60 years, pre-dating NAFTA by decades.

With the tariffs expected to remain in effect indefinitely, automakers have begun to make changes to their production footprint to offset the impact of tariffs. Some Canadian production has been shifted to the U.S., which is expected to lead to a decline in Canadian production this year of roughly 4% relative to 2025. Further reductions in production are possible, but large-scale reorganization would be suboptimal on a cost and logistics basis to implement under existing tariff policies. Additionally, the Canadian government’s counter-tariffs include penalties for production reductions, which it has used in recent months against General Motors and Stellantis. Canada is the largest export market for U.S. automobiles, accounting for 25-30% of the nation’s exports, making these penalties a material consideration for automaker production decisions.

Lastly, it is necessary to note that trade will continue to dominate the risk outlook for 2026. With the first review of CUSMA set to begin later this year, the potential for trade tensions to rise is a key risk. Furthermore, CUSMA exemptions to the 2025 tariffs were the only reason the industry did not buckle last year. The outlook for 2026 and beyond will be highly dependent on the outcome of the review, with the trajectory of the industry inversely related to the relative change in tariff policies.

Potential Impacts of New Agreements

Amid elevated trade tensions with the U.S., Canada has sought to diversify its trade exposure, including the automotive industry. In January, the government announced that it had reached an agreement with China to allow a fixed quantity of Chinese electric vehicles to be imported to Canada under the most-favoured-nation tariff rate (6.1%), in exchange for a reduction in Chinese agricultural trade restrictions. The quantity of vehicles permitted this year will be 49,000 – equating the quota to the 2023/2024 share of the market that Chinese vehicles held.

In 2024, Chinese EV imports to Canada were predominantly Teslas sourced from the company’s Shanghai facility, and somewhat conveniently, 49,000 is roughly how many vehicles Tesla sold in Canada last year. While it’s possible that Tesla may begin sourcing vehicles from China again for the Canadian market, the company’s decline in sales in recent months would leave room for other companies to take advantage of the quota. Chinese EV companies, such as BYD and Chery, have expressed interest in selling vehicles in Canada, so it seems likely that more Chinese EVs will be on roads in Canada over the coming years.

Given that the government’s quota also includes an allocation which must be met by affordable (sub-$35,000) vehicles, questions have arisen in terms of the potential impact on EV prices. Firstly, it’s important to note that Chinese EV companies have typically charged below average, but competitive prices when exporting to foreign advanced economies. Given that their volumes will be limited by the quota, they are likely to pursue a similar strategy upon their introduction to the Canadian market.

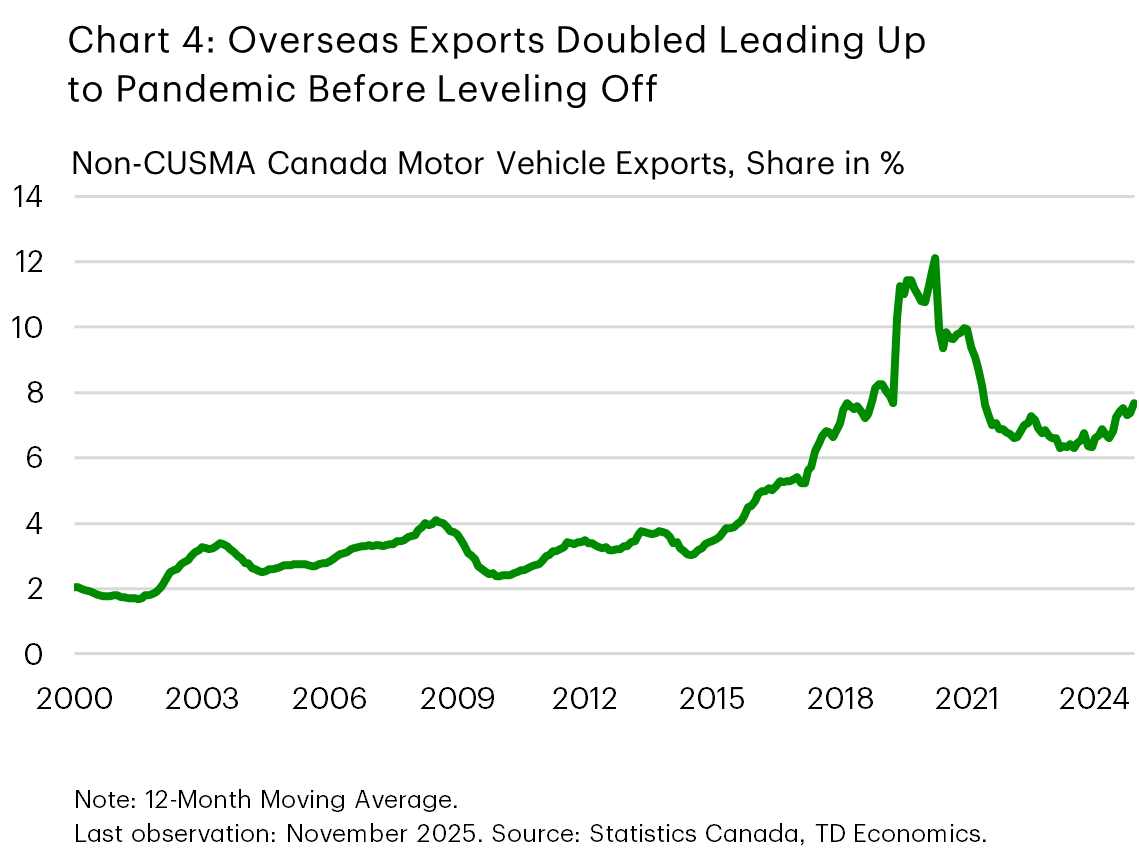

The Canadian government’s announcement on the agreement with China also noted that the government expected it to drive considerable joint-venture investment activity in the Canadian automotive industry. For now, it’s uncertain what form this could take. Given that 90% of exported automobiles and 80% of automobile parts are sent to the U.S., and the animosity the U.S. has for Chinese EVs, any investment would likely need to balance these dynamics. If Chinese production were to happen domestically, it seems likely that any quantity that isn’t consumed domestically would need to be exported overseas. Currently, only about 7% of exported vehicles from Canada are shipped outside the CUSMA region (Chart 4), so there is room to grow and diversify the 90% share accounted for by the U.S.

Outside of the China agreement, we have also heard from the federal government that South Korean and German companies are considering producing in Canada. While this would be beneficial for the nation and the industry, it’s worth noting that these discussions are tied to the government’s procurement of submarines - with each country an active bidder in the process - and are not currently substantiated. Regardless, the need for new investments in the industry in the wake of increasing U.S. protectionism is apparent.

Stable Demand Despite Trade Headwinds

Looking at the annual sales total for 2025, you might assume that it was a normal year of stable growth, with vehicle sales of roughly 2 million units – the highest level since 2019. Breaking it down to the monthly frequency, the magnitude of volatility last year caused by trade policies is evident. Front-loading ahead of tariffs lasted through July, averaging roughly 2 million units in seasonally adjusted annualized rate (SAAR) terms (Chart 5). In the latter half of the year, this rate fell to roughly 1.9 million as demand cooled. Still, demand remained healthier than expected given the headwinds facing the industry and the broader economy.

Several reasons likely led to this robustness in sales. First, domestic consumption is affected by the tariffs imposed by the government of that country. In Canada’s case, this applies to the 25% tariffs imposed by the Canadian government on imports of motor vehicles coming from the U.S. If the vehicle is compliant with CUSMA, then the tariffs only apply to the content of the vehicle not sourced from Canada or Mexico. Given that roughly 50% of the vehicles purchased in Canada come from the U.S., this would have had a notable impact on domestic sales if the government did not provide additional exemptions for the automakers which produce in Canada. This includes General Motors, Ford, Stellantis, Toyota, and Honda, which have a cumulative market share of roughly 60%. These exemptions lightened the impact of the tariffs on Canadian consumption.

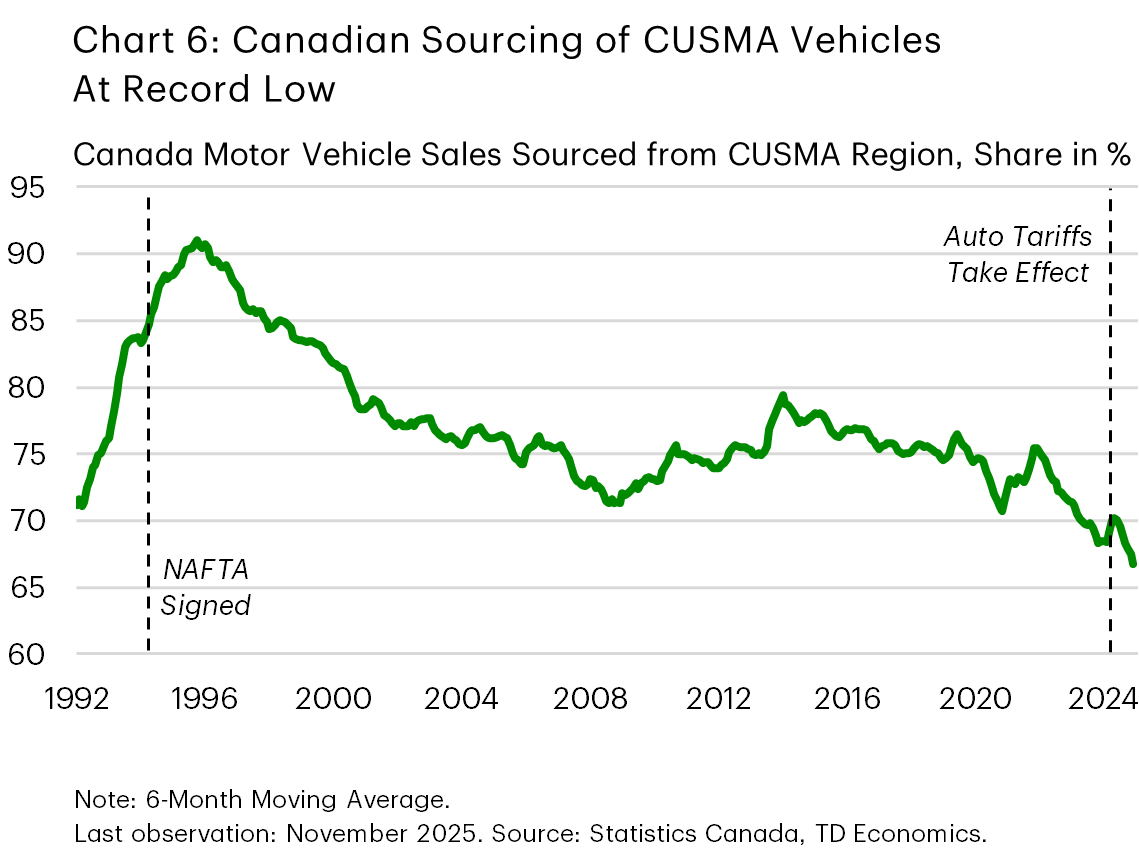

We also saw a modest reallocation of Canadian sourcing of motor vehicles, with Mexico seeing a modest increase in its share of Canadian imports (2-3 percentage-points), nearly equal in magnitude to the decrease in the share accounted for by the U.S. This reallocation served the purpose of shifting trade away from tariff-exposed regions. To a lesser extent, we have also seen higher imports from outside of the North American region, including Japan, South Korea, and Germany. As of November 2025, the share of Canadian motor vehicles sourced from within the CUSMA region was at a record low of roughly 65% (Chart 6). This trend began a couple years ago in 2022, as imports from overseas - mostly Japan – increased. This was likely driven by the combination of the CPTPP reduction in auto tariffs, which reached 0% in 2022, and the higher domestic content requirements of CUSMA relative to NAFTA. Now in 2025, we have seen the CUSMA share of vehicle sales dip again as tariffs raise intraregional costs.

Another positive influence on sales in 2025 was the easing in financial conditions, with the average financing rate falling by half a percentage point in the second half of last year. This likely brought some consumers that had been waiting on rates to fall off the sidelines. If sales in prior years had kept level with the pre-pandemic trend, then roughly 1-1.5 million more vehicles would have been sold. A fair amount of this pent-up demand is likely to continue to support sales over the coming quarters, but challenging economic fundamentals will keep a portion of this demand out of the market. In 2025 concerns about the economy were partly offset by strong financial asset returns, but as this wealth creation channel likely moderates this year, it is expected to become a waning tailwind.

Looking to 2026, a number of factors are likely to pose challenges for the Canadian sales outlook. First is the unlikelihood for further easing in financial conditions, as the Bank of Canada remains in neutral. With monthly payments continuing to hover around $1,000, affordability concerns are likely to remain a partial constraint on sales activity. The industry will also be contending with slowing population growth as the federal government seeks to course correct above average growth in recent years, which will reduce the size of the consumer market. Cumulatively we expect these factors, in addition to lingering trade uncertainty and its impact on the economy, to lead to a 4.3% decline in sales this year.

Bottom Line

The Canadian automotive industry managed to weather the storm of elevated trade tensions with the nation’s largest trading partner relatively well in 2025, but headwinds are growing as tariffs take greater effect. Sales notched a 6-year high last year, but are expected to retreat this year as economic growth remains subdued under the influence of tariffs. Production is also expected to decline in 2026, with shift reductions and idled plants weighing on output. New agreements with existing trading partners to shore up Canadian automotive production could yield dividends, but uncertainty related to the future of CUSMA may weigh on near-term developments. Nevertheless, the need to diversify automotive trade away from its current outsized U.S. concentration will likely be necessary to ensure the long-run viability of the industry amid growing U.S. protectionism.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share this: