Commodities Quick-Take

Marc Ercolao, Economist | 416-983-0686

Date Published: November 27, 2025

- Category:

- Canada

- Forecasts

- Commodities & Industry

Highlights

- Idiosyncratic factors are driving divergences in energy commodities. Oversupplied crude oil markets are weighing on the price outlook, while robust LNG demand has been bidding up natural gas.

- Base metals prices have been pressured higher following sharp tariff-induced selloffs earlier this year. Still-sluggish global demand will likely be offset by ongoing supply concerns, keeping metals prices on the firm side in 2026.

- Gold’s meteoric rally is taking a breather, but further monetary easing, continued central bank buying activity, and ongoing geopolitical risks are likely to see the yellow-metal test record highs again in 2026. Silver prices should follow suit.

- Oversupply fears in the wheat market will likely constrain near-term price growth despite sturdy global demand. Canadian canola markets hang in the balance as Chinese tariffs take hold.

- A slow recovery in US homebuilding combined with tariffs on Canadian softwood will keep lumber price growth modest over the forecast horizon.

Crude Oil – Is $60 is the new $80?

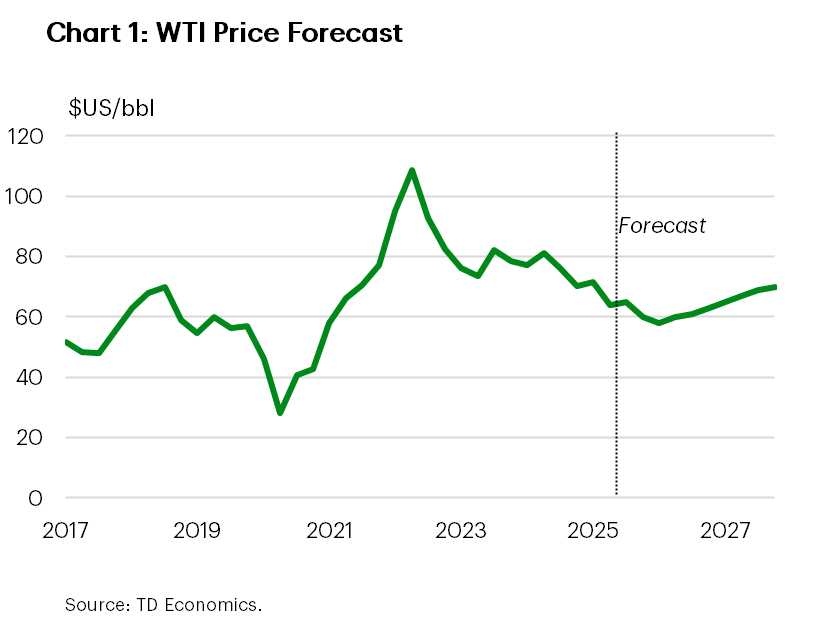

WTI prices have slumped throughout 2025 due to ongoing oversupply concerns and weakening global demand. At under $60/bbl, oil prices are over 20% lower than their 2024 average and $20/bbl off its early-year peak.

Much like when prices traded rangebound around $80-bbl between 2023 to mid-2024, we see oil prices coalescing around current levels until slowly grinding higher in the back half of 2026. We acknowledge that price risk is skewed to the downside as supply overhang outweighs potential support factors.

Global oil balances have shifted into a surplus of over 1 million/bpd this year, with the IEA projecting even larger surpluses of up to 4 million/bpd in the first half of 2026. Beyond that, we expect some alleviation in global trade uncertainty to support a modest firming in global oil demand and, in turn, more manageable market balances.

OPEC+ has been the driving force behind global supply growth, restoring its past 2.2 million/bpd of production cuts, while currently unwinding another tranche of offline supply. The group has indicated its intention to pause output hikes in early-2026, signaling awareness of weakening demand.

U.S. production has also contributed to global excess supply, on track to grow by a larger-than-expected 350k/bpd in 2025. In a softer pricing environment, we don’t expect the U.S. to pursue aggressive new drilling in 2026, especially as rig counts decline amid uncertain market conditions and breakeven barrel production limits are tested.

Elsewhere, oil markets will remain sensitive to geopolitical developments. The potential for escalating conflicts in the Middle East or Ukraine, along with strict enforcement of U.S. sanctions on Russia, could put production and exports at risk, keeping a floor under prices. While geopolitical risk premia are difficult to incorporate into any price forecast ex-ante, past episodes have induced temporary price bumps of $3-5/bbl.

On the Canadian side, Western Canada Select (WCS) has outperformed its WTI counterpart as demand for heavy oil remains sturdy. Thanks to a successful expansion of the Transmountain Pipeline (TMX), Canadian oil flows are rerouting from recent growth markets like the U.S. West Coast toward China, now Canada’s second largest oil export market. This has compressed the WCS discount to a $10-12/bbl range (reaching single digits earlier this year). We expect the discount through 2026 to remain below historical averages as spare capacity and operating cost advantages north of the border keep heavy barrels flowing.

Natural Gas Found Its Bottom

Natural gas markets are closing the year with solid momentum. The U.S. benchmark Henry Hub price recently surged above $4.50/MMbtu, the highest level since early-2023. We project that under current market conditions, 2026 average prices will keep firm at an average price of $3.95/MMbtu, 8% higher compared to 2025, before ample supply pulls down spot prices modestly in 2027. Relative to oil markets, the next couple of quarters should see natural gas prices outperform.

Colder weather forecasts have pulled forward some near-term demand for gas-intensive heating, while LNG feedgas demand remains robust. The bullish near-term price outlook is also a result of record-breaking U.S. LNG exports to European and Asian buyers. In a bid to rapidly expand export capacity in recent years, the U.S. has now cemented itself as the leading global LNG export market.

U.S. LNG exports are on track to ramp up by a sturdy 25% this year, helped by maintenance completion at key export hubs. New projects coming online in the near-term will support shipments into 2026. The robust demand for U.S. LNG underscores its role as a crucial transition fuel and a means of energy security for key buyers weaning off of less-reliable sources.

Price increases are also taking place at a time where U.S. domestic production has strengthened to near-record highs in recent months. This has pushed current storage levels to around 5% above seasonal averages. Given the higher hand-off point, U.S. production is projected to grow only modestly next year. Nevertheless, increased U.S. production, coupled with expansion in key markets such as Canada and Qatar, may result in natural gas oversupply by the end of 2026, exerting a downward force on prices.

Meanwhile, Canadian natural gas producers have temporarily shut in natural gas wellheads as increased production ahead of the new LNG Canada pressured already ample gas storages. Since briefly dipping into negative territory in September, benchmark AECO prices have recovered swiftly to around CA$2.50/gj, in line with long-run averages. The combination of recovering prices, rising winter demand, and expanding LNG exports is creating optimism among producers, though high storage levels remain a risk.

Elsewhere, the European benchmark Title Transfer Facility (TTF) has diverged from LNG price trends. At US$9.95/mmbtu, TTF prices sit little changed from average 2024 levels, as moderate demand and greater availability of LNG imports keep prices suppressed.

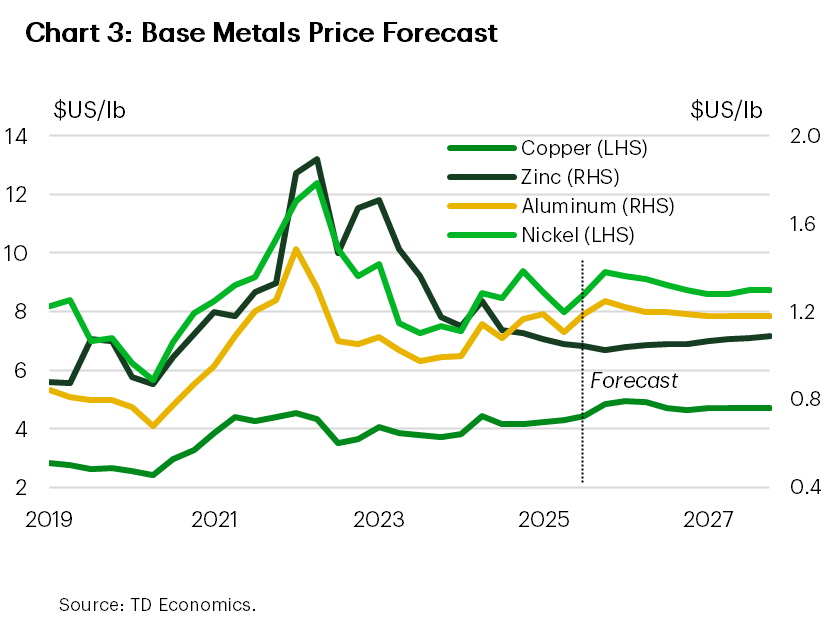

Base Metals – Grinding Higher

Base metal prices have been gaining some strength recently following sharp tariff-induced selloffs earlier this year. Indeed, surprising resilience in economic growth this year, particularly in key consumption markets like China, have bolstered the demand picture in recent months. Concerns have also been deepening on the supply side for key metals, which has added to upward pressure to near-term prices.

Heading into 2026, uncertainty around the outlook for global growth are likely to limit further upside in metals prices. Notably, concerns around a potential delay in interest rate reductions by the Federal Reserve have been feeding into this uncertainty. Beijing’s newly proposed stimulus measures for its struggling property sector have the potential to support metals demand; however, earlier interventions have only induced slight tailwinds to prices.

LME copper prices notched a record high in October as the industry faces significant supply disruptions. The Grasberg mine in Indonesia, the second largest copper mine in the world, suspended operations in September and isn’t slated to restart until July 2026. This follows other operational setbacks at several large mines this year, which have hampered output growth and pushed markets into a deficit. We expect copper to hold onto recent gains into 2026, pushing annual growth 8% higher to $4.80/lb, despite only a modest projected increase in global copper demand. Longer-term, copper is becoming more far-reaching, playing a big role in decarbonizing the economy as well as being used as an input to AI-fueled demand.

Aluminum, much like copper, has rallied on supply concerns. Global output growth is expected to slow as China – responsible for 60 percent of worldwide production – nears its self-imposed output cap with the aim of reducing emissions. Production shut-ins from European smelters are also gradually recovering, but output still remains at five-year lows. We forecast aluminum prices in 2026 to rise modestly to an average price of $1.20/lb before more balanced market conditions gently push prices lower in 2027.

Zinc prices have regained momentum after primary supply increases and falling manufacturing and construction demand weighed on prices in H1-2025. At $1.42/lb, prices are 20% above their early year lows, but markets may have a tough time holding these gains. Economic growth in China, the world’s largest zinc consumer, is expected to downshift next year. And while we may see some demand offset from global infrastructure and renewable energy investments, it may not be enough to absorb new supply coming to the market.

Elsewhere, the near-term outlook for nickel prices is less optimistic due to mounting oversupply concerns. We anticipate nickel prices will stall in 2026 before rebounding modestly to $7.10/lb in 2027. By most metrics, demand over the coming years should be decent as the EV sector quickly becomes an important consumer alongside nickel’s input into clean energy technologies. However, steady output out of Indonesia, who supplies 60% of the global market, could leave the supply-demand balance in its fourth consecutive annual surplus.

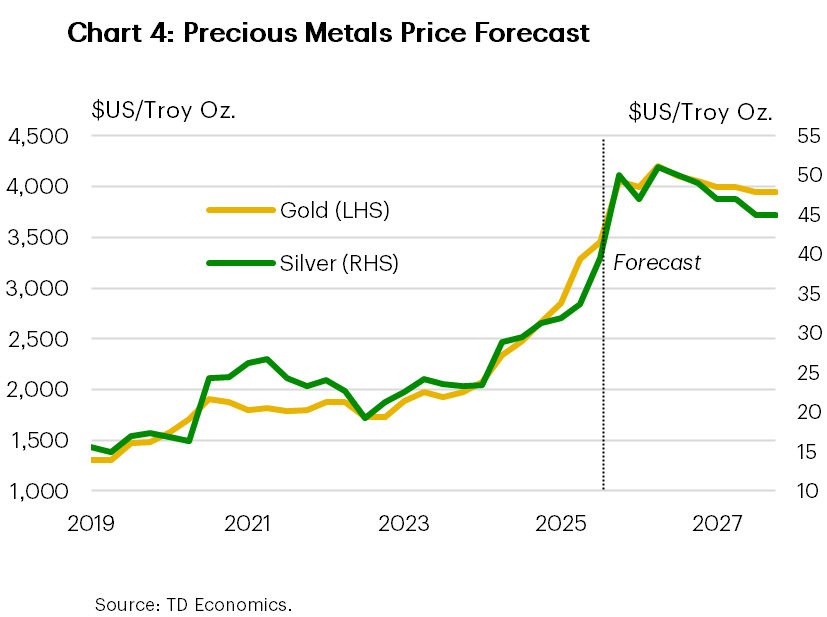

Precious Metals – Gold on Top of the Podium

Gold prices are on track to finish at the top of the commodities-return podium in 2025. Average 2025 prices will likely finish $1,000/oz higher than last year, yielding a near 50% annual return. Silver prices are expected to secure the second spot, at an estimated gain of over 30% for the year.

The meteoric gold run over the past year was fueled by a perfect storm of factors including falling bond yields, a depreciating dollar, robust central bank buying, and safe-haven and ETF fund flows. Prices have cooled by 7% since reaching their $4,400/oz peak last month, but bullion’s medium-term fundamentals remain positive. Our expectations of an additional 75 bps in U.S. interest rate cuts by Q3-26, combined with continued (though easing) central bank purchases and still-elevated geopolitical risks are all factors behind our bullish view for the yellow metal. We’d expect some short-term consolidation in the $3,900-$4,000/oz range before legging higher in the first half of 2026.

Silver prices, influenced by many of the same forces that drive bullion, should follow suit. Silver, however, is used as an input to more industrial uses and short-term fluctuations will be more closely tied to growth in global manufacturing, which is facing a more uneven recovery.

Agriculture – Bouncing Off Lows

In recent weeks, wheat futures have shown some signs of life following a largely disappointing performance over 2025. Prices have moved 7% higher since reaching their lowest levels in five years last month. In 2026, we forecast wheat prices to grow by another 5%, but remain below their 10-year average as global oversupply concerns continue to weigh on the market.

Global wheat stocks have been steadily rising since early last year, suppressing price growth. Most major world producers – notably Russia, Argentina, and Australia – have recorded increases in local supply estimates through the early-fall. Global wheat demand is still forecast to be durable next year, which will work to keep downward price moves limited. Much will depend on the evolution of Chinese demand, the number one buyer of wheat globally.

On the Canadian side, wheat has also posted increased yields for the year. Fortunately, Canadian wheat has moved south of the border at a decent clip, despite trade tensions. Absent any major disruptions, Canadian wheat exports should remain healthy in the near-term, which would prevent 2026 ending stocks from rapidly accumulating. The annual New Wheat Crop Report also confirmed that Canada is on track to be the third-largest global wheat exporter and the number one exporter of ‘high-quality’ wheat.

Canola exports on the other hand are lagging behind, with shipments year-to-date down 10%. Trade and demand channels have softened since China’s recently imposed 75.8% duty on Canadian canola seed – building on the 100% tariff on canola oil and meal levied in March. This jeopardizes nearly $5 billion in annual canola takeaway to China, the country’s second largest export market. No progress on a resolution has been made yet, despite diplomatic efforts. Any minimization or removal of tariffs would re-open a key export channel and support prices.

For now, and much like wheat, canola prices have gained a bit of traction in recent months, as higher demand and tighter spot availability alleviated broader supply concerns. We expect average canola price growth to be limited to around 3% in 2026 and 2027.

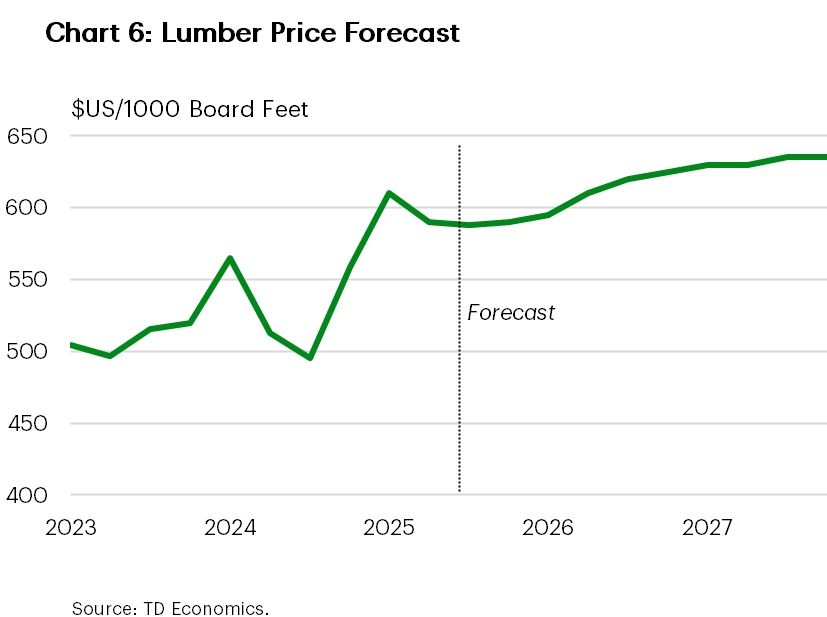

Lumber – Softness in Softwood

Lumber futures have whipsawed throughout 2025 with recent prices ($540/thousand board feet) settling at the lower end of the annual trading range. Prospects for 2026 remain subdued amid persistent weakness in the U.S. housing market compounded by intensifying pressure of U.S. tariffs on Canadian softwood. As such, we forecast prices will remain steady in the low range of $500-550/thousand board feet in the coming months. Past this, lumber demand may find some support as U.S. homebuilding picks up at the start of spring construction season in 2026.

U.S. residential building permits have plummeted to their lowest level in five years, while construction spending has contracted from year-ago levels. What’s more, housing starts also remain near five-year lows. The lumber market is facing substantial overhang as weak housing consumption has been unable to absorb the speculative inventory front-loading from earlier this year. We see some room for mortgage rates to fall by next summer, which alongside fiscal tailwinds and more certainty on the trade front, should lead to pick up in sales activity and improving lumber demand.

Elsewhere, existing U.S. antidumping and countervailing duties of 35%, plus new Section 232 levies of 10%, are proving to be a major headwind north of the border. The U.S. continues to be the dominant export market for Canadian softwood, accounting for 87% of exports in 2025. And while Canada is seeking to diversify exports to other regions like China, Japan, India and Europe, it’s unlikely to offset reduced U.S. access. In the meantime, producers have responded through production cuts and mill closures to help rebalance the market, which may lend some support to prices in the near term. The Canadian government is providing financial support, loan guarantees, funding for innovation, and “Build Canadian” policies to boost domestic wood use.

Forecast Table |

|---|

| Commodity Price Outlook |

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: