Highlights

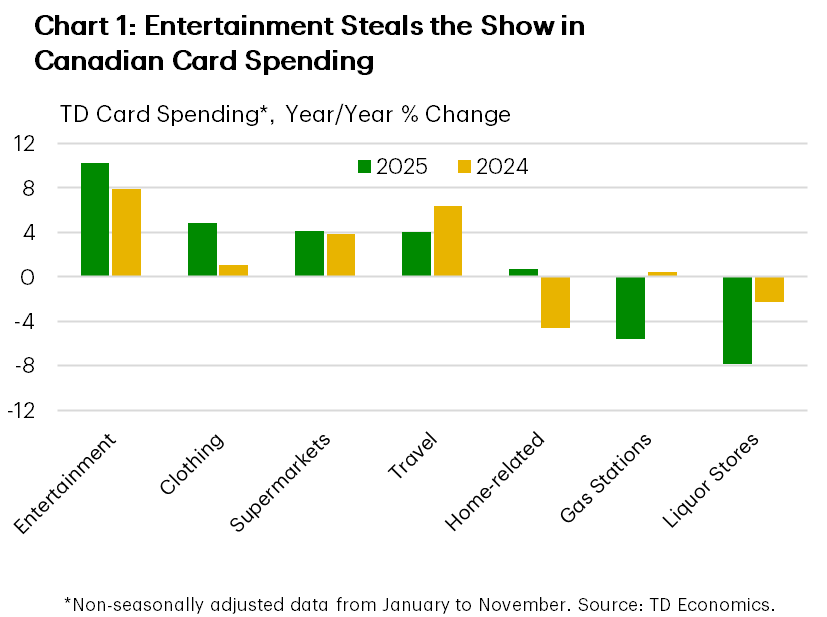

- TD card spending growth came in a touch stronger in 2025 through November, up 5.4% relative to 4.9% in 2024. The category mix broadly echoed 2024, with services spending once again outpacing goods, and goods spending making a modest comeback.

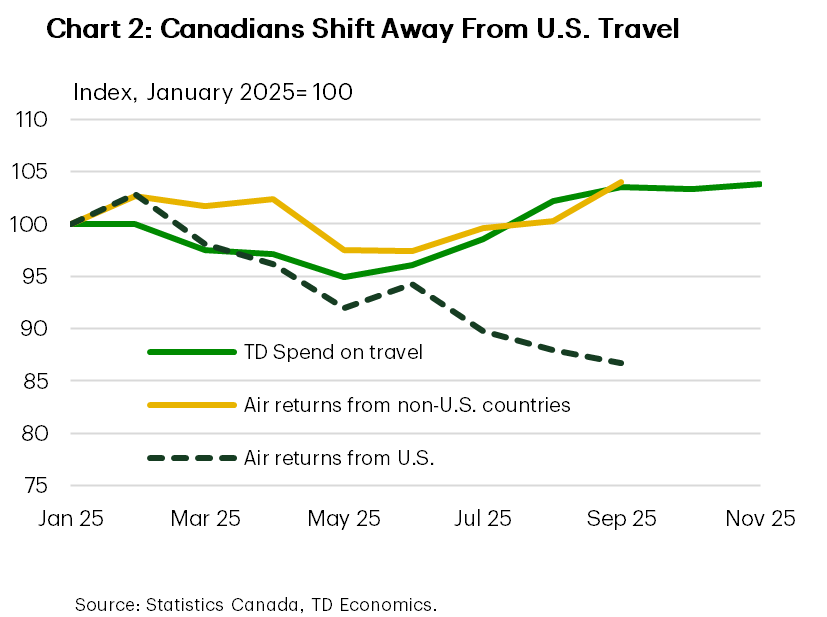

- Entertainment spending was the standout in 2025, leading overall growth and posting the fastest acceleration of any category. Travel spending cooled a bit overall as Canadians eschewed U.S.-bound travel.

- Home-related categories made a comeback in 2025, while several other discretionary categories, particularly clothing, also posted firmer growth than last year.

As December rolls in, so does the annual ritual of looking back at the year that was and daring to forecast the year ahead. With 11 out of 12 months of spending data in hand, this final TD Spending report of 2025 traces how consumer behaviour evolved over the past year, absorbs the lessons, and offers a view of what Canadians are likely to prioritize in 2026.

From a bird’s-eye view, TD card spending growth was a touch stronger at 5.4%, up from 4.9% in 2024. We attribute much of that resilience to the boost from lower interest rates. In fact, growth would likely have been stronger had consumer confidence not taken a hit from tariff tensions. Meanwhile, the category mix broadly echoed 2024, with growth in services spending again outpacing goods. This year, however, goods made a modest comeback relative to 2024. But, as always, the devil is in the details.

Recreation and entertainment – our catch-all category for pleasures large and small, from dining out to concerts and theatre, remained the heavyweight of TD cardholder spending. It claimed the largest share of total spending (16.7%) and posted the fastest acceleration of any category (Chart 1). The year began on a strong footing, stumbled in the spring, but regained momentum heading into summer.

Travel, its usual partner in crime, told a more nuanced story. This category, which largely tracks airline tickets, cooled, likely reflecting Canadians’ hesitation to travel to the U.S. amid trade frictions and a more confrontational tone from Washington. By late summer, nominal travel spending recovered, but U.S.-bound air travel continued to fall (Chart 2). In other words, Canadians kept spending on travel, just staying closer to home or travelling elsewhere. Choosing to spend more domestically became a defining theme of 2025 and likely helped support recreation and entertainment spending.

Goods spending saw its biggest boost from home-related outlays at home improvement centres and furniture stores. These categories had spent 2023 and 2024 deep in contraction. That finally turned around in late 2024 and early 2025, only to be dampened again by the broader cooling in home sales triggered by tariff uncertainty. We did see a welcome pick-up in this category over the last two months likely reflecting the rebound in the housing market in the spring and summer. But given the downside surprise in Q4 home sales and our downgrade for early 2026, we suspect the recent strength may prove temporary.

A handful of other discretionary categories – general merchandise, clothing, and sporting goods – also posted firmer growth than last year. Clothing accelerated sharply in October and November as holiday shopping got underway. So, if you’re hoping for a physical gift this year, odds are rising that it’s an ugly Christmas sweater. Meanwhile, liquor store spending has been running below prior years. This may reflect Ontario’s decision to expand alcohol sales to other retailers. (Or, perhaps Canadians started taking low-risk drinking guidelines to heart.)

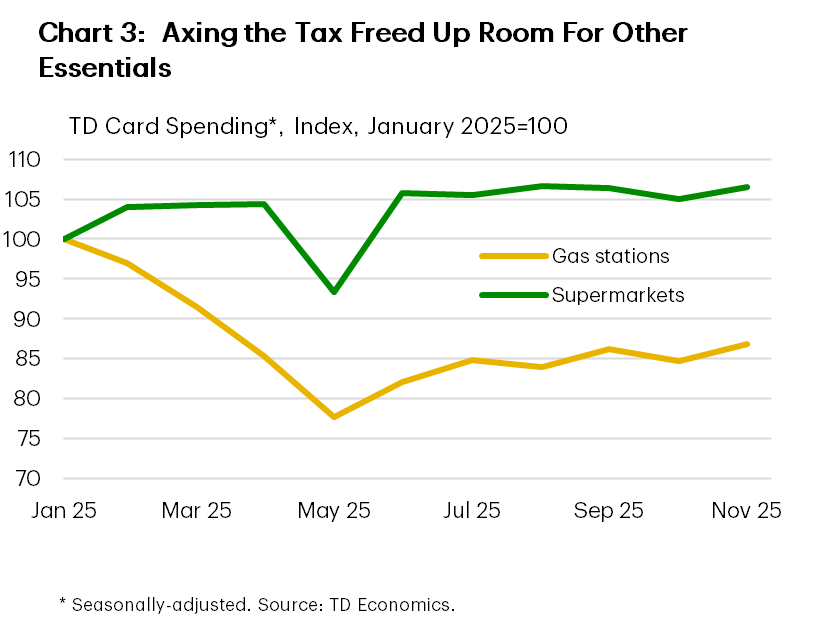

Spending on essentials paints a mixed picture. Outlays at gas stations fell sharply this year, reflecting lower fuel prices following the removal of the consumer carbon tax. This freed up capacity for households to spend elsewhere. Grocery spending, meanwhile, was a model of stability – holding near a 10% share of total spend and growing at roughly 4% throughout the year (Chart 3).

Bottom line

Canadians continued to spend on experiences this year, while shifting away from visits to American landmarks and adding more spending on physical goods. The trade and lower interest rate narratives run like red threads through spending preferences, though it has not been nearly as defining as the behavioural shifts seen during the pandemic. Overall, real personal consumption is expected to rise by a more modest 1.2% in 2026, slowing from the projected 2.5% this year.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: