The Weekly Bottom Line

Our summary of recent economic events and what to expect in the weeks ahead.

Date Published: December 13, 2024

- Category:

- Canada

Canadian Highlights

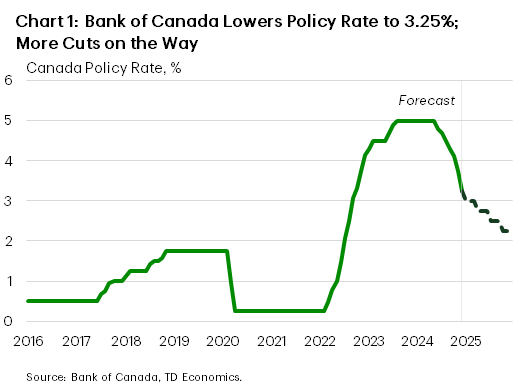

- The Bank of Canada lowered its policy rate by 50 bps to 3.25%. This is the second straight upsized cut to interest rates, and marks a cumulative 175 bps of easing since the Bank first lowered rates in June.

- There are more cuts to come in 2025, but the Bank’s forward-looking comments signaled greater uncertainty over the path for interest rates.

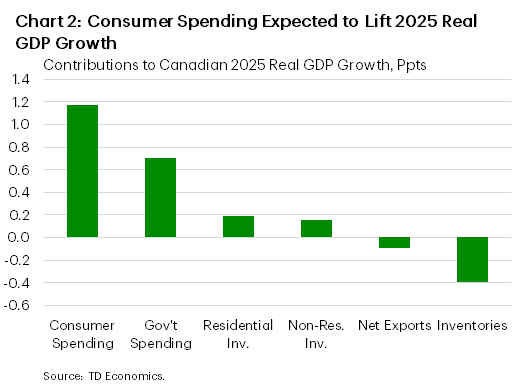

- Canadian household wealth continues to rise, bolstering our view that consumer spending will firm up over the coming quarters.

U.S. Highlights

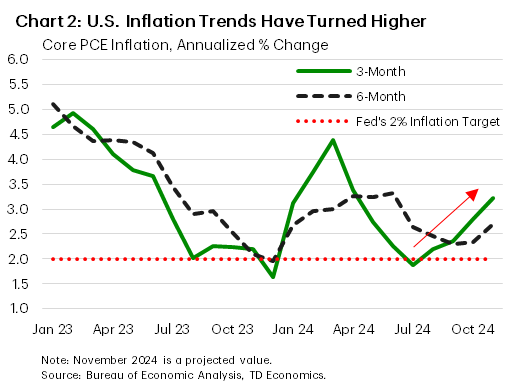

- November CPI inflation provided further evidence that progress on the inflation front has stalled.

- The FOMC is expected to cut its policy rate by another 25 bps next week and simultaneously hint towards a potential ‘pause’ in January to better assess recent inflation dynamics.

- The FOMC will also release a revised set of economic projections, which will shed some light on how Committee members’ views have shifted post-election.

It was the Bank of Canada’s (BoC) turn to take center stage this week and markets got the show they wanted. The Bank cut its policy rate by 50 bps to 3.25%–the second consecutive supersized cut. The BoC has now reduced the overnight rate by 175 bps since June (Chart 1). The decision met consensus expectations, but market moves over the week were choppy. The Canadian dollar appreciated almost half a percent immediately post-meeting but ended up losing ground, finishing the week at 0.7030 U.S. cents. Yields marched higher, with the Canadian 2 and 10-year bonds up 10 and 15 bps, respectively.

There is a lot to unpack in this announcement. The BoC has made it clear that the economy no longer needs to be clearly in restrictive territory. And with the Bank’s range for the neutral rate currently at 2.25–3.25%, the policy rate in the eyes of the BoC is in now in more balanced territory. The Bank feels that inflation is stabilizing around their two percent target and has now shifted towards prioritizing the softer growth outlook.

There was one key change in the statement that injected uncertainty about the path forward for interest rates. In October, the Bank stated that they “expect” to reduce borrowing costs if the economy evolves broadly in line with their forecasts. This week, that changed to, “going forward, we will be evaluating the need for further reductions in the policy rate one decision at a time.” It’s a meaningful shift in tone and one that all but takes another 50 bps move off the table.

The BoC acknowledged the host of domestic and external uncertainties facing Canada’s economy in 2025. For one, U.S. President-elect Donald Trump’s threat to place 25% tariffs on Canadian goods exports severely clouds the economic outlook. Meanwhile, recent immigration policy changes will stall Canada’s population growth inducing both demand and supply effects. A wave of fiscal stimulus including one-time payments to individuals and a temporary suspension of the GST also have the potential to reignite consumer spending channels. In fact, our recent forecast has consumer spending as one of the key drivers of 2025 real GDP growth (Chart 2). An update on Canadian household balance sheets this week also showed that wealth continues to rise, bolstering our view that spending should continue to firm in the near-term.

As discussed in our recent forecast, we expect the BoC to cut another 100 bps–or one 25 bps cut per quarter–in 2025 to reach our estimate of the “neutral” rate by 2.25%. There is little doubt that elevated interest rates did their part in taking heat out of the economy. We think a gradual pace of further cuts is the prudent decision to allow the economy to slowly close economic slack, while minimizing the risk of reigniting inflation. The BoC has is navigating a tough stretch ahead as it aims to balance many competing forces in an effort to properly calibrate interest rates.

Marc Ercolao, Economist | 416-983-0686

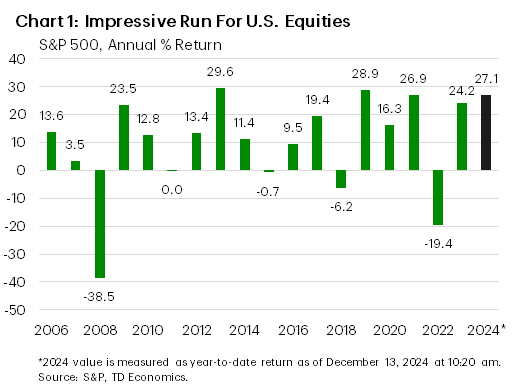

For a year that was supposed to eke out only modest equity gains, the S&P 500 is up an impressive 27% year-to-date (Chart 1). The return is even more notable given that the Federal Reserve has so far delivered on only 75-bps of policy easing, or considerably less than the 150-bps priced by futures markets for 2024 at the end of last year. And even though another quarter-point cut is universally expected next Wednesday CPI and PPI data out this week provided more evidence that progress on the inflation front is indeed stalling and will likely lead to a more gradual path of policy easing in 2025.

Headline CPI inflation accelerated by its fastest pace in seven months in November, pushing the twelve-month change to 2.7%, up from its three-year low of 2.4% in October. Meanwhile, core inflation rose at a similar pace to the prior three-months, though the composition of price pressures shifted somewhat. Services inflation cooled last month, owing to a notable deceleration in shelter costs, but this was offset by a sharp uptick in goods prices and firm readings on ‘supercore’ inflation.

The Fed’s preferred inflation gauge, the core PCE deflator, is released next Friday. Mapping the CPI data into core PCE points to a ‘soft’ 0.3% m/m increase in November, pushing near-term trends higher (Chart 2). This is likely to unnerve FOMC members, who need to see further evidence of cooling inflationary pressures before committing to future rate cuts. This is a message that Fed Chair Powell is likely to telegraph at next week’s policy announcement.

The FOMC will also release a revised set of economic projections, which will provide insight on how policymaker’s view of the outlook and future path for the policy rate has shifted post-election. In the September projections, the median ‘dot’ assumed 100-bps of policy easing in 2025, or nearly double what’s currently reflected in futures pricing. However, core PCE inflation is running about 25 bps hotter than the 2.6% assumed in the last set of projections for the fourth quarter of this year. This suggests that the median dots for 2025 could shift a bit higher. But that’s by no means a guarantee, as each Committee member will make their own assumptions on scope, magnitude, and timing of potential policy changes under the incoming administration. This could very well lead to a wider dispersion in forecasts.

This is exactly what happened in December 2016, following the last Republican sweep. Transcripts from those FOMC meetings show that roughly half of the FOMC members incorporated some degree of fiscal stimulus in their individual forecasts. So even though Powell is unlikely to speculate on the impact of potential policy changes during next week’s press conference, it’s very likely that some FOMC members will have baked in some impacts from tariffs and/or tax cuts into their revised projections. Given the policy uncertainties and the fact that recent inflation readings have shown that progress has stalled, we suspect that the FOMC will open the door to a ‘pause’ on rate cuts in January and shift to cutting rates at every other meeting in 2025 (see financial forecasts).

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: