Highlights

- TD Spend data suggests that the Eras Tour boosted spending in Ontario’s services sector relative to its own performance in November of previous years, but the overall economic impact was modest.

- One exception is recreation and entertainment (R&E) – a category that includes restaurants, bars, and concert venues – saw a remarkable year-on-year surge of 15% in spending in November.

- The boost in R&E may have been just enough to help Ontario outperform the national average in November – a welcomed break from an unfavourable trend.

It’s tempting to believe that a celebrity’s tour could single-handedly lift economic performance. Such is the premise behind “Swiftonomics” – the idea that Taylor Swift’s Eras Tour boosts local economies by spurring spending on travel, hotels, restaurants, sequined dresses, bejeweled purses, and, of course, makeup for red lips and rosy cheeks.

If economic growth were that simple, provinces could line up concerts year-round and watch GDP soar. To assess whether her November performances in Toronto had any meaningful impact on Ontario’s economy, we turned to TD Spend daily data. The six concert shows that ran November 14-16 and November 21-23 offer a prime opportunity to examine changes in consumer behaviour. Given the noisy nature of daily data, we refined our analysis by comparing year-on-year changes for corresponding days of the week in addition to the full month of November. We then compared year-on-year growth rates in Ontario relative to trends in the rest of Canada.

The data suggest that the Eras Tour boosted spending in Ontario’s services sector relative to its own performance in November of previous years, but the overall economic impact was modest. Even within services, the increase was within typical ranges, indicating that the growth may have reflected broader improvements in consumer sentiment rather than solely driven by the concerts. Sectors commonly associated with such events - travel, lodging, clothing and accessories – showed growth at the upper limit of their typical range but did not push into extraordinary territory. Still, we must give a nod to the notable acceleration in year-on-year growth relative to October, suggesting there was a joyful skip in the step of consumers.

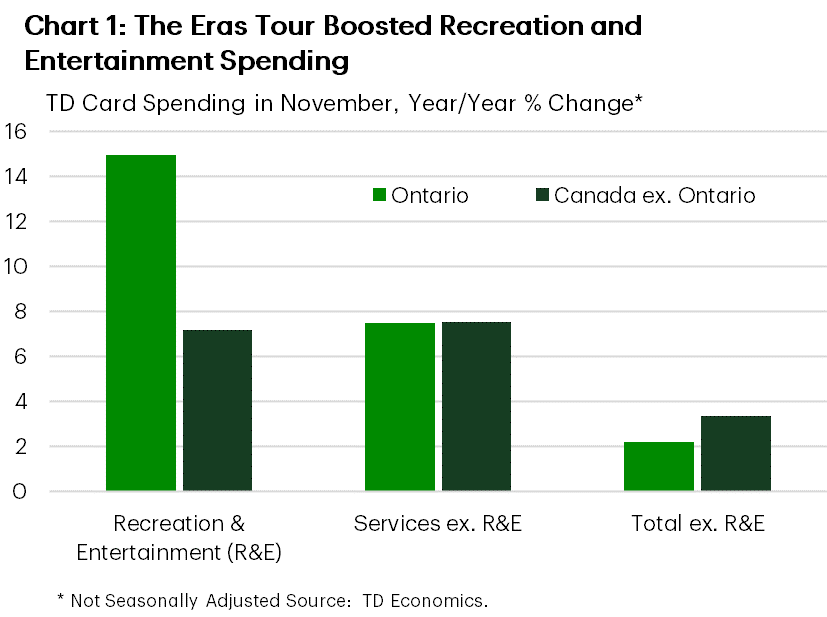

One area of spending was particularly fearless: recreation and entertainment (R&E), which includes restaurants, bars, and concert venues. Year-on-year spending surged by 15% in Ontario in November – more than double the 7.2% growth observed in the rest of Canada (Chart 1). In contrast, services spending excluding R&E was on par between Ontario and the rest of the country, while total spending excluding R&E grew at 2.2% in Ontario – 1.1 percentage points lower than in the rest of Canada.

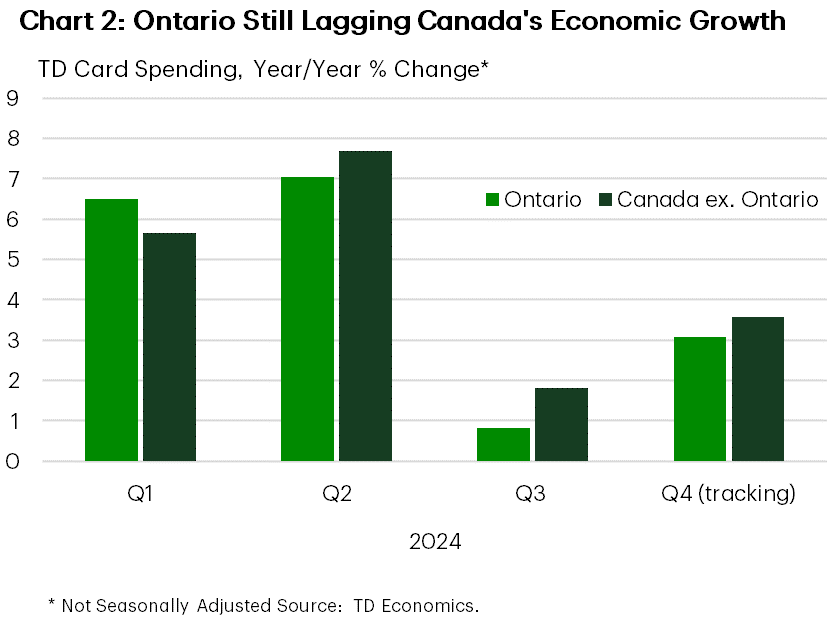

What we conclude is that the Eras Tour, as massively spectacular as it’s been, channeled spending into one category, rather than lifting all tides of spending. The boost in R&E spending, however, may have been just enough to help Ontario outperform the national average in November after five months of lagging. A welcomed break from an unfavourable trend that can still be seen in the quarter-on-quarter performance (Chart 2).

One caveat to this analysis is that TD Spend data accounts only for spending by Canadian residents and does not capture the total receipts of merchants in Ontario. This excludes the impact of international visitors, where the total spending-effect will be grossed higher. Statistics Canada retail sales data will offer a fuller picture, but we’ll have to wait until January to find out. Other sources of data could be border crossings and hotel occupancy rates that are also likely to come out early next year. Some sources point to a more pronounced impact, at least in Toronto. Destination Toronto estimated a $152 million impact in direct spending for the city’s economy, and data from Moneries – the top point of sales system in Canada – suggests international spending more than doubled during the period of the tour.

For now, it’s safe to say that Taylor Swift’s visit to Ontario felt more like a spending aftershock than the earthquake itself. It might be different in British Columbia, where she toured this weekend – we’ll have to wait and see. She did, however, make the whole country shimmer.

Now that the glow of the Eras Tour fades, it will be the time for Canada to wake up from its wildest dreams, roll up its sleeves, and tackle pressing realities: the housing affordability crisis, trade uncertainties, sluggish growth, and productivity challenges.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: