- Global growth has stood up to trade turmoil better than many feared earlier this year. Even with momentum expected to slow in 2026, it will be to a lesser extent than we expected three months ago.

- In contrast, the U.S. economy is forecast to gain a step as Fed rate cuts, the One Big Beautiful Bill Act (OBBBA) and regulatory changes provide a tailwind.

- Canada is also an economy of contrasts. Government initiatives to boost investment are likely to meet some resistance with 2026’s CUSMA review. The Bank of Canada has done its part, with government spending set to play an increasing role.

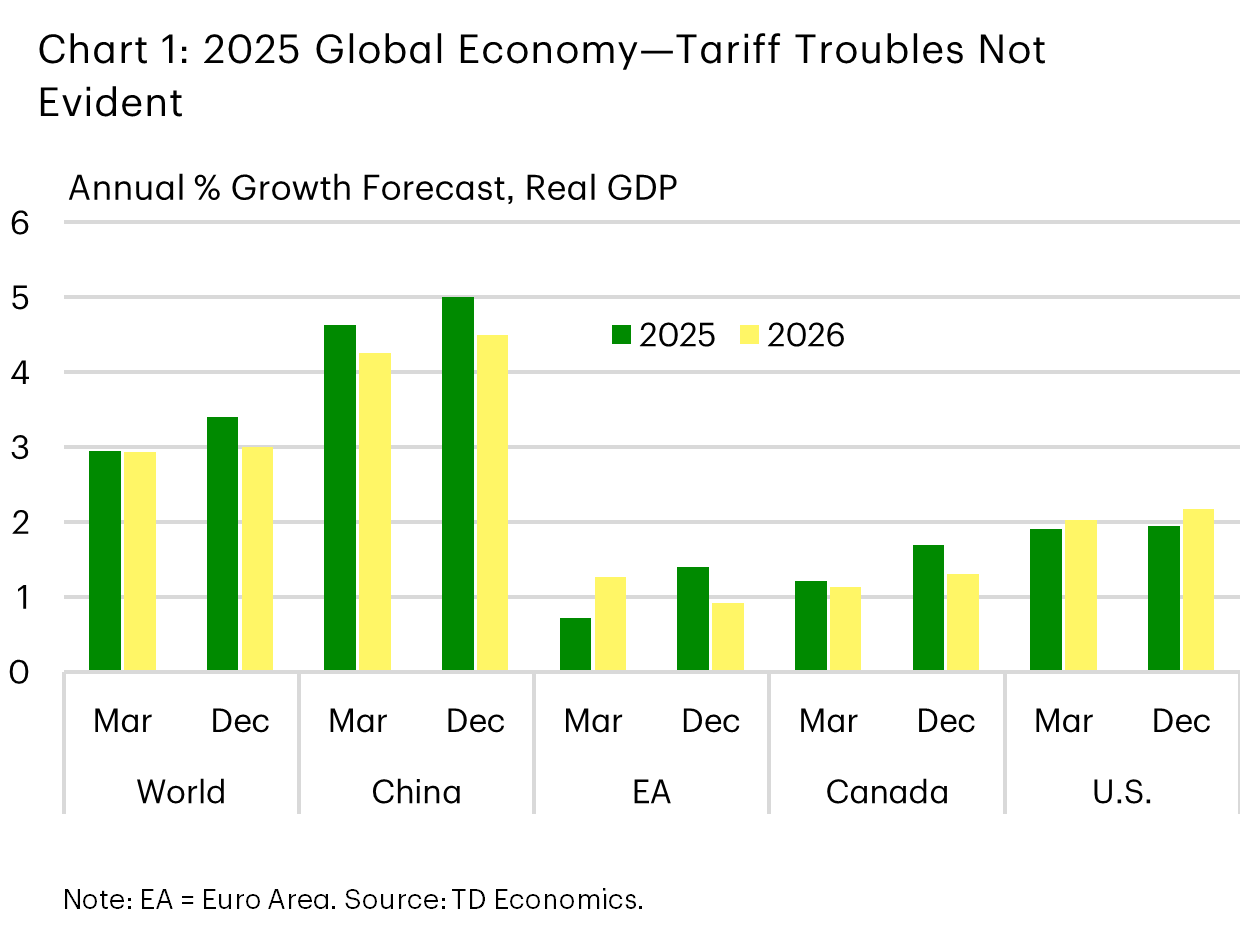

As the world turns the page on 2025, key global growth players are on track to meet or exceed our forecasts from earlier this year, despite the disruption from U.S. trade policy (Chart 1). For a variety of reasons tariffs have not proven as punitive compared to the announced tariff rates, and interest rate cuts by global central banks provided a needed tailwind (see report). Looking ahead, the same story will unfold, but a further downshift is likely as most major central banks have reached the end of rate-cutting cycles and must now ensure balanced policy against stable inflation. And while government deficits are expanding in many economies, this is not a universal theme. Some face pressures to consolidate, minimizing the global fiscal impulse next year.

China was among the forecast outperformers, albeit investment is now weakening. This most recent bump in the road will firm the resolve of authorities to prop up the economy through policy support next year. Meanwhile, governments in the eurozone are expected to ramp up spending, particularly on defense. However, it will take time for major countries to follow through on their announcements, with that fiscal impulse becoming more evident in the second half of 2026.

Tailwinds set to lift U.S. economy in 2026

The U.S. economy too was resilient and outperformed expectations, albeit much has yet to be revealed. The government shutdown has delayed the release of key official data, including third quarter GDP data, which is typically used to inform this forecast. Surveys and alternative private sector sources suggest some sluggishness has materialized recently. This wouldn’t be a total surprise in the face of the longest government shutdown in history, amidst the other policy shocks from trade and immigration.

However, looking ahead to 2026, there are at least three tailwinds set to lift growth, including: fiscal stimulus from the One Big Beautiful Bill (which will help to lift household incomes and boost business investment through the accelerated depreciation), regulatory reform and the AI data center power boom. These tailwinds create a healthy updraft in growth from 1.8% in 2025 (on a Q4/Q4 basis) to 2.2% next year.

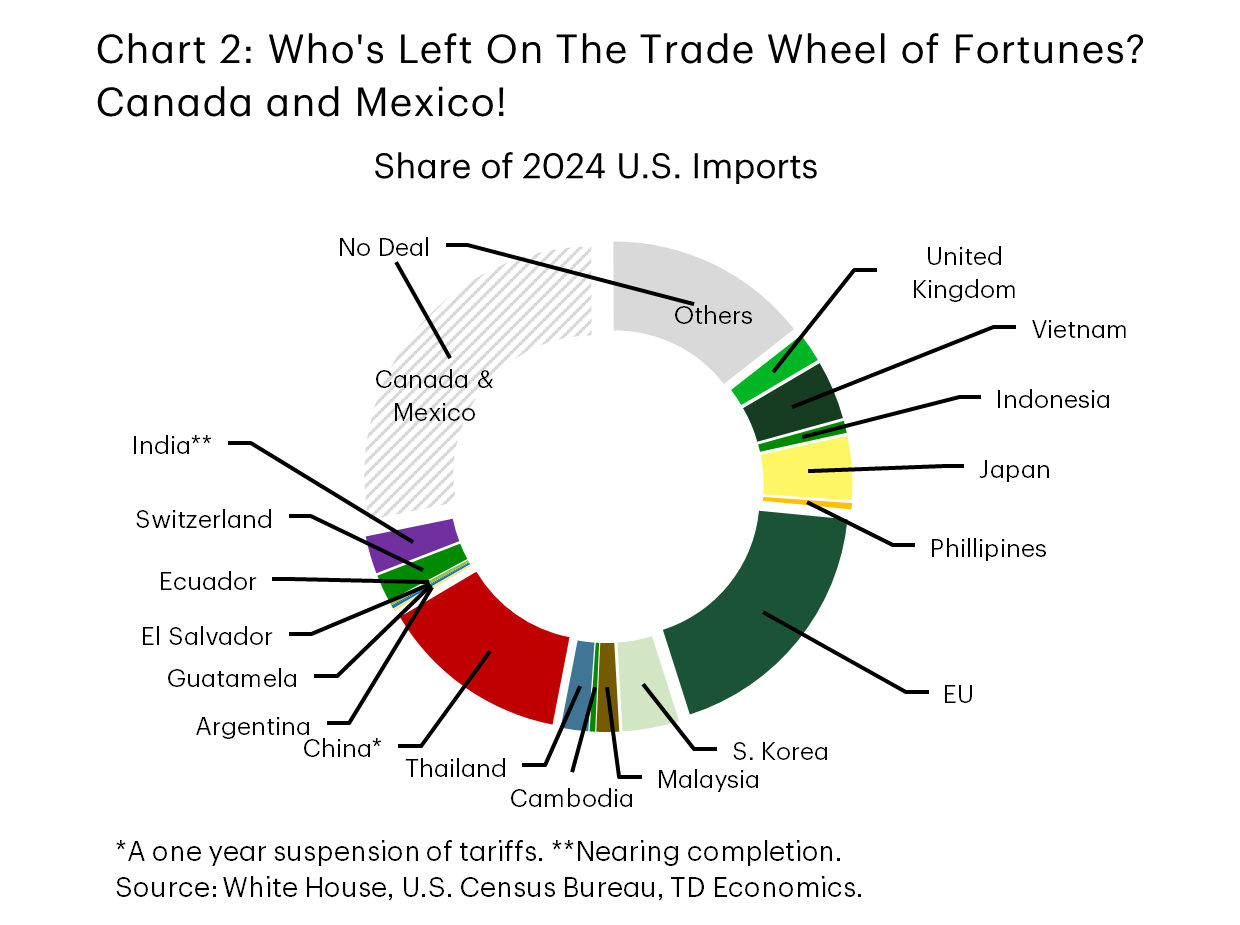

AI was not only a big part of the story in the stock market, but also in the real economy. AI related investments drove half the growth in the U.S. economy so far in 2025. CAPEX in most other areas remained subdued, reflecting heightened uncertainty following the stop-start rollout of trade policies. However, the recent string of trade agreements, which now covers 60% of US imports – has helped to reduce uncertainty (Chart 2). Nearly a quarter of small businesses are planning to make capital outlays over the next 3-6 months – the highest level in nearly a year. This supports a rotation in investment next year, supported by the OBBBA.

However, consumer spending has been losing steam. It grew at an annualized rate of 1.3% through the first nine months of the year – less than half its 2024 pace. Tighter immigration, a softening labor market, and general economic uncertainty have been contributors. There’s also reason to believe that lower-and-middle income earners have disproportionately pulled back on discretionary spending, while higher-income spending remains robust. Although delinquencies for credit cards and autos have risen across all income levels in recent years, the lower-and middle-income earners have seen the steepest increase with today’s rates holding well above pre-pandemic levels. Likewise, auto delinquencies for lower-and-middle income earners continue to climb.

Unfortunately, the Fed has nothing in its toolkit to address the ‘K-Shaped’ spending pattern that is taking hold. We expect the Fed to lower the funds rate to 3.25% in 2026, which should provide some relief to struggling households. As for future homeowners, they may not see as much of a benefit flow through fixed-term mortgage rates relative to today’s levels (see report). The White House has taken notice of household dissatisfaction, with confidence by some measures at an all time low. The administration has shifted focus towards addressing affordability more directly, starting by dropping tariffs on over 200 imported food products to help with grocery bills. It has proposed mortgage policy changes, including 50-year mortgages that lower payments but could push up housing prices over time. Also, portable mortgages may allow people to keep their lower rates when moving, which could help increase housing supply. Finally, President Trump has floated $2,000 tariff dividend checks for working-class families. It remains to be seen how much influence the fiscal hawks in Congress would have in restraining or altering that intent. In the meantime, these policy proposals are not included in our forecast but would boost consumer spending and the housing market if enacted.

Cloudy with a chance of tariffs for Canada

Canada’s outlook has a Charlie Brown cloud hanging over its head with the future of the U.S. trading relationship still undetermined. Tariffs already in place are having clear impacts on Canada’s economy, most obvious in the three straight quarters of businesses cutting back on investments. Unfortunately, we do not expect clarity on U.S. market access or a reduction in tariff rates in 2026. The review of CUSMA is underway and we don’t know which side of the coin the outcome will land. It could result in a better or worse situation than Canada’s already in. This uncertainty will hold back growth in the economy to another sub-par year in 2026.

Not all is downtrodden. Residential investment has held up through mid-year as re-sale activity picked up after a first-quarter freeze. Robust growth in rental construction has buoyed housing starts. However, this effect has faded to start the fourth quarter, as purpose-built rental construction slowed in October and sales have trended sideways since August.

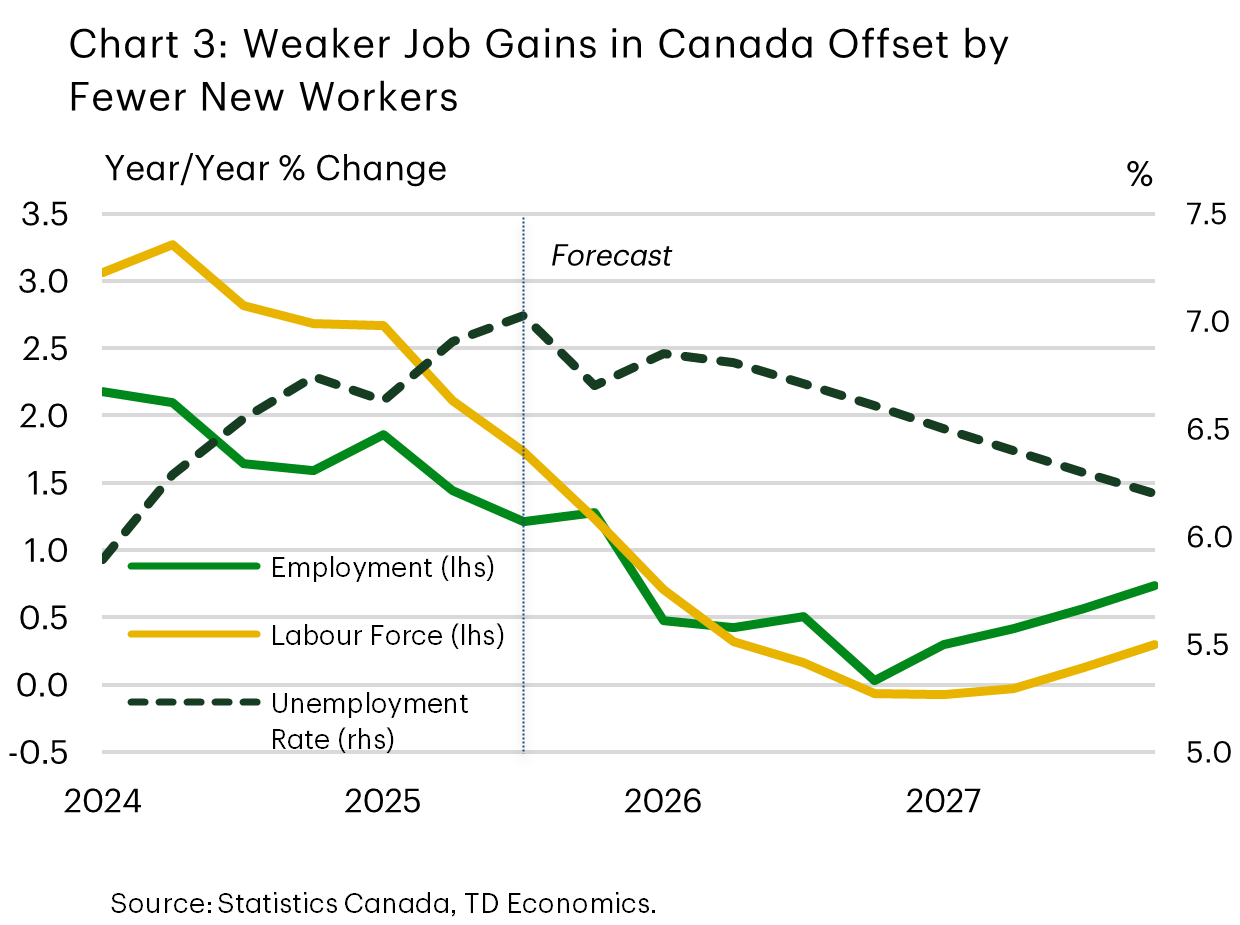

Canada’s labour market has also defied gravity recently. The unemployment rate had risen steadily since mid 2023, but has improved from 7.2% in the summer to 6.5% in November. Given the shifts in Canada’s immigration policy (see report), the labour force sees only minimal growth in the coming quarters, which limits the rise in the unemployment rate that would normally be expected given a very ho-hum economic outlook (Chart 3).

The consumer has been more resilient than expected so far in 2025, with patriotic spending domestically helping to buffer the hit to confidence. However, this performance gets harder to sustain next year as the longevity of economic uncertainty takes a toll on consumer confidence and hiring intentions. It will, however, help cap upward pressure on prices stemming from ongoing trade disruptions. We agree with the Bank of Canada’s assessment that inflation risks appear balanced. If the economy persists on the modest growth path outlined in the table, we expect the Bank of Canada to hold its overnight rate at 2.25% for the foreseeable future.

Before you head for the exits, there are upside risks to the forecast. Canada continues its efforts to diversify trade relationships and build out infrastructure. Government spending is a key support to growth over the next two years. We have been conservative on how much private investment is unleashed by the federal government’s recent efforts in the budget (see report). So, a better-than-expected execution presents an upside risk to the outlook. The other upside risk is on the trade front. If the CUSMA review goes better than expected and results in a more favourable tariff regime than today, we could see the dark clouds part on investor sentiment in Canada, brightening the growth outlook.

For any media enquiries please contact Oriana Kobelak at 416-982-8061

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.