Mortgage Holders Have Moved Away From The Cliff Edge

Maria Solovieva, CFA, Economist | 416-380-1195

Date Published: November 20, 2024

- Category:

- Canada

- Real Estate

- Consumer

Highlights

- Our analysis suggests that mortgage renewals are going to be less stressful for households than previously feared, with aggregate payments on Canadian mortgages poised to decline for balances outstanding as of mid-2024.

- The key factors behind this expected easing are lower interest rates and increased payments, which have helped to front-load the payment shock.

- In turn, reduced debt payments could stimulate consumer spending more than expected, shifting the balance of risks toward higher inflation. This could challenge the Bank of Canada’s goal of ‘sticking the landing’ and argues for a more measured and gradual approach to rate cuts.

Like the proverbial mouse that fell into milk and churned it into butter to survive, Canadian mortgage holders, facing renewals at much higher rates, took pre-emptive steps to reduce the impact to their budgets. Last year, despite widespread unease and predictions of hardship for households facing the steepest mortgage payment increases in decades, we argued that Canadian households could weather the renewal shock.

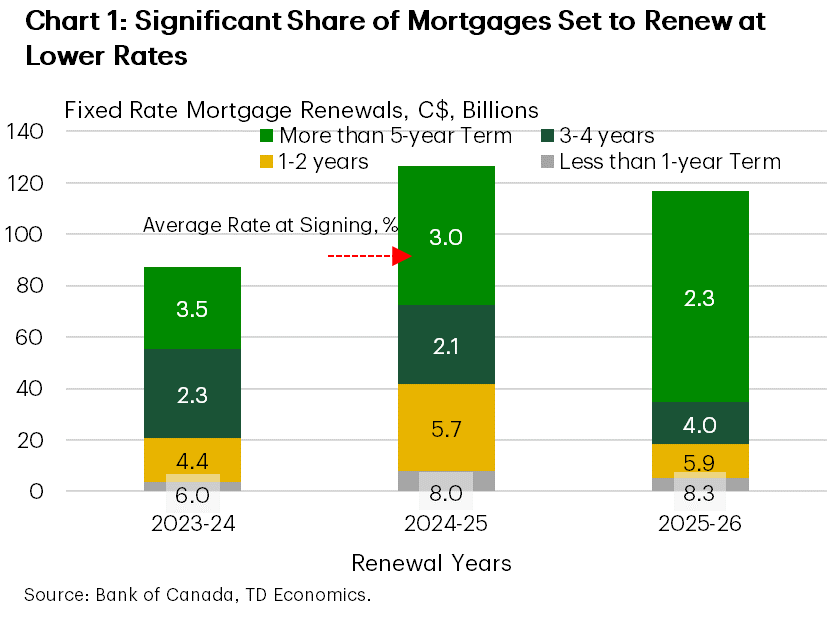

And indeed, they did – by refinancing into fixed-rate mortgages, increasing regular payments, and reducing spending to support debt servicing. In fact, many Canadians who renewed or initiated their mortgages at the interest-rate peak opted for shorter terms, positioning themselves to reset their mortgages at a LOWER interest rate in the coming year thanks to a significant reduction in interest rates (Chart 1). These actions reduced the financial stability risk associated with mortgage renewals, and created breathing room in consumer budgets, providing a moderate tailwinds to consumer spending. While we still expect consumers to remain cautious overall, this positive trend could offer a boost to consumer spending in 2025.

Mortgage Renewal Less Shocking than Feared

Unlike many analysts, in last year’s report, we anticipated that consumers could withstand the mortgage cost shock from renewing mortgages with historically low rates into ones with decade-high rates. Our view was based on detailed estimates of mortgage payments, drawn partially from TD’s internal mortgage data and complemented by several key assumptions, which we invite readers to review here. We have updated our estimates to align with what has transpired over the past year in payments, interest rates, and amortization.

The results suggest that, for the balance of Canadian mortgages outstanding as of mid-2024, aggregate payments are poised to decline by 1.2%—a significant easing relative to the 0.5% increase previously anticipated for 2025. This reduction will occur despite a higher-than-expected $75 billion (or 3.5%) increase in household mortgages outstanding to date.

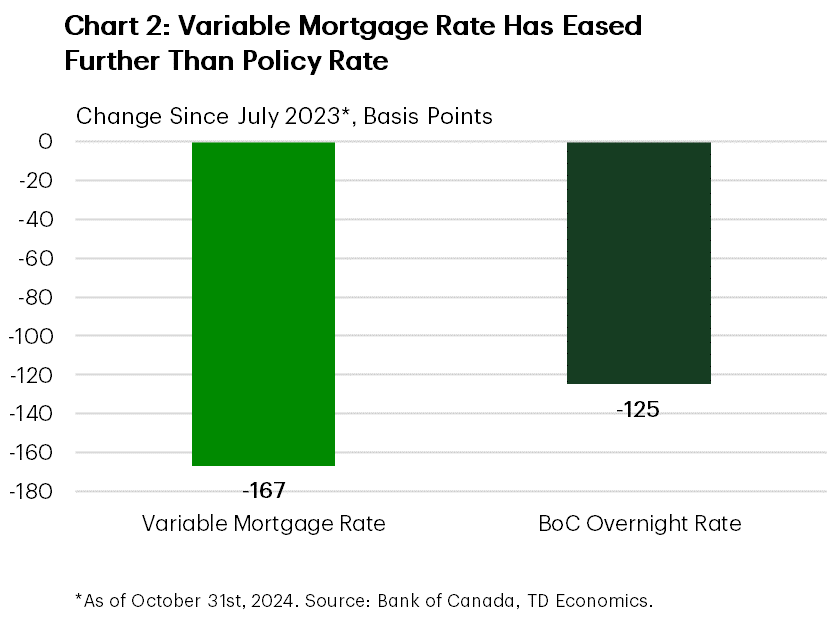

Two major factors drive this decline. The largest is looser-than-expected financial conditions. While the reduction in the overnight rate was in line with our forecast from a year ago, actual variable mortgage rates have dropped an additional 42 basis points due to heightened competition among lenders offering more attractive rates to secure customers (Chart 2). This competitive discounting extends into the fixed-rate market, albeit on a smaller scale.

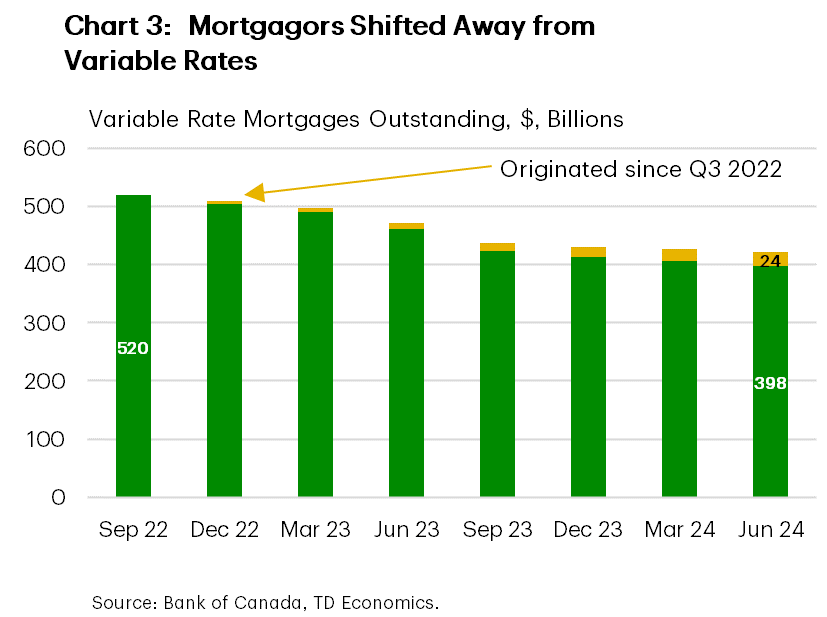

The second driver is a shift in mortgage composition, which has helped households front-load the payment shock. Borrowers have increasingly switched to fixed-rate mortgages, aiming to lower payments or avoid rate volatility (Chart 3). We estimate that of the $520 billion variable-rate mortgages (VRM) held at chartered banks at the end of 2022, 14% switched to fixed-rate mortgages or made pre-payments.

It’s Not All Roses

Aggregate statistics often mask the struggles some individual mortgage holders face. Despite this relatively positive outlook, certain borrowers are experiencing strain. According to Equifax, mortgage delinquency rates remain below pre-pandemic levels, but delinquency rates for most other credit products have reached or exceeded pre-pandemic levels. This suggests that some borrowers may be prioritizing mortgage payments over other debts. Furthermore, regional differences show a more nuanced picture, with Ontario and B.C. showing increased stress. In fact, Ontario has surpassed its pre-pandemic delinquency rates.

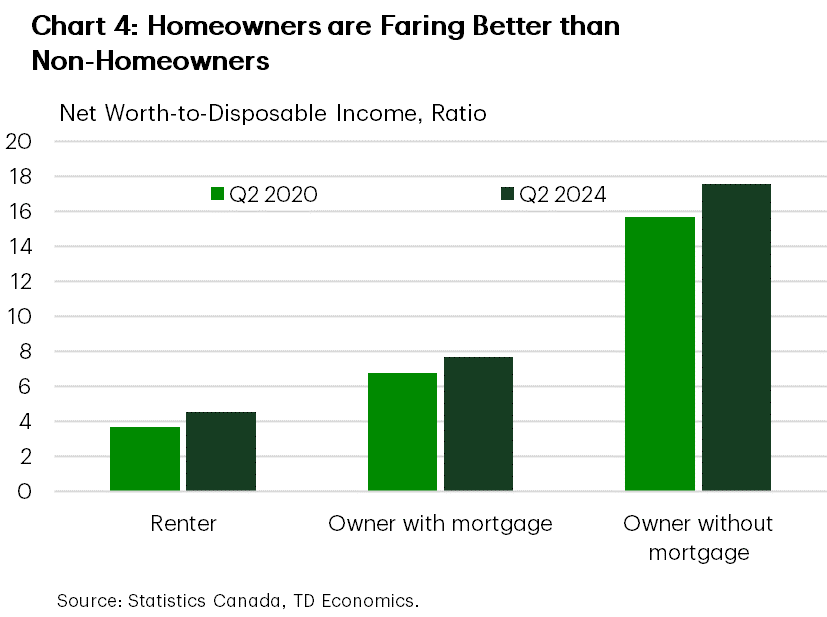

However, from an overall financial health perspective, households fortunate enough to have become homeowners in recent years are generally faring better than non-homeowners. The latest Survey of Financial Security underscores the significant role of homeownership in wealth accumulation across demographic groups. Recent data indicates that homeowners’ net worth metrics remain well above those of renters (Chart 4). That’s because despite recent declines, home prices remain approximately 30% higher than pre-pandemic levels, suggesting that most homeowners have built substantial equity that could be leveraged in tough times.

From Consumption Headwinds to Tailwinds

All in all, households appear to have financial flexibility, some of which is due to borrowers’ own efforts. The mortgage adjustments described above have come at a cost to the broader economy, as households reallocated funds toward debt payments, reducing consumption. It’s possible that some households overcorrected, cutting back more than necessary. The savings rate has surged to a high level relative to history, pushing cumulative ‘excess savings’ (those above the pre-pandemic trend) to an estimated $160 billion.

The shift from spending to saving is exactly what the Bank of Canada intended when it raised interest rates dramatically in 2022-23. But with the easing cycle now underway, lower mortgage payments have the potential to support consumer spending, just as higher payments previously dampened it. The largest economic boost from lower rates is likely to come from Canada’s favourite pastime—house shopping and related expenditures—as these are highly interest-rate sensitive. Lower rates have already begun to unlock housing demand, with home sales surging recently. TD Economics expects the Bank of Canada to cut rates by another 150 basis points through 2025, with the 5-year conventional mortgage rates projected to decline another 40 basis points through mid-2025. The federal government’s recent adjustments to mortgage rules aimed at helping “more Canadians, particularly younger generations, buy a first home” should further support both home sales and prices in early 2025.

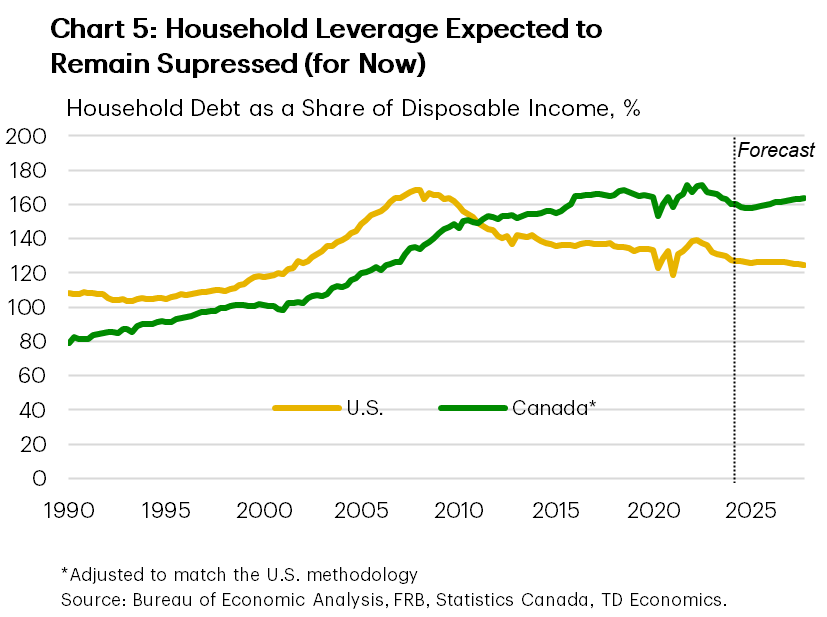

As a result, our latest estimates suggest new mortgage volumes will grow by 4-5% over the next two years. Combined with our projections for mortgage payment changes on outstanding balances, overall mortgage payments in Canada are expected to remain relatively flat for the next two years, keeping the Debt Service Ratio on a modest downward trend. Since mortgage payments are deducted from household income to calculate disposable income, this raises our disposable income forecast, leading to a lower debt-to-income ratio. This ratio is projected to dip below 160 in the first half of 2025 before resuming an upward trajectory. Despite this improvement, Canada’s debt-to-income ratio remains over 30 percentage points higher than in the U.S., where households underwent a sharp deleveraging post-Global Financial Crisis (Chart 5). This divergence helps explain Canada’s comparatively weaker consumer spending growth over the long term, as Canadians need to devote more of their budgets to servicing their larger debt burdens.

Nevertheless, over the short term, lower debt payments could contribute up to a 1.6 percentage point boost to annual average nominal consumption growth in 2025 if all savings are redirected into spending. While substantial, this boost may not significantly impact inflation, provided other areas (like shelter costs and wages) continue to moderate. However, this potential lift in demand should not be overlooked by the Bank of Canada, as it could tip the balance of risks toward higher inflation, challenging Governor Macklem’s goal of ‘sticking the landing’. In interest rate terms, this suggests a more measured and gradual easing approach, abandoning emergency-style cuts of 50 basis points.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: