The Weekly Bottom Line

Our summary of recent economic events and what to expect in the weeks ahead.

Date Published: March 6, 2026

- Category:

- U.S.

Highlights

- Global equity markets sold off this week, while energy prices pushed meaningfully higher following the United States and Israel’s strikes on Iran.

- Despite this week’s sharp move in oil prices, the impact to the U.S. economy remains relatively small, but that assumes the conflict is short-lived.

- The February employment report came in on the softer side, with hiring declining and the unemployment rate ticking higher.

Epic Fury Sends Shockwaves Through Financial Markets

The United States and Israel launched coordinated strikes on Iran over the weekend, prompting retaliatory counterattacks across other countries in the Middle East. On Monday, Iran announced that it would attack tanker ships passing through the Strait of Hormuz – a crucial choke point for 20% of global oil supply. Based on satellite imagery, shipping through the passage has effectively come to a halt. Energy prices pushed meaningfully higher this week, with WTI up roughly 33% (or $18per-barrel) and currently sits just north of $88 – its highest level since September 2023. U.S. equities were under pressure for most of the week, with February’s softer employment report adding further insult to injury on Friday. The S&P 500 looks to end the week down over 2%. Meanwhile, Treasury yields across the curve were about 20 basis points higher, as market participants pushed out the timing of expected rate cuts amid fears that higher oil prices will add further upward pressure to inflation.

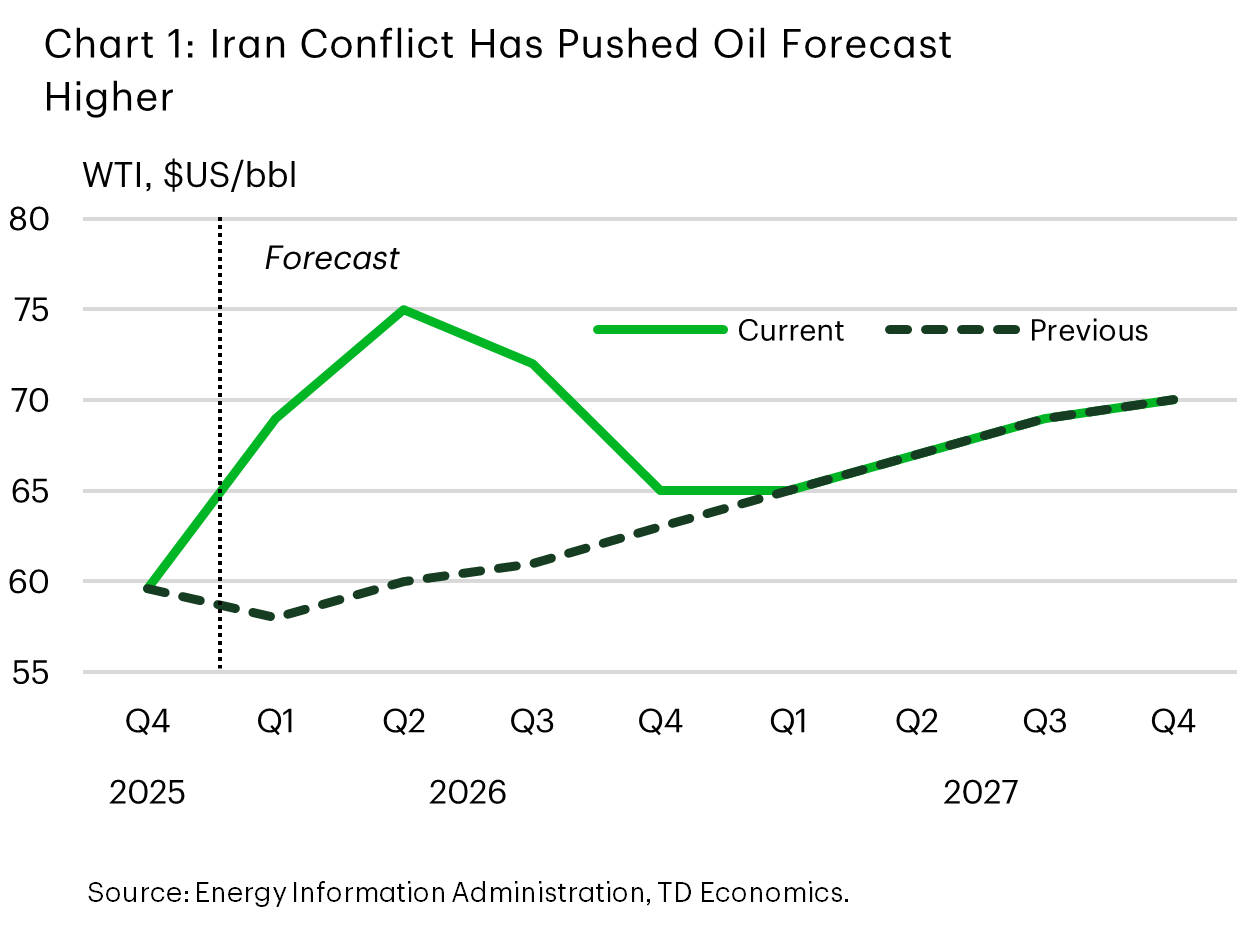

Despite the sharp move in oil prices, the impact to U.S. economy (so far) remains relatively small. In large part, that’s because the U.S. is now a small net exporter of oil, so energy shocks don’t pack the same punch that they used to. Case in point: we’ve marked-to-market our oil forecast, and the upgrade (shown in Chart 1) only shaves about a tenth of a percentage point from 2026 GDP growth – barely moving the needle considering our forecast of 2.7%.

But to say that uncertainty is elevated at the moment would be an understatement. President Trump and other administration senior officials have said this week that the conflict could drag on for at least another several weeks. This suggests further upside to oil prices over the near term, particularly if oil supplies were to remain choked off indefinitely.

From the Federal Reserve’s perspective, economic theory would tell us that policymakers should “look through” the energy shock given its supply driven nature. But because the jump in oil prices is coming atop already elevated inflationary pressures, Fed officials are likely to keep a close eye on inflation expectations. So far, market-based measures have remained well anchored, but there is a risk that they could start to drift higher, particularly if the conflict were to drag on.

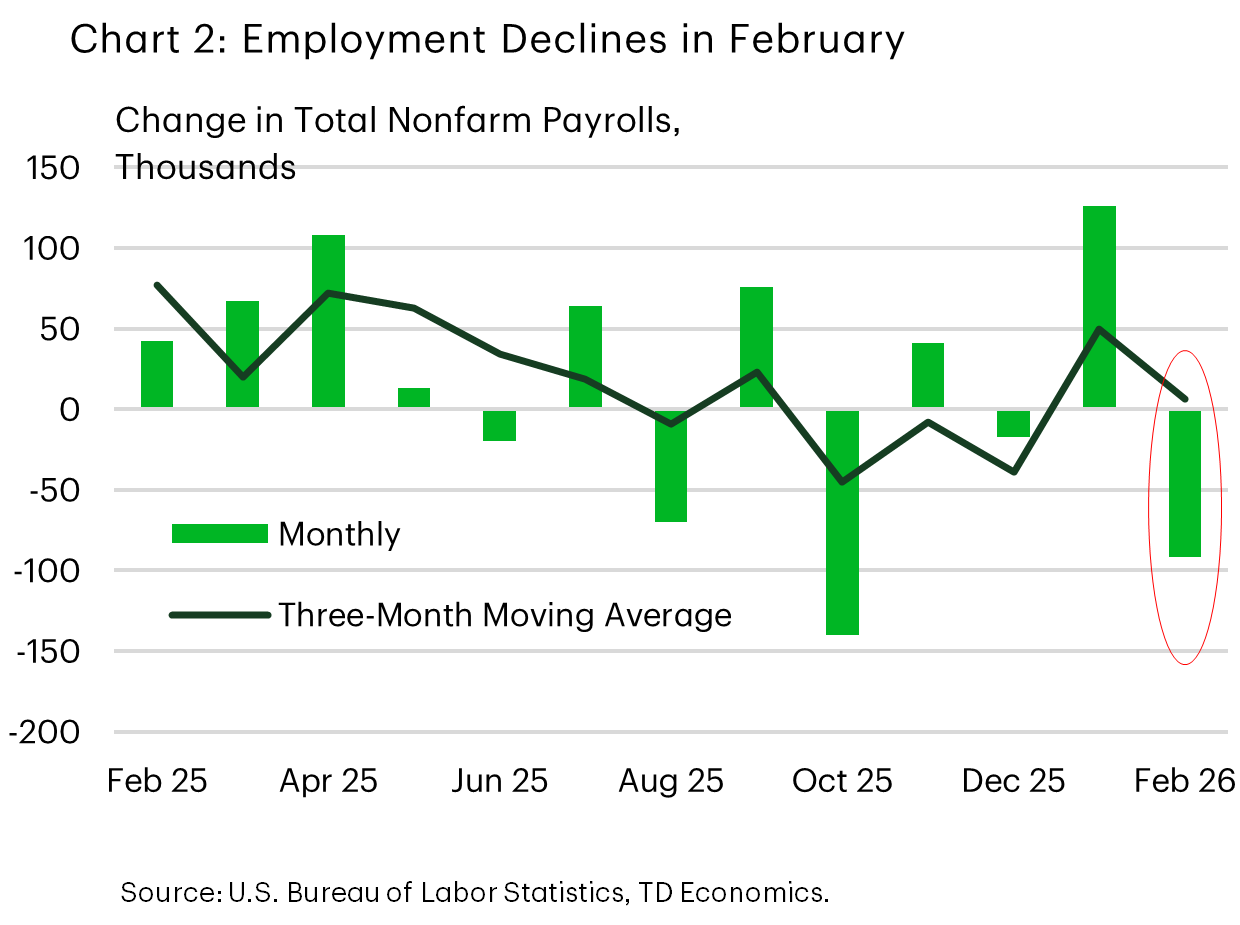

The further upside risk to the inflation outlook comes at a time when market participants have started to question the labor market narrative. Nonfarm employment unexpectedly declined in February (Chart 2), while the unemployment rate ticked up to 4.4%. On the surface, the employment report looked very weak, but there were a few factors including a strike and potential weather-related impacts that contributed to at least some of last month’s pullback. We feel it’s still too early to upend our prior thinking of the labor market – but it certainly underscores that current conditions are far from perfect. At the moment, the greater threat to the Fed’s dual mandate is price stability. That is reflected in market participants having pushed out the timing of next rate cut until September and are only 80% priced for a second cut.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: