The Weekly Bottom Line

Our summary of recent economic events and what to expect in the weeks ahead.

Date Published: June 27, 2025

- Category:

- Canada

Note: The next issue of the Weekly Bottom Line will be published on Thursday, July 3.

Canadian Highlights

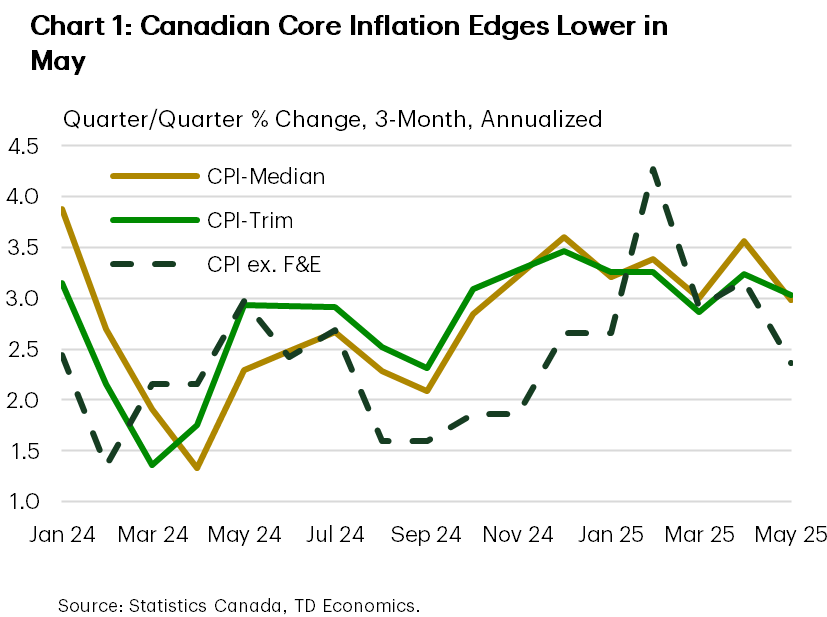

- Headline inflation for the month of May landed in line with expectations of a soft print. Core measures, while still elevated, showed signs of cooling.

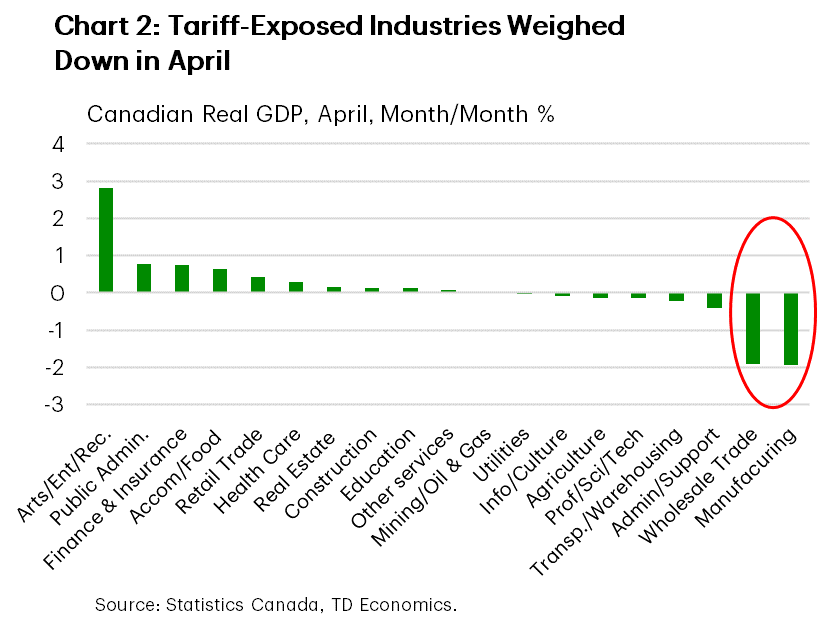

- Industry-based GDP contracted in April, with a similar fate expected in May. Tariff-exposed industries are bearing the brunt of the blow.

- Canada committed to the new NATO pledge to spend 5% of GDP on defence by 2035.

U.S. Highlights

- An abrupt ceasefire between Israel and Iran sent oil prices tumbling, while stock markets rejoiced on the news, with the S&P 500 up roughly 3% on the week at the time of writing.

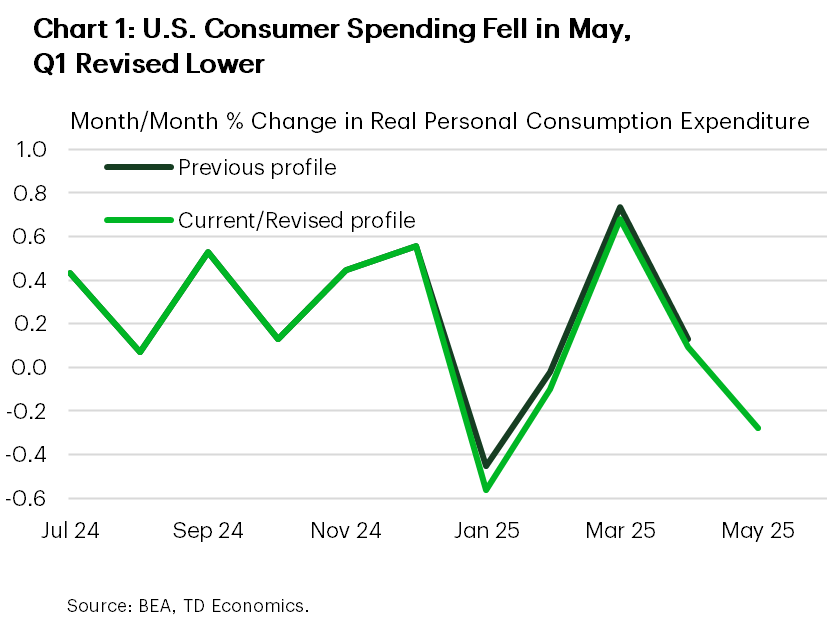

- The U.S. consumer is showing signs of fatigue with real spending falling 0.3% in May.

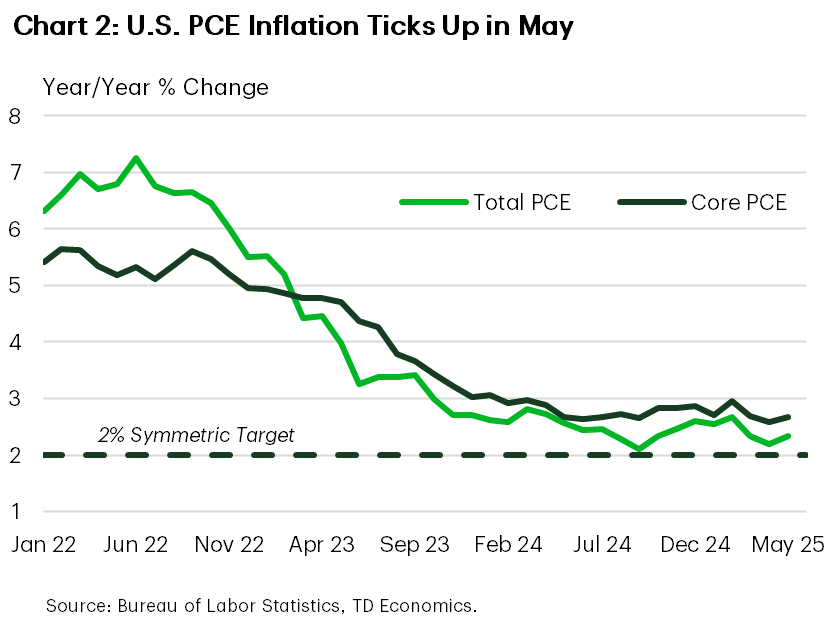

- The Fed’s preferred inflation gauge, core PCE, ticked up modestly from 2.6% to 2.7% (y/y) in May.

This week we received the first of two inflation updates that the Bank of Canada (BoC) will use to guide their policy decision on July 30. May’s headline inflation came in at a 1.7% year-on-year (y/y), meeting consensus expectations. Recent soft readings have been tamped down by the end of the consumer carbon tax, something we expect to linger for the coming months. Total inflation has averaged right at the BoC’s 2% target for the better part of the last year, with areas like shelter inflation starting to see some reprieve.

Core inflation on the other hand has run warmer, though underlying price pressures eased up a bit in May. Case in point, the BoC’s preferred core (CPI-trim and CPI-median) and the traditional core (ex-food and energy) measures all moved lower on a three-month annualized basis (Chart 1). One data point doesn’t make a trend, but it helps the narrative that inflation is showing some containment. Our view remains that a softening economic growth backdrop over the next two quarters should help keep a lid on inflationary pressures.

This view was reinforced after April’s GDP report showed the impact of tariffs on the economy becoming increasing clear. Canadian real GDP fell short of Statistics Canada’s advance guidance, falling by -0.1% month-on-month versus an expected uptick in activity. Tariff-exposed sectors disproportionately felt the pinch (Chart 2), with industries like manufacturing and wholesale trade registering their largest monthly declines in roughly four years and two years, respectively. Advanced estimates for May signal another contraction in economic growth. May’s trade data are due next week and will be under heavy scrutiny after exports cratered by almost 20% the month prior. A further contraction in shipments would all but confirm a weak second quarter of growth.

Now it’s about how the BoC views the balance of risks around growth and inflation. Markets expect the BoC to keep rates steady next month, though data over the past two weeks has the probability of a cut creeping closer to a coinflip. Based on the Bank’s recent messaging around inflation risk, they’ll likely need to see core prices ease further next month to entertain a rate cut at the next meeting. With Canada’s labour market showing cracks, consumers reigning in spending, and the housing market visibly strained, we think the BoC has headroom to cut the policy rate two more times this year.

Elsewhere, Canada’s defense spending is expected to ratchet higher as Prime Minister Carney signed the country on to NATO’s 5% of GDP spending commitment by 2035. The target is split into a 3.5% goal on “hard” defense outlays and 1.5% on defense-related infrastructure. On the latter, PM Carney noted that planned infrastructure and emergency preparedness spending will count towards the 1.5% goal. Nonetheless, a gap of $40-50 billion on annual spending exists – even after the additional ~$9 billion announced to reach the prior 2% target by end of the fiscal year.

Marc Ercolao, Economist | 416-983-0686

Geopolitical developments continued to grab headlines this week. However, the world breathed a sigh of relief when Pres. Trump announced a ceasefire between Israel and Iran on Monday. Oil prices fell sharply on the news, while equity markets rallied. This was followed by what appeared to be a successful NATO summit, where most members agreed to increase defense spending targets to 5% of GDP by 2035. Some good news also trickled in on the trade front, with China pledging to approve applications for rare-earth exports to the U.S. – a development that could pave the way for more fruitful trade negotiations. These developments appeared to overshadow more muted developments on the home front.

The passage of the ‘One, Big, Beautiful Bill Act’ hit a snag in the Senate, ahead of Thursday’s vote. The Senate parliamentarian reportedly ruled out several major measures in the legislation, most notably provisions related to Medicaid cuts – complicating the GOP’s math on spending cuts. It remains unclear if the bill will pass by the Republican’s self-imposed deadline of July 4th.

On the data front, the highlight of the week was the May release of personal income and spending. Personal income fell by 0.4% month-on-month (m/m), owing to a sharp pullback in transfer payments. Importantly, compensation to employees – nearly two-third of income – rose by a healthy 0.4% m/m. However, there were definite signs of waning consumer resilience. Goods spending fell 0.8% m/m, while services were flat on the month, with total spending down 0.3% on the month (Chart 1). Part of the softening in services spending was telegraphed earlier in the week in the third release of Q1 GDP, where it was revised to just a 0.6% gain (previously 1.7%), implying less momentum heading into Q2.

So far, the tariff impacts on inflation have remained relatively contained. While core PCE inflation – the Fed’s preferred gauge – heated up a touch in May, the monthly gain was due to relatively equal contributions from goods and services prices, pushing the year-on-year to 2.7% (Chart 2). Over the coming months, tariff impacts are expected to intensify, though the extent of price passthrough remains uncertain. Driving this point home, Chair Powell maintained a cautionary stance during his semiannual testimony to Congress this week, stating that he expects policymakers to stay on hold until they have a better handle on the impact tariffs will have on prices. This came in contrast to other Fed speakers, including Governor Waller and Bowman, who both noted that they support a July rate cut.

The growing divide among policymakers’ is shaped by differences in the expected passthrough from tariffs and underlying labor market conditions. Waller is of the view that the tariffs wont significantly boost inflation and that because of monetary policy’s long and variable lags, the Fed should proactively cut rates to head off potential downside risks to the labor market. However, Powell and others are of the view that the labor market remains in a good spot and need to see more definitive signs of softening before pushing ahead with rate cuts. This puts next week’s employment report in the spotlight.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: