Provincial Housing Market Outlook:

Activity to Remain Subdued This Year

Rishi Sondhi, Economist | 416-983-8806

Date Published: January 19, 2026

Highlights

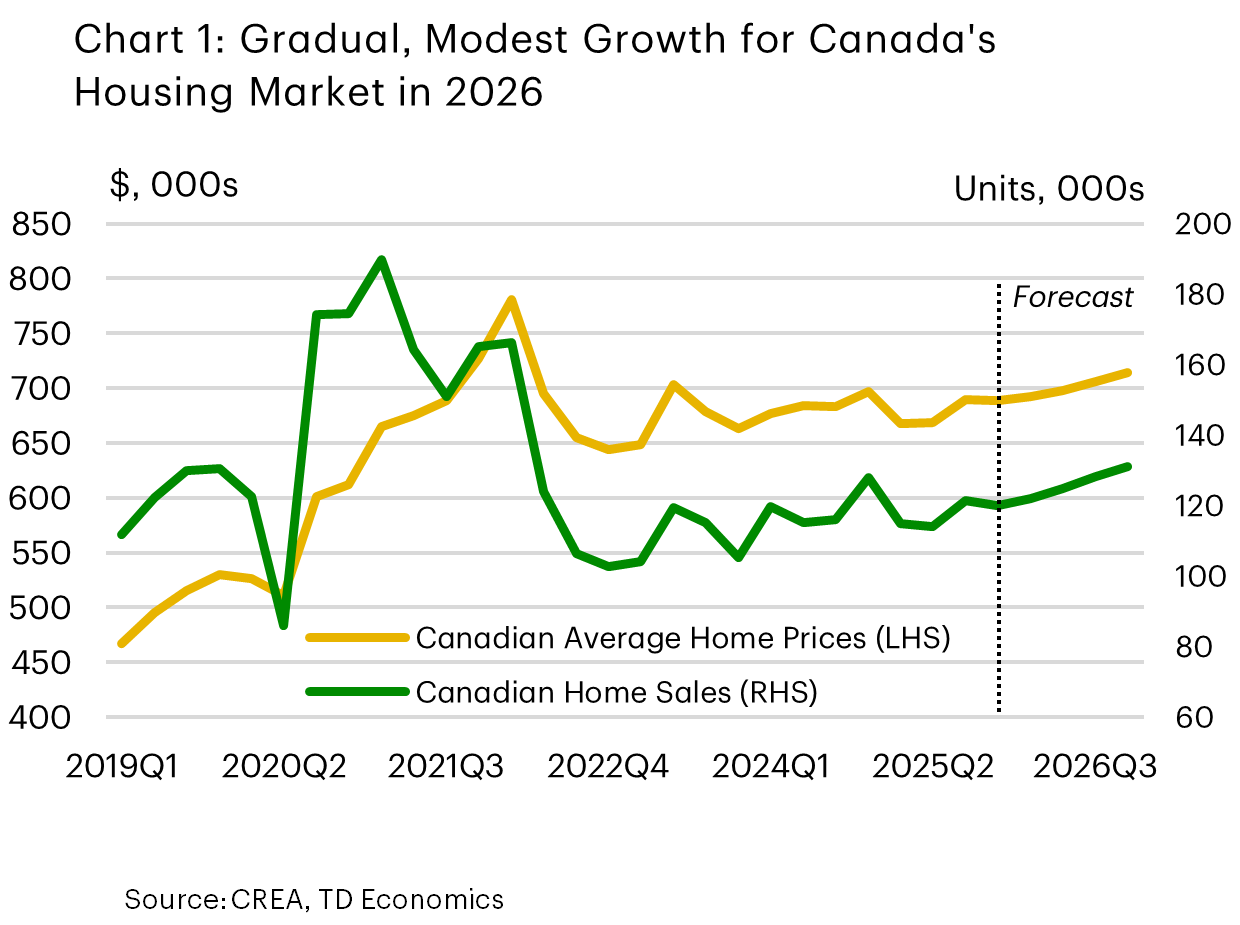

- After ending 2025 on a soft note, a gradual, modest recovery in Canadian housing is likely on tap in 2026, supported by pent-up demand. Restraining a stronger recovery will be elevated economic uncertainty, a subdued job market and a leveling off in interest rates with the Bank of Canada likely to stay on the sidelines this year.

- Markets in Ontario and B.C. should receive support from pent-up demand and some improvement to affordability although loose/supply demand conditions will likely restrain price growth.

- Saskatchewan and Manitoba recorded solid price growth in 2025, while softer gains took place in Alberta, amid more balanced conditions. Easing economic growth is likely to weigh on price gains in the Prairies this year.

- After relatively firm 2025 performances, cooler economic backdrops and affordability deteriorations should weigh on the rate of price appreciation in the Atlantic and Quebec this year.

After a robust Q3, Canada’s resale housing market lost momentum in the fourth quarter, with sales dipping and average prices coming in flat compared to the prior period. This disappointing showing sets 2026 off on a weaker footing and is consistent with a downgrade to our sales and price forecasts for the year ahead. We have, however, retained the view that a modest, gradual recovery will unfold for Canada’s housing market this year (Chart 1). Driving this projection is the expectation that pent-up demand will continue to be satiated and sales receive some support from solid or improved affordability in some markets. We’re also assuming no significant backup in economic uncertainty, which was a major factor weighing on demand last year. In our view, interest rates will be more of a neutral factor for the outlook in 2026, with the Bank of Canada likely to remain sidelined and no major movements expected in bond yields (which help determine fixed mortgage rates).

On the negative side, Canada is set to record another year of near zero population growth in 2026, driven by softer immigration flows and a net outflow of non-permanent residents. These newcomers typically have very low homeownership rates when they first enter the country, but rental demand will continue to be negatively impacted. This could feed back into investor demand, as lower rents would reduce the cash-flow from owned properties that are rented out.

In terms of risks to the outlook, on the upside we must be mindful that housing activity has had some tendency to surprise expectations to the upside in the past, which is certainly possible given large pent-up demand in key markets. On the downside, the upcoming CUSMA negotiations loom large for the economy, and by extension, the housing market. There’s also some risk that geopolitical tensions lift uncertainty, keeping potential buyers uneasy about the economic outlook.

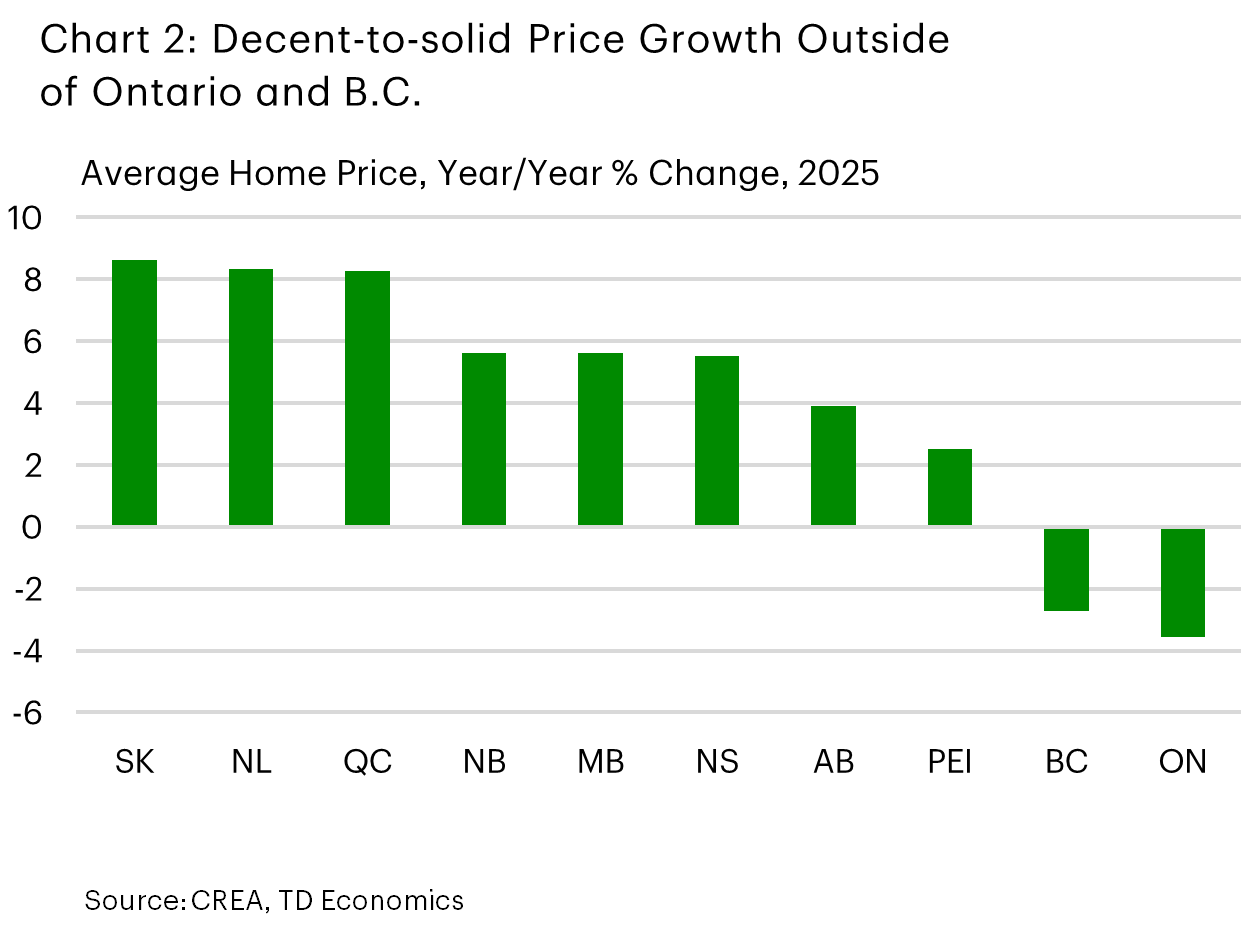

Looking across Canada (Chart 2):

Soft Conditions Prevail in British Columbia:

If it weren’t for Ontario, B.C. would take the mantle of weakest housing market in the country, although conditions in the province are nearly as soft. Sales tumbled about 6% last year, helping drive a roughly 3% decline in average prices. Vancouver posted an even weaker performance than the province overall, with sales and prices down 4% and 10%, respectively. In the GVA, weakness was broad-based across structure types, with benchmark detached prices down 2%. Meanwhile, GVA condo prices were off 3% amid highly elevated resale inventories.

Sales were negatively impacted by elevated economic uncertainty, stretched affordability and, most likely, weaker investor demand1. B.C.’s 20% house-flipping tax also took effect in January 2025. Bank of Canada data shows a decline in flipping activity in the first half of 2025 but flipped homes only account for about 3% of sales transactions in key markets in B.C., so the effect of the policy wasn’t huge.

Listings also increased last year, likely driven to some extent by the same factors probably impacting Ontario (see below). These include elevated carrying costs for investment properties, investors having trouble closing on pre-qualified purchases and reduced attractiveness of real estate assets for investors.

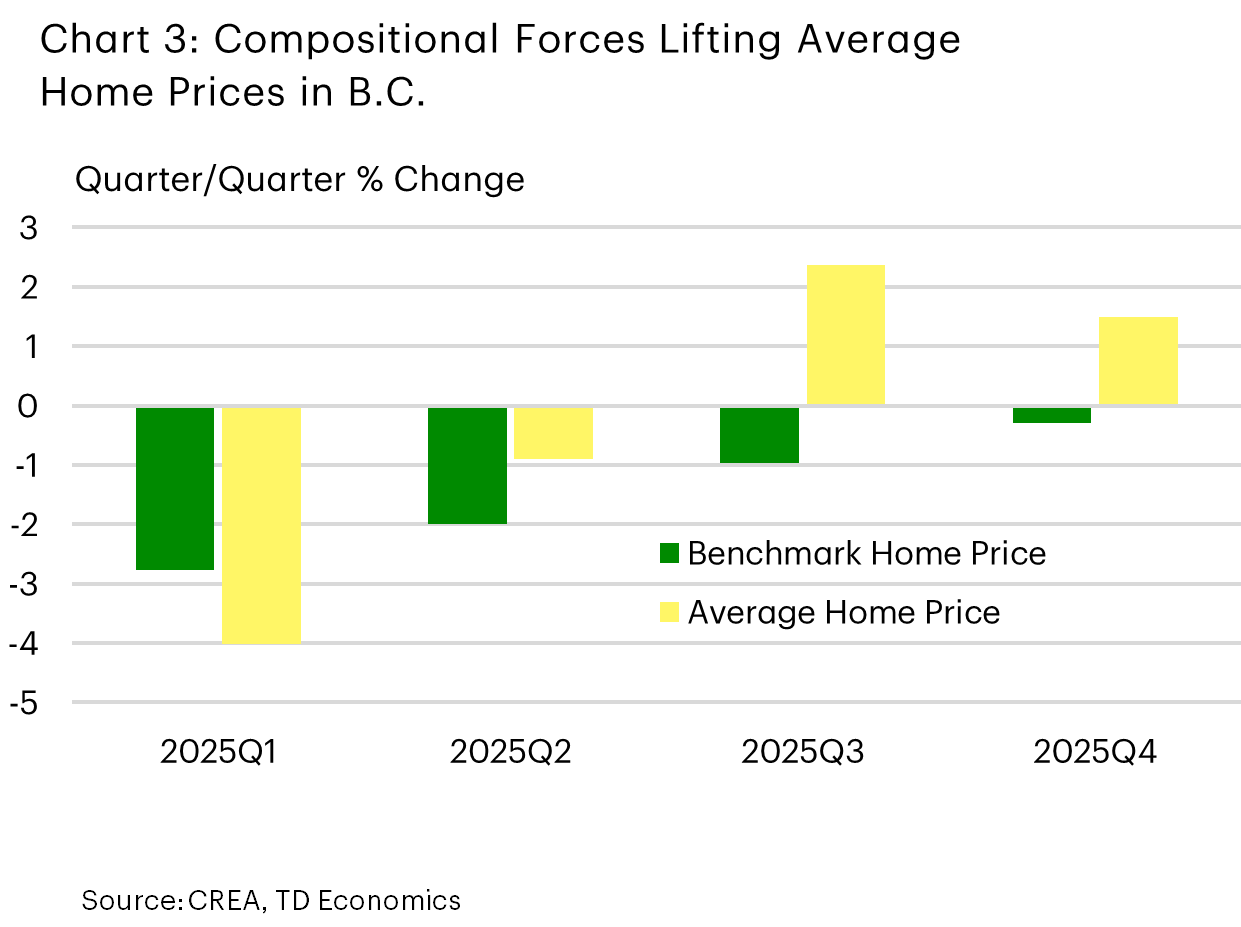

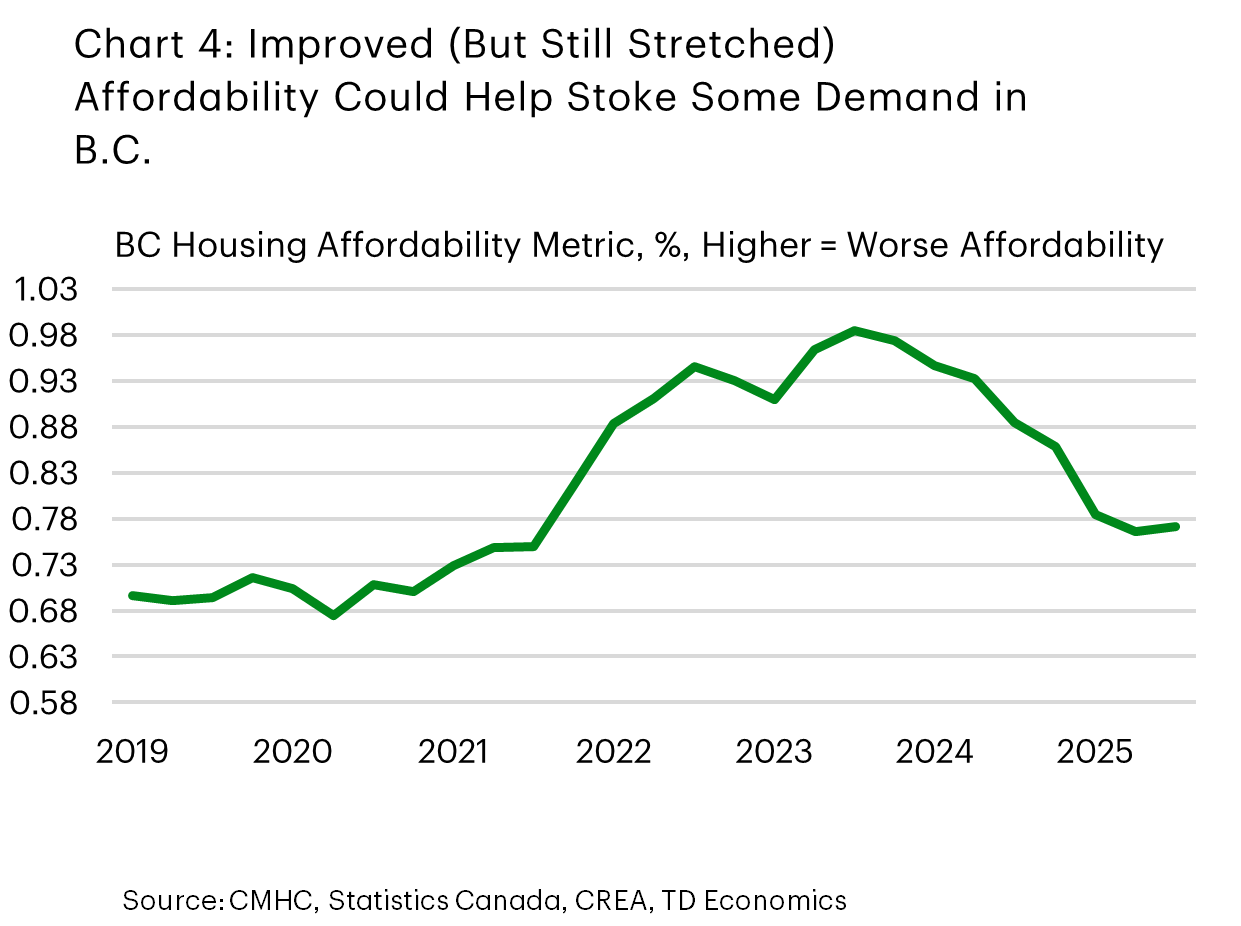

Despite loose supply and demand conditions, ‘compositional effects’ helped prevent an even greater decline in average home prices (Chart 3). Average prices can be skewed by the mix of homes sold, so more expensive homes would upwardly pressure the average price. This dynamic has unfolded in B.C., with average home prices rising 3% in the back half of 2025, versus a 1% decline in benchmark prices (which strip away compositional forces). We think this dynamic will hold in the near-term, keeping average home price growth positive. We also think that sales will be supported by significant pent-up demand that’s likely accumulated for more than two years. As evidence, note that per capita sales levels were 40% below long-term norms in December 2025, the weakest showing in the country. In addition, affordability (which is still stretched), has improved to a significant degree since 2023 (Chart 4).

Parts of the Prairies Bringing the Heat:

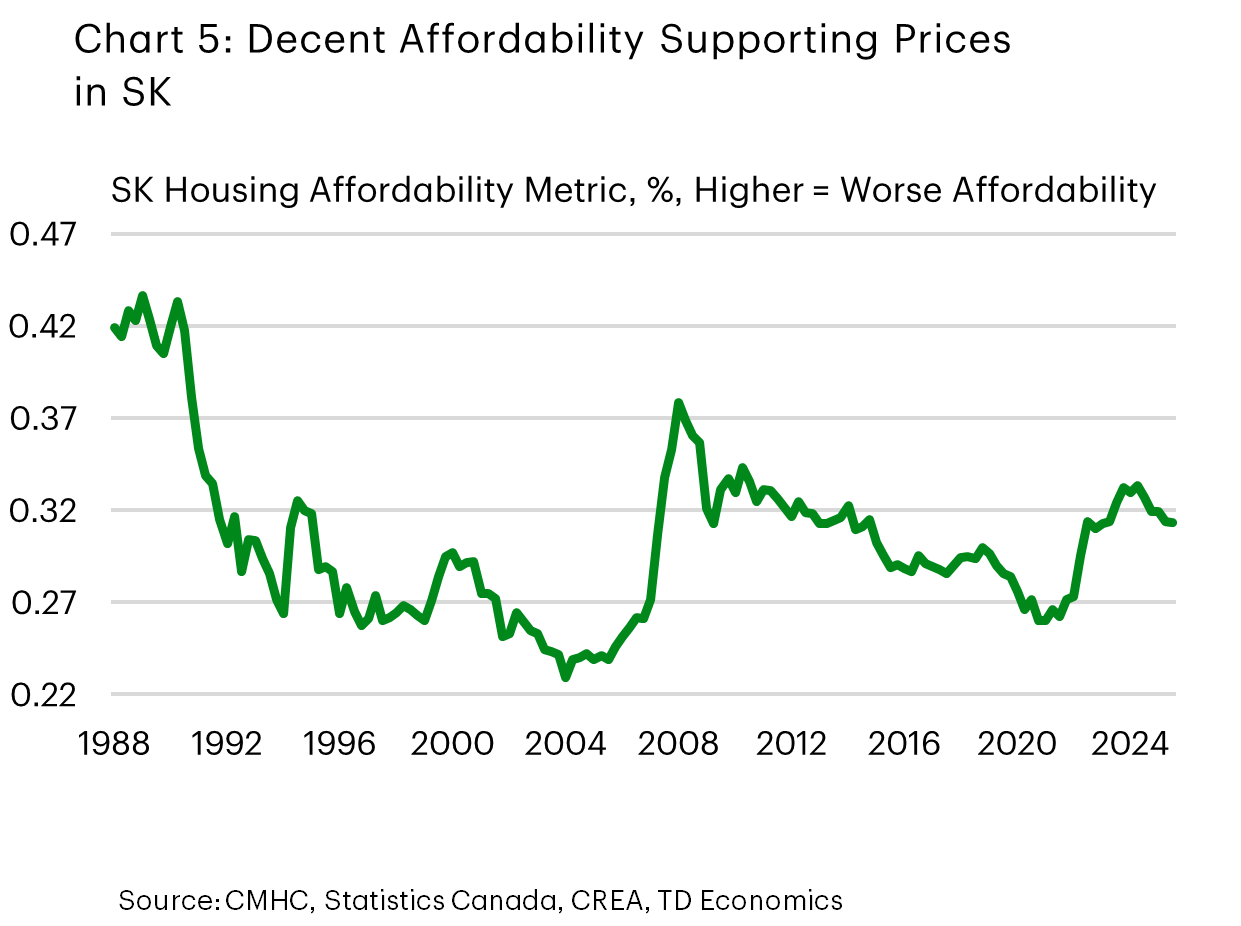

Saskatchewan continues to be one of the hottest housing markets in the country, with average home prices up 9% in 2025. Support for demand has come from solid affordability (Chart 5). Meanwhile, job growth has been relatively firm, backstopped by comparatively robust economic growth. On the supply side, resale listings remain relatively low. This has kept conditions tight and offers a solid starting point in 2026 for price growth. With Saskatchewan’s economy set to gear-down but outperform Canada’s again this year, we see home price growth slowing but remaining solid in Saskatchewan.

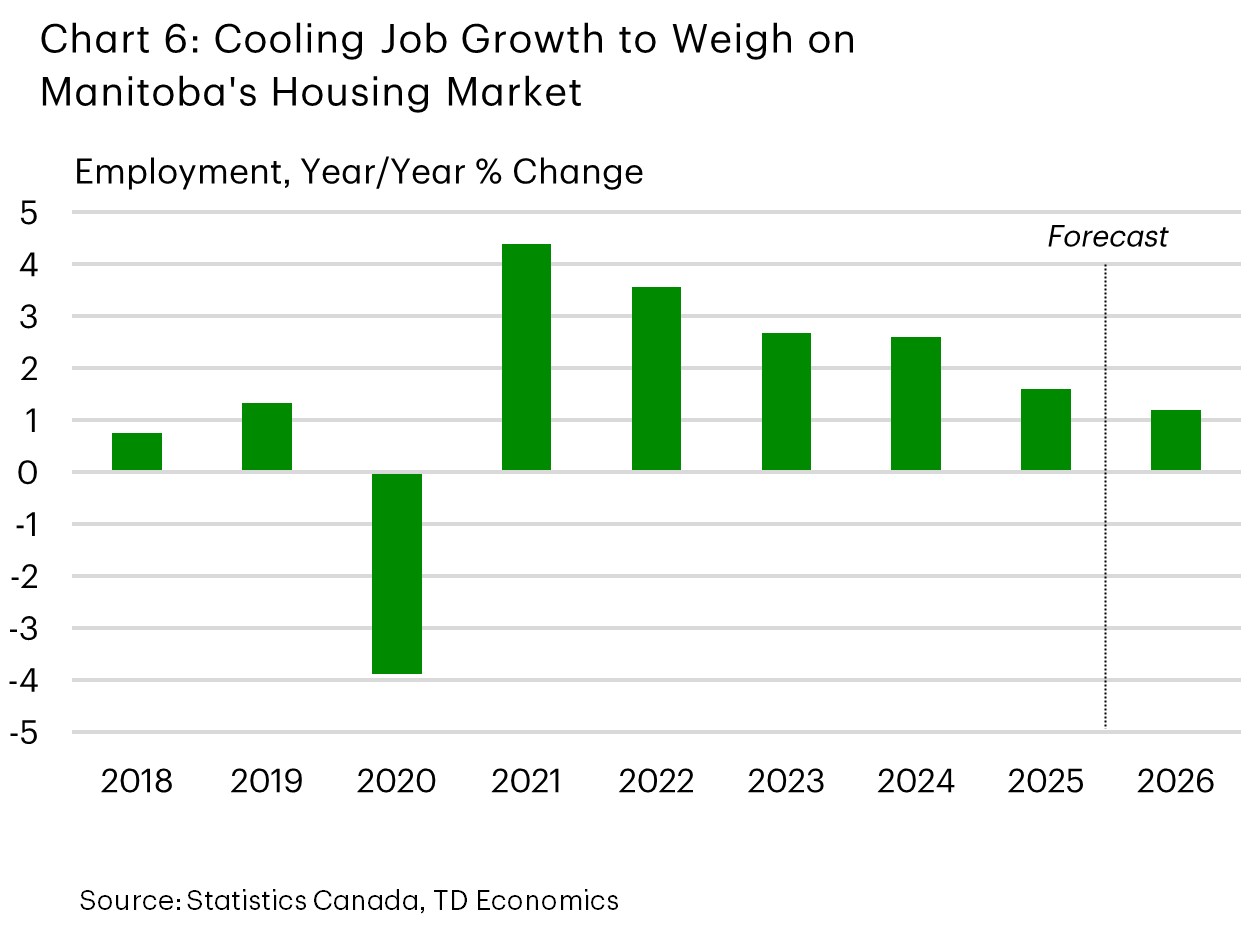

Despite Manitoba’s economy suffering during the trade war, the province still managed to post decent job growth – helped by goods-producing industries other than manufacturing. This has helped underpin confidence and housing demand, even as affordability has deteriorated. Meanwhile, resale supply continues to remain low, keeping markets tight. As a result, price growth has been solid. With job markets likely to give up some of last year’s strength (Chart 6) and supply likely to push a bit higher in response to past gains in valuations, we see quarterly price growth slowing this year. However, a tight starting point and solid momentum heading into 2026 mean that annual average price growth will likely remain healthy.

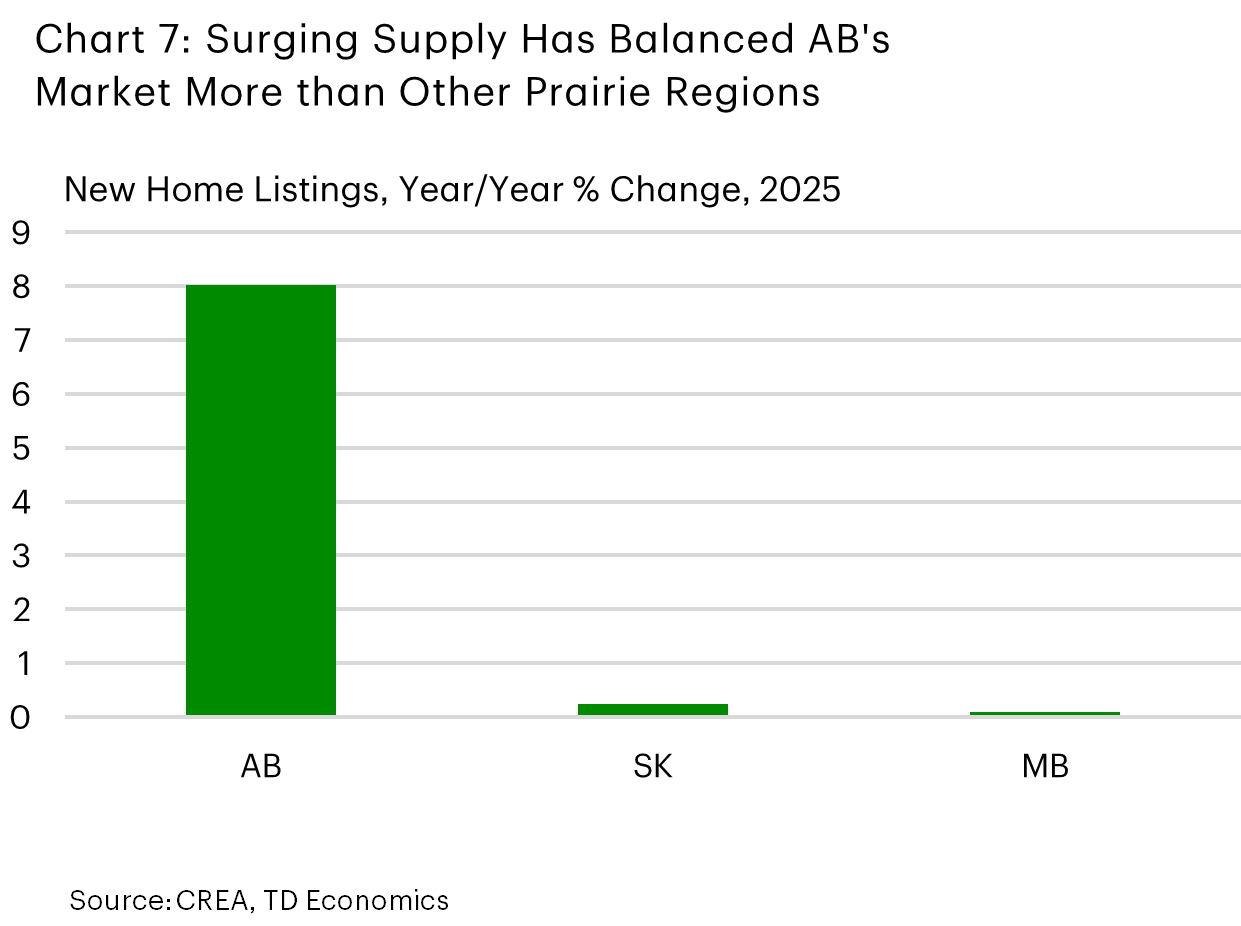

Alberta’s housing market differs from the other Prairie provinces in that it’s more balanced. Accordingly, price growth has been weaker, driven by slowing gains in Calgary, while Edmonton has been stronger. Home sales have pulled back from their lofty 2023/24 highs, weighed down by economic uncertainty and some deterioration in affordability. What’s more, interprovincial migration (while still reasonably firm) has eased from its 2023 high. This should impact ownership demand under the assumption that Canadians coming to Alberta from places like Ontario and B.C. are doing so due to attractive affordability. However, what has really set Alberta apart from the other Prairie provinces is a sharper gain in listings (Chart 7), with sellers responding to what was once the frothiest housing market in the country, likely abetted by a massive ramp up in new housing completions in recent years.

These more balanced supply/demand conditions, alongside cooling (but still positive) job growth and weaker population gains set-up for trend-like price growth in Alberta in 2026. Notably, we expect oil prices to be flattish this year at levels that last prevailed during the pandemic. This should restrain gains in nominal GDP, household incomes and home prices.

Loose Conditions to Cap Price Growth in Ontario:

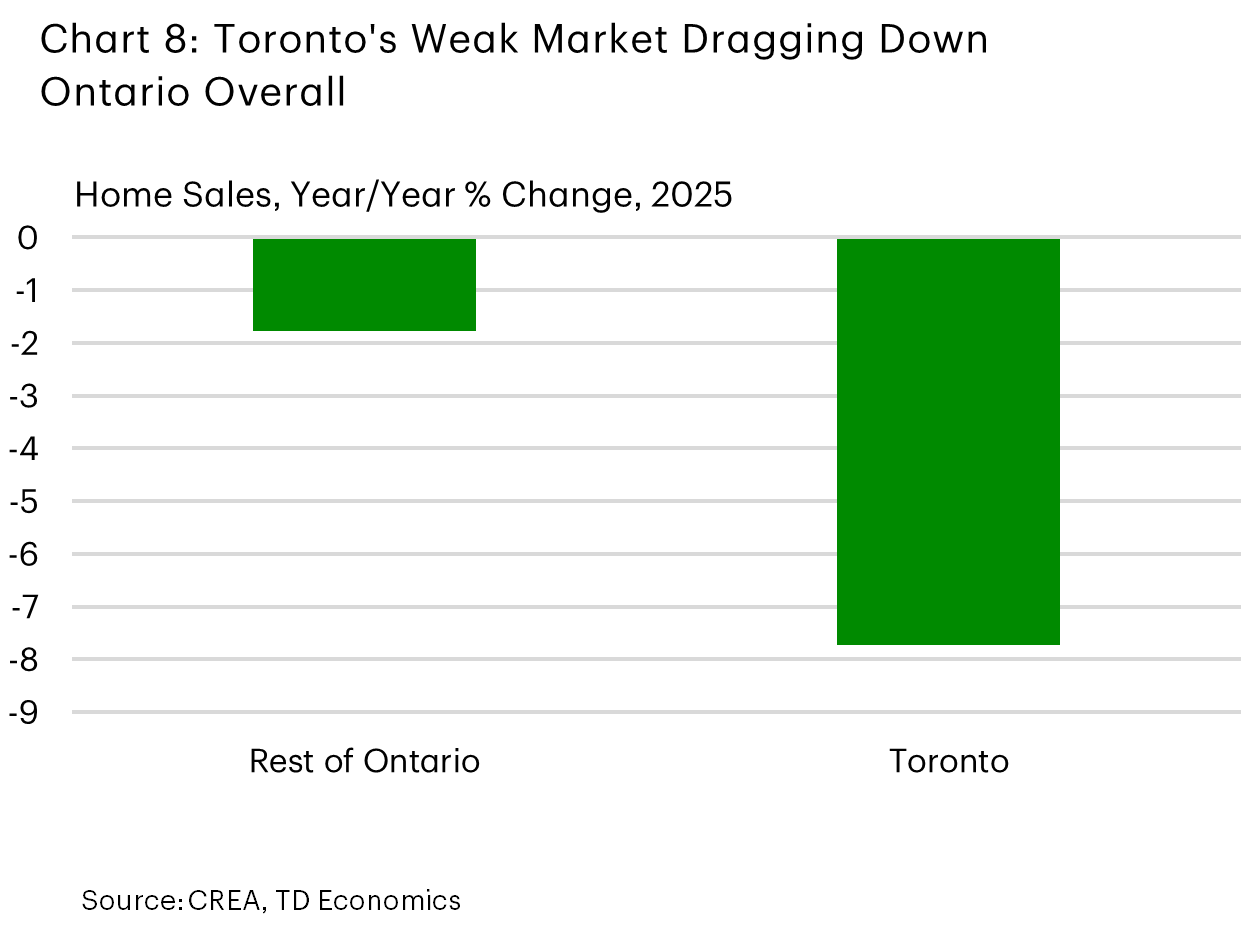

Ontario’s housing market is the weakest in Canada, with average home prices posting the steepest drop of any region in the country last year. This extended Ontario’s underperformance relative to the rest of Canada observed since 2023. In 2025, demand was hit by economic uncertainty and softness in the labour market. What’s more, affordability remained stretched for ground-oriented housing (detached/semis/towns). Continued investor flight away from condos impacted activity in the GTA, which had a much softer showing in both sales and prices than the rest of the province (Chart 8).

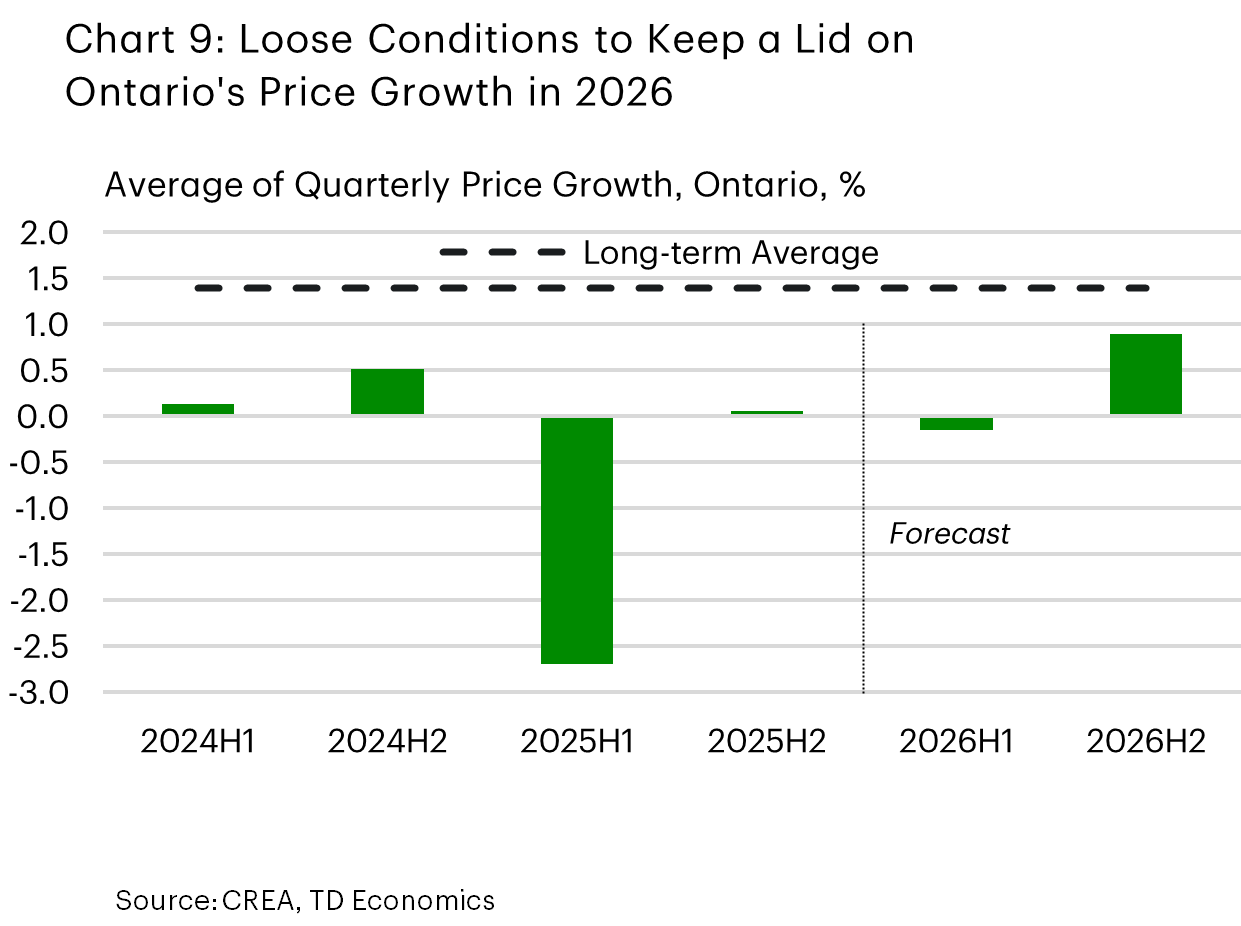

While demand was weak last year, supply pushed higher, as investors listed their properties (especially in the GTA) amid elevated carrying costs, difficulty in closing on properties that were pre-qualified at ultra-low, pandemic-era interest rates, and reduced attractiveness of real estate assets due to falling prices and rents. This backdrop left supply/demand balances heavily in favour of buyers heading into this year.

These loose conditions should keep price growth negative, on average, in the first half of 2026 (Chart 9). Thereafter, we see it inching into positive territory, supported by significant pent-up demand. Indeed, per capita home sales were some 25% below long-term averages in Ontario in December of last year. While by no means a panacea, the drastic improvement in GTA condo affordability should also help spur some modest demand in the resale market. Note that as of December 2025, benchmark GTA condo prices had fallen nearly all the way back to where they were before the pandemic struck, thanks to 9 straight quarters of declining prices. We’ve seen some tentative evidence that this dynamic could be supporting demand, with year-on-year growth in GTA condo resales turning positive in the third quarter of last year.

Quebec Seeing Firm Activity:

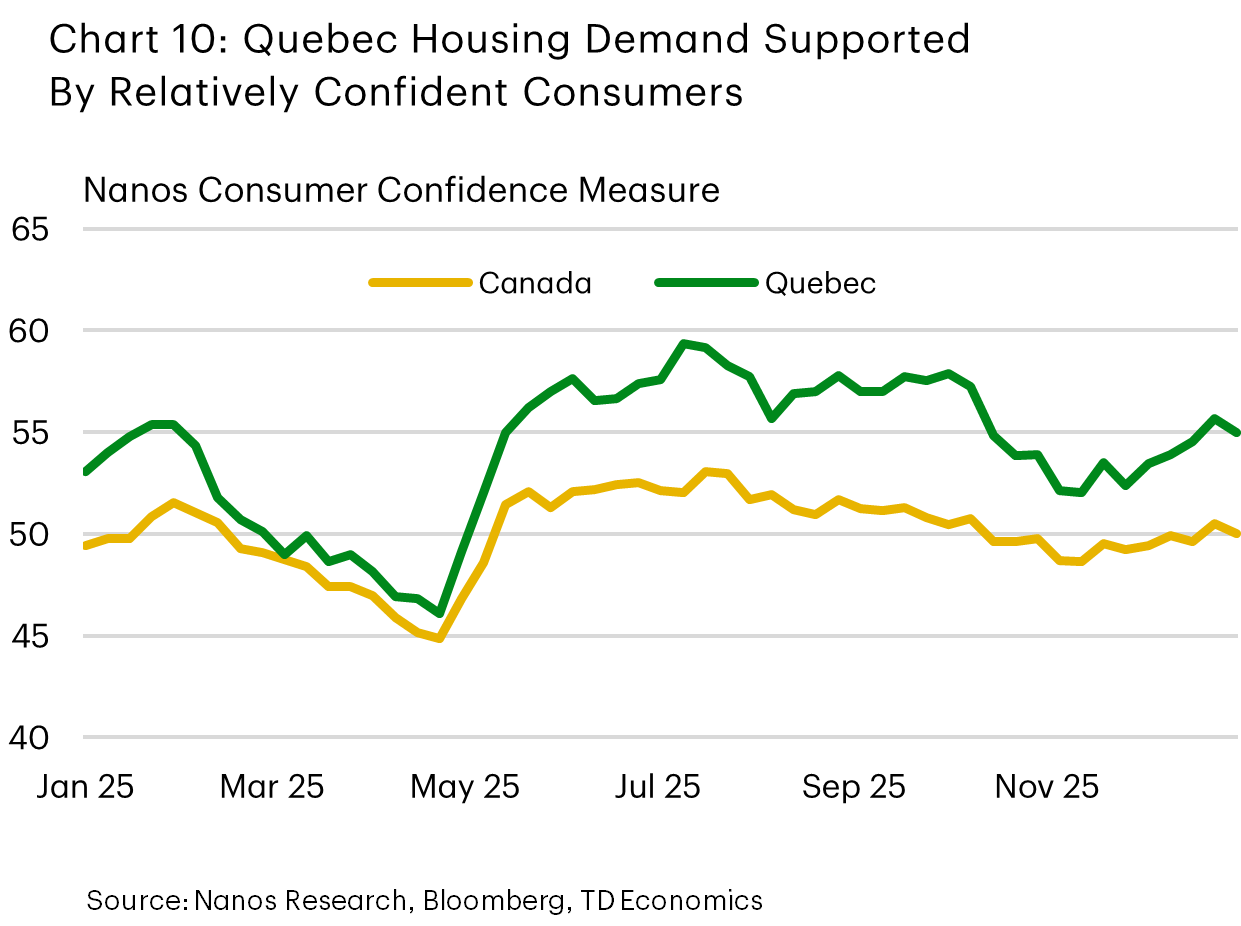

Home sales posted a strong gain in Quebec last year, boosted by job and income growth. In addition, some measures indicate that consumer confidence was relatively elevated in the province, which counts as a surprise given its exposure to the trade war (Chart 10). Household savings rates are also elevated, potentially offering some room for down payments. And, while new home completions have turned higher in recent years, much of these units have been slated for the purpose-built rental market, with completions of ownership units much softer. These factors have kept supply/ demand balances tight, supporting a huge gain in prices. Indeed, after a flat performance in 2023, home prices have jumped about 15%.

These price increases have deteriorated affordability. And, with the economy likely to record another soft performance in 2026, we see job growth slowing meaningfully. Meanwhile, per capita sales are 15% above long-term averages in Quebec, signalling some downside room to run for activity. Accordingly, we see sales growth easing meaningfully this year in the province. Meanwhile, resale supply should inch higher, lifted by past price gains. While tight conditions should keep price growth firm in the early part of 2026, we see these factors pulling it below its long-run average as the year wears on.

Home Prices Historically Elevated in the Atlantic:

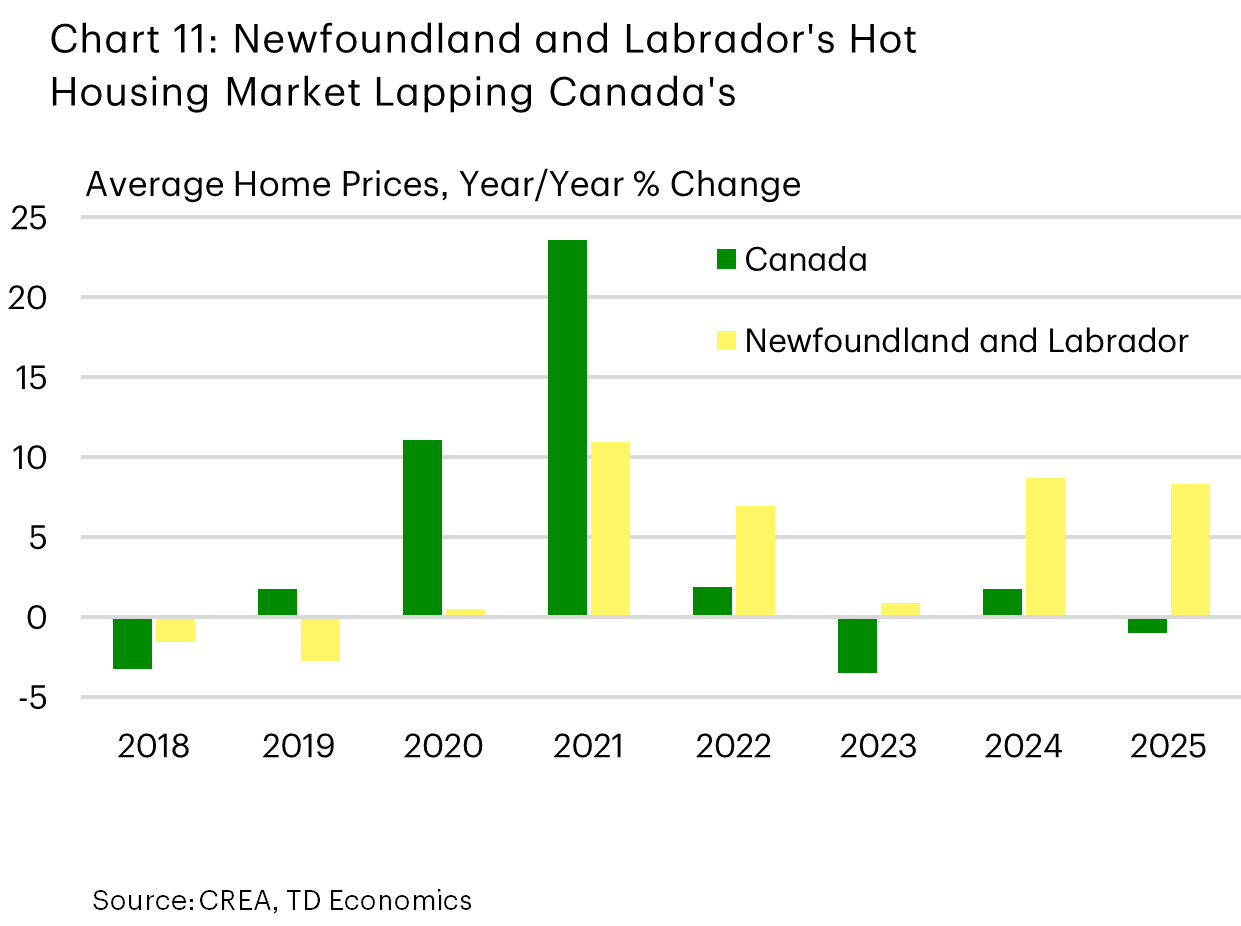

Newfoundland and Labrador’s housing market performance has been remarkable, in that the province’s price growth last year outpaced Canada’s by the largest margin since the Global Financial Crisis (Chart 11). Indeed, Newfoundland and Labrador posted near-double digit price growth last year for the second straight year. Healthy sales activity has supported this trend, itself underpinned by robust economic growth and accommodative affordability. Additionally, Newfoundland and Labrador has steered clear of the worst impacts from the trade war, with much of its largest export (oil) destined for Europe. New listings, meanwhile, were flat, potentially restricted by a relatively old population which tends to move less, leaving markets tight heading into 2026.

For this year, home price growth is likely to ease, alongside home sales, as economic growth cools and the province endures its 2nd straight year of net job losses. Still, tight near-term supply/demand balances and very favourable affordability should keep quarterly price growth above-trend.

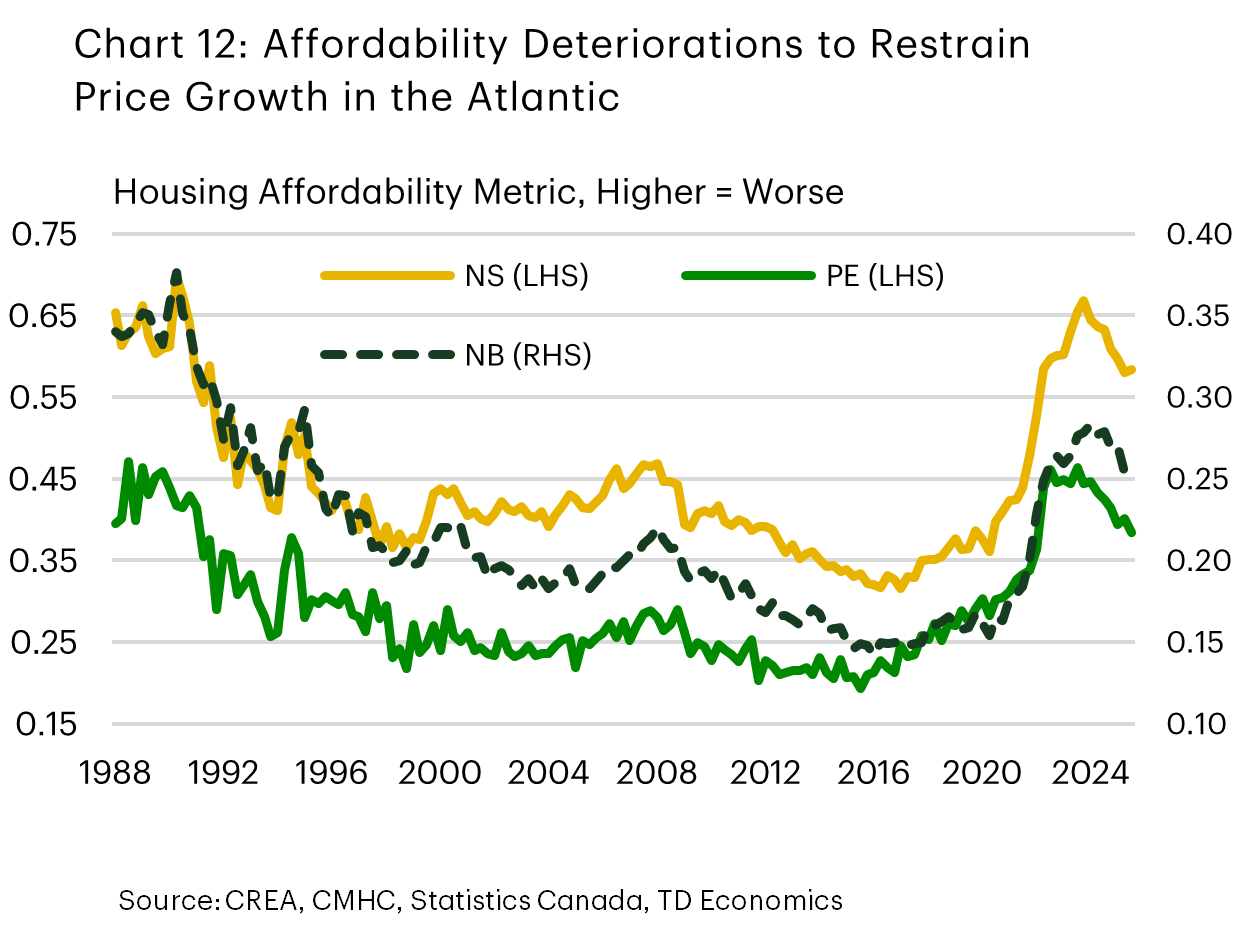

While Newfoundland and Labrador’s market is the tightest relative to its own history of any Atlantic Province, PEI’s market balance is close to long-term norms. Indeed, it has been for the past two years, normalizing from a previously tighter backdrop. This reflects churn backstopped by a healthy economy, with listings growing slightly faster than the solid sales gains observed past few years. In line with this, we’re forecasting a trend-like gain in PEI’s average home prices this year. Notably, much of this reflects firm price growth heading into 2026, with below-average quarterly gains expected thereafter due to the affordability deterioration the Island has faced (Chart 12). Population growth is slowing dramatically on the Island, but it’s largely being driven by non-permanent residents who have low homeownership rates, so the direct impact on ownership demand should be muted.

Listings growth outpacing that of sales also helped loosen markets a bit in Nova Scotia and New Brunswick in 2025. However, supply/demand balances still lean in favour of sellers, which is why we’re expecting firm near-term price gains in both markets. However, interprovincial migration has cooled, and affordability has deteriorated (home prices were roughly 90% above-pre-pandemic levels in both markets in December 2025. These forces should restrain price gains after the very near term.

Forecast Table |

|---|

| Home Sales and Price Outlook |

End Notes

- Note that timely data on investor activity in B.C. is scarce.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: