The Weekly Bottom Line

Our summary of recent economic events and what to expect in the weeks ahead.

Date Published: May 16, 2025

- Category:

- Canada

Canadian Highlights

- The Federal government is foregoing its usual spring Budget, but is pushing forward with election promises. The Ontario government expects to run a deeper FY 2025/26 deficit as economic relief clashes with a softening revenue outlook.

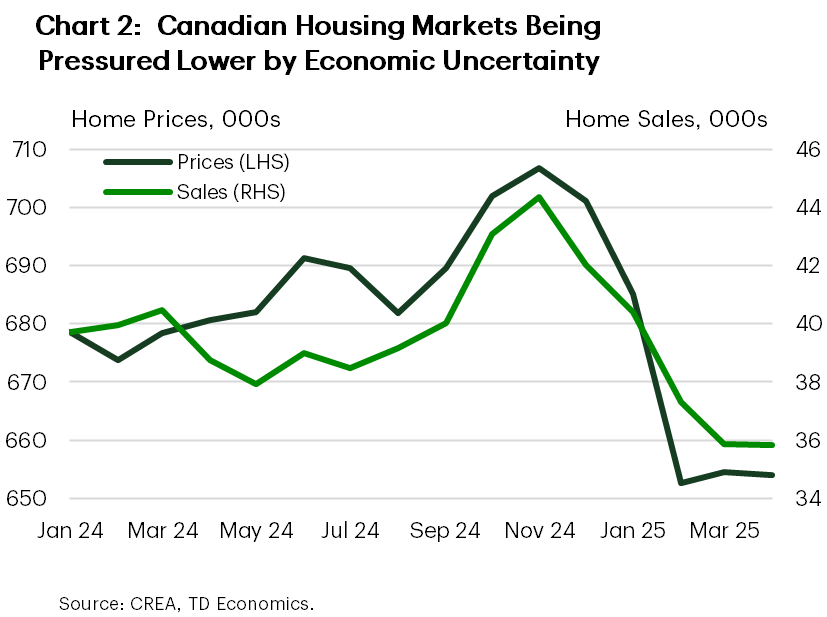

- Canada’s housing market remained subdued in April as weak consumer confidence weighs on sales activity.

- Inflation updates for April next week will be a key marker for the Bank of Canada’s policy decision on June 4th. We expect a print on the softer side before tariff impacts start to embed in prices.

U.S. Highlights

- U.S.-China trade tensions were toned down this week, with both countries agreeing to a temporary truce that would see some tariffs on each other’s goods come down substantially.

- Following a strong showing in March, retail sales barely grew in April. The details hinted at consumer efforts to get ahead of potential tariff-related price hikes.

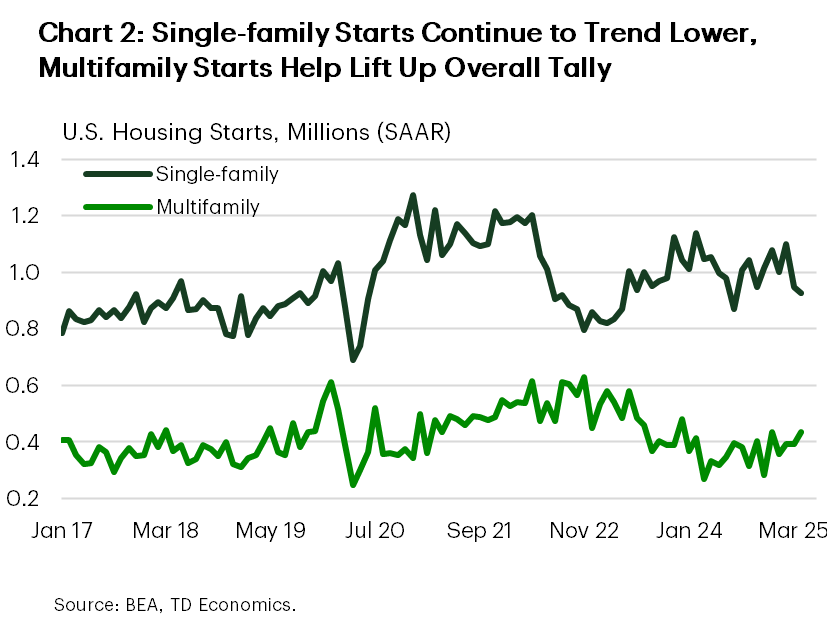

- Housing starts managed to eke out some modest growth in April, but the gain was entirely concentrated in the smaller and more volatile multifamily sector.

Canadian governments were in the spotlight this week amid a relatively light calendar for Canadian economic data. Volatility in Canadian financial markets also scaled back this week, mostly taking cues from developments south of the border. Canadian yields finished the week roughly flat, the TSX rallied by 1.5%, and the Loonie dipped three-tenths of a cent to 0.716 cents/USD.

On the federal government side, Prime Minister Mark Carney and his new cabinet hit the ground running, signing a symbolic order to prioritize their promised income tax cut by July 1st. This measure is part of a much larger Liberal election platform that includes $130 billion in new spending measures over the next four years (see analysis). By the government’s own preliminary tally, the spending will drive the projected budget deficit and debt burden higher in the near-term. That said, the government announced that they will forgo publishing an official federal budget this year. This means we’ll need to wait until the Fall Economic Statement, usually tabled between October and December, to understand the exact impacts on the country’s bottom line.

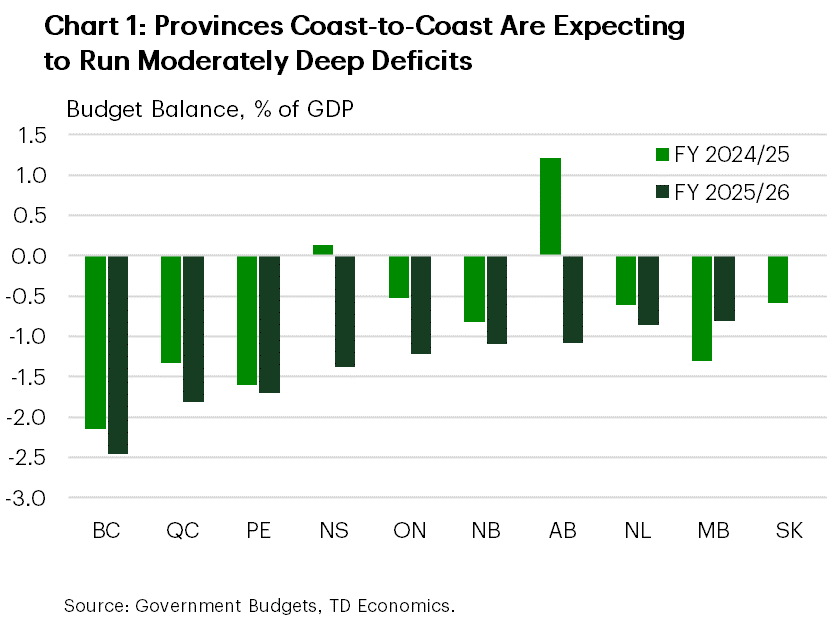

Meanwhile, Ontario released its FY 2025/26 Budget, officially wrapping up the provincial budget season. New measures related to tariff relief and broader economic support, combined with a contraction in near-term revenues, are expected to put the province’s books into a $14.6 billion deficit for the fiscal year (see analysis). Relative to the size of the economy, Ontario’s projected deficit is in line with those reported by most provinces across the nation (Chart 1). Ontario and Manitoba also signed a Memorandum of Understanding (MOU) supporting the removal of barriers to trade between their two provinces.

Shifting to the hard economic data, Canada’s housing markets continue to show signs of weakness (Chart 2). Existing home sales in April failed to generate any traction as economic uncertainty likely kept buyers on the sidelines despite lower interest rates. With the data we have on hand, we’re tracking another decline in Canadian home sales in Q2 following a sizeable first quarter contraction. The weakness is expected to be temporary. Ample pent-up demand exists and we expect it to start funneling back into markets by the fourth quarter as there is more certainty on the trade front, and homebuyers regain confidence and clarity. Elsewhere, housing starts bounced back in a meaningful way in April after steep declines in the two months prior, though they continue to soften on a trend basis. Ontario, in particular, stands out as construction responds to the past declines in demand.

On tap next week is April’s update on inflation. The print could show stable and easing price growth as the elimination of the consumer carbon tax has pushed energy prices significantly lower. Past this, we expect tariff impacts may start nudging inflation back towards 3% starting in May/June. The Bank of Canada (BoC) is waiting in the wings to make their next policy decision on June 4th and the economic evidence is increasingly painting a picture of a slowing Canadian economy. From our lens, the current situation gives the BoC room to deliver another quarter-point cut to the policy rate at the June announcement.

Marc Ercolao, Economist | 416-983-0686

Following the U.K. trade deal signed last week, the U.S. de-escalated its tariff fight with another key trade partner this week – China. Stock markets rejoiced on the news with the S&P 500 up almost 5% this week.

The U.S. and China announced a temporary truce, which would see both nations significantly reduce their tariffs for 90 days, effective May 14th. U.S. tariffs on China would drop from 145% to 30%, while Chinese tariffs on U.S. goods would fall from 125% to 10%. China also agreed to ease its critical minerals export restrictions. This development marks a major step in the right direction. Still, it is early days in negotiations and there’s potential for trade tensions to flare up again should an agreement prove elusive. Additionally, some of the damage is already done, with elevated tariffs that were kept on for several weeks already disrupting trade patterns and setting the stage for potential price hikes ahead. Recognizing these risks, at a speech this week Fed Chair Powell noted that “we may be entering a period of more frequent, and potentially more persistent, supply shocks – a difficult challenge for the economy and for central banks”.

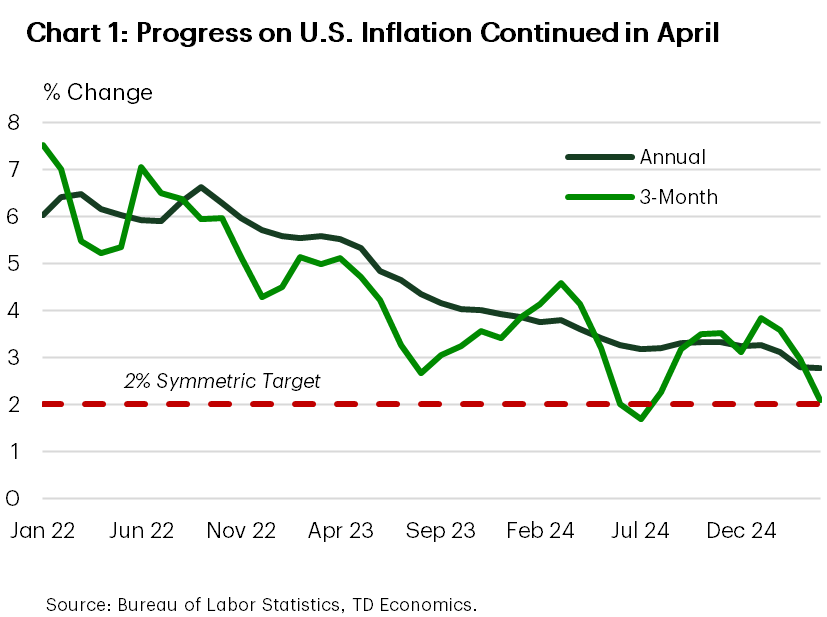

Up until April, inflation appeared to be moving in the right direction. Helped by a reduction in energy prices, total CPI inflation eased to 2.3% year-on-year (y/y) in April – the lowest level since 2021. Meanwhile, core CPI held steady at 2.8% y/y, but managed to trend lower on a 3-month annualized basis (Chart 1). Still, this trend is unlikely to last. Citing pressure from tariffs, Walmart announced plans to start passing on tariff costs as early as this month. Other retailers are likely to follow, and consumers will soon start to feel the heat.

With respect to the consumer, following a strong finish to the first quarter, retail sales grew only modestly in April. Sales at motor vehicle and parts dealers edged lower (albeit from an elevated level), while sales at gasoline stations fell more noticeably in part due to lower gas prices. Despite this, a decent showing in a few other categories, including bars and restaurants, and building material stores helped provide some counterbalance.

Pulling back the lens, last month’s retail spending data provided further evidence that consumers continued to front-run the tariffs by pulling forward purchases of some big ticket items. Meanwhile, ongoing gains in discretionary spending suggest that the consumer is managing to hold its own for now, despite downbeat sentiment. Housing starts also managed to eke out some modest growth in April (up 1.6% on the month), but under the hood, the details were mixed. Starts in the larger single-family sector continued to trend lower, with last month’s increase entirely stemming from gains in the smaller and more volatile multifamily segment (Chart 2).

All told, the de-escalation in the trade fight with China marks an important step in the right direction, and there could be more on the way, with President Trump today hinting at the potential for further de-escalation with other countries over the next 2-3 weeks. Still, this does not rule out additional flareups, and we are far from being out of the woods.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: