2025 Ontario Budget

Stimulus and Deficits

Rishi Sondhi, Economist | 416-983-8806

Date Published: May 15, 2025

- Category:

- Canada

- Government Finance & Policy

Highlights

- Budget 2025 largely follows through on previously announced measures meant to buffer the economy through a near-term bout of turbulence. Some $1.4 billion in tax relief measures are introduced for this fiscal year, although the scale of potential support to the economy increases considerably when other measures, like WSIB rebates and the 6-month deferral of business taxes are considered.

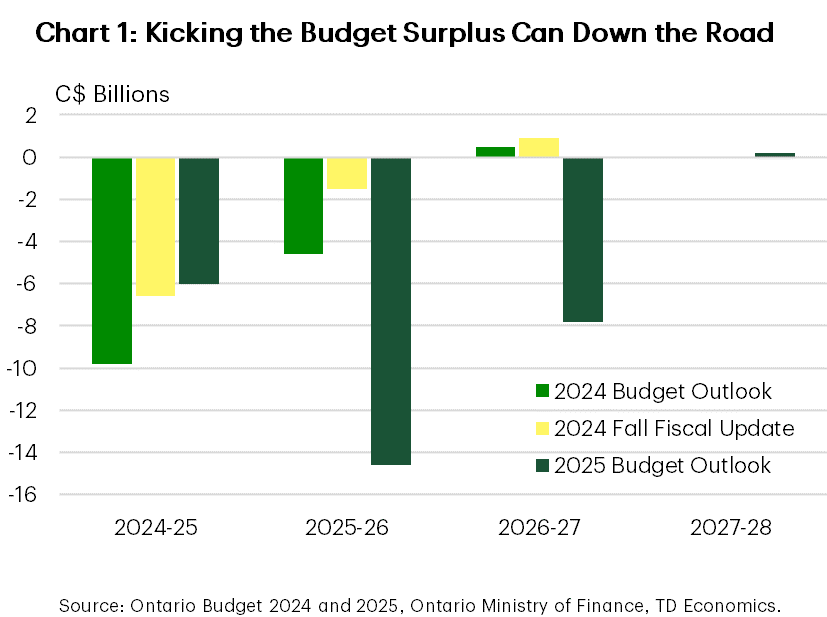

- Revenues are expected to decline this year amid a weak economy, and the deficit is forecast to climb to $14.6 billion. This represents 1.2% of GDP – around the midpoint of what other provinces are expecting.

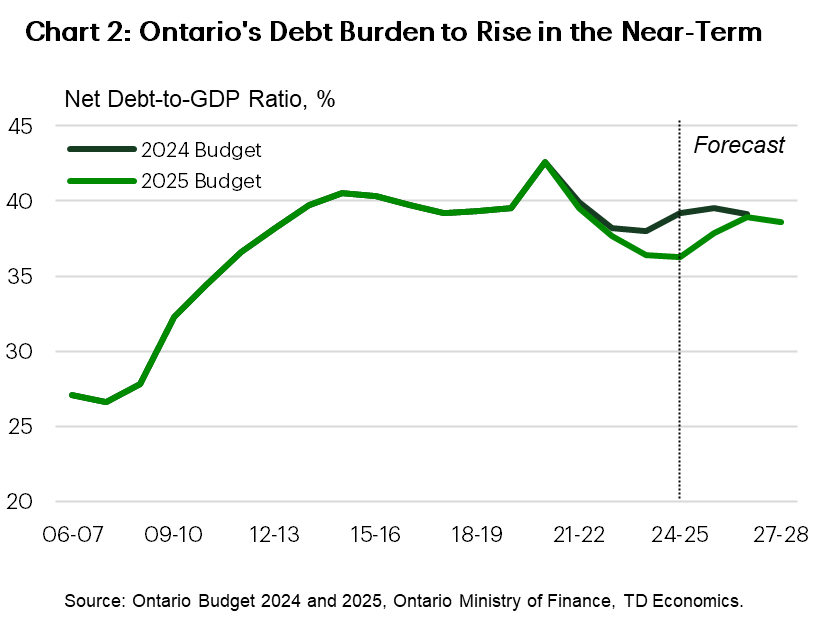

- The Province’s elevated net debt-to-GDP ratio is forecast to edge higher over the medium-term due in large part to a further ramp up in its capital spending plan. This could heighten fiscal vulnerabilities in the event of a deeper-than-expected downturn.

Prior to the release of Budget 2025, the Ontario government had announced measures to help buffer Ontario’s economy during the trade war. This included relief for businesses through tax deferrals and rebates. Budget 2025 formalizes several other previously announced supports, including the decision to make the gas tax cut permanent, increasing and expanding the eligibility for the Ontario Made Manufacturing Tax Credit, and the establishment of a new Protecting Ontario Account.

These measures do come with a fiscal cost, however, as the province’s deficit is expected to jump to $14.6 billion this fiscal year, representing 1.2% of GDP. This marks a notable deterioration from FY 2024/25, when robust nominal GDP growth helped limit the deficit to $6 billion (or 0.5% of GDP). Scaled to GDP, the projected FY 2025/26 shortfall would be middle-of-the-pack compared to other provinces, although well above the long-term average for Ontario. Meanwhile, net debt-to-GDP is seen as climbing over the forecast horizon.

Economy to Underperform Over Next Few Years

The government is forecasting subdued real and nominal GDP growth this year and next before a modest recovery takes place thereafter. Notably, the government’s nominal GDP forecasts are in line with our own (on average) over the next two years. Alongside the more obvious risks to Ontario’s economy from the trade war, it’s worth noting that Ontario is particularly exposed to the federal government’s immigration plan, as it targets a reduction in non-permanent residents as a share of Canada’s population and Ontario’s proportion is relatively elevated.

In a nod to the highly uncertain backdrop, the government has also taken the prudent step of developing different economic scenarios. In the faster growth scenario, tariffs are negotiated away relatively rapidly though uncertainty remains. Real GDP growth is about 0.8 ppts higher than the baseline scenario, on average, in 2025 and 2026. The slow growth scenario assumes 25% U.S. tariffs on all Canadian goods (10% on energy), with some Canadian retaliation. Real GDP declines slightly, on average, over the next two years. Note that the current state of play between the Canada and U.S. is significantly less severe than the assumptions underpinning the government’s downside scenario.

Revenue is projected to decline 0.8% this fiscal year, even with a solid gain anticipated from federal transfers, as a weak economy weighs on the government’s intake. In particular, corporate tax revenue is expected to pull-back as profitability takes a hit.

In terms of major revenue-side measures, making the gas tax cut permanent is seen as cutting revenues by about $900 million this year while changes to the manufacturing tax credit cost the government about $335 million.

Program Spending Set to Ease This Year

On the other side of the ledger, spending growth is forecast at 2.2% this fiscal year – roughly 3 ppts below the long-term average. Healthcare and education spending growth is projected to grow 2-3% this year, with the latter constrained by a decline in postsecondary spending. In contrast, “other programs” spending is seen as surging 9%. This category captures spending for the Skills Development Fund (topped up by $1 billion), and the Ontario’s Contingency Fund, meant to help address emerging risks. The Province will also keep $2 billion in reserve this year to enhance fiscal flexibility.

Ontario will also spend nearly $3 billion on “Significant Exceptional Expenses”, meant to cover compensation payments in the healthcare sector and legal settlement costs, including those associated with Indigenous Communities.

Interest costs are seen as totaling $16.2 billion this year. As a share of revenues, these costs are pegged at 7.4% this year, marking a notable step up from the 6.9% level in FY 2024/25, but well below the threatening levels observed in the 1990s.

The government will also create a new Protecting Ontario Account, which could offer up to $5 billion in support for businesses through liquidity relief and new programs aimed to cushion firms impacted by the tariffs. In addition, a new Trade-Impacted Communities Program will be formed to help businesses navigate disruptions caused by the U.S. trade war. The government will also top up the Building Ontario Fund by $5 billion.

Not Much Improvement Expected in Debt Burden

The province expects a deterioration in its debt burden over the medium term. This is driven by a combination of lingering deficits and an emphasis on capital spending. On the latter, note that Ontario is earmarking some $33 billion in overall infrastructure expenditures for this fiscal year, as part of a 10-year plan worth over $200 billion. The latter marks a $10 billion increase over last year’s budget. Transit infrastructure forms the bulk of expected outlays, although they’re relatively high for healthcare and education as well.

Net debt-to-GDP is slated to rise 2.3 ppts from its FY 2024/25 level of 36.3% by FY 2027/28. For this fiscal year, the debt ratio is pegged at 37.9% - above all other provinces except for Quebec and Newfoundland and Labrador. However, it’s forecast to remain below the 40% debt sustainability target the government has established.

Borrowing requirements for this fiscal year are expected to total $42.8 billion, down from $49.5 billion in FY 2024/25.

Bottom Line

Budget 2025 largely follows through with previously announced measures designed to help Ontario’s economy weather this bout of near-term economic turbulence. As such, there wasn’t much in the way of surprises delivered in this document. Notably, much of the relief that the government will provide is geared towards businesses.

All in, revenue measures are expected to offer $1.4 billion in tax relief this year. However, the scale of support climbs significantly when considering the hefty Protect Ontario Account and the $2 billion in WSIB rebates to safe employers. Businesses will also potentially find near-term cash flow relief through the deferral of provincial business taxes.

Hefty infrastructure spending is also pledged for this year, which could buffer the economy. Infrastructure investment also has the potential to lift productivity over the longer-term, which has been a sore spot for Ontario along with its provincial counterparts.

Even with these support measures announced, the province expects economic growth to hit a soft patch. Accordingly, Ontario’s fiscal position is anticipated to deteriorate in the near-term. The province still envisions balancing the budget by FY 2027/28, although this comes on the back of almost no program spending growth after this year, which will be a challenging proposition. Ontario’s elevated debt burden could also compromise its ability to respond to downside growth risks in the future.

Ontario Economic Assumptions

Annual Percent Change (Unless Otherwise Indicated)

| Calendar Year | 2022 | 2024 | 2025 | 2026 | 2027 |

| Real GDP | |||||

| Budget 2025 | 3.9 | 1.5 | 0.8 | 1.0 | 1.9 |

| TD Economics Forecast | 4.1 | 1.5 | 1.0 | 0.9 | 1.8 |

| Nominal GDP | |||||

| Budget 2025 | 9.2 | 5.2 | 3.1 | 3.0 | 4.0 |

| TD Economics Forecast | 9.4 | 5.2 | 3.8 | 2.6 | 3.8 |

| 3-Month Treasury Bill Yield | |||||

| Budget 2025 | 0.0 | 4.3 | 2.4 | 2.3 | 2.4 |

| TD Economics Forecast | 2.2 | 4.3 | 2.4 | 2.3 | 2.3 |

| 10-Year Gov't Bond Yield | |||||

| Budget 2025 | 0.0 | 3.4 | 3.1 | 3.2 | 3.4 |

| TD Economics Forecast | 2.8 | 3.4 | 3.1 | 3.0 | 3.0 |

Government of Ontario Fiscal Plan

[ C$ billions unless otherwise noted ]

| Fiscal Year | 2025 Budget Plan | ||||

| 23-24 | 24-25 | 25-26 | 26-27 | 27-28 | |

| Revenues | 209 | 221.6 | 219.9 | 227.9 | 237.9 |

| % change | 8.3 | 14.9 | -0.8 | 3.6 | 4.4 |

| Expenditures | 209.7 | 227.6 | 232.5 | 233.7 | 235.7 |

| % change | 5.5 | 8.5 | 2.2 | 0.5 | 0.9 |

| Program Spending | 195.2 | 212.4 | 216.3 | 216.7 | 217.9 |

| % change | 4.7 | 8.8 | 1.8 | 0.2 | 0.6 |

| Interest Charges | 14.5 | 15.2 | 16.2 | 17.0 | 17.8 |

| % change | 16.9 | 4.8 | 6.6 | 4.9 | 4.7 |

| Reserve | 0.0 | 0.0 | 2.0 | 2.0 | 2.0 |

| Budget Balance | -0.7 | -6.0 | -14.6 | -7.8 | 0.2 |

| % of GDP | -0.1 | -0.5 | -1.2 | -0.6 | 0.0 |

| Net Debt | 408.0 | 428.1 | 460.8 | 487.0 | 501.7 |

| % of GDP | 36.4 | 36.3 | 37.9 | 38.9 | 38.6 |

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: