GTA Condo Market Outlook:

More Pressure in Store for Beleaguered Sector

Rishi Sondhi, Economist | 416-983-8806

Date Published: May 1, 2025

- Category:

- Canada

- Real Estate

Highlights

- 2024 was another soft year for the GTA resale condo market, and this trend was maintained in the first quarter of this year. By the end of this year, condo prices will likely have dropped between 15-20% from their 2023Q3 peak, with about 10 ppts of this decline taking place this year. Soft population growth, elevated supply and economic uncertainty should all weigh.

- 2026 could bring improved fortunes for the market amid a supportive interest rate backdrop, waning tariff-related uncertainty, and stronger economic and job growth. However, chances of a heroic rebound are likely low, as population growth will likely be slow and condo affordability should remain strained.

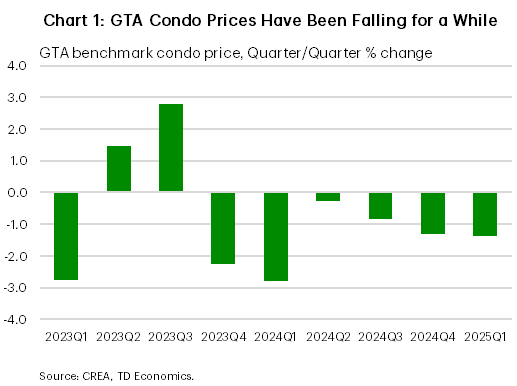

2024 was yet another weak year for the GTA resale condo market, with benchmark prices falling 4% in annual average terms and sales hitting their lowest level since the Global Financial Crisis. A glut of supply on the market coupled with a quiet demand backdrop at the end of last year meant that supply/demand balances heavily favoured buyers heading into 2025. Conditions such as this typically result in falling prices and this dynamic has held true so far in 2025 (Chart 1), with condo prices declining again in the first quarter (marking the 5th straight such drop), while sales activity was soft.

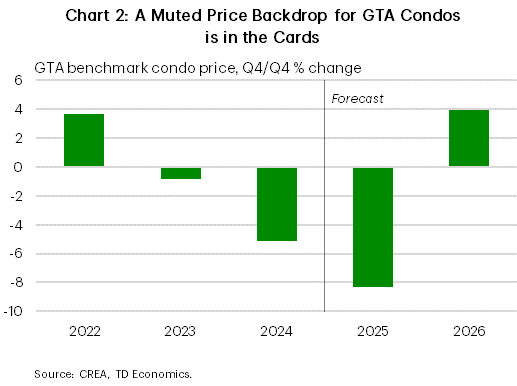

Last September we were calling for resale condo prices to continue declining into the early part of 2025. However, demand conditions have weakened materially since then, leading us to cut this bearish forecast even further. Now, we foresee condo prices falling through the rest of this year, such that by the time 2025 ends, they will have dropped between 15-20% from their 2023Q3 peak, with about 10 ppts of this downside taking place this year (Chart 2). Meanwhile, sales levels are likely to remain muted. Notably, this projection would erase much of the upside for condos gained during the pandemic, but not all, as prices would still be about 5-10 ppts above their pre-pandemic level even with this correction.

Several factors inform our 2025 view on condo prices:

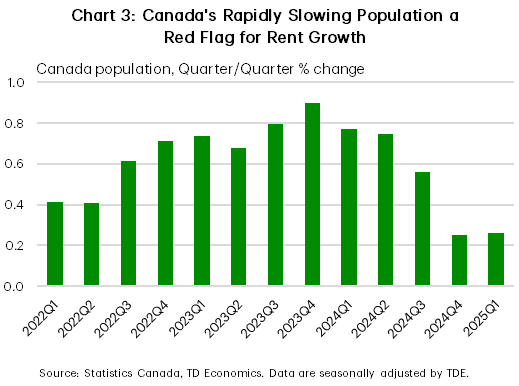

- Population growth is slowing rapidly as the federal government’s tighter immigration plan is unfolding (Chart 3). Alongside rising supply, this is downwardly pressuring rents. Note that in the resale market, rents for the average one-bedroom apartment in the GTA fell by 5% year-on-year in 2024Q4. Souring rent growth is likely turning off investors, with industry data suggesting that the share of homes being bought up these buyers is on the decline. It’s also possible that the allure of achieving an acceptable ROI through rising condo prices has faded for investors, given the weak conditions that have prevailed for a few years, and the large deterioration in condo affordability.

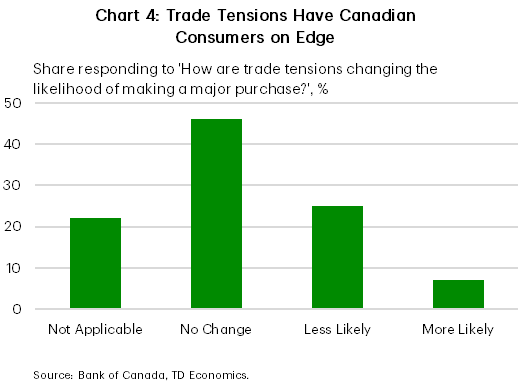

- The trade war (and associated economic uncertainty) is keeping potential buyers sidelined. A recent Bank of Canada survey found that 25% of respondents were less likely to make a major purchase given the trade tensions, versus 7% who were more likely (Chart 4). And this survey was taken in late January to late February, meaning that intentions could have soured further. The Conference Board’s March consumer confidence report also showed a rising share of Canadians thinking that it was a bad time to make a major purchase.

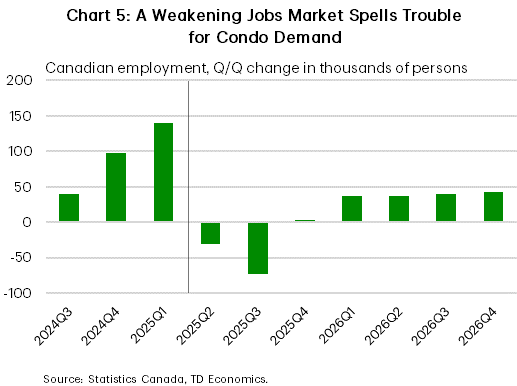

- The labour market appears to be buckling under the weight of tariffs, with employment declining in March, driven by full-time, cyclically sensitive sectors. Our forecast anticipates further near-term job losses (Chart 5), a moderately rising unemployment rate (to around 7%) and slowing wage growth.

- We anticipate the level of condo completions to fall significantly this year, and indeed, they were down 17% in the first quarter. That said, the level should remain relatively elevated. As these units complete, listings will likely see some upward pressure as they did in 2024.

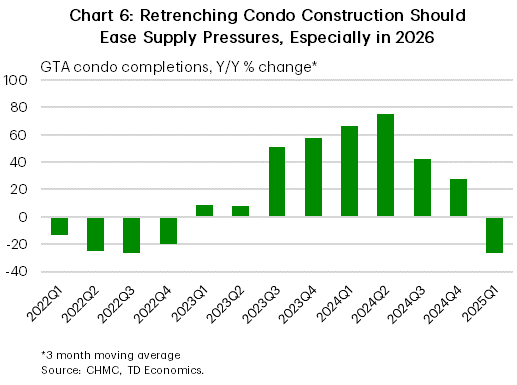

While 2025 is shaping up to be a poor one for GTA condos, 2026 could see some modestly improved fortunes. For one, the interest rate backdrop should be supportive and there is likely pent-up demand. The Bank of Canada will probably cut their policy rate by an additional 50 bps this year, bringing it to 2.25%, and hold it at that level through next year. It’s also worth noting that no major central bank has cut rates as aggressively as the BoC since last year, offering significant rate relief to buyers. Meanwhile, after moving higher recently due to tariff-driven inflation concerns, we expect bond yields to pull back a touch by year end (and in 2026). Tariff-related uncertainty should also wane into next year, giving some support to buyer confidence. We’re also expecting improved economic activity and hiring as uncertainty lessens. On the supply side, the impact on completions of the pullback in condo construction observed since the second half of 2024 should be more apparent next year. Indeed, we expect condo completions to fall to levels below recent averages, in turn reducing supply pressures faced in the market (Chart 6).

Notably, boosting housing supply is a priority for the newly elected federal Liberal government. The Liberals are pledging to eliminate the GST for first-time homebuyers who purchase homes under $1 million. This policy could support demand and, ultimately, supply. However, lags inherent in the homebuilding process suggest that the bulk of this impact on condo construction could happen after 2026. The Liberals are also promising to support construction through a new entity called “Build Canada Homes”, although much of the focus appears to be on affordable housing and purpose-built rental units. Liberals are also pledging to reduce development charges by 50%. As these charges are relatively high in the GTA, this could offer some upside risk to supply next year if implemented in a timely manner.

Although the GTA condo market should enjoy a firmer year in 2026, chances of a heroic rebound appear slim. For one, the anticipated turnaround in hiring and economic activity will probably be gradual and moderate, reflecting scaring on the psyche of households and businesses from the trade war. What’s more, population growth is likely to remain subdued next year as well, restraining rent growth and the overall attractiveness of condos as investment assets. In this vein, investor demand could take a backseat to other types of buyers (a dynamic that could hold true in 2025 as well), particularly first-time homebuyers, who typically tend to buy condos as their first purchase in the GTA. Finally, condo affordability is likely to remain strained next year, weighing on the scale of any potential bounce back in sales and prices.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: