Highlights

- Technological and production cost reduction advancements by Chinese automakers and battery manufacturers present an opportunity for Canada to diversify its electric vehicle supply chains through strategic partnerships.

- This could help Canada's auto industry to accelerate innovation, reduce production costs and increase the variety of EV models offered to consumers.

- More affordable and diverse product offerings, in turn, could help reverse the current slowdown in EV sales related to the phaseout of government subsidies amidst lingering consumer concerns over high EV prices and an insufficient charging infrastructure.

- American and European automakers already partner with Chinese companies to varying degrees. Canada has the added competitive advantage of an end-to-end supply chain that can bolster domestic industries.

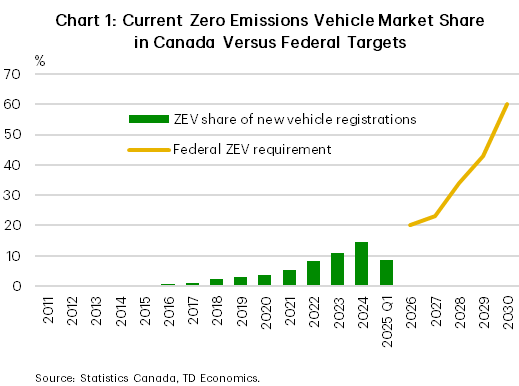

The Canadian government has identified decarbonizing the transportation sector as one of the key levers for reducing emissions economy-wide. In 2023, the Trudeau government implemented regulations that would have required zero-emission vehicles to comprise 20% of light-duty vehicle sales in 2026, with the target rising to 60% by 2030 and 100% by 2035. However, Prime Minister Carney recently announced the suspension of the 2026 sales target as electric vehicle (EV) sales have slowed sharply in 2025, putting the target virtually out of reach for an auto sector that is already struggling to adapt to the U.S. trade war (chart 1). In the first quarter of the year, battery and plug-in hybrid electric vehicles comprised 8.7% of new vehicle registrations, down from nearly 15% in 2024. The slowdown in EV sales momentum was driven in part by the drying up of federal and provincial consumer subsidies in 2025. Additionally, EV prices remain elevated relative to comparable internal combustion models, with the added disadvantage of consumer concerns regarding insufficient charging infrastructure. In recognition of the role affordability plays in EV adoption and achieving the larger goal of decarbonizing the transportation sector, the government has tasked itself with finding ways to bring more affordable EVs into the Canadian market.

To some degree, the challenges related to domestic prices and the charging infrastructure reflects a strategic choice the government made to confront perceptions of “dumping” into the Canadian market from China’s EV overcapacity, which was a byproduct of nearly two decades of significant subsidization of their industry to the tune of about US$230 billion1. This risked displacing domestic production through an unfair advantage, resulting in a 100% tariff on Chinese EVs last year. However, in doing so, Canada has inadvertently curtailed the adoption of the most advanced battery technology on the market. This risks throwing the baby out with the bath water.

Policies should be more strategically designed rather than a blanket approach. There are opportunities to enhance the domestic EV industry to improve the rate of adoption with a lower cost structure and enhanced technology while also generating domestic jobs. Partnering with China’s leading companies, if managed strategically and pragmatically, could vastly enhance Canada’s EV ecosystem and bolster the domestic industry.

How Do Global EV Technologies Compare?

Much has been written about the relative technological advantage of Chinese EV technology relative to that in North America and Europe. The technology gap is to be expected given that China began fostering this advantage nearly 20 years ago with hundreds of billions of dollars in subsidies to aid the sector2. However, defining this gap in more definitive terms is required to assess relative differences and the feasibility for traditional automakers to catch up.

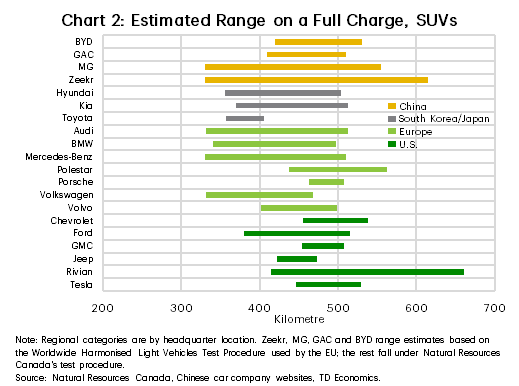

The first consideration is how far EVs can travel on a single charge. On this front, the differences are not material between Western original equipment manufacturers (OEMs) and their Chinese counterparts (chart 2). For example, the driving range of the different trims of the 2025 Ford Mustang Mach-E is between 380-515 km versus 420-530 km for BYD SUVs sold in the E.U. Moreover, these distances are already comparable to the mileage one would get from a full tank on a gasoline SUV and are more than sufficient for daily commuting for most people. EV range generally increases with the energy capacity of a battery, but larger batteries also cost more. OEMs typically balance the range and cost tradeoffs by offering different trims of the same model that have different battery sizes/range and, by extension, price.

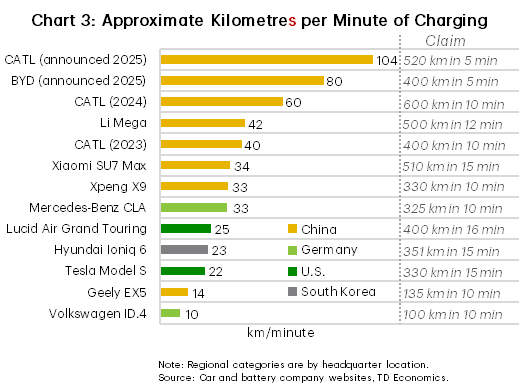

When it comes to consumer concerns on charging time, the current best-in-class models offered by some Chinese OEMs, such as Li Auto, are slightly ahead of the top-rated offerings from western OEMs like Mercedes-Benz and Lucid (chart 3). However, Chinese companies seem poised to catapult further ahead based on recent announcements by CATL and BYD. Both noted new battery technologies that can add 520 km and 400 km of range, respectively, in 5 minutes of charging. This would be comparable to the time it takes to fill a tank of gasoline for a similar range. This is an exciting development for EV innovation, but it will take time for companies to develop vehicles that are compatible with this new technology along with compatible charging infrastructure. Additionally, electricity grid upgrades will be necessary to enable the safe accommodation of the load demand from these ultrafast chargers to avoid straining the grid. To contextualize this, the new BYD 400km/5min Super e-Platform has a maximum charging power of 1 megawatt (MW), which means the power demand of charging just 500 vehicles simultaneously would be equivalent to about 10% of Toronto’s peak demand!

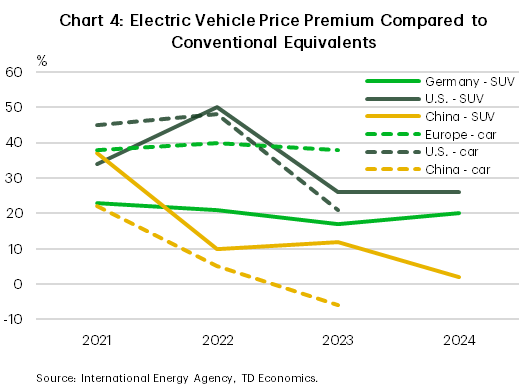

The last, and most consequential, consideration is the cost of the vehicle. Once again, Chinese OEMs are miles ahead of everyone in offering affordable models in the domestic Chinese market that in some cases, are cheaper than comparable internal combustion engine (ICE) vehicles (chart 4). According to data from the International Energy Agency, electric SUVs were only 2% more expensive than ICE SUVs in 2024 in China. Average electric car prices had fallen below those of conventional cars, as of 2023. In contrast, electric SUVs had a price premium of 26% in the U.S. and 20% in Germany while cars had a 21% and 38% premium in the U.S. and Europe, respectively.

Although Chinese EV manufacturers selling in overseas markets offer prices that are competitive, they are not the exceedingly low (US$10-20k) prices that are offered domestically in China. For example, the BYD Atto 3 Comfort model costs more than twice as much in Germany as it does in China.3 In part this is because when these vehicles are exported, they face higher costs related to shipping and logistics, tariffs, and vehicle specifications that conform with local standards. However, Chinese OEMs also charge higher prices net of these considerations to capitalize on stronger profit margins, in part to offset the lower profits earned in their competitive domestic market.

How Chinese Companies Got So Far Ahead

Several factors have enabled Chinese OEMs to gain a competitive edge. First, China’s EV industry has benefited from nearly two decades of production and consumer subsidies which have not only helped the industry to develop economies of scale but have also led to a battery manufacturing overcapacity. This overcapacity has driven down battery prices in China4, resulting in the low-cost EV models offered today.

Secondly, Chinese companies largely specialize in lithium iron phosphate (LFP) batteries, while in Western countries, nickel, manganese and cobalt-based (NMC) batteries are more common. While NMC batteries have higher energy density (energy capacity per unit of weight) and perform better in cold temperatures, LFP batteries are less costly since iron is more abundant and cheaper than nickel and cobalt. One estimate suggests the cost of production could be 35% lower for LFP batteries relative to NMC batteries.5 Furthermore, LFP batteries are less prone to overheating, making them more compatible with fast charging, a feature that has helped Chinese companies make significant advancements in developing fast charging technologies.6

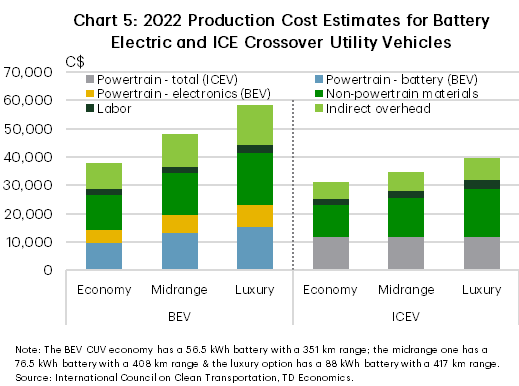

Third, vertical integration has enabled Chinese companies like BYD to have better control over supply chain costs in a way that many non-Chinese companies (barring a few like Tesla) do not. As an example, BYD, which started as a battery manufacturer, makes its own batteries and does so at a much lower cost than leading battery manufacturers such as LG Energy Solution, Samsung SDI and Panasonic, which supply many western OEMs.7 This is a notable advantage as batteries comprise a large proportion of EV manufacturing costs. For EVs available in Canada, battery costs are estimated to be over a quarter of total vehicle production costs (chart 5).8

Narrowing the Gap

Given the head start in EV technology that China gave itself and the subsequent gap that prevails between Chinese and Western OEMs today, the question then turns to whether this gap can be narrowed. Over the past few years, governments in Western nations invested tens of billions of dollars into consumer and production subsidies. In turn, the gap was narrowing. However, many of these subsidies have been wound down globally and OEMs will have to compete more directly.

Currently, OEMs are focusing their efforts on the highest cost component of an EV, the battery. Companies such as GM and Ford are pivoting towards LFP batteries for new entry level models that are expected to have lower prices compared to most current models. In North America, LFP battery production is expected to increase over the next few years as the Ford plant in Michigan comes online in 2026. In Canada, the PowerCo (Volkswagen) plant in Ontario will produce LFP batteries along with other battery chemistries, with production beginning in 2027. As well, Ultium Cells (a GM and LG Energy Solution joint venture) recently announced plans to convert part of its battery cell manufacturing facility in Tennessee to producing LFP batteries, with production expected to start in 2027. Other Korean and Japanese battery manufacturers are also investing in LFP batteries and ramping up production globally.

In terms of reducing charging times, non-Chinese manufacturers have been investing heavily in R&D. For instance, Samsung SDI announced about a year ago that it was on track to introduce batteries that can add 300 km of range in 5 minutes by 2026.9 While that range is now eclipsed by BYD’s 400 km and CATL’s 520 km announcements from earlier this year, it is still a big improvement relative to the current state of technology and also highlights that notable technological progress is happening outside China.

As well, many OEMs are partnering with Chinese battery makers and automakers to benefit from the technological advancements. The level of partnership varies. For instance, GM is directly buying batteries from CATL while awaiting the start of production at its Tennessee plant, while Ford is licensing battery and manufacturing technology from CATL for its Michigan plant. Other western OEMs are pursuing collaboration with Chinese OEMs to develop low-cost EV models. For example, Stellantis has acquired a 20% stake in Leapmotor and the two companies have formed a joint venture that will sell and manufacture affordable EVs outside China. The partnership is mutually beneficial as Leapmotor can expand its global sales by benefiting from Stellantis’ brand recognition and deep distribution and service networks, while Stellantis can capitalize on Leapmotor’s cost-efficient high-tech EV products to reach its EV sales targets. These types of partnerships could also enable western OEMs to learn from the operational processes of their Chinese partners, which have yielded faster vehicle development times and lower capital costs.

Global Trade Tensions, Old and New

The relative lack of Chinese EVs on the road in North America and most of Europe has been a deliberate government policy choice, with most nations implementing tariffs to protect their domestic manufacturing base. Less than a year ago, the U.S. and Canada imposed 100% tariffs on imported Chinese EVs, while the E.U. imposed 17-35% tariffs on EV firms producing in China – Tesla received a lower 7.8% tariff from the E.U. on vehicles produced in China. These measures became necessary in the eyes of these nations. EV adoption rates soared during the post-pandemic period and Chinese EV companies, many of which having already established economies of scale domestically, began to explore export opportunities. Several nations, including the U.S. and Canada, had imposed restrictions on the eligibility of Chinese EVs for consumer subsidies in years prior, but decided to take more direct action.

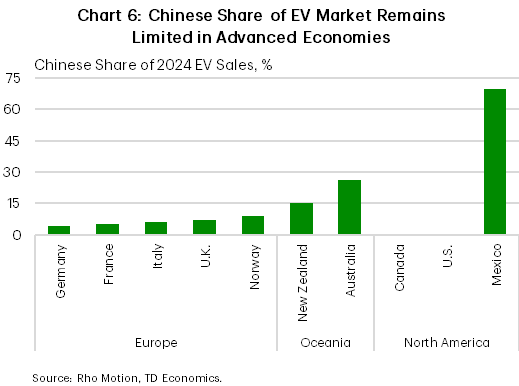

In contrast, other nations including the U.K., Norway, Australia, and New Zealand have not implemented measures to restrict Chinese EVs. Prior to the implementation of tariffs, the EV market share accounted for by Chinese companies in Europe was comparable across countries (chart 6). In the Oceania region, China’s relatively higher share is likely owing to geographic proximity. Interestingly, the high and low end of the spectrum are found in North America, where China’s sky-high 70% share of the Mexican EV market sharply diverges from the 0% share in the U.S. and Canada. The juxtaposition is striking, but can largely be explained by two factors. The first is a multi-year push by China into Mexico - albeit no Chinese EV companies currently produce vehicles in Mexico. The second is the exclusion of Chinese EVs from consumer subsidies in Canada and the U.S.

Canada’s tariff on Chinese EVs was implemented 4 days after the U.S. tariff went into effect, with both nations citing the risks posed to the North American market by unfair competition. This was not surprising as the two markets are heavily integrated in both production and sales. Roughly 95% of Canadian motor vehicle and parts exports are sent to the U.S. every year, while roughly 40% of U.S. motor vehicle and parts exports are sent to Canada. The former of these two statistics is largely why unilateral policy decisions in relation to the automotive industry are challenging for Canada, at least in terms of production. Since most finished motor vehicles produced in Canada are sent to the U.S. (over 80%), it would be infeasible to produce vehicles that are essentially banned by the U.S. This is not solely in relation to U.S. tariffs. The U.S. also has regulations which restrict Chinese software from being used in vehicles sold in the country.10 This means that even if a Chinese EV company were to produce vehicles in Canada that met the domestic content requirements of the USMCA, it would still be banned in the U.S. if its software was Chinese in origin. While full-scale production of Chinese EVs in Canada is unlikely, there are still several areas where Canada can look to bolster its EV industry through potential partnerships with China.

Policy Considerations

Given the EV technology gaps that remain between China and other nations and China’s desire to expand globally, some form of partnership could aid Canada in improving its EV ecosystem. This is already taking place in the sourcing of EV batteries and battery materials, with most major automakers partnering in some capacity with Chinese firms on this front. However, to date, this has largely occurred through trade, rather than investment partnerships. There are some exceptions, such as Ford’s licensing of battery production technology from China’s CATL for its battery production facility in Michigan. This is the same facility which will be used to produce the batteries for Ford’s recently announced US$30,000 electric pick-up truck.11 The question for Canadian policymakers is whether there’s a path for partnerships of this nature within its borders to the benefit of domestic workers and facilities?

Doing so would provide automakers that produce in Canada with options for enhancing partnerships with Chinese EV companies in areas such as battery components, batteries, charging infrastructure, and even EV production. Examples could include licensing agreements for battery production technology, partnerships in charging infrastructure technology, battery chemistry research and development partnerships, or joint EV platform development. Any of these options in isolation could help domestic automakers to accelerate innovation, lower production costs, and enhance consumer product offerings. Simultaneously, it would likely help Canada return its EV adoption rate to an upward trajectory by overcoming persistent consumer concerns related to cost and range anxiety. Even if these partnerships only impact the margins of the EV ecosystem, Canada could still vastly improve its EV infrastructure, providing material benefits to its economy and ambitions for EV adoption.

American automakers are already pursuing aspects of these proposals domestically and internationally by partnering with Chinese EV companies, and Canada should not overlook similar opportunities to diversify its auto production supply chain while also offering better and less expensive technology in addition to more consumer choices.

Canada is currently caught in the middle of growing strains in trading relationships with both the U.S. and China. But a strategy to diversifying auto exposure and production should not ignore the benefits of partnerships with other countries, especially a market leader like China. Canada could also consider pursuing these objectives jointly with other nations, such as the E.U., to diversify risk further.

Bottom Line

At the end of the day, there is a growing consensus that Canada needs a new gameplan when it comes to global trade and domestic policy. The EV market is a prime example of an industry that Canada has inherent competitive advantages (i.e. abundant critical minerals suitable for both LFP and NMC batteries, affordable clean energy, EV and battery manufacturing capacity, government support, and a ready-made skilled labor force in manufacturing production). This could be enhanced by partnerships with established leaders in innovation in the industry. Pragmatism will remain as essential as ever. But ingenuity in the face of new challenges will be important as Canada explores ways to boost its economy and achieve decarbonization goals in a shifting global trade environment.

Text Box 1: Could Battery Leasing Be an Alternative Way to Encourage EV Adoption?

Unlike traditional vehicle ownership where one buys an entire vehicle, battery leasing is a business model that separates ownership of an electric vehicle and its battery by allowing a customer to buy the vehicle and rent the battery from the automaker or a third party. This cost-effective strategy is currently being explored in China and Europe by some OEMs. The scheme effectively lowers the vehicle’s purchase price, which can promote faster consumer adoption. For instance, leasing the battery for the Nio ET Touring in Germany in 2024 reduced the upfront cost by 20-30%, with the addition of the monthly fee paid for the battery. By comparison, adding the cost of a standard and long-range battery would add approximately €12,000 and €21,000 ($19,400 and $33,900 CAD), respectively, to the sticker price.

OEMs have experimented with various versions of the model over the years. Renault, which was one of the first adopters, offered monthly leasing rates that were based on annual distance driven. The group also gave a lifetime warranty for the battery, guaranteeing to replace it if its capacity fell below a certain threshold while also giving customers the option to buy out the battery at any point during their contract. Additionally, the Renault model enabled sales into the second-hand market by allowing buyers to continue with the lease or to buy the battery. Nio has put a twist on the model. In addition to leasing batteries, it offers swapping services, which allow customers to exchange depleted batteries for fully charged ones in just a few minutes. The company claims its stations can complete a swap in a mere 3 minutes. Monthly leasing rates offered by Nio in Europe are said to include four monthly swaps, with additional swaps done at an extra cost.

On the face of it, offering battery rentals as an option could be one way to reduce the price disparity between EVs and ICE vehicles and spur EV demand. However, this would only work if the leasing fees are also attractive to customers. They cannot be so onerous that they make the combined cost of leasing and charging the battery more expensive than what one would spend on gasoline on a comparable ICE vehicle. Moreover, the contract would also have to guarantee the quality of the battery and make it easy for customers to sell the vehicle in the used-car market. It may also be necessary to update the way auto insurance is structured in North America to incorporate this new model.

End Notes

- Scott Kennedy, The Chinese EV Dilemma: Subsidized Yet Striking, Center for Strategic & International Studies (June 28, 2024)

- Scott Kennedy, The Chinese EV Dilemma: Subsidized Yet Striking, Center for Strategic & International Studies (June 28, 2024)

- Gregor Sebastian, Noah Barkin and Agatha Kratz, Ain’t No Duty High Enough, Rhodium Group (April 29, 2024)

- BloombergNEF, Electric Vehicle Outlook 2024

- Christopher Otts, GM Will Import EV Batteries From China’s CATL Despite Tariffs, The Wall Street Journal (August 7, 2025)

- Christian Davies and Song Jung-a, Battery makers aim to ease EV anxieties with 5-minute charge, Financial Times (October 8, 2024)

- Peter Campbell and Edward White, How China’s BYD played catch-up with Tesla, Financial Times (July 6, 2022)

- Jameel Shaikh and Ben Sharpe, Assessment of light-duty electric vehicle costs in Canada in the 2023 to 2040 time frame, The International Council on Clean Transportation Working Paper 2023-29 (December 2023)

- Samsung SDI, Can We Charge EVs to 80% in 9 Minutes? (November 5, 2024)

- U.S. Department of Commerce’s Bureau of Industry and Security, Commerce Finalizes Rule to Secure Connected Vehicle Supply Chains from Foreign Adversary Threats (January 14, 2025)

- The Ford Motor Company, Ford’s $5B Bet on America: Innovation Meets Efficiency in New EV Platform, Assembly Process and Midsize Truck (August 11, 2025)

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: