Stablecoins Enter the Mainstream

Date Published: September 11, 2025

- Category:

- US

- Financial Markets

- Government Finance & Policy

Highlights

- Stablecoins are shifting from crypto-asset trading tools to a regulated part of the U.S. financial system, laying the groundwork to reshape the payments system.

- Digital stablecoin technology, with its potential for programmability and transparency, could make payments—especially cross-border transactions—faster, cheaper, and more reliable, benefiting remittances, business-to-business (B2B) payments, trading, and compliance processes.

- The recently passed GENIUS Act requires U.S. payment stablecoins to be fully backed by safe, liquid assets and strict audits, aiming to anchor trust and prevent past failures that shook confidence in the sector.

- Stablecoin issuers hold large volumes of short-term U.S. Treasuries in order to maintain their one-to-one pegs with the dollar. As stablecoin supply grows, increased purchases could put modest downward pressure on bill yields, while redemptions could add volatility to short-term funding markets.

- Widespread foreign adoption could reinforce the reach of the U.S. dollar but risks undermining monetary policy transmission elsewhere. Domestically, greater use of stablecoins could draw funds away from bank deposits, raising bank funding costs and altering credit conditions.

- The operational rules written over the next 18 months will be pivotal in determining if the benefits promised by stablecoins outweigh the financial risks of wider adoption.

The recently enacted U.S. GENIUS Act brings U.S. stablecoins closer to the financial mainstream1. Stablecoins are digital assets designed to maintain a fixed value against national currencies. While stablecoins can track any currency (or other assets such as commodities), the U.S. has a strong first mover advantage. Dollar pegged stablecoins represent over 99% of total market capitalization.

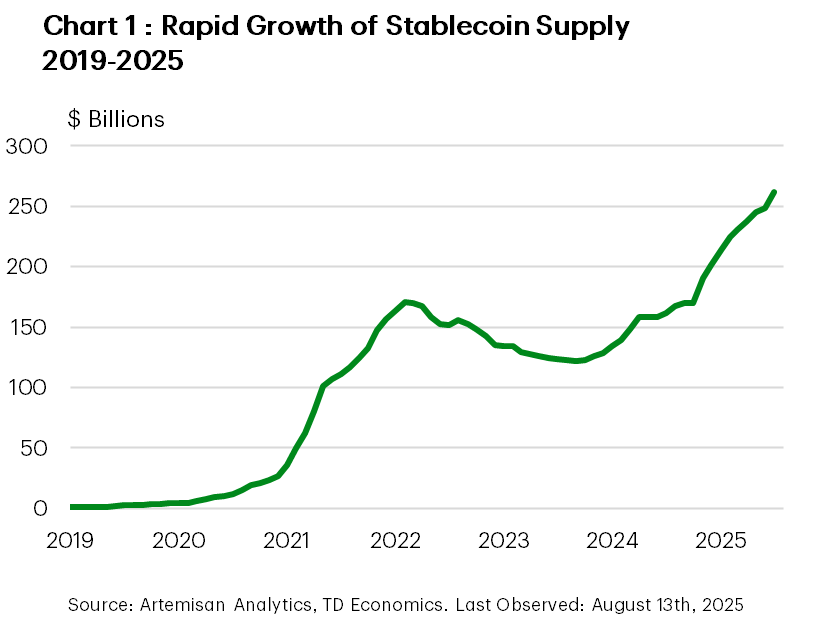

Stablecoins emerged in the mid-2010s as tools for cryptocurrency traders. By holding dollar-pegged tokens, traders could move instantly between crypto positions without leaving the digital ecosystem. Over the past decade, U.S. dollar stablecoins have grown from $5 billion into a nearly $250 billion market (Chart 1). Despite rapid growth and expanding use cases, stablecoins are still used primarily in crypto trading. Total tokens in circulation currently account for just 1% of total U.S. money supply.2

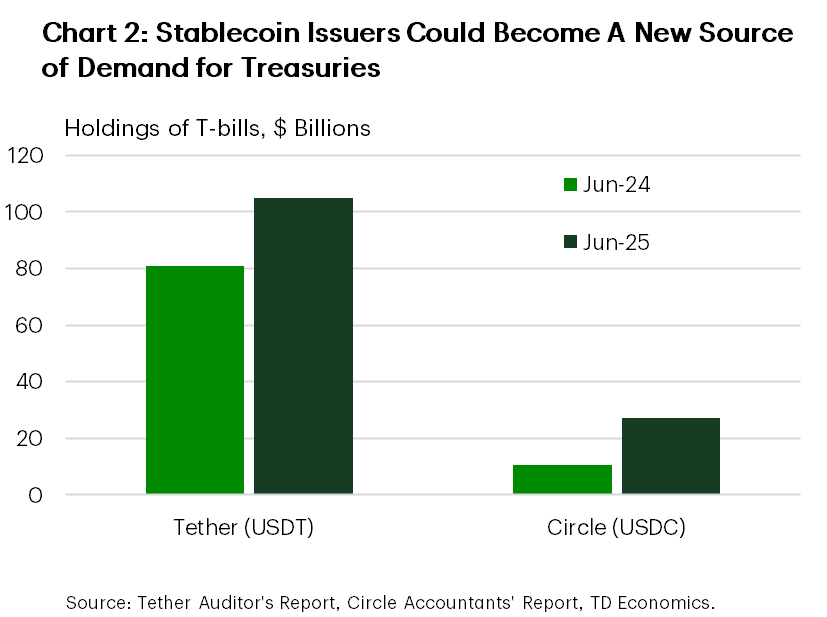

Still, with adoption continuing to expand, stablecoins hold the potential to become credible payment alternatives. They offer particular appeal in cross-border transactions and remittances, which often come with high fees and take considerable time to clear, especially in emerging markets. They may also gain ground in business-to-business (B2B) payments and as an alternative to retail payments, offering faster settlement and lower cost. As stablecoin usage potential grows, so does its importance to financial markets. Issuers’ purchases of short-term U.S. Treasuries are already a measurable source of demand for U.S. Treasury bills and look to increase further (Chart 2).

The GENIUS Act aims to raise confidence that payment stablecoins will be available on demand and maintain their value against the dollar. By setting clear standards on reserves, requiring frequent disclosures and ongoing supervision, the act aims to prevent the kind of de-pegging episodes that disrupted the industry in the recent past.3 Most importantly, issuers must maintain one-to-one backing in high-quality liquid assets such as short-term U.S. Treasuries or demand deposits at insured financial institutions. These reserves must be reported monthly and examined by an independent accounting firm, and they must be kept legally separate from the issuer’s own funds.

The GENIUS Act will not go fully into effect until rule making is finalized (January 2027 at the latest), but its enactment starts a transition period in which federal agencies will clarify the rules of the game and ensure compliance.4 The law does not eliminate all risks. Stablecoins could still face sudden runs if trust falters, and their heavy use of Treasury bills creates a new channel for stress to spill into funding markets. Differences in stablecoins’ regulatory framework across jurisdictions could complicate compliance and impede adoption. Meanwhile, their overseas use could affect capital flows and complicate monetary policy in other countries. Fragmentation, security and fraud risks also remain. Balancing efficiency and stability will depend in no small part on the details of rulemaking over the next year and a half and the ongoing vigilance of regulators thereafter.

From Trading Tools to Payment Infrastructure

Stablecoins emerged in the mid-2010s as a means to maintain digital dollar balances on crypto exchanges. Rather than cashing out to bank accounts, traders could use stablecoins to move between more volatile crypto assets and a stable digital dollar.

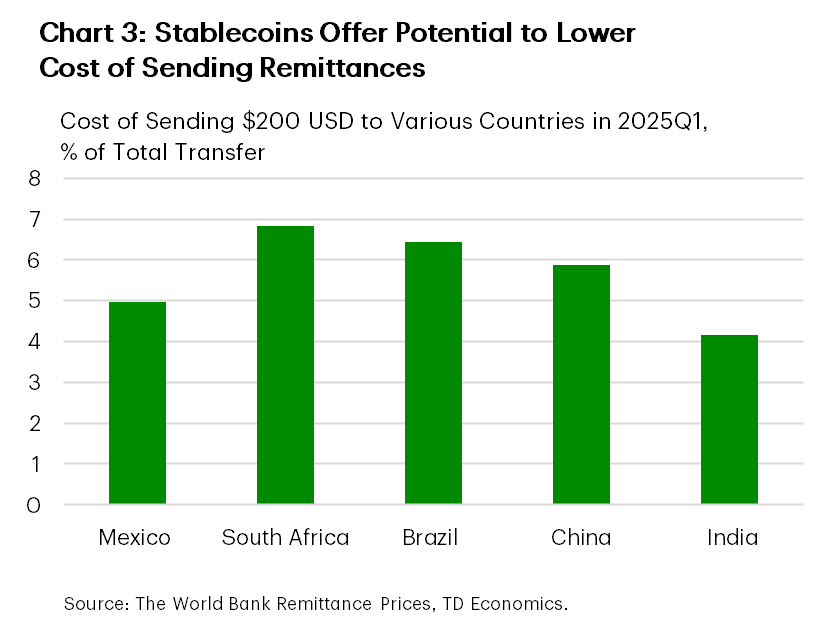

Use cases have since expanded beyond simple crypto trading (Table 1). Stablecoins offer the potential to make payments quickly 24/7. Cross-border payments and remittances are the most compelling use cases. Traditional international payments that rely on chains of correspondent banks may take days to clear, while providers offering faster transfers often charge high fees. Currently, the average cost of sending money across countries globally is 6.5% of the transaction (Chart 3). A well-managed, dollar-pegged token on a regulated platform, by contrast, could settle such payments in minutes. For exporters paying overseas suppliers, online marketplaces paying global sellers, or families sending remittances, the appeal is clear.

Industry pilots point to the shift. In 2023, Visa expanded a pilot to settle cross-border obligations in the stablecoin Circle (USDC) on the Solana blockchain, reducing settlement time from days to under an hour.5 In the retail sector, PayPal introduced PayPal USD enabling peer-to-peer payments and cross-border merchant purchases across 160 countries.

Table 1: Stablecoin Uses & Use Cases

| Segment | Use Today | Scale | Future Potential | Opportunities & Limits | ||||

| Consumers & Households | Sending money abroad, paying friends and family, storing value (particularly in countries with high inflation). | Stablecoins represent around 3% of all money sent across borders. | Could extend to everyday purchases, online shopping, digital services, and greater reach for the unbanked. | Offers faster, cheaper transfers and dollar access. Cards are easier, widely used and trusted. Unbanked will need cash agents and/or smartphones. Consumers require on- and off-ramps to facilitate exchange to and from fiat money. | ||||

| Businesses & Merchants | Paying overseas workers, managing cross-border cash, enable B2B payments with enhanced transparency and smart contracts, facilitate expansion into regions with weak banking infrastructure. | About $1.5 trillion in 2024, a sliver of the $100 trillion global business payments market. | Broader merchant acceptance, instant settlement, loyalty programs. | Could lower costs and speed up settlement via 24/7/365 service, improve payment transparency and increase automation with smart contracts. Offers opportunities for better liquidity management. Most customers still prefer cards, merchants face accounting and compliance hurdles. | ||||

| Institutions & Settlement Infrastructure | Moving money between exchanges, trading, simultaneous settlement, smart contract-based automation, intra-day liquidity management, automatic regulatory checks and posting collateral. | Roughly $27.6 trillion in 2024, making up over 80% of stablecoin activity. | Broader use in settling securities trades, liquidity management, payments and greater integration of "smart" contracts. | Could enable faster, 24/7 settlement, improve treasury operations, automate settlement processes via smart contracts, and serve as a settlement asset in a tokenized financial ecosystem. However, legal frameworks are still evolving, and there are challenges with integrating legacy financial infrastructure, as well as cybersecurity and operational risks, and interoperability issues. | ||||

| Public Sector & NGOs | Pilot projects sending aid in digital dollars, with cash-out at local agents. | Still very small compared with global aid and remittance flows. | Wider use in humanitarian settings and high-cost payment corridors. | Can speed up aid and improve transparency. Will depend on local cash networks, mobile access, and oversight. | ||||

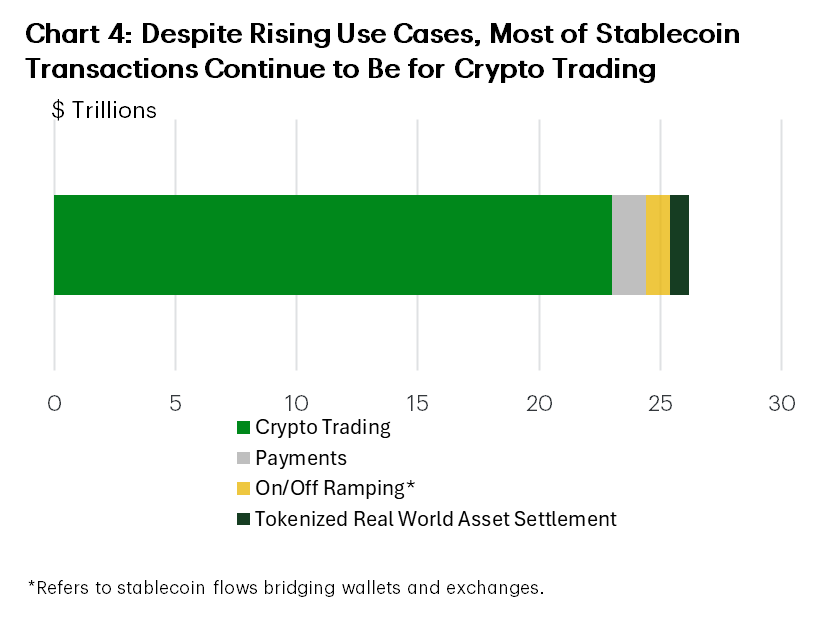

Despite these expanded use cases, so far nearly 90% of all stablecoin transactions continue to be for crypto trading. Adoption for payments remains relatively low at present, with payments accounting for just 6% of all transactions (Chart 4). Cross-border payments are also relatively small, with stablecoins accounting for just three percent of the total.6 The volume employed in capital markets (primarily exchanged for Treasury bills but also settlement in the purchase of bonds, funds, and other securities) is just under one percent of global capital markets transactions.7

Still, growing demand for practical applications, improvements in infrastructure and legislative changes have led to growth in stablecoin supply. Between 2019 and 2025, the stock of stablecoins in circulation has increased from under $5 billion to more than $250 billion. And the industry is expected to grow further. Current projections on stablecoin growth vary greatly depending on the scale of adoption, with low-end estimates around $500 billion and high-end estimates up to $2 trillion by 2028, depending on regulatory clarity, technological advancements, speed of adoption and market integration.8,9

A Relatively Consolidated Industry at Present

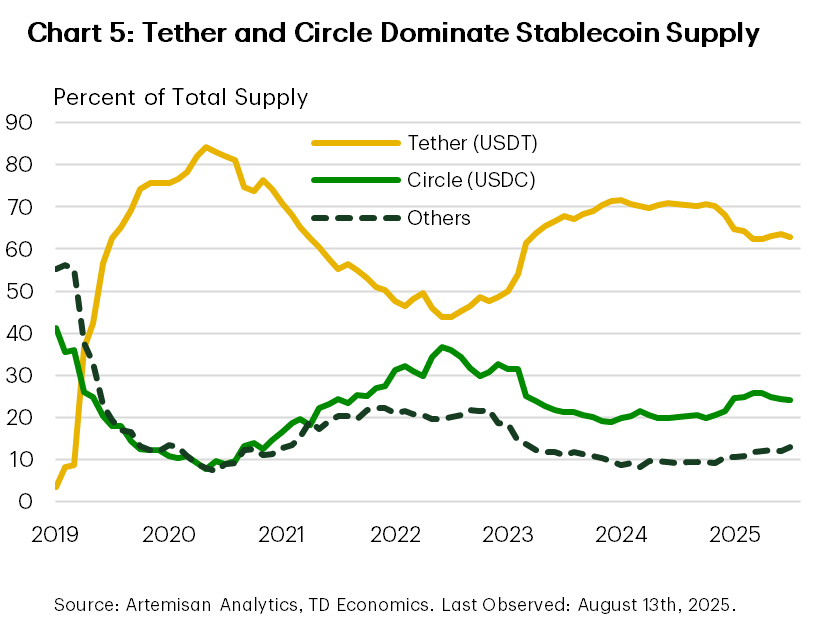

The stablecoin market has expanded quickly but remains highly concentrated. Tether (USDT) holds about $164 billion in circulation—around 63% of total coins—followed by Circle (USDC) with roughly $65 billion, or one quarter (Chart 5).

Network effects and user trust favor consolidation, but fragmentation is likely to persist in the near-term, especially as systems proliferate across borders and networks. Consolidation brings scale and ease of acceptance, but also the possibility of systemic risk. With broad acceptance, failure at a single large issuer could disrupt a potentially significant part of the payment ecosystem. Fragmentation, in contrast, may reduce concentration risk but at the cost of interoperability, liquidity fragmentation, and increased complexity for users.

Ultimately, for wide adoption, payment stablecoins will have to be interoperable across wallets, blockchains and country borders. We are not there yet, but technological advancement alongside a more certain regulatory framework is likely to move stablecoins in this direction.

From Market Failures To Regulatory Action

The push for regulation stems from hard lessons. Despite its promise to maintain a constant value, stablecoins’ early days were marked by a series of disruptions. In May 2022, the algorithmic stablecoin TerraUSD collapsed. It was not backed by dollars or other assets but relied on a linked token, LUNA, and algorithmic changes to supply to maintain its peg. When confidence fell, the mechanism failed, wiping out tens of billions in value and causing several large crypto lenders to fail.

Terra’s collapse was a shock to the crypto ecosystem, showing the dangers of engineered pegs. Less than a year later, the de-pegging of Circle’s USDC added a further warning that even transparent fully backed stablecoins were exposed to old-fashioned banking risks. In March 2023, $3.3 billion of Circle’s $40 billion reserve pool were trapped in the collapse of Silicon Valley Bank. The momentary loss of liquidity created uncertainty, leading to a brief de-pegging of USDC. The episode exposed liquidity and counterparty concentration risks even among well-backed tokens. Tether also experienced temporary dislocations during periods of market stress and heavy redemption demand.

Measured against the U.S. financial system, these amounts are modest. U.S. commercial banks collectively hold between $23 and $25 trillion in assets, orders of magnitude larger than any single stablecoin incident. Yet despite the limited systemic risk, these de-pegs still disrupted markets and drew widespread attention. As stablecoins grow, the potential impact of such episodes will grow with them, making formal guardrails on reserves, redemption, and custodial protections essential.

GENIUS Act Anchors Trust with Clear Guardrails

The enactment of the GENIUS Act provides a clear policy signal as to how U.S. dollar-backed payment stablecoins are expected to operate within the American financial system. The legislation outlines a high bar for reserve quality, disclosure, and governance.

To address the issues of potential runs due to de-pegging, stablecoins must be backed one-to-one by high-quality liquid assets, specifically short-term U.S. Treasuries, demand deposits at insured banks or credit unions, overnight repurchase agreements backed by government securities, or, for banks, balances held at the Federal Reserve. These assets are chosen to maximize liquidity and minimize credit risk under a range of market conditions.10 Meanwhile, transparency is reinforced through monthly reports audited by independent public accounting firms, and customer funds must be segregated from issuer balance sheets.

Supervision is embedded in the Act through a mandatory federal licensing regime. Non-bank issuers must obtain approval from the Office of the Comptroller of the Currency (OCC) or, if their outstanding issuance is below $10 billion, may operate under qualifying state oversight, while bank issuers remain under their existing federal regulators – the OCC, Federal Reserve, Federal Deposit Insurance Corporation (FDIC), or National Credit Union Administration (NCUA) – depending on their charter type.

Stablecoin issuers are prohibited from paying interest to holders. However, as they already are actively doing, third-party platforms could continue to offer incentives independent of issuers. PayPal is currently offering 4% in rewards on users’ PayPal stablecoin (PYUSD) balances, while Cryptocurrency exchange platform Coinbase offers rewards to customers on their USDC balances.11,12 Last year, Circle spent 60% of the income it earned on its reserves on distribution and transaction costs, mainly to platforms such as Coinbase.13

Text Box: Compliance with the GENIUS Act—What Tether and Circle Must Do Now

With the GENIUS Act now law, issuers have an (up to) three-year phase in period to become fully compliant. U.S. intermediaries may not offer stablecoins unless issued by a licensed (or recognized foreign) issuer.

Practical implications differ by firm. Circle already discloses reserves frequently and relies on cash and short dated Treasuries, positioning it closer to compliance. It went public in June 2025, spotlighting governance and reporting. New rules will bring more frequent reserve disclosures and supervisory audits, but this is largely in line with their strategy of embedding USDC within regulated financial markets.

Tether, by contrast, reports significant bitcoin and gold alongside large Treasury bill and repo holdings. These assets are outside GENIUS’s permitted reserve list for U.S. issuance, so a U.S. compliant product (or use of the “foreign issuer” pathway) would require adjustments.

Foreign issuer access is possible but conditional. Treasury must deem a jurisdiction’s regime “comparable,” foreign issuers must register, and U.S. trading can be halted if an issuer is found non-compliant. How “comparable” will be defined has yet to be determined.

The Rulemaking Phase Kicks off in Earnest

The GENIUS Act sets broad requirements, but many of the details still need to be worked out in forthcoming rulemaking. The OCC, the Federal Reserve, and the Financial Crimes Enforcement Network (FinCEN) will all have a role in specifying operational standards and supervisory practices. These details matter because they will decide how stablecoins behave under stress and how safely they can be integrated into the wider financial system.

In particular, while the statute specifies reserves must be held in high quality liquid assets, regulators must still define the operational details. Treasury holdings are capped at maturities of 93 days, but rules could require even shorter terms. Regulators may also set limits on how much must be kept in cash or bank deposits, and establish diversification requirements so reserves are not concentrated with a single custodian or counterparty, similar to the approach taken under EU regulations.

Redemption procedures will have to clarify cut-off times and how they match up with bank operating hours. While a stablecoin token can change hands instantly on a blockchain, the dollars behind it must still settle through bank payment systems, which do not operate 24/7. Without alignment, redemptions could be delayed or bunch up in ways that strain liquidity. Technical interoperability requirements will also determine how easily payment stablecoins integrate with existing payment systems.

Licensing rules for non-bank issuers will need to set out governance standards, capital requirements, and contingency plans for outages or cyberattacks. Cybersecurity standards will have to reflect the fact that billions of dollars can be moved in minutes. Finally, anti-money laundering and counter-terrorist financing requirements will need to apply across all intermediaries, including digital wallet providers, to make sure the protections currently existing for bank payments also apply to token payments.

These decisions will help determine whether stablecoins serve as resilient payment tools, or become fragmented, risky payment silos.

Stablecoins in Global Payments

Cross-border payments are central to stablecoins’ use case as well as macro significance. In countries with high inflation or limited access to U.S. banking, dollar-pegged tokens offer a practical alternative to local cash or banking systems. Stablecoins offer protection against local inflation as well as devaluations and capital controls. By lowering the barrier to dollar access, stablecoins could expand the dollar’s use in the everyday transactions of households and businesses beyond American borders.

For the United States, this reinforces dollar dominance and may help to sustain global demand for U.S. safe assets. For other countries, increased usage of U.S. denominated stablecoins could weaken the hand of domestic policymakers. The European Central Bank (ECB) has expressed concern that if dollar-based stablecoins become a parallel medium of exchange, domestic monetary policy will lose traction in steering financial conditions.14 It has hastened its own digital currency initiatives in response.15 The International Monetary Fund (IMF) has also cautioned that reliance on dollar-backed digital currency could speed up capital outflows and weaken local banking systems.16 In short, stablecoins may provide security and convenience to individuals and businesses outside of the United States but complicate stability for foreign policymakers.

A New Buyer at the Short End

If digital dollarization projects U.S. money abroad, stablecoin reserves can shape U.S. financial markets at home. Stablecoin reserves are mostly held in short-term U.S. government debt, making them a significant source of demand for Treasury bills. As of the second quarter of 2025, Tether and Circle had combined holdings of about $132 billion of U.S. Treasuries (see Chart 2 above) – more than South Korea’s holdings of U.S. Treasuries.17,18 Right now this is about 2% of the size of the Treasury bills market, but this share will increase should stablecoin supply expand briskly.19,20

The growth of the stablecoins market and legislation come at a time when U.S. government debt is projected to rise considerably, increasing borrowing needs. However, as noted in our recent report, foreign demand for Treasuries has been declining. Simultaneously, the U.S. government has been issuing more short-term bonds to lower its borrowing costs. In this context, stablecoin issuers represent a fresh and potentially durable investor base. Their demand could help absorb the growing bill supply and keep short-term rates modestly lower than they would otherwise be.

That said, stablecoin demand is concentrated in very short-dated Treasury bills, typically those maturing in under 90 days, and buying pressure is most likely to lower yields in that corner of the market. However, while increased demand for Treasuries may lower short-term borrowing costs, it could also increase volatility. Should stablecoin owners redeem balances at a rapid pace, yields could move higher quickly. Recent research by the Bank of International Settlements (BIS) found that large inflows and outflows into the stablecoin market have had an asymmetric impact on Treasury bill yields.21 Stablecoin inflows that were roughly twice the size of the typical daily change were found to reduce three-month US Treasury yields by 2–2.5 basis points within 10 days, while outflows of the same magnitude had a larger impact, raising yields by 6–8 basis points. In other words, stablecoin outflows raise yields by two to three times as much as inflows lower them.

Beyond the Treasury market, large stablecoin flows could disrupt repo, money market funds, or foreign exchange markets during stress. A major redemption event could spill into these broader short-funding and currency markets if not mitigated through liquidity buffers or central bank facilities.

Impact on Banks and Credit Intermediation

Because most reserves sit in cash like assets rather than bank deposits, growth in stablecoin balances may displace traditional deposits and gradually raise banks’ funding costs. The GENIUS Act’s prohibition on paying interest to token holders is meant to limit direct competition with deposit accounts, but it does not remove the appeal of a highly liquid, programmable dollar instrument. Nor does it bar third parties from offering rewards or yields outside the issuer’s control, which could still divert balances from banks.22

The effect on deposits and financial conditions will depend on adoption patterns (wholesale versus retail, domestic versus offshore) and on rulemaking choices. Some jurisdictions require a minimum deposit share for reserves. Under the European Union’s Markets in Crypto Assets (MiCA) regime and related European Banking Authority standards, at least 30% of reserves must be held as deposits with depository institutions, rising to 60% for significant issuers. Both Tether and Circle currently hold only a small fraction of their reserves at financial institutions: 13.4% for Circle and less than 1% for Tether. However, if U.S. rules took a similar approach to the one in the E.U., some reserve balances would flow back into the banking system as corporate deposits, though those funds may still prove more flight prone than traditional core deposits.

In large enough volumes, a migration of balances to stablecoins could alter banks’ liability structures, raise funding costs, and reduce flexibility in extending credit. According to estimates by the American Bankers Association, if banks lose 10% of their core deposit base, funding costs could rise by 20 to 30 basis points.23 Households and small businesses that rely most on bank credit would feel this impact more directly through higher borrowing costs and tighter access. Wealthier clients and larger firms, with more diversified funding options, would likely be less affected. Community banks, which depend on retail deposits to support much of their small business and farm lending, could also face greater strain.

The extent of the impact will depend on how quickly adoption grows, how liquid issuer reserves end up, especially in stress, and how banks adapt with innovations like tokenized deposits and faster payment options. Clear regulatory communication on redemption rules, emergency lending and backstop facilities will be critical to limiting instability.

Bottom Line

The GENIUS Act represents a meaningful step in bringing payment stablecoins under federal regulation, setting clear rules on reserves, audits, legal protections, and supervisory oversight. The aim is to build trust in these instruments and reduce the uncertainty that has surrounded them.

Handled well, stablecoins could make payments faster, cheaper, and more transparent, particularly across borders where traditional systems remain slow and costly. They also hold a promise to modernize the existing payment system in other ways, allowing for instant settlement, programmable smart contacts and automated regulatory checks for businesses and financial markets. However, handled poorly, stablecoins could transmit shocks, heighten funding-market volatility, or open the door to cyber and operational risks. Even with one-to-one reserves in Treasuries and deposits, sudden redemptions or failures at key platforms could create stress.

Much will depend on the details still to come in rulemaking, including how redemption rights are enforced, how reserves are balanced between deposits and Treasuries, and what safeguards apply to third parties that distribute or offer yields on stablecoins. These choices will shape how the system functions in practice, not just in principle.

The broader challenge is that the technology will not stand still. As adoption widens, policymakers will need to remain forward-looking and adaptable, adjusting guardrails as use cases evolve.

End Notes

- U.S. Senate “Guiding and Establishing National Innovation for U.S. Stablecoins of 2025” (GENIUS Act of 2025), S.394, 119th Congress. Congress.gov, 2025, https://www.congress.gov/bill/119th-congress/senate-bill/394/text

- M1 money supply composed of currency, demand deposits, other liquid deposits.

- Rai, Vikram. “Are Stablecoins a Risk to Financial Stability?”. TD Economics,1 June 2022, https://economics.td.com/domains/economics.td.com/documents/reports/vr/crypto/Are_Stablecoins_a_Risk_to_Financial_Stability.pdf

- It could be implemented earlier if regulators issue final regulations sooner. The act goes into effect either 18 months from its enactment or 120 days after final regulations have been issued.

- Visa. “Visa Expands Stablecoin Settlement Capabilities to Merchant Acquirers.” Visa Inc., 5 Sept. 2023, https://investor.visa.com/news/news-details/2023/Visa-Expands-Stablecoin-Settlement-Capabilities-to-Merchant-Acquirers/default.aspx

- McKinsey & Company. “The Stable Door Opens: How Tokenized Cash Enables Next-Gen Payments.” 21 July 2025, https://www.mckinsey.com/industries/financial-services/our-insights/the-stable-door-opens-how-tokenized-cash-enables-next-gen-payments

- McKinsey & Company. “The Stable Door Opens: How Tokenized Cash Enables Next-Gen Payments.” 21 July 2025, https://www.mckinsey.com/industries/financial-services/our-insights/the-stable-door-opens-how-tokenized-cash-enables-next-gen-payments

- Singh, Rashika. “J.P.Morgan Wary of Stablecoin’s Trillion-Dollar Growth Bets, Cuts Them by Half.” Reuters, 3 July 2025, https://www.reuters.com/business/finance/jpmorgan-wary-stablecoins-trillion-dollar-growth-bets-cuts-them-by-half-2025-07-03/

- U.S. Department of the Treasury, Treasury Borrowing Advisory Committee. Digital Money. Presentation, 30 Apr. 2025. https://home.treasury.gov/system/files/221/TBACCharge2Q22025.pdf

- The requirement of one-to-one reserve backing lowers the risk of de-pegging and runs, particularly for institutional clients, who can redeem directly with stablecoin issuers, but it does not eliminate it for retail users who only have indirect access on the secondary market exchanges. The fact that the majority of retail stablecoin users can only purchase and sell stablecoin via an intermediary, who are not obligated to redeem a coin for $1, has drawn warnings from Security and Exchange Commission (SEC) commissioner Caroline A. Crenshaw.

MIT Digital Currency Initiative. “1:1 Redemptions For Some, Not All.” MIT Media Lab, 15 July 2025, https://www.dci.mit.edu/posts/stablecoin-redemptions-for-some-not-all - PayPal. PayPal USD (PYUSD). Accessed on 3 Sept. 2025, https://www.paypal.com/us/digital-wallet/manage-money/crypto/pyusd

- Coinbase. USD Coin (USDC) Rewards FAQ. Accessed on Sept. 3, 2025, https://help.coinbase.com/en/coinbase/coinbase-staking/rewards/usd-coin-rewards-faq

- Demos, Telis. “Circle’s Relationship with Interest Rates Isn’t a Straight Line.” The Wall Street Journal, 6 June 2025, https://www.wsj.com/finance/investing/circles-relationship-with-interest-rates-isnt-a-straight-line-499499b8

- Schaaf, Jürgen. “From Hype to Hazard: What Stablecoins Mean for Europe.” European Central Bank Blog, 28 July 2025, https://www.ecb.europa.eu/press/blog/date/2025/html/ecb.blog20250728~e6cb3cf8b5.en.html

- Asgari, Nikou. "EU Speeds Up Plans for Digital Euro After US Stablecoin Law." The Wall Street Journal, 22 August 2025. https://www.ft.com/content/8ad60169-d1e5-4d2c-b928-d53d668f0ec6?accessToken=zwAGPnU33A3AkdOK1gFp0eVNLNO5KNU9Zo8Oxg.MEUCIQCAfvOW_4TTkjGP0kGzNoc-u-gOKpXbTEmhuVLm9u5DxgIgb-4ekiFxVCbWUTTNez30T7vGuJgfCKPwMIaVsC76a1I&sharetype=gift&token=e99bf75c-d118-4072-89e5-ef1786c37d7e

- International Monetary Fund. “Digital Money, Cross-Border Payments, International Reserves, and the Global Financial Safety Net: Preliminary Considerations.” IMF Note 2024/001, 4 Jan. 2024, https://www.imf.org/en/Publications/IMF-Notes/Issues/2024/01/04/Digital-Money-Cross-Border-Payments-International-Reserves-and-the-Global-Financial-Safety-538733

- Deloitte & Touche LLP. Independent Accountants’ Report: June 2025. Assurance report for Circle Internet Financial, 30 July 2025, https://6778953.fs1.hubspotusercontent-na1.net/hubfs/6778953/USDCAttestationReports/2025/2025%20USDC_Examination%20Report%20June%2025.pdf

- BDO Italia. Independent Auditor’s Report on the Financials Figures and Reserves Report. Assurance report for Tether International, 31 July 2025, https://assets.ctfassets.net/vyse88cgwfbl/2SGAAXnsb1wKByIzkhcbSx/9efa4682b3cd4c62d87a4c88ee729693/ISAE_3000R_-_Opinion_Tether_International_Financial_Figure_RC187322025BD0201.pdf

- Ahmed, Rashad, and Iñaki Aldasoro. “Stablecoins and Safe Asset Prices”. BIS Working Paper no. 1270, May 2025, https://www.bis.org/publ/work1270.pdf

- U.S. Department of the Treasury, Treasury Borrowing Advisory Committee. Digital Money. Presentation, 30 Apr. 2025. https://home.treasury.gov/system/files/221/TBACCharge2Q22025.pdf

- Ahmed, Rashad, and Iñaki Aldasoro. “Stablecoins and Safe Asset Prices”. BIS Working Paper no. 1270, May 2025, https://www.bis.org/publ/work1270.pdf

- Bank Policy Institute. “Closing the Payment of Interest Loophole for Stablecoins”. 12 Aug. 2025, https://bpi.com/closing-the-payment-of-interest-loophole-for-stablecoins/

- American Bankers Association. “How Stablecoins Could Affect Borrowing Costs for the Government, Businesses, and Households.” ABA Banking Journal, 14 July 2025, https://bankingjournal.aba.com/2025/07/how-stablecoins-could-affect-borrowing-costs-for-the-government-businesses-and-households/

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: