The Weekly Bottom Line

Our summary of recent economic events and what to expect in the weeks ahead.

Date Published: March 6, 2026

- Category:

- Canada

Canadian Highlights

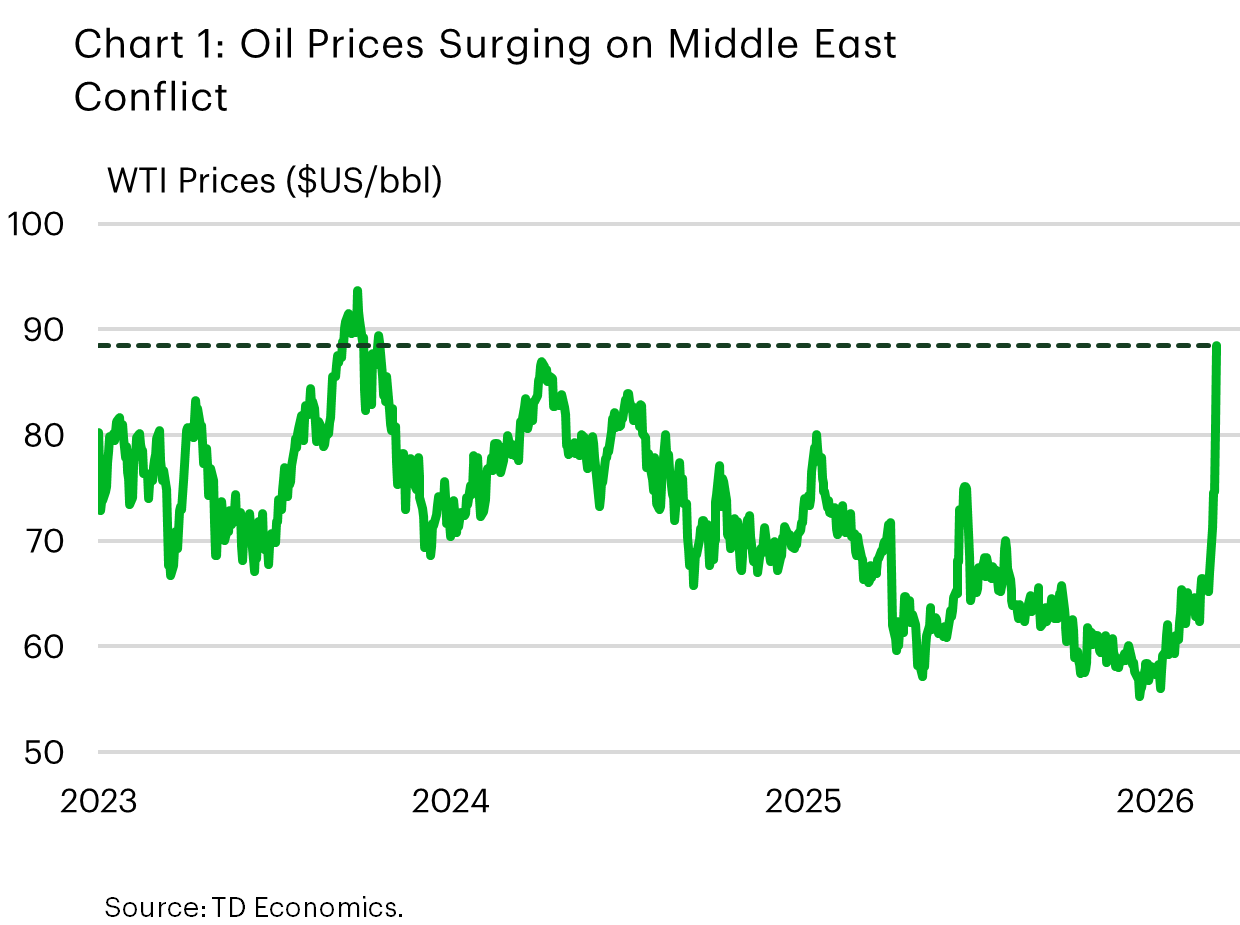

- Escalating conflict in the Middle East has sent oil prices parabolic. Major disruptions at the Strait of Hormuz leaves the near-term price outlook highly uncertain.

- Higher oil prices are a short-term boost for Canada’s energy sector and public revenues, but are already hitting consumers, with national gasoline prices up sharply on the week.

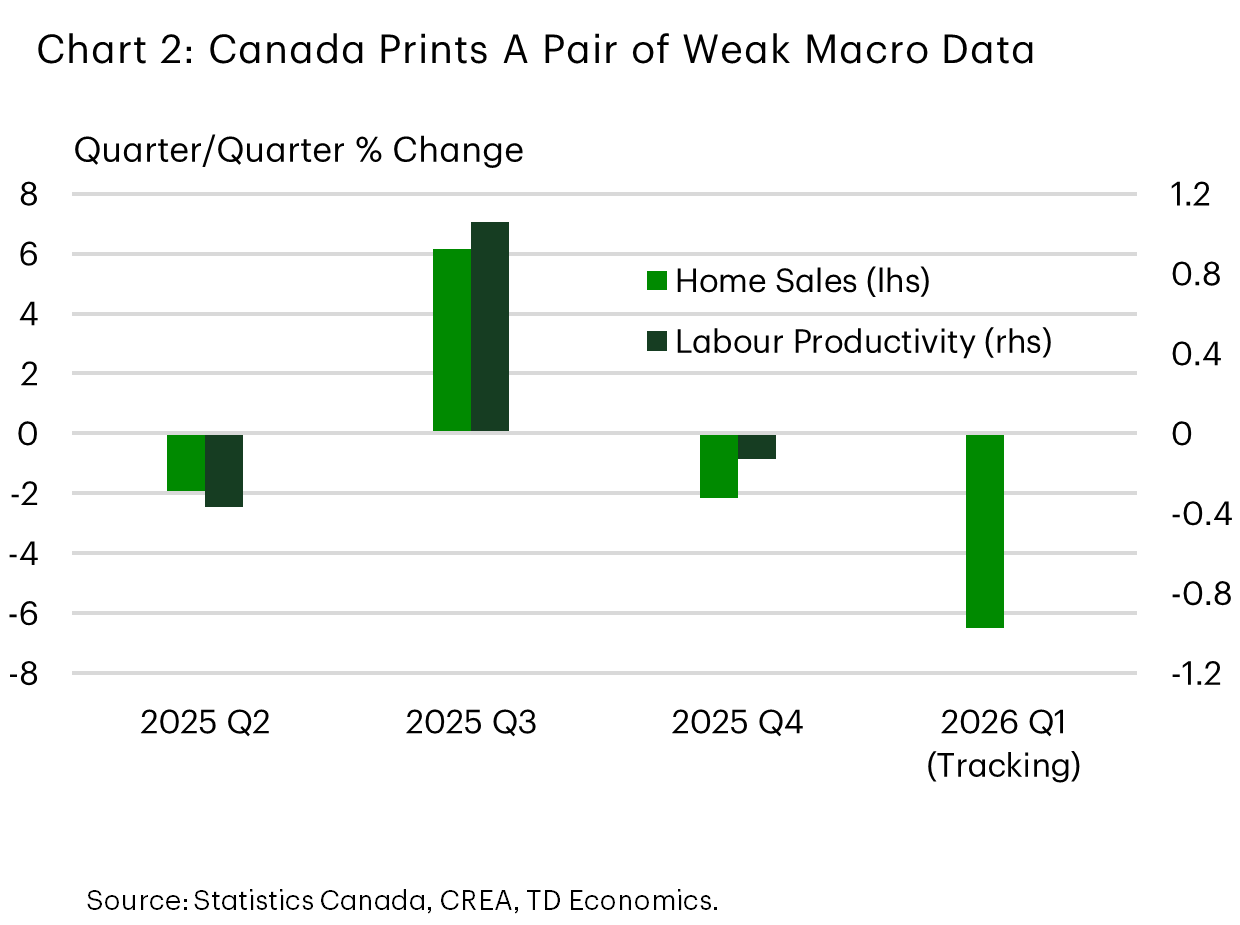

- The limited Canadian data this week was soft. Preliminary home sales data for February flatlined while Q4 productivity edged lower.

U.S. Highlights

- Global equity markets sold off this week, while energy prices pushed meaningfully higher following the United States and Israel’s strikes on Iran.

- Despite this week’s sharp move in oil prices, the impact to the U.S. economy remains relatively small, but that assumes the conflict is short-lived.

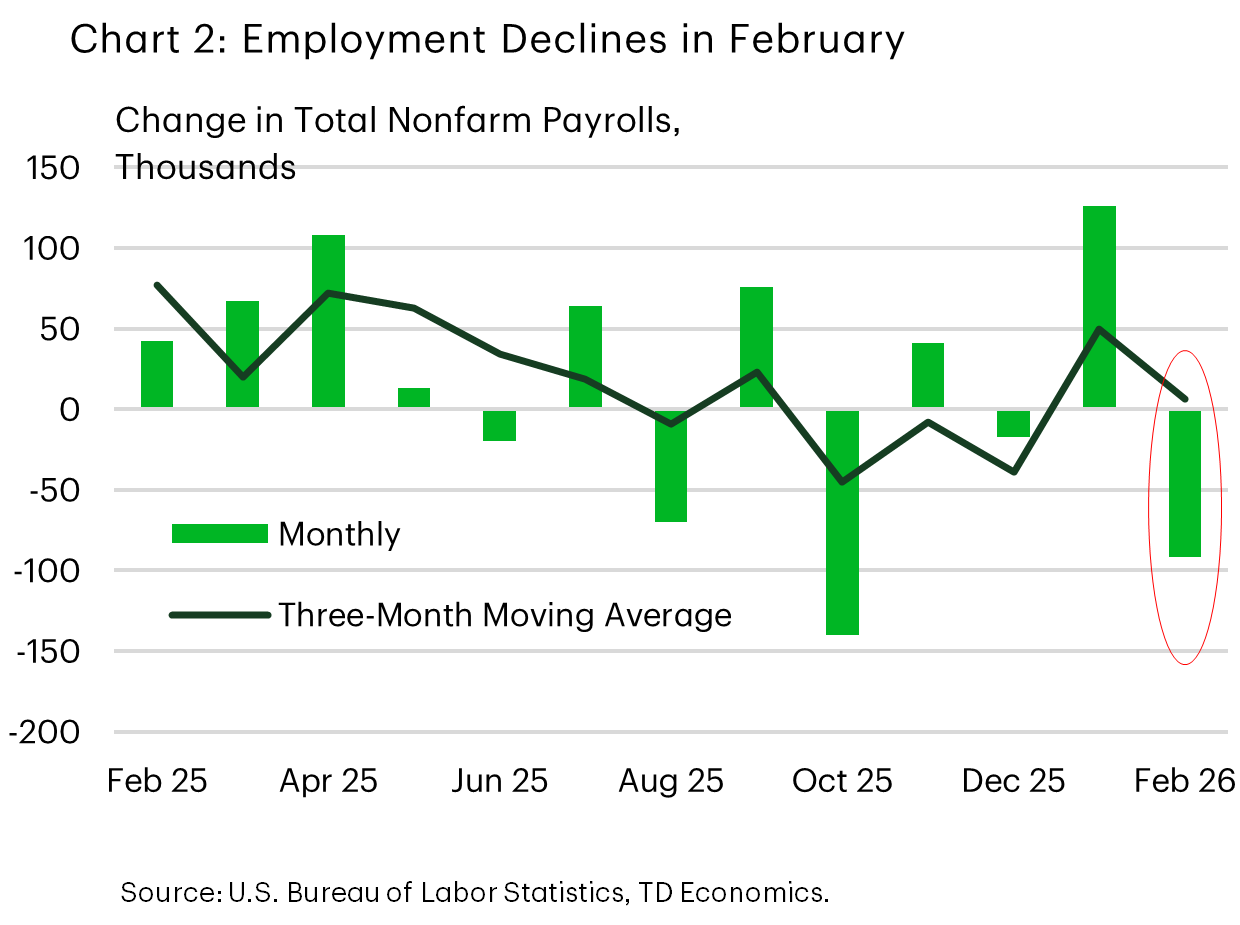

- The February employment report came in on the softer side, with hiring declining and the unemployment rate ticking higher.

Escalating conflict in the Middle East dominated headlines this week. WTI oil prices surged an eye-watering 30% since last Friday to over $89/bbl – it’s highest level since late-2023, but changing by the minute (Chart 1). The key concern is the Strait of Hormuz, a choke point for 20% of global oil supply. At the time of writing, oil is not being transported through the Strait, and major Gulf producers are approaching storage limits, forcing them to make difficult decisions about near-term production. So far Iraq and Kuwait have started ratcheting back production, with Saudi Arabia and the UAE expected to start cutting soon.

Oil price forecasts are highly uncertain at this time. For now, we anticipate prices will stay elevated near current levels for the month of March, before very gradually easing in the months following. Risk premiums are assumed to stay high as the current episode is widely viewed as the most significant threat to Middle East energy supply in several years. A worst-case scenario could see prices breach $100/bbl should more oil supply go offline for longer and major infrastructure is damaged. We chart out some macroeconomic implications (here).

Canadian energy stocks caught a bid this week, though broader volatility pulled the TSX down 2%. Markets also began pricing higher inflation expectations into bonds, pushing 2 and 10-year Canada yields up around 20 basis points (bps) on the week. For Canada, rising oil prices are seen as a tailwind to energy producers’ revenues and government coffers. The downside is that Canadians are starting to see increased prices at the pumps. The national average price for gasoline has jumped 12 cents per litre (an almost 10% gain) this week, with further moves higher likely on the way.

Outside of geopolitical events, Canadian data was light (Chart 2). A pulse check on Canadian housing markets via preliminary sales data for February showed a minimal bounce back in home sales after a dismal performance in January. Though sales gains edged higher in major B.C. and Quebec markets, a pullback in Toronto largely offset these gains. Elsewhere, Canadian productivity slipped in the fourth quarter, putting overall productivity growth in 2025 up a modest 1.1%. The data reinforces that Canada’s productivity problem is structural and will take time to see material improvements.

Meanwhile, Prime Minister Carney continued his quest to bolster trade relations with global trading partners. In a trip to India this week, Canada finalized a $2.6 billion uranium supply agreement, with product to be delivered between 2027-2035. Assuming shipments are evenly distributed through the trade deal horizon (~280 million/year), this would bump Canada’s total uranium shipments up by almost 10% annually. Nominally, the deal represents a very modest portion of Canada’s overall trade portfolio, but it is expected to have positive regional impacts for Saskatchewan, with Cameco serves as the principal supplier.

The United States and Israel launched coordinated strikes on Iran over the weekend, prompting retaliatory counterattacks across other countries in the Middle East. On Monday, Iran announced that it would attack tanker ships passing through the Strait of Hormuz – a crucial choke point for 20% of global oil supply. Based on satellite imagery, shipping through the passage has effectively come to a halt. Energy prices pushed meaningfully higher this week, with WTI up roughly 33% (or $18per-barrel) and currently sits just north of $88 – its highest level since September 2023. U.S. equities were under pressure for most of the week, with February’s softer employment report adding further insult to injury on Friday. The S&P 500 looks to end the week down over 2%. Meanwhile, Treasury yields across the curve were about 20 basis points higher, as market participants pushed out the timing of expected rate cuts amid fears that higher oil prices will add further upward pressure to inflation.

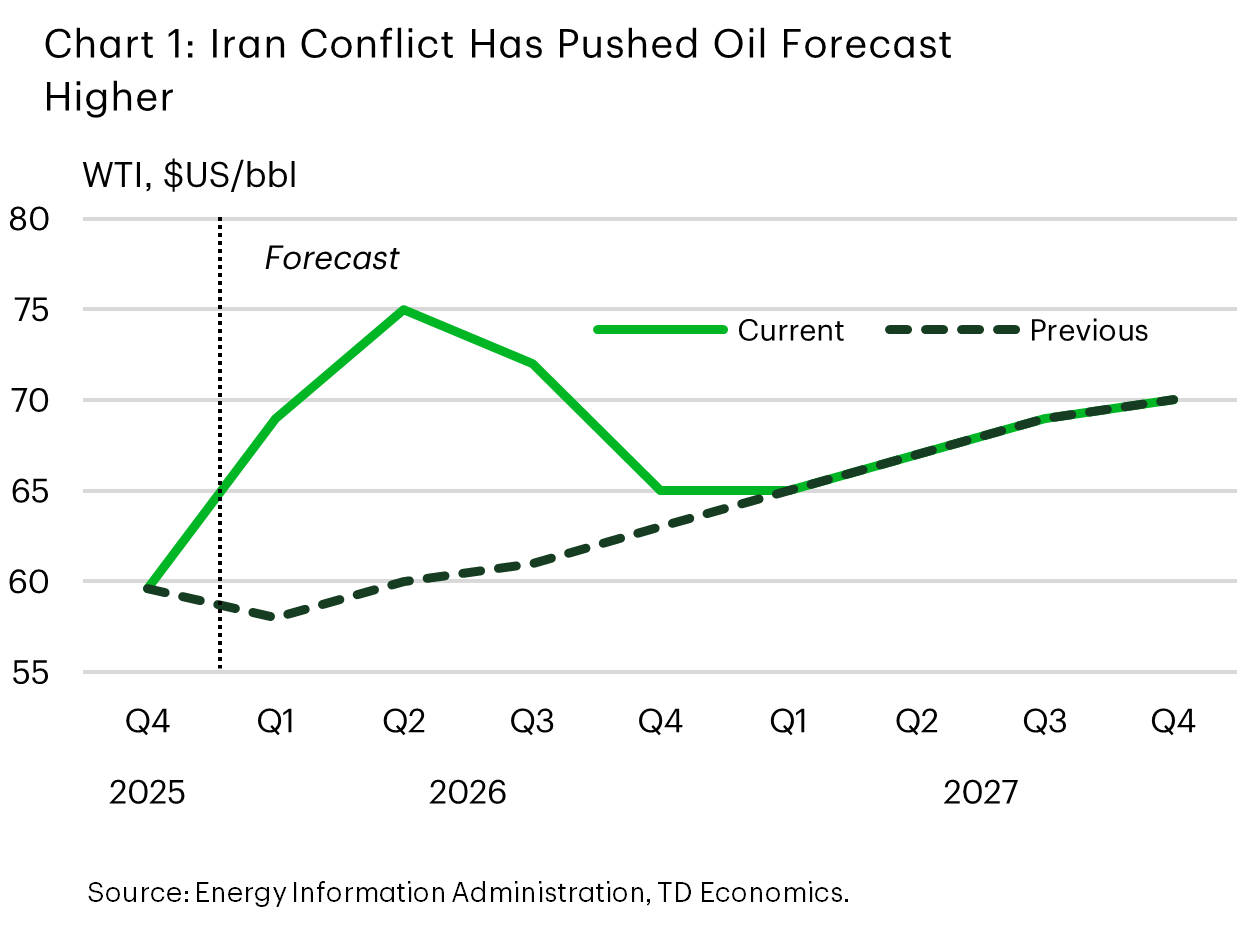

Despite the sharp move in oil prices, the impact to U.S. economy (so far) remains relatively small. In large part, that’s because the U.S. is now a small net exporter of oil, so energy shocks don’t pack the same punch that they used to. Case in point: we’ve marked-to-market our oil forecast, and the upgrade (shown in Chart 1) only shaves about a tenth of a percentage point from 2026 GDP growth – barely moving the needle considering our forecast of 2.7%.

But to say that uncertainty is elevated at the moment would be an understatement. President Trump and other administration senior officials have said this week that the conflict could drag on for at least another several weeks. This suggests further upside to oil prices over the near term, particularly if oil supplies were to remain choked off indefinitely.

From the Federal Reserve’s perspective, economic theory would tell us that policymakers should “look through” the energy shock given its supply driven nature. But because the jump in oil prices is coming atop already elevated inflationary pressures, Fed officials are likely to keep a close eye on inflation expectations. So far, market-based measures have remained well anchored, but there is a risk that they could start to drift higher, particularly if the conflict were to drag on.

The further upside risk to the inflation outlook comes at a time when market participants have started to question the labor market narrative. Nonfarm employment unexpectedly declined in February (Chart 2), while the unemployment rate ticked up to 4.4%. On the surface, the employment report looked very weak, but there were a few factors including a strike and potential weather-related impacts that contributed to at least some of last month’s pullback. We feel it’s still too early to upend our prior thinking of the labor market – but it certainly underscores that current conditions are far from perfect. At the moment, the greater threat to the Fed’s dual mandate is price stability. That is reflected in market participants having pushed out the timing of next rate cut until September and are only 80% priced for a second cut.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: