The State of Play on Interprovincial Trade

Rishi Sondhi, Economist | 416-983-8806

Date Published: August 14, 2025

Highlights

- All provinces have taken some steps towards the removal of interprovincial trade barriers. This is a potentially encouraging development and could help offset some of the impact of the Canada U.S.-trade war.

- However, actions have not been uniform. Ontario has arguably gone the farthest in terms of removing its barriers, followed by Nova Scotia and Manitoba. PEI, and B.C. have also enshrined into law legislation aimed at removing trade barriers. In contrast, Newfoundland and Labrador and New Brunswick have been more deliberate in their approaches.

- While these moves should yield economic gains over time, the scale of the boost could be limited by several factors, including the fact that not all provinces have trade agreements in place, and non-agreement barriers still exist. What’s more, evidence suggests that most firms that trade interprovincially already face no obstacles at all.

A silver lining flowing from the Canada-U.S. trade tensions is that all provinces have acknowledged the need to enhance their interprovincial trade. And indeed, important steps have been taken, but progress hasn’t been uniform. Recently, federal Bill C-5 has passed, with the intent of removing federal barriers to interprovincial flows of goods, services and labour. However, much of the heavy lifting necessary falls on the provinces. This note assesses where the provinces currently stand in terms of breaking down trade barriers and examines some potential benefits from boosting trade within Canada, including the need to be realistic about the possible gains.

The Historical Performance of Provinces

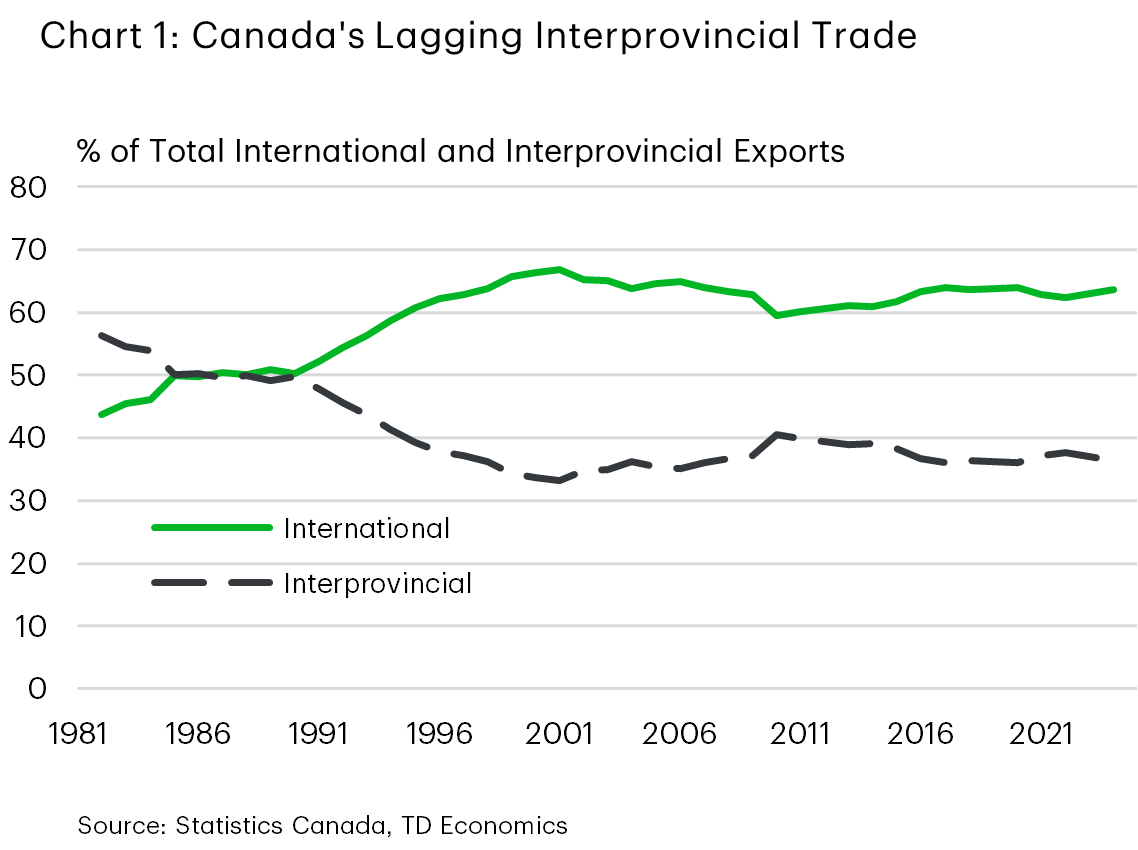

Before we dig into the progress made by the provinces, let’s take stock of the nation’s interprovincial trade performance. First, we note that total inflation-adjusted interprovincial trade (i.e. exports + imports) amounts to about 35% of provincial GDP – seemingly a hefty number, but down 3 ppts from 10 years ago. In comparison, international trade amounts to about 65% of GDP, and has oscillated around that number for over 20 years (Chart 1). Comparing to other jurisdictions, nominal shipments across member states in the European Union (EU) account for about 22% of EU GDP, versus 18% for Canada.

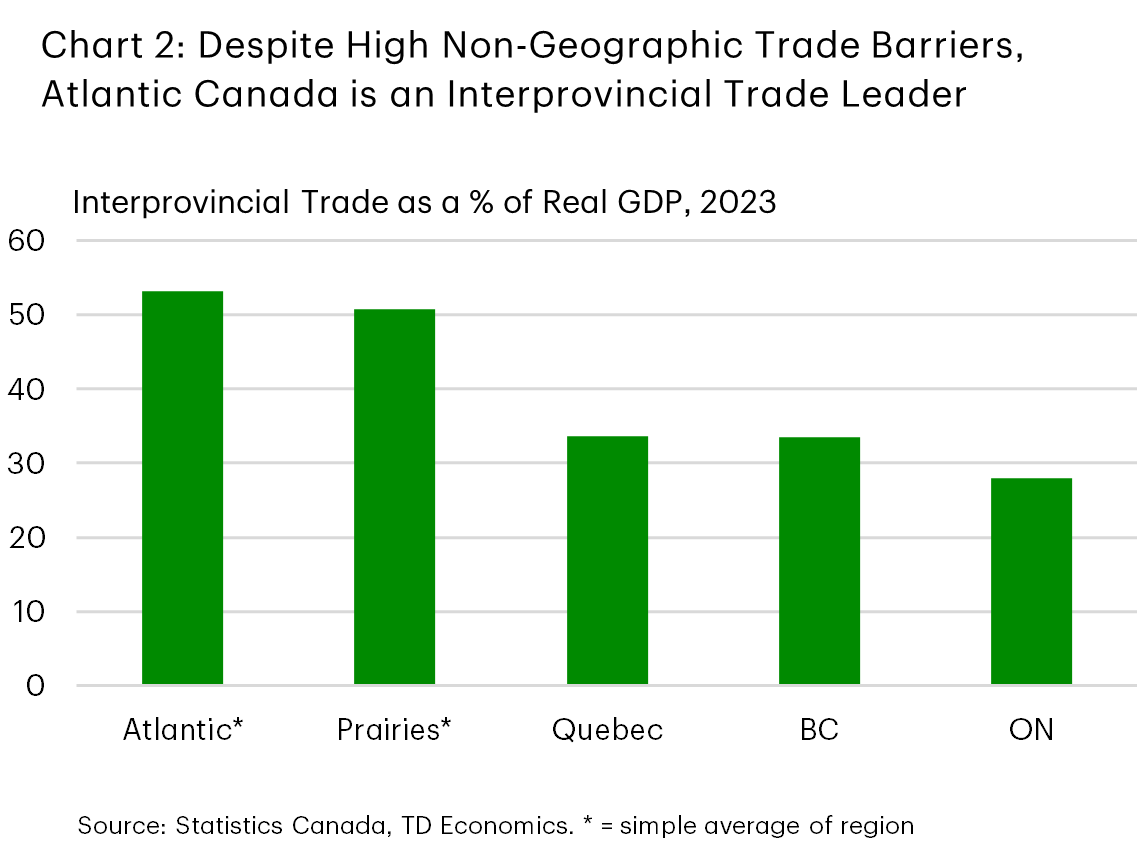

Second, the situation varies across provinces, with interprovincial trade accounting for about 50% of GDP in the Atlantic (supported by goods trading) and the Prairies, boosted by regional proximity, close economic ties and the New West Partnership Trade Agreement (NWPTA). The latter is a free trade agreement signed in 2010 between Alberta, Saskatchewan and B.C. with Manitoba joining in 2017. Elsewhere, interprovincial trade accounts for around 30 – 35% of GDP in Ontario, B.C. and Quebec (Chart 2).

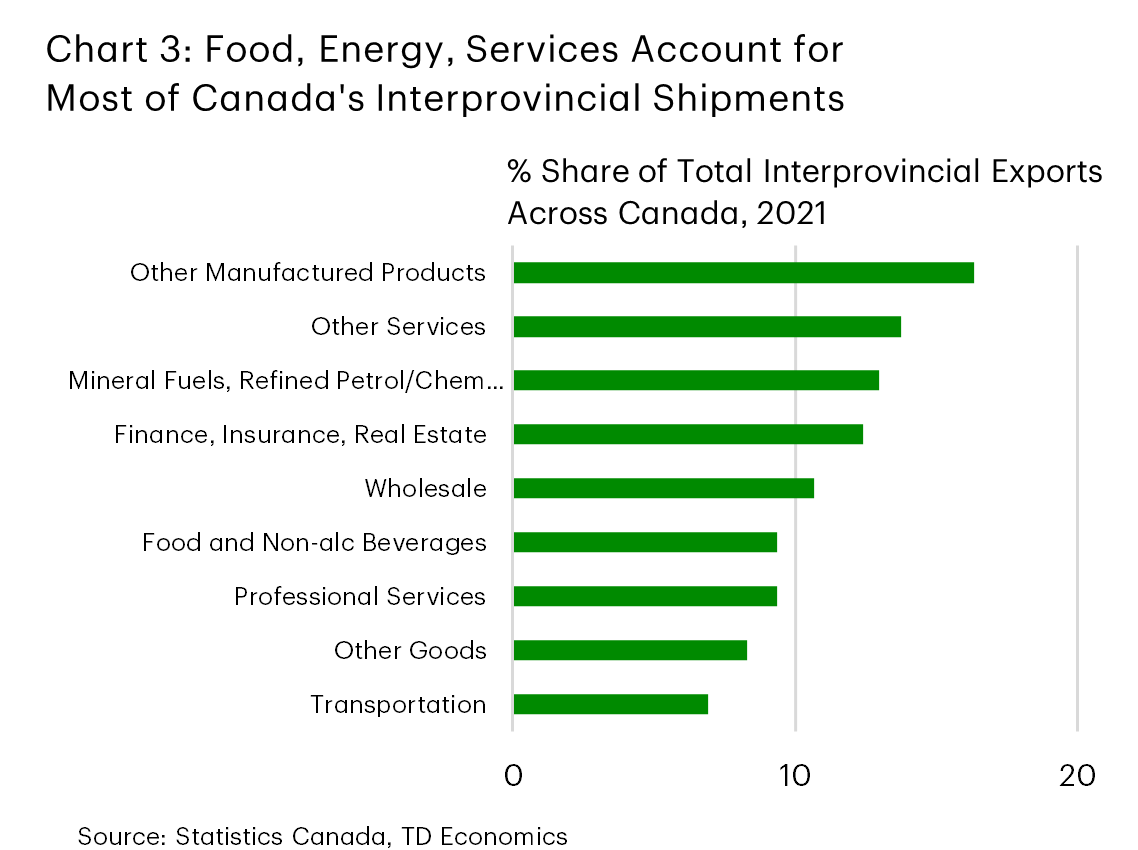

Third, in terms of what gets traded interprovincially, mineral fuels, refined petroleum products and food/non-alcoholic beverages account for about 45% of goods shipments. On the services side, wholesalers, transportation, finance/insurance and professional services capture about 60% of the value (Chart 3).

Recent Steps Provinces Have Taken

Arguably, Ontario has gone the furthest in terms of removing interprovincial barriers in the trade of goods and services as well as those impacting investment and labour mobility (Table 1). The province has dropped all its party-specific exceptions to the Canadian Free Trade Agreement (CFTA)1. Ontario will also establish a framework for direct-to-alcohol consumer sales and has made it easier for certified or licensed workers from other provinces to operate in Ontario (including healthcare workers).

Nova Scotia has also moved its dial by a relatively large margin through legislation that removes CFTA exceptions for provinces that reciprocate and adopts mutual recognition for goods (i.e. if a good produced outside of Nova Scotia is of sufficient quality for that province or territory, it’s acceptable for Nova Scotia). Nova Scotia’s legislation also recognizes certified or licensed labour from other parts of Canada, although it doesn’t cover healthcare workers.

Manitoba has passed legislation that offers mutual recognition of goods and services, while also relaxing labour mobility rules for certified or licensed trades (except for some professions, including healthcare, lawyers and others). Legislation removing trade barriers has also received royal assent in PEI. The Island’s legislation imbeds the mutual recognition of goods while also focusing on labour mobility (although, like Manitoba, doesn’t cover professions in healthcare, legal and others). B.C.s’ legislation, meanwhile, contains provisions for the mutual recognition of goods and services. Quebec has introduced its own legislation, focused on the mutual recognition of goods, although provisions that relax labour mobility restrictions would be balanced against other criteria.

Elsewhere, Alberta and Saskatchewan haven’t signed new trade agreements into law, but both have signed Memorandums of Understanding (MoUs) with Ontario that commit towards improving interprovincial trade. However, these are not legally binding. Alberta has a comprehensive agreement with Nova Scotia however, that removes CFTA exceptions and implements mutual recognition of goods/services/labour between the two provinces. Both Alberta and Saskatchewan are also part of the NWPTA, with Saskatchewan actively encouraging other provinces to join.

New Brunswick and Newfoundland and Labrador have arguably been more cautious. However, Newfoundland and Labrador has signed an MoU with New Brunswick with the aim of boosting their mutual trading relationship (although it, too, is not legally binding). New Brunswick has signed MoUs with Manitoba, PEI, and Ontario committing to removing trade barriers and improving credential recognition. New Brunswick will also allow direct-to-consumer alcohol sales with other participating Canadian regions.

Potential Benefits of Interprovincial Trade

Research has established that there would be a boost to the economy from relaxing interprovincial trade barriers. It has also suggested that the largest gains, in terms of real GDP per capita, could be had in the Atlantic region, where non-geographic trade barriers have been estimated to be higher, followed by Quebec2. Another point from the research is that the services industries (such business services, transportation, and recreation) have relatively large trade barriers, and could therefore benefit disproportionately from the removal of trade barriers3.

In terms of how much of a lift that could be offered, numbers as large as $200 billion annually have been cited by provincial governments. However, other research points to benefits that are significantly smaller than this. For example, a 2017 Bank of Canada study estimated a 0.2% annual lift to Canada’s potential GDP from a significant, 10% reduction in interprovincial trade barriers. An IMF study suggested that the signing of interprovincial trade agreements was associated with a reduction in trade barriers of between 1 – 4 percent4.

It makes some sense that gains from interprovincial trade liberalization would on the lower end of estimates. For one, the highest estimated gains come from scenarios that assume that internal trade barriers are eliminated across Canada. In practice, trade barriers haven’t fully been removed. For instance, all provinces except Ontario currently maintain some exceptions to the CFTA. In Nova Scotia’s case, the removal of CFTA exceptions only applies to reciprocating provinces. And, of course, not all provinces have enshrined interprovincial trade agreements into their laws.

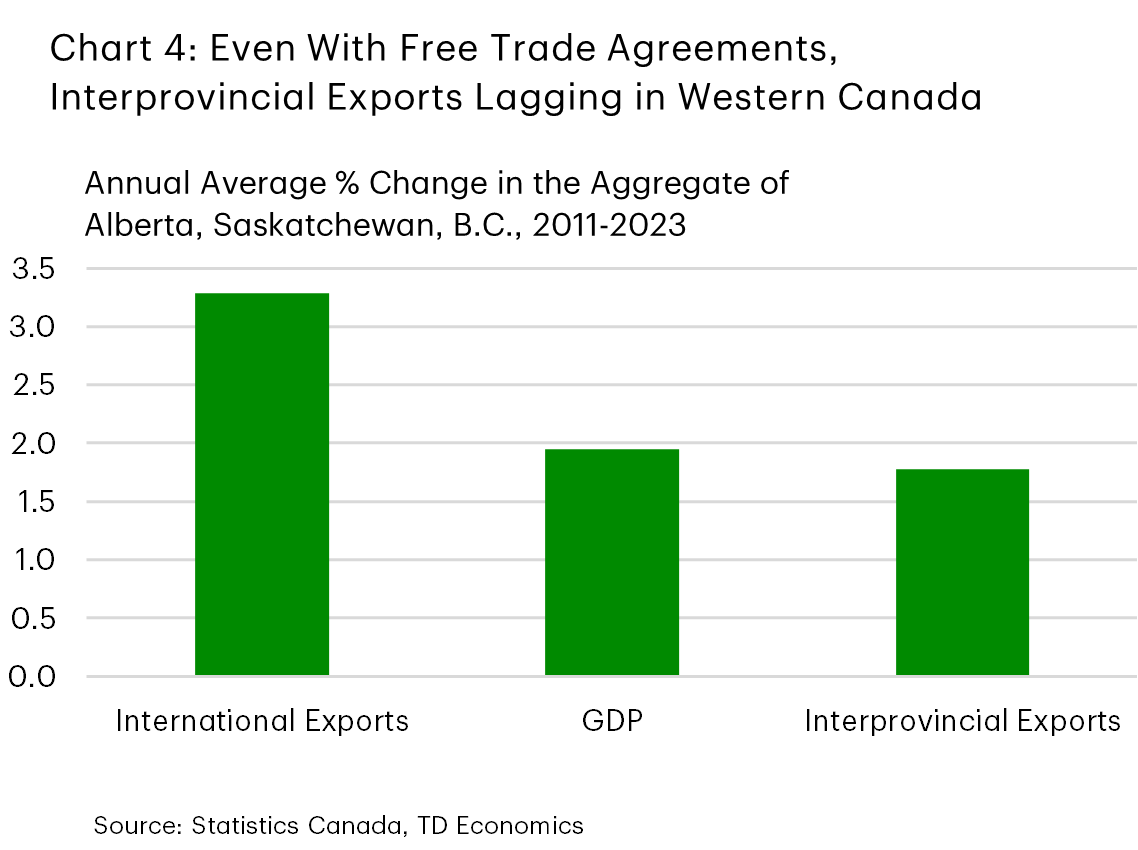

Even with agreements in place for jurisdictions like Ontario, Nova Scotia and Manitoba, there’s no guarantee that interprovincial trade will boom higher. For example, mutual recognition is an important feature of the NWPTA. However, even with this agreement, growth in interprovincial exports from the 3 original signatories of Alberta, B.C. and Saskatchewan has lagged that of international exports and even overall GDP growth, albeit by a slight amount for the latter (Chart 4).

In addition, and perhaps most notable, Statistics Canada survey data suggests that, of those firms that trade interprovincially, two-thirds report facing no obstacles at all. Of the businesses that do face obstacles, the largest is having to navigate complex tax systems that vary by province.

Bottom Line

With Canada-U.S. trade tensions simmering, all provinces have taken some steps towards eliminating their interprovincial trade barriers. This is a potentially welcome development that could help offset some of the negative impacts of the U.S.-Canada trade war.

Some provinces have gone further than others, with Ontario, Nova Scotia and Manitoba arguably pushing the furthest. However, PEI and B.C. have recently signed legislation aimed at enhancing trade. On the opposite end, New Brunswick and Newfoundland and Labrador have been more cautious. Quebec also stands out in that it’s the one government yet to sign an MoU with any province, but has introduced legislation to make interprovincial trading freer, subject to criteria.

While gains from interprovincial trade should manifest from these actions, their magnitude will be restricted by several factors, including the fact that not all provinces have trade agreements. Moreover, geographic trade barriers remain, as do others (such as having to navigate complex tax systems). Finally, most firms that trade interprovincially already report doing so obstacle-free.

Table 1: Measures Taken This Year to Enhance Interprovincial Trade

| Province | Actions Taken | Notes |

| BC | Interprovincial Trade Bill Receives Royal Assent in May. MoUs signed with ON and MB | Mutual recognition of goods and services, 2 exceptions to CFTA removed in February |

| AB | MoU signed with ON, Agreement with NS | |

| SK | MoU signed with ON, PEI, MB | |

| MB | Interprovincial Trade Bill Receives Royal Assent in June. MoUs signed with ON, NB, SK, BC, PEI | Mutual recognition of goods and services, legislation not applicable to certain occupations |

| ON | Interprovincial Trade Bill Receives Royal Assent in June, MoUs signed with BC, PEI, AB, SK, MB, NB, NS | Party-specific CFTA exceptions removed, mutual recognition of goods, labour, direct-to-consumer alcohol sales |

| QC | Interprovincial trade bill introduced | Mutual recognition of goods, provisions on labour are tighter than in other jurisdictions |

| NB | MoUs signed with ON, MB, PEI, NL | Removed 5 exceptions to the CFTA |

| NS | Interprovincial Trade Bill Receives Royal Assent in March. ON, AB, B.C., MB, PEI recognized as reciprocating provinces. | CFTA exceptions removed for reciprocating jurisdictions, mutual recognition of goods, labour (except healthcare), direct-to-consumer alcohol sales for provinces with agreements |

| PE | Interprovincial Trade Bill Receives Royal Assent in May. MoUs signed with SK, MN, ON, NB, NS | Mutual recognition of goods, labour (except healthcare, lawyers, other professions) |

| NL | MoU signed with NB |

End Notes

- Note that an “exception” to the CFTA acts as a trade barrier because it forms an exemption from the Agreement’s rules.

- Alvarez, J., Krznar, I., Tombe, T., (July 2019). Internal Trade in Canada: Case for Liberalization, IMF Working Paper. https://www.imf.org/en/Publications/WP/Issues/2019/07/22/Internal-Trade-in-Canada-Case-for-Liberalization-47100

- Ibid.

- Ibid.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: