New England (Jump to Section)

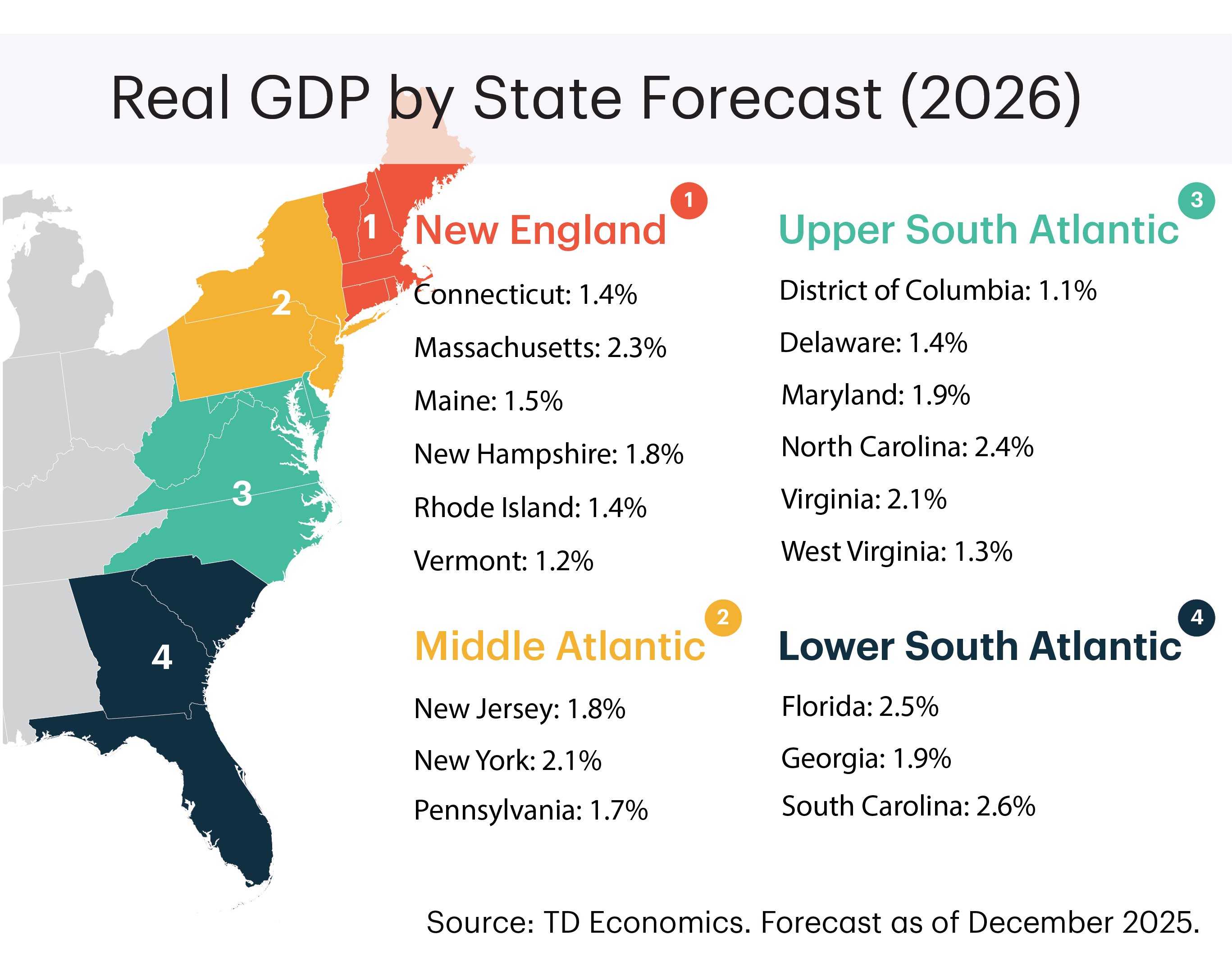

- The New England economy has cooled in 2025 as a combination of reduced tourist inflows, federal research funding cuts, and trade uncertainty has weighed on the region. We expect real GDP growth to ease to 1.8% this year amid this backdrop but rise modestly to 1.9% in 2026 alongside further fiscal and monetary policy support. Job growth has slowed in recent months while the labor force has experienced declines, keeping the unemployment rate elevated. We expect the unemployment rate to average 4.0% next year, but reduced immigration could keep labor markets tighter than previously expected. The region's housing market is also expected to remain tight amid persistently low supply levels, with price growth of 2.6% in 2026 continuing to outpace the national average.

Middle Atlantic (Jump to Section)

- A rebound in the region's financial industry has helped to boost economic growth in 2025, particularly in New York. For 2026, we expect growth to remain near 2% amid more certainty on the trade front and a bit more easing in monetary policy. The region's unemployment rate is expected to end the year slightly higher but fall gradually moving through 2026. The region's housing market has softened through 2025, which we expect to continue into 2026, bringing price growth more in line with its historical average of 3.1%.

Upper South Atlantic (Jump to Section)

- Growth in the Upper South Atlantic looks to have slowed to 1.7% in 2025 from 2.8% in the previous year. The downshift is evident in the DMV (D.C., Maryland and Virginia), where high exposure to the federal government sector has been a headwind in light of DOGE efforts and the government shutdown. Growth should improve in 2026, although a moderate handoff to the year is poised to keep activity slightly below the national pace at 2.0%. North Carolina's well-rounded economy should return at the top of the regional leaderboard with projected growth of 2.4% this year and next.

Lower South Atlantic (Jump to Section)

- Economic growth in the Lower South Atlantic has slowed this year, but at 2.5% looks to have kept an edge over the nation thanks to an above average performance from South Carolina (2.9%) and Florida (2.8%). Weakness at the start of the year looks to have held back Georgia, which is estimated to have grown at a still decent 1.6%. The regional economy has further runway ahead and should benefit from tailwinds such as a lower interest rate backdrop, tax cuts, and improved certainty on trade. Still, a soft handoff to 2026 will curtail the acceleration, likely keeping the region's growth at 2.3% – a hair above the national outlook.

For more details on our national forecast see our Quarterly Economic Forecast.

New England (CT, MA, ME, NH, RI, VT)

Connecticut: National Defense Spending to Bolster State in 2026

Connecticut's economy picked up modestly after a slow start to the year, thanks to a rebound in its white-collar sectors. The finance & insurance sector benefited from another year of above average financial asset returns, which has also helped to bolster consumption trends in the state. As this impulse moderates we expect monetary and fiscal policy support to lead to a return to more normal economic growth in 2026 of 1.4%.

One supportive influence on the state economy next year will be the increase in national defense spending, which is expected to surpass $1 trillion for the first time. This stems from provisions outlaid in the One Big Beautiful Bill Act, including $29 billion for the shipbuilding & maritime base which should help to ease local bottlenecks. Illustrative of the impact, the state's three largest defense firms (Electric Boat, Sikorsky, and Pratt & Whitney) have cumulatively been awarded $13.7 billion over the past three months alone.

However it will take time for these investments to filter through to the local economy, and the backdrop for 2025 has been lukewarm on aggregate. The unemployment rate, at 3.8% in September, has risen by over half a percentage-point since the start of the year, driven by a soft hiring backdrop. This trend has continued recently, as a pickup in job growth over the summer has faded, but it coincided with a contraction in the supply of labor which has worked to tighten the labor market. Through the end of the year, we expect the unemployment rate to rise slightly based on an uptick in unemployment claims during the period, before leveling off to average 4.2% in 2026.

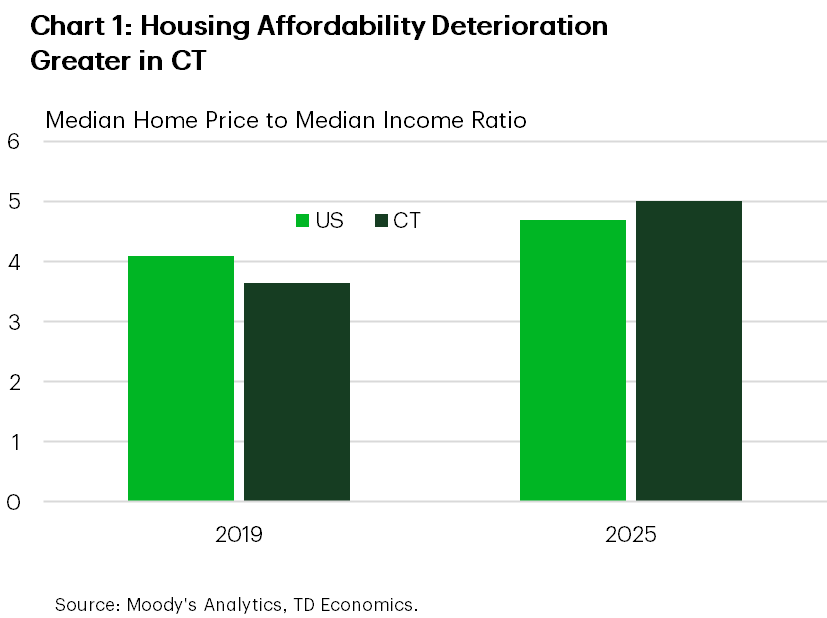

Consistent with the modest pick-up in the economy over the near-term, house price growth has followed a similar trajectory after a summer slowdown. Amid tight supply conditions, price growth was 7% higher year-on-year in September, well above the national average of 1.2%. As a result, housing affordability in Connecticut has deteriorated further, with its delta relative to the nation continuing to grow (Chart 1). On the supply side, there has been an improvement in homebuilding activity through the second half of the year, but we still expect price growth to remain above the national average through 2026 at 3.6%.

Massachusetts: High-Tech Sector Partially Offsetting Material Economic Weaknesses

The Bay State economy continues to be propped up by strong growth in the information technology sector, which has papered over the weakness in most other industries. The financial sector has also helped to provide partial stabilization to the state economy on the back of strong financial asset price growth. For 2026, we expect lower interest rates to provide a modest boost to growth, reaching 2.3% next year.

Despite the much-needed support, multiple headwinds continue to face the Bay State. One of which is the decrease in federal funding to educational institutions, of which Massachusetts has a high concentration. For fiscal year 2025, National Institute of Health (NIH) awards in Massachusetts fell by 3.7% or $126 million, with much of this coming from the elimination of R&D contracts (government defined research projects). With additional cuts likely in 2026, the challenges currently facing national R&D hubs like Boston are expected to continue.

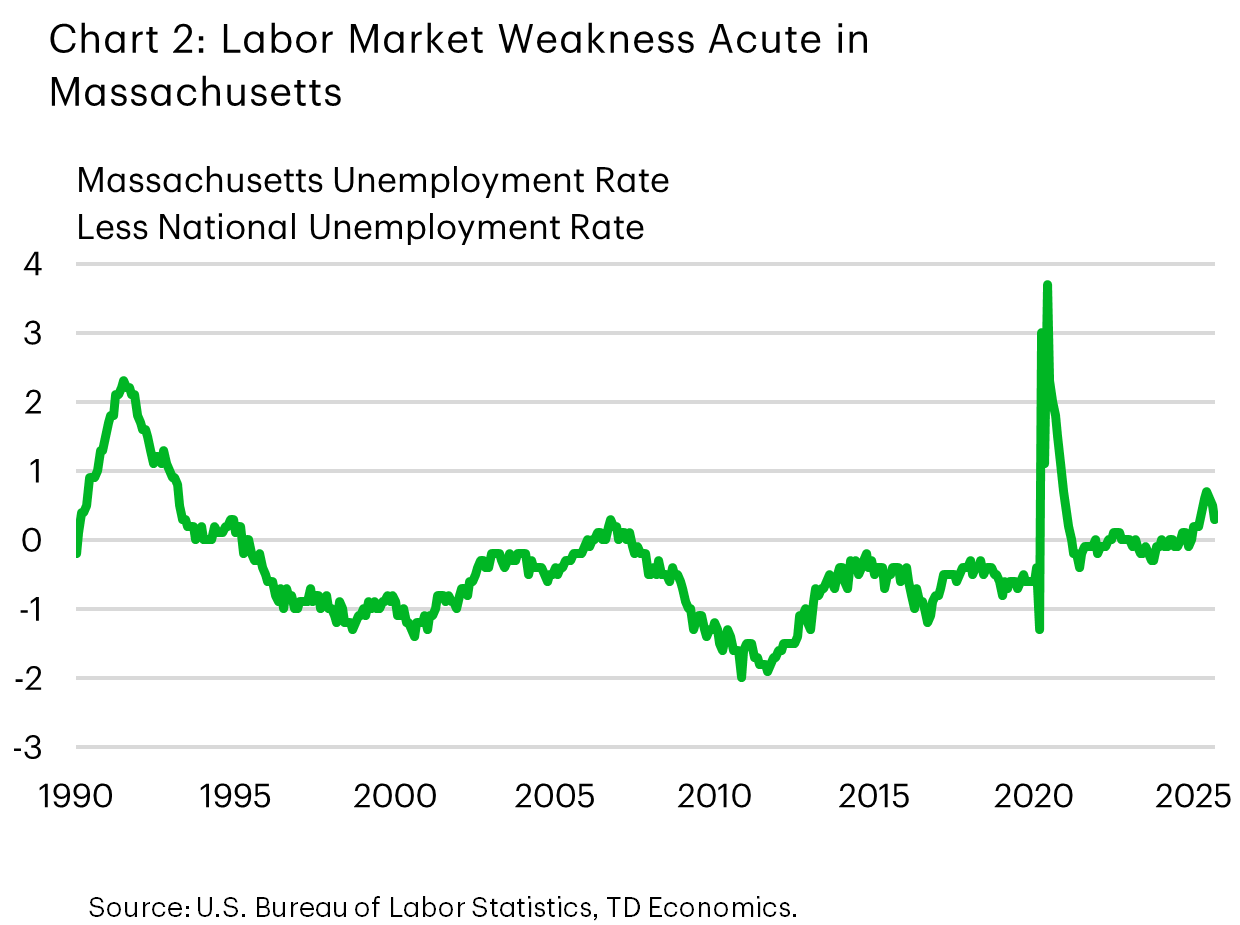

While other high growth sectors in Massachusetts, such as finance and information technology, have performed more favorably in 2025, it has not translated into material employment growth. Subdued hiring rates in the state have kept the unemployment rate elevated, with its difference relative to the nation at its highest level in nearly twenty years outside of the pandemic (Chart 2). With labor force growth cooling and expected to be constrained by lower federal immigration targets, we anticipate that the unemployment rate will fall through 2026 to average 4.2%, with a rebound in hiring through the second half of the year pushing it down further to 3.5% in 2027.

The softening economic backdrop in Massachusetts has also weighed on the housing market, with price growth flatlining over the summer. Still, supply levels remain exceptionally low, which has helped to foster a rebound in price growth more recently despite persistent affordability challenges. Supply challenges stemming from homeowners that locked in low rates during the initial post-pandemic period have been exacerbated by the fact that homebuilding activity has remained the weakest in the Northeast for several years now. While we expect housing price growth to moderate to 1.9% in 2026, risks are to the upside owing to acute supply shortages.

New Hampshire, Maine, Vermont: Labor Force Losses Pose Acute Challenges to Regional Economy

The northern tri-state regional economy has encountered material headwinds in 2025 with few sectors growing outside of the non-cyclical health care sector. A softening real estate market has also reduced the prior support it had been providing to the economy, at a time when slowing international tourism is materially weighing on consumption trends. We expect the influence of these trends to moderate shifting into 2026, allowing for real GDP growth of 1.8% in New Hampshire, 1.5% in Maine, and 1.2% in Vermont.

Two of the main headwinds facing the northern tri-state region include lower tourist inflows and slowing immigration growth. With year-to-date international traveler visits to the three states down 21% year-on-year, the impact on the leisure & hospitality and retail trade sectors has been material, resulting in thousands of job losses. Tourism accounts for roughly 10% of GDP in Maine and Vermont, versus 3% nationally, highlighting the outsized impact these trends have on the region. Although this will remain a headwind over the near-term, we expect the impact to growth in 2026 to fade as the initial shock recedes and international events such as the 2026 FIFA World Cup (with nearby Boston hosting several games) helping to offset lower inflows.

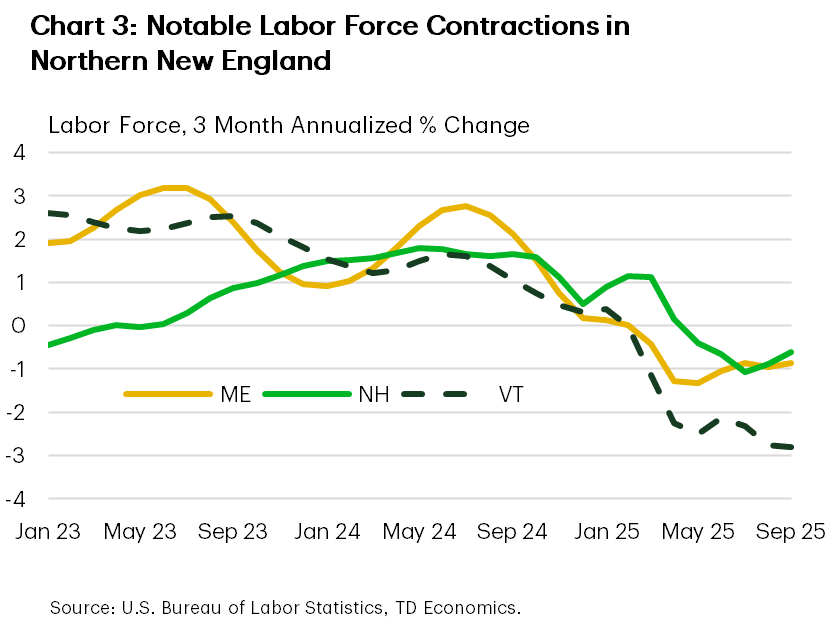

Conversely, slowing immigration growth is expected to remain a more persistent headwind. Advanced aging demographics, such as those that exist in the northern tri-state region, require migration (domestic or international) to offset natural population losses. However, all three states have seen labor force declines in 2025 (Chart 3), likely owing to fewer international and domestic migrants. This initially led to higher job opening rates due to labor supply challenges, but more recently slowing hiring activity amid economic weakness has reversed this trend. The unemployment rate as a result has remained elevated in all three states, but a declining labor supply has begun to reverse this trend. For 2026 we expect unemployment rates to average 3.2% in Maine, 3.0% in New Hampshire, and 2.6% in Vermont.

The softening economic backdrop has led to some cooling in the housing markets of all three states this year. Year-to-date price gains have outpaced the national average in Maine and New Hampshire, at 1.9% and 1.3% respectively, while Vermont has lagged, with prices down 0.6%. Above average homebuilding activity in all three states has helped to gradually ease supply constraints, which is expected to lead to further moderation in home price growth in 2026 to 3.0% in Maine, 2.7% in New Hampshire, and 2.4% in Vermont.

Middle Atlantic (NJ, NY, PA)

New Jersey: International Trade Headwinds Only Partially Abated

The Garden State economy has remained subdued through 2025, as outsized trade exposure has weighed on the region. Some offsetting support has been provided by the large white-collar sector, led by the financial industry, while the health care sector has also continued to expand as demand from the state's relatively older population grows. We expect stable economic growth for New Jersey in 2025 of 1.6%, with growth rising to 1.8% next year with additional fiscal and monetary policy support.

Tumultuous trade policy developments have proven unfavorable for the transportation & logistics hub of New Jersey, with goods imports to the state down 13.9% year-on-year in August. Front-loading activity in the first quarter of the year, particularly for food and pharmaceutical products, has since subsided and driven the retrenchment recorded more recently. While many of the tariffs implemented by the administration have been reduced, the U.S. effective tariff rate is still at a level not seen in generations, which is likely to remain a headwind for New Jersey in 2026 given imports account for 18% of the state's GDP.

The New Jersey labor market has weakened in 2025, with the unemployment rate rising to its highest level in a decade outside of the pandemic. Employment losses, particularly in trade-exposed sectors and the public sector, have restrained aggregate job growth which has been primarily driven by moderate gains in the white-collar and health care sectors. Additional upward pressure on the unemployment rate has been prevented by a tightening in the state's labor supply, with the labor force 0.3% lower year-on-year in September. More stringent immigration policies are likely constraining the main source of population growth for the state. Shifting into 2026, we expect the unemployment rate to fall to average 4.7%, as the labor market comes into better balance.

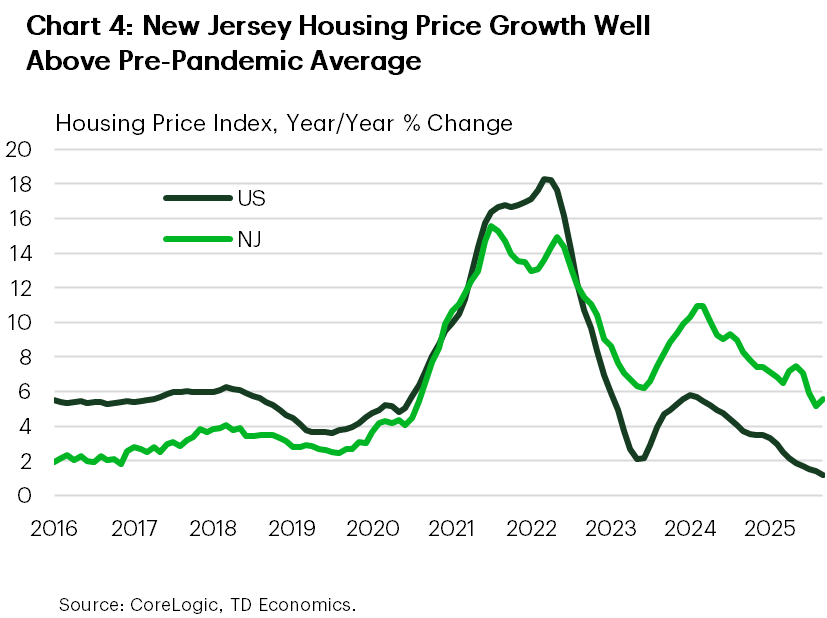

Housing price growth in the Garden State tumbled from stratospheric levels over the summer months but rebounded more recently. Supply constraints, a commonality in the Northeast region, and robust demand has kept annual price growth 4-5 percentage points above the national average – a sharp contrast relative to the 2-3 percentage point lag the state was accustomed to in the pre-pandemic period (Chart 4). With homebuilding activity weakening in 2025, we expect price growth to remain elevated at 4.0% next year.

New York: AI Boom Offsetting Limited Growth Elsewhere

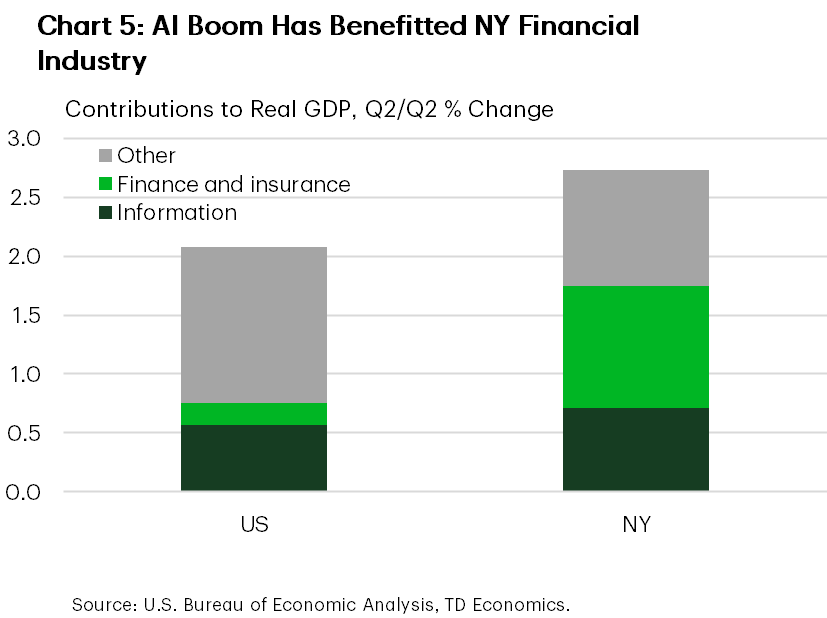

The Empire State economy has recorded solid, but exceptionally concentrated economic growth in 2025. The financial and technology sectors, both largely influenced by the boom in artificial intelligence (AI) investments, has accounted for the lion's share of real GDP growth this year. The financial sector is also benefitting from a rebound in merger & acquisition activity. The large health care sector, which accounts for 1 in 5 jobs in the state, has also provided support, but growth in other sectors has been limited overall. Real GDP growth is expected to hit 2.5% this year, before moderating slightly to 2.1% in 2026.

Despite the AI driven boost to local economic activity, employment growth in the affected sectors has not followed suit. It would be premature to conclude that this represents productivity enhancements in the state, particularly as much of the impact is stemming from gains related to financial assets (Chart 5). Nevertheless, productivity enhancements are likely over the long term as adoption rates increase and businesses climb the learning curve of the new technology.

Employment gains, similar to economic growth in the state, have also been concentrated but in health care instead of finance and technology. Excluding health care, New York would have lost over 50,000 jobs year-to-date in 2025, with material layoffs occurring in most sectors, including manufacturing, construction, financial activities, professional & business services, educational services, and federal government. The breadth of sectoral weakness in hiring activity reflects both a slowdown in the local economy - one that is being partially obscured by AI windfalls – and the impact of policies implemented to reduce federal funding and the federal workforce. Despite softening employment trends, a decline in the state's labor force had led to a modest drop in the unemployment rate in 2025, but more recently this has been reversed. We expect the unemployment rate to remain near current levels through 2026, averaging 4.3%.

Consistent with the broader economy, the New York housing market has cooled through 2025. House price growth had been outpacing the national average over the past year, but decelerated sharply in recent months. Given low levels of housing inventory, with many existing homeowners locked in to mortgages sporting lower rates than current prevailing rates, we expect house price growth in 2025 to remain elevated at 3.6% before falling to 2.7% next year.

Pennsylvania: Easing Economy to Stabilize into 2026

The Keystone State economy has continued to record stable, albeit slowing economic growth through 2025. The large health and education sectors have remained a solid anchor for the economy, while the white-collar sector has also seen modest growth. For 2026, we expect economic growth to progress on a similar trend relative to 2025, with temporary factors offsetting softening economic fundamentals and allowing growth to hit 1.7%.

In 2026, Pennsylvania will host a number of events, including a portion of the nation's 250th anniversary celebrations and several matches of the FIFA World Cup, which are both expected to provide a boost to tourism activity. At the same time, with tens of billions of dollars in utility investments related to artificial intelligence infrastructure starting to flow, the aggregate growth outlook for 2026 will be on a solid footing. However, we expect carry forward of the slowing economic backdrop in 2025 to constrain growth from achieving an above-average reading next year.

In 2025, the labor market deterioration has been material, with the hiring rate falling sharply to a historic low (Chart 6). These trends led the unemployment rate to rise gradually this year, despite a 0.3% year-to-date contraction in the state's supply of labor. With aggregate job growth largely concentrated in the non-cyclical health care sector, the Keystone State has shown clear signs of slowing. We expect the unemployment rate to trend higher to average 4.3% next year, as broader labor demand remains soft over the coming months.

Pennsylvania's housing market has remained resilient despite the slowdown in the economy, with price growth accelerating in recent months after easing in the first half of the year. Housing supply levels have remained the healthiest in the Northeast, though they still lag the national average slightly. In terms of affordability, Pennsylvania is the only state in the Northeast with a median home price to income ratio below the national average. These factors likely supported price growth recently. However, we expect price growth to decelerate to a more historically normal range in 2026 of roughly 2.9% and remain near that pace into 2027.

Upper South Atlantic (DC, DE, MD, NC, VA, WV)

DC-Maryland-Virginia (DMV): Expected Improvement in the Year Ahead

Federal government cutbacks have continued to weigh on economic activity in the DC-Maryland-Virginia (DMV) region. Economic indicators so far confirm the regional economy is experiencing slower growth compared to last year. Virginia is estimated to have grown at a pace slightly below the nation’s, but Maryland and D.C. lag considerably. Modest annual growth of 0.9% in D.C. masks recessionary conditions. D.C. saw negative growth in the first half of 2025 and lost over 8,000 jobs. The hiring trend did not improve through summer and early autumn. Meanwhile, the latest government shutdown led to additional, if mostly temporary, layoffs.

As 2026 unfolds, economic activity should gradually improve. The disruption from federal sector weakness is expected to subside, leading the regional economy to find firmer footing. Additional interest rate cuts from the Federal Reserve will help too. Consumer-related industries, such as housing, will be the clear beneficiaries. However, the soft handoff to the new year means annual growth profiles in 2026 will likely remain near this year's levels. Growth in the DMV region is forecast to improve to 2.0% from 1.7% this year.

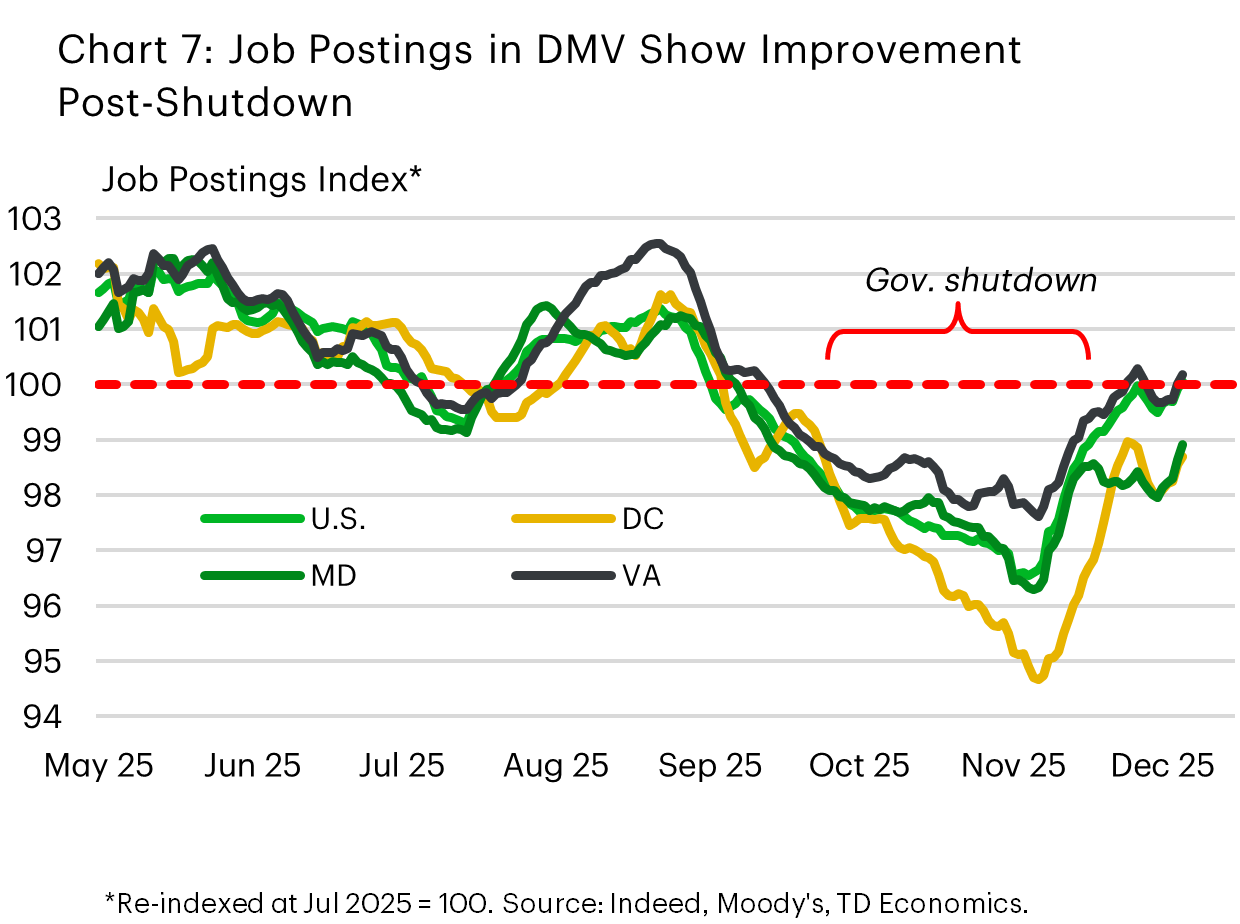

Besides weighing on the regional economy, the government shutdown has also added to the data fog. Labor market trends just prior to the shutdown pointed to a slower hiring pace across the region. However, the regional rankings remained unchanged from earlier this summer. Virginia’s job growth continued to match the national pace. Maryland’s slipped into shallow negative territory, while D.C. continued to shed jobs, driven by the federal sector. Still, job availability relative to the number of unemployed, remained slightly higher in all three compared to the U.S. average. This is partly because the labor force levels in the DMV have generally eased in recent months – a factor that helps to suppress unemployment numbers. On a more positive note, private market data points to improved labor market demand across the region following the shutdown (Chart 7). This theme also applies to D.C., complementing an improved signal from weekly initial jobless claims. The latter surged in October but have since fallen to more typical levels. Overall, we anticipate unemployment rates in the region to trek a bit higher over the near term before trending lower as the economic backdrop improves.

Recent company expansions reinforce the notion of pockets of resilience. Large expansions have been announced in the pharmaceutical and medical space. These include multibillion-dollar investments from Eli Lilly and Merck in Virginia, and expansions from AstraZeneca, SJ Inc. and Nature Cell in Maryland. These efforts are poised to generate 1,100 jobs in each state. Marking a positive development in the tech space, Systems Planning & Analysis expansion in Virginia is set to create over 1,200 jobs. Additionally, while the manufacturing backdrop remains challenged, expansions from Hitachi Energy in Virginia and JD Fields HDM in Maryland mark recent green shoots. These projects are poised to generate 1,000 jobs combined across the two states.

Green shoots can also be found in housing. Similar to the national story, sales remain at low levels, but prices appear to have found a touch of stability. Still, this may be related to a recent decline in mortgage rates, rather than any strengthening in demand fundamentals. Home prices have trekked modestly higher in Maryland and Virginia, where ongoing tight inventories (just under a 3 months' supply in each) keep them in seller’s territory. Meanwhile, in D.C., after dropping in the first half of 2025, price declines have slowed, with home prices moving mostly sideways. Further bouts of weakness cannot be ruled out, especially in D.C., with the labor market there expected to remain soft over the near term. But, overall, we anticipate price growth to trend moderately higher next year.

In sum, while the DMV faces ongoing challenges, the groundwork for recovery is being laid. Signs of improvement should become more apparent in the second half of next year.

North Carolina: A Magnet for Investment

North Carolina’s economy continued to outperform both its neighbors and the nation in 2025, with estimated growth at 2.4%. However, this strong performance conceals some volatility. After a surge in the second quarter, growth looks to have slowed, a trend also reflected in the labor market. Despite these fluctuations, the state’s fundamentals remain solid. Population growth is expected to stay well above the national rate, providing a strong foundation. North Carolina continues to attract plenty of new investment, supporting its slight economic-growth edge over the nation. We expect the state to retain a growth pace of 2.4% in 2026, just above the national pace.

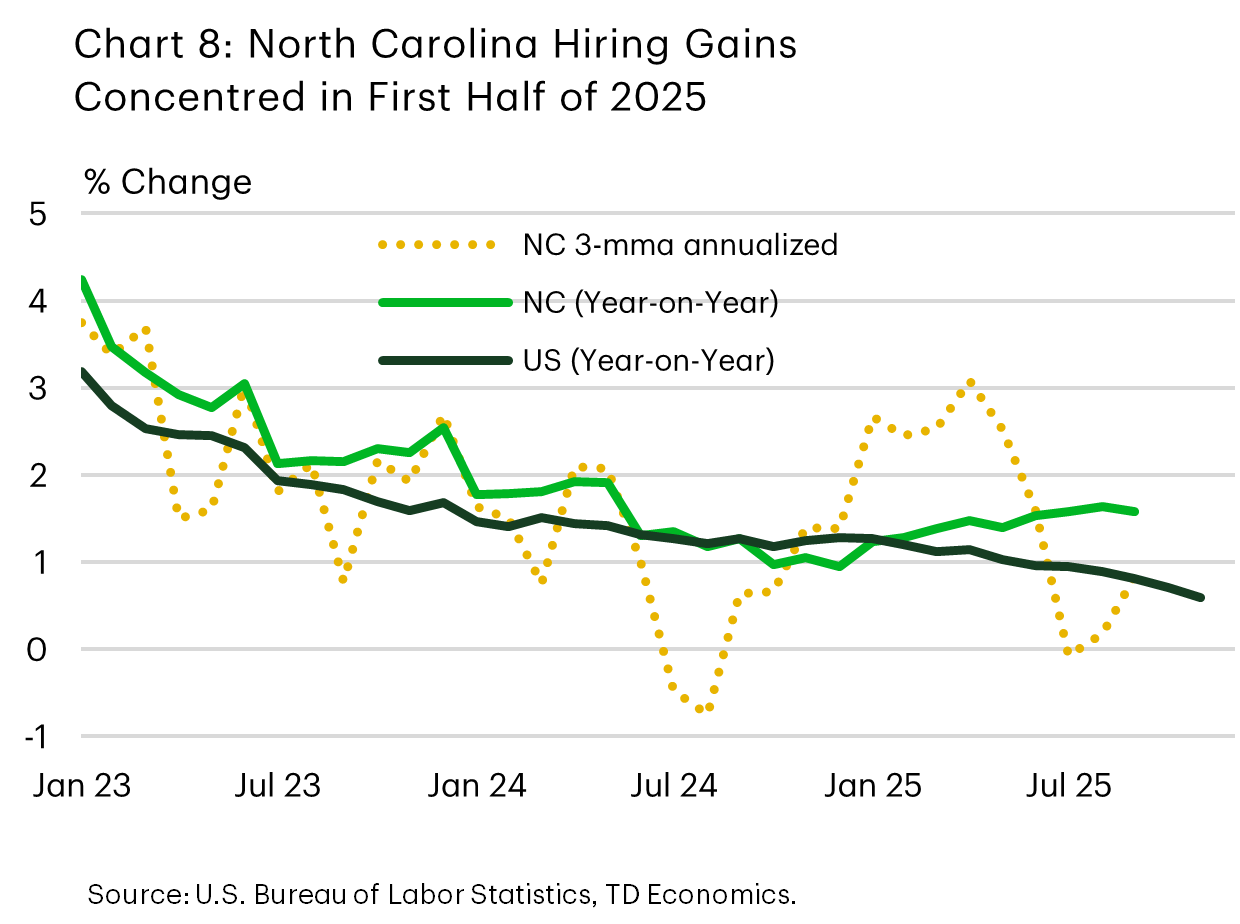

As of September, payroll growth was up 1.6% year-over-year, marking a modest acceleration. However, most gains occurred in the first half of the year, with hiring slowing in late summer (Chart 8). Even so, the unemployment rate has held steady at 3.7%, only slightly above its recent low of 3.4%. Looking past the volatility that may come with October data due to the government shutdown, there are signs that hiring stabilized later in the year. Job availability remains higher than the national average, with private data showing a mild increase in job postings through early December. There’s scope for the unemployment rate to drift higher over the near term as a flat labor force picks up once again. But the positive jobs backdrop suggests any increase will be moderate and temporary, with the state’s unemployment rate to remain below the national average over the forecast horizon.

Ongoing investments and expansions reinforce the positive outlook. These span a variety of sectors, including finance, professional & tech, and healthcare – which have been key jobs contributors so far this year. In finance, expansions from Citigroup and Aspida Financial Services are set to create 1,500 jobs. In the tech sector, Amazon’s $10 billion data center and AI campus in Richmond County will generate 500 jobs, while in pharmaceuticals, Novartis’ $770 million investment will create 700 jobs. Ongoing investments in manufacturing should, at a minimum, help stymie the modest downtrend in sectoral payrolls. Building on expansions from firms such as JetZero (aircraft, $4.7B and over 14,000 jobs) and Eco King Solutions that were announced earlier this summer, more recent examples include investments from Scout Motors (autos) and Vulcan Elements (rare earth magnets). Combined investments of over $1B in the latter two should lead to 2,200 jobs. Smaller-scale manufacturing expansions from Environmental Air Systems, Fit Precast, and CITEL will generate another 500 jobs. Additionally, Maersk’s decision to choose Charlotte for its North American headquarters will create 500 jobs in the logistics space.

Economic activity will also benefit from lower interest rates, especially consumer-related industries. The housing market remains in a more balanced position than nationally, with a months' supply of inventory sitting at 5.5 (vs. 4.4 for the nation). Combined with a continued decline in apartment rents, it is no surprise that home price growth has underperformed recently. We anticipate the tide for home prices will turn later next year, though the pace of gains should remain slow due to ongoing affordability challenges.

Lower South Atlantic (SC, GA, FL)

South Carolina: Keeping the Edge

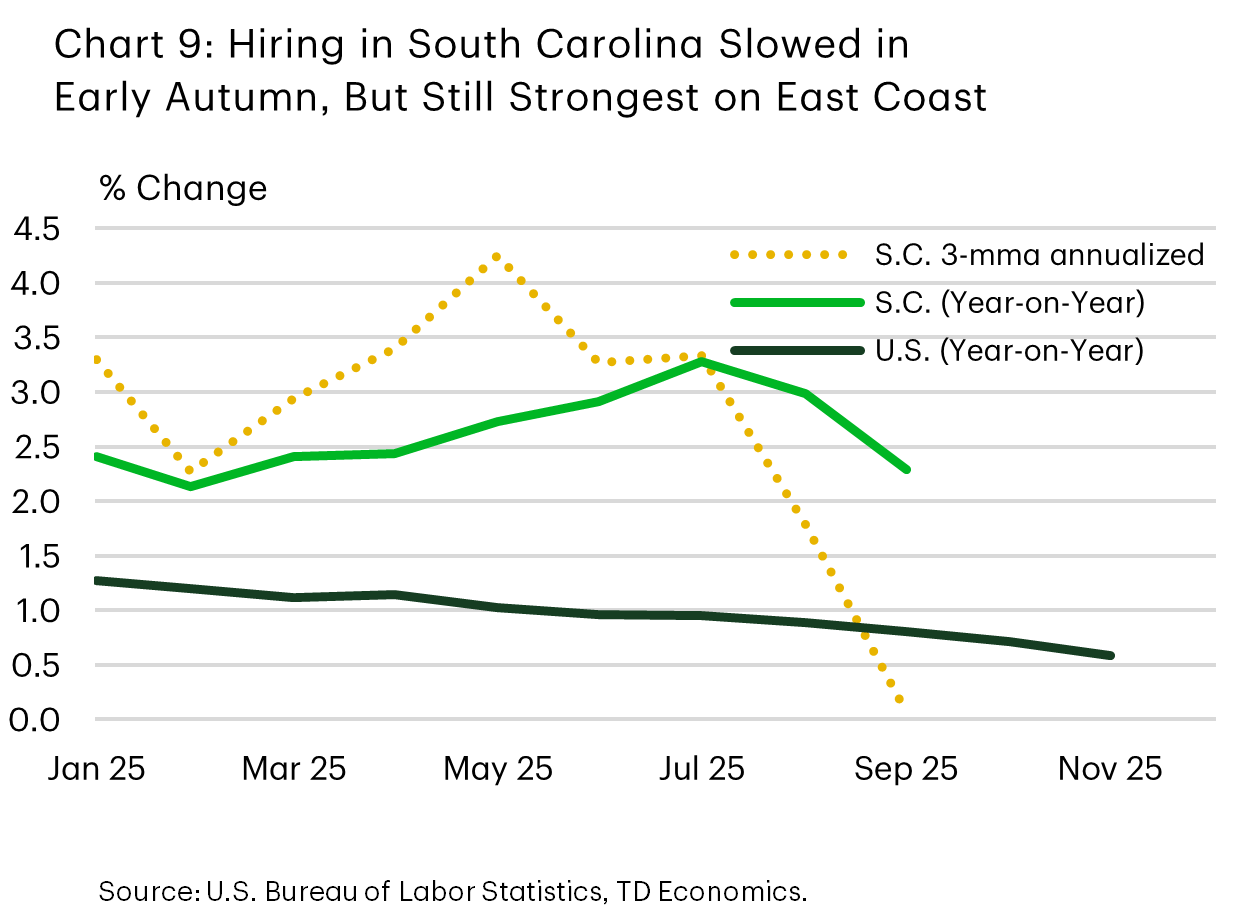

South Carolina is capping off another successful year in 2025, with the state economy expected to have grown by 2.9%. While leading the East Coast region for the second year in a row, this year's profile still marked a notable slowdown from its 2024 pace. We anticipate that the state will remain at the top of the regional leaderboard in 2026. Trade risks linger, given the state's elevated exposure on this front, but have failed to take a meaningful bite out of economic activity so far. Exports to China have fallen sharply, but total exports have still trended higher thanks partly to increased shipments to Europe. Employment growth has moderated in recent months, highlighting a moderating backdrop in the second half of 2025 (Chart 9). A soft transition into 2026 will limit next year’s annual growth, even as economic activity is expected to grow at an above-average pace of 2.6%. South Carolina is set to benefit from the same tailwinds as the country as a whole, including lower interest rates, increased trade certainty, and tax changes from the One Big Beautiful Bill Act (OBBBA).

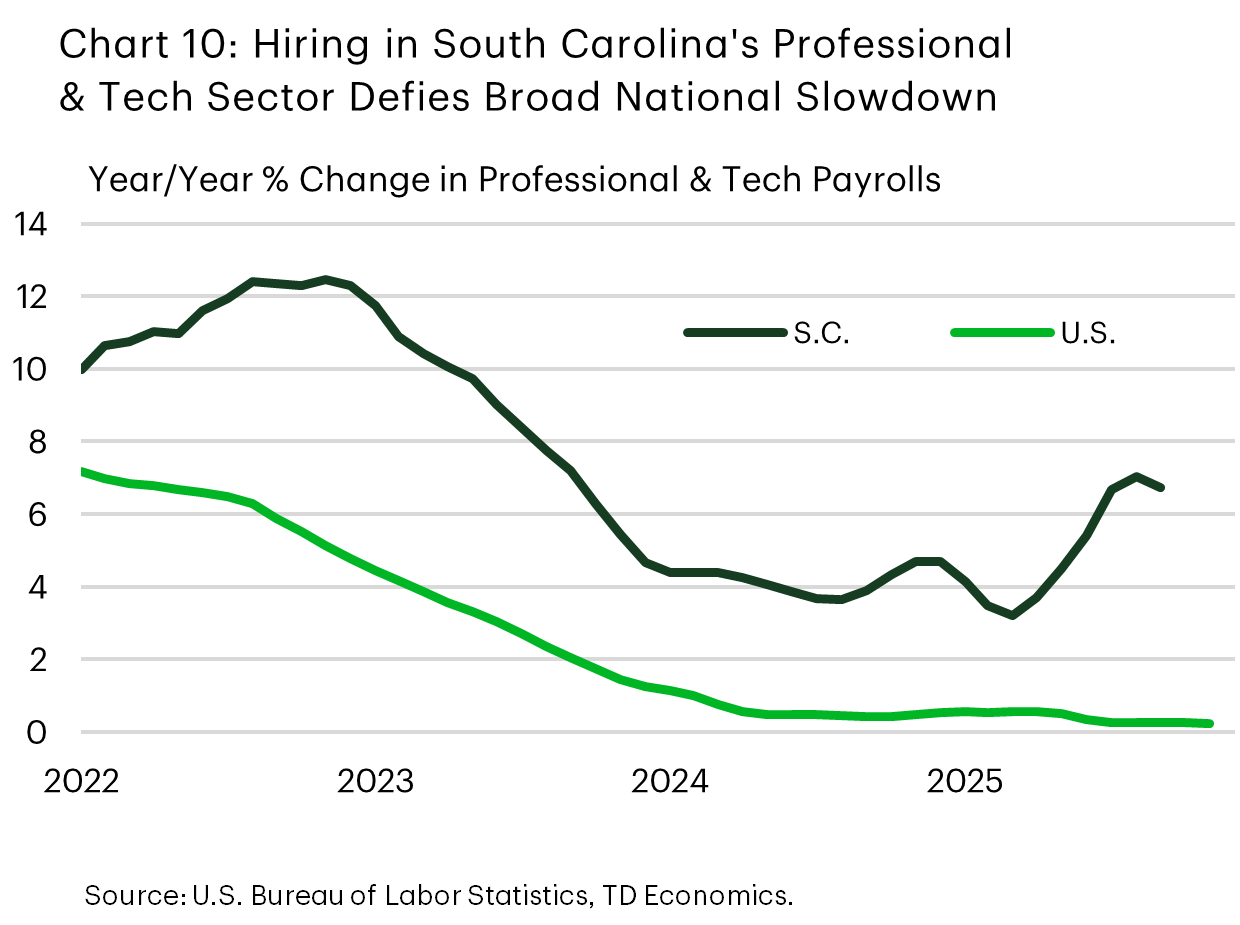

The unemployment rate has ticked up recently alongside cooler hiring, coming in line with the national average. However, this also reflects a recent pickup in labor force growth. There is scope for the unemployment rate to rise further in the near term, but we anticipate it will peak just below the national cyclical high of 4.5%, before drifting lower over the following quarters. High-frequency job postings data shows the availability of jobs continues to hold up better than nationally. The state has plenty of drivers and should look past the latest jobs slowdown, with a more typical hiring trend to resume in the months ahead. Job growth in sectors such as healthcare (+4.6% y/y) and especially professional & tech (+6.8% y/y) continue to run ahead of the national average (Chart 10). Ongoing expansions and investments in these areas suggest they have more runway ahead. Google's massive $9 billion data center investment is a major boon. Meanwhile, expansions from firms such as Charles River Laboratories, Xoted Biotech Labs, and Novant Health (medical centers), bode well for the medical and life sciences sector.

Recent investments span a variety of sectors but remain especially prevalent in manufacturing and related branches. In the automotive space, recent examples include expansions from Sodecia Aapico JV, ElringKlinger, and ZF – which together are expected to generate 700 jobs. In aerospace, expansions from Boeing (which is growing its 787-jet production capacity), Woodward, and Eaton, are poised to support 1,300 new jobs combined. Numerous smaller investments in general manufacturing and defense will also lend a hand, with new initiatives from firms such as First Solar, QMP, Wijo Pouches, Pratt Industries, Asis Boats, Keel (defense) – poised to generate nearly 1,400 jobs.

Overall, the state retains solid fundamentals, including decent population growth. A greater reliance on domestic in-migration should provide some stability at a time when international immigration is slowing. This, coupled with the ongoing investment wave, supports our view that the Palmetto State will grow at a healthy clip of 2.6% in 2026. The outlook also assumes an improved housing backdrop, with home price growth – currently soft – to drift above 3% in the second half of 2026.

Georgia: More Gas in the Tank

Economic growth in Georgia is estimated to have slowed to 1.6% in 2025, but this owes in large part to a weak start to the year. Next year, the Peach State economy will likely continue to trail neighbors South Carolina and Florida. However, several factors are expected to support a rebound. We anticipate economic growth will improve to nearly 2% in 2026, moving closer to the national average.

Georgia's unemployment rate has defied the broader national trend, recently heading lower to 3.4% from 3.6% earlier in the year. While a welcome development, the details reveal a more nuanced story. The decline in the unemployment rate has been supported by moderate pullback in the size of the labor force. But that trend is already changing, with labor force gains in early autumn signaling the downward pressure on unemployment will prove temporary.

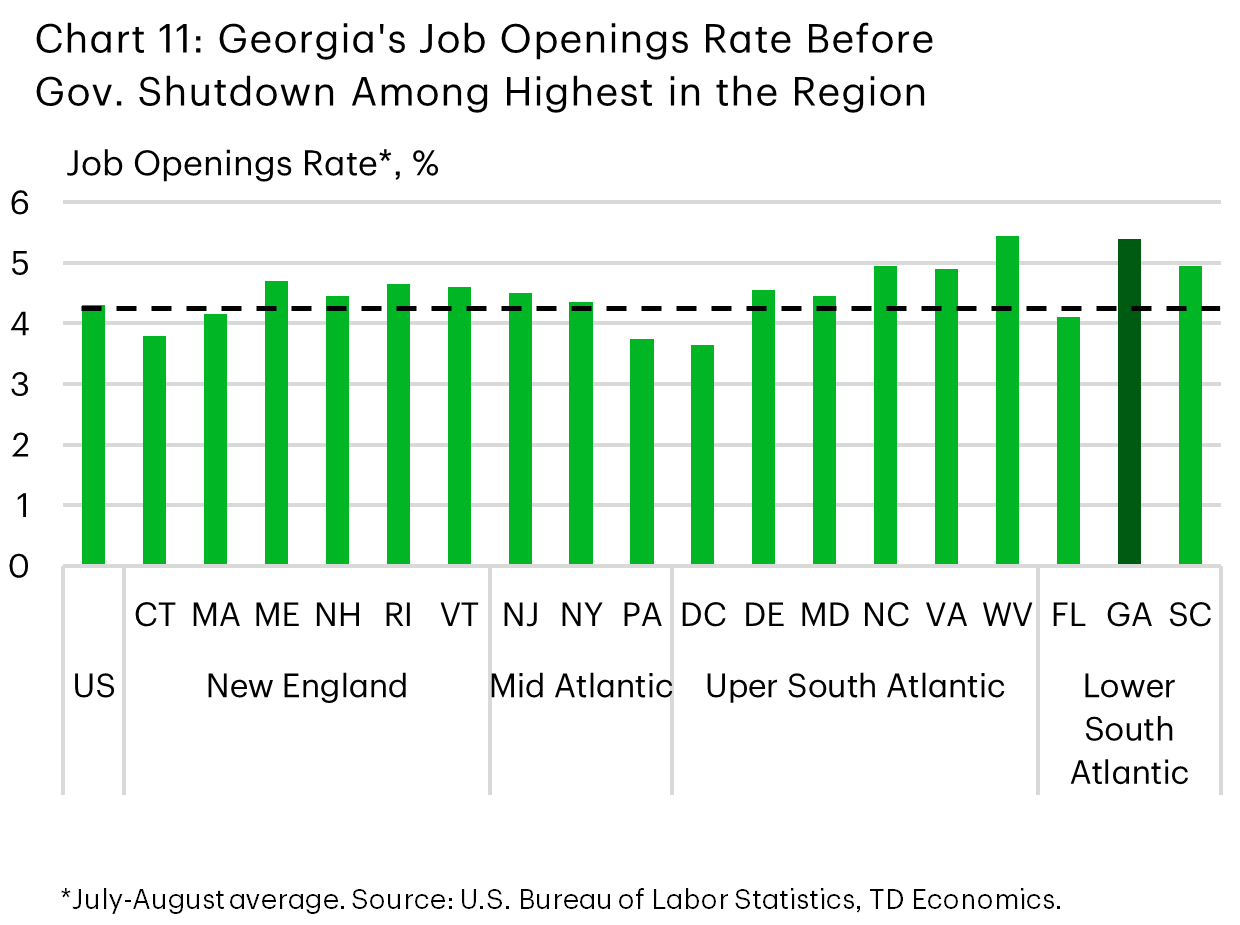

Job growth in Georgia has been volatile in 2025. The year started off on weak footing, followed by a strong rebound over spring, before slowing to a crawl once again through early autumn. However, several indicators point to renewed momentum ahead. Georgia's job openings rate was among the highest in the region just before the federal government shutdown. High-frequency job posting data through early December confirms this trend, and ongoing company expansions further support a positive outlook.

Manufacturing employment growth stands out as a bright spot, with payrolls up 1.2% year-to-date, in contrast to job losses at the national level. Recently announced expansions suggest the positive trend should continue. These include those at Virginia Transformers Corp. (power transformers), JS Links America (rare earth magnets), and Socomec (electrical components), which are poised to create 1,200 jobs combined. Defense-related expansions from Norma Precision and Underwood Ammo (ammunitions, +700 jobs combined) also bode well for the sector, while large ongoing investments in the EV space are poised to provide support over the longer term.

Green shoots extend beyond manufacturing, with expansions from firms such as Salesforce (250 jobs) and BioTouch (480 jobs) marking positive developments in areas like software and healthcare logistics. Healthcare has been the strongest jobs contributor this year. Major investments by networks such as Wellstar, Atrium, and Colquitt Regional are set to expand capacity and create hundreds of new jobs.

Georgia's economy will also benefit from broad national tailwinds such as a lower interest rate environment and tax changes in the OBBBA that will support consumer spending, and potentially increased trade certainty. The latter would lend a hand to the logistics sector – one of the weaker job performers this year. Meanwhile, the same elements supporting consumption should lend a hand to housing. Weakness in rents and home prices, coupled with strong gains in average hourly earnings (+8% y/y), has helped improve housing affordability. These conditions should help sow the seeds to an improved housing backdrop. We anticipate home price growth, currently slightly negative, to trend higher as 2026 progresses, rising to around 3% by year’s end.

Florida: From Great to Good

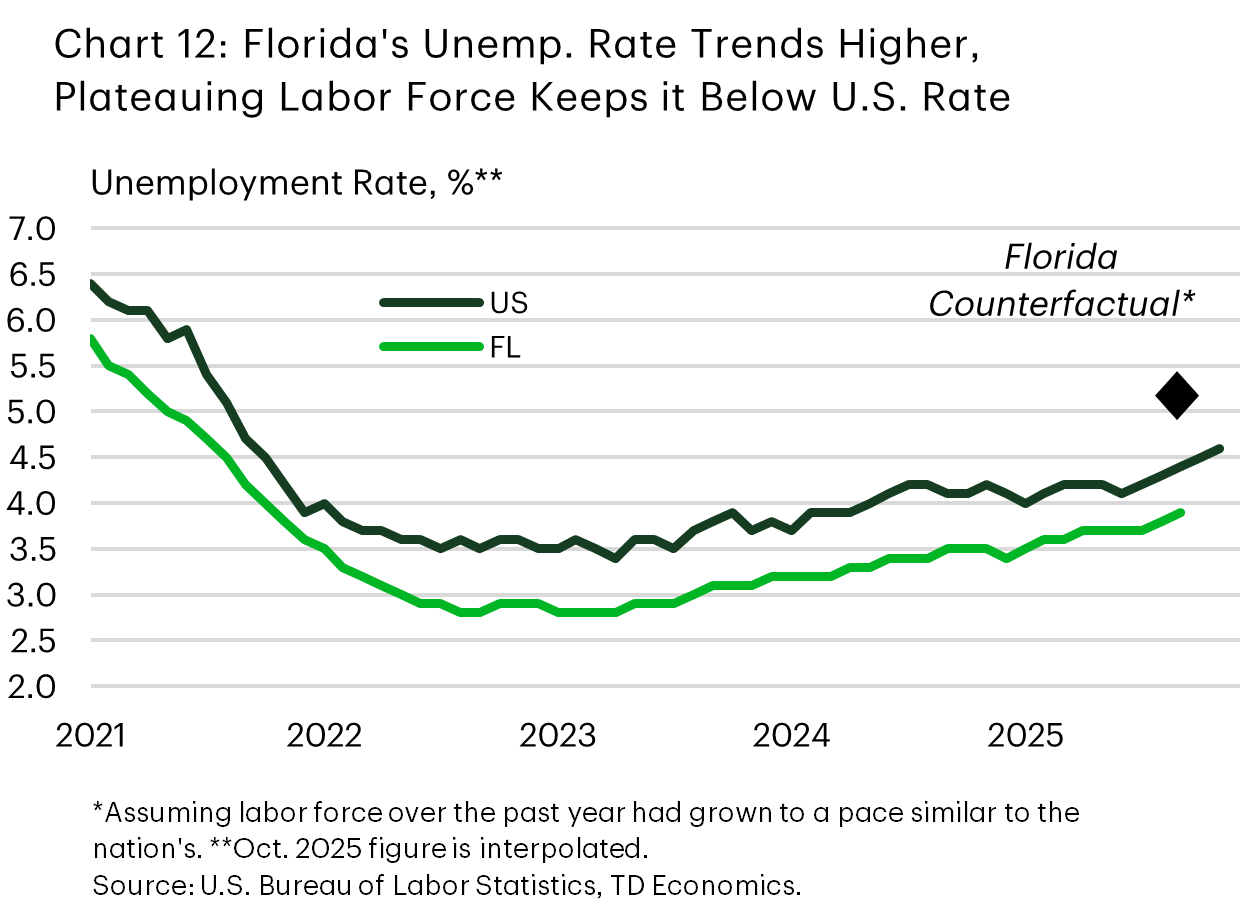

Economic activity in the Sunshine State moderated from 3.3% in 2024 to an estimated 2.8% in 2025. The year began robustly, but momentum faded in the second half as the state confronted multiple headwinds – housing market challenges, slower migration inflows, and waning tourism support. This pattern is evident in the labor market. Florida has posted consistent payroll declines since June, and the unemployment rate has risen, narrowing its gap with the national average. However, the unemployment rate would be even higher were it not for a sharp slowdown in labor force growth (Chart 12).

Florida’s workforce has barely grown since mid-2024 (+0.3%), compared to a 1.7% increase nationally. This reflects a marked drop in labor force participation and diminished population growth. Domestic migration inflows slowed last year, while international migration increased, helping tame the slowdown in population growth. More recently, however, this support has faded due to a more restrictive immigration environment. We expect this dynamic to continue to suppress the unemployment rate in the near term. In line with this, we expect Florida's unemployment rate to peak at a little over 4% at the turn of the year, before trekking lower thereafter as hiring re-accelerates and begins to absorb slack.

Despite current challenges, Florida’s labor market has more runway ahead. There is still nearly one job opening for every unemployed worker – similar to the national average. Additionally, several companies are expanding in the state. Recent announcements from ServiceNow (AI hub in West Palm Beach), Santander (banking), Project Janus (medical device manufacturing), and BioStem Technologies (biotech) are set to create nearly 1,500 jobs combined.

Florida is set to benefit from the same tailwinds as the nation, including lower interest rates and tax changes from the One Big Beautiful Bill Act (OBBBA). Both will support consumption, partially offsetting weaker spending from undocumented immigrants (see here). This is especially relevant for Florida, which has the highest share of undocumented immigrants in the country – an estimated 7% of the population, versus 4% nationally.

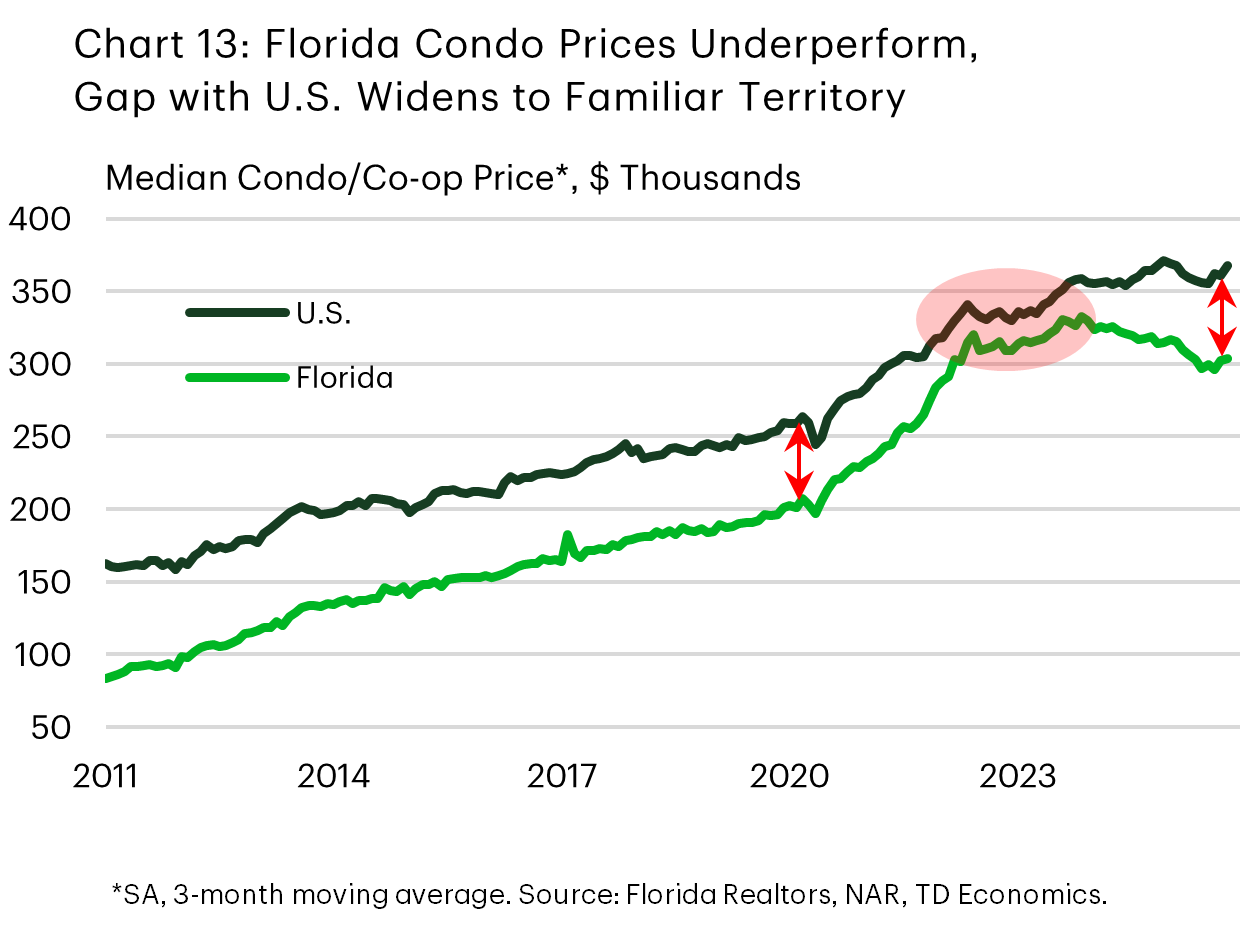

Lower rates will also aid specific sectors like housing. While still lagging, Florida’s housing market has shown recent improvement: sales have edged higher and price declines have abated on a trend basis, though condos remain deep in the red. The condo market continues to show significant slack, with a 9.3-month supply of inventory compared to 5.1 months for single-family homes. As such, it will take longer to recover. As housing conditions eventually improve, homebuilding should accelerate too. This will provide much-needed support for construction, where hiring has slowed to a crawl. After recent underperformance, Florida home prices – including condos – have returned to a more typical balance relative to national prices (Chart 13). This bodes well for an eventual strengthening in domestic migration inflows.

A stronger economy and less trade uncertainty next year should lift domestic tourism demand. However, Florida’s tourism sector – with its substantial international exposure – will likely continue to face challenges with international visits in the months ahead.

All told, we forecast Floridan's economy to expand by 2.8% in 2025 and 2.5% in 2026. The latter is held back by soft handoff at the turn of the year, hiding an improved quarterly growth pace in 2026 relative to the second half of 2025.

Tables

TD State Forecasts

| States | Real GDP (% Chg.) |

Employment (% Chg.) |

Unemployment Rate (Average, %) |

Home Prices (% Chg.) |

Population (% Chg.) |

||||||||||

| 2025F | 2026F | 2027F | 2025F | 2026F | 2027F | 2025F | 2026F | 2027F | 2025F | 2026F | 2027F | 2025F | 2026F | 2027F | |

| National | 2.0 | 2.2 | 2.1 | 0.9 | 0.5 | 0.5 | 4.3 | 4.2 | 4.0 | 1.3 | 1.6 | 3.4 | 0.6 | 0.3 | 0.3 |

| New England | 1.8 | 1.9 | 1.8 | 0.2 | 0.4 | 0.4 | 4.1 | 4.0 | 3.6 | 4.5 | 2.6 | 3.0 | 0.3 | 0.2 | 0.3 |

| Connecticut | 1.6 | 1.4 | 1.5 | 0.4 | 0.2 | 0.3 | 3.7 | 4.2 | 4.1 | 7.0 | 3.6 | 3.4 | 0.2 | 0.1 | 0.2 |

| Massachusetts | 2.2 | 2.3 | 2.1 | 0.0 | 0.5 | 0.6 | 4.6 | 4.2 | 3.5 | 3.5 | 1.9 | 2.9 | 0.4 | 0.3 | 0.3 |

| Maine | 0.4 | 1.5 | 1.4 | -0.1 | 0.2 | 0.2 | 3.4 | 3.2 | 3.1 | 3.8 | 3.0 | 3.1 | 0.3 | 0.2 | 0.3 |

| New Hampshire | 1.5 | 1.8 | 1.7 | 0.7 | 0.4 | 0.3 | 3.1 | 3.0 | 2.8 | 4.8 | 2.7 | 3.0 | 0.3 | 0.2 | 0.3 |

| Rhode Island | 0.9 | 1.4 | 1.2 | 0.5 | 0.3 | 0.2 | 4.7 | 4.4 | 4.1 | 6.0 | 3.4 | 3.0 | 0.2 | 0.1 | 0.2 |

| Vermont | 1.0 | 1.2 | 1.1 | 0.7 | 0.4 | 0.2 | 2.6 | 2.6 | 2.6 | 2.9 | 2.4 | 2.8 | 0.0 | 0.1 | 0.1 |

| Middle Atlantic | 2.1 | 1.9 | 1.6 | 1.1 | 0.7 | 0.4 | 4.3 | 4.4 | 4.3 | 4.4 | 3.1 | 3.0 | 0.1 | 0.1 | 0.1 |

| New Jersey | 1.6 | 1.8 | 1.7 | 0.5 | 0.6 | 0.5 | 4.9 | 4.7 | 4.3 | 6.1 | 4.0 | 3.3 | 0.3 | 0.3 | 0.4 |

| New York | 2.5 | 2.1 | 1.6 | 1.2 | 0.7 | 0.4 | 4.2 | 4.3 | 4.3 | 3.6 | 2.7 | 2.9 | 0.0 | 0.0 | -0.1 |

| Pennsylvania | 1.5 | 1.7 | 1.4 | 1.4 | 0.6 | 0.4 | 4.0 | 4.3 | 4.2 | 4.3 | 2.9 | 2.9 | 0.2 | 0.1 | 0.1 |

| Upper South Atlantic | 1.7 | 2.0 | 1.9 | 0.9 | 0.7 | 0.8 | 3.7 | 3.7 | 3.5 | 2.6 | 1.6 | 3.3 | 0.6 | 0.5 | 0.7 |

| District of Columbia | 0.9 | 1.1 | 1.3 | -0.8 | 0.1 | 0.3 | 5.9 | 5.9 | 5.4 | -1.2 | 0.6 | 2.3 | 0.3 | 0.2 | 0.3 |

| Delaware | 2.0 | 1.4 | 1.4 | 0.9 | 0.5 | 0.6 | 4.1 | 4.3 | 4.2 | 2.3 | 1.6 | 3.0 | 0.7 | 0.6 | 0.9 |

| Maryland | 1.0 | 1.9 | 1.7 | 0.5 | 0.4 | 0.5 | 3.4 | 3.3 | 2.9 | 2.3 | 1.3 | 3.2 | 0.4 | 0.3 | 0.3 |

| North Carolina | 2.4 | 2.4 | 2.2 | 1.5 | 0.9 | 1.1 | 3.7 | 3.9 | 3.8 | 2.3 | 1.5 | 3.4 | 1.0 | 0.9 | 1.1 |

| Virginia | 1.7 | 2.1 | 2.1 | 0.9 | 0.7 | 0.8 | 3.4 | 3.5 | 3.1 | 3.2 | 1.8 | 3.5 | 0.5 | 0.4 | 0.6 |

| West Virginia | 0.2 | 1.3 | 1.1 | 0.1 | 0.3 | 0.2 | 3.9 | 4.4 | 4.4 | 5.1 | 2.0 | 2.6 | -0.2 | -0.2 | -0.2 |

| Lower South Atlantic | 2.5 | 2.3 | 2.4 | 1.2 | 1.0 | 1.3 | 3.7 | 3.9 | 3.7 | -0.1 | -0.2 | 3.2 | 1.1 | 1.0 | 1.2 |

| Florida | 2.8 | 2.5 | 2.6 | 1.2 | 1.0 | 1.3 | 3.8 | 4.0 | 3.7 | -1.5 | -1.0 | 3.1 | 1.2 | 1.1 | 1.3 |

| Georgia | 1.6 | 1.9 | 2.0 | 0.5 | 0.8 | 1.0 | 3.5 | 3.8 | 3.7 | 2.0 | 1.1 | 3.2 | 0.8 | 0.8 | 0.9 |

| South Carolina | 2.9 | 2.6 | 2.5 | 2.5 | 1.3 | 1.3 | 4.3 | 4.1 | 3.8 | 3.0 | 1.8 | 3.7 | 1.1 | 1.0 | 1.2 |

For any media enquiries please contact Oriana Kobelak at 416-982-8061

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.