That First Canuck-cut Will Be a Doozie

Beata Caranci, SVP & Chief Economist | 416-982-8067

James Orlando, CFA, Director & Senior Economist | 416-413-3180

Date Published: January 10, 2024

- Category:

- Canada

- Forecasts

- Financial Markets

Highlights

- The Bank of Canada is expected to start cutting its policy rate this spring, despite inflation remaining above the target, and shelter inflation likely still running hot.

- This will create a communication challenge in anchoring household inflation expectations, which are already elevated and tend to overweight housing cost pressures.

- There is already evidence that the inflation cooling process is widening to more products. The share of products where inflation is less than 3% has grown , and the share in outright deflation territory is also on the high side relative to the pre-pandemic period.

- The Bank of Canada will need to convincingly pivot its public communication to emphasize that shelter costs do not define broader inflation trends in Canada. To neglect to do so runs the risk of leaving rates too high for too long and sacrificing too much economic growth.

- At the same time, the central bank will have to trade off this risk with the risk that persistent growth in shelter costs limits its ability to re-anchor consumer inflation expectations.

Be it markets or media, nobody is questioning that 2024 will mark the year of the rate-cut. However, it’s going to be a tricky communication exercise for the Bank of Canada. That first step will be a doozie in anchoring household inflation expectations.

The central bank will have to cut interest rates in the face of stubbornly high shelter costs because to neglect to do so risks running the economy aground. In turn, this could amplify household inflation expectations, which are sensitive to developments in home prices and perceptions of affordability. Currently, CPI shelter costs are running at 5.9% year-on-year (y/y) and account for just over half the growth in headline inflation. Shelter costs will maintain a magnified influence when the Bank of Canada starts cutting its policy rate in the spring, potentially accounting for upwards of two-thirds of overall inflation.

And we may be shy on this estimation. Canada can’t meet annual population growth of 1.25 million with less than 300 thousand new housing completions without creating serious structural shortages and increasing pent-up demand. While we currently forecast home price growth to be in the single digits this year and next due to the deterioration in affordability, there is upside risk to this forecast once interest rate cuts get underway, which would put upward pressure on shelter inflation.

There’s not much the Bank of Canada can do to address a structural shortage of housing supply. That responsibility falls into the lap of governments to ensure specific policies related to population growth have parallel housing supports. But, the Bank of Canada is charged with anchoring inflation expectations around its 2% target, which is made more difficult by this challenge.

There are three key reasons why that first interest rate cut will need to occur while the annual rate of inflation is still at the upper end of the central bank’s targeted range. First, the real interest rate is already in restrictive territory. Duration and level will come under the microscope with each passing month. A real policy rate of 2% (adjusted for the neutral rate) is consistent with past recessionary periods and will only push higher as inflation continues to ease.

Second, aside from rising economic risks, financial risks could also become magnified. Last year, in a client note, To Err Is Human, we observed that while the Bank of Canada does not manage the supply-demand imbalance of housing, it still needs to consider whether its interest rate setting contributes to amplifying financial risks. Leaving interest rates at the effective lower bound for too long following the pandemic fueled a high uptake in variable rate mortgages and an escalation in household mortgage debt. Now the central bank must keep those risks top of mind at the other end of the spectrum in leaving rates too high for too long. This is definitely not an argument for a return to low interest rates. But it is an argument to adjust the braking force on the economy, by gradually easing the foot off the pedal.

Lastly, although the Bank’s preferred core metrics of inflation won’t yet be at a desirable level when that first interest rate cut occurs, the breadth of consumer items driving the pressure should be narrowing. This trend started 18 months ago. Inflation, by its very nature, is a matter of breadth. It’s always the case that aggregate figures on inflation can be propped up by outsized moves in a small number of components, but that does not speak to the overall condition of consumer demand across the entire economy. “No problem,” you say, “the central bank’s preferred trimmed inflation metric takes care of this issue with the removal of shelter costs that are driving the upper end.” Not so. Even here, shelter carries an influence.

This three-pronged thought framework sounds simple enough as a basic overview, but not so if you’re a central banker, which will be one of the toughest jobs within the financial industry this year. The stars won’t be perfectly aligned on the inflation front relative to the timing of when interest rate cuts will need to commence. And this could create a huge communication challenge for a central bank that may already have a credibility problem on its inflation fighting credentials on main street.

That’s the short version; now let’s get into the nitty gritty of the analysis behind our argument.

How much pain can the BoC take?

Laying out the Bank of Canada’s dilemma boils down to two decision paths. If shelter remains a prominent driver of inflation, as we think it will, any monetary policy response that does not pivot to focus on other drivers of inflation would mean that policy rates would likely stay higher for longer. This would result in weaker economic growth than our baseline forecast. A recession would be fairly certain in that scenario. Alternatively, a communication pivot away from the influence of shelter could risk maintaining elevated inflation expectations among households, taking longer for the Bank of Canada to restore its credibility. It is a matter of which type of risk the central bank can live with.

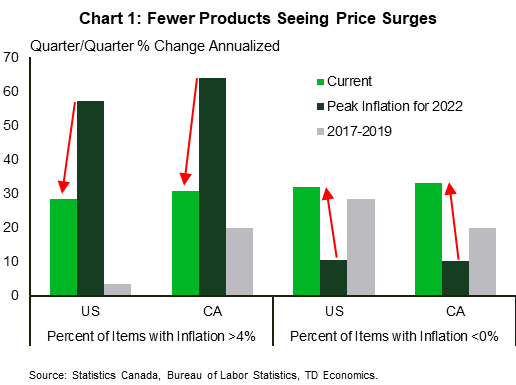

Let’s look at the breadth of inflation. Back in 2022, high inflation was everywhere. Supply chain bottlenecks and a commodity price shock hit everything from everyday items like food and gasoline to longer lasting products like washing machines. Price gains were broad-based, with approximately 60% of items increasing by 4%+ in Canada and the U.S. (Chart 1). That was a toxic combination of both breadth and magnitude, especially when compared to periods of stable inflation or recent rate hiking cycles. For instance, between 2017 and 2019, when the Bank of Canada started to get nervous about inflation risks and ultimately raised interest rates to a peak of 1.75%, the number of CPI items increasing by more than 4% amounted to just 8% of the basket in Canada (and 4% in the U.S.).

The good news is that the share of items comprising price growth of 4%+ has already halved within the CPI basket. Unfortunately, the breadth is still too high given the magnitude of gains occurring within the heavy-hitting shelter component. This is apparent considering that core inflation is running at 3.5% despite a tripling in the share of items with outright price declines relative to the peak period — a representation that’s even greater than prior periods of stable inflation.

This phenomenon is not unique to Canada, but the interpretation differs slightly depending on where you look. In the U.S., Fed Chair Powell has been encouraged that inflation is moving decisively in the right direction, while BoC Governor Tiff Macklem has emphasized that many items are still rising at a pace that is “not normal”. Macklem highlighted high inflation for food, non-durable goods, and shelter prices.

In both the U.S. and Canada, shelter prices show close to 6% growth. But, U.S. rent prices have already decelerated two percentage points from a peak of nearly 9% y/y in early 2023. Given the decline in market-based rents over the last few months (a leading indicator), this trend should continue to push overall shelter inflation lower. The same story cannot be said for Canadian inflation. For one, rent prices are not easing. Rents have been growing at around 8% y/y. Worse, incredibly low vacancy rates in major city centers have caused the three-month annualized rate of rent growth to top 11%! That means about 9% of the core CPI basket is running at double digit rates.

Rents are increasing not just due to the population growth impulse, but because the higher cost of carrying a mortgage is implicitly passed into rents. And then there’s a second direct influence of monetary policy within the shelter inflation metric. The rise in the BoC’s policy rate has pushed up mortgage interest costs (5% of the core CPI basket) a whopping 30% y/y. That compares to the previous peak of 25.4% y/y in 1982. In that case, the BoC policy interest rate hit a high of 21%. Today’s lower rate of 5% has been no match for the speed of adjustment and the impact of moving off the zero lower bound.

Half of the contribution to products with inflation above 4% in Canada comes from shelter. Now, some may say that the BoC’s trimmed mean and median core inflation metrics will neutralize this influence by stripping out high shelter prices. But this is not so straight forward. In the November reading, shelter prices remained in the trimmed mean metric due to its disproportionate weighting. Indeed, rent prices and non-core items like restaurant meals were included in the trimmed mean measure for November, even though their prices rose by more than 5% annualized on the month. It’s important to note that the combination of shelter plus food and energy accounted for 56% of the trimmed mean basket in November.

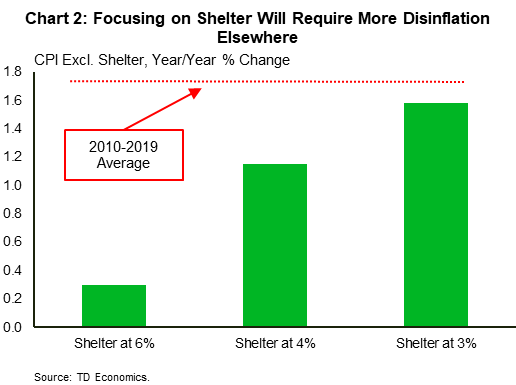

If the BoC wants to get core inflation down to 2% while shelter prices remain high, it will need to sacrifice more economic growth. Calculating a counterfactual with shelter inflation holding at 6% requires the rest of the inflation basket to decelerate to approximately 0.5% in order to sustain inflation at 2%. To get that outcome requires a large build-up of economic slack within every other area of the economy. Comparatively, CPI excluding shelter averaged 1.75% during the ‘low inflation’ period of 2010 to 2019 (Chart 2), which goes to show this would be no easy task to achieve absent a recession. Within Chart 2, two other more conservative scenarios for shelter price growth are captured, and these too speak to the difficult task ahead for the consumer basket making up the rest of household expenditures.

This is where the magnitude of economic sacrifice comes into play. The current 5% policy rate is 200 basis points above the BoC’s top-end range for the neutral (neither accommodative or restrictive) rate and nearly 300 basis points above our view. This is already impacting the economy through weak consumer spending, which is only going to get worse in 2024 as more homeowners reset at higher mortgage rates. Should the Bank keep the policy rate high for too long, the amount of money households will dedicate to paying their debts will continue to rise beyond its current all-time high. With less money for people to spend elsewhere, the BoC’s “growth sacrifice” becomes magnified.

This may well require a leap of faith comes in easing interest rates before the ideal backdrop on inflation. Our GDP forecast of a meagre 0.5% rate of growth in 2024 could easily turn into no growth at all if interest rates are held too high for too long.

And behind door #2 – anchoring inflation expectations

The BoC is mandated to keep inflation stable at around 2%. Would cutting interest rates prevent the Bank from achieving this goal in the short run? Possibly. If interest rate cuts, even modest, spur housing demand and strong price growth, it may be harder to re-anchor consumer expectations for a few reasons.

First, there’s plenty of research to show that households anchor their inflation expectations within personal experiences and following home prices is practically a sport in Canada. High leverage and homeownership rates, alongside non-stop media attention keep housing developments at the center of casual conversations. Empirically, one study in the U.S. showed that a one percentage point increase in house price expectations led to a 0.24 percentage point increase in household inflation expectations. This was outsized relative to the benchmark and reinforced how house price expectations were overweighted in setting inflation expectations.

Second, households also show a tendency to overweight inflation expectations towards experiences or items that reflect more extreme moves, even when those items make up a smaller share of their expenditures. Clearly housing doesn’t make up a small share of household expenditures, making this a higher risk. The fact that extreme price movements have been a trademark of CPI over the past three years further complicates this. Household expectations may have been conditioned to be even more sensitive to upside shifts in prices than the decade prior to the pandemic in when inflation was a boring affair.

So, the challenge for the Bank of Canada will be twofold. It will need to trust the process and start cutting interest rates before inflation is comfortably at target, while also successfully convincing the public that it knows what it’s doing. The first will encompass a leap of faith, because there’s always embedded forecast error with the combination of known and unforeseen events. The second will require a convincing pivot in communication on why shelter costs do not define the inflation universe for Canada.

It’s possible the Bank of Canada is already starting to prepare the public in this understanding. Within the December Summary of Deliberations, members noted concern over a premature easing in financial conditions that could spark a rebound in the housing market and fuel shelter price pressures. At the same time, they agreed that monetary policy cannot solve for the structural shortage of housing supply, with specific mention that members would monitor closely the evolution of shelter price inflation and its contribution to core inflation and total CPI. In central-bank-speak, this may be their way of saying that they need to think about isolating this sector’s influence from broader demand trends within the economy.

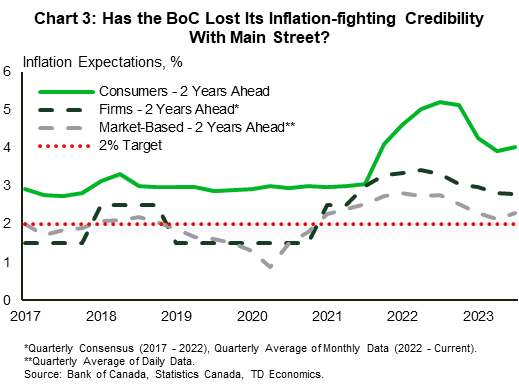

We think this pivot is necessary for the BoC to strike the right balance between exerting too much pressure on the economy versus stoking inflationary pressures again. Consumer inflation expectations generally run higher than the inflation target, so some deviation is not cause for alarm. But, the gap is holding particularly wide this time around even as consumers look two years ahead (Chart 3). This is partly related to a phenomenon known as adaptive expectations, where people view the future based on what has happened in the recent past. The effects can be long lasting. Ever talk with someone who took out a mortgage in the 1980s and hear them comment that the current generation doesn’t even know what high rates are?

Breaking this psychology is what raises the possibility that the Bank of Canada will opt to leave interest rates high for longer. Although many might view this outcome as a miscalculation that could drive the economy more deeply into recession, it could also be thought of as a tactical maneuver that’s required to reset household inflation expectations.

Bottom Line

This year is already shaping up to be a difficult one for the Bank of Canada. With the economy having flatlined in the second half of 2023 and annual core inflation rates still at uncomfortable levels, the BoC will be forced down one of two paths: Fight shelter-fueled inflation until the bitter end or recognize that growth/inflation dynamics will warrant rate cuts sooner rather than later.

Luckily for the BoC, recent inflation readings have been more convincing to allow for a communication pivot. CPI excluding shelter now sits just above the BoC’s 2% target (y/y), and even its preferred indicators are averaging just 2.4% on a three -month annualized basis. This signals that annual core inflation rates are heading in the right direction. Consumers have already pulled back spending and more are likely to join the fray as homeowners continue to renew at higher rates. Less spending will create greater downward pressure on inflation going forward, but the Bank of Canada won’t be able to wait until all the stars align before starting the process of normalizing interest rates.

Forecast Tables |

|---|

| Interest Rate Outlook |

| Foreign Exchange Outlook |

| Global Stock Markets |

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: