Balancing Canada’s Pop in Population

Beata Caranci, SVP & Chief Economist | 416-982-8067

James Orlando, CFA, Director & Senior Economist | 416-413-3180

Rishi Sondhi, Economist | 416-983-8806

Date Published: July 26, 2023

- Category:

- Canada

- Real Estate

- Government Finance & Policy

- Labour

There are many memorable scenes in Karate Kid that offer life lessons, and even some for policymakers. Canada’s population surge brings to mind Daniel balancing on the bow of a rowboat with Mr. Miyagi saying “Better learn balance. Balance is key.”.

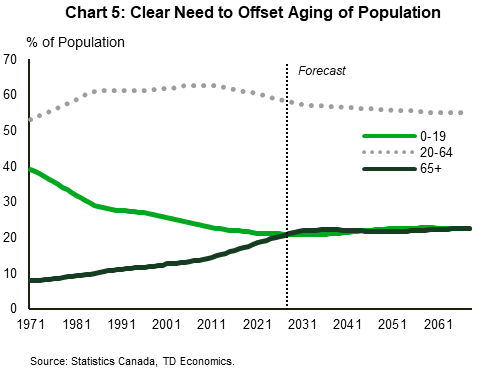

For years, economists had been warning that aging demographics would throw the economy off-kilter by straining economic growth, tax revenues, and the social system. A ramp up in skilled-based immigration offered a solution. Government policies have delivered, but now the question is whether the sudden swing in population has gone too far, too fast.

Highlights

- Canada’s population boomed by 1.2 million people over the last 12 months. The positive support to the labour market and economic growth risks coming at a cost of worsening dislocations in other segments of the economy.

- Continuing with a high-growth immigration strategy could widen the housing shortfall by about a half-million units within just two years. Recent government policies to accelerate construction are unlikely to offer a stop-gap due to the short time period and the natural lags in adjusting supply.

- In addition, we estimate that the neutral interest rate level would likely need to be lifted by an extra 50 basis points relative to prior assumptions on population growth.

- The population surge is a textbook demand shock. If sustained over time, the boost to industry profits, labour income and government tax revenues help re-align priorities to what’s in high demand versus what’s in short supply. However, the operative words are ‘over time’. The speed of change defines whether economic and social factors can ‘catch up’.

- Policymakers must strike the right balance between the ability to absorb population growth within the economic and social infrastructures, while leveraging policies to better utilize the current workforce and integrate new Canadians.

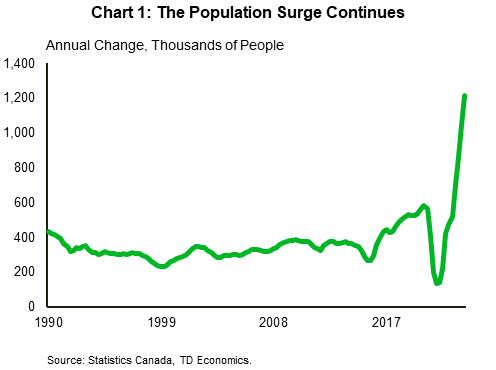

Canada’s 1.2 million population expansion over the past year is more than double the pace in 2019 and in the years that preceded it (Chart 1). For comparison, the U.S. population, which stands at nearly ten times the size, is estimated to have grown by a nearly comparable amount. This “great Canadian migration” has been met with a combination of optimism and apprehension.

Canada has achieved this milestone by pulling on two levers. It has steadily lifted immigration targets, which are slated to welcome 500,000 people per year by 2025. But the bigger factor more recently has been in facilitating the entry of non-permanent residents (NPRs) in larger numbers. Of that 1+ million population influx, 60% arrived through the NPR channel. This second channel is an integral part of Canada’s immigration plan to solve workforce shortages, but the speed at which it unfolded was not telegraphed and caught many economists off guard. Evaluations of the future housing stock, be it for ownership or rental, were already pointing to worsening affordability across the country even before this sudden influx. We estimate that a continuation of a high-growth immigration strategy would widen the housing shortfall by about a half-million units within just two years. Recent government policies to accelerate construction are unlikely to offer a stopgap in this short time period due to the natural lags that exist in adjusting supply.

And social pressures are not limited to housing. The OECD estimated that Canada ranked 31 of 34 countries in the number of acute care hospital beds on a per capita basis in 2019. That ranking is unlikely to have improved given the rapid expansion in population despite provincial and federal governments identifying and accelerating the recruitment of health care workers. Infrastructure too needs to expand. Canada’s starting position was already on the back foot in all of these areas.

While the right hand has been solving for labour market shortfalls, the left hand has not put in place the appropriate infrastructure to absorb this large influx of people, particularly if the intention is for a continuation on a longer-term basis. Policy needs to strike a balance with sustainable growth, lest we tip into the drink. As Mr. Miyagi said, every aspect of life needs balance. Economists would adapt this to say, the whole eco-system must have balance…from housing to medical capacity to social support platforms. Greater thought and estimation needs to occur on what’s a true absorption rate for population growth. Policy cannot be singularly focused on the perceived demands of employers, and even educational institutions.

The Million People Question…

…will it be repeated?

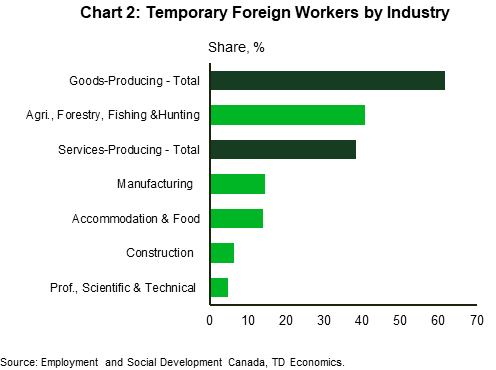

Early indications are that the rapid acceleration in population growth will persist through 2023, at the very least. The NPR classification is a catch-all for those with a work or study permit, or refugee status. All three categories remain on the rise. Last year, the Canadian government attempted to address labour shortages through a host of remedies.1 This included removing the limit on the number of low-wage positions a company can fill using Temporary Foreign Workers (TFWs) in seasonal industries. Firms also saw the limit upped on allowable TFWs to 20% of their workforce. Currently, there isn’t a specified time period for this limit to revert back to the original 10%. In addition, firms in selective industries that were identified as having high job vacancies could bump their international workforce even further to 30%. This policy is intended to remain in place through October 2023. The combination resulted in a 68% jump in the number of positions approved for TFWs in 2022. The highest share of these positions, at over 40%, was in agricultural, forestry, fishing and hunting, followed by manufacturing and food/accommodation (Chart 2).

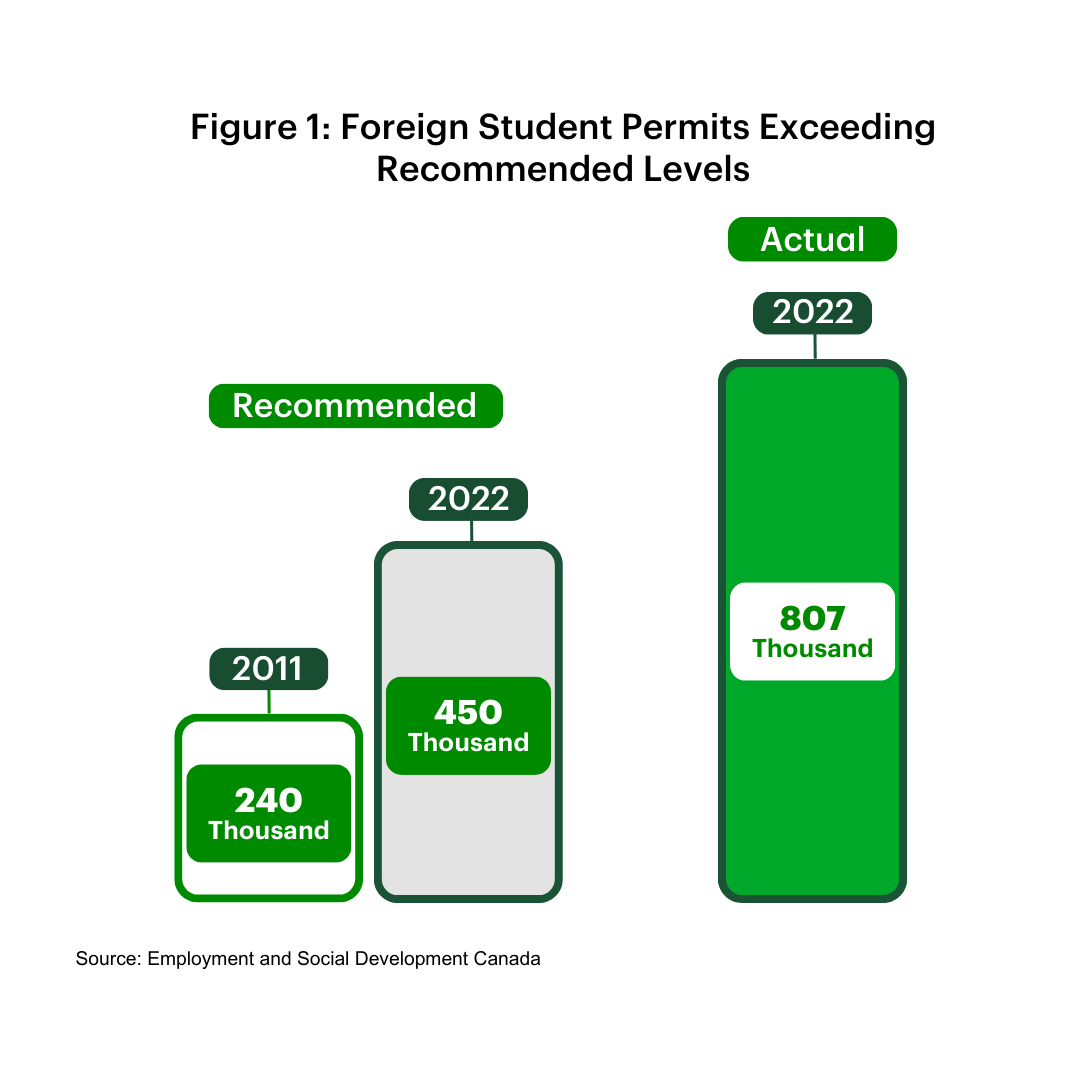

Canada also continues to absorb a population surge among international students, where many simultaneously contribute to the workforce. Rightly so, here too the government has facilitated pathways towards permanent residency and immigration. This is a badge of honour for Canada, which is heavily sought out by the best and brightest from around the world. Recognizing their importance, a Canadian federal advisory panel recommended a doubling in the number of international students from approximately 240k in 2011 to 450k in 2022. However, Canadian educational institutions have far exceeded those recommendations with 807k study permits in circulation as of last year (Figure 1).2 In fact, educational institutions first surpassed the target back in 2017 and never looked back. This has garnered a lot of attention. Institutions have benefitted from higher international student tuition fees, but there seems to be little coordination and oversight of student capacity nationwide. International students need to be absorbed within Canada’s existing social infrastructure from affordable living options to health care capacity.3

The final channel within NPRs is asylum seekers. This varies year-to-year depending on global events but has trended at an average of 30k people over 2011 to 2021.4 However, Russia’s aggression on Ukraine displaced millions and Canada stepped up to provide a safe harbour. Over 1.1 million applications have been submitted under the Canadian-Ukraine Authorization for Emergency Travel (CUAET) and, so far, roughly 800k have been approved. Of these, 169k people entered the country over fifteen months. It’s hard to know how many people among the remaining approved applications will actually enter the country, given that some may have since chosen other locations. Regardless, the existing and potential entry are large numbers that require resource planning on a longer-term basis. The temporary residency extends three years, after which here too there are various pathways to permanent residency.

All of these influences suggest that 2023 will be another one-million person year, and quite possibly higher.

A Government Guarantee: Benefits and Pitfalls

Long before the recent “amped up” changes in immigration policy, Canada had a strong reputation for its successful recruitment of workers across the globe. The Trump administration in the U.S. even looked into replicating its success. Canada is an international recruitment force to be reckoned with, reflecting an ability to quickly pivot on the policy front. Most recently, this was evident in the Tech Talent Strategy announcement. Among other measures, U.S. H-1B visa holders (and their accompanying family members) were able to receive Canadian work permits.5

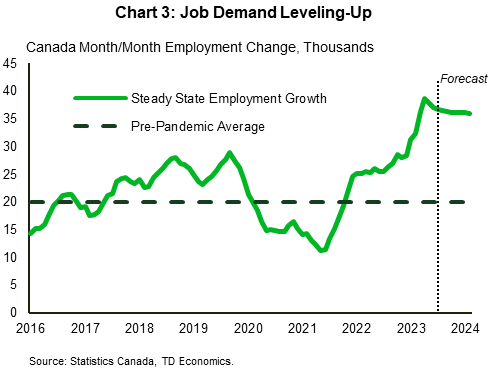

The benefits of Canada’s efforts are evident in the labour market. Since last spring, monthly job growth has averaged around 40k, compared to the 20k trend over the 2010 to 2019 period (Chart 3). Even with that pace, unfilled job vacancies remain at around 800K. If not for high labour force growth, the unemployment rate may have tightened to as low as 4.5%, rather than levelling out in a 4.9% to 5.4% range that has already led to strong wage pressures. In the counterfactual world, the pass through to inflation could have been stronger, and the Bank of Canada would not have had the luxury of skipping meetings during the spring months in hiking rates.

But it’s hard to know for sure. The population influx, in the near term, also places a floor under the country’s GDP growth, which could be resulting in less sensitivity to interest rate movements and/or longer lags. Consumer spending has defied expectations, propelling Canada to the top of the G7 leaderboard for GDP growth during the first quarter of 2023. To get a sense of whether the parts are equal to the whole, economists have started to emphasize alternative measures to gauge underlying economic health. More and more, there are references to per capita measures, which reveal an economy largely moving sideways over the past two quarters while other countries, like the U.S., race ahead despite far less population growth. The Conference Board of Canada even recently coined the term “city-cessions” to describe a decline in per capita consumer spending among the majority of major urban centers. This helps to explain how it’s possible for Canadians to feel strain on their quality of life, while also producing some of the best spending and economic growth figures among peer countries.

The whole is larger than the parts. In the world of the Bank of Canada, the setting of interest rates must address the whole, leaving the parts feeling worse off with time.

Now that the post-pandemic strains are moving into the rear-view mirror, how this next stage in the labour market unfolds is less obvious. Most job vacancies remain in lower pay and lower skilled industries.6 Recent research by Statistics Canada already revealed that new-to-Canada workers are underemployed relative to their skill level.7 In turn, this “government guarantee” of importing workers in increasing numbers and across skill levels may further create a counter-incentive for employers to address chronic weak productivity and labour market inefficiencies. Canada was already ranked last among G7 countries for investment in research and development, according to the OECD. Worse, the institution predicts the country will remain in the tail position for the coming decade when it comes to GDP per capita.

This has significant implications for Canada’s competitiveness on the global stage. It’s important to strike the right incentives in balancing labour availability and productivity-enhancing investments. Industry sectors that have been hiring more TFWs also have lower labour productivity. This is the first cautionary tale of pressing too hard on the immigration channel as the be-all and end-all solution to aging demographics. Other cautionary tales are also playing out within the social fabric of Canada.

Housing Gets the Short Stick

The most apparent is within the housing market. We estimated that from 2023 through 2025, Canada could fall short of supplying demographically driven demand requirements by about 215k units, as strong population growth collides with a downcycle in housing construction. However, that forecast embeds an assumption that population growth eventually returns to patterns telegraphed prior to the expansion of non-permanent resident policies that were intended to accommodate pandemic disruptions.

Should that not occur and Canada repeats last year’s cycle of record inflows, then the supply/demand gap for housing swells to over 500k units through 2025. Perhaps even more concerning is that even if population growth slows back towards a long-term average that undershoots our baseline path, the country would still be deficient by about 150k units. In other words, housing supply will struggle to keep pace with Canada’s rapidly expanding population under each scenario. A meaningful improvement in affordability will likely remain elusive.

Part of this is due to the fact that supply is already on its back foot and naturally responds with a lag to demand. To facilitate building in a more timely manner, governments have been trying to remove barriers. In Ontario, a few examples include the City of Toronto approving changes that encourage density and the provincial government’s decision to lower development charges for rental units. Even if these changes help spur homebuilders into action, the typical construction timeline leaves years to reap the benefits of higher completions. Applying an aggressive assumption that these policies allow homebuilders to reach and sustain record level completions, a housing deficit would still persist if Canada continues to have annual population growth of one million or more. To make matters more challenging, as explored in the next section, strong population growth can lead to a higher structural interest rate, which can erode the economics of construction, while also eroding affordability for homeownership. Adding up the pieces, concerns around affordability will not likely abate in the foreseeable future. This cautionary tale of housing pressures can be applied to many other parts of society, from social systems to health care to physical infrastructure. Everything needs balance.

What’s the BoC to do?

The population surge is a textbook demand shock. People settling in Canada immediately become consumers in search of everything from housing to new clothes to furniture to cars. Although economists have been pointing to a slowing in per capita spending patterns by households, the aggregate impact is what matters in creating a disconnect with supply, and eventually feeding through to price pressures. This disconnect is most stretched in the near-term, as the demand shock overwhelms the economy’s ability to rapidly respond. Over time, the boost to industry profits, labour income and government tax revenues helps re-align priorities to what’s in high demand versus what’s in short supply. However, the operative words in that sentence are ‘over time’. The speed of change matters to whether the economic and social factors can catch up.

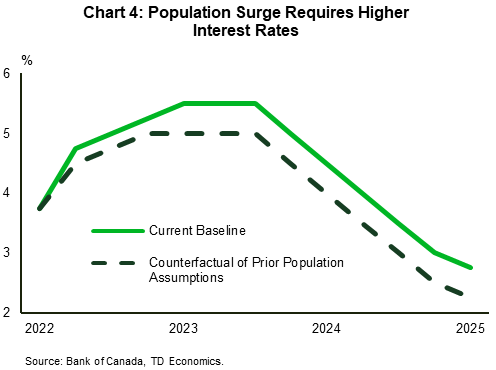

So where does that leave the BoC? The central bank has a single mandate to provide a stable inflationary environment, so any demand shock that carries persistence would likely need to be addressed via a higher level of interest rates (in the absence of some offsetting productivity surge, which has not been Canada’s forte). We calculate that the neutral level of interest rates would rise by an extra 50 basis points to counterbalance the Federal government’s immigration targets relative to the prior assumptions on population growth (Chart 4). And there isn’t quite as easy a solution when it comes to home price inflation. As noted in a previous report,8 this is one area in the economy that can be particularly problematic due to its long reach in influencing prices directly within the economy, as well as expectations of future inflation.

Moving Forward

While population growth is a good thing and a necessary remedy to aging domestic demographics (Chart 5)9, the benefits erode if it occurs too fast relative to a country’s ability to plan and absorb new entrants within the economic and social infrastructure. Chronic tensions can quickly become acute for provinces and cities that absorb a higher population share. Dislocations widen, creating an even larger come-from-behind strategy in addressing housing affordability and quality of life issues.

Part of the solution lies in pulling on all available levers. There’s plenty of evidence indicating that removing workplace barriers can unleash supply within the existing population, while also right-skilling people to roles. For instance, in a recent report, we noted how flexible work and lower daycare costs have led to a surge in mothers with young children entering the workplace.10 Their participation rate jumped 4 percentage points since 2020. This was more than double the pace of the prior three years and a faster acceleration relative to the rest of the female population. Imagine how much tighter the job market would be without these additional 100,000+ women, with jobs largely concentrated in full-time employment. To sustain this influx of workers, Canada needs to press harder on creating the needed childcare spaces, which we estimate will fall short by 243,000 to 315,000 by 2026.

Other examples exist, such as recent initiatives to reduce credential-recognition barriers among medical professionals, engineers and others. One telling example came from when the College of Registered Nurses of Alberta streamlined its application process.11 This created a flood of registrations for internationally trained nurses already living in the country. In other words, these individuals were already integrated into the existing housing/social system and wouldn’t create a source of new demand. In another instance, the Professional Engineers of Ontario recently eliminated the need for ‘Canadian experience’ as an application requirement.12 This too is likely to draw applicants from the domestic population. These reviews need to occur at every level to challenge self-imposed barriers, including the trades sector where shortages have been reported within many construction fields. Most trades take between two and five years of training.13 For instance, are the 9,000 apprentice hours to become an electrician in Ontario still the optimal amount of time? That’s roughly a five year time period (or more, depending on how many hours a person can secure from an employer). What should be done to accelerate learning and safety requirements? Labour force barriers come in many shapes and sizes.

The more Canadian employers, institutions and governments remove workplace barriers, the more pressure it can take off other areas of the social system - like demand for housing and health care services - by limiting the degree to which labour shortfalls lead to higher external recruitment. That will still need to happen, but these statistics are a reminder to pull on both levers to eliminate friction.

A lot can be done to better integrate both new and existing Canadians so that people can reach their full potential. It can’t just be a matter of bringing in an unchecked amount of people to take the lower paying jobs on offer - particularly if it underutilizes the workforce and disincentivizes companies to invest. The Canadian economy already trails peers when it comes to investment in productivity enhancing technology. To set the country up for success, policy needs to be balanced in ensuring an appropriate infrastructure is in place to bring the best out of workers and families. This way the economic pie won’t just grow in size, but the quality will increase as well.

End Notes

- https://www.canada.ca/en/employment-social-development/news/2022/04/government-of-canada-announces-workforce-solutions-road-map--further-changes-to-the-temporary-foreign-worker-program-to-address-labour-shortages-ac.html

- https://open.canada.ca/data/en/dataset/90115b00-f9b8-49e8-afa3-b4cff8facaee/resource/3897ef92-a491-4bab-b9c0-eb94c8b173ad

- https://www.auditor.on.ca/en/content/annualreports/arreports/en21/AR_PublicColleges_en21.pdf

- https://www.canada.ca/en/immigration-refugees-citizenship/services/refugees/asylum-claims/processed-claims.html

- https://www.canada.ca/en/immigration-refugees-citizenship/news/2023/06/canadas-tech-talent-strategy.html

- https://economics.td.com/ca-filling-job-vacancy

- https://www150.statcan.gc.ca/n1/pub/75-006-x/2023001/article/00006-eng.htm

- https://economics.td.com/ca-perspective-01112023

- https://economics.td.com/ca-demographics

- https://economics.td.com/ca-space-between-us

- https://www.theglobeandmail.com/canada/article-international-trained-nurses-licenses-canada/

- https://toronto.ctvnews.ca/international-engineers-don-t-need-canadian-work-experience-to-get-license-in-ontario-1.6409486

- https://www.canada.ca/en/services/jobs/training/support-skilled-trades-apprentices/become-apprentice.html

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

CBC Interview

Listen here

Share: