Highlights

- Internal TD mortgage and credit card data quantifies how much mortgage holders have adjusted their spending in the face of higher interest rates.

- When we separate mortgage holders by the year of their mortgage reset, we find that people who have reset more recently (2023) have pulled back their spending to a greater degree than people with earlier resets (2022 and 2021).

- We also find that consumers who are scheduled to reset rates in 2024 have yet to pullback spending as much as they likely will have to next year. This will weigh on overall consumer spending within the economy, but we don’t estimate this impact will be enough on its own to send the economy into recession.

High household debt is the biggest vulnerability of the Canadian economy. As more homeowners reset their mortgages at higher rates, less disposable income is available to maintain consumer spending. While recent weakness in spending data is consistent with this narrative, mapping the direct impact of mortgage resets on spending behaviour has been out of reach. To uncover this effect, we use internal TD credit card and mortgage data to follow cohorts of consumers through time to assess how people with mortgages are responding to higher interest rates.

Higher Rates = Less Spending

When the Bank of Canada (BoC) first started increasing its policy rate in early 2022, we knew that tough times were coming for Canadian households. Total household debt amounts to $2.9 trillion, with mortgage debt comprising 74% of that amount. This debt alongside a 300 basis point increase in mortgage rates has resulted in Canadians allocating 15.4% of their incomes to pay their debts, up from 13.6% in 2020. While these levels might not seem like much at first glance, at American’s peak indebtedness just before the Global Financial Crisis, they were spending 13.2% of their incomes to service their debts.

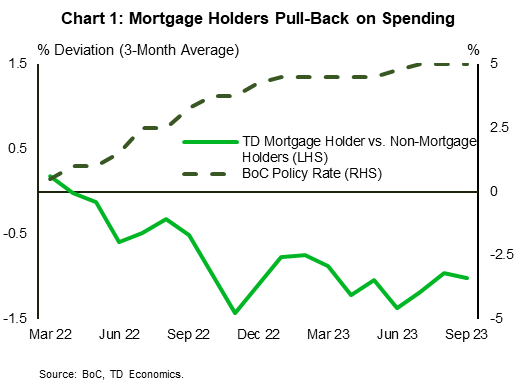

To assess how Canadians are coping with high levels of debt, we took anonymized internal TD data to determine how spending patterns have changed in the face of rising interest rates.1 We organized consumers into two groups: those that have mortgages and those that do not.2 What we found was that as the BoC kept hiking rates, consumers that held a mortgage started spending less relative to those without a mortgage. By our calculations, mortgage holders pulled back spending by approximately 1% versus non-mortgage holders, resulting in a $6 billion reduction in spending on an economy-wide basis (Chart 1). What this means is that while growth in real consumer spending has tracked 1.5% year-on-year (y/y, as of Q3 2023), it would have come in at approximately 1.9% y/y in the absence of higher mortgage rates.

Not every mortgage holder has the same experience

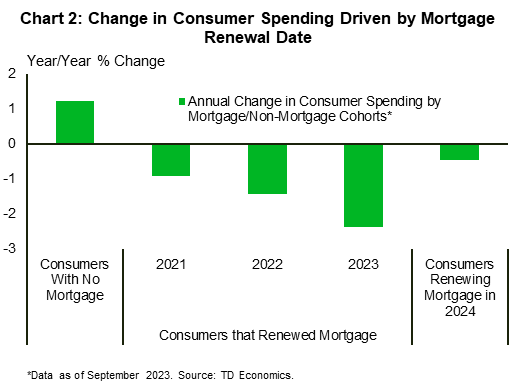

If you ask a mortgage holder how they have been coping with higher mortgage rates, the answer will depend on the date of their mortgage renewal. A mortgage holder that reset in 2023 at a 5% to 6% mortgage rate will have had a very different experience than someone that is still locked into a low mortgage rate from 2020. For this reason, we divided up our cohort of mortgage holders based on when their resets occur. Chart 2 shows how the spending behaviour differs across these groups. This is where things really start to get interesting.

Our first finding is that people who do not have a mortgage have increased their spending over the past year (as of September 2023). Strong employment gains and rising wages have apparently been enough to support increases in consumer spending. Importantly, the majority of Canadian households do not have a mortgage, so this cohort will have an outsized impact on the overall economy.

Second, mortgage holders’ spending behaviour differed depending on when they reset. Those that reset in 2021 have pulled back on spending (-0.9% y/y), but to a lesser degree than those who reset in 2022 (-1.4% y/y). Mortgage holders who reset in 2023 have pulled back the most (-2.4% y/y). These actions reflect the fact that each cohort reset at different mortgage rates, and the later the reset, the more the spending adjustment.

Our third finding focuses on the spending behaviour of mortgage holders who will reset in 2024. We’d note that they have pulled back on spending over the last year (-0.5% y/y), likely as a precaution, knowing a sizable payment shock may be coming. But the extent to which they have adjusted has been much less than those that have reset this year. This implies that when the 2024 cohort goes through their reset next year, we’d expect to see them trim spending to a greater degree than they already have, putting further downward pressure on overall consumer spending.

How will this impact Canada’s economy in 2024? The Bank of Canada has noted that 47% of all mortgages will have renewed at higher rates by the end of this year.3 By the end of next year, 65% of all mortgages will have renewed. We have already seen this impact, with mortgage holders who have reset in the last three years cutting spending by approximately 1.5% y/y in nominal terms on average. Given that the 2024 cohort looks set to renew their mortgage at rates 200 basis points higher than they are paying now, they will be experiencing a similar payment shock to the 2023 cohort. In this case, total spending within the economy would be pulled down by an additional 0.5 percentage points. This is a contributing factor to why our forecast for consumption growth will go from +1.6% for 2023 (Q4 vs Q4) to just +0.6% in 2024.

Bottom Line

Mortgage holders have started to adjust their spending in the face of higher interest rates. We find that people who have reset more recently have pulled back their spending to a greater degree than people with earlier resets. We also find that consumers who are scheduled to reset rates in 2024 have yet to pullback spending as much as they likely will have to next year. Importantly for our Canadian economic forecast, this means further cuts to consumer spending next year. And while it does not look like this mortgage reset will be enough to tip the economy into recession, the Canadian consumer is becoming increasingly stressed by high interest rates.

End Notes

- All data are calculated as nominal not-seasonally adjusted average spending per calendar month. Both fixed interest rate and fixed payment variable rate mortgages are included.

- TD mortgages are not floating payment, where holders of these mortgages see payments increase with interest rates. The absence of these mortgages likely increases the relative spending behaviour of mortgage holders in our data.

- Mortgage reset quantities taken from: https://www.bankofcanada.ca/2023/05/financial-system-review-2023/

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: