UAW Strike 2023:

Human Capital Investments Aplenty

Andrew Foran, Economist | 416-350-8927

Date Published: November 9, 2023

- Category:

- Us

- Labor

- Commodities & Industry

Highlights

- The roughly six-week long UAW strike is estimated to have reduced light vehicle production in September and October by 195k units.

- The UAW gained considerable wage improvements, with all current members expected to be in the top wage tier by 2027 making over $88k per year – a 33% increase including the reinstatement of cost-of-living-adjustments (COLA).

- The ability of the Detroit-3 automakers to pass on higher labor costs to consumers is expected to be limited in the near-term, which may weigh on firm profitability and long-run investments in electric vehicles.

The United Auto Workers (UAW) union ended its six-week long strike against the Detroit-3 automakers (General Motors, Ford, and Stellantis) during the final week of October. Ford was the first automaker to reach a tentative agreement on October 25th, followed by Stellantis (October 28th) and General Motors (October 30th). The 40–45-day strike (varying by automaker) is estimated to have resulted in the loss of roughly 195k vehicles, primarily among SUV and pick-up truck models. Economic gains for the UAW were sizeable, with cost-of-living-adjusted (COLA) wages expected to be upwards of 30% higher by the end of the four-year contract. While this represents a clear win for the union, Detroit-3 automakers may need to recalibrate their long-term investment commitments to accommodate the higher labor costs.

Strike-Related Production Impacts

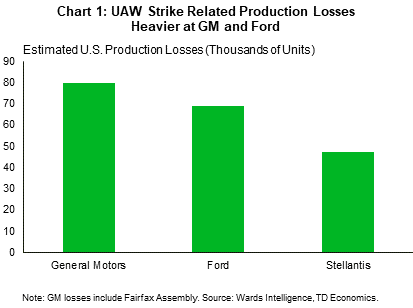

By the final days of October, over 40k UAW members were on the picket line and production losses related to the strike equated to roughly 195k vehicles. Among the three automakers, GM and Ford incurred heavier production losses, with each company having three assembly facilities offline by the end of the strike (Chart 1). Although Stellantis was hit hard during the first wave of the strike when its largest U.S. plant in Toledo, Ohio was shutdown, that was the only assembly facility it had offline for the majority of the strike. By the time the company’s Sterling Heights facility was hit by the strike, an agreement came just five days later. Unsurprisingly, the largest losses were incurred by the facilities hit the earliest in the strike, although the behemoths hit last were quickly gaining on the facilities hit earlier.

In total, the strike reduced light vehicle production in the U.S. by a little over 10% between September and October, resulting in a 0.2 percentage-point hit to GDP. However, the Detroit-3 automakers are expected to gradually boost production at affected facilities over the coming months to recoup lost production. The bounce-back in production may ultimately be limited though, as the capacity utilization rate for automotive manufacturing has been at its pre-pandemic level for the past two quarters, meaning production was already in full swing to make up for the supply deficits of previous years.

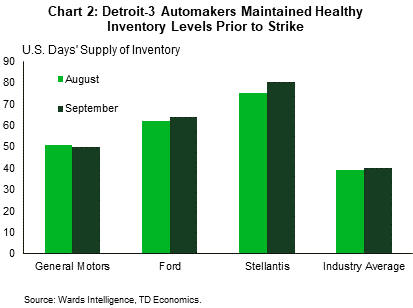

The strike-related production losses were also occurring at a time when each firm had healthy inventory levels, and likely some excess in the case of Stellantis (Chart 2). For reference, the pre-pandemic industry average for days’ supply was 60 – 70, which is roughly where Ford and GM stood prior to the strike and about 20 days below where Stellantis stood. This will likely mitigate the impact on consumers down the road, however these are aggregate measures and the impact on individual models will likely vary.

Sizeable Wage Gains Across the Board for Union Members

The headlines have justifiably focused on the economic gains achieved by the UAW, which include general wage increases of 25% over the four-year contract. However, with the newly reinstated cost-of-living-adjustment (COLA) included, the gains are expected to be roughly 33%. Furthermore, the gains will be shared broadly among UAW members, as the union was successful in reducing the timeline for progression to the top wage tier from eight years to three. This means that before this new contract expires, every current hourly UAW member will have maxed out their earnings potential for their role.

This immediate transition to a shortened wage progression timeline will also create outsized gains at the lower end of the wage tier ladder, as members with 2-4 years on the job see instant gains between 40-50%. Those with less than 1 year on the job will see an immediate pay bump of roughly 38%, while those with 8+ years on the job will see a more modest but still notable 11% bump in pay. In annual terms, assuming a 40-hour work week, this new top wage tier is expected to progress up to $88k by 2027 for hourly production workers (Table 1). In turn, skilled workers will see their estimated top annual wage hit $105k by 2027. Given the magnitude of these gains in the pipeline, it is unsurprising that we are seeing other automakers in the U.S. begin to boost their offerings as well, with Toyota recently increasing their top wage rates.

An important caveat here is that UAW members will continue to pay slightly higher union dues until their strike fund reaches $850 million. Prior to the strike, the fund had roughly $825 million which was its highest level in several years. Funding the most recent strike has likely put the fund over $100 million below its $850 million target. This means that the higher rate of dues (roughly 30 hours pay per year for hourly workers) is expected to continue for the foreseeable future.

In addition to wage gains, the UAW also obtained ratification bonuses, product/work commitments, enhanced tuition assistance, and enhanced health and retirement benefits. Interestingly, Ford and Stellantis also agreed to pay $50k separation packages to an unlimited number of retirement eligible production and skilled employees. The offer is only available in 2024 for Ford, and 2024 and 2026 for Stellantis. Although this only pertains to a relatively small share of the UAW membership, it is likely intended to allow the automakers to trim their headcounts as labor costs rise expeditiously in the coming years.

Table 1: UAW Top Tier Hourly Wages Under New Contract

| Hourly | Annual | |||

| Production | Skilled | Production | Skilled | |

| Prior | 32.05 | 36.96 | 66,664 | 76,877 |

| 2023 | 35.70 | 42.65 | 74,256 | 88,712 |

| 2024 | 37.22 | 44.38 | 77,418 | 92,310 |

| 2025 | 38.68 | 46.05 | 80,454 | 95,784 |

| 2026 | 40.20 | 47.79 | 83,616 | 99,403 |

| 2027 | 42.60 | 50.57 | 88,608 | 105,186 |

Automakers Assess and Recalibrate

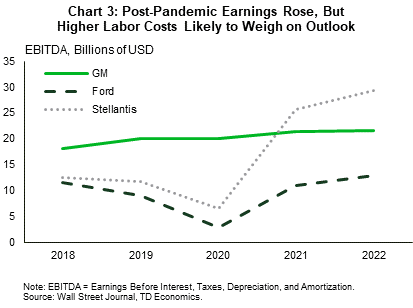

The Detroit-3 automakers came into negotiations on a solid financial footing after several years of strong earnings growth (Chart 3). While auto sales declined significantly in 2021/2022 due to persistent supply challenges, the prioritization of higher end model production coupled with rapid supply-constrained price growth allowed the Detroit-3 automakers to grow their earnings despite lower unit sales. Although the strike will put a dent in 2023Q4 earnings, all three companies have seen solid earnings growth over the first three quarters of 2023.

While this is undoubtedly positive for the Detroit-3, the developing macroeconomic background is unlikely to be conducive to their ability to pass on higher labor costs to consumers. One reason is because prices have already risen by roughly 25% over the past three years. This ultimately proved to be unsustainable as higher financing rates and improving inventory levels have pushed prices down by 3.4% so far this year. With the Federal Reserve expected to keep interest rates elevated for the foreseeable future, inventory levels continuing to improve, and the labor market beginning to soften, upward price movements will likely be limited over the near-term. This ultimately means that the Detroit-3 automakers may have to absorb the higher labor costs resulting from the recent UAW agreements. While estimates of the total labor costs associated with the new agreements are preliminary, Ford’s Chief Financial Officer John Lawler said on a conference call that the contract would raise average labor costs by $850-900 per vehicle, equating to billions of dollars in additional costs per year.

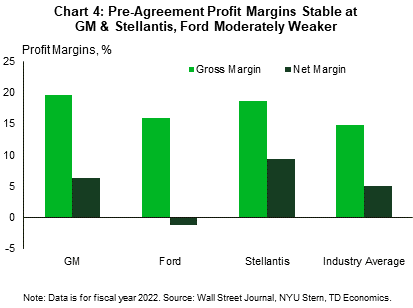

Each of the three companies have above average gross profit margins (Chart 4), meaning they are able to sell their products for more than they cost to produce. This relative outperformance continues to hold true when total costs are included to calculate net profit margins, although Ford dipped slightly below last year.

While the potential for margin compression is never welcome news for shareholders, the timing is also not ideal for the companies’ long-term electric vehicle (EV) plans. Two years ago, the Detroit-3 put out a joint statement announcing their intention to target EV sales of 40-50% of U.S. annual volumes by 2030. To that end, all three companies have drastically increased their investments in EV production, with tens of billions of dollars being allocated to achieve their 2030 targets. Ford has already announced that it will postpone $12 billion in EV investments due consumer price sensitivity while GM is delaying EV production at its Orion Assembly plant in Michigan for similar reasons. Over the long-run EV prices would be expected to decline as companies invest in their productive capabilities and achieve efficiencies of scale but narrowing profit margins would make that more challenging. Ultimately, the expected return to trend economic growth in 2025 should allow the Detroit-3 to pass on some of their now structurally higher labor costs to consumers, but near-term cost increases may weigh on long-run investment decisions in the interim.

Bottom Line

The UAW implemented a six-week long strike against the Detroit-3 automakers, disrupting automotive production by 195k and obtaining notable economic gains for their efforts. With all current UAW members expected to reach the top wage tier – which will be roughly 33% higher by 2027 – before the end of the new contract, the Detroit-3 automakers are scheduled to see a material rise in labor costs in the coming years. Given the current macroeconomic environment and the increased price sensitivity of consumers, the Detroit-3 may have difficulty passing these higher costs on to consumers. In turn, this may pose challenges to the long-term EV ambitions of the three automakers as their investment decisions adapt to higher labor costs. That is not to say that their plans will be derailed, just that some recalibration may be required as the distribution between physical and human capital investments adjusts to the new contracts.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: