U.S. Trade Vulnerabilities in Critical Minerals: Pressure Points Amid Rising Tensions

Andrew Foran, Economist | 416-350-8927

Date Published: October 22, 2024

- Category:

- Us

- Trade

- Commodities & Industry

Highlights

- In 2022, the U.S. designated 50 minerals as critical to the economy and national security. These minerals are used in countless products including automobiles, energy systems, electronics, and military equipment.

- China dominates the global production of more than half of the critical minerals outlined by the U.S. government, which it has leveraged over the past year amid rising trade tensions between the two nations.

- Shifting supply chains away from China will be difficult in the near-term for several critical minerals, but a combination of higher domestic production, alternative import sources, and utilizing substitute minerals where feasible will help to improve future supply chain resiliency.

In 2022, the United States designated fifty minerals as critical to the U.S. economy and national security1 as experiences with supply chain disruptions during the pandemic elucidated the potential for future trade vulnerabilities. For most of these minerals, the U.S. has minimal domestic deposits or refining capacity and as such is largely dependent on its trading partners to procure the supplies that it needs. China dominates global refining capacity for over half of the critical minerals listed, which creates a challenge for the U.S. amid rising trade tensions between the two nations. China has already shown its willingness to leverage its position in global markets to apply pressure on the U.S. and continues to have abundant dry powder should tensions rise further.

In recent years, the U.S. has made progress in diversifying its exposure away from China, but fully eliminating trade vulnerabilities remains a considerable challenge in the near-term. This means that critical minerals will continue to be a key area of U.S. trade policy moving forward, not only in terms of balancing its current trading relations with China but also in terms of fostering alternative sources with its other trading partners.

Critical Mineral Sourcing & U.S. Trade Exposure to China

While critical minerals can be found around the world, the extraction of raw, individual critical minerals tends to be concentrated in a handful of countries. Examples include lithium (72% of global mine production in Australia and Chile), cobalt (74% of global mine production in the Democratic Republic of Congo), platinum (67% of global mine production in South Africa), and niobium (90% of global mine production in Brazil)2. This level of concentration applies to roughly two-thirds of the critical minerals earmarked on the U.S. list, while the remaining third have a greater degree of producer diversity.

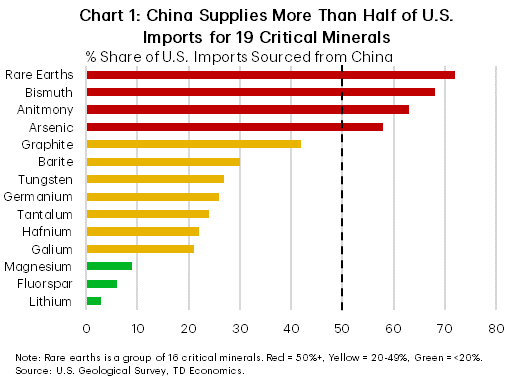

Of the two-thirds of critical minerals with highly concentrated raw mineral production, China exercises complete or near-complete control over most of them. China dominates the global industry for the extraction of roughly half of the fifty critical minerals outlined by the U.S. and extends its influence further through the control of global refining capacity for additional critical minerals. Of the fifty critical minerals, thirty-one have extraction and/or refining capacity concentrated in China. This is why China is the primary import source for the U.S. for twenty-one critical minerals. Within this group, the sixteen rare earth minerals, in addition to arsenic, antimony, and bismuth, have the greatest reliance on China, with more than 60% of U.S. imports of each coming from China (Chart 1).

Critical Mineral Trade Restrictions to Date

Given the outsized role China plays in the global production of critical minerals, current trade tensions present a unique challenge for the U.S. Historically, China has used export restrictions on critical minerals to benefit its domestic market, but more recently it has used them to punish nations for taking actions that it disagrees with. The earliest instance of this was back in 2010, when China restricted exports of rare earth minerals to Japan over a maritime incident in the East China Sea. Fast-forwarding to today, China has announced restrictions on exports of four critical minerals to the U.S. in retaliation for recent U.S. trade measures. The minerals restricted by China include some products of gallium, germanium, antimony, and graphite.

The critical minerals targeted by China were strategically selected, as the U.S. relies on China for at least one-quarter of its imports of all four of these minerals. This reliance is even higher in the case of graphite (42%) and antimony (63%). China also exercises significant control over the complete supply chains of most of these minerals, which will complicate the ability of the U.S. to find alternatives.

However, it is important to note that China has only restricted certain products of each mineral and that the restrictions are flexible in their application. Chinese exports of wrought (refined) and unwrought (unrefined) germanium and gallium to the U.S. equaled zero in the first half of 2024, but exports of germanium oxides & zirconium dioxides increased by 23% relative to the first half of 2023. Germanium oxides are used for different lenses while the metals are generally needed for electronics. Exports of both versions are currently subject to restrictions by China – though to clearly different degrees. The restrictions on graphite have also been nuanced, with Chinese natural graphite exports to the U.S. down 75% in the first half of the year, while exports of artificial graphite were up 50%. China’s restrictions are likely to continue to be strategically implemented as it seeks to leverage its position while simultaneously attempting to balance its current precarious economic conditions.

In the interest of diversifying its supply chains away from their current reliance on China, the U.S. has also implemented tariffs on several critical minerals from China3 (Table 1). The twelve critical minerals targeted by the U.S. were also strategically selected to avoid placing significant stress on supply chains. The U.S. has limited exposure to China for most of these critical minerals, in part owing to that fact that China does not have significant control over the global production of most of them. Among the twelve critical minerals targeted, the tariffs placed on tungsten and graphite have the most notable potential for disruptions, as China is the primary supplier to the U.S. for each.

Table 1: Critical Mineral Trade Restrictions To Date

| U.S. Import Tariffs* | China Export Restrictions |

| Aluminum | Gallium (August 2023) |

| Chromium | Germanium (August 2023) |

| Cobalt | Graphite (December 2023) |

| Graphite | Antimony (September 2024) |

| Nickel | |

| Niobium | |

| Indium | |

| Manganese | |

| Tin | |

| Tantalm | |

| Tungsten | |

| Zinc |

In addition to trade restrictions on critical minerals, each country has also implemented restrictions targeting adjacent sectors. In May, in addition to the aforementioned critical minerals tariffs, the U.S. also announced tariffs on several critical mineral dependent technologies, including solar panel cells, semiconductors, lithium-ion batteries, and permanent magnets. Many of these technologies are dependent on critical minerals from China that would be challenging to find substitutes for in the near-term. By targeting downstream products reliant on critical minerals, the U.S. is hoping it can incentivize domestic production, but it simultaneously adds to trade tensions which may result in Chinese restrictions on the very critical minerals that the U.S. will need to manufacture these products.

China is acutely aware of its position, and while it has not yet made sweeping restrictions on its critical mineral exports to the U.S., it has taken steps to complicate the U.S. objective of diversifying its trade exposure. At the end of last year, China implemented a ban on the export of rare earth extraction and separation technologies4. In addition, its prior antimony restrictions also included restrictions on refining technologies for the mineral. China has developed advanced knowledge of refining techniques for many critical minerals over the past few decades as it established the dominant global position that it holds today. A lack of access to that knowledge, while foreseeable amid the current state of trade tensions between the two countries, will make the U.S. ambition for alternative sources of refined critical minerals more challenging.

Excluding China, by Choice or Necessity

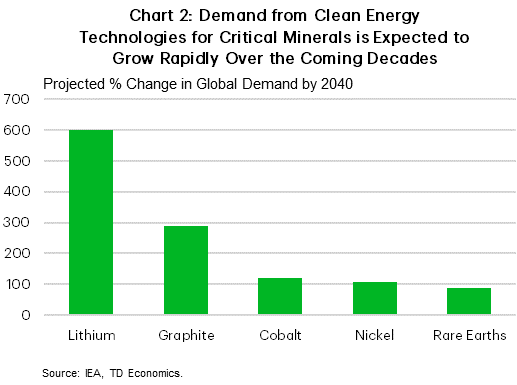

Circumventing China’s dominant position in global critical mineral supply chains will be a considerable, but not necessarily insurmountable, challenge in the coming years. In many cases, the U.S. can find (and in several instances already has found) alternative sources for the raw critical minerals that it requires. In fact, it already has free trade agreements in effect with nations that possess vast reserves of critical minerals, such as Canada and Australia. However, in many cases the mineral extraction capacity to fully meet current demand in the absence of Chinese supplies is not currently in place. This deficiency becomes more glaring in the context of meeting future demand, particularly in relation to the expected exponential rise in demand from renewable energy systems and electric vehicles for certain critical minerals (Chart 2).

The highest priority for the U.S. should be fostering alternative sources or finding substitutes for the critical minerals which it currently has the greatest reliance on China for. This includes rare earths, bismuth, antimony, and arsenic. The challenge is that China dominates the global extraction and refining capacity for all of these minerals, meaning it will be difficult to foster alternative supply chains in the near-term. China has already placed export restrictions on antimony, but restrictions on U.S. access to rare earths would have more significant implications for the U.S. given their use in advanced technologies and electric vehicles.

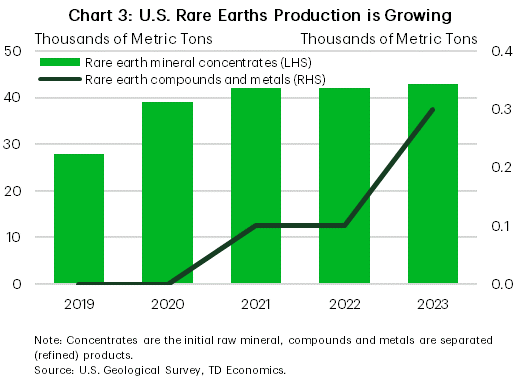

Realistically, no single country can currently offset China’s production of these four minerals, but a combination of higher domestic production and higher imports from other nations is helping to partially bridge the gap. As an example, the U.S. Department of Defense has allocated $439 million over the past four years to increase U.S. extraction, refining, and downstream assembly of finished products related to rare earth minerals5. Since 2019, U.S. mine production of rare earth minerals has increased by 54% and it has remained the second largest global producer after China. However, owing to a lack of domestic refining capacity, almost all of this production continues to be exported, although the U.S. has seen its production of refined rare earths rise in recent years (Chart 3).

On aggregate, U.S. import reliance on China for rare earths has fallen by 8 percentage points since 2019, but this has primarily been driven by a reallocation of demand towards other foreign sources, such as Estonia and Malaysia. As additional domestic refining capacity comes online over the next two years, import reliance is expected to fall modestly, but amid growing domestic demand the U.S. will remain vulnerable to potential Chinese export restrictions on rare earth minerals for the foreseeable future.

As the U.S. does not have any active mines for the other three critical minerals with high trade exposure to China, supplies will remain largely reliant on other trading partners. However, U.S. exposure to China for these minerals is largely owing to the latter’s dominance of global production, meaning alternatives are limited overall. The exploration of possible alternative minerals would be wise in this instance, with all three capable of being substituted to a certain degree according to U.S. Geological Survey reports.

For the other thirty critical minerals with a lower import reliance on China – graphite is the highest at 42%, most others average 25% or lower – some combination of higher domestic production, higher imports from other trading partners, and the adoption of substitute minerals where feasible can be used to reduce the nation’s reliance on China over the long-term. Coordination with allied nations will be paramount in achieving these goals, with the G7 Five-Point Plan for Critical Minerals Security6 in addition to the 14 nation Minerals Security Partnership7 offering examples of how this is being pursued. Over the near-term, progress is likely to be slow as resources are gradually built up in the U.S. and other nations outside of China. This means that current supply chain vulnerabilities are expected to persist in the near-term, with the potential for notable trade disruptions if trade tensions between the U.S. and China rise further. Ultimately investments made today should provide the foundations for improved supply chain resiliency in the future, but the road to get there will likely be challenging.

Bottom Line

Amid rising trade tensions between the U.S. and China, critical minerals have come to the fore. Over the past year, China has restricted the export of four critical minerals to the U.S., while the U.S. has placed import tariffs on twelve critical minerals from China to incentivize a reallocation of domestic demand towards other sources. China’s dominant position in critical mineral supply chains poses a challenge for U.S. ambitions to diversify its procurement pipelines away from the world’s second largest economy, with near-term diversification unlikely for several critical minerals. Over the longer-term, investments in domestic production, partnerships with allied nations, and innovation should allow the U.S. to reduce its import reliance on China for critical minerals.

Table 2: Minerals Designated as Critical to the U.S. Economy and National Security

| Critical Mineral | Primary Use |

| Hafnium | nuclear control rods, alloys, and high-temperature ceramics |

| Iridium | coating of anodes for electrochemical processes and as a chemical catalyst |

| Rhodium | catalytic converters, electrical components, and as a catalyst |

| Ruthenium | catalysts, as well as electrical contacts and chip resistors in computers |

| Arsenic | semi-conductors |

| Cesium | research and development |

| Fluorspar | manufacture of aluminum, cement, steel, gasoline, and fluorine chemicals |

| Gallium | integrated circuits and optical devices like LEDs |

| Graphite | lubricants, batteries, and fuel cells |

| Indium | liquid crystal display screens |

| Manganese | steelmaking and batteries |

| Niobium | steel and superalloys |

| Rubidium | research and development in electronics |

| Tantalum | electronic components, mostly capacitors and in superalloys |

| Bismuth | medical and atomic research |

| Rare Earths* | catalytic converters, ceramics, glass, metallurgy, and polishing compounds |

| Titanium | a white pigment or metal alloys |

| Antimony | lead-acid batteries and flame retardants |

| Chromium | stainless steel and other alloys |

| Tin | protective coatings and alloys for steel |

| Cobalt | rechargeable batteries and superalloys |

| Zinc | primarily metallurgy to produce galvanized steel |

| Barite | hydrocarbon production |

| Tellurium | solar cells, thermoelectric devices, and as alloying additive |

| Platinum | catalytic converters |

| Nickel | manufacture of stainless steel, superalloys, and rechargeable batteries |

| Aluminum | all sectors of the economy |

| Vanadium | primarily alloying agent for iron and steel |

| Germanium | fiber optics and night vision applications |

| Magnesium | alloy and for reducing metals |

| Tungsten | primarily used to make wear-resistant metals |

| Zirconium | high-temperature ceramics and corrosion-resistant alloys |

| Palladium | catalytic converters and as a catalyst agent |

| Lithium | rechargeable batteries |

| Beryllium | alloying agent in aerospace and defense industries |

End Notes

- U.S. Geological Survey Releases 2022 List of Critical Minerals

- U.S. Geological Survey

- USTR Finalizes Action on China Tariffs Following Statutory Four-Year Review

- Center for Strategic & International Studies: What China’s Ban on Rare Earths Processing Technology Exports Means

- DOD Looks to Establish ‘Mine-to-Magnet’ Supply Chain for Rare Earth Materials

- Annex to the G7 Climate, Energy and Environmental Ministers’ Communique: Five-Point Plan for Critical Minerals Security

- U.S. Department of State, Minerals Security Partnership

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: