U.S. Small Businesses – Still Going Strong

Shernette McLeod, Economist | 416-415-0413

Tarek Attia, Research Analyst

Date Published: May 17, 2024

- Category:

- U.S.

- Business Investment

Highlights

- Since the upheaval of the pandemic, American small businesses have shown remarkable resilience with both new business applications and the number of small business establishments surging.

- There was notable growth in the micro business segment (those with fewer than 5 employees). Women and minority owned small businesses also made notable strides in this period, increasing their representation among the pool of small business owners.

- Challenges remain for the small business sector, largely relating to financing. These challenges, however, also represent opportunities to meet their needs. In doing so, these businesses will be better enabled to continue contributing to the resilience of the U.S. economy.

The pandemic was tough on all businesses and even more so for small businesses (see report) as restrictions limited operations, resulting in a significant drop in revenues and for some small businesses, permanent closure. Since then, however, small businesses have made significant strides in overcoming the setback, evident in the sizable growth of small business establishments. Optimism among small business owners has also improved recently. A recent TD Bank survey revealed that a majority of small business owners (90%) are optimistic about the future of their businesses. This is up from 80% the previous year. Successful small businesses are an important element of dynamic local communities and are indispensable to the U.S. economy given that they employ almost half of private-sector workers and contribute over 40% to GDP. This report updates the landscape of the small-business sector since the pandemic and outlines some challenges they may face going forward.

Small Business Formation Post-Pandemic Remains Elevated

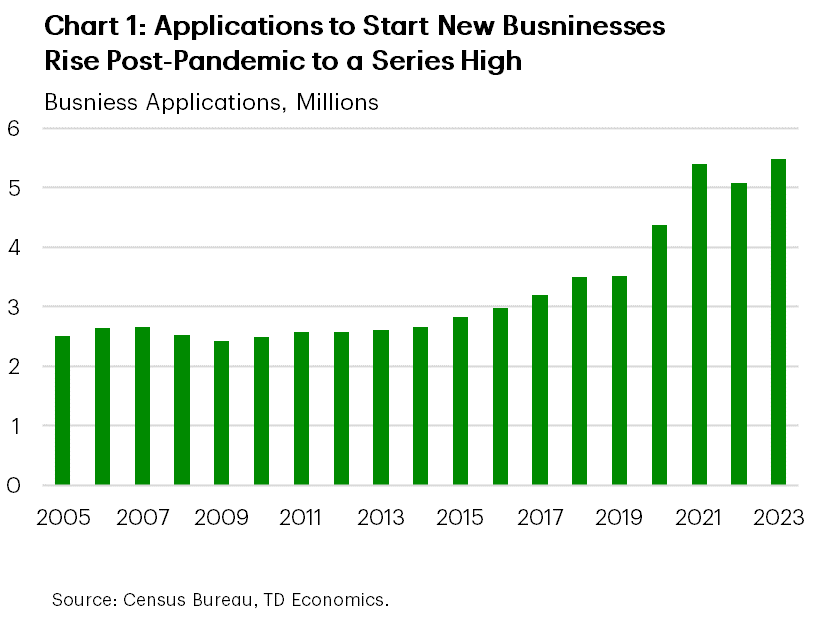

Activity among American entrepreneurs has been flourishing in the past few years. In fact, applications to start new businesses—a precursor to actual new business formation—rose substantially between 2020 and 2023 by the highest rate (12.5% annual average) than at any period since the start of the dataset in 2004 (business applications grew by 2.5% on average prior to 2020) (Chart 1). Notably, 2023 had the highest number of new business applications on record (5.5 million), with approximately 32% of these identified as high-propensity business applications or those most likely to result in non-owner job creation. This jump in business application is also expected to result in a higher number of actual new businesses. On average between 2016 and 2019, 8.3% of business applications lead to business formations within four quarters. As such, given the 20.4 million business applications filed between 2020 and 2023, if past relationships hold, there could be close 1.7 million new businesses formed.

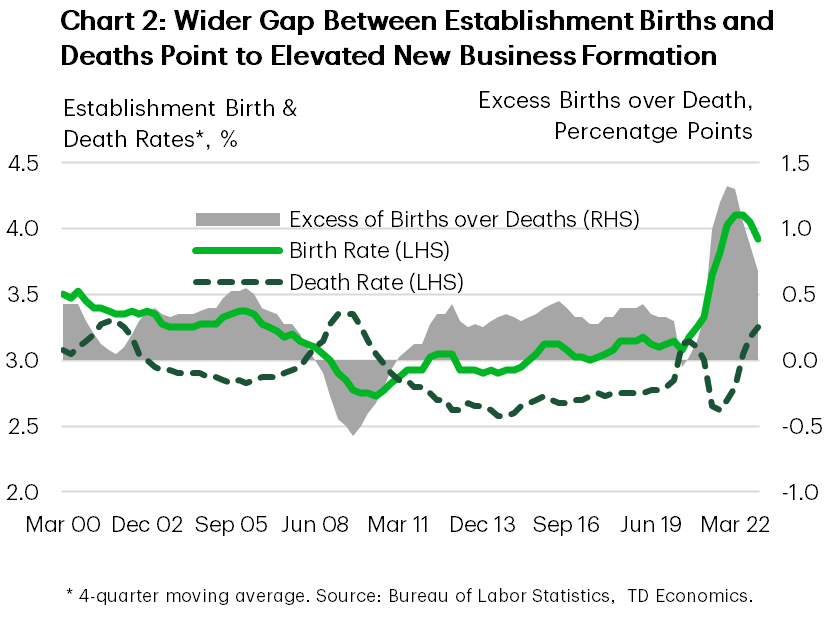

This expectation is already playing out if one looks at establishment births and deaths. An establishment is a single physical location of a business, which may have many locations. Establishments births accelerated in 2020 and reached an unprecedented 4.1% of total establishments in 2022, compared to a birth rate of around 3.2% in prior years. While establishment deaths have picked up more recently, they have remained relatively consistent with historical patterns. The net result has been a widening in the gap between establishment births and deaths – a much wider gap than has existed in the prior two decades – with a resulting increase in net new businesses (Chart 2). This result is corroborated by the notable rise in business establishment counts from the Quarterly Census of Employment and Wages. Between 2020 and 2023 business establishments in this survey, on average, grew by 4.0% annually, much higher than the 1.8% average annual grow recorded prior to the pandemic (i.e., 2016 to 2019). The main take-away is that coming out the pandemic, there has been a surge in both new business applications and new business formations. What’s more, many of these newly formed businesses may rightly be classified as small and micro businesses.

Breaking Down the Boom in Small Business Formation

Size of Firms

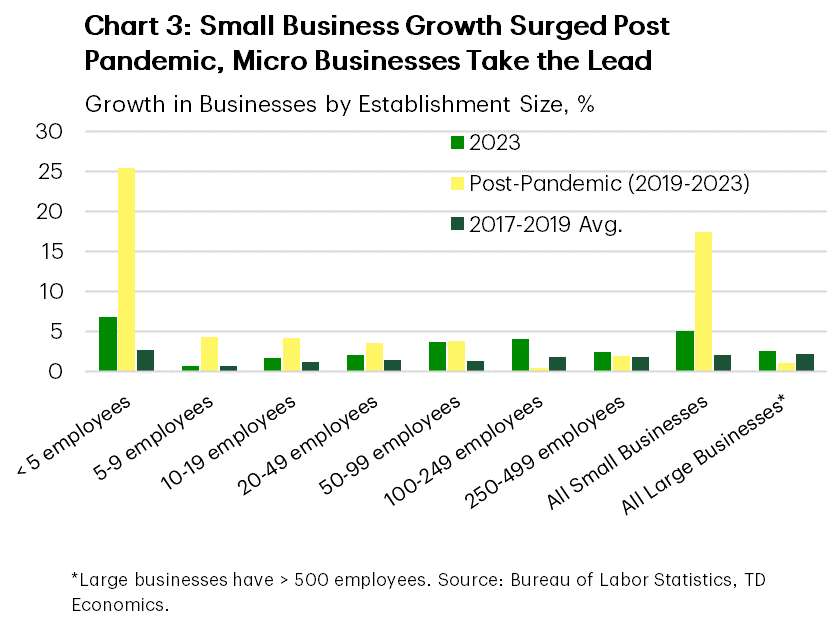

Small (and even micro) businesses lead the charge in business formation. With surging establishment births outnumbering deaths, analysis by the Federal Reserve has found that the distribution of firm size has shifted to the left, such that a larger share of firms and employment is accounted for by smaller firms.1 Prior to the pandemic, growth in small business establishments and larger sized establishments were generally on par at around 2%. Post-pandemic however, there was a clear acceleration in the growth of small businesses relative to their larger sized counterparts. Additionally, among small businesses, the firm size that experienced the largest growth coming out of the pandemic were those with fewer than 5 employees (Chart 3). This finding is also supported by results from the most recent survey of consumer finances (2022) which reported that the majority of households who owned businesses were those that were either non-employers (i.e. the owner is the sole employee) or ones that had between 2-5 employees. Only 22.4% of these business owning households had more than 5 employees.

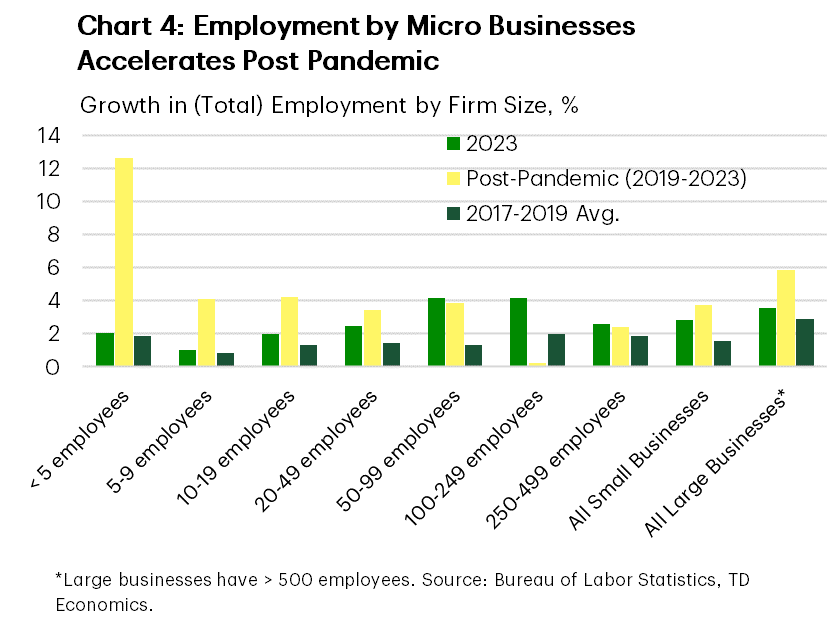

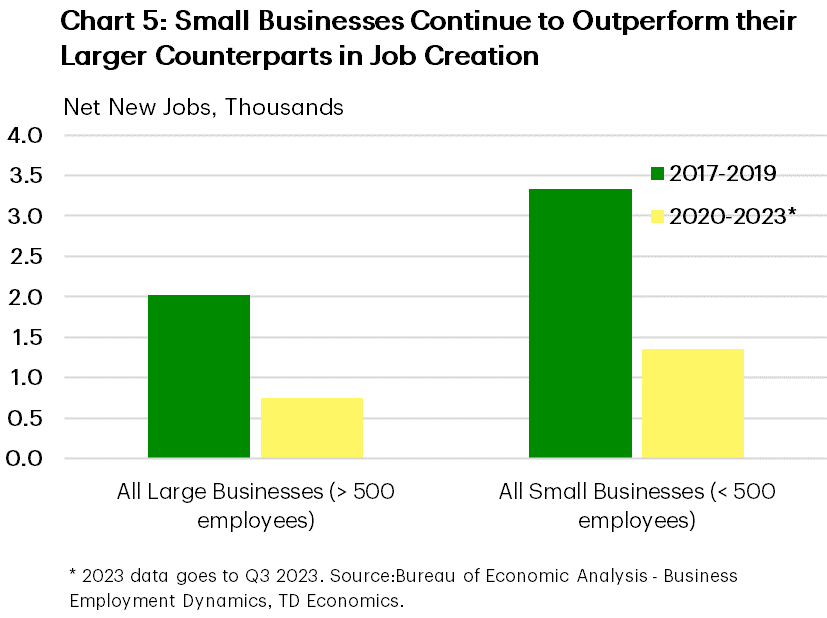

Not only did the number of small business establishments expand rapidly after the pandemic, but so did their gain in employment. Again, this was mostly evident among micro businesses (those with less than 5 employees), whose post-pandemic growth in employment significantly outpaced all other categories (Chart 4). In 2023, mid-sized small businesses (those with 50-249 employees) also experienced notable gains in employment. Looking at an alternative dataset, the business employment dynamics, it is also evident that small businesses have retained their edge in churning out new jobs, relative to larger firms (Chart 5), having added close to 1.4 million net new jobs compared to almost 750k at larger firms.

Women and Minority Business Owners Make Progress

Who owns small businesses has seen some shifts since the pandemic as well. Data from various sources show that business formation as well as business ownership among women and ethnic minorities increased. In 2019, prior to the pandemic, data from the Federal Reserve and U.S. Census Bureau indicated that approximately 21% of employer firms (i.e. firms with at least 1 non-owner employee), were owned by women. By 2023, this figure had risen marginally to about 22%. More importantly, a majority of these businesses reported being profitable (63%) despite challenges faced coming out of the pandemic. Similarly, Gusto – a payroll, benefits and human resource management company – found in its annual survey that almost half (49%) of the new small businesses formed in 2023 were owned by women. This is a notable increase from 29% reported in 2019.

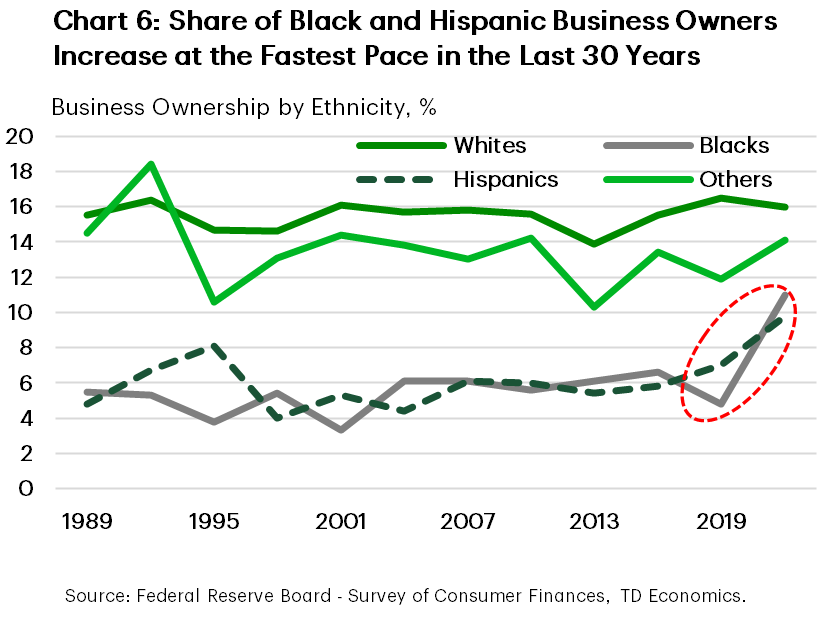

Significant strides in business ownership were also made by ethnic minorities following the pandemic. The Survey of Consumer Finances shows that business ownership among Blacks grew at a faster pace between 2019 and 2022 than at any time during the previous three decades (Chart 6). Business ownership among Hispanics also grew notably during that time (up 2.8 ppts). Data from Gusto’s survey is in line with these results, showing that Black entrepreneurship doubled to 6% in 2023 relative to 2019 and moved from 8% to 13% among Hispanics. While there is still ground to be gained relative to their white counterparts, progress since the pandemic has been impressive.

Where New Small Businesses Find Opportunities

In terms of location, the business application boom has been quite evident in Florida, which had the highest number of business applications in 2023. They were followed by California, Texas, New York, and Georgia to round out the top five. On a per capita basis, the highest number of business applications were from Wyoming, Delaware, Florida, Georgia and Colorado. Most applications for new businesses in 2023 were filed in the retail trade (977k), professional services (687k) and construction (543k) industries. These three categories were also the top three in 2019 and experienced notable increases in the volume of applications between the two years (87%, 50% and 42% respectively).

Looking at the actual number of new small businesses established after the pandemic, there were notable surges in the information, professional & business services, and the education & health services categories. These industries experienced growth in the post pandemic period which significantly outpaced their pre-pandemic averages (Table 1). Overall, there was greater acceleration of small business growth in the service sector relative to its pre-pandemic average. This is not surprising given that service oriented small businesses were the most severely impacted by the pandemic. The notable gain since then testifies to the innovativeness and resilience of small business owners, who overcame the destruction of old business models and processes to adopt newer, more creative, and efficient ones – thereby resulting in significant growth.

Table 1: Growth in Small Business Establishments (%)

| 2023 | Post-Pandemic (2019-2023) | 2017 - 2019 Avg. | |

| All Small Businesses (<500 employees) | 5.0 | 17.5 | 2.0 |

| Goods Producing | 3.2 | 11.0 | 2.3 |

| Resources and Mining | 1.5 | 4.4 | 0.9 |

| Construction | 3.4 | 12.3 | 3.0 |

| Manufacturing | 3.5 | 10.4 | 1.2 |

| Services Providing | 5.2 | 18.5 | 2.0 |

| Trade,Transport and Utilities | 2.3 | 6.1 | 0.7 |

| Information | 12.6 | 56.6 | 6.7 |

| Finance | 3.8 | 16.8 | 2.5 |

| Professional and Business Services | 7.3 | 28.8 | 3.5 |

| Education and Health | 6.0 | 19.4 | 3.7 |

| Leisure and Hospitality | 3.2 | 9.3 | 2.6 |

| Other | 2.9 | 3.1 | 1.5 |

Challenges Facing Small Businesses

The pandemic was a challenging time for small business finances, with several business owners noting that they experienced significant difficulties, including weak demand, heightened expenses, mandated closures and limited credit availability. While government assistance helped many weather the storm, payments are now coming due under certain loan programs, and for some small businesses that have not yet returned to pre-pandemic levels of profitability, servicing this debt can pose a challenge.

Access to startup funds and meeting ongoing credit needs also tends to be an area where many small businesses encounter difficulties. This is generally even more pronounced among women and minority owned businesses. In 2023, for example, only about 2% of invested venture capital dollars went to female-only founders– a figure which has remained between 2-3% for much of the last decade.2 The Fed’s small business credit survey also shows that minority-owned firms are about half as likely as their white counterparts to have all their credit needs met by their financial partners. Not surprisingly, most small businesses, especially in the start-up stage, rely on personal funds (i.e., owner’s personal savings, family/friends) to meet the financial needs of the business. As such, the amount of debt outstanding for small businesses tends to be lower than for larger and/or more established businesses.

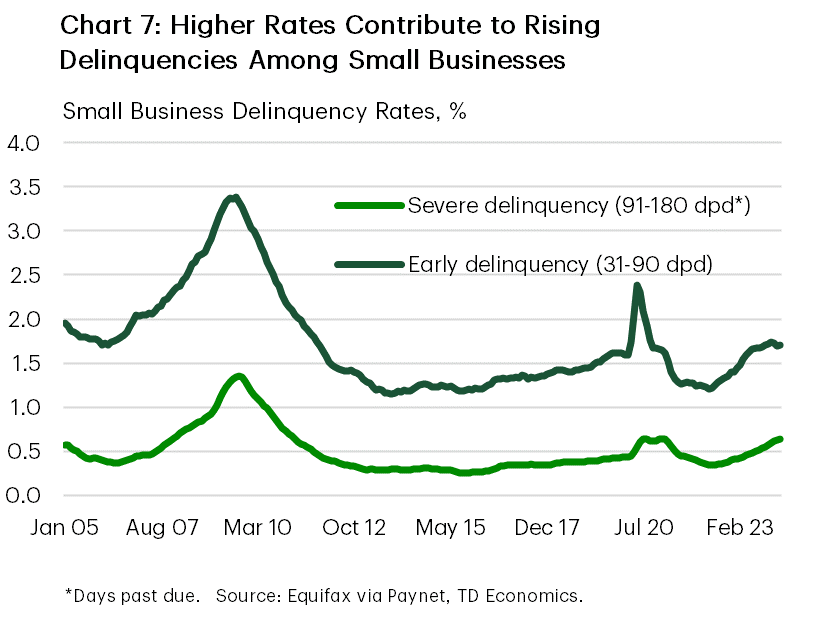

That said, in the fourth quarter of 2023 there was over $65 billion in small business loans outstanding according to the Kansas City Fed Small Business Lending Survey. This represents a 9.3% increase over 2019 Q4. Lenders still note however that there has been a decline in loan demand among small businesses, which is not surprising, given higher interest rates. Additionally, there has been an uptick in delinquencies. After declining to 1.2% in early 2022, early delinquencies among small businesses have risen to 1.7% as of March 2024 (just above their pre-pandemic level of 1.6% in December 2019.) Severe delinquencies (90+ days past due) are currently at the same peak level reached during the pandemic (Chart 7). This suggests that some small businesses continue to face challenges, which has inhibited their ability to service their loans.

However, relief is on the horizon on high inflation and interest rates. Inflation has retreated notably from the heights attained immediately following the pandemic. And, the Federal Reserve has indicated that policy interest rates have likely peaked, which means lower rates could be in the pipeline for small businesses currently facing elevated borrowing costs. Financial institutions in the most recent Fed Senior Loan Officer Opinion Survey have also indicated greater willingness to lend relative to much tighter lending standards last year. With several small business owners citing these factors (inflation and high interest rates) as the main headwinds facing their businesses, relief on these fronts is in the offing.

Bottom Line

There has been a resurgence in the U.S. entrepreneurial spirit coming out of the pandemic. This has resulted in a surge in both business applications and business formations, particularly in the small business space. Notably, there has been an increase of business dynamism among micro, women and minority-owned businesses. While small businesses continue to face challenges, especially with respect to financing, these obstacles are particularly evident among this subset of small business owners. The notable increase in their numbers combined with the challenges they face in accessing adequate financing, highlights opportunities to better meet the needs of these market segments. In doing so, this would provide the resources needed by not only these, but by all, small businesses so that they can continue growing and contributing to the resilience of the U.S. economy.

End Notes

- See Ryan A. Decker and John Haltiwanger 2022, Federal Reserve Board, Business Entry and Exit in the Covid-19 Pandemic; A first Look At Official Data.

- See Funding for female founders remained consistent in 2023 and Funding to Female Founders.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: