Fractured Supply Chains &

U.S. Contingency Planning: Rare Earth Minerals

Andrew Foran, Economist | 416-350-8927

Date Published: November 19, 2025

- Category:

- U.S.

- Trade

- Commodities & Industry

Highlights

- China’s imposition of stringent export restrictions on rare earth minerals this year starkly illustrated the vulnerabilities that exist in global supply chains.

- U.S. imports of rare earth products fell notably prior to the 1-year détente reached between the U.S. and China in late October.

- Shifting the concentration of rare earth supply chains away from China will be a challenge, but the foundation has already been laid and bolstered efforts can materially enhance global supply chain resilience.

The threat of China curtailing exports of rare earth minerals has been on the radar of policymakers in D.C. for the better part of a decade, but China’s monopoly over the industry limited the pool of viable alternatives. Now in 2025, as trade relations between the world’s two largest economies have deteriorated, China has opted to apply strategic pressure to a vital nerve in global supply chains.

Recent negotiations between the U.S. and China resulted in a year-long delay to most of the Chinese trade restrictions, which will buy the U.S. some time. However, China accounts for nearly all global rare earth refining and a substantial share of the derivative product market, meaning replacing Chinese supplies will likely be nearly impossible before the 1-year truce expires. Over the longer term, partnerships with peer nations, bolstering domestic refining capacity, and finding alternatives to rare earth minerals where feasible would help to mitigate supply chain risks.

Rising Trade Tensions & Strategic Pressure Points

Trade relations between the world’s two largest economies deteriorated considerably in the first half of 2025, with tensions coming to a head in April as both countries raised tariffs to prohibitive levels. Subsequent negotiations yielded a suspension of most tariff policies, but both countries continued to implement trade restrictions on the other as negotiations continued. Perhaps the most consequential of which was China’s decision to begin placing restrictions on the export of certain rare earth minerals and their derivative products.

These restrictions were not an outright ban but required exporters to obtain a special licence to export the impacted products, with the expectation that a greater degree of scrutiny would be applied to exports being sent to the U.S. These restrictions began in April, when China targeted 7 rare earth minerals in addition to all downstream metals, compounds, and magnets. This included permanent magnets, which are a highly valued derivative product of rare earth minerals and one of the main forms in which rare earth minerals are imported to the U.S., either individually or embedded in finished goods.1

Six months later, China added restrictions to 5 more rare earth minerals (Table 1). But perhaps more importantly, Chinese authorities unveiled far more broad-based extraterritorial export restrictions on rare earth minerals and permanent magnets. If implemented, China would impose restrictions on any product that had 0.1% or greater of its content value accounted for by Chinese rare earth minerals, whether the product was produced domestically or abroad. The restrictions would also apply to rare earth minerals produced using Chinese controlled rare earth technologies.

The Chinese Ministry of Commerce emphasized that licenses for compliant, civilian-use exports would be granted, but this policy effectively established a flexible shut-off valve on the global supply of rare earth minerals. The 1-year détente reached between the U.S. and China puts this policy on hold for a year, but the probable implementation of this policy in the not-too-distant future raises significant questions for U.S. supply chain resilience.

Table 1: List of Rare Earth Minerals Under Export Controls by China

| Restricted by China as of: | Rare Earth Element | Common Uses |

| Apr 25 | Scandium | Super alloys, ultra-light aerospace components, X-ray tubes, baseball bats, lights, semiconductors |

| Yttrium | Ceramics, metal alloys, rechargeable batteries, TV phosphors, high-temperature superconductors | |

| Samarium | High temperature magnets, nuclear reactor control rods and shielding, lasers, microwave filters | |

| Gadolinium | MRI contrast agent, memory chips, nuclear reactor shielding, compact discs | |

| Terbium | Green phosphors, lasers, fluorescent lamps, optical computer memories | |

| Dysprosium | Permanent magnets, lasers, catalysts, nuclear reactors | |

| Lutetium | PET scan detectors, superconductors, high refractive index glass, X-ray phosphor | |

| Oct 25 | Europium | Liquid crystal displays, fluorescent lighting, red and blue phosphors |

| Holmium | Lasers, nuclear reactors, catalysts, magnets | |

| Erbium | Lasers, vanadium steel, infrared absorbing glasses, optical fibers | |

| Thulium | Portable X-ray machines, microwaves | |

| Ytterbium | Infrared lasers, chemical reducing agent, rechargeable batteries, fiber optics | |

| Unaffected to Date | Lanthanum | Batteries, optical glass, camera lenses, petroleum refining catalysts |

| Cerium | Catalysts, metal alloys, radiation shielding, water purifier | |

| Praseodymium | Magnets, lasers, pigments, cryogenic refrigerant | |

| Neodymium | High-strength permanent magnets, lasers, infrared filters, hard disc drives | |

| Promethium | Atomic batteries, scientific research |

How Much Control Does China Have Over Global Rare Earth Supply Chains?

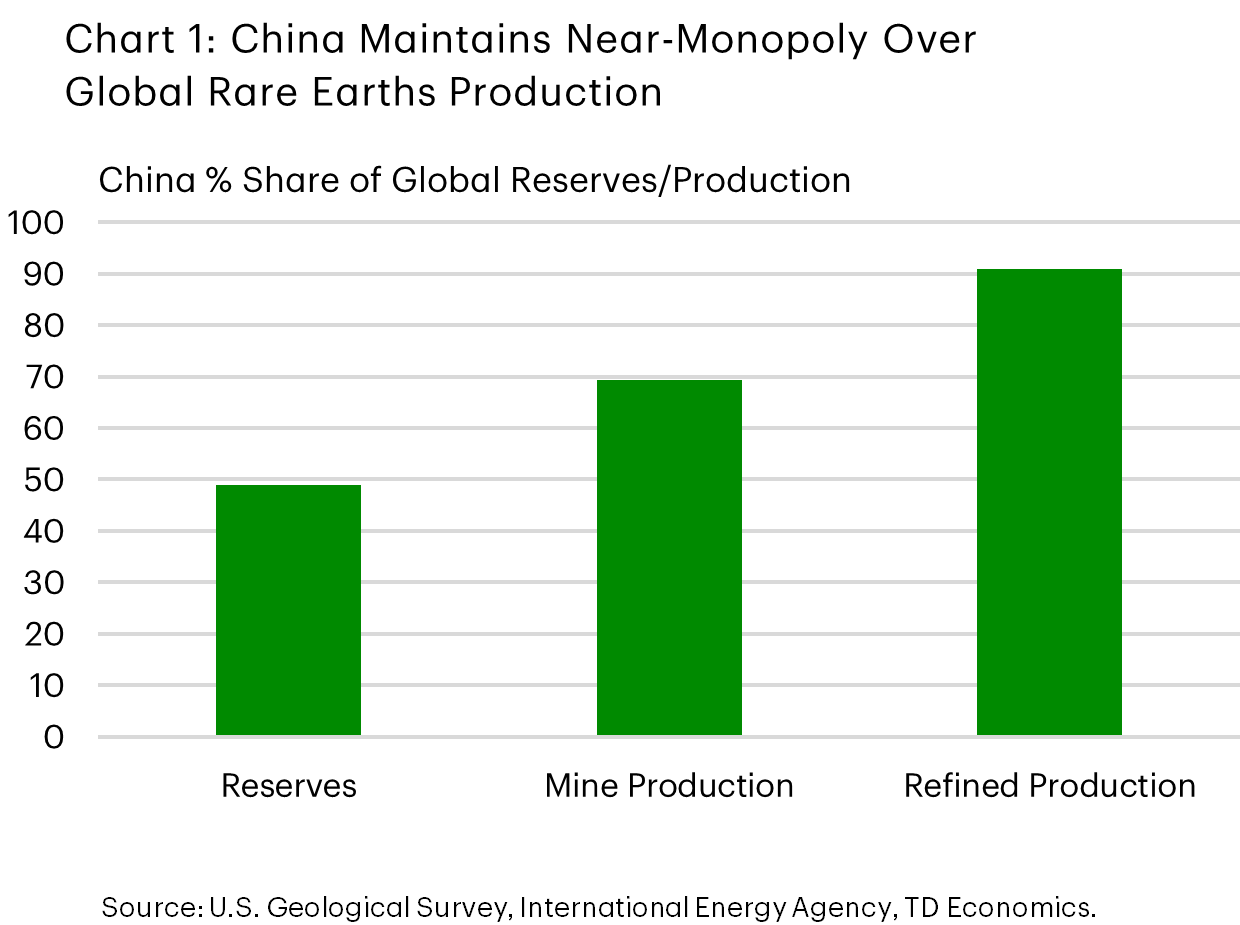

China exercises a near complete monopoly over global rare earth supply chains. The nation possesses roughly half of global rare earth mineral reserves, while accounting for 70% of global mine production, and roughly 90% of global refined output (Chart 1). While China’s upstream control of rare earth mine output is high, it is incomplete, with the U.S. accounting for the second highest share of the global market at 12%. However, much of the rare earth mine output sourced outside of China ends up in Chinese refineries. This illustrates the significance of China’s recent export restriction announcements related to rare earths, with any stringent implementation likely to be felt across the global economy.

After the April announcement, Chinese exports to the U.S. of rare earth minerals fell considerably, but much of this can be explained by mean-reversion following the surge in imports at the start of the year ahead of the expected imposition of U.S. tariffs (Chart 2). Note that rare-earth minerals, both raw and refined, were exempted from reciprocal tariffs but subject to the fentanyl tariffs imposed on China, which were equal to 10% in February, 20% in March, and then lowered back to 10% in November after recent negotiations.

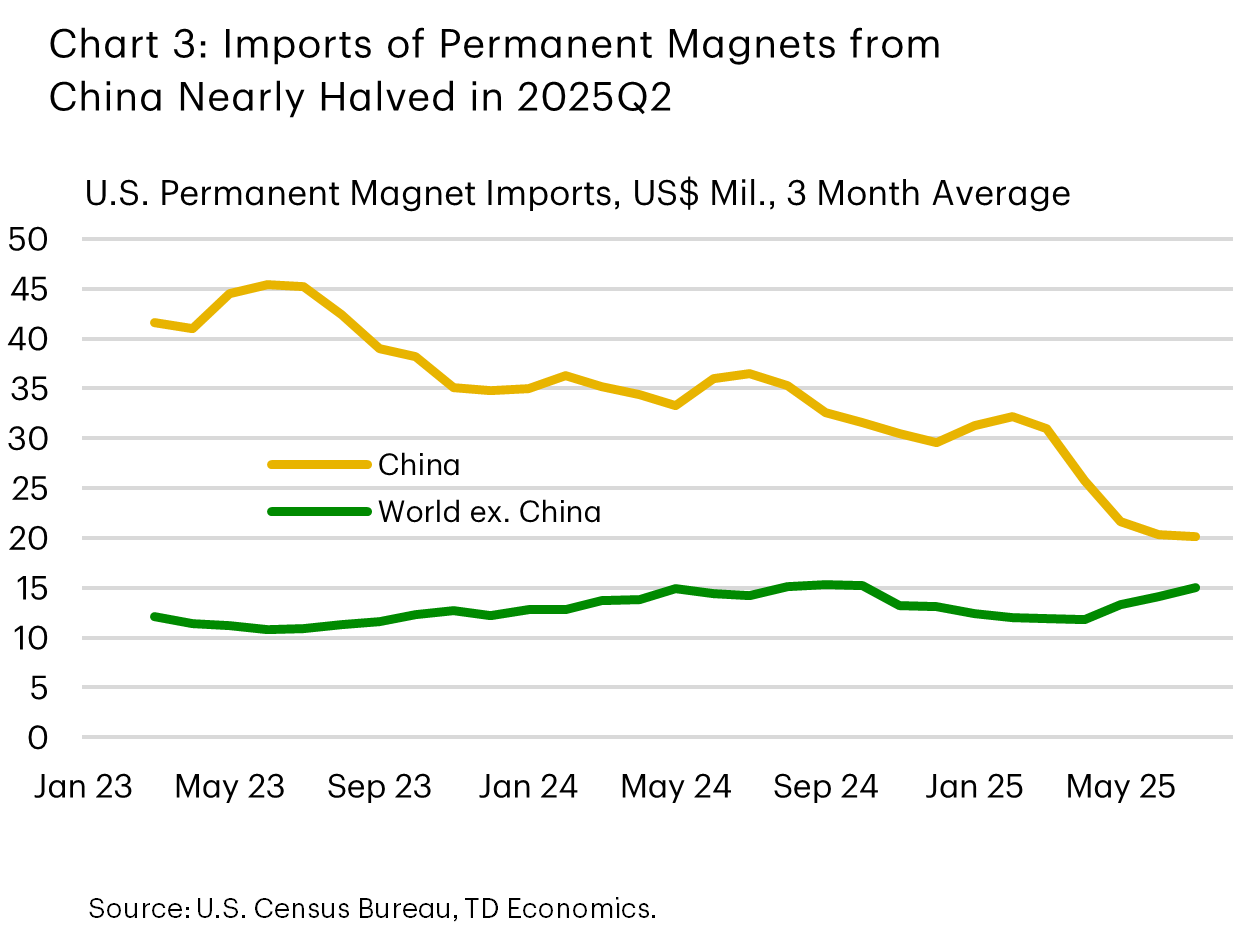

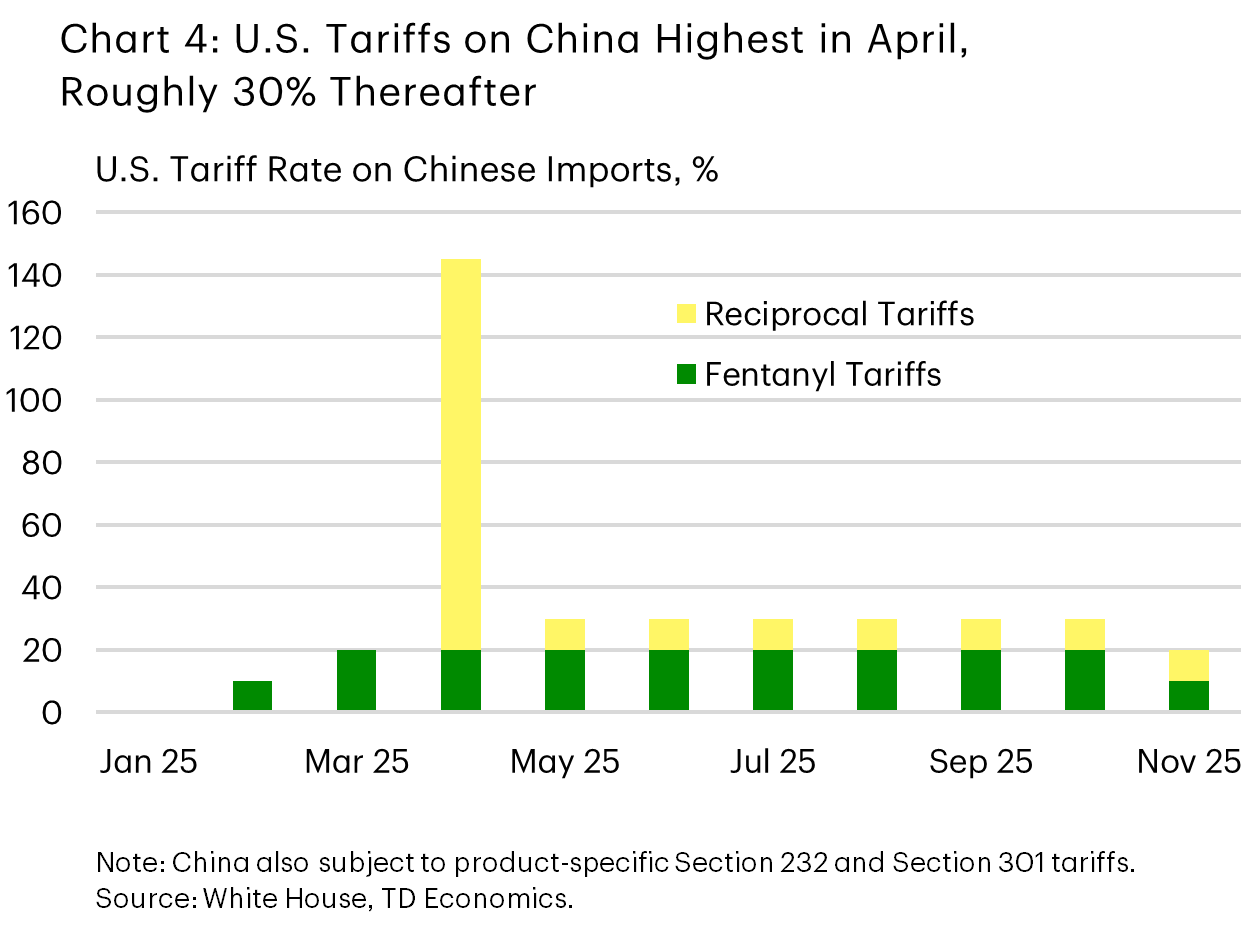

In the case of permanent magnets, which also faced Chinese export restrictions starting in April, we saw U.S. imports fall by roughly a third between the first and second quarter (Chart 3). Given there was limited front-loading of imports prior to the imposition of restrictions, it seems likely that the Chinese measures, in addition to the U.S. tariffs on China, caught most importers by surprise. While this decline could stem from a stringent enforcement of Chinese restrictions, the plateau through the summer suggests this trend was more likely driven by U.S. tariff policies. Permanent magnets were not exempted from either the fentanyl or reciprocal tariffs imposed on China, which cumulatively rose from well over 100% in April to roughly 30% in May, where they sat until being lowered to 20% with the most recent negotiations in late October (Chart 4). Additionally, in an environment where alternative supplies were readily available, we would expect to see an uptick in imports from other nations in Chart 3. However, with China accounting for 94% of permanent magnet production, according to the International Energy Agency, this clearly did not occur.

With Chinese export restrictions now paused until November 10th, 2026, the clock is ticking for the U.S. to bolster its efforts to find alternative rare earth mineral sources, particularly in terms of refined and derivative products.

Fostering Supply Chain Resilience in 2026 & Beyond

U.S. efforts to increase critical mineral supply chains have been underway for several years now, but circumventing China has proven to be a tall order. U.S. measures have primarily taken two forms; increasing domestic production and fostering alternative supply sources. The former has proven to be successful to date, with U.S. production of refined rare earth minerals growing by over 400% year-on-year in 2024. This brought U.S. import reliance for refined rare earths down from over 95% to 80% according to the U.S. Geological Survey. This was in part a byproduct of efforts by the Biden administration to foster “Mine-to-Magnet” supply chains, including over $330 million in Department of Defense contracts provided to MP Materials and Lynas USA for rare earth processing projects.2 These initiatives also included upstream mine production and downstream permanent magnet production projects, illustrating the concerns policymakers had surrounding the risks of Chinese control of global supply chains well before the now suspended restrictions were announced earlier this year.

Note that in addition to the financial support provided to domestic firms to shore up rare earth production, the Biden administration also imposed tariffs on China, citing unfair trade practices, to incentivize these efforts. Most of these tariffs were imposed on semi-finished and finished products (semiconductors, electric vehicles, batteries, solar panel cells, and certain critical minerals) but they also targeted permanent magnets with a 25% tariff scheduled to take effect in 2026. This led to a decline in China’s share of U.S. permanent magnet imports, from 77% in 2023 to 66% over the 12 months through July. In addition to financial incentives and tariffs, the Biden administration also sought to enhance multilateral collaboration, including through the Minerals Security Partnership and the G7, whereby efforts to increase supply chain resilience were discussed with other advanced economies and nations which possess reserves of critical minerals.

The Trump administration has also taken efforts to foster improved domestic production capacity of rare earth minerals and permanent magnets, including through direct funding which in most instances has been provided in exchange for equity in the recipient companies.3 This includes rare earth mining & processing firm MP Materials, which is now majority-owned by the U.S. government, in addition to the rare earths processing & recycling firm ReElement and the permanent magnet production firm Vulcan Elements.

On the tariff front, while Section 232 national security tariffs on critical minerals are being investigated by the Trump administration, the tariffs have not been scheduled as of yet. However, as previously noted, rare earth minerals and permanent magnets were caught by the broader tariffs imposed on China and other nations earlier this year. As the U.S. has announced several negotiated tariff agreements in recent months, several have included partnerships on rare earth mineral mining and processing. The most comprehensive have been the bilateral agreements with Japan and Australia, which included agreements on working in partnership to secure rare earth mineral supply chains. The U.S. tariff agreement with Malaysia also included a commitment for Malaysia to refrain from imposing restrictions on rare earth mineral and magnet exports to the U.S. Collectively the U.S. is continuing to pursue international partnerships on rare earth mineral production, but placing a greater emphasis on bilateral rather than multilateral agreements.

Bottom Line

Rising trade tensions between the U.S. and China in 2025 have resulted in a tumultuous year for rare earth supply chains. Recent negotiations have yielded a 1-year suspension of most trade measures implemented by each country, providing much needed relief for the vital industry, but risks to global supply chains have risen. China’s imposition of far-reaching export restrictions, if exercised, could create material ripples in the U.S. and global economy. With this in mind, the U.S. and its peers have enhanced efforts to foster alternative supply chains, but circumventing China’s monopoly over rare earth and permanent magnet supply chains will likely be impossible before the expiration of the détente. However, over the coming year, higher domestic production, partnerships with peer nations, innovation can help the U.S. to greatly improve its supply chain resilience.

End Notes

- Rare Earths Mineral Commodity Summary 2025, United States Geological Survey.

- Fact Sheet: Biden-Harris Administration Takes Further Action to Strengthen and Secure Critical Mineral Supply Chains. September 20th, 2024.

- Trump administration and private investors sign off on $1.4 billion deal with rare earth startups, Associated Press, November 4th, 2025

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: