U.S. Office-to-Apartment Conversions:

A Silver Lining, Not a Silver Bullet

Admir Kolaj, Economist | 416-944-6318

Date Published: July 18, 2023

- Category:

- Us

- Real Estate

Highlights

- With plenty of office space sitting vacant in a post-pandemic world and clear need for affordable housing, office-to-apartment conversions appear to present a win-win opportunity given that they can help reduce the slack in the office market, while simultaneously boosting the supply of apartments for rent.

- Several stars need to align to make such conversions economically viable. In general, buildings ideal for conversion are those with a high vacancy rate and not exceedingly large floor plates (i.e., generally less than 14,000 square feet). Older buildings are generally better at fitting this mold. But, overall, only an estimated small share of office buildings across the country are thought to be ideal candidates for conversion.

- Despite grabbing plenty of media attention, estimates of office-to-apartment conversions show that this remains a fairly minor force at both removing office inventory from the market and adding to apartment supply. As such, we continue to view this trend as more of a silver lining from a difficult situation rather than a silver bullet.

- While there’s scope for the office-to-apartment conversions trend to gain some more traction ahead – especially in a scenario where the trouble brewing in the office sector leads to more buildings being sold at a steep discount – there are headwinds too. Key among these is a recent softening in multifamily market and an already-rich apartment supply pipeline.

The pandemic’s lingering impact continues to weigh heavily on the office commercial real estate (CRE) sector. While most areas in the economy have resumed some pre-pandemic normalcy, remote and hybrid work arrangements remain popular and the return of workers to the office has faltered. For those able to work remotely, close to 30% of a typical five-day workweek is still spent away from the traditional office. Meanwhile, office space remains underutilized, with occupancy in ten major U.S. metro areas still averaging only half the pre-pandemic level. In a recent report, we covered the weak office narrative in detail, including risks surrounding it, such as the potential for large defaults as more office loans come up for renewal (see here). Since then, there has been little sign of improvement, with the U.S. office vacancy rate increasing to a new all-time high of roughly 13.1% in the second quarter of this year.

One solution bandied about to address the growing glut in the market is to repurpose office space. Office properties have a variety of reuse potentials (i.e., hotels, distribution centers, lab space), but the conversion into apartment units remains the most common reuse trend.

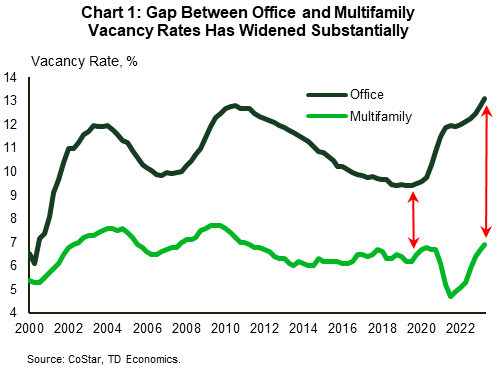

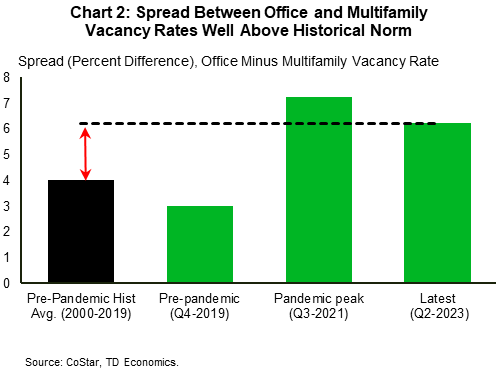

Office-to-apartment conversions could provide benefits on two fronts: reduce the oversupply in the office market and, at the same time, helping to boost overall low residential inventories with the potential to curtail high housing costs. Highlighting this opportunity is the wide gap between office and apartment vacancy rates. While not as high as earlier in the pandemic, the spread between the two remains well above the historical average (Chart 1 and 2). The fact that office prices have fallen more sharply in comparison to residential housing recently, is another potential tailwind. Still, converting office space into apartments is easier said than done given a myriad of obstacles, including structural, regulatory and financial. In addition, the rental apartment market has been displaying signs of softening, which may be an added factor limiting the upside for conversions over the medium term. In this vein, we view office-to-apartment conversions more of silver lining generated by a market response to an extremely challenging situation, rather than a silver bullet.

Many Stars Need to Align to Make Office-To-Apartment Conversions Possible

While they may look similar, office buildings are organized and built differently from apartment buildings, so they are often not easy to convert. A common obstacle to these conversions is the availability of natural light, which is essential for residential housing but not so much for offices. As such, office buildings with very wide floor plates don’t tend to be ideal for conversion, because sections of the building that do not receive natural light would find very limited use as residential housing. Estimates around the ideal building size vary. The shape of the building (i.e., square or rectangular etc.) can also make a difference. However, there’s some consensus that the most ideal office buildings for conversion are those with floor plates no larger than 14,000 square feet (i.e., roughly 120 by 120 feet).1 This would eliminate a good chunk of large office buildings scattered across the country.

Moreover, bringing an office building up to code for residential use often involves changes to things like the plumbing, electrical, and waste management systems, along with others changes such as having to add windows to every bedroom (in many jurisdictions, windows that can open). All these adjustments can substantially increase the cost of a project.

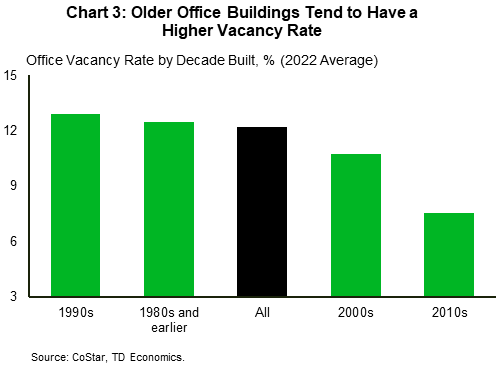

Theoretically, an office building sitting side by side a similar-sized apartment building should sell for the same price minus the costs of conversion. But once you factor in the added complexity and risks of the conversion process (construction work in older buildings often tends to uncover unpleasant and costly surprises) and the fact that not all the available office space can be effectively converted into residential space, the office building would likely need to sell at a discount even after the estimated conversion costs have been factored in. In this vein, developers must steer toward office buildings that sell cheap enough for these projects to be financially viable – an added barrier that further distills the number of candidate buildings for conversion. Keeping with the cost theme, another very important consideration is the existing occupancy of an office building. A building may be mostly vacant, but existing office tenants tend to have long-term leases in place. Getting out of these lease obligations may add to the costs for the new owner. Generally, the lower the occupancy in a building, the less burdensome it will be to settle with and to move out existing tenants. All in all, developers must generally tilt their sights toward older-type office buildings, as these tend to have much higher vacancy rates and tend sell at a discount compared to newer, more modern office buildings (Chart 3).

Because of all the reasons described above, the pool of buildings that may be good candidates for conversion appears to be limited, though estimates vary widely. A report focusing on the NYC metro area estimated that only about 3% of some 1,100 office buildings that it tracked in the Big Apple would meet the criteria for having the potential to be converted into apartments. Other estimates suggest that nationwide the share could be much higher (i.e., +10%). A recent CBRE report sheds some more light into the matter. Looking specifically to downtowns and setting the following criteria – a floor plate less than 15,000 square feet, built before 1980, more than 50% vacant – it finds that just 1% office space may be ideal for conversion. However, when removing the mostly vacant criteria (+50% vacant), this share grows to 13%.

Office-To-Apartment Conversions Trend Remains a Minor One

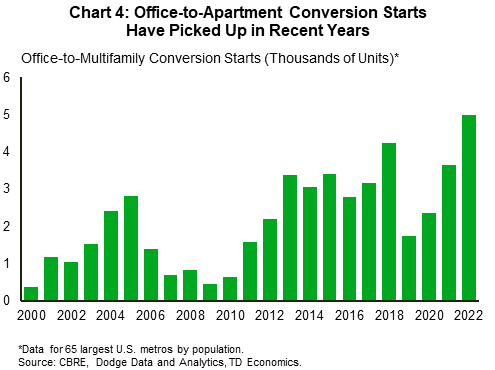

Office-to-apartment conversions have received plenty of attention of late, but this trend tends to account for only a small portion of the new apartment supply. Highlighting this theme, a CBRE report shows that between 2016 and 2022 the firm tracked only some 90 completed office-to-multifamily conversions projects across 26 major U.S. office markets, with these adding collectively only 14,000 apartment units.2 Taking a wider view by looking at conversions across 65 largest U.S. metro areas, the data suggest that conversion starts have increased over the last few years, but still total only a few thousand per year (Chart 4). To put this into perspective, note that total multifamily starts last year came in at 547,000 units.

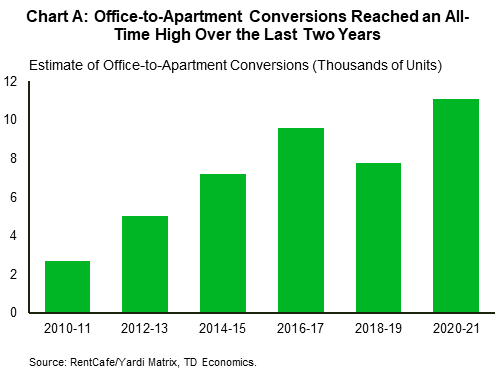

Yet another source estimates that office-to-apartment conversions in the U.S. topped 11,000 units over the 2020-21 biennium (see Chart A in the appendix).3 While this was a notable increase from the two-years prior, it still made up for only a small portion of the new apartment supply, with total multifamily completions topping 745,000 over the same two-year period. Ultimately, all these estimates confirm that even as the conversion trend has picked up some steam, it remains a minor one in the grand scheme of things.

A Softening Rental Market Will Pose Added Challenges for Conversions

Besides the fact that the spread between office and multifamily vacancy rates remains well above its historical average, yet another element that supports the office to apartment conversion trend is the steep decline in office property values. The scale of the recent decline in the latter varies by data source and method of measurement. For instance, the CoStar office market sale price index, available on quarterly frequency, reveals a 9% decline from the recent peak (and roughly -25% in the transaction sale price per square foot, with the latter smoothed through a four-quarter moving average). Meanwhile, another source, the Green Street Commercial Property Price Index (CCPI), available on a monthly frequency, shows a 31% price decline for the office sector from recent peak.4 These measures point to above-average declines for the office sector. In general, the more office property values fall in relation to residential housing, the stronger the case for conversions. As such, further declines in office property values ahead could present additional opportunities, provided that the residential market continues to hold up better. That said, with the economic cycle turning, signs of softness are starting to show in the rental apartment market too.

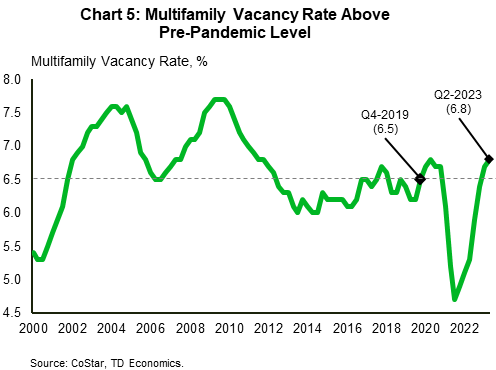

Market-based data show that the multifamily vacancy rate has increased from a record low 4.7% in autumn of 2021 to 6.8% in the second quarter of this year, bringing the rate further above its pre-pandemic level (Chart 5). This trend has taken shape as demand for rental apartments has come in significantly below new deliveries over the last few quarters. Rent growth has also lost considerable steam – a message echoed by several market-based rent measures. CoStar data point to slow, though still slightly positive, rent growth. Meanwhile, Redfin data indicates that the U.S. median asking rent is not much different from a year ago (down 0.6% year-on-year in May and up a soft 0.5% in June).

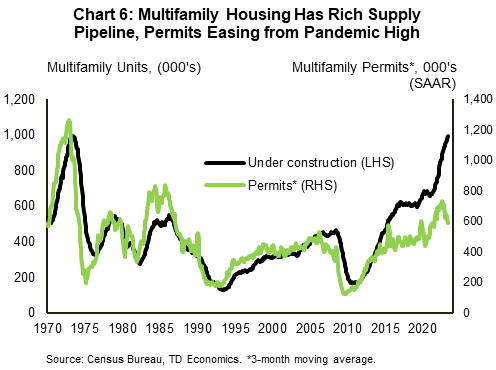

According to the Census Bureau, there are now close to one million multifamily units under construction – a level that’s near the record high experienced back in 1973 (Chart 6). The vast majority of these apartments, some 95%, are geared toward the rental market. The pandemic lengthened completion timelines, which means that this supply won’t come to market all at once but rather in stages – something that will limit the disruption. Still, as more supply makes its way to market, it should further loosen conditions, with the multifamily vacancy rate expected to migrate further above its pre-pandemic level in the quarters ahead. Ultimately, looser conditions in the traditional multifamily market may limit some of the appeal of office-to-apartment conversions, and in a more adverse scenario may pose a risk to such projects. Amidst the rich supply pipeline, builders appear to already be taking a more cautionary approach by easing on multifamily permits recently (Chart 6). In addition, with banks tightening credit standards for all types of commercial loans recently, developers may find it more difficult to fund these presumably risker projects moving forward.5

Loose Conditions in High-End Rental Market, An Added Headwind to Conversion Projects

At present, the downward pressures on the multifamily market are concentrated in higher-end 4 & 5 star properties. The vacancy rate for these grades is significantly higher compared to more affordable alternatives (Chart 7). Rent growth in this sub-segment has also been somewhat softer. This may be another impediment, as it could limit the stream of office-to-apartment conversions geared toward the higher-end rental market. Conversions could be tilted toward the lower end of the apartment market to help satiate demand for more affordable housing. However, in this segment, multifamily operators will have to charge lower rents. For instance, consider that the national 3-star average rent is $600 lower than that for 4 & 5 star properties (as per CoStar data). This would represent a lower return on investment compared to what could have been possible by converting office buildings to higher-end rental apartments, which may make some developers less eager to pursue such plans. Public policy, however, can play an important role in bridging this gap by either providing financial incentives to make the projects more economically viable or by reducing non-financial barriers such as structural and zoning requirements.

Bottom line

With a clear need for affordable housing and plenty of office space sitting vacant in a post-pandemic world, there’s an opportunity to address this two-headed challenge by repurposing office space. Converting office space into apartments would help reduce slack in the office market, while at the same time boosting the supply of apartments for rent. Office-to-apartment conversions may have grabbed plenty of media attention and risen somewhat in popularity over the pandemic, but the data show that they remain a very small part of multifamily supply pipeline.

Converting an office building into apartments is not always possible or straightforward. Several stars need to align to make such conversions economically viable – something that we believe will keep this a minor trend in the grand scheme of things for the foreseeable future. There’s scope for such conversions to gain some more traction over the medium term, especially in a scenario where conditions in the office market continue to deteriorate, resulting the sale of older, mostly empty office buildings – the ideal buildings for conversion – at a steep discount. However, a clear softening in the rental apartment market is a new headwind that will work in the opposite direction, likely reducing developers’ appetite for taking on such projects.

Appendix

End Notes

- See Moody’s reference here, and CBRE reference here.

- See CBRE report here; note that Manhattan office-to-multifamily conversions before 2022 are excluded in this estimate.

- See RentCafe article here.

- See Green Street report here.

- Presumably risker in relation to standard multifamily projects, because of the potential for costly surprises when renovating or working on older structures.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: