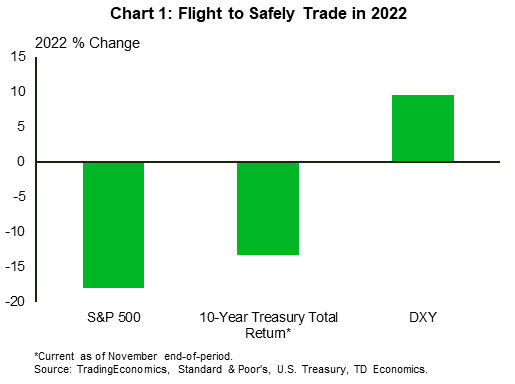

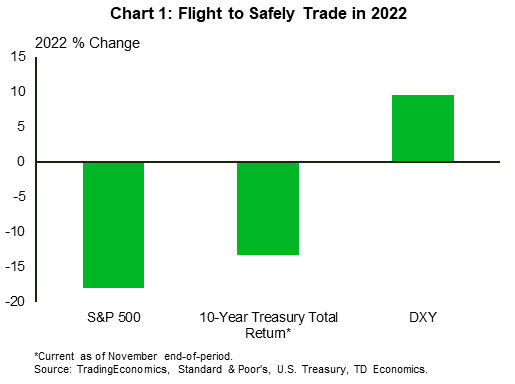

It was a rough year for financial markets. 2022 started with central banks refraining from delivering a rate hike in a nod to ongoing virus risks. Meanwhile, Russia’s attack on Ukraine and the resulting energy crisis was nowhere in sight. The year ended with over 400 basis points in interest rate hikes in just 10 months, while the flight-to-safety trade pushed equities into bear market territory and the U.S. dollar to new highs (Chart 1). Though 2022 was a year of change, there was one thing that stayed the same - It started and ended with high inflation.

With sights now set on 2023, investors would normally be hopeful for a bounce back following such a tumultuous year. But an economic slowdown clouds the outlook, with analysts still divided on its timing and depth. It’s little wonder that sentiment for the new year is absent of its usual holiday cheer.

History in the making

The Federal Reserve’s 50 basis point hike at its final meeting of 2022 received attention for the “step down” it represented relative to the outsized moves that proceeded the prior four FOMC meetings. But this overlooks the bigger picture. That decision lands in the history books as the fastest tightening cycle in the Fed’s entire history of inflation targeting. It’s tough medicine for an economy with inflation that trended approximately 6 percentage points above its target for much of the year, but it is now starting to show some payoff.

Headline CPI is down 2 percentage points from the June peak (at 7.1%), while the more pertinent three-month rate of core inflation has steadily declined over the last five months to sit at 4.3% (annualized). We expect this trend to continue, with three-month rates of core and headline inflation dropping below 3% by the second half of 2023. This means that the peak policy rate is within sight, evidenced by a tight distribution of Fed views within the “dot plot” for next year, with only a 75 basis point gap between the bears and the bulls on the committee.

Fed will fight to hold the line in 2023

Hiking the policy rate to a high level when the economy is doing well is one thing. But keeping rates high in the face of weakening growth is a different story. We anticipate the U.S. economy is at risk of shedding over 1 million workers in 2023, with an unemployment rate that will rise 1.5 percentage points. That would inject the needed slack to ease concerns that wage-push pressures could feed into inflation. And markets seem to be on the same page.

Financial markets have priced the fed funds rate at 5% by March 2023. However, they are also expecting the Fed will have to cut the policy rate in the second half of 2023 and continue cutting through 2024. Based on the path of policy inferred in Treasury yields, upwards of 175 basis points in rate cuts are embedded in the next two years. It is for this reason that the U.S. yield curve has inverted so dramatically, with the spread between the U.S. 10-year and 3-month Treasury yield at a whopping -70 basis points. Markets are clearly stating that the Fed is not just hitting the end of its rate hiking cycle, but that the likely path for the economy will warrant an easing in short order. This view has roots in the lessons of the past. The last time the slope of the yield curve was this negative was in the summer of 1981, when the effective fed funds rate reached its all-time peak of 22.4% and a lengthy 16-month recession took place.

The notion of a weaker economy is getting reflected in recent movements within yields. Since October, U.S. yields are down around 50 basis points across the curve. This is reflected in other asset classes, such as mortgage rates and corporate yields, which are down roughly 80 and 100 basis points, respectively. Some easing in financial conditions has also caused the U.S. dollar index to climb down from its peak by nearly 10%, after a near 20% surge earlier in the year. Most of this decline is coming against advanced economy currencies, such as the British pound and the euro.

Negative sentiment towards Europe has troughed as the region surprised markets with a swift build-up in energy storage ahead of winter that allowed their energy prices to rapidly decline. This has averted the worst-case scenario for Europe. At the same time, because inflation remains too hot for any season of the year, the European Central Bank and the Bank of England have dialed up their hawkishness, both in rhetoric and actions. The combination has fortified yields in Spain, Germany, and the UK, making them more attractive to investors who are rethinking some of those safe haven flows.

There’s rarely a straight line between uncertainty and market outcomes. 2023 will usher in the next phase of the economic cycle that fully manifests the past action of central banks. Consumer resilience will be tested under the weight of declining real incomes, higher debt service costs and thinning savings. Businesses are likely to show less enthusiasm in competing for new workers. During those early turning points of a business cycle, investors fret over the depth and duration of any economic weakness. This usually reignites volatility that can drive investors back towards the safety of the U.S. dollar until there’s some assurance that the worst has been averted. In other words, investor sentiment in the first half of 2023 may reflect rolling hills before that final mountain top is spotted.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.