Market Insight:

Bond Yields Rise With Higher Inflation Expectations

Beata Caranci, SVP & Chief Economist | 416-982-8067

James Orlando, CFA, Senior Economist | 416-413-3180

Date Published: January 21, 2021

- Category:

- US

- Forecasts

- Financial Markets

Highlights

- Long-term bond yields have risen alongside improved prospects for the economic outlook.

- The gradual upward trend that started several months ago developed a tailwind following the Georgia Senate runoff and President Biden’s significant fiscal package proposal.

- Embedded in yields is a repricing of market inflation expectations, which shot up from depressed levels in early-2020 to more than 2% today.

- The yield curve will continue to steepen this year and next as markets pull forward pricing for the policy rate path of the Federal Reserve.

The first few weeks of 2021 have been marked by a near 20 basis point jump in government bond yields. The U.S. 10-year Treasury yield has pushed through the 1% psychological threshold to sit at 1.10%. This is an extension of an upward trend that started in August 2020. Since that time, the outlook for economic growth has improved, pushing the peak-uncertainty period to the background. The same can be said for future inflation, prompting the repricing of bond yields. This dynamic should continue to press yields higher in the coming months.

The first few weeks of 2021 have been marked by a near 20 basis point jump in government bond yields. The U.S. 10-year Treasury yield has pushed through the 1% psychological threshold to sit at 1.10%. This is an extension of an upward trend that started in August 2020. Since that time, the outlook for economic growth has improved, pushing the peak-uncertainty period to the background. The same can be said for future inflation, prompting the repricing of bond yields. This dynamic should continue to press yields higher in the coming months.

Fiscal Policy: Of course, you realize this means war on bonds!

Optimism towards more fiscal stimulus has been the latest contributor to the move higher in government bond yields. With Democrats gaining influence over the Senate, a near-$2 trillion package has been put on the table by President Biden. This comes on top of a $900 billion bipartisan deal struck in the final days of last year to support struggling American households and businesses. A government safety net firmly in place improves consumer sentiment, let alone the momentum shift that will naturally occur as improved household finances dovetail with fewer business restraints as vaccine distribution builds within the population in the coming quarters.

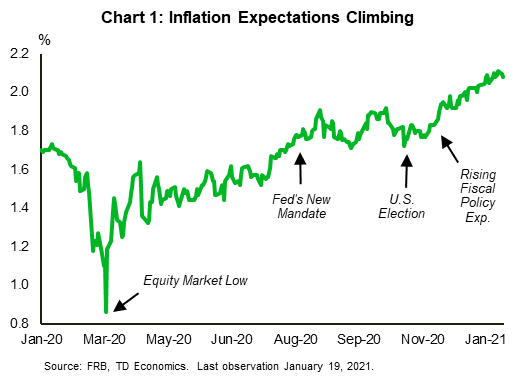

Higher growth expectations come with higher inflation expectations. In Chart 1, we show that market-based inflation expectations have continued to rise since the worst of the pandemic-induced sell-off in March 2020. After falling to less than 0.9% at that time, market participants now see inflation consistent with the Fed’s target, at 2.1%.

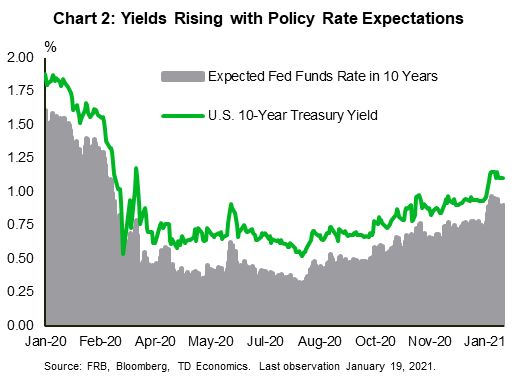

Likewise, this earlier rebound in inflation is paralleled in rate hike expectations. As we show in Chart 2, market pricing for the Fed’s policy rate a decade from now is starting to move up. After hitting rock bottom in August 2020, the expected policy rate has increased approximately 60 basis points. It is no coincidence that the U.S. 10-year Treasury yield has paralleled this movement.

Likewise, this earlier rebound in inflation is paralleled in rate hike expectations. As we show in Chart 2, market pricing for the Fed’s policy rate a decade from now is starting to move up. After hitting rock bottom in August 2020, the expected policy rate has increased approximately 60 basis points. It is no coincidence that the U.S. 10-year Treasury yield has paralleled this movement.

Despite the recent swift repricing, the policy rate has more room to go. The market is expecting the fed funds rate to be only 0.9% in the long run. In contrast, Federal Reserve members see it closer to 2.5%. Our expectation is right in between those two worlds, where we have penciled in the effective rate at 1.85%. This has two implications. The first is that it would still leave a modestly negative real rate that can hardly be considered as restrictive. The second is that the UST 10-year yield will need to rise further, as markets gradually price a higher endpoint for the fed funds rate.

More Curve Steepening Ahead

This shift in central bank expectations doesn’t occur overnight. Until the central bank hints at the road map, the yield curve will continue to steepen with the short end pinned to a floor. In mid-December, the Fed maintained a commitment to keep its policy rate at effectively zero through 2023. This commitment is not written in stone, however. It is based on developments and assumptions at that point in time. Higher economic growth expectations from a much larger injection of fiscal stimulus, combined with a successful vaccine rollout could pull forward the timing of a rate hike. Even so, any pull-forward in the timing would likely be a modest adjustment of one-to-two quarters in the absence of sustained build-up in inflationary pressures.

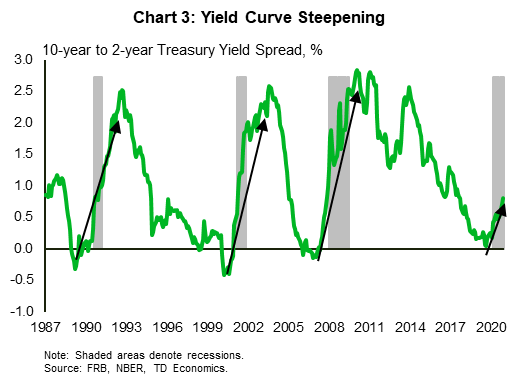

Since the short-end of the curve reflects the agreement between market participants and the central bank, the spread between the UST 10-year and UST 2-year yield reached a three year high of 90 basis points last week. This steepening of the yield curve is exactly what investors should expect at this point in the economic cycle (Chart 3). Just like in past cycles, after reaching a trough right before the recession, the yield curve pivots well ahead of the exit of a cycle, steepening even during the worst of the pandemic.

The Foreign Exchange Impact

The shift in economic risks has taken some of the shine off the U.S. dollar. After peaking in late-March 2020, the greenback has since depreciated approximately 12%. Though much of this move was an unwind of the pandemic-induced flight-to-safety trade, the sell-off has gone even further. The dollar is now trading approximately 3% below its pre-pandemic level.

The recent greenback weakness has a lot to do with the nature of the global economic recovery. Economies that are leveraged to the boom in manufacturing have seen their currencies outperform. Just take a look at China. It has flexed its economic prowess, being the only major economy in the world to achieve positive GDP growth over 2020. At the same time, the US economy is 3% below last year’s GDP level. China’s dominance in manufacturing exports contributed to the more than 10% appreciation of its currency versus the U.S. dollar from its 2020 low.

With China’s success has come renewed demand for raw materials. Commodity exporting countries like Canada and Australia have benefited from the lift in prices for raw materials, like copper and iron ore. Even though both Canada and Australia are still in the process of recovering, the demand for their exports has caused their currencies to appreciate against the U.S. dollar.

Bottom Line

Optimism towards the economic recovery has raised expectations for future growth and inflation. The improved outlook has pushed up inflation expectations just north of 2% and caused a partial repricing of the Federal Reserve’s policy path. Consequently, longer-term bond yields have continued to rise. We think there is more to go as the economic recovery solidifies over the coming months. The success of the vaccine deployment and its efficacy will be huge in determining whether the economic forecasts become reality. Over the last few months, the changes to the forecast have favored a more rapid economic recovery. For the sake of the economy, we hope it continues to surpass our expectations.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.