A History of Fed ‘Puts’

James Orlando, CFA, Director & Senior Economist | 416-413-3180

Brett Saldarelli, Economist | 416-542-0072

Date Published: March 21, 2023

- Category:

- Us

- Financial Markets

Highlights

- The recent turmoil in the banking sector has brought flashbacks of the Global Financial Crisis and added an additional degree of uncertainty to an already clouded economic outlook.

- History has shown that the Federal Reserve will act as a backstop to support financial market stability. Over the last two weeks, it has once again proved that it is ready and willing to be the lender of last resort, providing needed liquidity in times of stress.

- Although the Fed is doing what is needed, its willingness to support markets can create a moral hazard by incentivizing risk taking behavior, underscoring the need for effective macroprudential policy.

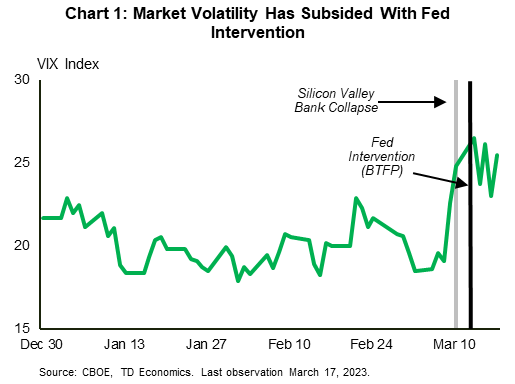

The recent failure of Silicon Valley Bank (SVB) reverberated through financial markets, stoking fears of another banking crisis. Bank shares tumbled 13%, with the regional bank index down more than 30%. Risk-off activity was reflected in the Volatility Index (VIX), which reached an intraday high of 29.6 after averaging 20 to begin the year (Chart 1). This extended to bond markets, with speculative grade credit spreads spiking 200 basis points (bps), while the U.S. Treasury volatility index reached a closing high of 199 points.

At the same time, however, overall gauges of financial stress have so far remained more muted compared to the Global Financial Crisis (GFC) and other historical risk-off episodes. This more subdued response in financial markets is largely due to the prompt and decisive intervention of the U.S. Fed and other regulators. Chief among the moves include a guarantee of all deposits held at SVB and Signature Bank, the establishment of the Bank Term Funding Program (BTFP) to provide liquidity to eligible deposit taking institutions, and coordinated swap lines amongst other central banks.

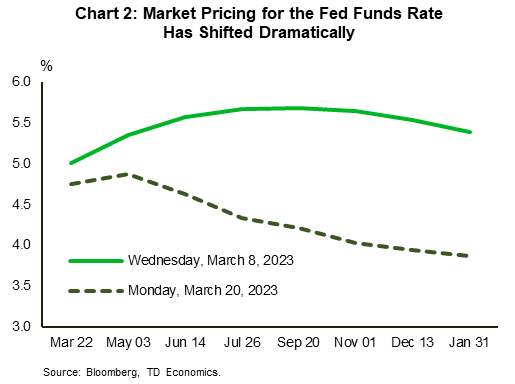

While policy makers have been able to quell volatility so far, the banking turmoil has put the Federal Reserve at a crossroads where it must balance financial stability against its commitment to curtailing inflation. Market expectations point to the Fed prioritizing the former, with investors now pricing a terminal fed funds rate at 5% for the upper bound, with 75 basis points in rate cuts priced over the next year (Chart 2). This dramatic shift in market pricing has been reflected in Treasury yields, with the U.S. 2-year yield falling nearly 1 percentage point, after reaching its highest level in 15 years. While the current uncertainty plaguing financial markets has the Fed in a tough spot, history shows that in times of stress, its first priority is market stability. And although in the past it has singularly used its interest rate hammer to support markets, recent actions to create liquidity via BTFP and through access to the discount window, show that the Fed now has many more tools at its disposal to achieve its aim.

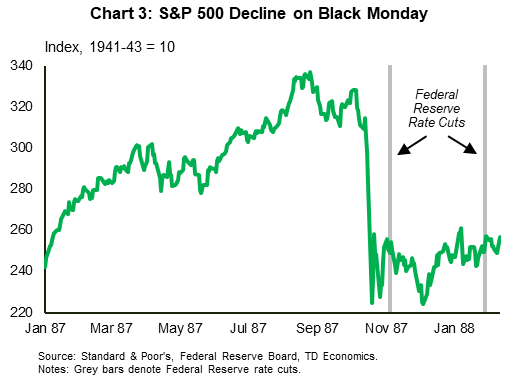

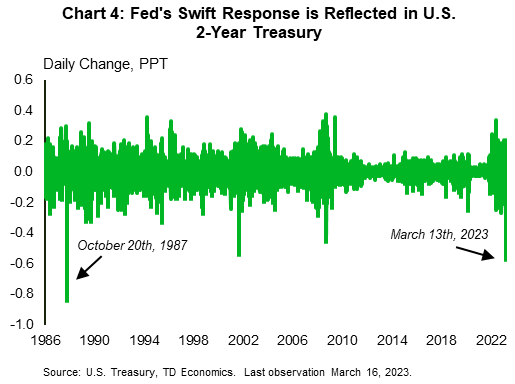

1987 Black Monday

Looking back, one of the most notable Fed interventions came following the stock market turmoil in 1987. On October 19th (Black Monday), the S&P 500 experienced its largest single daily decline, falling over 20%, while the VIX spiked to 150.2, its highest level on record (Chart 3). To calm financial markets, then Federal Reserve Chair Alan Greenspan issued a statement prior to trading on October 20th, stating that “the Federal Reserve, consistent with its responsibilities as the Nation’s central bank, affirmed today its readiness to serve as a source of liquidity to support the economic and financial system.”1 Additionally, the Fed began to conduct open market operations to reduce short term borrowing rates and subsequently cut the federal funds rate from 7.3% in November 1987, to 6.5% in February 1988. The prompt response by the Fed is reflected in the U.S. 2-year Treasury yield, which fell by 84 basis points on October 20th (Chart 4). The Fed’s efforts to stem the stress worked, with equity markets able to recover and recession avoided.

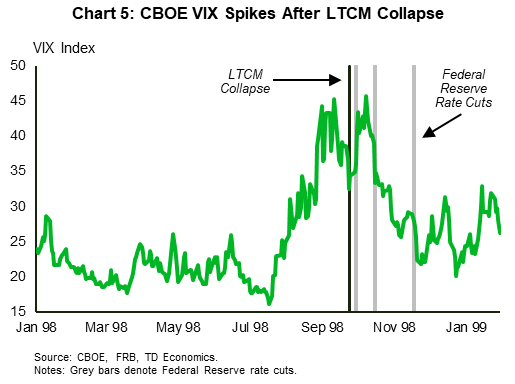

1998 Long-Term Capital Management

The collapse of billion-dollar hedge fund Long Term Capital Management (LTCM) in 1998 provides further evidence of the Fed’s willingness to intervene into financial markets and suppress volatility. After trading within a narrow band throughout most of 1998, the VIX began to increase sharply in August as Russia devalued its currency and subsequently defaulted on its debt (Chart 5). LTCM suffered significant losses from its exposure to Russian financial assets, and a bailout was orchestrated by the Federal Reserve Bank of New York. To stem the market volatility, the Fed responded with a series of rate cuts, including an inter-meeting 25 bps cut in October 1998.2 The loosening of financial market conditions prevented the bleed through to the real economy, and the Fed was once again able to prevent a recession.

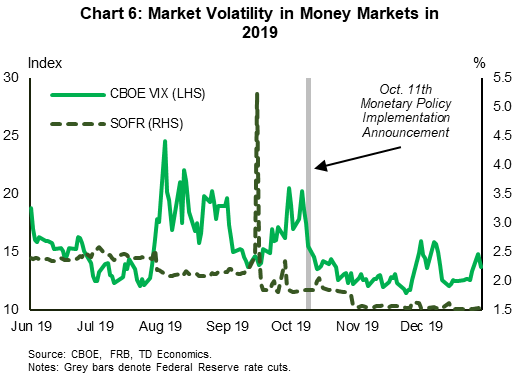

2019 Money Market Stress

In a more recent example, stress hit money markets in September 2019 following the Federal Reserve’s efforts to wind-down its massive balance sheet built-up after the GFC. Although the Fed had already paused Quantitative Tightening and cut rates in July, liquidity continued to decline sharply. This caused overnight borrowing rates (SOFR) to surge, stoking volatility across financial markets (Chart 6). The Federal Reserve immediately intervened in the overnight repo market, thereby increasing the amount of liquidity and putting downward pressure on SOFR. The Fed continued its support in October, as it cut rates again and committed to purchasing Treasury bills, which restarted the expansion of its balance sheet.3 This calmed markets, and if it weren’t for the onset of the pandemic, the economic cycle would have had more room to run.

In a more recent example, stress hit money markets in September 2019 following the Federal Reserve’s efforts to wind-down its massive balance sheet built-up after the GFC. Although the Fed had already paused Quantitative Tightening and cut rates in July, liquidity continued to decline sharply. This caused overnight borrowing rates (SOFR) to surge, stoking volatility across financial markets (Chart 6). The Federal Reserve immediately intervened in the overnight repo market, thereby increasing the amount of liquidity and putting downward pressure on SOFR. The Fed continued its support in October, as it cut rates again and committed to purchasing Treasury bills, which restarted the expansion of its balance sheet.3 This calmed markets, and if it weren’t for the onset of the pandemic, the economic cycle would have had more room to run.

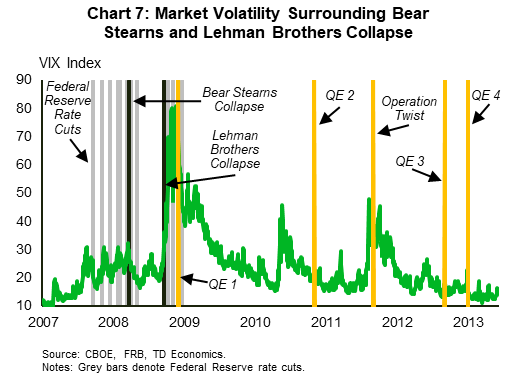

2008 Global Financial Crisis

While there is no shortage of the Fed using its tools to rein in financial market instability, its decision to allow Lehman Brothers to fail in September 2008 is a prime counterexample. The Lehman bankruptcy was shocking in part because other financial institutions before it had run into trouble and were provided emergency loans by the Fed. By letting the systematically-important Lehman fail, the financial market stress intensified, leading to the most severe economic downturn since the Great Depression (Chart 7). Although the Fed supported other banks post-Lehman, cut the fed funds rate to zero, and conducted Quantitative Easing for years after, the damage was done. It took a decade for the U.S. economy to recover from the GFC, leaving a lasting memory for policy makers.

Final Take

The quick action from the Federal Reserve in response to SVB (and other banks) shows that the central bank knows its role as a lender of last resort. It has learned its lesson from the failure of Lehman and is working from the same playbook of other past financial market stresses. Its timely response shows that it is willing to quickly adjust course, prioritizing the stability of financial markets. If we have learned anything over the last two weeks, it is that the Fed ‘Put’ is still alive.

Herein lies the issue for regulators. While backstopping institutions is important in moments of crisis, it creates the potential for moral hazard. Knowing that the central bank will step in when institutions get into trouble incentivizes risk taking. This underscores the importance of effective macroprudential policy to help the financial system withstand shocks. Indeed, better capitalized large U.S. banks following the advent of Dodd-Frank has provided some reason for optimism that the current stress won’t upend the financial system. Given recent events, it is clear that effective policy will need to be broadened in order to avoid future stresses.

End Notes

- Carlson (2007).

- IMF (1998).

- FOMC Statement October 11, 2019.

References

- Anbil, Sriya, Anderson, Alyssa and Senyuz, Zeynep (2020), “What Happened in Money Markets in September 2019?”, Federal Reserve Board: https://www.federalreserve.gov/econres/notes/feds-notes/what-happened-in-money-markets-in-september-2019-20200227.html

- Board of Governors of the Federal Reserve System, Press Release (2019). Statement Regarding Monetary Policy Implementation. https://www.federalreserve.gov/newsevents/pressreleases/monetary20191011a.htm

- Carlson, Mark (2007), “A Brief History of the 1987 Stock Market Crash with a Discussion of the Federal Reserve Response”, Federal Reserve Board: https://www.federalreserve.gov/pubs/feds/2007/200713/200713pap.pdf

- Fleming, Michael and Liu, Weiling (2013), “Near Failure of Long-Term Capital Management”, Federal Reserve Bank of St. Louis: https://www.federalreservehistory.org/essays/ltcm-near-failure

- IMF World Economic Outlook, Interim Assessment, Dec. 1998. https://www.imf.org/external/pubs/ft/weo/weo1298/pdf/file3.pdf

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: