The Economic & Fiscal Impacts of U.S. Defense Spending in 2026 and Beyond

Andrew Foran, Economist | 416-350-8927

Date Published: October 22, 2025

- Category:

- U.S.

- Government Finance & Policy

Highlights

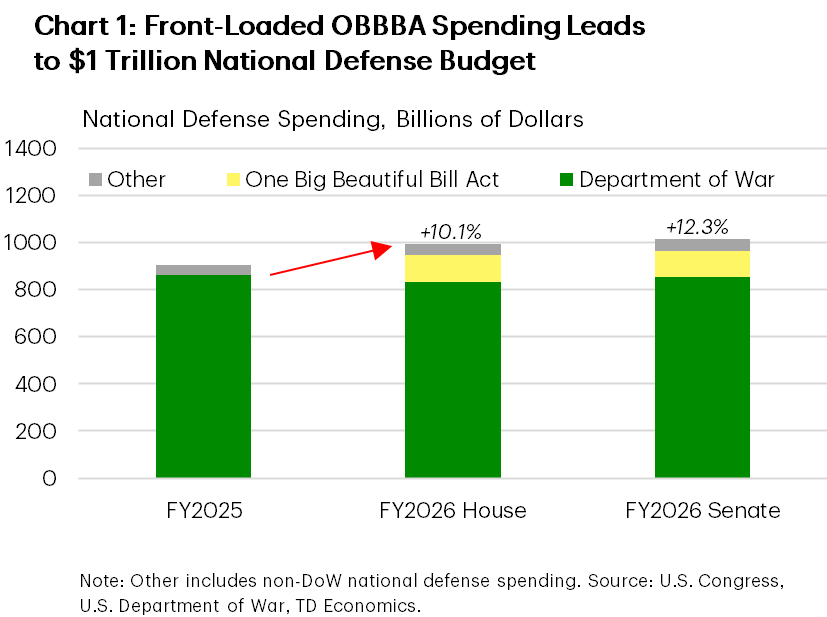

- The Trump administration is expected to front-load defense appropriations included in the One Big Beautiful Bill Act in fiscal year 2026, driving defense spending above $1 trillion (+15% year-on-year).

- We expect this to boost real GDP growth by 0.2 percentage points next year, with a larger gain in 2026 inhibited by existing production and labor capacity constraints.

- Over the long run, meeting the new NATO defense spending targets will necessitate hundreds of billions of dollars in additional annual appropriations which could be fiscally challenging for the U.S.

The share of the U.S. federal budget allocated towards defense expenditures was nearly 30% at the end of the Cold War but now sits at 10% today. This decline reflects both a shifting geopolitical environment over the past 3 decades in addition to the growing pressure placed on public finances by rising entitlement obligations and the legacy costs of fiscal stimulus implemented during the past two recessions.

Now in 2025, the administration is planning to raise defense spending domestically by roughly 15% in fiscal year 2026 alone using appropriated funding from the One Big Beautiful Bill Act (OBBBA) (Chart 1). This is likely to raise defense spending as a share of GDP to 3.3% while adding 0.2% to real GDP growth. The growth impact would be even larger if the spending were to be allocated more efficiently. However, existing production capacity and labor constraints are likely to restrain the near-term impact.

In addition to potential physical capacity concerns, fiscal constraints are also likely to play a role over the coming years given NATO commitments to raise defense spending targets. Even though the U.S. already spends 3% of GDP on defense, raising that to 3.5% by 2035 as specified would equate to an additional $400 billion per year in annual appropriations. Given the projected growth in entitlement spending and the rising costs of maintaining the national debt, this target may be challenging to fiscally maintain. If hitting the new NATO target is the will of Congress, consideration will need to be given to how these challenges can be overcome.

Rearmament in 2026 & Beyond

As of the time of writing, the amount allocated to national defense in fiscal year 2026 remains uncertain, as Congress has not yet passed the relevant appropriation bill. While the House of Representatives passed a version of the bill, a unified bill with the Senate will be required before the budget becomes law. Based on the House version of the bill and the preliminary draft compiled by the Senate Committee on Armed Services, it seems the baseline allocation for defense will not change much relative to the previous year. Note that this would also be the case if a full year continuing resolution is ultimately used by Congress to fund the government. While the baseline allocation is likely to remain stable, Congress allocated $150 billion for defense spending over the next 5-10 years in the One Big Beautiful Bill Act (OBBBA) passed in July, which is expected to bolster U.S. defense spending over the coming years.

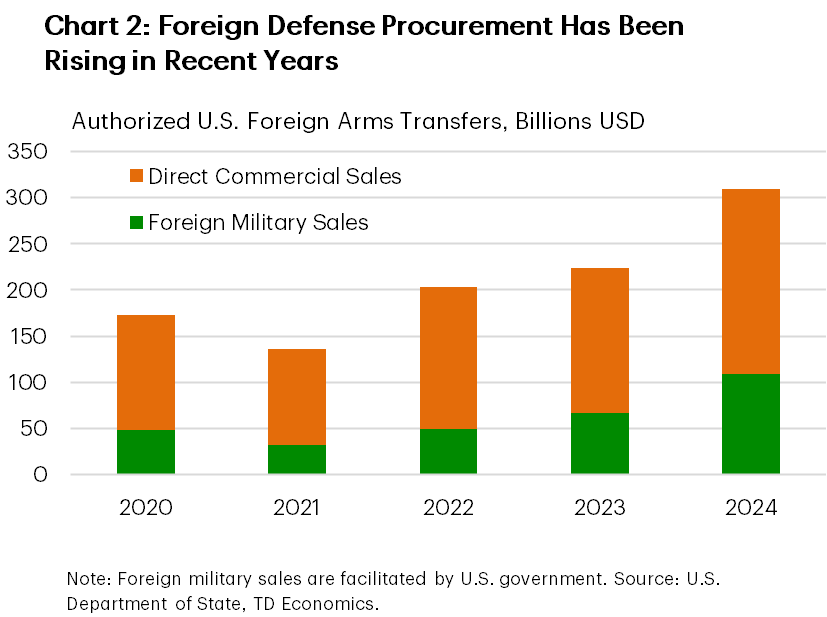

In addition to domestic defense spending, it seems probable that foreign defense spending will also continue to rise over the coming years based on the commitment of NATO nations to raise defense spending from the current target of 2% of GDP to 5% by 2035. An important caveat is that 1.5 percentage-points (ppts) of the 5% commitment can be expended on critical infrastructure, with the remaining 3.5ppts allocated to traditional defense procurement. This still represents a significant increase in defense spending, which is likely to bolster the recent trend of rising foreign demand for U.S. defense goods (Chart 2).

However, there are mixed signals on how much of this will feedthrough to the U.S. defense industry. The European Union’s (EU) coordinated plan for defense procurement, ReArm Europe, which will encompass a sizeable share of the increase in NATO defense spending over the next half-decade, places an emphasis on shoring up the bloc’s domestic defense industrial base to meet demand. Although this may limit the expected uptick in foreign demand for U.S. products over the coming years, trade deal agreements announced by the U.S. administration in recent months have included unspecified commitments by the EU, Japan, and South Korea to increase their purchases of U.S. defense products. Summarily, foreign demand is likely to add moderate upward pressure to the demand function of the U.S. defense industrial base over the coming years.

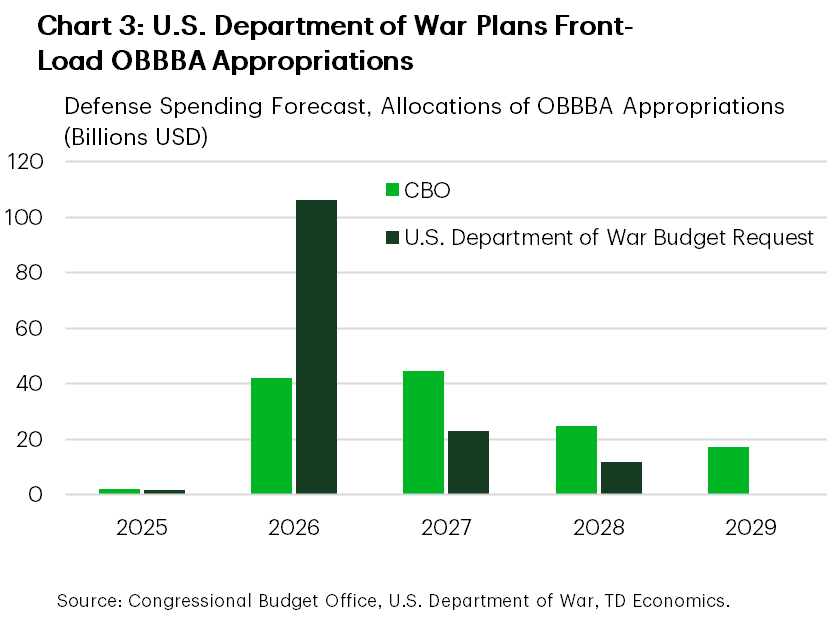

On the domestic front, the OBBBA sum included specific provisions across a host of investments, including shipbuilding, air & missile defense (related to the President’s Golden Dome initiative), munitions production, research & development, servicemember quality of life enhancements, and nuclear deterrence. Golden Dome aside, many of these investments can be found in regular annual appropriations, but these investments stand out for two reasons. First, the timeline under which the Department of War (previously Department of Defense) has identified for these outlays is very front-loaded, with over $113 billion earmarked for 2026 alone (Chart 3). This will bring total national defense spending north of $1 trillion to 3.3% of GDP.

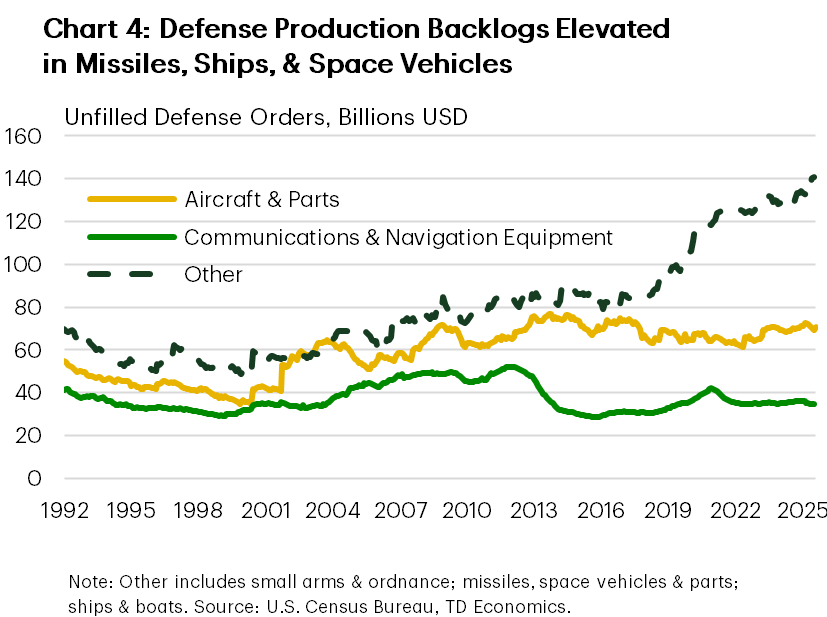

The economic impact of this uptick in spending will rely on the efficient allocation of appropriated funds, essentially the ability of the existing defense industrial base to absorb the increase in demand. Congress did exercise some foresight in this regard, as indicated by the second notable inclusion of these provisions; investments in manufacturing and labor capacity. Backlogs of defense orders have accumulated in recent years (Chart 4), driven by supply and demand factors. With the latter expected to see a significant expansion in the coming years, further examination of the former is necessary.

Supply Side Economics: The Defense Industrial Base

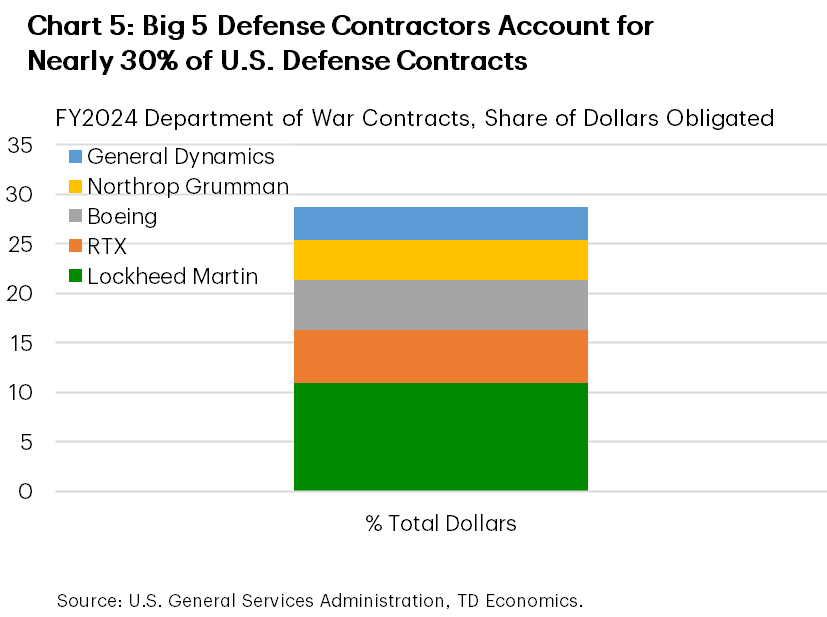

Appropriating defense funding is only half the battle when it comes to defense procurement. Once the funding becomes available, contracts are typically awarded to private defense contractors through a bidding process. Many are allocated through competitive bidding, but on a value-adjusted basis, only about half are awarded competitively.1 This is primarily owing to the high costs of producing major weapon system platforms (i.e. submarines, fighter jets, etc.), in addition to the notable consolidation that has occurred in the U.S. defense industry over the past few decades. The ‘Big 5’ defense contractors – Lockheed Martin, Boeing, RTX, Northrop Grumman, and General Dynamics – alone accounted for nearly 30% of Department of War obligated contract funding in fiscal year 2024 (Chart 5). However, they only accounted for 0.1% of total contracts, which illustrates their dominance of big-ticket items in the Department of War budget.

Beyond the process of awarding the contracts, which on its own can take several years, there is also the consideration for how quickly existing production facilities can accommodate new orders. For non-complex systems that also have commercial uses, such as food, medicine, and certain aerospace parts, this can often be a non-issue. However, for more complex systems involving advanced engineering (i.e. nuclear submarines, stealth aircraft, etc.) this can be a multi-year process, with existing backlogs for some products stretching well beyond 2030. Even if the manufacturing infrastructure to produce the product exists, these contracts are typically awarded in multi-unit lots which can accumulate over time if there are slowdowns in production.

For example, the Virginia class attack submarine is produced at two shipyards located in Connecticut and Virginia. The U.S. Navy procures the submarines at a rate of 2 per year, but the annual production rate of the shipyards is closer to 1 per year, which has led to a growing backlog of orders.2 This also precludes consideration for the 3-5 units ordered by Australia under the AUKUS defense agreement and the start of construction on the new Columbia class submarine, both of which will add additional pressure to the submarine industrial base. To attempt to address this issue, Congress has been investing in the submarine industrial base since 2018 with nearly $10 billion expected to be cumulatively allocated by 2029. The OBBBA will add to this funding, both in relation to the submarine industry as well as others, but it will likely take years for the investments made in industrial capacity to have a material effect, as existing initiatives have shown.

The OBBBA also included funding to bolster the industrial base for munitions, which the administration has highlighted as a priority, in addition to accelerating the delivery of next generation aircraft. While capital investments to alleviate production bottlenecks are sensible, Congress should ensure that public funds are tied to monitored production goals. However, the lack of competition in many defense industries could prevent Congress from achieving its goals in a timely or efficient manner.

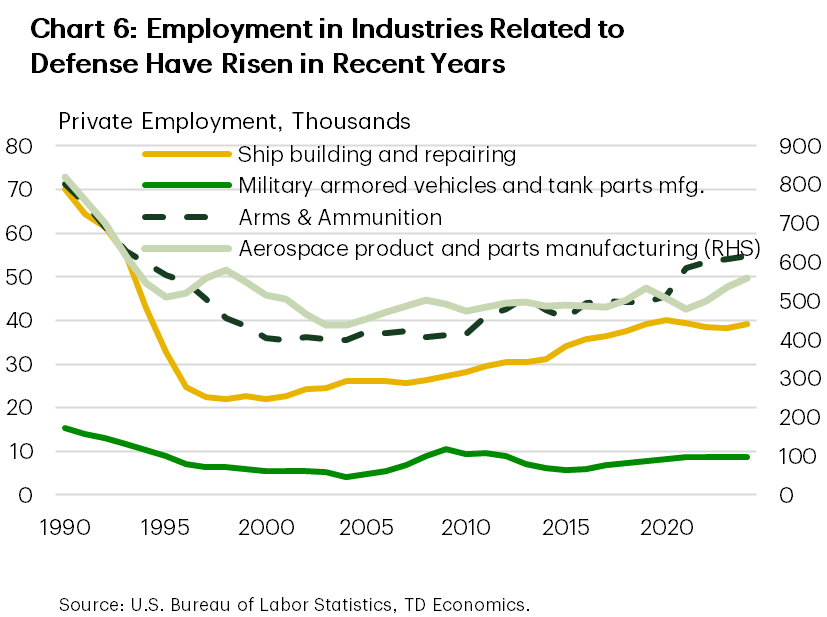

Beyond manufacturing capacity constraints, labor supply challenges have also been pervasive in the defense industry. These challenges are common across the broader manufacturing sector, with aging demographics leading to rising retirements, a large incidence of which in 2021-2022 led to a sizeable depletion of the defense industry workforce. As the median age of the population continues to rise with the aging baby boomer cohort, these supply pressures are likely to grow. This has been occurring at a time when domestic and international demand have been rising, which has added demand pressures to an industry that’s already facing significant labor constraints.

Public and private funding has helped to partially offset labor supply challenges in recent years, with sophisticated education and apprenticeship pipelines established by several defense companies. This has led to solid growth in most manufacturing industries with defense exposure (Chart 6). Efforts by Congress to address this issue were bolstered by additional funding allocated in the OBBBA, which typically aligns with the industries receiving manufacturing capacity investments (i.e. naval shipbuilding and munitions). The OBBBA also included investments for the use of artificial intelligence in defense manufacturing, which is also being pursued by private defense companies, and could potentially lead to productivity enhancements over the long-term.

Considering the full extent of capacity constraints that are likely to constrain the economic impact of the OBBBA defense allocations, we expect the most likely scenario to see 0.2ppts added to real GDP growth in 2026, before falling to roughly 0.1ppts through 2029. This does not necessarily mean that the economic impact will be less than a scenario with efficient allocation, rather that it will be more spread out over time as backlogs persist and capital investments take time to buildup capacity.

Fiscal Capacity & Long Run Defense Spending

On its own, the $150 billion allocated to defense spending over the next 5-10 years in the OBBBA will not likely have a material impact on the U.S. fiscal budget. Equal to an average annual outlay of $30 billion per year, this is a drop in the bucket compared to the nation’s roughly $7 trillion in annual expenditures. However, if the U.S. is to meet the new NATO defense spending target over the long run, that could prove to be more fiscally challenging.

For U.S. defense spending to hit 3.5% of GDP in the year 2035, the defense budget would have to grow by roughly 40% - equal to an extra $400 billion per year - relative to the fiscal year 2025 budget. If the U.S. were to try to meet the full 5% NATO target through defense spending, which is not required under the existing agreement, then the defense budget would need to rise by nearly $1 trillion by 2035.

Finding hundreds of billions of dollars in additional annual appropriations will not be an easy task in the current fiscal environment. The nation’s aging population is expected to drive cumulative expenditures on the largest federal programs including, Social Security, Medicare, and Medicaid, 72% higher by 2035 according to the Congressional Budget Office. That equates to nearly $2.5 trillion dollars in additional annual spending. This, in addition to the rising cost of financing the growing national debt burden, is part of the reason why finding hundreds of billions in additional annual funding for defense by 2035 could prove to be a challenge for the federal government given it would likely require difficult political decisions.

Bottom Line

Over the near-term, defense spending related to the OBBBA is expected to provide a boost to real GDP growth of 0.2ppts in 2026, with additional modest support provided in the following years. Despite earmarked funds from the OBBBA to shore up manufacturing and labor capacity, existing backlogs and labor supply shortages are likely to remain a headwind to defense spending for the foreseeable future. Over the long term, meeting higher defense spending targets in accordance with the new NATO commitments could be a challenge for the U.S. amid the evolving fiscal capacity landscape.

End Notes

- “State of Competition within the Defense Industrial Base”, Office of the Under Secretary of Defense for Acquisition and Sustainment, February 2022.

- “Navy Virginia-Class Submarine Program and AUKUS Submarine (Pillar 1) Project: Background and Issues for Congress”, Congressional Research Service, March 2025.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: