Heavy is the Head:

Challenges to King Dollar

Vikram Rai, Senior Economist | (416)-923-1692

Date Published: May 31, 2023

- Category:

- US

- Financial Markets

- Trade

Highlights

- Interest from countries across the globe in alternatives to the U.S. dollar-dominant international monetary and financial system has grown since the U.S. decision in 2022 to freeze Russia's foreign currency reserves.

- The most notable efforts to conduct international trade and finance without the U.S. dollar have been led by China.

- Despite the recent pronouncements from authorities in China, Russia and elsewhere, movement away from the U.S. dollar globally has been slow and small.

- Innovations in digital currencies, particularly central bank digital currencies, could reduce the need for those outside the U.S. to use dollars for international trade and cross-border banking. These have the potential to further erode the U.S. dollar's dominant but receding position.

- While dollar dominance is not going away any time soon, the international monetary system is likely to shift slowly towards a multipolar regime, with the role now filled by the dollar shared with the euro, a more open yuan, and future central bank digital currencies.

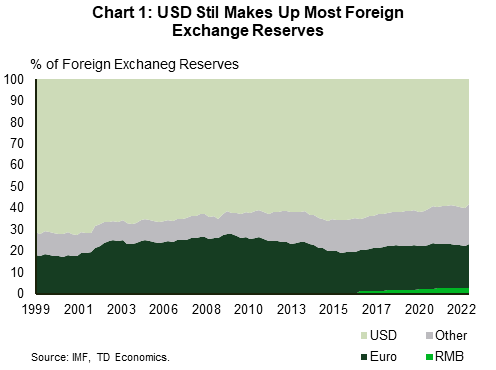

The U.S. dollar is the most widely held currency in the world and has made up a large majority of countries' foreign exchange reserves since the end of WWII. The available data shows that it has had a fairly stable majority for the past two decades (Chart 1).

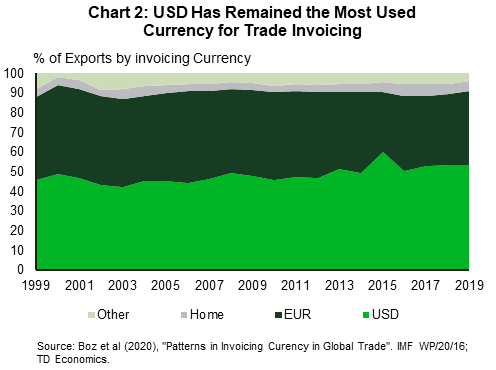

More than this, the dollar is the most used currency for trade invoicing, bond issuance, and cross-border banking1. While U.S. exports account for only around 15% of global exports, countries on average invoice around 50% of their exports in dollars (Chart 2).

The dollar is most notably not the most used currency for trade invoicing everywhere – for most countries on the euro and some African countries that trade heavily with euro area economies, the euro is the most invoiced currency. Nonetheless, the value and availability of the dollar is so potent that there are many trades where neither the importer or exporter have any direct relationship with the U.S., but still conduct their trade in dollars.

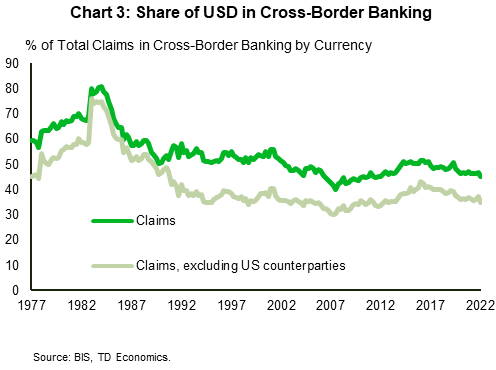

The same is true in international finance more broadly (Chart 3). Cross-border banking is largely conducted in dollars and has been for as long as data is available.

The prevalence of the dollar in the international monetary and financial system has given the United States an "exorbitant privilege," as famously said by French finance minister Valéry Giscard d'Estaing. The French finance minister was referring to the ease with which the U.S. could finance a sustained trade deficit, as well as the greater flexibility this privilege afforded the country to pursue its domestic and foreign policies of choice.

Initiatives to challenge dollar dominance

A corollary of the privilege enjoyed by the U.S. being "exortbitant" is that it is not enjoyed by other countries. Historically, the cost to those countries has been the additional challenge in financing their trade and government deficits. While inconvenient, this has been something that many countries have accepted. However, the American government's decision in February 28 to freeze the foreign currency reserves of the Russian central bank, which were held in Russia's accounts at the Federal Reserve Bank of New York and other western central banks, has motivated some countries to make greater efforts to reduce their dependance on dollars.

China has been at the forefront of such efforts, pushing to trade crude oil in yuan and to conduct its trade with Brazil, India, and Russia in yuan or local currency. Since the 1970s, nearly 80% of global oil sales have been priced in dollars, creating significant demand for the currency. The challenge to the "petrodollar" is significant, both economically and symbolically – the convention of Saudi Arabia and other OPEC exporters to price their crude oil export has supported demand for dollars, as every country trades in crude oil markets and therefore must hold them. Other countries are also engaging in commodity trade without using dollars now; for example, Indian refiners have been purchasing Russian oil using UAE dirhams.

There are other incremental efforts to chip away at the dollar's status or to carve out space in international trade and finance that does not rely on it. The BRICS (Brazil, Russia, India, China) economic block will reportedly discuss creating a new currency at their upcoming summit in August 2023. A full-fledged currency union between such disparate economies is unlikely to come to pass, but the announcement signals a commitment to conduct more of their trade and finance without dollars. In a similar vein, there are reports of talks between Brazil and Argentina to a create a common currency to support regional trade. And the Reserve Bank of India has set up a facility to allow banks from 18 countries to settle payments for international transactions in Indian rupees.

De-dollarization – a long road ahead with an uncertain destination

It is not, by any measure, a sure thing that the dollar will be replaced as the dominant global currency, though it does seem likely that the gradual evolution of the international monetary and financial system towards multipolarity will continue. The speed of change is limited by weaknesses of nascent challengers to the dollar, which all have a long way to go before they can credibly offer the same benefits.

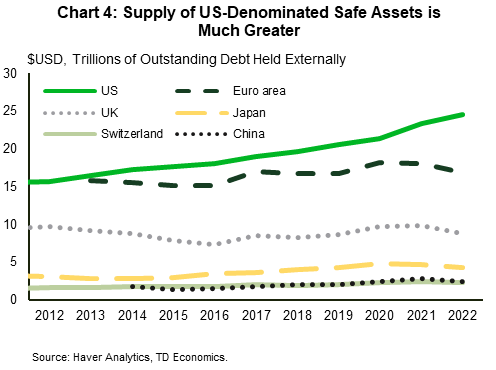

For one, the supply of safe assets – government-issued debt – from the United States is much larger than for any other issuer (Chart 4). Despite China's rapid growth, it is very far from being competitive as a supplier of safe assets to the world. This is a major, albeit somewhat circular, component of the dollar's relative strength – holders of wealth demand safe assets that can be relied on as a store of value, and the American government is unmatched in its ability to issue debt, in part because of the demand created by those seeking safe assets.

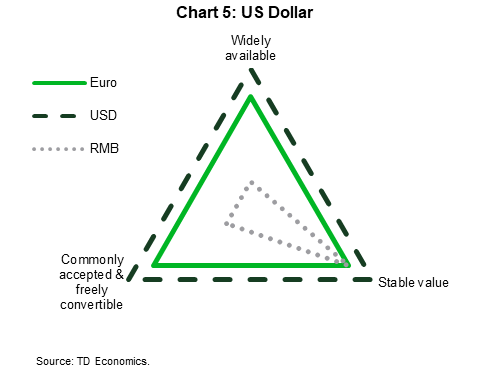

The largest challengers to the dollar today are the euro and the RMB. Compared to both, the dollar has advantages in being more widely available and freely convertible. The euro is challenged as the currency of choice for the supply of safe assets because euro-denominated government bonds are not all issued by the same government, and it is difficult to argue all euro government bonds are equally safe. China's RMB is not freely convertible, nor is it available in great supply outside of China today, making it a challenging choice (Chart 5). Active effort by China would be needed to improve the attractiveness of the RMB on these dimensions, and it is an open question whether this occurs or how quickly it could.

Events could unfold that accelerate these forces. For example, the dollar is commonly accepted in part because of confidence in the United States government to always repay treasury obligations on time. Should something occur that causes the world to lose confidence in treasuries, such as a debt default stemming from political brinkmanship, the decline of dollar dominance would likely accelerate.

Digital currencies, including central bank digital currencies, are another challenge to the system of dollar dominance. Most central banks, including China's, now have some work or research underway related to creating a digital currency. Widespread adoption of other digital currencies could erode the dollar's position by removing the need to use it as a vehicle for settling payments. These efforts are all in their early stages, and the institutions involved are focused on testing the technical and operational capabilities of theoretical digital currencies. After this, we expect several years of work lie ahead in determining the legal and governance framework for central bank digital currencies.

Bottom Line

Several countries have shown frustration with the dominance of the dollar and are pursuing alternatives for conducting international trade and cross-border banking. In addition to this, digital platforms, including cryptocurrencies and central bank digital currencies, may one day offer an alternative. While the dollar remains the dominant and most-used currency, the long-term trend is away from it.

The last time the dominant currency switched, it went from one superpower to another, moving from the British pound to the U.S. dollar. History is unlikely to repeat itself. Today, the dollar's nascent challengers are more diverse. Within the next decade or two, there is great potential for regionally-dominant currencies and a multipolar international regime to emerge, with the roles filled now by the dollar shared with the euro, a more open yuan, future central bank digital currencies, and possibly other options we have yet to see.

Footnotes

- See, for example, "The International Monetary and Financial System", Pierre-Olivier Gourinchas, Hélène Rey, Maxime Sauzet, Annual Review of Economics 2019 11:1, 859-893.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: