Some Banks Fail, but It’s Not a Free Fall

Maria Solovieva, CFA, Economist | 416-380-1195

Date Published: March 17, 2023

- Category:

- Us

- Financial Markets

- Consumer

- Business Investment

Highlights

- A classic run on banks rippled through the financial system, but the regional banks’ equity underperformance reflects the idiosyncratic nature of this episode.

- Risk sentiment tightens financial conditions and feeds through to the real economy if it remains unresolved for a period of time. At this early juncture, it may not deter the Fed from raising interest rates on March 22nd, but can certainly put the May meeting on ice if pressures persist.

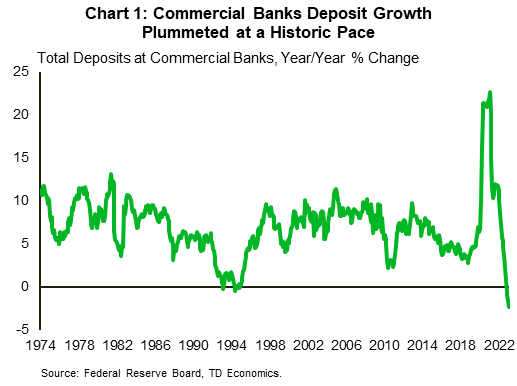

The Federal Reserve was blind sighted by an evolving risk that was right under its nose. While it tightened monetary policy at an unprecedented pace, deposit growth within commercial banks plummeted at an historic pace (Chart 1). Some of this movement reflected the outcome of quantitative tightening and some reflected a shift in depositor preferences into higher yielding products. Predicting this shift was actually well within forecast models, offering little element of surprise. Predicting individual behaviors and market confidence, however, is another story.

Unless you've been completely cut off from every form of communication, by now it's well known that the sudden failure of Silicon Valley Bank was more than a classic "run on a bank". The aggressive rate hike cycle pressured the market value of the bank's financial assets, even though these were deemed high quality and liquid. Meanwhile, a concentration of a large amount of uninsured deposits from start-up companies left the bank exposed to a sudden shift in confidence. Once the financial market participants witnessed a mass deposit exit and a swift bank failure, it opened the door to lurking risks within other institutions. The fear of the known unknown kicked in.

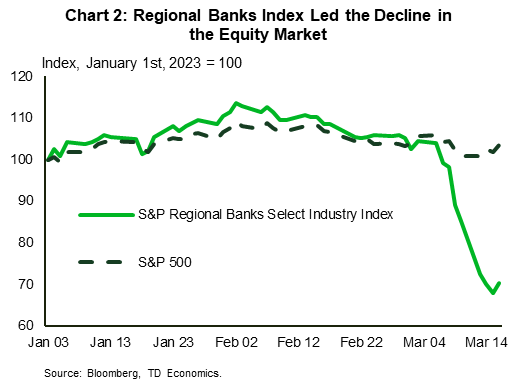

However, that fear has largely been contained, at least at this juncture. The pressure on equity markets was not economy wide. A concentration within the banking sector was further narrowed to the regional banks’ sub-sector. In the period between March 8th and March 15th, the S&P’s Regional Banks Sub-Industry Index lost more than 30% of its value while the S&P 500 index declined by 2.5%, half of which was due to the pressure on the banking sector (Chart 2). While large, the magnitude of change is not unprecedented. During the Global Financial Crisis – the poster child of the banking sector crisis – the index lost almost 80% of its value (albeit, in a period of six months), while its maximum daily loss was 1.5 times greater than the current episode.

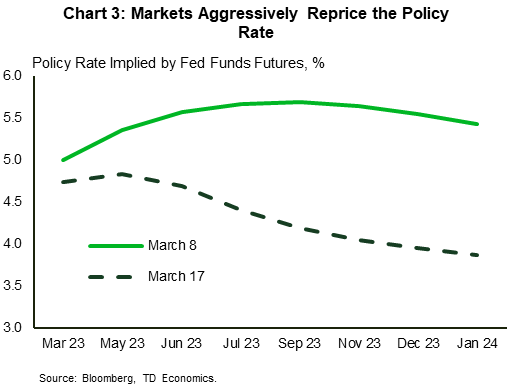

The relative containment of the crisis doesn’t negate the seriousness of the situation. Look no further than within expectations for the fed funds rate. In a matter of ten days, the futures market turned upside down, shifting its pricing from a 50-basis point hike in March and a 5.75% terminal rate, to 25-basis point hike and a terminal rate 85 basis points lower (Chart 3). On March 13th, the two-year yield collapsed by 57 basis points to 4.03% – the largest decline since the Black Monday market crash of 1987. This initially pushed the U.S. dollar down 2% relative to other currencies. But, the greenback reclaimed its strength as a safe-haven currency as soon as the confidence shock drifted over the Atlantic. As the biggest shareholder of Credit Suisse declared no interest in upping its funding commitment to the already-beleaguered institution, the greenback finished 1.5% below March 8th level.

In both cases, the respective regulators and the central bank stepped in to provide a liquidity backstop, having learned from the past that the first order of business is to stabilize financial market shocks that have the potential to seize up the system if left unchecked. The second order of business will be to ensure guard rails are in place to limit a future episode. This usually comes in the form of more oversight. Market chatter has already settled on one possible change for U.S. mid-and-small sized banks to lower the banks’ asset threshold at which stricter capital and liquidity rules start to apply from $250 to $100 billion. Another proposal being bantered about is to put more rigor into the stress test that assesses valuation of banks capital during a hypothetical macroeconomic recession scenario.

From an economic perspective, any permanency in tighter financial conditions among mid- and smaller-sized banks that flows through to tighter credit standards will impact loan demand and the real economy. The irony is that this feedback loop might help the Fed tap down domestic demand and contain inflationary pressures, as long as pressure on financial conditions remain ‘controlled’. Up until now, the U.S. economy was described as stronger-for-longer, with consumers and job demand completely defying the odds. Time will tell.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: