US Automotive Outlook:

Supply, Demand, and the Financing Gap Between

Andrew Foran, Economist | 416-350-8927

Date Published: April 11, 2024

- Category:

- U.S.

- Commodities & Industry

Highlights

- U.S. light vehicles sales tracked 15.4 million (annualized) units in the first quarter of 2024, 2.7% above the year-ago level.

- North American automotive production rose 9.6% year-on-year in 2023 and is expected to converge to the lower end of the pre-pandemic range next year.

- Sales are expected to continue to rise but remain below the pre-pandemic pace as elevated financing costs continue to restrain sales activity.

The automotive industry has emerged from the shadow of the pandemic and its accompanying supply chain disruptions which weighed on the industry for over two years. Production activity has grown significantly as a result, with 15.6 million vehicles produced in North America last year – a 9.6% gain relative to 2022 and only 3.9% below 2019 levels. U.S. light vehicles sales in turn grew by 12.7% last year as model availability improvements helped to satiate some of the pent-up demand among retail and fleet customers. However, the automotive market has lost steam to start 2024 as elevated financing costs continue to sideline potential buyers and gradually push up auto loan delinquencies. Affordability challenges have eased modestly due to the combination of labor market strength and falling vehicle prices, but the gap created by elevated interest rates remains sizeable.

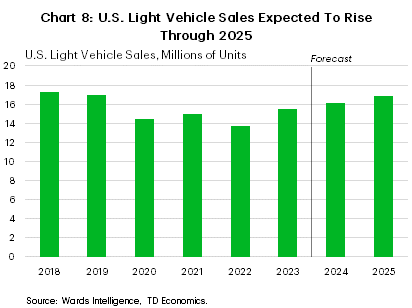

For 2024, we expect light vehicle sales to grow 3.7% above last year’s level, rising to 16.1 million units. Growth is expected to slow relative to 2023 as the initial post-pandemic bounce-back recedes and elevated interest rates remain a constraint on sales activity through most of the year.

North American Auto Production Normalizing

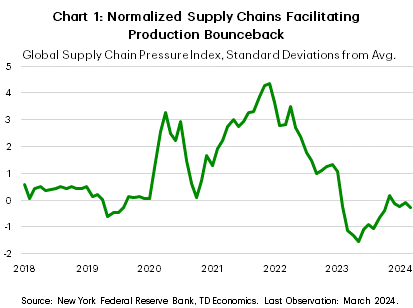

Last year marked the return to normality for international supply chains as the demand for goods eased under elevated global interest rates and pandemic lockdowns no longer encumbered the transportation & logistics sector. While elevated geopolitical tensions still pose a moderate risk, current supply chain conditions are still consistent with pre-pandemic levels (Chart 1).

This allowed North American automotive production to grow by 9.6% year-on-year (or over 1.37 million units) in 2023. Total production output was only 3.9% below the 2019 level last year, however this relative underperformance was in part driven by disruptions related to the United Auto Workers (UAW) strike against the Detroit-3 automakers (General Motors, Ford, and Stellantis) at the end of last year (see here). With a total of eleven assembly plants offline by the final days of the strike, nearly 200k units were cumulatively lost between September and October.

In addition to the short-term implications of lost production in 2023, the new UAW collective agreement is expected to increase labor costs for all automakers. This includes the direct effects for the Detroit-3 as well as the indirect effects for other OEMs as they seek to remain competitive in recruitment and retention. General Motors and Ford have noted that the new contracts will add roughly $9 billion to their costs over the length of the four-year agreement.

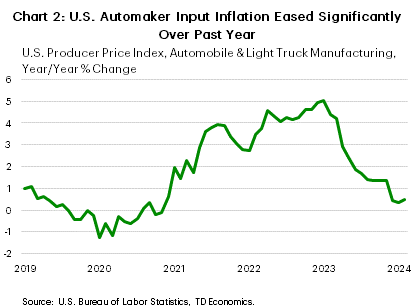

Excluding labor costs, most input costs for automakers have seen deflation relative to their pandemic peaks over the past year, including steel, rubber, plastics, and glass. This has helped to normalize aggregate input price pressures (Chart 2), although the immediate double-digit wage increases included in the most recent UAW contract will apply upward pressure to total costs in 2024.

Nevertheless, we do not expect this to be an impediment to current automotive production as most OEMs remain on a solid financial footing and are capable of strategically incorporating these costs. However, the Detroit-3 has already indicated that they will be recalibrating their long-term investment strategies accordingly, with General Motors and Ford both announcing delays in some new EV investments. For 2024, we anticipate that North American light vehicle production will rise 2.9%, before subsequently returning to the lower end of the pre-pandemic production range in 2025.

Consumers See Gas Prices Stabilize Above Pre-Pandemic Level

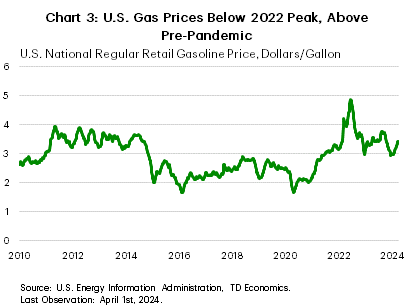

The national average price for gasoline has fluctuated between $3 and $4 per gallon since the end of 2022, although seasonality and falling oil prices briefly drove prices down below $3 in December for the first time since mid-2021. More recently, both these trends have inverted, pushing gas prices up to $3.4 at the end of the first quarter. A gradual increase in gas prices through the spring and into the summer is normal, as warmer weather boosts mileage counts and gasoline consumption.

On aggregate, gasoline prices have settled into a holding pattern above the pre-pandemic price level but below that seen prior to the 2014 oil price crash (Chart 3). This is roughly consistent with developments in oil markets as crude prices influence almost 60% of the cost of gasoline. While gas prices remain above the pre-pandemic level, Americans are consuming roughly 5% less gasoline than they were in 2019. One reason for this is that Americans are driving fewer miles than they were previously, with total miles driven in 2023 0.2% below the 2019 count. The shift towards hybrid/remote working arrangements in some sectors is likely partly to blame, as Americans commute less on average. This does not negate the need for vehicles but may influence replacement demand over the long-term as vehicles for some households are driven for longer.

High Financing Costs Push Up Auto Loan Delinquencies

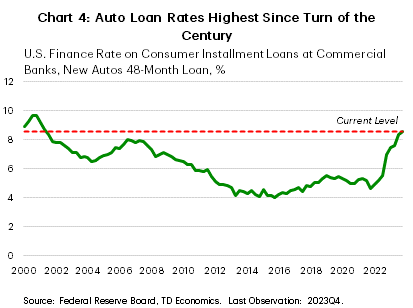

The Federal Reserve has not raised interest rates since July of last year, but elevated financing rates continue to weigh on the auto sector. The average financing rate on auto loans rose above 8% in the second half of last year, bringing it to its highest level since 2000 (Chart 4). However, falling vehicle prices and higher incentives have helped to push down the average monthly payment for new vehicles to roughly $750 at the start of 2024. This is down from the peak of nearly $800 in late 2022, but still about 50% above the amount paid in 2019.

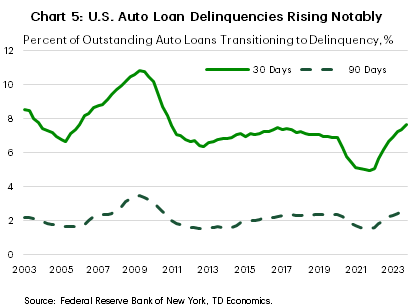

As households contend with higher prices in most spending categories, in addition to the restart of student debt repayments at the end of last year, we have seen delinquencies on auto loans rise. The share of outstanding auto loans transitioning to a state of delinquency was at its highest level since 2010 at the end of last year (Chart 5). While the pace at which delinquencies are accumulating is concerning, the share of the outstanding balance of auto loans that is seriously delinquent (90+ days overdue) remains below the pre-pandemic level. This will be an area we continue to monitor as interest rates are expected to remain elevated through this year.

Sales Trending Higher on Economic Resilience

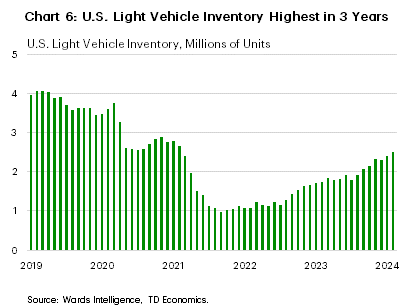

Light vehicle sales continued to trend higher over the past year, rising by 12.7% in 2023, aided by the rebound in production which boosted supply to its highest level in three years (Chart 6). The days’ supply of inventory was equal to 49 in March, which is notably above the year-ago reading of 36 and only moderately below the pre-pandemic level of 60-70. This has in turn helped to modestly improve affordability, with incentive spending continuing to rise and the average transaction price (ATP) falling 2.2% year-on-year in February. Overall, robust demand has kept concessions minor, with incentive spending as a share of ATP still only half of its pre-pandemic level.

The strength seen in demand has been supported by several factors, with the main one being that sales have lagged the pre-pandemic trend by roughly 10 million units over the past four years, creating a backlog of demand. While not all of this demand will be converted into sales, there are a number of tailwinds which may lead to a stronger conversion rate. One example is the robustness of demand among fleet customers, which were largely curtailed by supply shortages in prior years. In addition, the national average for corporate profit growth has exceeded ATP growth over the past four years, which when combined with fleet discounting helps to explain demand resilience amid elevated financing costs.

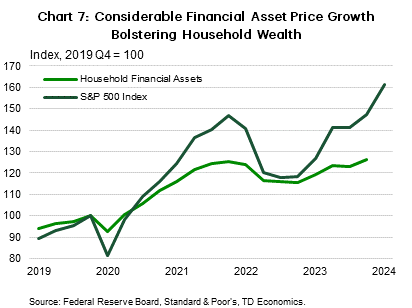

However, the picture for the larger retail segment is less clear, with growth lagging that seen in fleet sales in 2024. For households, nominal income growth has modestly lagged ATP growth and notably lagged growth in average monthly payments for financed vehicles. This illustrates the deterioration in affordability that has occurred over the past four years as households are required to spend a higher share of their income to purchase a vehicle. This is likely keeping a sizeable portion of pent-up retail demand on the sidelines, but considerable wealth gains over the past few years is helping to bridge the gap for some consumers (Chart 7). In addition to sizeable financial asset valuation growth, with the S&P 500 index seeing average annual returns of 11.8% since 2019, tens of millions of American households have also seen their property values rise by an average of 44% since February 2020. This has also occurred after millions of mortgage holders were able to lock in historically low interest rates in 2020-2021, which dragged down the median mortgage payment and increased the relative disposable income of these households.

Material wealth gains, particularly among older Americans, have likely worked to keep consumer spending elevated over the past few years. At the same time, economic and labor market resilience has kept real wage gains growing at a healthy pace, which in addition to price declines and incentive spending growth, is gradually helping to improve vehicle affordability for more Americans. Nevertheless, further concessions will likely be required to keep sales growing though 2024 as financing costs remain a considerable headwind.

Looking to 2024, we expect sales to grow by 3.7% to 16.1 million units (Chart 8), with growth in the second half of the year picking up as the Federal Reserve begins to lower borrowing costs gradually. In terms of forecast risks, it is prudent to note that recent analysis by the Congressional Budget Office has suggested that immigration growth over the past few years may have been significantly higher than initially reported.1 With automotive supply chains now normalized, this could pose an upside risk to our forecasts moving forward.

Bottom Line

The U.S. automotive industry has returned to a state of relative normality after several years of disruptions related to the pandemic in addition to last year’s UAW strike. Now with production trending higher, supply levels have returned to healthier levels allowing sales to push higher through the end of last year. Sales volumes have lost some traction moving into 2024 as affordability challenges remain notable under elevated financing costs, but we still expect sales to trend higher this year as prices fall to more sustainable levels and the economy continues to support demand via solid real income growth.

Footnotes

- ‘The Demographic Outlook: 2024 to 2054’, Congressional Budget Office.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: