Highlights

- Higher borrowing costs are leaving a permanent mark on the Canadian families who by the end of 2024 would have to budget for a roughly 30% increase in their monthly mortgage payments, on average.

- On aggregate, mortgage payments growth is forecast to slow next year, remain relatively flat in 2025 but pick up again in 2026, even if Canadian economy falls into a mild recession in 2024.

- Elevated mortgage payments will create an enduring drag on consumption and broader economic growth.

- Despite this, a relatively more resilient job market and largely unspent excess deposits should provide enough support for an average Canadian family to manage an increased debt servicing cost.

The fastest increase in interest rates in decades means Canadians with mortgages are renewing at rates they likely did not expect at the beginning of their mortgage terms. By the Bank of Canada's estimates, roughly 50% of mortgages that were initiated before interest rate hikes began will face higher rates by the end of this year. In some cases, this will increase their monthly payments substantially, weighing on discretionary spending. With interest rates likely to remain higher for longer (see report), families will need to devote more of their budgets towards debt payments. We estimate that increased mortgage payments have already reduced real consumer spending. Our earlier report, which uses internal data, suggests that growth in real consumer spending would have been at least 0.4 percentage points higher in 2023 in the absence of higher mortgage rates. This estimate represents a lower bound as it doesn't account for variable rate mortgages where payments change with rates. The actual impact could be as high as one percentage point. Importantly, we anticipate this impact is likely to persist over time, albeit with fluctuations influenced by the volume of renewals and interest rates prevailing at the time. This is a key factor behind our anemic outlook for consumer spending over the medium term (see forecast).

No Escape From Higher Rates

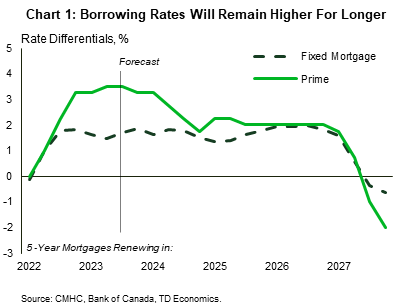

Since 2018, all uninsured (and since 2021 for all insured) mortgage borrowers at federally regulated financial institutions have been required to qualify at a rate 2 percentage points higher than their contracted mortgage interest rate, or OSFI's qualifying rate ranging between 4.89-5.25%, whichever is higher. Today, many households are living out that "stress" scenario, as their budgets need to stretch further to cover mortgage payments at rates 1.5-3.5 percentage points higher than what they signed up for originally. For those who haven't locked in their rates, the rate shock is even higher (Chart 1).

To illustrate this, we will imagine three families who bought an average priced house in July 2018 ($486k) with 20% down and a 5-year mortgage that renewed this year. The family who opted for a fixed rate mortgage (FRM), would have seen their monthly payments increase from $2,138 to $2,438, or $300 per month at renewal if they renew into an FRM at around 6.0%. By comparison, a household with a variable rate mortgage (VRM) started off with a lower monthly payment of $1,835, but their payments rose by $570 per month under fixed payments or $540 per month for variable payments, respectively if these borrowers also decide to lock in their rates at 6.0%. This assumes no pre-payments, accelerated repayments or other changes that could affect amortization.

As we move forward, borrowers will face different payment changes when their mortgages come up for renewal depending on the type of mortgage, the amount of the original loan, and in the case of VRMs with fixed payments, the interest rate path during its life. About half of mortgages that were outstanding before the tightening cycle began have yet to be impacted by higher rates. We expect borrowing costs to come down over the next few years, but to remain higher than their pre-pandemic and pandemic era lows. Under our rate forecast, all mortgages entered between 2018 and 2022 will face higher borrowing costs. For an average household with mortgage debt, the increase in the yearly minimum mortgage payments will be nearly 30% higher by the end of 2024.

Impact of Mortgage Renewals Will Ebb and Flow

While many individual households are feeling or will soon feel the financial pain of higher interest rates when their mortgages renew, to determine the impact on consumer spending overall in the Canadian economy, we focus on the growth in all mortgage payments economy wide. The overall mortgage payments consist of the total amount paid by all borrowers combined – those who have already seen their payments rise and others that are yet to renew. Economy-wide payments are forecast to continue to grow in 2024, but at a slower pace. The slow-down is rooted in our forecast for the yield curve, as we anticipate that the Bank of Canada will be in a position to cut rates by mid-2024.

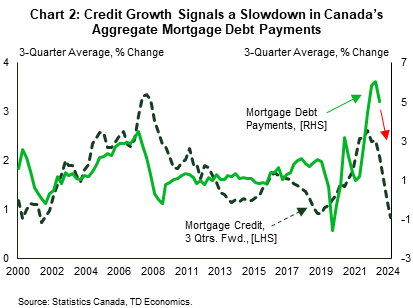

Lackluster mortgage growth will also contribute to the slowing trend. This may not be obvious at first, but if we take a deeper look at what's been driving these payments higher over the past two years, it has been the rapid growth in debt. In fact, growth in national mortgage payments crested at 6.6% in Q4 2022, decelerating to 2.4% in Q3 2023 as outstanding mortgage credit slowed. The fact that fewer people are taking out new mortgages and the new mortgages are smaller than at the peak in 2022 (albeit only by 15%) also slows overall growth in national mortgage payments. We expect that quarterly growth of economy-wide mortgage credit will continue slowing to under 0.5% by year-end. There is typically a two to three quarter lag in movements between mortgage lending and aggregate mortgage payments (Chart 2).

To estimate the impact of upcoming renewals on national mortgage payments, we used TD's internal mortgage data. There are a few caveats to these estimates. First, TD's data may not be representative of the national picture. In fact, product composition, average rates, and contractual amortization are all very likely to be different from the data set we used. Second, we made several assumptions on variable rate mortgages with variable payments, as this product is not offered at TD1. Finally, we build assumptions around the path of mortgage payments growth for new originations that are not part of our static dataset.

We estimate that overall growth in mortgage payments for the country as a whole is 19.4% in 2023 and an additional 3% in 2024, with little growth in 2025. This assumes that borrowing rates begin to fall in 2024 and that we see a slow-down in average mortgage origination growth to 2.5%. TD Economics expects the Bank of Canada to cut interest rates by 150 basis points next year, and a further 125 basis points in 2025, and that the 5-year Government of Canada bond yield, which heavily influences Canadian mortgage rates, decline steadily through the middle of 2025 (Chart 1). The drop in the policy rate typically translates into a lower prime rate, which will reduce payments for borrowers with VRM-variable payment mortgages.

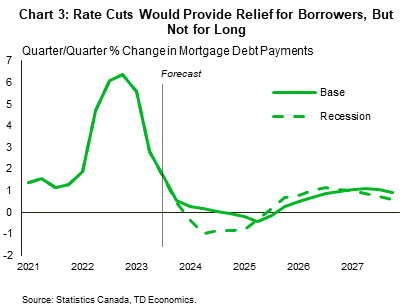

Looking beyond 2024-25, renewals of fixed rate mortgages at higher rates will continue to boost growth in mortgage payments, but as fixed-payment VRMs taken out at ultra-low rates in the pandemic come up for renewal in 2025-26 they will contribute to an uptick in mortgage payments to 1.2% and 3.2% per year in 2026 and 2027, respectively. However, there is a fair bit of uncertainty in these estimates because borrowers could opt to increase their mortgage payments or make lump sum payments in advance of renewal which would mitigate the increased payments at renewal, and hence overall growth in mortgage payments.

Even if the pressure of interest rates eases in our alternative recession scenario, the renewal cycle of VRM mortgages with fixed payments still results in a positive contribution to mortgage payments starting at the end of 2025 and reaching its peak in Q3 2026 (Chart 3). In this scenario, the policy rate drops to 0.75%, the unemployment rate rises by 3.1 percentage points and home prices decline by 30% by the end of 20242. This is because even in the recession scenario, we don't expect interest rates to recalibrate to the ultra-low crisis level of the pandemic period.

One key observation from this scenario is that, while lower rates in 2024 do provide some relief in terms of payment increases for FRM and VRM-variable-payment mortgage holders, this reduction may be somewhat less pronounced for VRM-fixed-payment borrowers. This is because those borrowers’ payments did not adjust as rates rose during the initial hiking cycle, resulting in them paying down less principal, which temporarily increased their effective amortization. Returning to the original amortization schedule at renewal contributes to a payment increase, which would add to the impact of higher rates. It’s worth noting that VRM customers will also benefit from the lower rates to some extent. Although their payment increases are still expected to be higher than those with fixed mortgages, both groups will see the benefits of reduced interest costs due to the lower rates.

Leverage to Weigh on Long-Term Growth

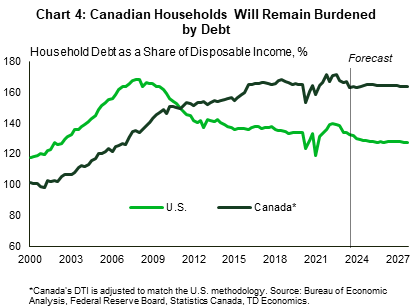

Over the last decade Canadian households have borrowed at a faster pace than their incomes have grown. Even before the pandemic, Canada stood out as a country with the highest debt-to-disposable income (DTI) ratio – a common measure of leverage – among its G7 peers. In 2020—21, at the peak of the pandemic, Canadian households were able to improve debt leverage mainly thanks to generous pandemic benefits that helped lift income. However, this was a temporary relief: the real estate boom flourishing in the background accelerated debt growth, moving the DTI ratio to a new high in the third quarter of 2022.

Once debt growth slowed and income growth accelerated, the ratio started to ease recently. Despite the marginal improvement, this ratio is expected to remain permanently higher. This is because higher mortgage interest payments are netted out when calculating personal disposable income, lowering the denominator of the ratio. This contrasts with our expectations for the DTI in the U.S., which has a mortgage market structure with a longer renewal cycle and lower absolute household debt levels following a sharp deleveraging cycle post the Global Financial Crisis (Chart 4).

In Canada, the combination of high debt levels and slower income growth will create an enduring drag on consumption and broader economic growth in turn. This results in Canadian consumer growth lagging that of the U.S. for the next a few years. Still, without an unexpected economic downturn, the mortgage renewal cycle is unlikely to trigger an economic crisis. We expect that any slowdown in the job market will not be as severe as past economic downturns. This should place a floor under incomes to manage the increase in debt servicing costs. Indeed, the fact that roughly 70% of all mortgages initiated in the past five years have been subjected to income stress test gives some confidence in this. Another mitigating factor is the existence of almost $140 billion in excess deposits, which in contrast to their American counterparts, remain untouched. Almost all these resources are kept in less liquid term products, suggesting that Canadians may have put them aside anticipating higher costs. Channeling these savings to offset the upcoming income shock should soften the blow and support an orderly renewal cycle.

End Notes

- We assume 35% of the Q2 2023 stock of all variable rate mortgages in Canada vary with payments. Mortgage amortization for this segment is assumed to be constant.

- The decline in home prices is assumed to be driven by an adjustment in supply-demand dynamics rather than an income shock.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: