Mortgage Rule Changes to Add Fuel to Canadian Housing Recovery

Rishi Sondhi, Economist | 416-983-8806

Date Published: October 16, 2024

- Category:

- Canada

- Real Estate

Highlights

- On December 15th, the federal government will roll out mortgage rule changes that make it easier to purchase a home for those taking out insured mortgages.

- These measures should offer a lift to Canadian home sales and prices next year. However, their impact will be blunted by an array of factors, including the affordability erosion induced by their implementation.

- Mitigating the impacts of these policies may be positive from a financial stability perspective, as the measures will likely encourage households to take on more debt at a longer term, and insured borrowers have typically been more prone to bouts of financial stress.

The federal government has recently announced two changes to Canadian mortgage rules (effective December 15th, 2024) that will make it easier to qualify for purchasing a home. As the surge in home sales early in 2024 (amid a steep drop in bond yields at the end of last year) and in the spring of 2023 (after the Bank of Canada paused its rate hiking campaign) taught us, Canadian housing market activity can be highly reactive. Yet, we don’t think that these measures alone will unleash a housing boom. Instead, they’ll likely offer a secondary tailwind to a market that’s already gaining decent traction in 2025 on the back of lower borrowing costs and a gradually improving economy (see here). What’s more, the affordability boost offered by these measures will likely also erode as home prices are raised by their implementation, thereby limiting their effectiveness.

Targeting to Limit Support from Amortization Rule Change

One measure involves expanding the maximum mortgage amortization period for first-time homebuyers who take out insured mortgages (i.e., with a down payment of less than 20%) from 25 to 30 years. In an effort to revive slumping pre-sales, amortizations will also be extended for the purchase of all newly built homes. This should offer some help to activity in the new home space, supporting housing construction in turn. That analysis is beyond the scope of this report, which focuses on resale market impacts.

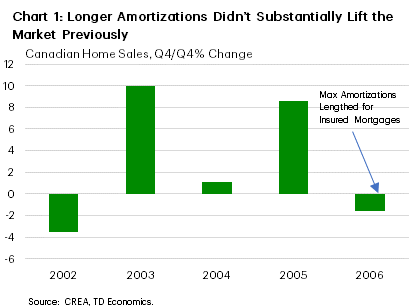

This isn’t the first-time that the federal government has extended amortization lengths. In 2006, CMHC began a pilot program to begin insuring mortgages with 30-year amortizations, instead of 25. That same year, this program became permanent, and CMHC also announced that mortgages with amortizations of 35 and 40 years could be insured. So, these measures marked a sizeable change from the prior status quo. Even still, econometric analysis tells us that these policies offered a statistically significant, but small impact on Canadian home sales growth when implemented (Chart 1).

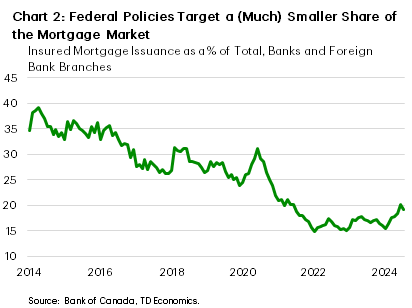

In the here and now, we estimate that a first-time homebuyer with a “typical” family income, facing a “typical” house price, who puts down the minimum mortgage payment could see their purchasing power increased by around 9% (roughly equivalent to a 90-bps interest rate reduction). On its own, this is a meaningful difference. However, the impact on the market will be blunted by the fact that it only applies to first-time homebuyers who take out an insured mortgage. Only about 44% of total sales are to first-time buyers, according to data from the Bank of Canada. Moreover, a relatively small 20% of mortgages issued this year have been in the insured space (Chart 2), although we acknowledge the likelihood of a probable increase in this share in the wake of these policy changes.

Homebuyers in GTA and GVA to Benefit from Higher Mortgage Insurance Cap

The other policy change involves raising the cap for which a potential buyer can obtain an insured mortgage from $1 million to $1.5 million. This means that, for example, a purchaser who buys a detached home in Toronto valued at $1.2 million (the median price in August) could put down about $95k as a down payment, instead of needing $240k as before.

We estimate that about 20% of homes in Canada are priced between $1 – 1.5 million, potentially signaling a sizeable boost to activity from this policy. The GTA market should see the most benefit, given that it likely has the largest share of homes priced in this range of any major market in the country. The GVA should also see a disproportionate benefit compared to urban centres in most other provinces, but bear in mind that an outsized amount of homes in Vancouver are priced above this threshold. For example, sales of homes priced above $2 million account for about 15% of the GVA market.

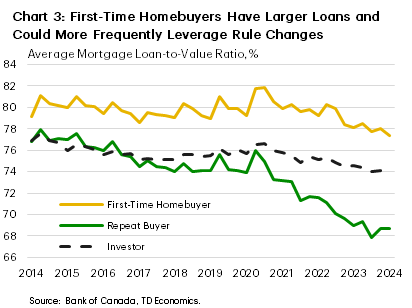

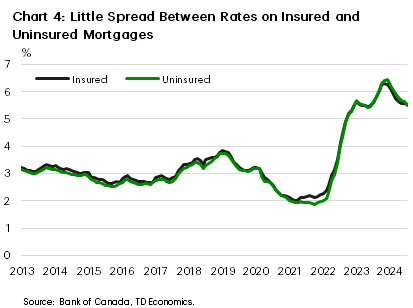

However, most buyers have a 20% (or more) down payment and are therefore not obtaining an insured mortgage. First-time homebuyers are more likely to have an insured mortgage and may be the most inclined to leverage this policy change (Chart 3). This is especially true given that the interest rates on insured and uninsured mortgages are similar (Chart 4), offering little incentive for repeat buyers (for example) to take out an insured mortgage (which results in less initial equity in the home and a requirement to pay CMHC mortgage insurance).

There’s also the question of how much income is required to qualify for this relatively expensive housing. For instance, a buyer who puts down the new minimum down payment required to buy a home valued at $1.05 million will need a household income of about $170-180k to meet typical qualification thresholds. This would be difficult for many first-time homebuyers. Meanwhile, a $1.45 million home would need about $225-245k under the same assumptions – a stretch for many households. For reference, 80% of Canadian households had incomes below $150k in 2020, although this share has probably reduced since then.

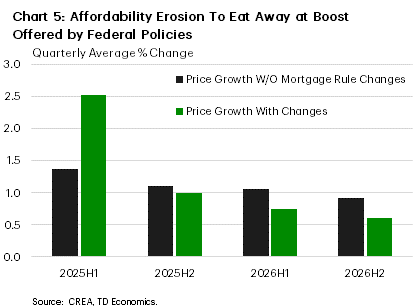

Policies to Buoy Housing Next Year

Although we’ve detailed factors that limit the potential for these rule changes to drive new purchases in the resale market, some support for housing is in the cards. In fact, we estimate that by the end of 2025, both Canadian home sales and average home prices will likely be about 2-4 ppts higher than they would have been absent these policies, with much of this boost accruing in the first half of the year. However, by the end of 2026, the affordability erosion resulting from these policies will have eaten away at the initial lift to sales, and left prices only marginally above whether they would have been otherwise (Chart 5).

We recognize the potential for some uncertainty around our estimates and there are risks to the housing outlook on both sides of the ledger. On the one hand, activity that would have taken place this year could be pushed into 2025, as buyers wait for the new rules to commence before purchasing. On the other hand, it could be the case that housing reacts more aggressively to the federal policies than what we’ve penciled in, especially in a falling rate environment.

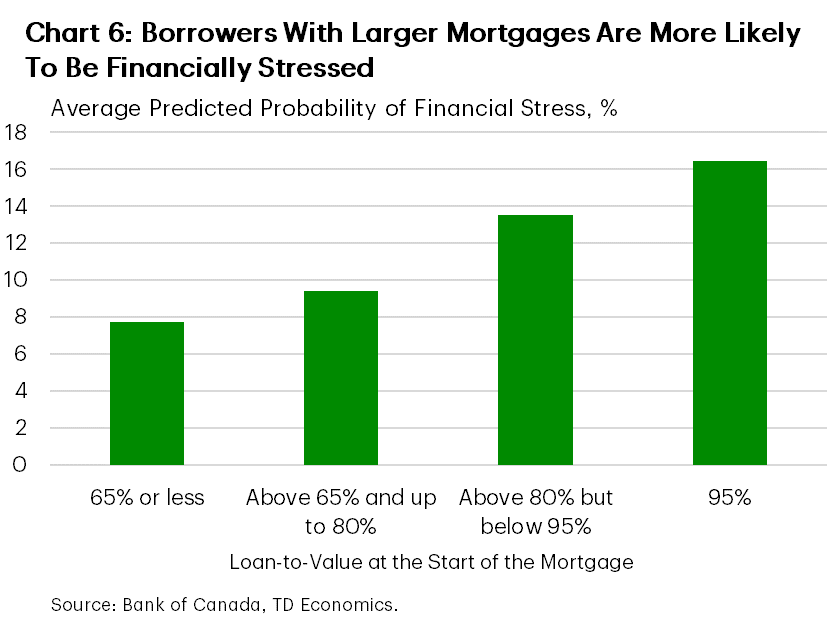

There are other nuances worth paying attention to. The higher threshold for insured mortgages will unlock access to new, more expensive structure types for many buyers, resulting in a lift to average home prices (which are upwardly pressured when costlier housing is purchased). The measures will also likely cause some shift towards insured mortgages of longer amortizations, which has its own implications. For instance, Bank of Canada research indicates that borrowers with higher loan-to-value ratios are more likely to be delinquent on their loan obligations (Chart 6). The analysis also found that longer amortization periods are associated with a greater probability of financial stress, noting that they reduce the ability to lengthen amortizations should income prospects be damaged. Also, delinquency rates are about 30% higher for insured mortgages at non-bank lenders, according to CMHC. These trends suggest the potential for some fragility to be introduced into the broader financial system.

Bottom Line

The federal mortgage rule changes should offer a notable lift to both home sales and prices in the first half of 2025, contributing to what should be a firm year for sales and price growth. However, the impact will be blunted by a multitude of factors. The decision to lengthen amortizations is limited to first-time homebuyers. Meanwhile, the raising of the threshold for which a 20% down payment is required may be missing the mark a little, in that those most likely to make use of the rule change (first-time homebuyers), may not necessarily have the incomes to afford the homes that the measure is targeting. However, mitigating the impacts of these policies may be positive from a financial stability perspective, as the measures will likely encourage households to take on more debt over a longer-term horizon.

End Notes

- Bilyk, O et al. “Can the characteristics of new mortgages predict borrowers’ financial stress? Insights from the 2014 oil price decline.” Bank of Canada Staff Analytical Note 2021-2022 (September 2021). https://doi.org/10.34989/san-2021-22

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: