Canada’s interest rate conundrum: Too much of a good thing

Beata Caranci, SVP & Chief Economist - 416-982-8067

Maria Solovieva, CFA, Economist | 416-380-1195

Date Published: November, 2024

- Category:

- Canada

- Forecasts

- Financial Markets

Highlights

- A call for a jumbo cut to head off mortgage reset rates must be assessed carefully. Surprisingly, roughly a quarter of mortgages will reset at a LOWER interest rate next year.

- For those renewing into higher rates, the shock might be milder than expected, given a 30% increase in home prices and wages. Years of debt repayments have also built equity room, which homeowners, including those with variable-rate-fixed-payments mortgages, can use to lower payments if needed.

- While rapid rate cuts can relieve mortgage pressures, they also stoke risks. Restoking housing demand, pulling forward consumer spending, weakening purchasing power and dampening investment through a softer loonie. Indeed, there is such a thing as too much of a good thing.

Last week, we published on the Bank of Canada’s decision to deliver an outsized 50-basis-point interest rate cut. Some clients have commented that a faster descent is necessary to head off mortgage renewal risks. The concern is embedded in the lingering effects of the pandemic. In 2020, home sales shot up 40% in just twelve months as the Bank of Canada slashed the policy rate to near-zero. Homebuyers responded to a once-in-a-generation deal on mortgage rates. Now as 2025 approaches, those renewing a 5-year mortgage – the preferred term in Canada – could face sticker shock.

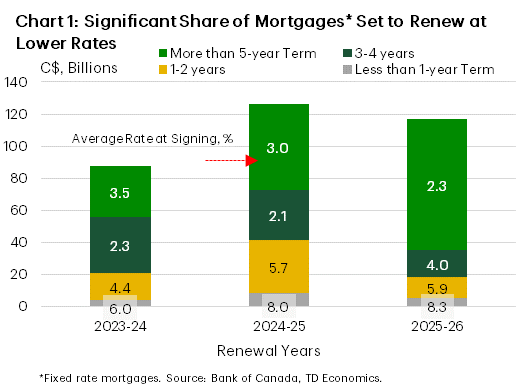

Chart 1 offers some comfort with three key messages:

First, it will likely surprise many that roughly a quarter of mortgages will reset at a LOWER interest rate. Many homeowners in the past two years selected shorter mortgage terms in the hopes that the Bank of Canada would be cutting rates as renewals hit. Good call! The savings will be tremendous. Depending on the institution, the current 5-year mortgage rate is between 4.0% and 4.7% compared to the prior average transaction rates of 5.8% to 6.9% for those folks. That’s a huge step down that will free up disposable income.

Second, the majority of mortgages coming up for renewal next year and in 2026 sit at an average rate of 2.5%. There will be upward pressure on monthly payments for these folks. However, not as much as you might think. Since 2020, Canadian home prices and wages have both risen by over 30%. And five years of debt paydown has created equity room that could be taken back up if homeowners want to mitigate the increase in monthly mortgage payments by extending their amortization.

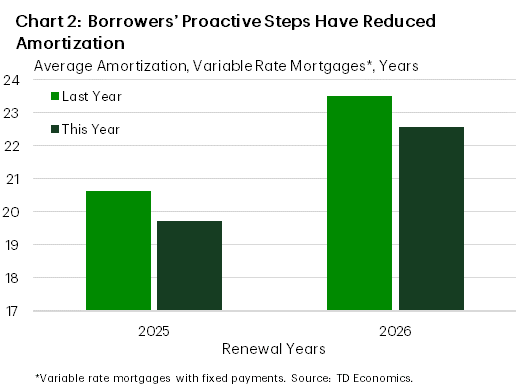

The benefits of lower rates and higher equity hold true for variable rate mortgage holders too. Those with variable payments have already experienced some rate relief due to 125 basis points in interest rate cuts so far. For a $500,000 mortgage, this translates to a $370 reduction in the monthly payment. For borrowers whose payments do not adjust with rate changes, these reductions will bring benefits at renewal in the form of either lower monthly payments or a shorter amortization period. Moreover, it appears that this group is faring better than initially anticipated when analysts looked at the data a year ago. Many borrowers have proactively increased their payments, effectively reducing their average amortization period by a full year (Chart 2).

Lastly, financial risks are further lowered than many Canadians presume due to past macroprudential rules. Canada’s mortgage stress test requires mortgage applicants to qualify not at their contract rate, but at an interest rate that is two percentage points higher, or a floor rate of 5.25%, whichever is higher. With the 5-year mortgage rate floating at around the 4% mark, homeowners who secured rates in the 2% range in 2020 remain within the scope of that stress test. If they qualified then for a mortgage, they should be sitting in a better spot today with the benefit of time and wage gains, presuming there hasn’t been a change in the household income status. Given the lack of job losses in the job market, this assumption holds true for most.

Bottom line, when rates were rising rapidly, mortgage renewals were on everyone’s mind as a key risk that required flagging by the Bank of Canada. But it no longer presents itself as that lurking monster of 2025. By extension, it’s not the smoking gun for ongoing 50 basis point rate cuts. It’s important to balance the two-sided nature of risks. The other side is inadvertently restoking the housing market, leading to a new cycle of restrained affordability and debt accumulation. The Bank must also be mindful of underestimating the spending impulse. A more rapid rate-cut cycle will pull forward or front load consumer spending relative to a gradual cycle. Because data is lagged, by the time it’s readily observed, the momentum impulse could be stronger than anticipated and require course correction. And finally, caution is warranted in creating too wide an interest rate spread to the U.S.. The loonie has already broken below a technical threshold by dipping below 72 cents. Chronic weakness reduces Canada’s purchasing power abroad, which can become counterproductive to investment because firms source a significant amount of machinery and equipment from other countries.

We must remember, there is such a thing as too much of a good thing.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: