Two Years to Remember:

The Impact of the Pandemic on Florida's Tourism Industry

Shernette Mcleod, Economist | 416-415-0413

Date Published: December 9, 2021

- Category:

- Us

- State & Local Analysis

Highlights

- No other industry has been harder hit by the pandemic than tourism and few regions as hard as Florida. Between limits on crowds and capacity, restrictions on travel, and a slump in domestic demand due to health concerns, Florida's travel and tourism industry ground to a near halt in 2020.

- As restrictions ebb, the tourism sector is regaining momentum, but the lingering effects of the pandemic on the industry are becoming apparent. Leisure travel is showing clear signs of improving, but business travel – an important driver of hotel revenue – is much further behind. Theme parks have been resilient, but the cruise industry is operating under a cloud of legal uncertainty.

- The pandemic has also altered the employment landscape. Florida's tourism-related businesses have expressed increased difficulty in finding staff, suggesting that the national trend of elevated job openings and rising quit rates are also playing out in the state's travel and leisure sector.

- As with the pandemic, the future of the industry is still evolving. There are some positive outcomes heading into 2022, such as increasing visitor arrivals; however, the industry is still not out of the woods yet. With the emergence of a new strain of the coronavirus, which could prompt greater caution among would-be travelers and resurgence of restrictive policies, there is still some degree of uncertainty which the industry will have to navigate as the new year dawns.

The COVID-19 pandemic has been devastating to the international tourism market. With its warm climate and multiple world-renowned tourist attractions, Florida has been at the center of the damage. The sector was hard hit by the pandemic, which lead to dramatic reductions in visitor arrivals.

As 2021 progresses, slowly but surely, the world is returning to Florida. The first to return are leisure travelers, especially Canadians looking to escape the Great White North for the winter. Business travelers are likely to be slower to return and are a more uncertain source of demand given changes to the nature of work and business travel brought on by the adoption of digital technologies.

As demand returns, the challenge for the industry may be ramping up employment. The industry has seen one of the largest increases in job opening and quit rates since the pandemic. Attracting and maintaining workers is likely to require higher wages, epitomizing the trend seen in the broader American economy. The industry's ability to attract sufficient workers will play a part in how quickly the Sunshine State is able to restore one of its most economically important industries to its former heyday.

Overall, Florida's recovery from the pandemic induced downturn is well underway, despite unevenness among market segments. With less restrictive policies and travelers eager to get back to their vacation hotspots, prospects for further progress are encouraging. This assumes no major new curveballs on the Covid-19 front. In particular, the new Omicron variant could jeopardize those prospects, if it results in another wave of measures aimed at containing its spread.

Tourism is Vital to Florida's Economy…

Tourism is a major player in Florida's economic landscape. In 2019, the leisure and hospitality industry accounted for nearly 6% of real state GDP, 14% of total employment and 15% of state sales tax collection.1

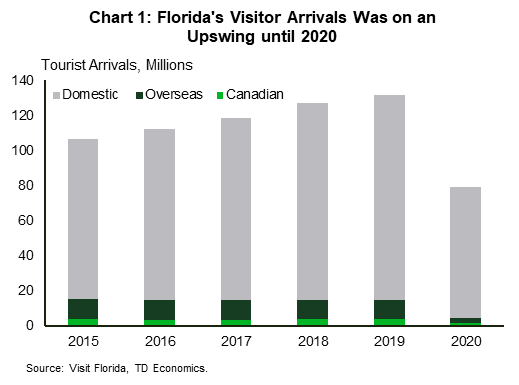

Total visitors to Florida averaged 119 million in the five years prior to 2020, with domestic travelers accounting for the bulk of this number (Chart 1). Arrivals reached a record high of 131.4 million in 2019, just prior to the pandemic, growing at an annual average rate of 5.9% over the five-year period. According to research commissioned by Visit Florida (the state's tourism marketing agency), in 2019 out-of-state visitors added $96.5 billion to Florida's economy, more than the entire GDP of 13 other states.

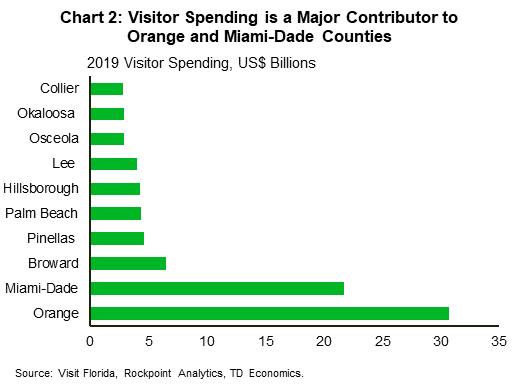

At a regional level, the areas most dependent on tourism are the Central region, followed by the Southeast and the Southwest. In 2019, valued added from the tourism industry was estimated at over $30 billion for the Central Florida economy with the top two employers in the region being Walt Disney World Resort and Universal Orlando Resort. At the county level, Orange County (encompassing Orlando) and Miami-Dade topped visitor spending in 2019 at $30.7 billion and $21.7 billion respectively (Chart 2).

…And Then There Was COVID-19

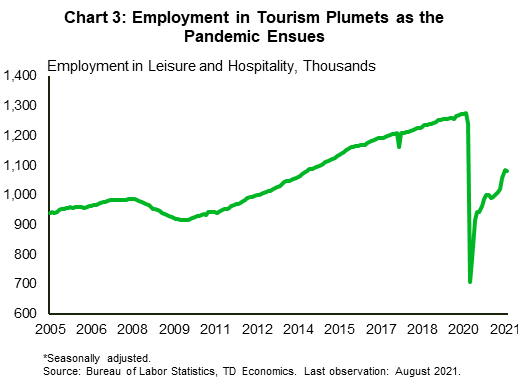

This was the lay of the land before the pandemic took hold. In March 2020, the first two official cases of COVID-19 were reported in Florida. With lockdown measures put into effect in April, many non-essential businesses were forced to close. These included major tourist attractions such as Walt Disney World Resort, Universal Orlando Resort, SeaWorld Orlando, Legoland Florida and Busch Gardens Tampa Bay. Employment in the industry began to decline in March 2020, but in April 2020 it plummeted by almost 43% (Chart 3) – the largest month-over-month decline in its history.

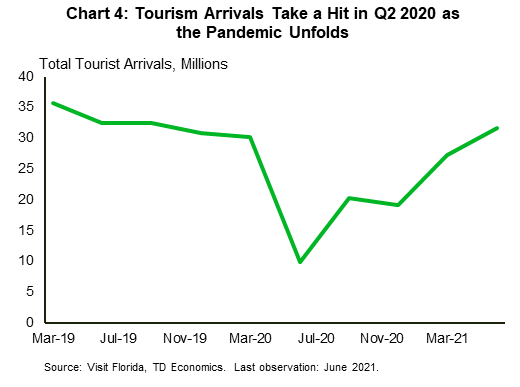

Visitor arrivals also declined sharply. Quarter-over-quarter tourist arrivals declined by 67.5% in the second quarter of 2020 (Chart 4). The year-over-year decline was even larger at almost 70%. As international borders were closed, overseas and Canadian travelers fell by a combined 96.5% in the second quarter of 2020 relative to the previous year.

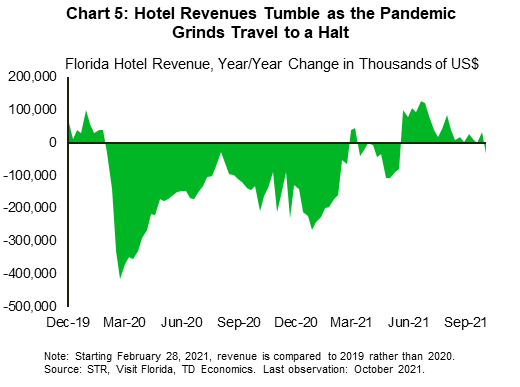

The absence of international travel to Florida was disastrous for local businesses. The hotel industry was one of the hardest hit. Data from Visit Florida show that in April 2020, at the onset of the pandemic, hotel demand declined by approximately 78% relative to the same period in 2019. Hotel revenue in the state bottomed out between March and April of 2020, with hotels earning $415 million less than they did during the same period in 2019 (Chart 5).

The impact was not limited to just the obvious sectors, but also to ancillary businesses such as retailers and transportation operators. In metro Orlando, for example, visitor arrivals were down by 53% from 75.8 million to 35.3 million between 2019 and 2020, with international visitor arrivals down almost 75%. According to data from the Central Florida Hotel & Lodging Association, the average visitor spends $615 per trip to Orlando. The reduction of 40.5 million visitors likely resulted in almost $25 billion in lost visitor spending.

As lockdowns went into effect, real state GDP declined by 30.1% (annualized) in the second quarter of 2020 – the largest quarterly decline on record. The decline was felt most acutely in the arts, entertainment, and recreation industry (down 92.9% annualized), followed closely by accommodation and food services (down 86.9%). These two categories account for the bulk of tourist related activities.

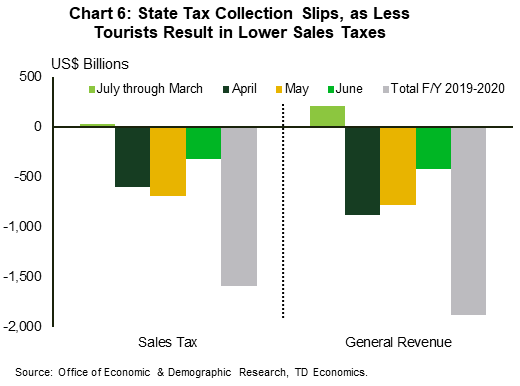

State and local governments that depend on sales and hotel tax revenues did not escape the effect of declining tourist arrivals. The Office of Economic & Demographic Research, which publishes the state's official revenue estimates, reported that Florida's General Revenue was $1.9 billion (5.7%) lower than projected for the fiscal year (ending June 2020). Sales tax collection, the largest contributor to the General Revenue fund, was over $1.5 billion lower than projected for the fiscal year. This loss occurred in the final quarter of the fiscal year (April-June) due to the effects of pandemic lockdowns (Chart 6). Losses were attributed largely to significant declines in the leisure and hospitality industry.

Florida's Tourism Numbers Rebounding from the Pandemic

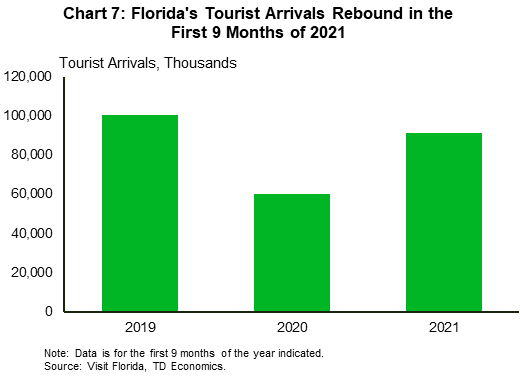

As 2021 progresses, tourism numbers have been promising. For the first nine months of 2021 (the most recent data available), Florida welcomed 91.5 million visitors, up 51.9% from the first nine months of 2020, but down 9.1% from the same period in 2019 (Chart 7). The upswing was driven largely by visitors from other parts of the United States (up 55.9% year-on-year). Overseas visitors were also up 30.8% and with the land border still closed, Canadian visitors were down a substantial 89.2% relative to the same period in 2020.

Data for the fourth quarter is expected to improve as the number of COVID-19 cases trend down in Florida and the U.S. border reopens to international travel for fully vaccinated individuals. Canadians are likely to lead the charge back to the Sunshine State. These expectations however may be tempered by the recent emergence of the Omicron variant of the virus, which may prompt the re-imposition of lockdown measures and travel restrictions.

The Canadian Snowbirds are Back

Canada is overwhelmingly the top international source of tourists to Florida. There were 3.6 million Canadian visitors to Florida in 2019, more than double the second highest visitor destination, the United Kingdom.

In a 2018 Canada-Florida Economic Impact Study, the Canada Trade Commissioner Service estimated that 500,000 Canadian snowbirds descend on Florida during the winter months. With some staying up to six months, these visitors were estimated to contribute $6.5 billion to the Florida economy. Given the restrictions imposed on international travel, this fillip has been missing for almost two years.

The relaxing of restrictions on air travel has helped to alleviate this problem, but as most snowbirds drive to the Sunshine State, the ban on non-essential land border crossing has, up until very recently, been a major roadblock. The removal of those restrictions for fully vaccinated travelers on November 8th is expected to boost visitor arrivals this winter.2 Vacasa, a management company for vacation homes in North and South America, reported a notable rise in traffic on its online platform after the new rules were announced. Canadian users’ views at rentals in snowbird-popular destinations in particular, jumped by 120%. As visitors prepare to head back to their winter escape in Florida, they are likely to face higher prices, as increased demand and the red-hot housing market have also pushed up the price of vacation rentals in the state.

International Travel Gearing up to Bounce Back

The recent removal of travel restrictions did not only affect land borders, but also international air travel. The policy change lifted COVID-19 travel restrictions for all fully vaccinated foreign nationals. Prior to this, there were bans on visitors from China, Canada, Mexico, India, Brazil and much of Europe as well as other nations. This news was welcomed with great enthusiasm by many in Florida's tourism industry, as prior to the pandemic, international travelers accounted for about 11% of tourism in the state.

Notwithstanding the lifting of the travel ban, the return of international travelers to the U.S. is likely to be gradual but, assuming no further setbacks, also steady. Canadians are some of the first to take advantage of the relaxed rules, while the first scheduled flights from some European countries are not due until March 2022.

The good news is that airports in Florida received intentions to resume transatlantic service from several international airlines as soon as possible after the policy took effect. On the day of the reopening, Miami International Airport reported that international arrivals were already running 5,000 ahead of the previous Monday.3 Similarly, international seat capacity on flights through Orlando International Airport have already risen by 40,000 from what they were in October and are scheduled to increase by an additional 88,000 seats in December.4

Theme Parks on the Mend

The return of international visitors is great news for the major attractions (and hotels) that cater to them. Pent-up demand for travel has also allowed these businesses to raise prices, thereby further padding their bottom lines. Global hospitality data and analytics firm STR reported that in Tampa Bay for example, the average rate for a hotel room rose 33.6% in October 2021 relative to October 2019.5

Similarly, entertainment venues in the Sunshine State have managed to carve out record revenues coming out of the pandemic. SeaWorld announced its largest Q3 earnings to date, an astonishing 391% increase over the same period in the previous year and 10% over Q3 2019. While quarterly park attendance was up significantly relative to 2020 (7.2 million vs 1.5 million) it was still down by 900,000 relative to third quarter 2019.6

Universal Orlando also had a record-breaking quarter. The Chairman and CEO of Comcast, (Universal Orlando's parent company), noted that the three months ending September 2021 was the most profitable in the theme park's history. This stellar performance helped the theme parks division of the company to earn approximately $1.4 billion in revenue, significantly above the $385 million earned in Q3 2020.7

The theme parks and related business units of Disney also reported rising income. For the quarter ended October 2nd 2021, this business segment brought in $5.45 billion in revenues, 99% higher than the $2.77 billion earned in the same period of 2020.8

Overall, theme parks in the state are recovering from the pandemic even before the arrival of larger numbers of international guests that are expected to come over the next year. While new variants continue to pose a threat, the stage is set for 2022 to be an even better year for this segment of Florida's tourism industry.

Leisure Up but Business Down and Cruise in a Quandary

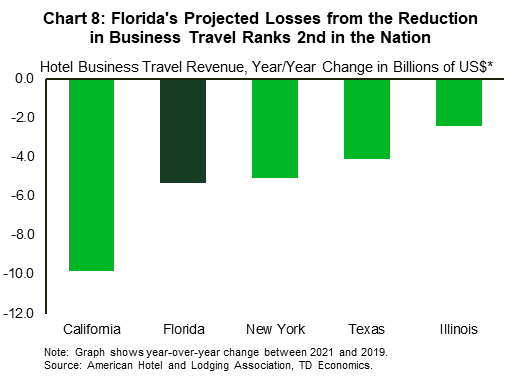

Despite the increase in tourist arrivals, the gains within the industry have been uneven, with business travel lagging behind leisure. According to the Florida Restaurant and Lodging Association, Florida's hospitality industry is projected to experience a reduction in business travel for 2021 valued at $5.3 billion. The association estimates that business trips to Florida will be down 61% this year compared to 2019. Relative to 2019, Florida is projected to end 2021 with the second-highest business travel losses in the nation, only behind the state of California (Chart 8).

Finally, the reopening of the cruise industry, which has been shut down since March 2020, has been problematic. Though several cruise companies based in the Sunshine State have already resumed operations since this summer, their continued operation faces legal challenges. Cruise lines have been requiring passengers to show proof of vaccination in order to board; however this practice contravenes legislation put in place (in July) by the state's Governor prohibiting a company from requiring any customer to show proof of vaccination. A federal judge ruled in August that Norwegian Cruise Line can require their passengers departing from Florida to show vaccination status before boarding. The Governor however, has vowed to appeal this ruling. The battle has become even more complicated as several destination ports, in the Caribbean for example, have required that cruise passengers be fully vaccinated in order for the ships to call at their ports. As the legal challenges make their way through federal court, the operations of cruise companies continue with that cloud hanging overhead. Nevertheless, the industry has started to regain speed, though it will take some time before it returns to pre-pandemic levels of operation.

The Pandemic has Changed the Employment Landscape in Florida's Tourism Industry

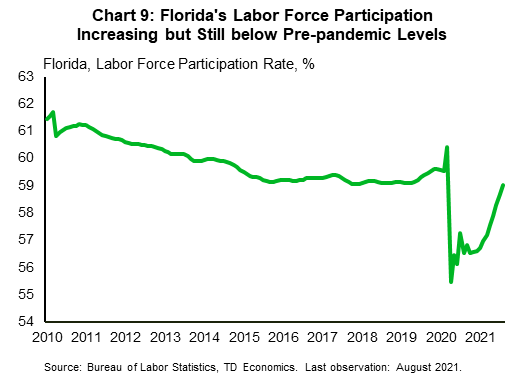

As it did throughout the United States, Florida's labor force participation took a hit during the pandemic. While the metric has been on the rise since then, it still remains below the pre-pandemic level (Chart 9).

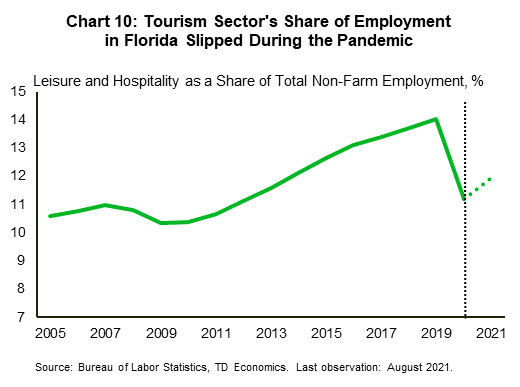

Anecdotal evidence from employers in the tourism sector suggests that the lack of labor supply is more severe in the sector relative to others. Several businesses in the industry, from hotels to restaurants have noted that staffing is a major issue, and it is negatively affecting their operations. This is further supported by a decline in leisure and hospitality's share of total employment in Florida (Chart 10). In 2020, employment in the industry accounted for 11% of total nonfarm employment, down 2.9 percentage points from 2019. The share has been rising throughout 2021, but still remains below the pre-pandemic level.

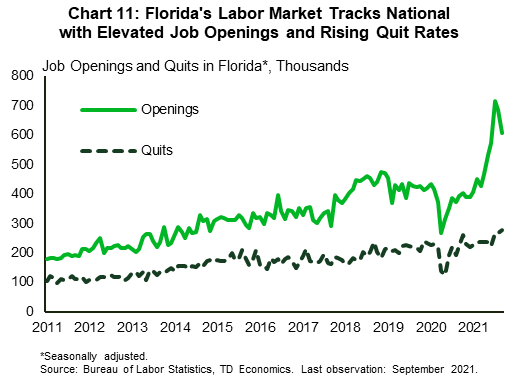

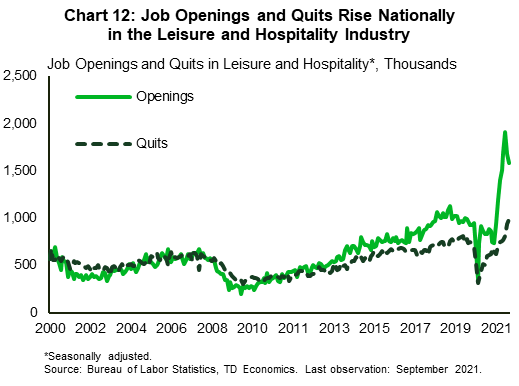

There were 609,000 job openings in Florida in September and about 279,000 people voluntarily quit their jobs (Chart 11). National data present an even more sobering picture – 4.4 million American quit their jobs (a 3% increase over August and the highest rate ever recorded since data collection began in 2000). Nationally, quit rates were particularly high in the hospitality and leisure sector (Chart 12). Even with quits rising, the leisure and hospitality industry still shed 324k jobs between July and September. While industry-specific data is not available at the state level, it is reasonable to extrapolate a similar occurrence in Florida.

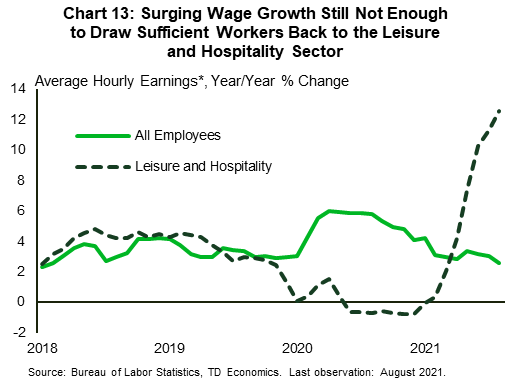

The reasons for the lack of labor supply are many and varied, some related to wage levels, personal preferences, childcare options and others to health concerns. Many positions in the hospitality industry are low paying, thus the pullback in the industry during the pandemic gave many of these workers an opportunity to retrain. Despite double-digit wage increases in recent months – the highest among all Florida industries (Chart 13), the leisure and hospitality industry continues to face worker shortages. It remains to be seen how long worker shortages last, but as long as they do, they will act as a constraint on the pace of recovery in the industry.

The Latest Curveball - Omicron

As at writing, a new variant of the coronavirus, dubbed Omicron, has emerged. If the new variant triggers another wave of infections globally then all bets are off. More lockdowns, more travel restrictions and a return of travel hesitancy could be in the forecast. This time around, policymakers appear to be leaning more toward vaccinations and testing as opposed to the widespread lockdowns and travel bans that were prevalent at the start of the pandemic. Still, the U.S. administration imposed a temporary ban on non-U.S. citizens travelling from South Africa, where the variant was first detected, and seven other Southern African nations. The ban, however, is not as extensive as previous travel bans that the U.S. has imposed and since repealed, and Southern Africa represents a relatively small share of travelers to the United States.

To combat the variant, President Biden has also reduced the testing timeline from 72 to 24 hours for travelers entering the U.S. regardless of vaccination status and extended a mask mandate on airplanes and other forms of public transportation. As these measures take effect and more information about the Omicron variant becomes available, they are likely to have an impact of Florida's tourism sector, particularly with respect to international travelers. The scope of the impact remains uncertain and the Omicron unknown represents a downside risk to the industry.

Bottom Line

The tourism industry in Florida is a major contributor to the economic success of the state. It plays a significant role in employment, business activity and government revenues. The onset of the COVID-19 pandemic was a major blow to the industry. The imposition of lockdown measures and travel restrictions for visitors from international destinations resulted in the temporary closure of many tourism related businesses.

As government responses became less restrictive, the industry began to emerge from the worst of its effects. Initially, recovery relied heavily on domestic visitors. With the removal of travel bans, international visitors are poised to make a comeback, barring any future negative developments related to the Omicron variant. The bounce back of international travel is expected to be led by a surge of snowbird visitors from Canada that have missed their usual Florida getaway over the last 20 months.

Theme parks and attractions in the state are already reporting record-breaking revenue as 2021 comes to a close. They have been able to weather the worst of the pandemic and should continue to improve heading into 2022.

Unfortunately, business travel has not experienced the same rebound and is likely to be slower to recover as the pandemic has reoriented several companies' approach to corporate travel. The cruise industry is also facing legal challenges as they attempt to navigate the post-pandemic world aboard a ship.

Finally, one concerning repercussion of the significant layoffs that occurred during the height of the pandemic is a reduction in the leisure and hospitality work force. As recovery ramps up in the industry, attracting and maintaining workers will be key to the industry's future success.

End Notes

- Sales taxes were the largest contributor to the state's general revenue at 76% in FY 2018/2019.

- The Canadian government's removal of required PCR tests for visits under 72 hours may help to further increase shorter trips to the state.

- Sun Sentinel, " Welcome back! With COVID restrictions lifted, South Florida tourism spots throw open their doors to international travelers", https://www.sun-sentinel.com/business/fl-bz-international-tourists-covid-florida-20211108-3o7xscppaba4jln3c5dgsbah34-story.html

- Click Orlando, "Orlando International Airport travelers happy to see U.S. allowing more international travel", https://www.clickorlando.com/news/local/2021/11/08/orlando-international-airport-travelers-happy-to-see-us-allowing-more-international-travel/

- Tampa Bay Times, " As hyperinflation talk mounts, Florida reckons with rising prices", https://www.tampabay.com/news/business/2021/11/03/as-hyperinflation-talk-mounts-florida-reckons-with-rising-prices/

- SeaWorld Entertainment, Investor Relations, "Q3 2021 Earnings Release", https://s1.q4cdn.com/392447382/files/doc_news/SeaWorld-Entertainment-Inc.-Reports-Third-Quarter-and-First-Nine-Months-2021-Results-2021.pdf

- Spectrum News, "Universal theme parks stay profitable as pandemic recovery continues", https://www.mynews13.com/fl/orlando/news/2021/10/28/universal-theme-parks-profitable-comcast-earnings?web=1&wdLOR=cF848A573-DE0D-4B70-AD12-4E81986F96D7NAHB, "What Home Buyers Really Want", Mar 2021,

- Walt Disney 4th Quarter Earnings, https://thewaltdisneycompany.com/app/uploads/2021/11/q4-fy21-earnings.pdf

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share this: