Yes, the title of this presentation comes from a famous soap opera. It’s appropriate to depict the past year, full of economic and political drama. We’re on the cusp of closing out 2025, a dramatic 365 days marked by the shifting sands in government policies and corporate behaviors.

And this final quarter of the year has brought forward more pivots that will keep us glued to the next episode. My only hope is that the economic drama doesn’t run sixty-three seasons like the soap opera!

There are three main messages to review:

- Globally the negative effects from the trade war have been muted relative to expectations, in part because countries show evidence of finding new markets or engaging in trade diversion. Canada falls into the first bucket.

- Even with the lack of U.S. economic data due to the government shutdown, tensions have re-surfaced on the K-shaped economy. This term was previously used to describe the pandemic, marked by not just the differing fortunes between income groups, but diverging forces.

- Cost of living pressures have prompted the administration to take action on – or contemplate – a number of policy shifts.

2025 Global Economy: Tariff Troubles Not Evident

Last quarter, I mentioned that the U.S. forecast hadn’t changed a whole lot despite the dramatic policy shifts throughout the year. That’s because of the many cross currents from lower interest rates, to the OBBB, to the negative impacts from tariffs calibrated against companies shielding consumers with inventory stockpiling and other behaviors.

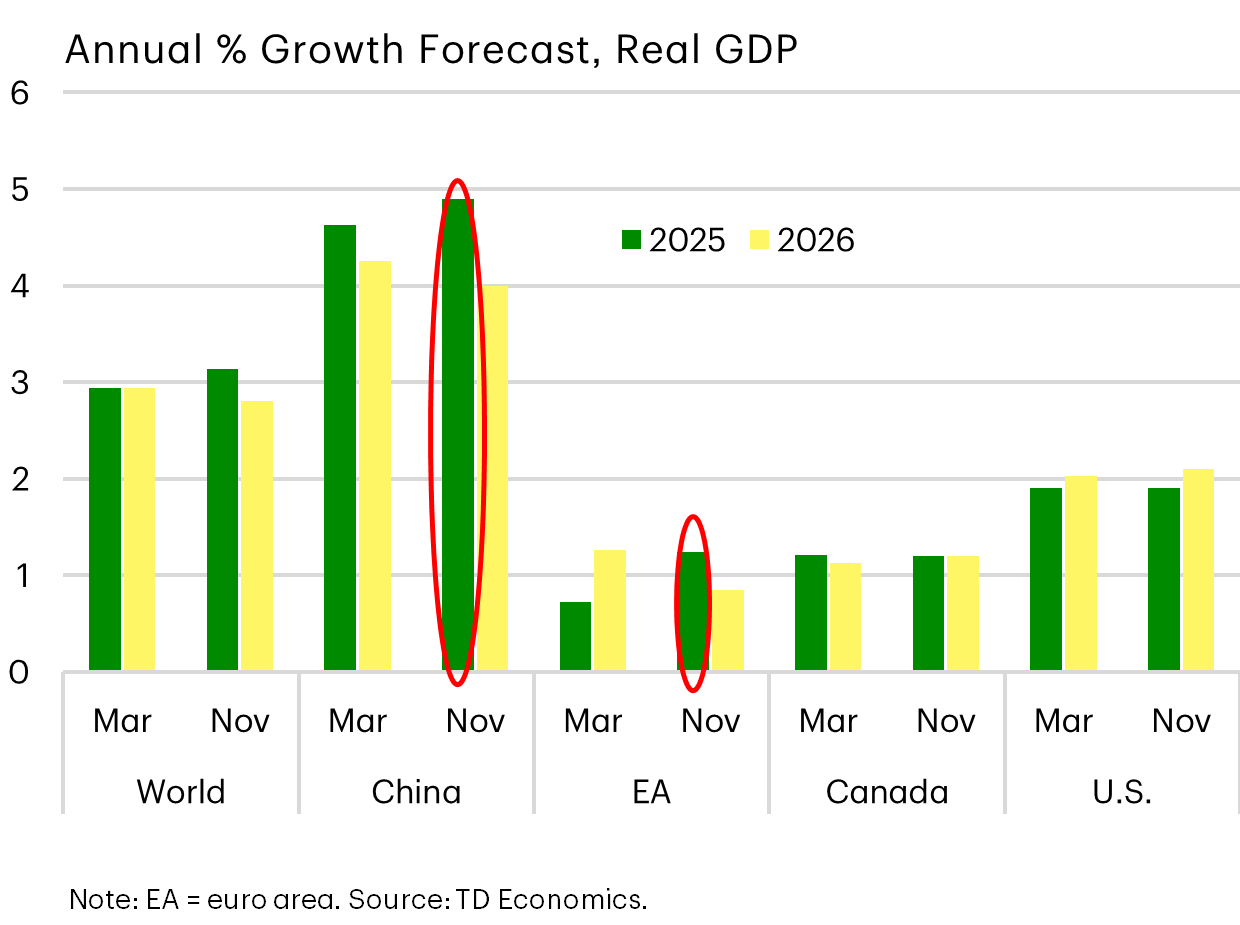

This graph shows that it’s not just a US theme, but a global one.

Between the March forecast cycle and this month, there were few markdowns, and even some modest upgrades for regions like the E.U. and China. Many countries mobilized quickly on fiscal programs, like increased defense spending, or in China’s case, successfully finding new markets for their products.

Trade Diversion: China Finding New Markets, And Canada Too

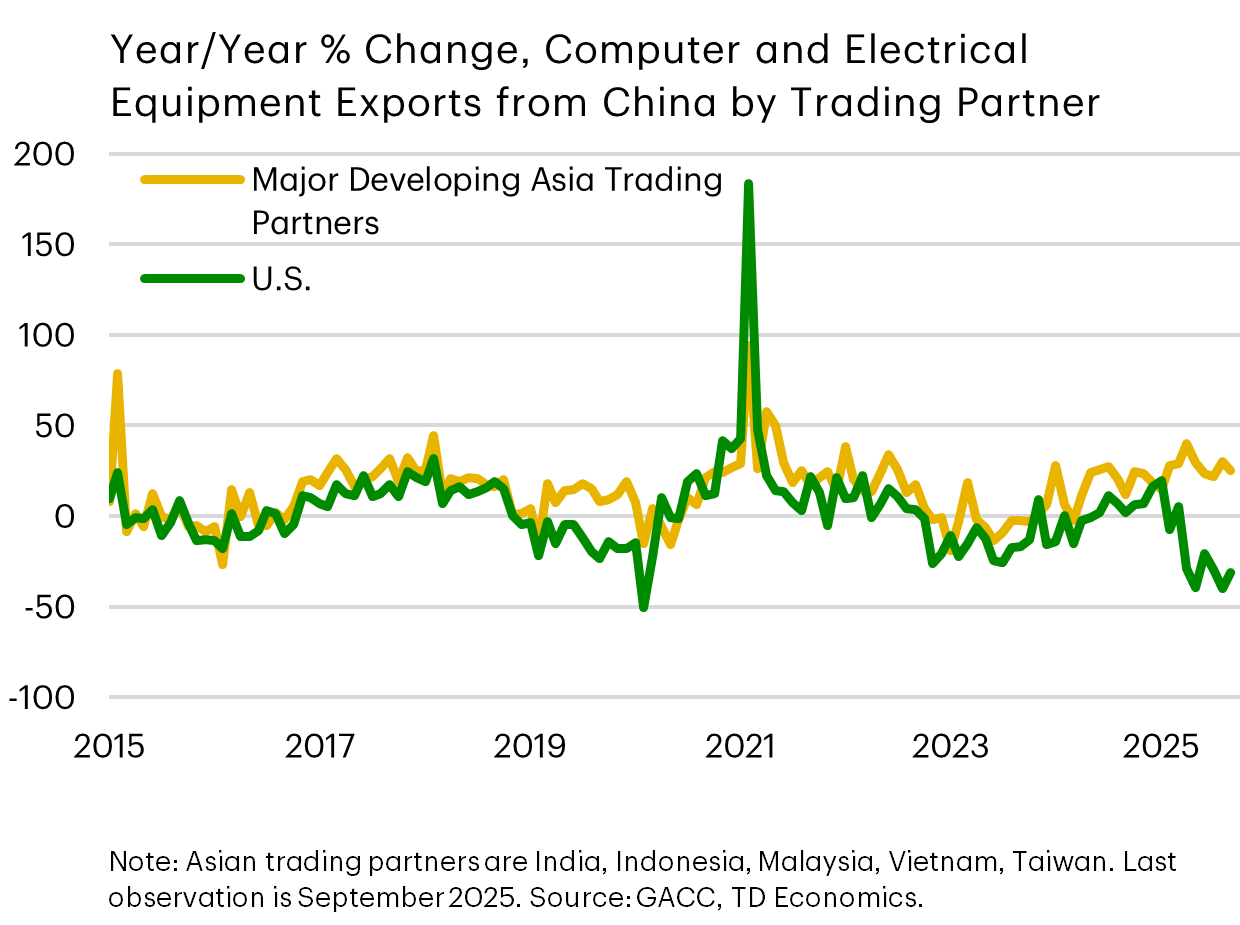

To that point, China’s most tech-exposed exports to the U.S. versus their Asian trading partners.

Once U.S. tariffs were threatened, trade immediately shifted to other markets, mitigating most of the negative impact to China’s aggregate exports. So far, it’s an impressive pivot and exactly what economic theory predicts would happen when a country has a strong comparative and competitive advantage in certain products.

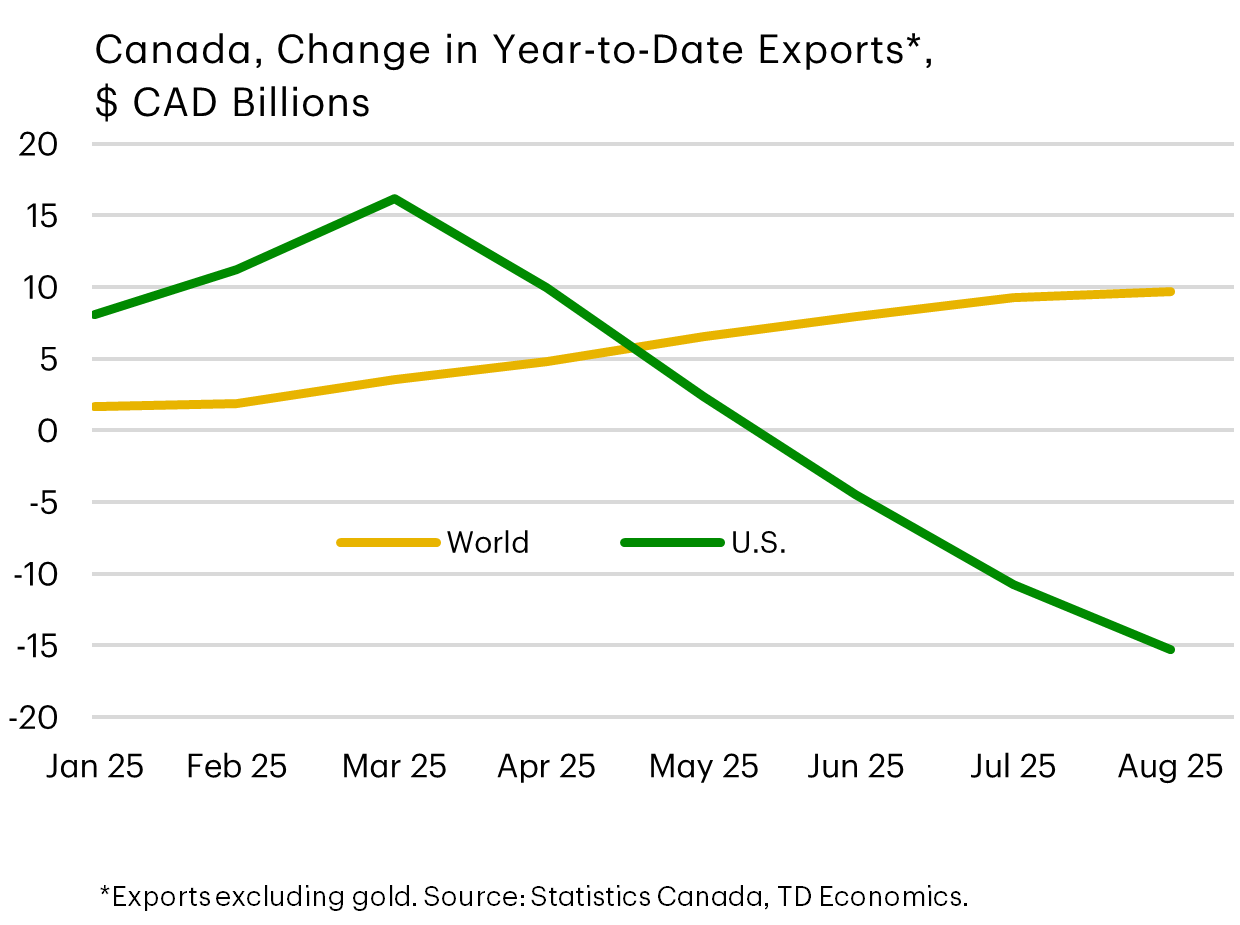

Canada is also succeeding in rotating its export markets. Although not as successful as China in fully offsetting the impacts, the speed of adjustment was certainly faster than many expected given the high trade dependence on the United States.

What and where are the next destinations?

- Oil exports are responsible for ~35% of the gain to other foreign markets (this excludes gold shipments and U.S. exports).

- Canada has increased exports to 27 partners by $6.6 billion.

- The biggest export swings have been to China, Denmark, Hong Kong, the Netherlands and Singapore.

- Although the dollar value hasn’t been enough to offset the decline to the U.S., which clocks in at $15 billion, it’s helped cushion the blow.

Tariffs Paid Not As High As The “Sticker Price”

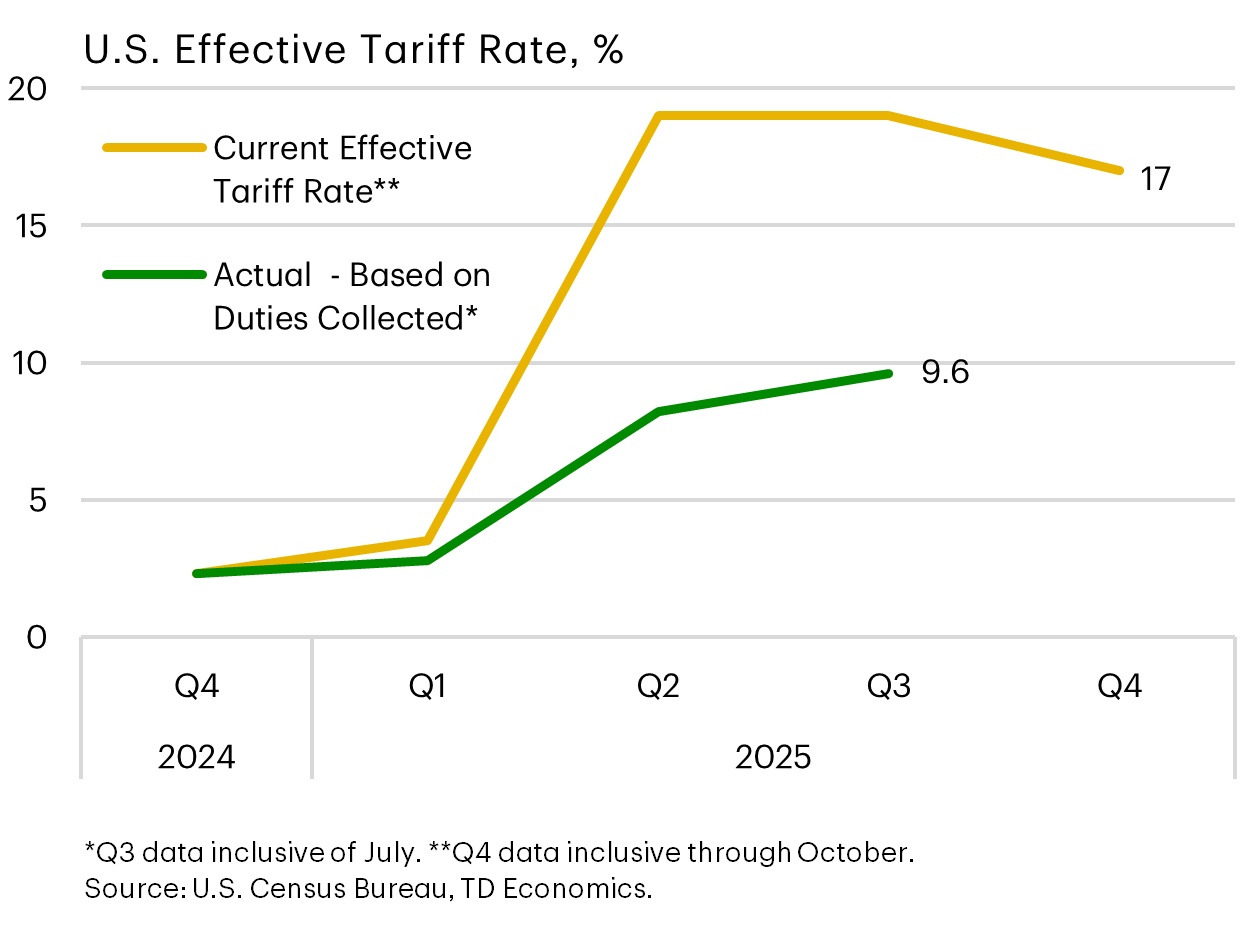

The global impacts of the trade war are also mitigated by lower duties collected relative to what is prescribed in the President’s executive orders. In turn, this is shielding consumers from the full downstream impact on prices not just for the U.S., but globally.

A combination of factors are at play, from supply chain substitution, to the U.S. administration adjusting tariffs on imports deemed critical, to companies absorbing some of the tariffs in their margins.

So stating a tariff rate is one thing, but rapid and evolving behavioral adjustments are shielding the global economy from a sharper impact.

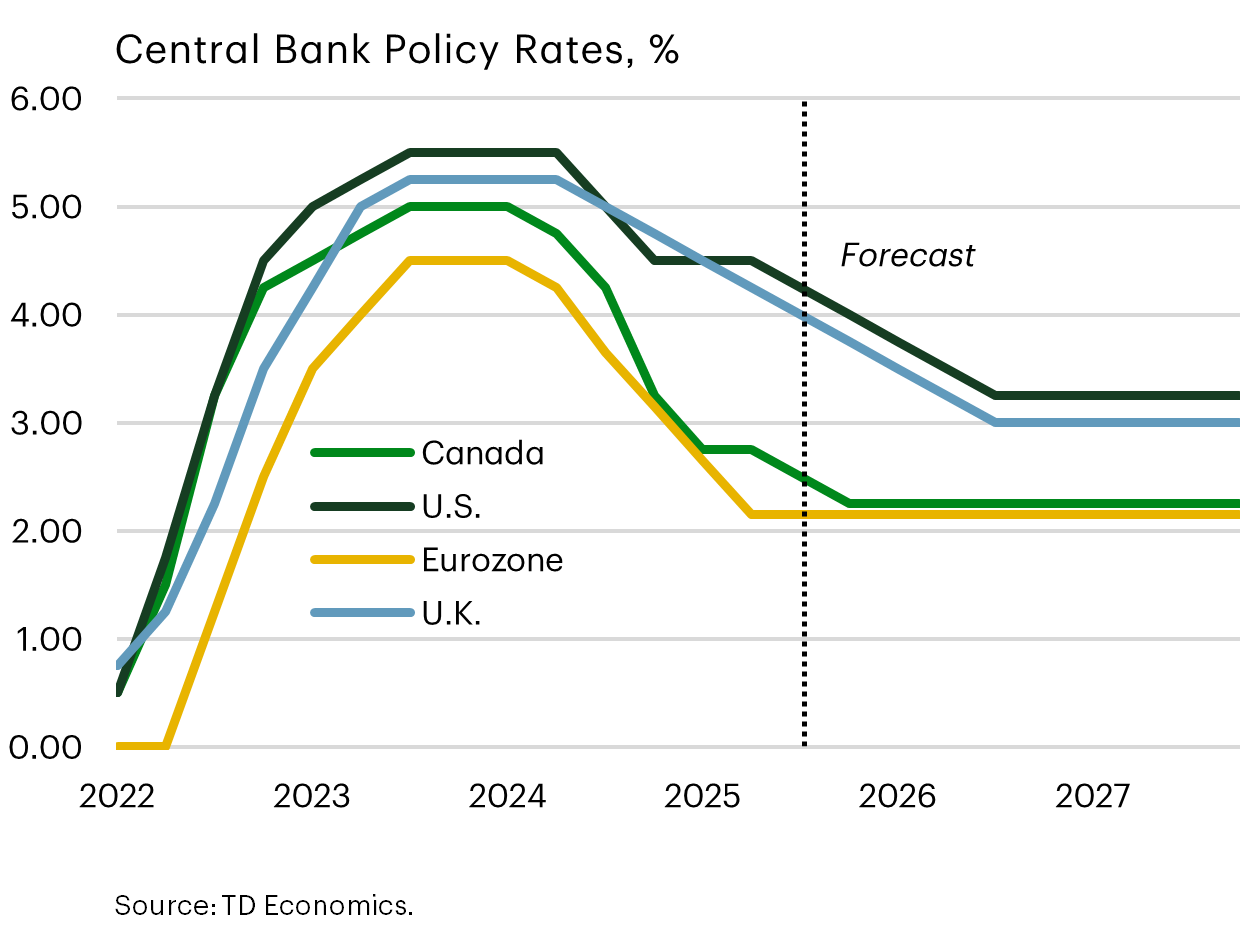

Central Bank Coordinated Rate-Cuts Lend A Helping Hand

And, of course, an improvement in financial conditions is also lending a helping hand, whether it’s in wealth creation from the stock market, a narrowing in credit spreads or lower interest rates.

At this point, we think the Bank of Canada is done on the interest cycle. It was out in front of most central banks in the speed and magnitude of decline, with 100 basis points occurring just this year under the trade war. With the policy rate at 2.25%, it’s already at the bottom end of the Bank of Canada’s neutral estimate.

That’s meaningful because Governor Macklem has repeatedly stated that monetary policy is limited in addressing the structural shift facing the economy. And at the last meeting, he was unusually prescriptive in forward guidance to note that economic growth would likely have to slip below their forecast, already very modest at just 1.1%, for them to react in 2026.

And now that the Federal government has stepped up to the plate with some big spends in capital investment, this takes some pressure off of the central bank to do the heavy lifting.

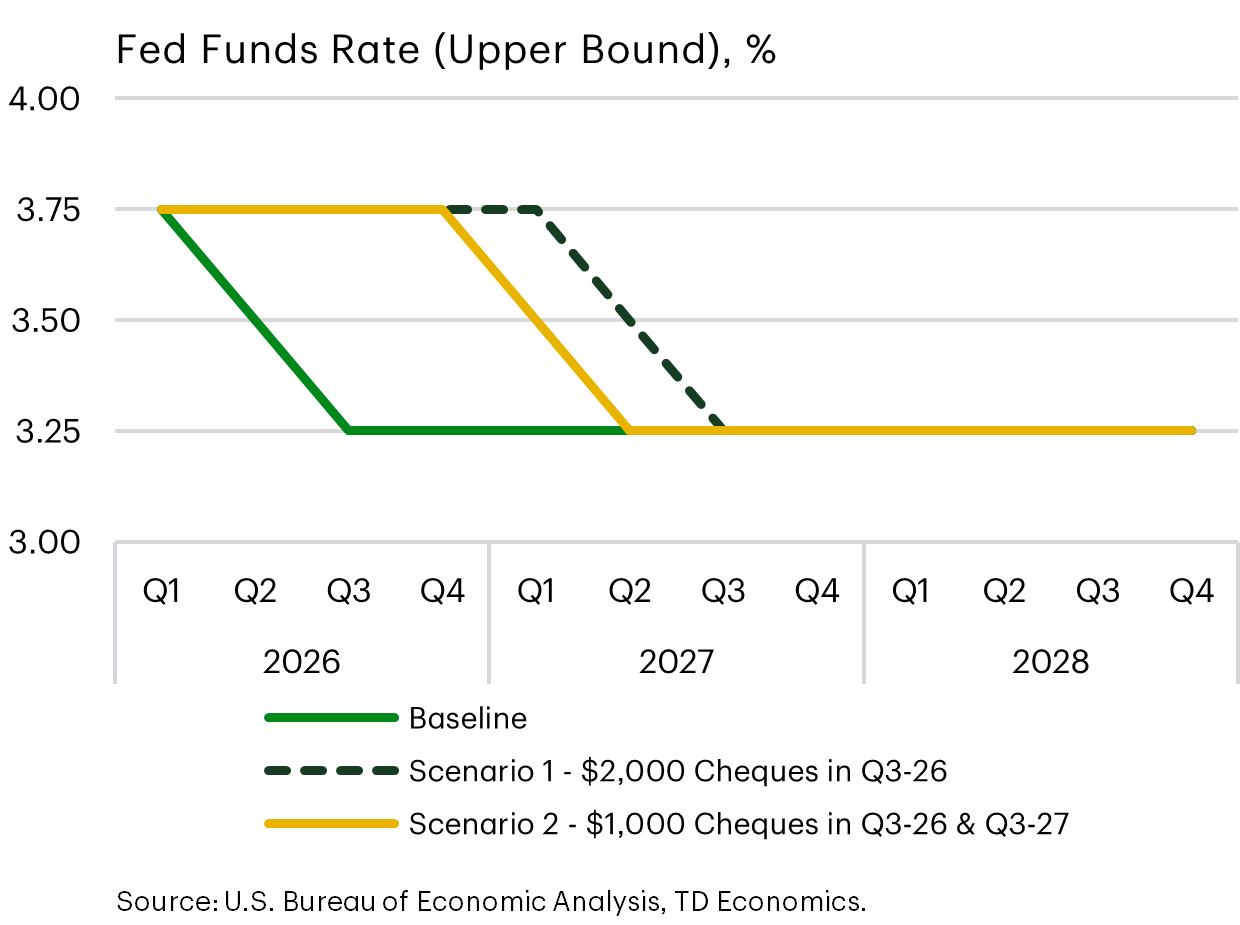

As for the Federal Reserve, our view hasn’t changed. We think they’re driving towards a resting place of 3.25% next year, but it might be in a stop-and-go manner given the data interruption from the government shutdown. So as a precaution, we pushed out the timing of hitting 3.25% to the third quarter, which also aligns to the new Fed Chair being in seat and likely wanting to put their own stamp on policy.

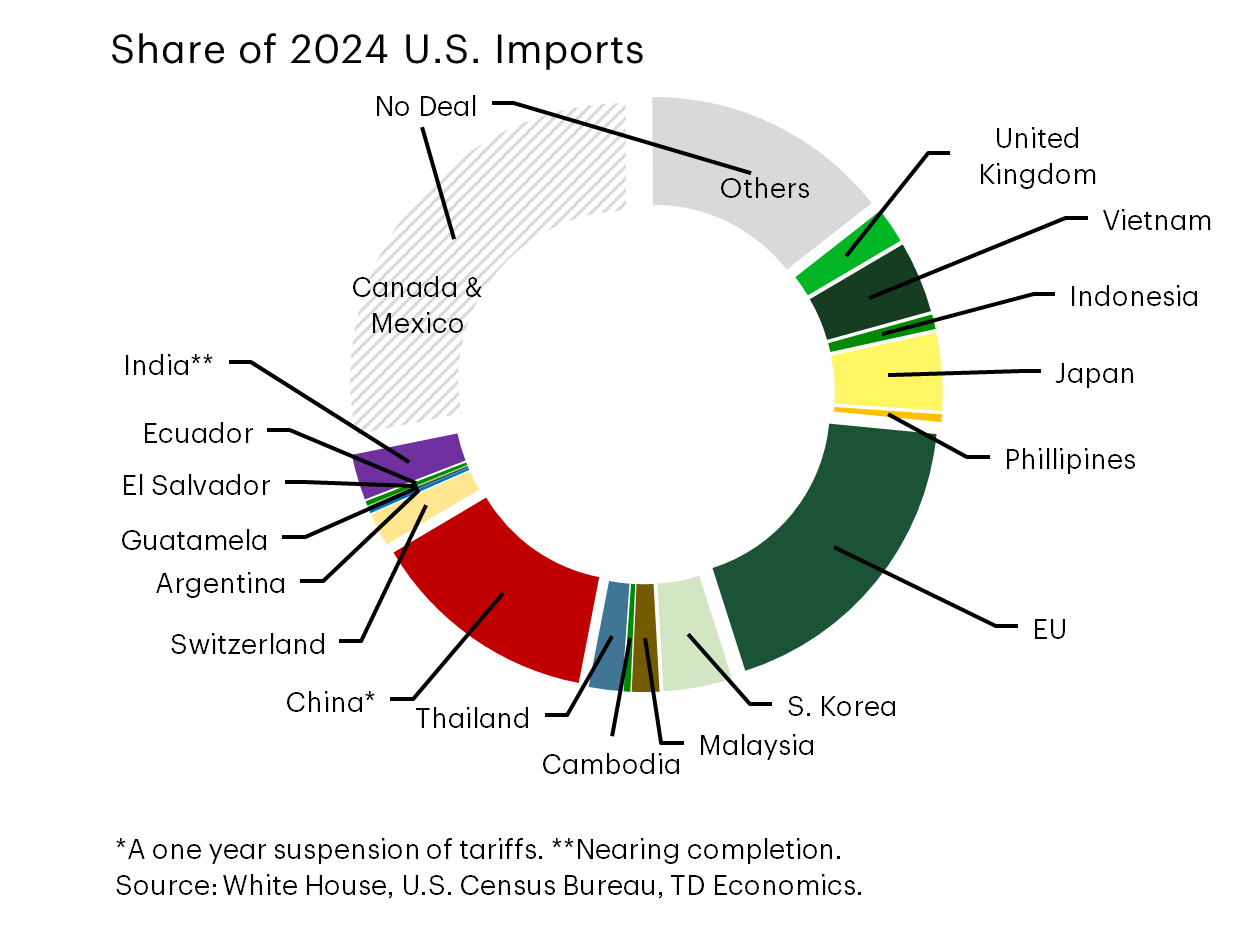

Who’s Left On The Wheel of Trade Fortunes? Canada and Mexico!

After a slow start to the year, trade deals were rapidly underway this quarter. Normally I’d say this provides more certainty to the business environment, but not as much as this donut graph leads us to believe.

First, since last quarter, the U.S. went from securing agreements with countries that covered 30% of their imports to today’s value of 60%. Canada and Mexico are the last remaining major trading blocks at 28% of U.S. imports.

Now, I’m using the words, “trade deal” liberally. Often details still need to be negotiated and the implementation process differs by country. Take the European-U.S. deal, which was announced in July, but requires E.U. parliamentary approval to remove tariffs and other barriers, such as limits to agricultural imports.

However, E.U. lawmakers are unlikely to vote before February and President Trump is already showing frustration and threatening retaliation. And the yardstick keeps moving. Recently, Commerce Secretary Lutnick indicated that lowering the tariff rate on steel and aluminum may require additional concessions on European rules for big tech companies.

So trade deals offer hope of stability, but are not yet creating that environment for businesses.

The text box is similar to what was shown last quarter on the common characteristics of the trade deals that Canada and Mexico will likely be facing. Nothing has changed except for item number four, where the China trade truce was placed at only a one-year timeframe, to be reviewed thereafter. This would certainly give Canadian businesses pause if CUSMA renegotiation in 2026 results in a higher review period frequency rather than the initial six-year cadence. If that were to happen, we would not anticipate a recovery in new business investment in Canada that’s oriented to serve the U.S. market.

Common Features in U.S. "Deals":

- 10-15% base tariff rate

+ removal of retaliatory tariffs

+ lower barriers to US companies (tariffs and regulation)

- Purchase agreements & Investment commitments

- (Some) Section 232 tariff relief

- New feature?

- Short timeframe on the tariff-truce (i.e. China)

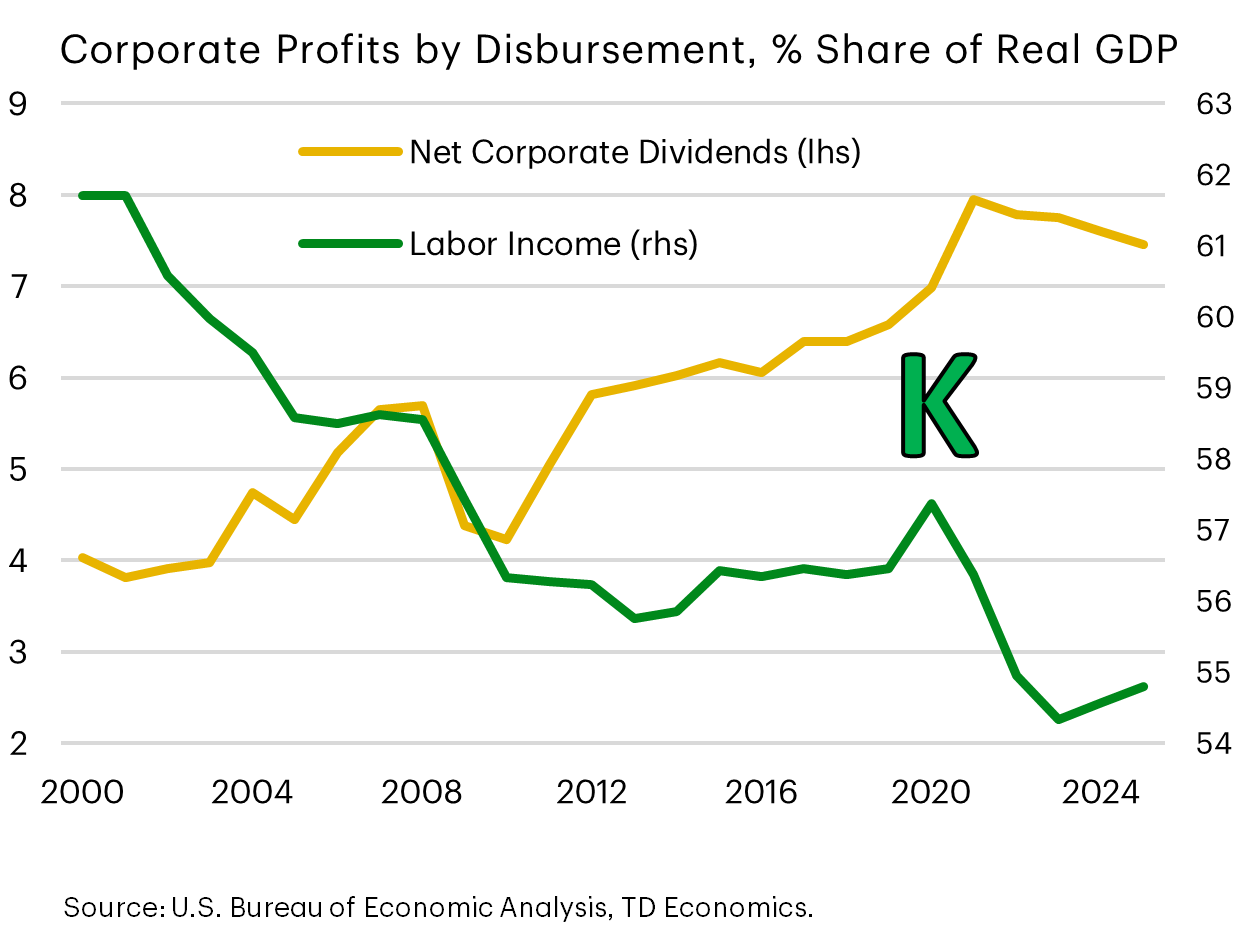

Why is The K-Economy Back In Focus For the United States?

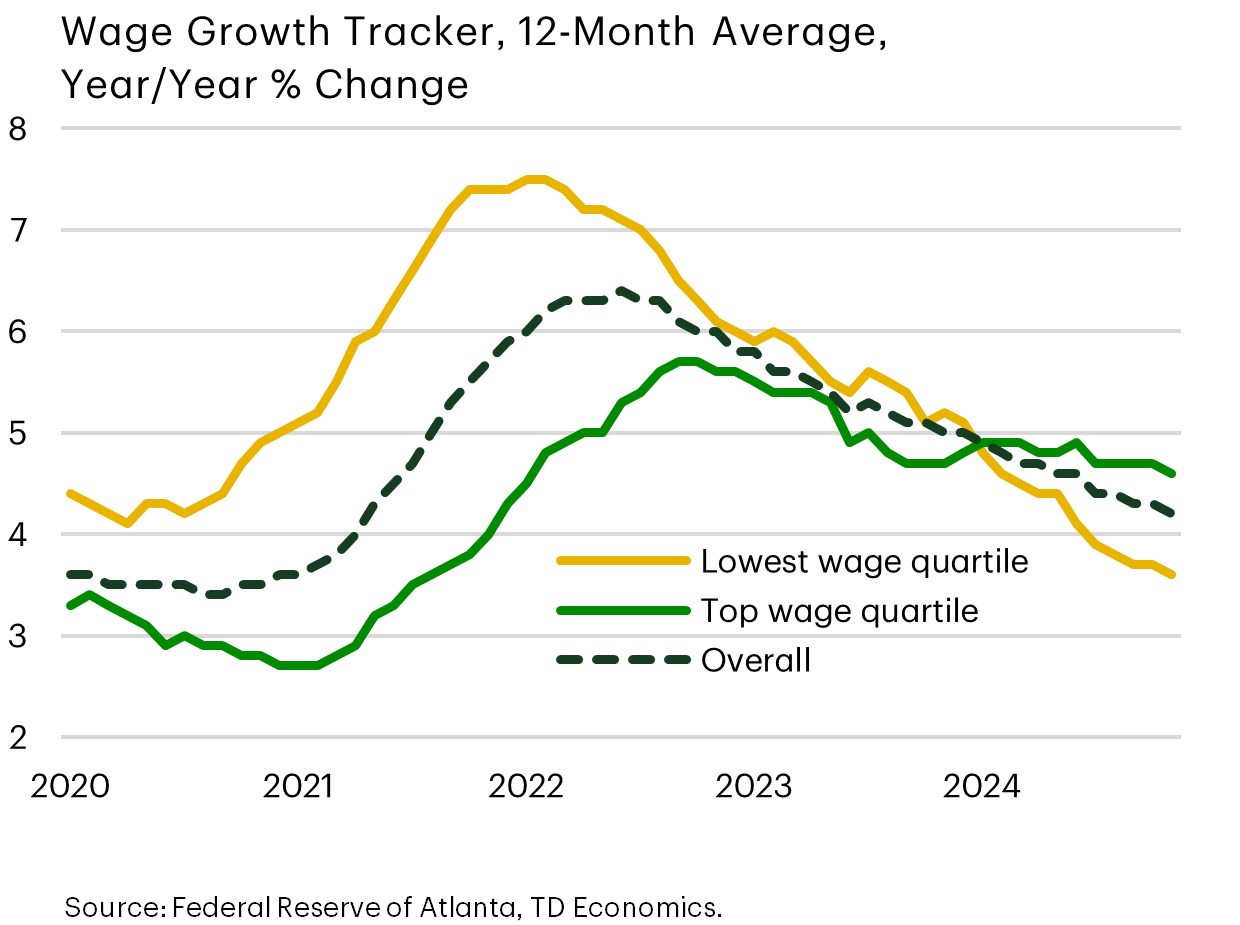

With Trump’s team busy cutting trade deals, two other themes popped up this quarter with a focus exclusively on households. Discussions on the K-shaped economy became front-and-center, with data reinforcing the step down in the benefits flowing from the job market to the average household relative to the benefits derived from the corporate sector.

The second, and related theme, honed in on household affordability, which caused the Trump administration to pivot policies to get in front of criticism that insufficient progress had been made on campaign promises to improve living costs. Both will be reviewed in more detail with the next few graphs.

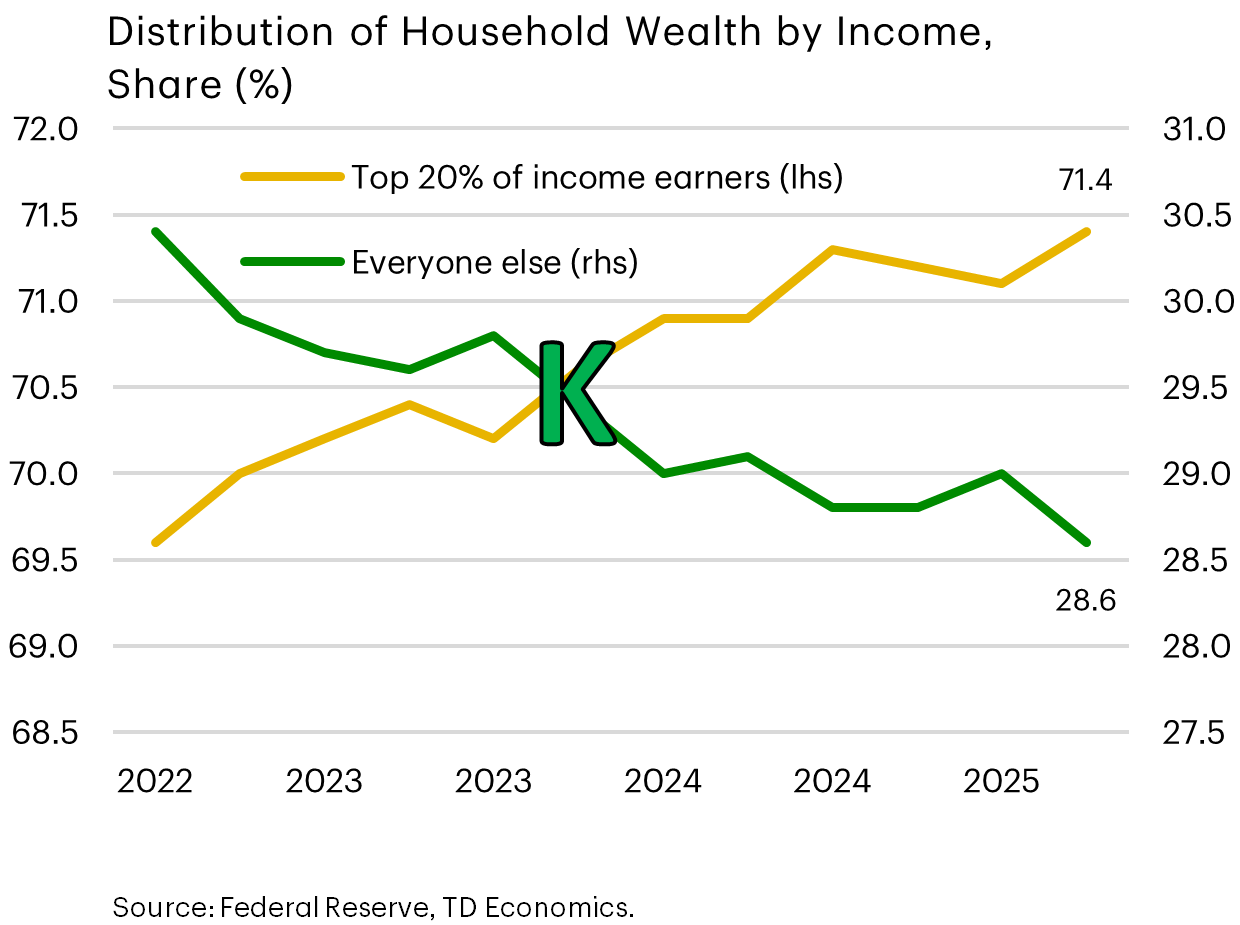

Wealth Concentration Deepens Among Higher Income Households

The distribution of household wealth across income earners is a perfect example of the differing and diverging trends that encapsulate a K-shaped economy. It’s not a new story that the wealth-pie grows for the top 20% of income earners. But it now has the attention of Trump’s administration after election campaigns focused on the cost of living by Democrats put up decisive wins, from Mamdani in NYC to dominant Democrat wins in Virginia and NJ relative to pollster expectations.

Why? The incredible gains in the stock market this year tend to advantage the top 20% of income earners, where financial assets represent just over 80% of their total wealth compared to 66% for the remaining households. And the high U.S. interest rate environment risks further widening the disparity between lower- and higher-income groups. High-income households maintain greater savings, allowing them to benefit from elevated rates, whereas lower- and middle-income households tend to face increased borrowing and debt-servicing costs.

Lastly, because lower- and middle-income households derive most of their income from employment, the deceleration in job demand is compressing wages more rapidly for this group, building on the tension within this debate.

The White House Message: Lower Prices, Bigger Paychecks

Enter the Trump-team’s strategic pivot.

First attempts to convince Americans that prices were falling and their paychecks were outpacing the cost of living proved tone-deaf. The contents of the box below is pulled from the White House page.

The media leaned into criticism of the administration’s use of the Breakfast Basic Index referenced by DoorDash. Although I’m a fan of avocados, it’s a less conventional choice for the every day American family. And even for those who consume them regularly, there would be less excitement over a 9 cent drop in avocados relative to a $4 dollar increase in ground beef from the prior year, which makes up a larger share of their weekly grocery bill.

And the last point made on wage growth outpacing restaurant price increases is a narrow lens relative to the day-to-day expenses of households.

White House Message:

President Trump has tamed inflation

- The Breakfast Basics Index — three eggs, a glass of milk, a bagel, and an avocado — decreased 14% between March and September and 1.7% over the past year.

- The Everyday Essentials Index — toothpaste, shampoo, toilet paper, laundry detergent, pain medicine, and diapers — fell over the past year.

Americans are beginning to see price declines

- Over the past year, prices actually declined for cheese, cereals & bars, fresh fruits, frozen meals, packaged meals, condiments, batteries, computers & accessories, phones & accessories, medicines, oral care, vitamins & supplements, outdoor products, and toys & games.

President Trump’s policies are fueling wage growth

- Nationally, wage growth is outpacing restaurant price increases — including at the city level in half of the cities studied.

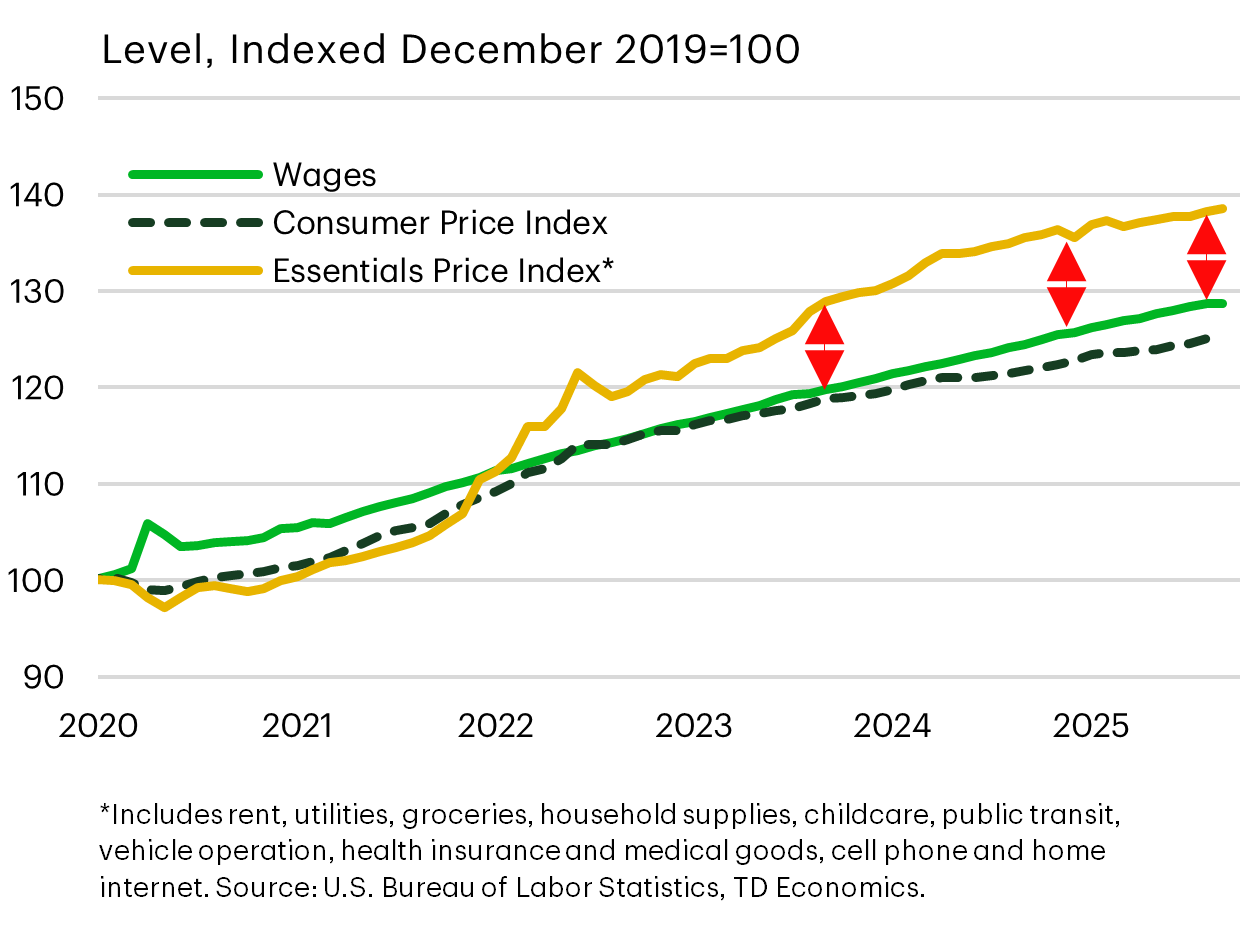

Inflation Feels Higher – Wages Not Keeping Up With Essentials

To address this, we created an “essential price index” that’s more representative of the average American experience in areas where they have little choice on substitution or avoiding payments. These include rent, utilities, childcare, public transit, and so forth…captured in the list footnoted in the graph.

Graphing the level of that index relative to wages shows there’s been zero compression between these metrics. The red arrows are all the same height since the end 2023, pushing against repeated promises since the campaign trail to end inflation and bring down the prices of all goods.

For an economist, that was never a realistic promise but obviously had popular appeal. Now, with nearly a year under the Administration’s belt and with mid-term elections coming into scope, perceptions of poor affordability is public enemy #1 now for Republicans.

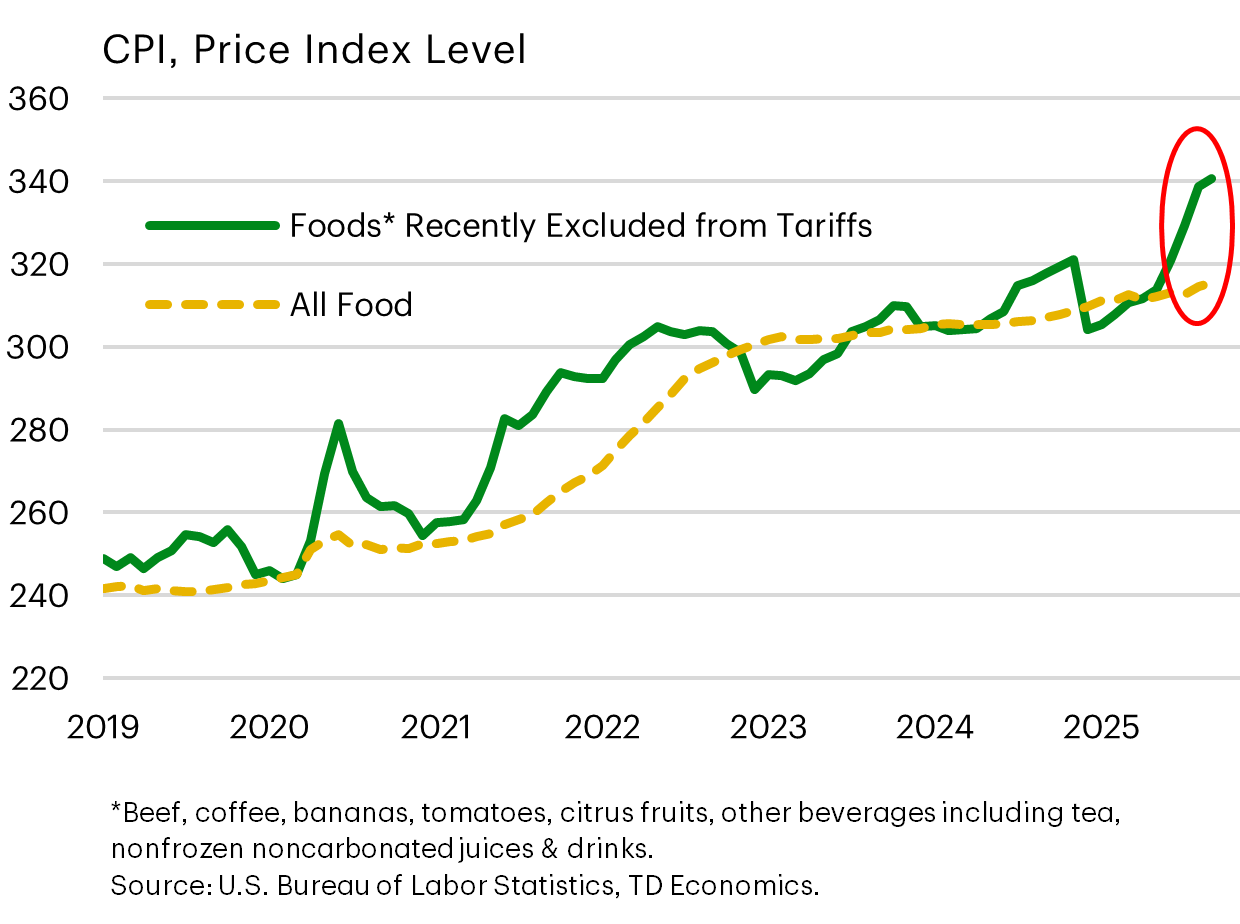

Policy Shift #1 – Tariffs Removed On 200+ Food Items

So on November 14, the Administration announced the removal of reciprocal tariffs on a list of over 200 food products imported into the United States. We created a price index of those items to show the acceleration and why their messaging wasn’t landing for main street households.

Had President Trump not removed tariffs from these items, the picture would have worsened into 2026 because the full scope of reciprocal tariffs only took effect in August. Prior to that date, grocers were stockpiling where possible, with imports of these products rising 34% relative to last year. And, of course, you can’t do that with fresh vegetables or meat.

While the optics is high for these items, from a macroeconomic perspective, the overall impact on economy-wide inflation will be more limited because these categories account for less than 2% of total U.S. imports. And for the Federal Reserve, their core measure of inflation excludes food and energy when assessing broader underlying inflationary trends. But there’s no doubt that this policy pivot should help support consumer sentiment.

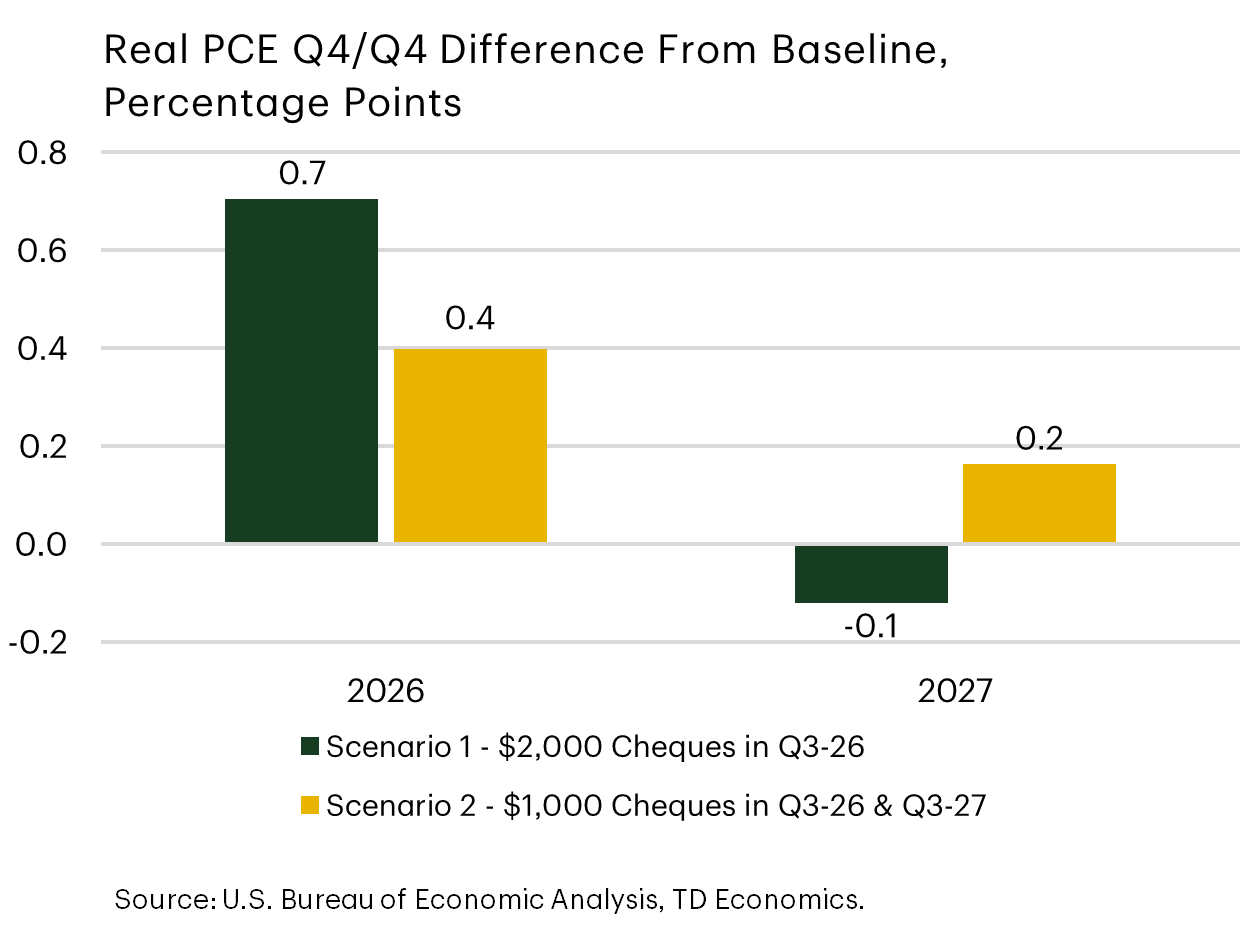

Policy Shift #2 - “Tariff Dividends”

Two other Republican policy proposals came about following wins by Democrats that put cost-of-living concerns front-and-center.

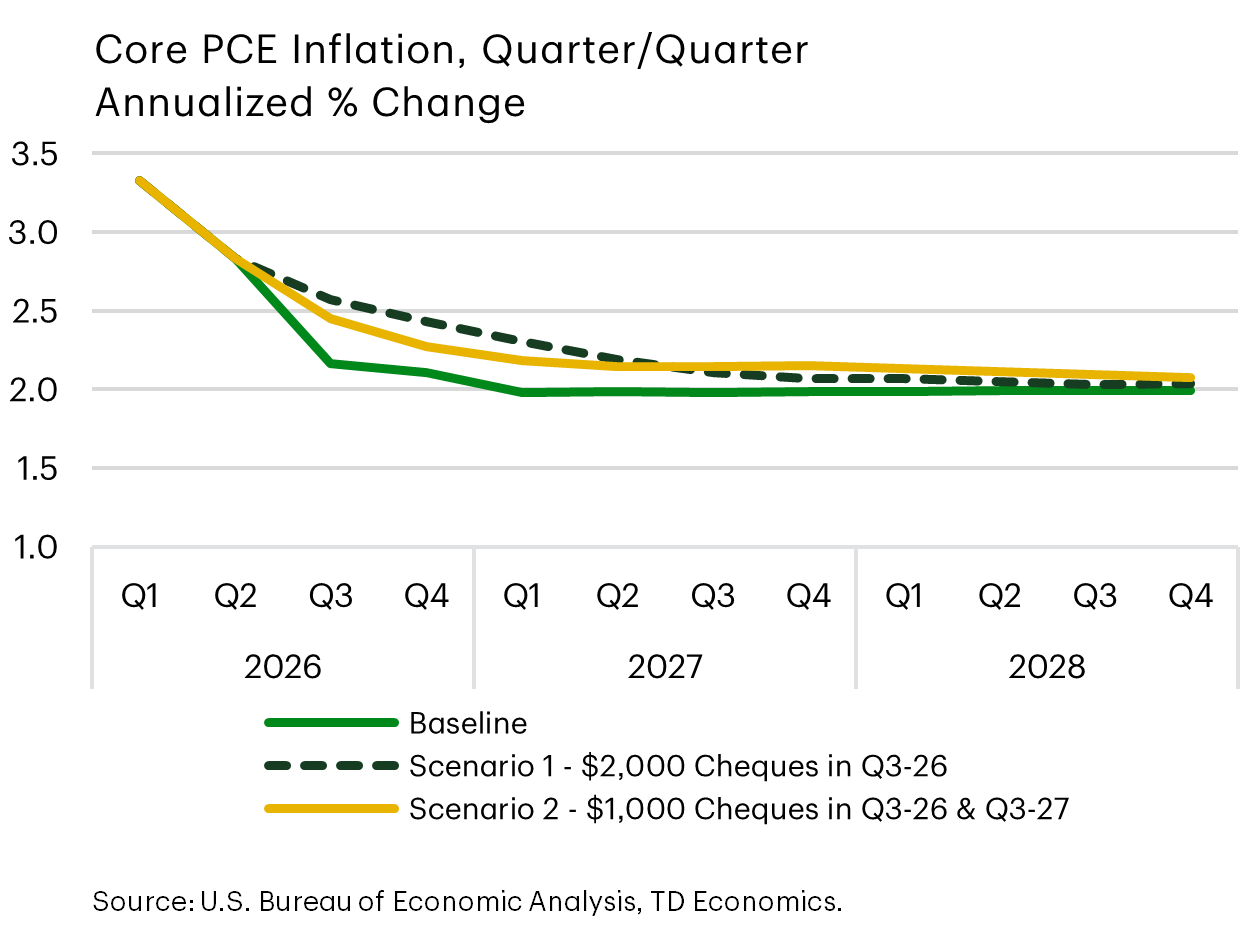

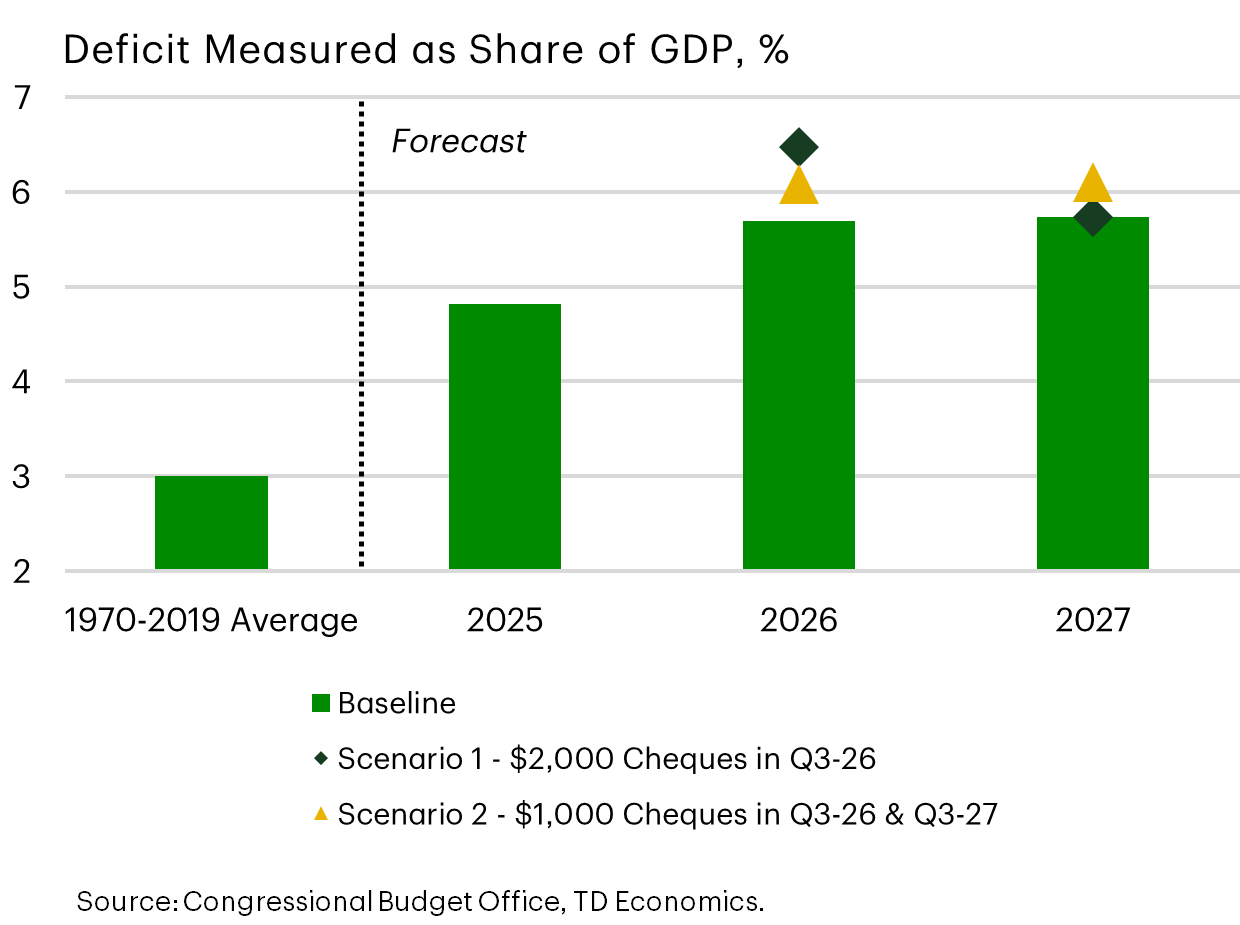

The most intriguing was President Trump’s mention to distribute $2000 to households via the collected tariff revenue. It’s since been reframed as a tariff dividend. Analysts quickly jumped on the math to show that the collective amount to Americans would exceed the value of the collected tariffs annually. Doing so would put the stimulus on par with the American Rescue Plan. The black lines and bars in these graphs show the large knock-on impacts to consumer spending, inflation, our fed funds expectation and government deficits.

Since this seemed unrealistic we created a second scenario deemed more realistic to how rhetoric has since evolved, represented by the gold lines and bars. We assume the tariff dividend concept reflects a 50% distribution of revenues to tax filers with incomes below the $80,000 threshold, and the rest of the tariff revenue dedicated to debt paydown. And we assumed that the holds in place a couple years, rather than being a one-off payment.

Doing so still provides a meaningful lift to consumer spending, in part because lower income households are more liquidity constrained, causing their spending multiplier from a government transfer to be higher than other segments of the population, where there’s a greater tendency to save the extra funds.

The bottom line is that anything that materializes with this concept of a tariff dividend would boost our economic outlook, but it needs to be viewed dynamically with adjustments in our fed policy expectations and deficit projections. In other words, markets may impose a higher risk premium on yields that erodes some of the net benefit to households.

Policy Shift #3 – Housing Affordability

The second affordability proposal by President Trump relates to housing and falls under two concepts that would lift our forecast for both home sales and prices.

The first is the idea of portable mortgages – which allow borrowers to transfer their existing loan and rate to a new property. This is being discussed to ease the “locked-in” effect that’s holding back supply because people don’t want to give up favorable mortgage rates for new contracts that are above 6%.

The second proposal is the 50-year mortgage, which could drop the average mortgage payment on a median-priced home by $150-250/month. However, extending the amortization period also nearly doubles the interest paid over the lifetime of the loan, if carried to maturity. It’s possible the 50-year mortgage would have limited appeal.

Regardless, both policy measures require time for legislative changes and implementation, which could take up to a year. Of the various new policy proposals, the tariff dividend has more far-reaching tentacles into the economy relative to any changes that may occur in the mortgage market.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share this: