Highlights

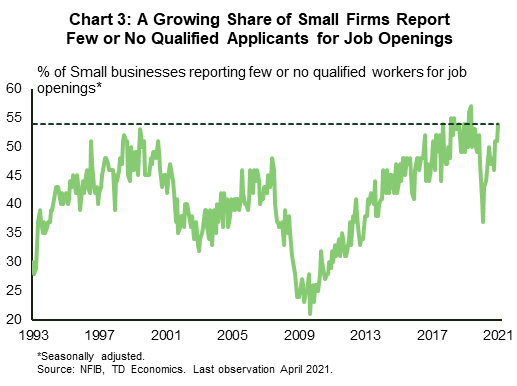

- Unfilled job openings among U.S. small businesses rose to a record high in April. Despite still-elevated unemployment, a signficant share of small businesses – some 54% – report few or no qualified applicants to their job postings.

- The reasons behind the difficulty in finding qualified workers are not straightforward. Recent headlines have gravitated toward the role that enhanced unemployment benefits may be playing in discouraging some individuals from returning to the workforce. But, there are likely many other important factors at play (e.g. skills mismatch, fear of contracting COVID-19, childcare obligations at a time when many schools and daycares remain closed).

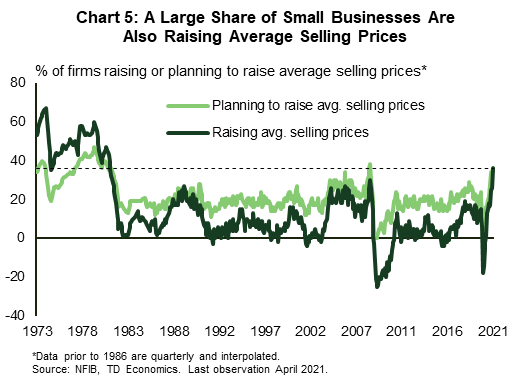

- Some small businesses (31%) are boosting worker compensation in order to attract the right talent. At the same time, a significant portion of businesses (36%) are also uploading the added costs from wages or other input costs to the end-user through higher prices. This supports the "reflation" narrative.

- Some of the obstacles that are making it difficult to find workers will dissipate as the pandemic moves further into the rear-view mirror, but in the near-term, it may weigh on the pace of the labor market recovery.

The U.S. labor market has made considerable progress in recent months, but it still has a long way to go before it's back to pre-pandemic levels. The latest jobs report showed that in April there were 8.2 million fewer Americans employed than prior to the pandemic and 9.8 million officially counted as unemployed. Broader measures of unemployment put the tally even higher. For example, the number of people receiving unemployment benefits from all available programs (including pandemic emergency programs) stood at 16.9 million in the week ending on April 24th. Indeed, by all accounts, there's still a lot of slack left in the labor market. Yet, despite this, there are also growing voices among businesses about the difficulty of finding qualified workers.

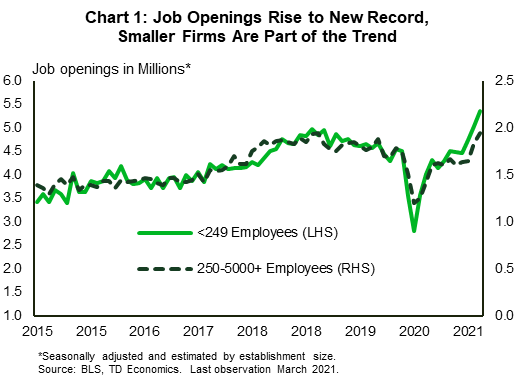

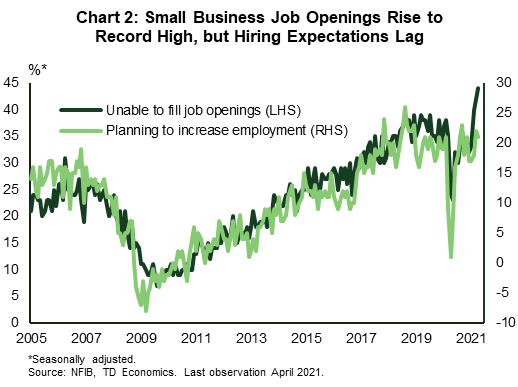

These concerns are rooted in a surge in unfilled job openings, as the pandemic continues to loosen its grip on the economy. Data from the Job Openings and Labor Turnover Survey shows that job openings expanded by nearly 1.4 million during the first three months of the year to 8.1 million – a record high. Firms of smaller sizes have joined in on this trend (Chart 1). A survey from the NFIB, which focuses exclusively on small businesses, reveals more of the same, with job openings setting a new record high for the third consecutive month in April (Chart 2).

Small Businesses Struggle to Find Qualified Workers

Small businesses generally reflect employees that exhibit a higher quit rate relative to those of the largest firms. While job openings among them are plentiful, expectations that these openings will be filled (and thus result in an increase in employment) lag (Chart 2). This is likely a testament of the difficulties that small businesses face in hiring the right talent in the current environment.

Last month, about a third of small businesses reported few qualified applicants to their openings, while more than a fifth reported no applicants. This makes for a total of 54% of businesses reporting few or no qualified applicants – not far off from the pre-COVID levels and among the highest in the survey's history (Chart 3). What's more, despite the myriad of issues that small businesses cite as areas of concern, such as competition from large business, taxes and inflation (the latter has seen a notable uptick recently), they continue to point to quality of labor as the single-biggest problem.

Several Factors are Contributing to the Difficulty

Pinpointing the reasons as to why businesses are having a hard time finding qualified workers when there's plenty of labor market slack is not straightforward. Recent headlines have gravitated toward the role that enhanced unemployment benefits may be playing in discouraging some individuals in returning to the workforce. In this vein, many states are now gearing up to remove the enhanced unemployment benefits early. The role of unemployment benefits should not be overlooked, especially when it comes to the potential impact for lower-paid industries. But, evidence that even more highly paid industries are struggling to fill job openings (i.e. manufacturing and construction), speaks to a much broader issue. Indeed, a number of other factors are suspected to be at play.

A skills mismatch is another element to consider. The pandemic appears to have had a profound impact on those that became unemployed in making them reassess their career paths. A recent study shows that two thirds of those that lost their jobs had "seriously" thought about changing their field of work or occupation (see here). The fact is that skills from one industry may not be easily and readily transferable to another industry. For example, skills in leisure and hospitality, the sector that bore the pandemic's brunt on job losses, may not be adequately transferable to manufacturing. The goal of upgrading their skills in the hopes of switching careers can make some workers hesitant to jump in the same industry or role as before, while unemployment benefits keep rolling in.

A steep reduction in immigration and the fact that there were plenty of relocations within the country during the pandemic (such as the shift in population to the suburbs, or the Sunbelt), could also be contributing to the misalignment in the supply and demand of labor. At the same time, while the fear of contracting the virus has eased recently, it is likely still weighing on the eagerness of some workers to get back to work. Similarly, the balancing of family obligations while the pandemic is ongoing (i.e. caring for older parents or children when some schools and daycares remain closed), may also be limiting the ability of some workers to get back on the payroll. Competition from large businesses, although not cited as a major obstacle at the national level, is likely playing a notable role in some regions.

Large employers like Amazon, Walmart, McDonald's, Costco, Chipotle and many others have boosted or are planning to further boost wages in order to attract workers (see here).

Raising Worker Compensation, an Effective Way to Retain Workers and Attract New Talent

Most of the aforementioned obstacles will dissipate as the pandemic further loosens its grip on the economy (i.e. fear of contracting the virus will ease further and more daycares and schools will reopen). But, for the here and now, one of the most effective ways to attract the right talent would be to increase compensation. Plenty of small businesses are doing just that. The share of firms increasing worker compensation rose to 31% in April – one of the better showings in NFIB survey's history (Chart 4). Meanwhile, another 20% plan to raise worker compensation in the next three months.

The ability of small businesses to keep raising wages will be limited by the squeeze on profit margins. Sales and earnings have trended higher in recent months, facilitating the increase in compensation. Should the expanding economic cycle continue unperturbed, a continuation of the positive earnings trend should allow more increases. However, it should be noted that as of now, small businesses are still somewhat skeptical regarding an improvement in the economy.

Another way for firms to retain profit margins is to upload some of the added costs from wages and other input costs to the end-user through higher prices. Again, plenty of small businesses are doing just that, with the share of those that are raising average selling prices increasing to 36% – the highest level since the 1980s (Chart 5). Meanwhile, an equal share of businesses are also planning to raise prices in the months ahead. This is yet an added element that supports the "reflation" narrative.

Bottom Line

All told, the fact that small businesses are having difficulty in finding qualified workers at a time when there's still plenty of labor market slack should be added to the list of anomalies caused by the pandemic. While some of the obstacles that are currently at play will dissipate with time, in the near term, it may weigh on the pace of labor market recovery.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share this: