Sizing Up the U.S. Debt Ceiling Agreement

Andrew Foran, Economist | 416-350-8927

Date Published: June 1, 2023

- Category:

- US

- Financial Markets

- Government Finance and Policy

Highlights

- An agreement to suspend the debt ceiling was reached on Memorial Day weekend and after being passed by the House of Representatives on Wednesday evening has now been sent to the Senate.

- The agreement, outlined in the Fiscal Responsibility Act of 2023, suspends the debt ceiling for two years and caps discretionary spending for 2024-2025. This is expected to marginally reduce the fiscal deficit over the next decade and have a relatively small impact on the economy overall.

- With default avoided, focus will now turn to near-term market risks related to both a surge in T-bill issuance by the Treasury to rebuild its liquidity buffer and the potential for a U.S. credit rating downgrade.

The agreement reached between President Biden and Congressional leaders on Memorial Day weekend to suspend the debt ceiling until 2025 appears to be successfully clearing procedural hurdles on its way to Congressional passage. The deal – outlined in the freshly minted Fiscal Responsibility Act (FRA) – passed the House by a comfortable margin on Wednesday and will now proceed to the Senate. With only a few days left until the Treasury potentially runs out of funds, it is imperative that the agreement reaches the President’s desk in a timely fashion. The deal will prevent catastrophic default, but won’t change the economic or fiscal landscape in any great way. We estimate that economic growth will be roughly 0.1 percentage points lower in 2024 and that the fiscal deficit as a share of GDP will be half a percentage point lower by 2030.

What Is Included in the Agreement?

The FRA is centered around a set of spending caps which will remain in place for the next two years. For 2024, there will be a 3.3% increase to defense spending while non-defense discretionary (NDD) spending will be kept roughly equal to 2023 levels. In the following year, total discretionary spending would grow by 1% relative to 2024 levels. The FRA also rescinds several previously legislated expenditures, including roughly $30 billion in unspent pandemic funding and $1.4 billion of last year’s IRS funding increase, with the latter set to be reappropriated to other NDD categories. In addition, Biden’s 2024 budget allocation for the Toxic Exposure Fund – a fund that covers veteran medical expenses related to environmental exposure – was included in the FRA, which represents a 33% increase relative to 2023 levels.

There were also several changes to non-monetary items related to outlays. This included adjustments made to Supplemental Nutrition Assistance Program (SNAP) benefits, with the upper limit of the work requirement for able-bodied adults without dependents rising to 54 from 49 and additional waivers included for veterans and homeless people. In addition, the FRA included permitting reform related to streamlining the environmental review process, with time limits of 1 -2 years implemented based on the complexity of the review. This section of the bill also deemed the Mountain Valley Pipeline project of national interest and approved all of its outstanding permits, thus clearing the way for the natural gas pipeline between West Virginia and Virginia to complete construction. Lastly, federal student loan repayments and interest accrual, which have been on pause since the passage of the CARES act in March 2020, are scheduled to resume in late August. This is not a net new development as the Department of Education had previously announced this timeline, but the decision would now be codified.

An important caveat here is that final budget allocation decisions will not be decided until the budget appropriations process begins in late summer. This will be when decisions are made on what spending categories within non-defense discretionary spending will be cut to meet the spending caps. If Congress is unable to pass the required appropriations bills by January 1st of 2024 or 2025, then the FRA includes provisions that will require both defense and non-defense discretionary spending to be reduced by 1% relative to 2023. In recent history, Congress has rarely met the October 1st deadline (the start of the fiscal year) for passing all the appropriation bills and has used continuing resolutions to give themselves more time to pass the bills. If a continuing resolution is still in place on January 1st in either 2024 or 2025, then the 1% discretionary spending cut will apply. For reference, the 2023 budget was signed into law on December 29th, 2022.

What Hurdles Remain in Congress?

Although the text of the FRA has been approved by the administration and congressional leaders, it still must pass through both chambers of Congress. House representatives were called back from their Memorial Day recess (previously scheduled to last until June 5th) early in order to begin the process of passing the FRA. This began on Tuesday when the House Rules Committee narrowly voted to send the bill to the House floor by a margin of 7-6. Then came the much-anticipated vote in the House of Representatives Wednesday night in which the FRA passed 314 – 117, with 67% of Republicans and 78% of Democrats voting ‘aye’. The bill should be able to pass the Senate; however, there could still be some hurdles along the way as some senators have voiced their intention to try to stall the bill or add additional amendments. Senate majority leader Chuck Schumer advised members to be prepared to work through the weekend should it be necessary as the bill has to pass before Monday. Even if the bill follows an expediated path to Biden’s desk, the tightness of the timeline will keep markets anxious until the bill passes the Senate.

What Concessions Were Made?

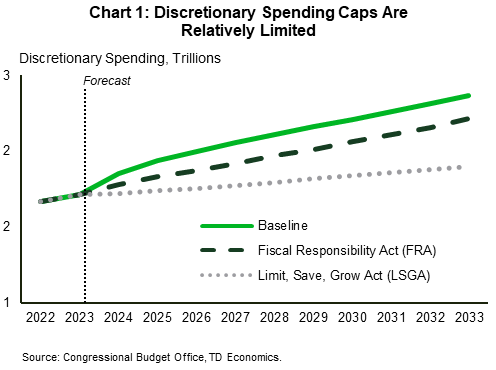

If the starting point of the negotiations for Democrats is considered to be an unconditional debt ceiling increase and the starting point for Republicans is considered to be the ‘Limit, Save, Grow Act’ (LSGA), then both sides yielded notable concessions. The LSGA aimed to cut discretionary spending in 2024 back to 2022 levels, then cap its annual growth at 1% for the following decade. In comparison, the FRA caps allow discretionary spending to increase by roughly 1% in 2024 and 2025, with no enforceable limitations in the following years (Chart 1). Other big-ticket items that were included in the LSGA but absent from the FRA include the repeal of energy tax credits & spending from the Inflation Reduction Act, eliminating the administration’s student debt cancellation plan, and expanding work requirements in Medicaid.

The concessions offered by Democrats include capping discretionary spending for the next two years, clawing back some of the increase in funding for the IRS outlined in the Inflation Reduction Act last year, and expanding the SNAP work requirement age for able-bodied adults without dependents to 54 from 49. In addition, the approval of all outstanding permits for the Mountain Valley Pipeline could be considered a concession although opinions vary within the Democrat party. Bipartisan achievements within the FRA are mostly related to spending for defense and veterans. For example, the 3.3% increase in defense spending in 2024 and the increase in funding for the Toxic Exposure Fund were both included in Biden’s budget proposal from March but were favorable to most Republicans as well. At the end of the day, both sides can claim some victories from the FRA.

How Does This Affect the Fiscal Outlook?

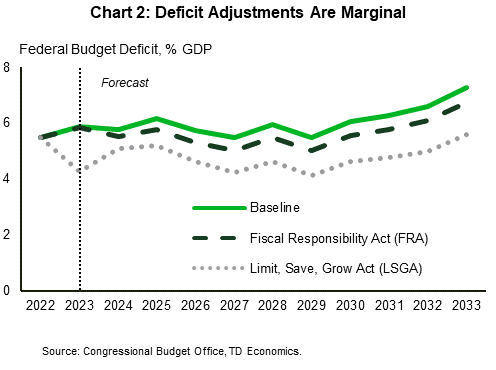

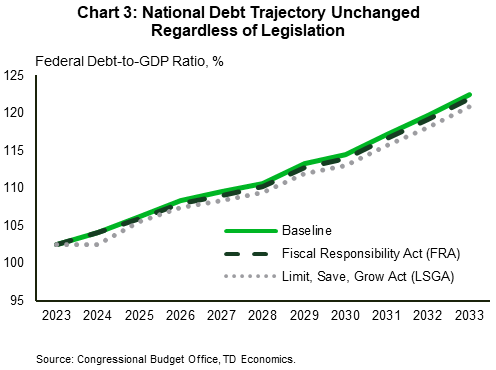

While the deal may have prevented a potentially catastrophic default, it does little to alter the United States’ unsustainable longer-term fiscal path. On the contrary, it barely puts a dent in the deficit and debt profiles (Charts 2 and 3). The core of the savings accumulated by the FRA over the next decade will come from the caps on discretionary spending, with the CBO estimating that it will save $1.3 trillion over the next decade. Other than that, the only other savings from the FRA expected over the next decade come from the lower interest expenses ($188 billion) and the recission of unused pandemic spending ($11 billion). Interestingly, the cuts to IRS funding are expected to add to the deficit by $2.1 billion over the next decade due to foregone revenue from clamping down on tax avoidance. In total, the FRA is expected to save the U.S. $1.5 trillion over the next 10 years, but with a deficit of $1.4 trillion in 2022 alone, it will do little to alter the current debt trajectory of the U.S.

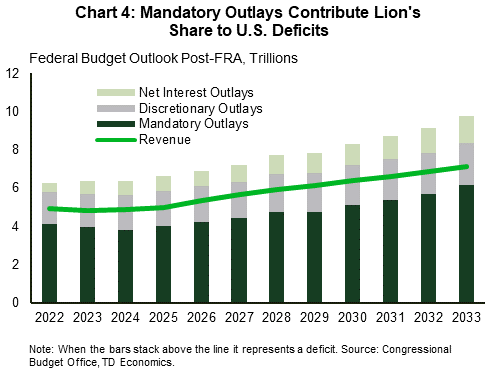

The reason for this is because Congress largely targeted non-defense discretionary spending, which only represents about 13% of total fiscal expenditures. Even if Congress set total discretionary spending (including defense) to zero in 2030, it would still run a deficit due to the sheer size of mandatory outlays (Chart 4). By 2030, the CBO expects that mandatory outlays will consume 80% of the federal government’s revenue. This is largely due to the aging population in the U.S. and the upward pressure it is expected to put on social security and Medicare payments. If the U.S. is serious about reducing its deficit, it will need to consider enacting reforms to its mandatory expenditures and/or procuring new sources of revenue.

The reason for this is because Congress largely targeted non-defense discretionary spending, which only represents about 13% of total fiscal expenditures. Even if Congress set total discretionary spending (including defense) to zero in 2030, it would still run a deficit due to the sheer size of mandatory outlays (Chart 4). By 2030, the CBO expects that mandatory outlays will consume 80% of the federal government’s revenue. This is largely due to the aging population in the U.S. and the upward pressure it is expected to put on social security and Medicare payments. If the U.S. is serious about reducing its deficit, it will need to consider enacting reforms to its mandatory expenditures and/or procuring new sources of revenue.

How Will This Affect the Economy?

Before the details of the FRA were known, the U.S. economy was expected to slow notably over the course of this year as elevated interest rates weighed on consumers and businesses. In terms of the net new additions included in the FRA, it is expected to have a minimal impact on the economy. In summary, the bill included no new taxes, increased defense spending, and kept non-defense discretionary spending roughly flat for 2024. The caps on discretionary spending could shave 0.1 percentage points off GDP growth next year, with the peak impact expected to be in 2024. The approval of outstanding permits for the Mountain Valley Pipeline will likely be an offsetting boost for the regional economy of West Virginia and Virginia, but at the national level the impact is expected to be minimal.

The greatest impact to the economy from the FRA will likely come in the third quarter of this year, when the three-and-a-half-year moratorium on federal student loan repayments and interest accrual ends. Although this was already expected to be the timeline based on the Department of Education’s extension announcement last November, the FRA essentially removes uncertainty from the timeline and prevents the Biden administration from extending the moratorium again. Many consumers, already facing high prices and high interest rates, are expected to see their monthly expenses increase by hundreds of dollars. This is expected to be a material risk to consumption and economic growth in the second half of this year. In addition, the Supreme Court decision on the Biden administration’s student debt relief program is expected to be rendered later this month, which if struck down may also weigh on consumption this year.

How Are Financial Markets Reacting?

After the deal was officially announced Saturday evening and the text of the bill made available 24 hours later, most markets had the holiday on Monday to mull over the details. Despite the good news that an agreement had been reached, markets remained cautiously optimistic as they were cognizant of the tight timeline and the potential hurdles that remained in passing the bill through Congress. The 10-year Treasury yield has tracked steadily lower, currently sitting at 3.62% - roughly 20 basis-points below last Friday. Equity markets were lower to start the week before rising after the bill passed the House, with the S&P 500 up 0.3% as of the time of writing.

Markets should get a mild reprieve once the FRA is officially passed, but this could be short-lived. With default risks set aside, focus will promptly shift back to other worries, notably sticky inflation, overheated job markets, and the odds that the Fed may have to push interest rates higher.

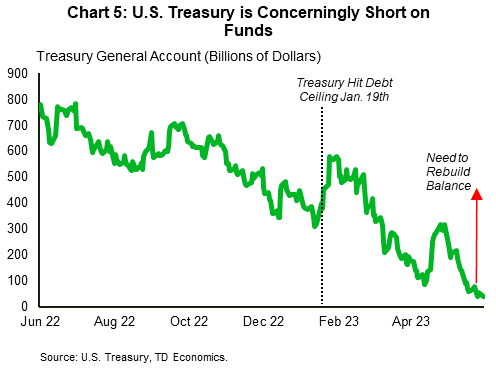

Bond markets will also be wary of the need for the U.S. Treasury to ramp up short-term debt issuance to meet its near-term fiscal obligations and rebuild its liquidity buffer (Chart 5). The increased supply of T-bills is expected to drain liquidity from financial markets, which could push up yields across the curve and further tighten credit conditions. In addition, the eleventh-hour nature of the debt ceiling agreement coupled with medium-term fiscal challenges raises the risk that the U.S. may have its credit rating downgraded, especially after Fitch put the U.S. credit rating on negative watch last week. Back in 2011, S&P downgraded the U.S. 4 days after the debt ceiling agreement was passed. These two risks will be closely watched by markets in the coming weeks.

Bottom Line

The President and Congressional leaders reached an agreement to raise the debt ceiling for two years in return for two years of discretionary spending caps. The deal came eight days before the Treasury is scheduled to run out of money and while Congressional leaders are optimistic that the agreement will pass without issue prior to the deadline, markets will remain cautious. The agreement is expected to save $1.5 trillion over the next decade, but this is only expected to slightly reduce the fiscal deficit. The economic impact is also expected to be relatively small, although the end to the moratorium on student debt repayment represents a near-term risk to consumption. In addition, the last-minute nature of the agreement will raise financial risks related to the uptick in T-bill issuance and a potential credit rating downgrade.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: