Pandemic Trends Ease Ahead of the

U.S. Holiday Shopping Season

Admir Kolaj, Economist | 416-944-6318

Date Published: November 2, 2022

- Category:

- US

- Consumer

- Real Estate

Highlights

- The fading of the pandemic has allowed consumers to ease on online shopping and purchase more goods in store. In this vein, e-commerce’s share of retail sales has fallen from a peak of 16.4% at the height of the pandemic to 14.5% over the past year.

- Improved in-person shopping activity has benefitted the retail commercial real estate (CRE) sector, which is having a bit of a renaissance moment. The sector has the lowest vacancy rate in years and sports elevated rent growth. That said, this success is also the work of a very lean supply pipeline.

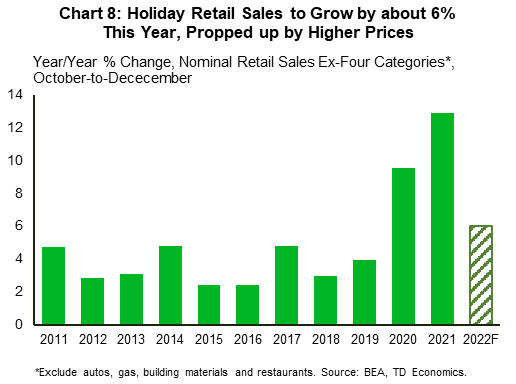

- Looking to the busy holiday shopping season, we don’t expect a repeat of last year’s strong performance. The cash registers will keep on ringing, with holiday sales forecast to grow by about 6% year-on-year in the fourth quarter, but the tally will be largely propped up by higher prices.

With the third anniversary of the pandemic outbreak approaching, many aspects of U.S. economy have been slowly returning closer to their pre-COVID setting. This gradual normalization has been particularly evident in the nation’s retail sector, with pandemic-juiced demand for many retail goods beginning to pull back to more sustainable levels in favor of service spending where healthy pent-up demand persists. Moreover, online shopping has ceded some ground to physical shopping over the past year compared to the peak in online shopping activity in the early stages of the pandemic. One beneficiary of this recovery has been commercial real estate (CRE) sector, where retail vacancies have fallen back to their lowest level in years.

Heading into the all-important holiday shopping season, there is considerable uncertainty around how key retail trends will play out over the next few months. Amid the growing number of headwinds households are showing increased signs of caution, which could limit the overall envelope of spending and further tilt the balance of spending towards non-discretionary items. Meanwhile, the risk of a bad combination of seasonal viruses and COVID-19 could dampen the recovery of in-store traffic.

In-Store Shopping has Regained Some Ground vis-à-vis E-commerce

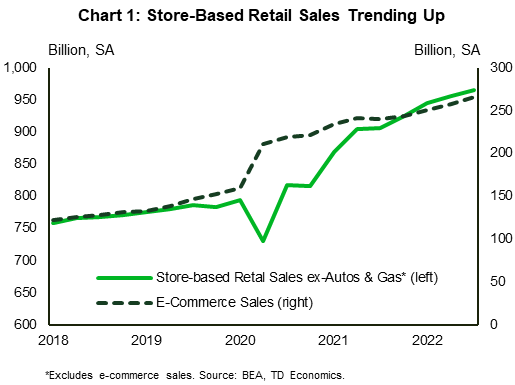

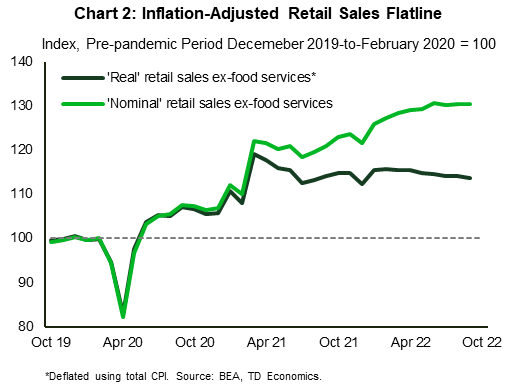

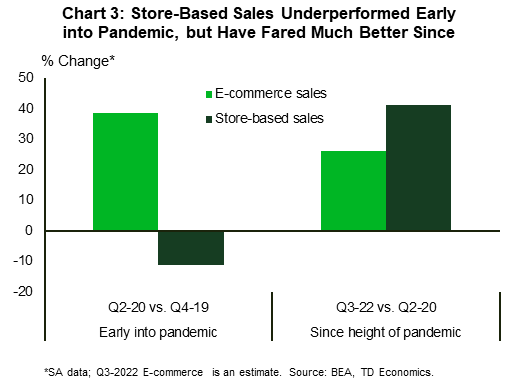

Retail spending has continued to trend higher this year and is up roughly 30% compared the pre-pandemic period. Earlier in the pandemic, this upward trend was more organically driven, with sales volumes benefitting from the shift in spending toward goods. However, over the past year, the sales tally has been largely lifted by higher prices, with volumes generally moving sideways since mid-2021 (Chart 2). Complementing these broad trends are changes in the ways that consumers shop. Early into the pandemic, when lockdowns where widespread, consumers were forced to do more of their shopping online. But, as restrictions faded over time, consumers began to gradually return to their old ways (in-person shopping), with spending at brick-and-mortar stores picking up pace. In this vein, e-commerce sales were up an estimated 25% between the second quarter of 2020 and the third quarter of this year, but total retail sales excluding e-commerce were up a much stronger 40% (Chart 3). This latter tally is slightly softer when omitting categories such as autos and gas (products that are not typically sold online), but a 32% gain still marks a clear outperformance vis-à-vis ecommerce. On a sectoral basis, this trend has been especially pronounced in clothing and accessory stores, where in-store sales have staged a sharp recovery since the economy reopened, and to a lesser extent in furniture & home furnishings, and in sporting goods, hobby and book stores.

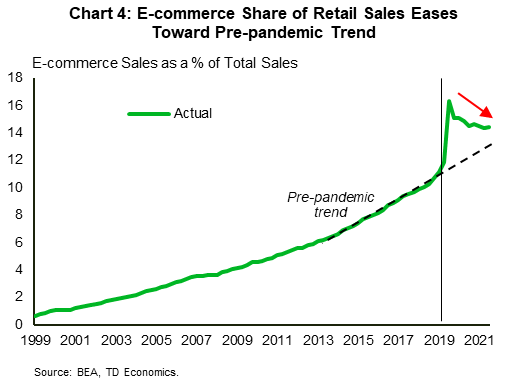

Consistent with the above trends, the share of shopping done online has abated, easing from a record high 16.4% in the second quarter of 2020 to around 14.5% over the past year. This is still above where it would have been had it followed pre-pandemic trend, but the difference has narrowed over time (Chart 4). The U.S. is not alone in experiencing this reversal in activity, with IMF research pointing to a similar trend for many advanced economies.

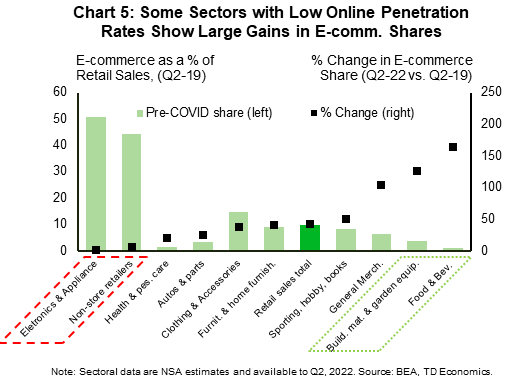

At the sectoral level, data show that the gains made by e-commerce have been more persistent for sectors such as food and beverage, along with building material and garden equipment stores (Chart 5). The impact has been relatively more muted for sectors such as autos & parts dealers, and health & personal care stores, though these still retain a larger e-commerce share compared to before the pandemic. On the other hand, the shares of electronics & appliances stores and non-store retailers have pulled back noticeably since their pandemic peak, leaving them little changed relative to the pre-pandemic period. The reason for this is partially because these two sectors had very high online penetration rates to begin with. As we’ve pointed out in prior research, there are limits to how high e-commerce penetration rates can go. Consumers will always be inclined to purchase some goods in person (i.e., due to impulse shopping, need to satisfy immediate necessities, need to feel/try out certain products etc.).

Retail CRE Is Having a Renascence Moment

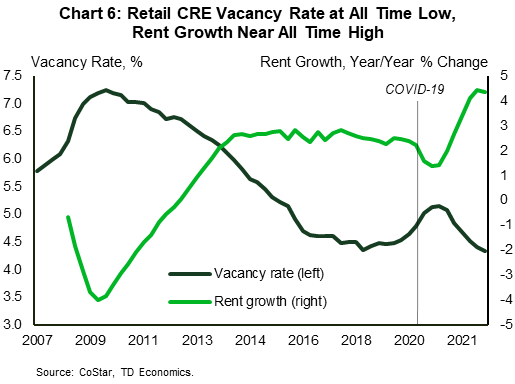

Improved in-person shopping activity and growing store-based receipts (despite the latter receiving a clear lift from higher prices) are proving a benefit for the retail commercial real estate (CRE) sector. Vacancies in the sector are at the lowest level in recorded history, with the data stretching back to 2007 (Chart 6). Meanwhile, rent growth has been accelerating and is near the highest rate in 15 years. Given these developments, it is fair to say that the retail CRE sector is having a bit of a renaissance moment. Digging deeper, however, reveals that this success owes not simply to an improvement in demand but also (and to a great deal) to the supply backdrop.

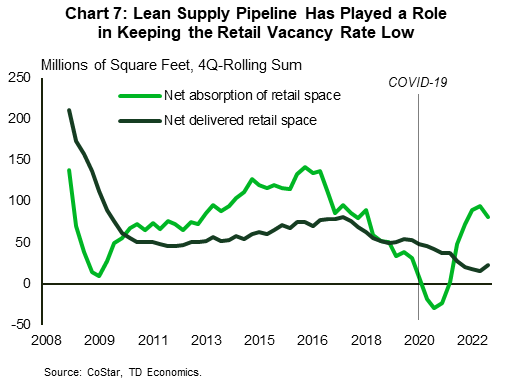

For many years now, retail has had the weakest construction pipeline out of all four major CRE sectors. The construction pipeline and the delivery of new retail space weakened further following the onset of the pandemic. This meant that despite the moderate downtrend in demand for retail space since its cyclical peak in the third quarter of last year, the low level of new product brought to market has helped support the improvements in the vacancy rate and rent growth (Chart 7). Over the long-term, e-commerce is still poised to grow its share of the sales pie, so investment in the retail space is still expected to remain relatively muted.

The 2022 Holiday Shopping Season: Less Bang For your Buck

Unlike last year’s holiday shopping season, which was one for the books, this year’s is likely to prove somewhat underwhelming. We expect retail sales excluding categories that are not typically associated with holiday spending (i.e., gas, autos, restaurants, building materials) to rise by about 6% year-on-year this season (October-to-December). In a typical year, this would be far from a soft print (Chart 8). But with price growth running hot, it is clear that sales will be largely (if not entirely) propped up by higher prices rather than increased volumes. While surveys provide only a guide to spending patterns – i.e., holiday sales last year came in generally better than pre-season questionnaires suggested – they tend to support the notion that consumers will get less bang for their buck. Recent surveys show that while holiday budgets are likely to remain largely unchanged from 2021 levels consumers plan to purchase fewer gifts. Indeed, a smaller nine gifts are planned for this year compared to sixteen last year.1 Muted holiday hiring plans among retailers are an added factor that plays into this year’s underwhelming narrative. According to a recent report only 15% of small independent retailers plan to hire temporary workers for the holidays, less than half last year’s tally.

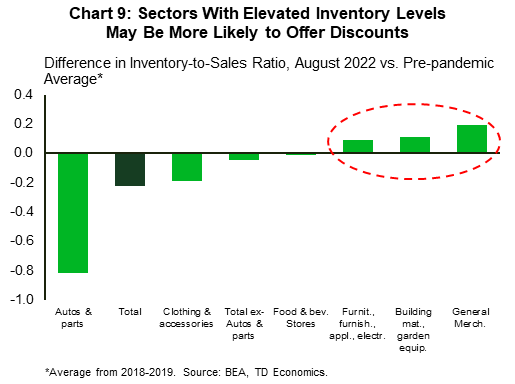

A still healthy labor market will continue to offer support to spending in the months ahead, but several factors will act as headwinds, with inflation at the forefront. Inflation continues to take a big bite out of consumers’ wallets. This is especially true for more typical necessities, such as food, shelter and energy, but extends to plenty of other categories such as transportation and health care. Having to pay more for essential items is likely to put a squeeze on spending for discretionary items, such as gifts. Lower income consumers are likely to be more affected. A recent survey confirms very different spending profiles between low and high-income consumers, with planed spending among those that earn less than $50,000 this holiday season down 17% from 2021.2 Consumers will be on the lookout for deals and may still catch a break in some pockets of retail, such as general merchandise stores, where elevated inventory levels may warrant more generous discounts (Chart 9).

The second-order impacts of elevated inflation cannot be understated. The Fed has raised interest rates aggressively this year to slow demand and rein in price growth. Besides raising consumers’ debt costs, the aggressive hiking cycle has also weighed on real estate and risk assets, such as equities, with the wealth effect taking a hit. In this vein, consumer expectations have softened and sit much lower compared to year-ago levels.

Shoppers have also been spreading out their holiday spending over longer periods of time, in part to take advantage of available deals. A recent survey showed that 56% of consumers started their holiday shopping in October this year – an increase from 45% last year. Gift cards have also been growing in popularity. These funds are likely to be used down the road (i.e., in January). All told, more activity may take place outside of the more traditional holiday shopping window, which, at the margin, may lead to a more lukewarm print for the more traditional holiday shopping months.

A reorientation in spending away from goods toward services is an added factor that could dampen the sales outlook. With the worst of the pandemic now in the rearview mirror, consumers should continue to place more of a focus on experiences this year. Having said that, this trend is far from assured. Flu cases are higher than usual this year and another virus – R.S.V. (respiratory syncytial virus) – is straining pediatric hospitals in some parts of the country. Moreover, the recent rise in COVID cases in Europe reminds us that we’re not completely past the pandemic. This potential trifecta, which could worsen as the winter approaches, may lead consumers to exercise more caution. As it stands, nearly two thirds of Americans (63%) plan to do at least part of their shopping in store this year – an increase from 58% last year. Should conditions worsen, having to dust up the ‘pandemic’ playbook would likely weigh on in-store shopping (and experiences) to the benefit of online shopping.

Bottom Line

As the pandemic fades into the rearview mirror, consumers have eased off their cellphones and laptops and returned to purchasing more goods in person. This trend has benefitted the retail commercial real estate sector, which currently sports a vacancy rate that’s the lowest in fifteen years.

With fewer dollars spent online relative to the height of the pandemic, the share of online shopping has fallen from a peak of 16.4% to 14.5% over the past year. For categories that had very high online penetration rates before the health crisis, the pandemic gains in the share of e-commerce have proven rather fleeting. However, some sectors that had low online penetration rates to begin with (i.e., food & beverage, building materials) are doing a better job at holding on to the additional e-commerce activity generated during the pandemic.

Looking to the busy holiday shopping season, we don’t expect a repeat of last year’s strong performance. The cash registers will keep on ringing, with holiday sales forecast to grow by about 6% year-on-year, but tally will be largely propped up by higher prices. With the pandemic mostly in the rearview mirror, consumers are signaling that they will be more likely to roam the malls this holiday season, but the risk of a bad combination of seasonal viruses and COVID-19 could still dampen the recovery of in-person shopping.

End Notes

- The Deloitte survey shows that consumers plan to purchase only nine gifts this year compared to sixteen in 2021.

- 2022 Deloitte Holiday Retail Survey: https://www2.deloitte.com/content/dam/insights/articles/us175738_holiday-retail-travel/DI_2022-Holiday-retail.pdf

- JLL Retail Holiday Survey 2022: https://www.us.jll.com/content/dam/jll-com/documents/pdf/research/americas/us/jll-us-retail-holiday-survey-2022-final.pdf

- Ibid. (JLL survey above).

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share this: