Market Insight: Financial Markets do the Monster Mash

Beata Caranci, SVP & Chief Economist | 416-982-8067

James Orlando, CFA, Senior Economist | 416-413-3180

Date Published: October 14, 2021

- Category:

- US

- Forecasts

- Financial Markets

Highlights

- Financial markets have been coming to grips with a number of headline risks ranging from Chinese property bubbles to soaring energy prices. Though the risks may turn out to be little more than a short-term scare for risk assets, there is a fundamental move happening in the bond markets that is likely to endure.

- The Federal Reserve is preparing to taper its Quantitative Easing (QE) program and is signaling that it is going to hike rates at a swifter pace than many had been expecting. This outcome is finally starting to be priced into fixed income markets.

On every street, there’s always that one house that kids flock to for Halloween. For me, it was the painted white clapboard house where the owner handed out full-sized bags of chips and chocolate bars packaged into a brown lunch bag for every child. The expectations within the neighborhood set in and more kids arrived every year. The owners kept up their efforts knowing they couldn’t possibly reduce the treats they gave out.

Halloween is once again upon us, but this year central banks are getting ready to reduce the treats they will be handing out. All the while, government brinkmanship and global risks have come back to haunt financial markets. Equities have been volatile and soaring energy prices have brought back memories of the 1970s. Added to the list of events are woes from China’s real estate giant, Evergrande, amongst others. And, not to be overshadowed, we have a U.S. government that can’t seem to resolve an ongoing saga of debt ceiling limitations beyond temporary and short-term options. All of this has investors wondering, is this a trick or a treat? Buy the dip or pull back risk exposure? For fixed income investors, bond yields across major economies have started to rise. Although financial market volatility could prove to be as short-lived as a sugar high, we believe the rise in yields will endure.

Central Banks Hand Out Less Candy

We have seen central banks become consistently more confident in the strength of the global economic recovery. For the Federal Reserve (Fed), members have pulled forward the start of the rate hiking cycle into 2022 (from a prior expectation of 2023 in June, and a consensus for 2024 back in the March DOT plot). Additionally, it is widely expected that the Fed will begin tapering its balance sheet in December and will end net-new Quantitative Easing (QE) by the middle of next year. Simply put, the Fed will be exerting less influence on bond yields.

They are not alone in pulling back on monetary stimulus. We have already seen the Reserve Bank of New Zealand, the Bank of Korea and the Norges Bank lift policy rates off the floor. The overarching theme is that the ‘normalizing economy’ no longer warranted crisis management policy. As the economic rebound continues, rising inflation and asset price growth (housing) will be a thorn in the side of central bankers. This is why the Bank of England (BoE) isn’t too far behind. It is quickly preparing to end QE and may be in a position to hike its policy rate as early as year-end. Even the European Central Bank (ECB), which has provided an exorbitant amount of stimulus over the past decade, is prepping markets that the ‘crisis phase’ of the pandemic is over and the emergency programs are no longer needed.

This winding down of emergency stimulus isn’t a shock for Canadians. The Bank of Canada (BoC) has been leading the pack, cutting its government bond purchases over the last year and completely ending programs that were no longer needed (mortgage bond purchases, for example). We expect the Bank to make another reduction in its bond purchases in October and cease all net-new purchases in the beginning of 2022.

Though the Canadian economy was caught in the Delta-variant web over the last few months, the economy is hitting its stride once again. We anticipate economic growth will jump above 4% in the fourth quarter and surpass 5% in the first half of 2022. This will put the economy back on track to be fully recovered by the second half of 2022, placing the BoC in a position to raise its policy rate before the end of that year.

Don’t Fear Less Loose Policy

The evolution of central bank policy has brought about lots of client questions. Many are worried that tighter policy will thwart the economic rebound. That it will reduce lending, profits, and even cause a stock market correction. To that point, we’d argue that less loose monetary policy doesn’t mean tight monetary policy.

When a central bank says it is going to reduce the amount of bonds it is buying (or eliminate bond purchases altogether), it is merely easing its foot off the monetary accelerator. It is still stimulating the economy, just to a lesser degree. This is because bond purchases are supplemental to the main instrument, the policy rate. While the central bank can anchor short rates with its policy rate lever, it uses QE and forward guidance to weigh down the long end of the yield curve. As most people, businesses, and governments borrow at longer maturities, holding down long-term rates incentivizes more borrowing. Though this policy helped the economy bounce-back very quickly, central bankers run the risk of erring too much on the side of caution.

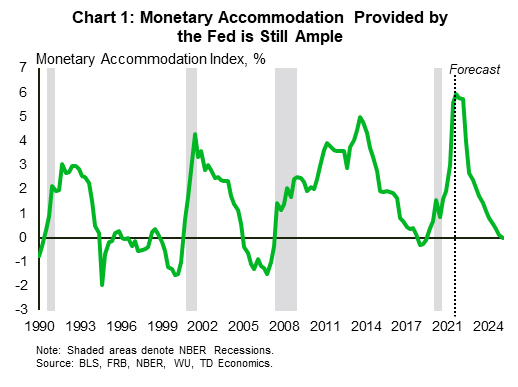

For the Fed, tapering and ending QE should be viewed as the first step in allowing the economy to stand on its own two feet. With U.S. policy rates at the floor, there is a ton of monetary support still in the system. In Chart 1, our Monetary Accommodation Index shows the amount of room for the Fed to cut policy support before its actions become restrictive. By this estimate, the Fed will still be providing monetary stimulus to the economy through 2024.

Watch the Bond Market Reaction

Since the Fed began pivoting its communication towards less monetary support in March 2021, the U.S. 10-year yield declined from a peak of 1.74%, to a low of 1.19% in August. This move ran counter to the Fed’s rhetoric because market participants were focused on the temporary slowdown in economic momentum related to the Delta variant. Now that case counts are on the decline and the economy is showing resilience, the market mindset has started to change. Yields have risen decisively over the last month, with the 10-year pushing above 1.6%.

Adding to the direction has been the persistence of high inflation and its implication for the future path of Fed policy. As we have been warning, supply-chain issues can last for a lot longer than people think. And even when it gets resolved, the demand push from the underlying strength of the economy will keep inflation higher than the pre-crisis period for years to come. This adds to the motivation that central bankers should ensure that policy reflects the balance of risks.

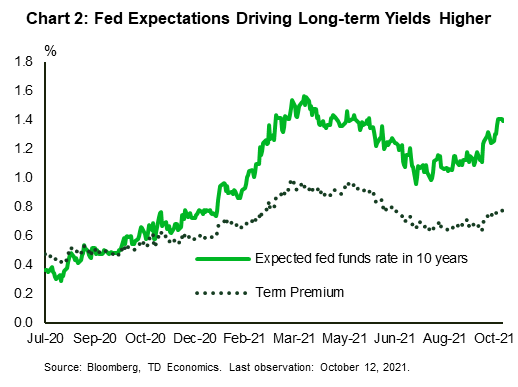

Breaking down the yield curve into expectations for the path of Fed policy and the term premium, we find that the former was twice as impactful relative to the latter in forcing yields higher over the last two months (Chart 2). This implies that markets are starting to believe the forward guidance of the Fed. It also implies that the recent move higher in yields should have staying power.

Bottom Line

The month of October is notoriously scary. It is not just the Halloween costumes, thriller movies, or the threat of a visit to the dentist after eating too much candy. It is also the month that’s credited with some of the most terrifying market crashes. There was the Bank Panic of 1907, the 1929 Stock Market Crash, and the more recent Black Monday Crash of 1987. Reading the news headlines over the last few weeks may have sent shivers down your spine. However, markets have largely kept their cool, despite the occasional bad day.

Central bankers have also shown nerves of steel by looking past the risks and focusing on the strength of the rebound. Many major central banks are removing emergency monetary policy. Whether it be ending QE or, in some instances, hiking rates, the trend is underway and starting to solidify in yields. Just like the Monster Mash, it’s caught on in a flash. The party has just begun.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.