Highlights

- Despite growing worries about recession, US regional labor markets continued to improve throughout the first half of 2022 with declining unemployment rates and solid job gains.

- A decelerating trend in job growth that began earlier this year was checked by an unusually strong increase in jobs in July.

- The strength of labor markets in the Southeast has proved more resilient, whereas the Northeast has been marked by a more pronounced slowdown in some parts given labor supply challenges.

- The post-pandemic jobs recovery rate in the Southeast is among the highest in the country while the other East Coast states all lag the national rate of recovery.

July was a banner month for non-farm payrolls in the U.S., with national job gains doubling expectations and returning to pre-pandemic levels. This marked a sizeable deviation from a gradual decelerating trend that began earlier this year and persisted throughout the second quarter (Q2). However, with the unemployment rate back at its pre-pandemic level and 50-year low of 3.5%, the U.S. is rapidly running out of would-be workers to sustain that pace of hiring, let alone the growing headwinds on the demand side of the ledger.

The picture for TD’s East Coast footprint is broadly like the national, with July providing to be a respite from a general slowdown in job growth. Having said that, a small number of states, particularly in the Southeast, have shown more resilient strength. Most of the East Coast states now have unemployment rates within 1% of their previous business cycle lows (Table 1).

Table 1: Unemployment Rate (UR) Relative to Previous Cycle and Labor Force (LF) Recovery

| Current UR, % | UR Relative to Previous Cycle Low | LF Recovery | |

| West Virginia | 3.7 | -1.0 | -0.2% |

| Rhode Island | 2.7 | -0.7 | 0.2% |

| Georgia | 2.8 | -0.6 | 1.9% |

| New Hampshire | 2.0 | -0.5 | -0.8% |

| North Carolina | 3.4 | -0.3 | 1.9% |

| Vermont | 2.1 | 0.0 | -5.6% |

| Florida | 2.7 | 0.0 | 3.5% |

| United States | 3.5 | 0.0 | -0.4% |

| Pennsylvania | 4.3 | 0.0 | -1.5% |

| Virginia | 2.7 | +0.1 | -2.6% |

| Maine | 2.8 | +0.2 | -3.0% |

| District of Columbia | 5.2 | +0.3 | -4.8% |

| Connecticut | 3.7 | +0.3 | -2.6% |

| New Jersey | 3.7 | +0.5 | -1.2% |

| Massachusetts | 3.5 | +0.6 | -0.6% |

| New York | 4.4 | +0.7 | -3.9% |

| Maryland | 3.9 | +0.8 | -4.8% |

| South Carolina | 3.2 | +0.8 | 3.6% |

| Delaware | 4.4 | +0.9 | 4.2% |

New England – Recovery Slowing, Reversing in Parts

The New England labor market has tightened further in recent months, with all states experiencing further declines in their unemployment rates. Despite this improvement, unemployment rates in Connecticut, Massachusetts, and Maine all remain above their pre-pandemic levels. The exceedingly low unemployment rate seen in Vermont (2.1%) is largely due to its scarred labor force, which remains 5.6% below pre-pandemic levels. Maine and New Hampshire are also affected by this to a lesser extent.

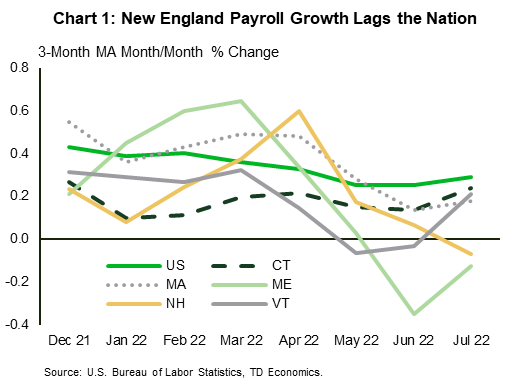

The deceleration trend in payroll growth seen at the national level up to June followed by an uptick in July was consistent with the state-level picture in New England (Chart 1). Connecticut and Massachusetts have seen sizeable improvements in hiring relative to the start of the year; however, payrolls remain 1.5-2.5% below their pre-pandemic level. The picture was less idyllic in New Hampshire, Maine, and Vermont where payrolls had been on a declining trend in the first half of 2022. The subsequent July turnaround was most pronounced in Vermont, followed by Maine, which shook off three consecutive months of job losses. Despite the recent uptick, Vermont is still 4.3% below its pre-pandemic level of jobs which remains partially impaired by a slow labor force recovery. New Hampshire did not benefit from an uptick in job growth in July, but rather job gains continued to slow as it closes in on a full recovery in jobs (1% below pre-pandemic levels as of July).

Mid-Atlantic – Still Recovering, NJ Passes the Torch

New Jersey and Pennsylvania saw their unemployment rates fall in recent months, to 3.7% and 4.3% respectively, while New York’s has remained at 4.4% since May. Pennsylvania is the only one of the three with an unemployment rate below its pre-pandemic level and as of July has returned to the trough of the last business cycle, though this was aided in part by a labor force that is still 1.5% below pre-pandemic levels. Labor markets in New York and New Jersey have yet to fully recover from the pandemic’s damage, with each having an unemployment rate +0.7% and +0.5% respectively above their previous cycle’s low. New York’s labor force made steady progress in the first half of this year, but still remains 3.9% below its pre-pandemic level. New Jersey’s labor force recovery has marginally outpaced Pennsylvania, now sitting at 1.2% below pre-pandemic levels. However, both states have seen labor force growth slow in recent months.

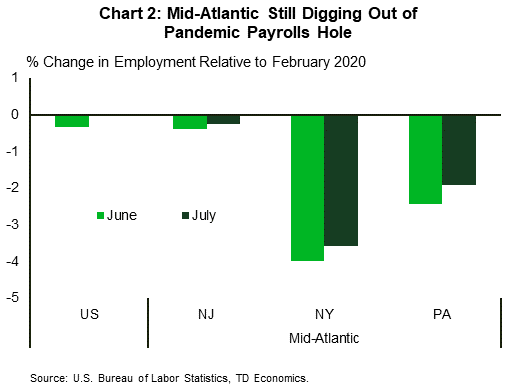

The Mid-Atlantic states saw a more modest rate of deceleration in job growth relative to the national level during Q2. New Jersey’s payroll growth rate has retreated steadily from the elevated levels recorded in Q1-22, a trend that was continued in July. In contrast, New York has maintained a more stable rate of payroll growth, in line with the nation, but ticked slightly higher in July. It’s worth noting that the Garden State is now within 0.2% of its pre-pandemic payrolls level while the Empire State is still 3.6% below pre-pandemic levels (Chart 2). Pennsylvania, which began the year trailing its neighbors as well as the nation in terms of job growth, has more recently broken from the pack, recording a hefty jump in hiring in the June-July period. The Keystone State remains about 2% below its pre-pandemic employment level but has improved by over 1% since March.

Upper South Atlantic – NC Leads the Way

The unemployment rate in the National Capital Region (D.C., Maryland, and Virginia) has decreased modestly in recent months, but remains slightly elevated relative to its previous business cycle trough. D.C. and Maryland have the worst labor force recoveries in the region, each sitting at 4.8% below pre-pandemic levels. Virginia is slightly better off at 2.6% below pre-pandemic levels, but this deficit is a factor in its low unemployment rate of 2.7%. North Carolina’s unemployment rate has declined to its lowest level in over twenty-years. This is a feat made even more impressive by the fact that its labor force is almost 2% larger than it was pre-pandemic. Delaware, which saw even larger labor force gains during the pandemic (+4.2%), has a relatively high unemployment rate as a result, with the current level almost a full percentage point above the previous cycle trough.

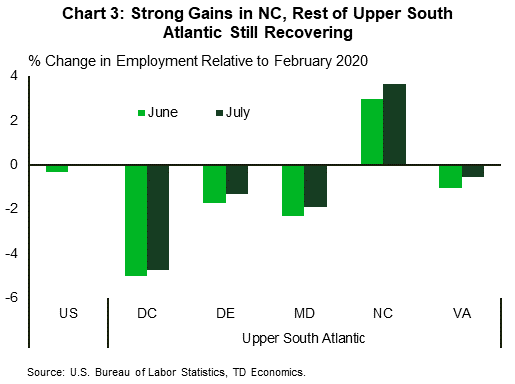

The District of Columbia (D.C.) saw a rise in job growth in July after seeing no change in June. This may only be able to put a small dent in its persistently weak labor market recovery with employment still 4.7% below pre-pandemic levels (Chart 3). Maryland and Virginia saw payroll growth decelerate more in line with the nation in the first half to June, although both states recorded higher job growth than the nation in July. Despite this, both states have worse post-pandemic job recovery rates (-1.9% and -0.5% respectively) than nationwide, which is now fully recovered.

Delaware and North Carolina have seen relatively robust strength in their rate of job growth with both states seeing job gains accelerate throughout Q2-22 and into July. This has added to North Carolina’s already strong post-pandemic recovery rate, which now sits at 3.6% above its pre-pandemic payrolls level. Conversely Delaware lags behind the nation with payrolls still 1.3% below pre-pandemic levels.

Lower South Atlantic – Leading the East Coast Recovery

The Lower South Atlantic region has been a clear winner along the East Coast in terms of pandemic recovery. Florida has seen its unemployment rate decline to its previous cycle low of 2.7%, managing to fully absorb its large labor force gains (+3.5%). South Carolina’s labor force has seen similarly strong growth, but has a bit more labor market slack, with its unemployment rate sitting 0.8% above its previous cycle low. That said, at 3.2%, South Carolina’s unemployment rate remains lower than the national average. Georgia saw its unemployment rate reach an all-time low of 2.9% in June and has also benefited from solid labor force growth of 1.9% relative to its pre-pandemic level.

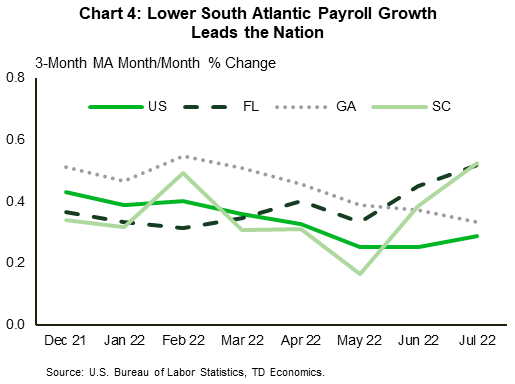

The Lower South Atlantic region has continued to outperform in terms of job growth since the spring. Florida and South Carolina saw job growth accelerate in June and July, while Georgia has begun to slow and converge with the national level (Chart 4). All three states have higher payroll levels now than they did before the pandemic, with Florida leading (+4%), followed by Georgia (+3.1%), and South Carolina (+1.6%). While the Lower South Atlantic region has outshone its peers in terms of the labor market recovery, we are seeing early indicators that its strength is beginning to slow. Jobless claims have been increasing since late June and job openings have begun to decline in recent months which may be early signs that the robust growth in employment seen in the region is beginning to run out of steam.

Bottom Line

The theme of a well-performing national labor market, with solid job growth and a falling unemployment rate, is echoed across most of the East Coast states. Despite this, there is evidence to suggest that job growth was beginning to slow in Q2, with a faster deceleration seen in the New England region. The slowdown in the Mid and Upper South Atlantic regions had been roughly on par with the nation, whereas the Lower South Atlantic has held up better.

July data marked a brief departure from this recent trend of slowdown, with many East Coast states recording job growth rates that exceeded the national growth rate. However, with unemployment rates near cyclical lows in most states and the Federal Reserve continuing to raise interest rates to tame inflation, it is unlikely that payroll growth at this level is sustainable. Over the coming months we should see the deceleration trend tighten its grip, although the pace of the slowdown will vary by state.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share this: