Higher Rates Delay U.S. Housing Recovery, But Some Improvement Expected in 2025

Admir Kolaj, Economist | 416-944-6318

Date Published: December 9, 2024

- Category:

- U.S.

- Real Estate

- Labour

Highlights

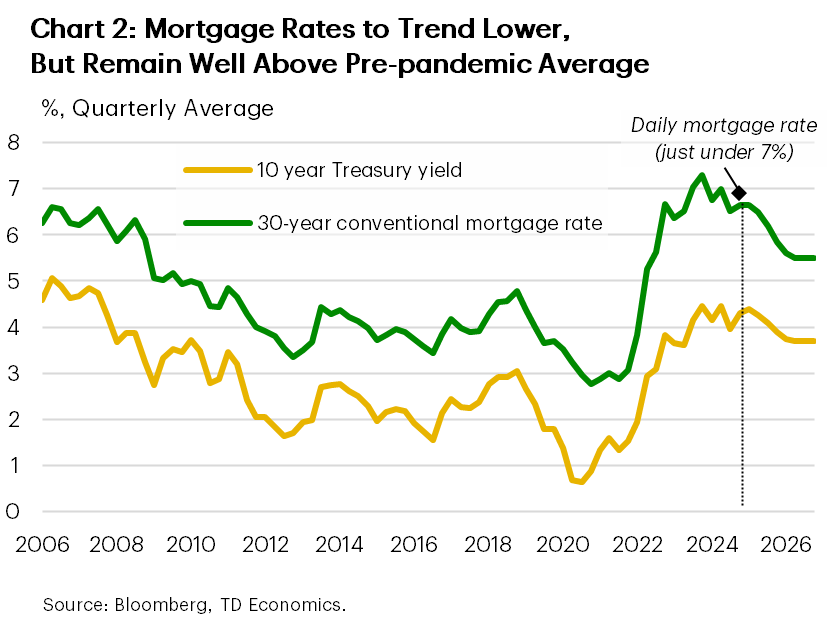

- After declining through the spring and summer, 30-year mortgage rates rebounded back near 7% this autumn on the back of rising bond yields. Strong economic data and policy-related uncertainty – notably around the new administration’s use of import tariffs – have been key catalysts behind this rate backup. As such, further upward pressure on rates in the near term can’t be ruled out.

- Under the assumption that the worst case is avoided on tariffs and the Fed continues to trim its policy rate, mortgage rates should begin to turn the corner in mid-2025. By the end of next year, we project the 30-year borrowing rate will fall back to around 5.8%, before stabilizing to 5.5% by mid-2026.

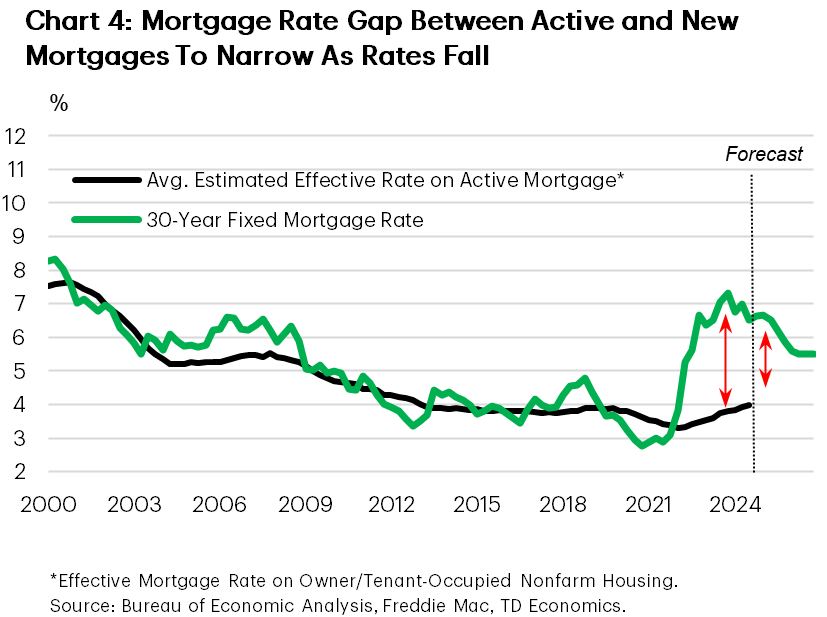

- Provided that our rate forecast materializes, expected lower rates ahead will carry a two-pronged benefit for housing, lending a hand to demand, but also boosting resale supply as the shrinking gap between existing and new mortgage rates will help nudge some homeowners to put their properties for sale.

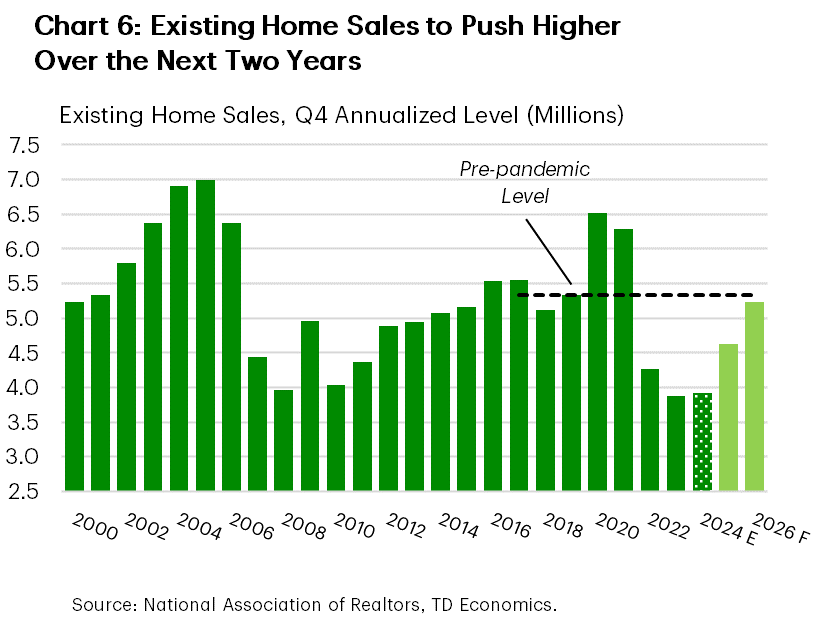

- We project existing home sales will rise to near 4.6 million (ann.) by the end of 2025 – a healthy gain from current levels, but one that’ll still leave activity well below pre-pandemic levels. We anticipate further gains the following year, with activity to rise to 5.2 million by the end of 2026, which would bring it closer to pre-pandemic levels.

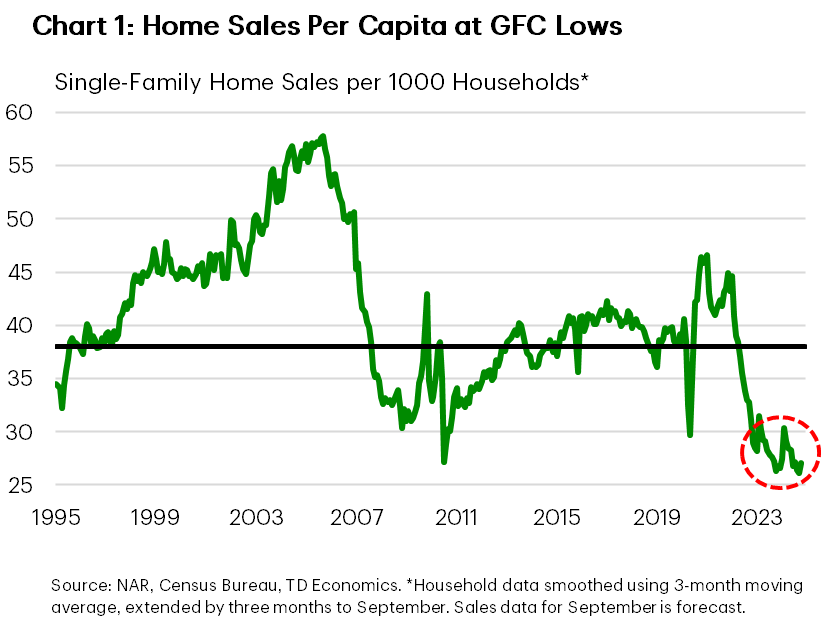

After some pick up in sales activity at the beginning of the year, existing home sales have since turned lower and are likely to retest last year’s cyclical lows over the near-term. The picture leaves even less to be desired in per-capita terms, with sales continuing to plumb historical depths (Chart 1). Home prices, on the other hand, have continued to hold up, as supply in the resale market remains tight by historical standards. Strained housing affordability is the key culprit behind the weak levels of sales, reflecting the sharp run-up in prices in recent years, and the significant increase in mortgage rates. The 30-year fixed mortgage rate currently sits a little under 7%, roughly double its early-2022 level before the Federal Reserve began tightening its policy rate. Our forecast assumes that rates will drift lower starting in mid-2025 alongside a further easing in the policy rate, which should help ease affordability pressures and lead to a gradual recovery in sales activity. However, there are no shortage of risks in the path ahead, particularly on the rates front, that could lead to a more gradual recovery in housing activity.

Mortgage rate volatility: Rates to fall, but not in a straight line

After drifting lower through the summer, mortgage rates U-turned higher in October, rising by nearly 100 basis points (bps) to around 7% recently. This is only 40bps below their peak earlier this year, and one of the highest levels over the past two decades. The Trump trade has been the most recent catalyst pressuring yields higher, as market participants view the incoming administration’s major policy proposals as both inflationary and likely leading to structurally higher deficits. Unsurprisingly, home sales have mounted no recovery, and remain more than 30% below their early-2022 pre-Fed tightening levels. The latest increase in mortgage rates will impede some of the progress that was starting to emerge in the housing market.

At this point, Fed officials are still signalling a gradual pace of rate cuts going forward. Our baseline forecast assumes that the incoming administration takes a ‘gentler’ approach on tariffs as opposed to the universal tariffs President-elect Trump campaigned on, resulting in only modest upward pressure on inflation. Under this scenario, we suspect the Fed would continue to take a gradual approach to cutting rates next year, helping to pressure longer-term yields and mortgage rates lower (Chart 2). This will be welcome news for housing activity. However, note that even when stabilizing at 5.5% by the end of 2026, mortgage rates are still anticipated to be 180 basis points higher compared to their pre-pandemic level of 3.7%. This means that from a financing standpoint, the housing market will not receive the same level of support that it did in the pre-pandemic period.

Other supporting elements

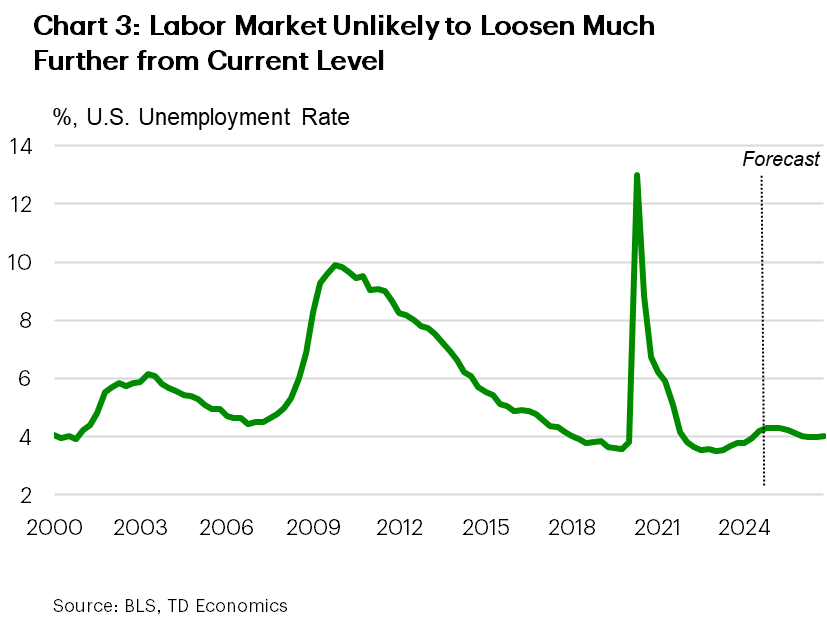

Lower mortgage rates are not the only tailwind that should provide some lift to sales next year. A still resilient labor market should continue to support decent gains in household’s real disposable income growth over the coming years and help to offset the further expected gains in home prices.

On the supply-side, low resale inventories have been a major factor restraining home sales in recent years. This is largely tied to the fact that elevated mortgage rates have discouraged “would-be” sellers from putting their properties on the market, as the average homeowner would likely see a near doubling in their mortgage rate. However, as rates trend lower, this so-called ‘lock-in effect’ should begin to dissipate (Chart 4). This will help entice more owners to put their properties on the market, bringing the inventories in the existing market into better balance.

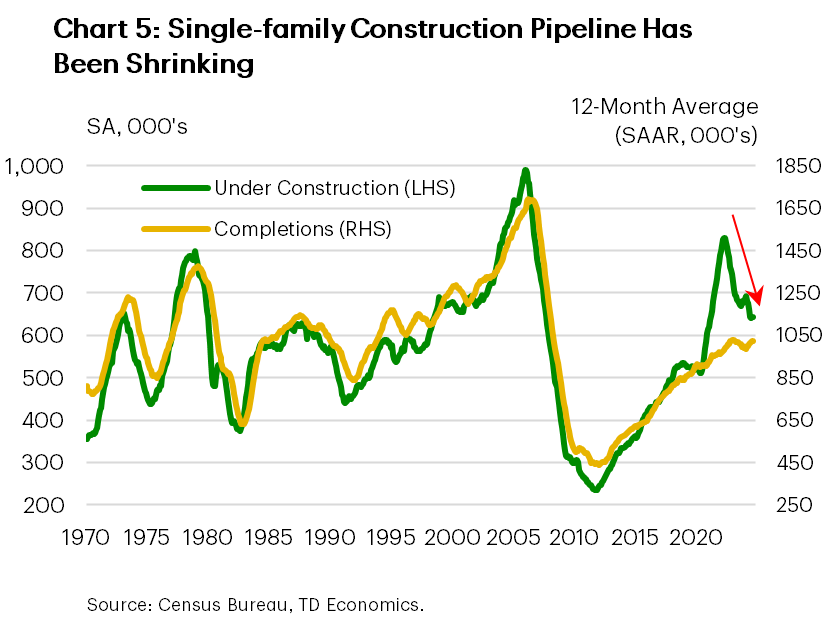

Conversely, supply in the new home sale market is likely to see some volatility. There’s still quite a bit of new supply under construction, but the rapid increase in interest rates in recent years has taken a toll on builders – a theme that has recently been reflected in a leaner construction pipeline (Chart 5). At its cyclical peak in mid-2022, there were 830 thousand single-family units under construction, whereas now that figure has dropped to 640 thousand. Provided rates turn lower as we expect, homebuilding should start to turn higher in the second half of 2025.

Tight Immigration Policy May Weigh on Housing’s Recovery Path

An important element putting some uncertainty on housing demand are the potential changes to immigration policies under the new administration. President-elect Trump campaigned on tighter immigration and mass deportations, which if implemented, would result in slower population growth and potentially lead to some softening in both housing and rental demand. That said, the fact that homeownership rates among unauthorized immigrants tend to be much lower – estimated at under 30% in 2019, compared to a U.S. average of 65% for the same year – suggests that its the rental market that will likely feel the brunt of impact.

Turning to the supply-side, the scale of improvement in homebuilding may also be impacted by immigration policy. Consider that most of the recent homebuilding activity is currently concentrated in the South Census region, which accounts for more than half of all housing starts. Several large states in the region, such as Texas, rely heavily on unauthorized immigrants as a source of labor in the construction sector (see here). As such, the combination of tighter immigration and mass deportations would make it harder for builders to secure workers. This could weigh on the pace of homebuilding, with states and regions that rely heavily on unauthorized immigration as a source of labor likely to be most adversely impacted.

Overall, with tighter immigration policy to weigh both on demand and (new) supply, the net impact is likely to be a moderately slower recovery for existing home sales than otherwise would be the case assuming status quo. The scale and scope of the incoming administration’s immigration policies will ultimately determine the size of the impact on the housing sector.

Existing home sales expected to push higher over the next two years

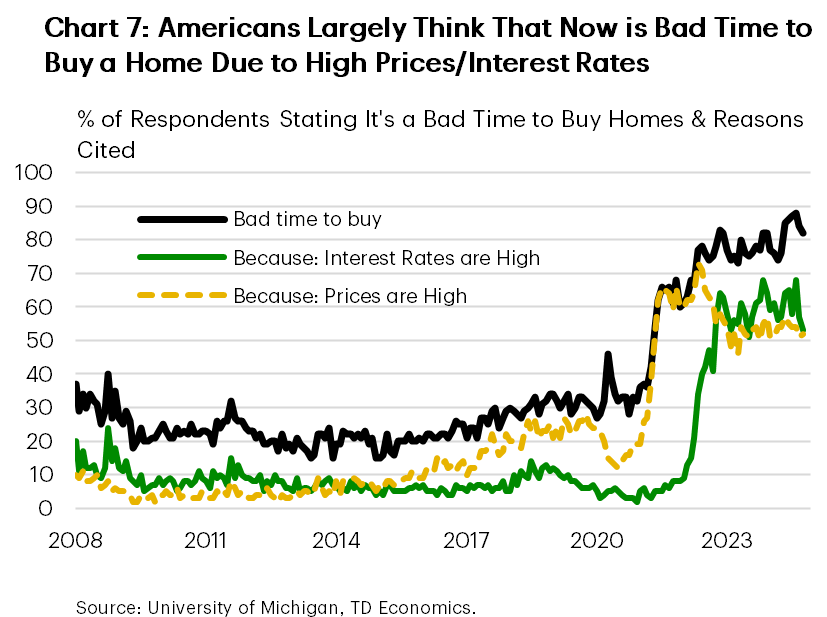

Assuming our baseline outlook materializes as expected, home sales are likely to drift a bit lower over the near-term before moving largely sideways through the first half of next year. Provided we see some downshift in mortgage rates, sales should start to tick higher in the second half of the year, reaching 4.6 million (annualized) by the end of 2025. This would mark a notable improvement from current levels, but would still leave activity considerably below pre-pandemic levels, which are unlikely to be reached until late-2026 (Chart 6). The overall middling sales outlook for 2025-26 is in tune with factors that are holding back home sales and our view as to what’s likely to ameliorate ahead. Surveys show the two main culprits behind the widespread belief that now is “not a good time to buy” are high interest rates and high prices (Chart 7). While the former will improve, it is unlikely we’ll see any meaningful giveback in prices.

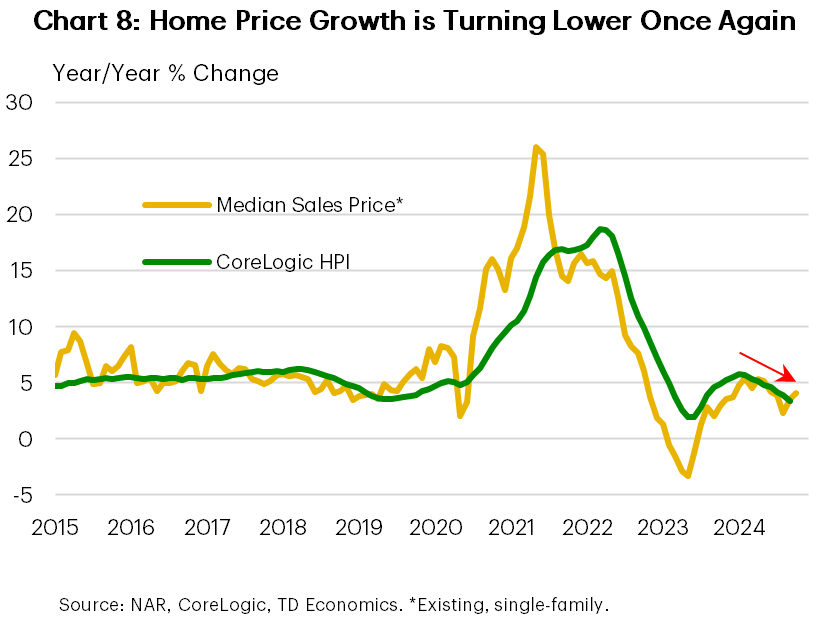

Speaking of home prices, we anticipate only moderate growth over the next two years, in part because of a rising inventory environment, but also due to still-strained housing affordability. Our forecast calls for a gain of a little over 2% in 2025 (as measured by the CoreLogic home price measure). A softening trend in home price growth at the turn of the year adds some credence to this view (Chart 8). However, over time, with rates settling at a lower level and resale activity to trek higher, home price growth should return to a trend-like pace that’s more inline with income growth, likely moving above 3% (annualized) in 2026. With this in mind, one thing appears certain – while housing affordability will see some improvement from falling rates and rising incomes, a major recalibration does not appear to be in the cards.

Bottom Line

The potential inflationary impulse from policy changes concerning tariffs and tax cuts, presents some upside risk for interest rates and therefore a downside risk to the housing recovery. But, assuming that a worst-case outcome can be avoided on this front, we believe that the right pieces will eventually fall into place for resale activity to push higher over the coming years. With the Fed still poised to gradually cut its policy rate, longer-term Treasury yields should drift lower, and also pressure mortgage rates lower. This should lead to a moderate improvement in affordability and bring more existing supply to the market. Putting all the pieces together, we anticipate existing home sales will rise to 4.6 million (annualized) by the end of 2025, before increasing further to 5.2 million by the end of 2026 – an improvement that would bring resale activity closer to its pre-pandemic level. Meanwhile, home prices are expected to rise at only a moderate pace over the next two years, given a gradually improving supply backdrop and ongoing affordability challenges that will take time to shake off.

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: