The US Electric Vehicle Market:

Navigating the Road Ahead

Thomas Feltmate, Senior Economist | 416-944-5730

Date Published: November 19, 2020

- Category:

- U.S.

- Commodities & Industry

Highlights

- Electric vehicles continue to gain global market share, though uptake in the US has been noticeably slower compared to other leading markets including China and Europe. Several reasons are to blame, including less generous government subsides, lack of charging infrastructure, and limited model selection.

- Price remains a key barrier to sales, with electric vehicles still costing anywhere from $10,000 – $20,000 more than comparable gasoline models. However, significant enhancements in battery technology has brought prices down considerably in recent years. This trend is expected to continue, with price parity potentially being reached as early as 2022/23.

- COVID-19 helped to erase more than a third of global car sales through the first four months of the year. The electric market has held up comparatively better, owing to its specific consumer demographic and targeted fiscal support measures enacted in China and some European nations. Similar programs should be considered in the US to further the rotation to electrification and facilitate the sales of electric vehicles across the income spectrum.

- A cornerstone to President Elect Biden’s campaign called for substantial reform to existing climate change initiatives. Not only has he committed to significantly building up existing charging infrastructure but has also suggested that fuel emission standards be modified such that the US inches closer to the exclusive sale of 100% zero-emission vehicles. The initiatives laid out in Biden’s platform are ambitious to say the least and will require a Democratic-controlled Senate in order to implement many of the proposed policies.

Technological advancements have occurred rapidly over the last several decades, and perhaps one of the most notable areas of development has been the automotive sector. Electric vehicles and plug-in hybrids (EVs) have made significant inroads to the retail market in recent years and are expected to gain significantly more market share over the coming decade. Continued innovations in battery development alongside further model diversification will help to not only better align EV prices to comparable internal combustion engine (ICE) models, but also provide the consumer with an equivalent amount of model selection – helping to better level the playing field over the medium-term.

How Successful Have Electric Vehicles Been in Penetrating the Global Market?

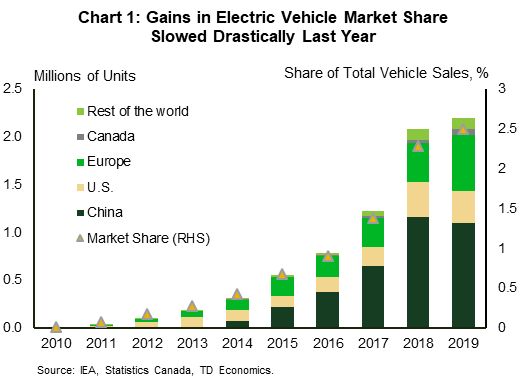

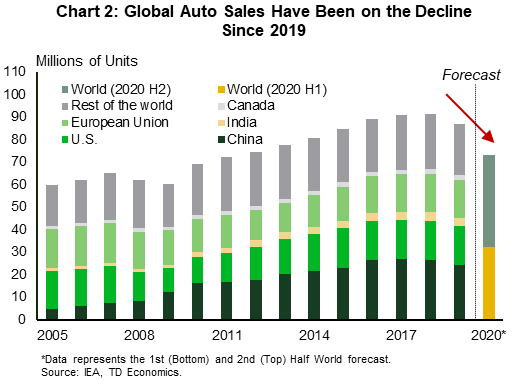

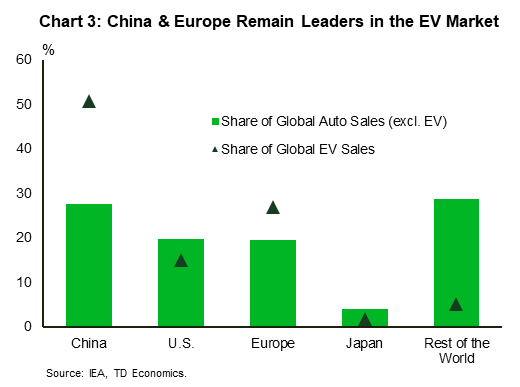

Electric vehicles have been around for over 20 years, but consumer uptake of these vehicles has been relatively slow. Global EV sales last year were 2.1 million units, up 3.8% from the year prior (Chart 1). While the gains were by no means a breakneck pace, EVs performed far better than the entire market, which was lower by 4.3% (Chart 2). Despite outpacing overall vehicle sales, EVs accounted for just 2% of total sales in the US. Even in China, which accounts for slightly more than half of the global EV market, sales only amount to 5% of the country’s total annual sales (Chart 3). One notable exception has been Norway, where EV popularity has been the highest among all other developed nations – accounting for 55% of annual sales in 2019 and continuing to grow through 2020. Much of Norway’s success in consumer uptake has been the result of favorable government incentive programs, including large reductions in the purchase price through subsidization as well as road tax reductions of up to 90%. Additional incentives include breaks on parking, toll fees and ferry charges. While Norway’s incentive programs are by far the most generous in the world, other European countries including Iceland (23%), Netherlands (15%), Sweden (11%) and Finland (7%) have followed a similar roadmap and have also seen a noticeable increase in EV demand in recent years.

Previous Headwinds Appear to Be Abating

Despite the recent gains, EVs still represent a very small piece of the overall pie, accounting for just 2.7% of global car sales. The relatively slow adoption reflects a host of factors, but perhaps the most obvious has been cost. Despite the many innovations, EVs still carry a high upfront price tag, with most models costing anywhere from $10,000-$20,000 more than the comparable ICE model. Indeed, the price differential is somewhat narrowed after factoring in government subsidies and other costs of ownership, though in most cases, this alone does not close the price gap entirely. Moreover, government subsides differ substantially by country, making EV ownership far more cost effective in the countries offering the most generous subsides. This is exactly the case in Norway (and to a lesser extent other European countries), where after factoring in all the government incentives, purchasing an EV is sometimes cheaper than a comparable gasoline powered vehicle.

At the heart of the hefty EV price tag, lies the battery. Limited production capacity has meant that battery output has lagged, ultimately restricting the number of vehicles coming to market. Indeed, the scale of battery manufacturing plants has significantly increased in recent years and will be further helped along by the recent rollout of several new mega power plants. To give some context, traditional battery manufacturing facilities typically produce anywhere from 3 to 8 gigawatt-hours per year (GWh/year), whereas the mega facilities are expected to produce an output of nearly three times that upper bound, exceeding 20 GWh/year. Industry experts expect that five more of these facilities worldwide will be fully functional by 2023.

Outside of scale, battery prices have also been inflated due to material costs. Cobalt is a key mineral used in lithium-ion batteries and is by far the most expensive component – costing anywhere from $32,000-$35,000 a metric ton. However, here too, manufacturers have made significant advancements. Recent innovations in battery chemistry has shown that nickel-based cathodes could be a viable alternative, offering an even higher energy density, longer life cycle and costing a fraction of the price.

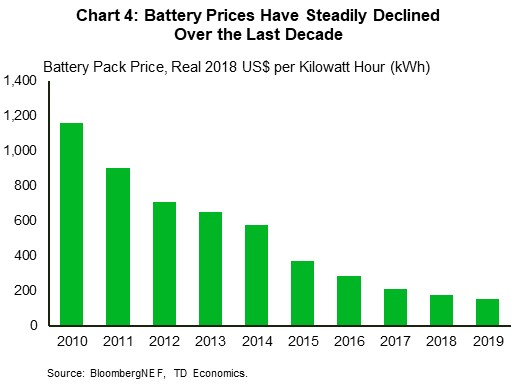

The combination of improving scale and design enhancements has already put significant downward pressure on battery prices over the last decade. According to data provided by BloombergNEF, battery pack prices have fallen from $1,160 KWh (USD) in 2010 to $156 KWh in 2019 (Chart 4). Industry experts expect this trend to continue over the coming years, such that price parity between EV and ICE models could be reached as early as 2022/23.

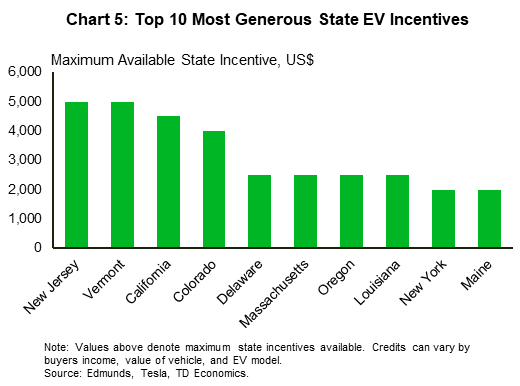

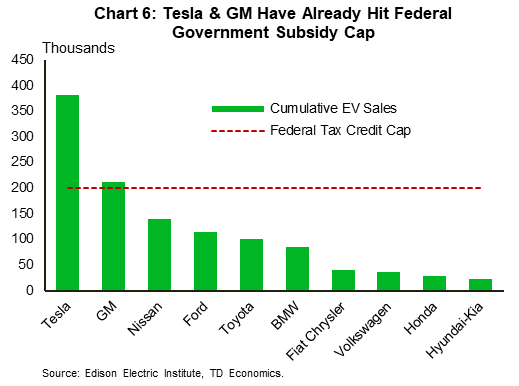

Achieving price parity (or at least more in the ballpark) will be a key factor required to propel the EV market forward, particularly in North America. As already mentioned, significant government subsidies have been largely responsible for the increased popularity of EVs across many European countries. In the US, the maximum federal tax credit is $7,500, which even after factoring in the most generous state subsides, still leaves the consumer paying more upfront (Chart 5). Moreover, the federal tax credits are already being “phased out” for some US automakers. The expiration date is different for each manufacturer and only comes into effect after the automaker sells 200,000 qualified vehicles. Once the sales threshold is reached, the maximum incentive is halved to $3,500 for six-months, then halved again for another six-months after which it is completely phased out. Both Tesla and GM have long passed those thresholds, while Nissan and Toyota will likely reach them sometime over the next year (Chart 6). History has already shown that EV sales have been overly reliant on government subsidies. China is properly the best example, where sales fell abruptly in the second half of 2019 following a significant reduction in its subsidy program. Given the status quo, the same is likely to play out in the US as more automakers reach the 200,000 sales threshold.

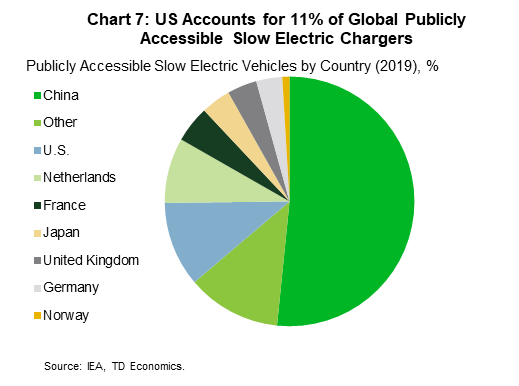

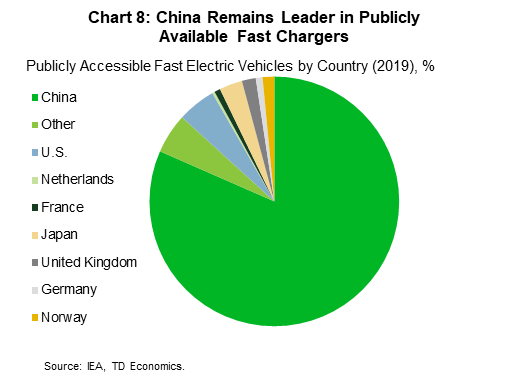

Range anxiety remains another key barrier for many consumers, as current charging infrastructure is simply not adequate for long distance drivers – particularly those moving to a fully electric model. As of late-2019, there were over 20,000 public charging stations in the US, which were estimated to have 69,000 connectors – nearly one-fifth of which are fast chargers (Chart 7 & 8). While many players including utilities, oil & gas companies and automakers are all actively investing in this space, it is generally understood that charging capacity will need to grow exponentially to satisfy the growing fleet of EVs. In fact, the International Council of Clean Transportation estimates that by 2025, approximately 200,000 charging points will be required in the 100 most populous areas alone, just to meet the growing demand in these markets. Indeed, President Elect Biden has said he’d pledge federal dollars – committing to build 500,000 charging stations across the US – though no firm commitment on timing has been released.

How Has COVID Impacted the EV Market?

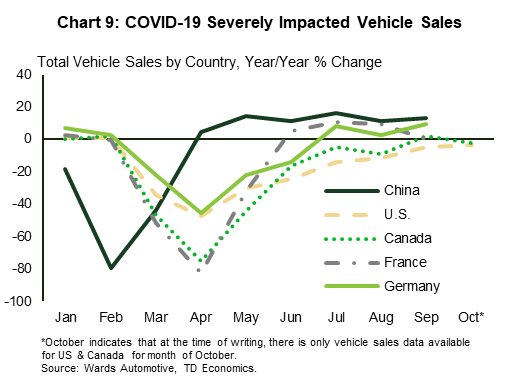

Between January and April, global car sales were below year-ago levels by over 9-million units, as severe lockdown measures erased more than a third of expected sales through the first four months of the year. Unsurprisingly, the timing and extent of the declines were dictated by the timing and severity of the lockdown measures implemented by each region. In China, sales in February were over 80% below year-ago levels, whereas in the US (-50%), Germany (-45%), Canada (-75%) and France (-80%), sales didn’t trough until April (Chart 9). Global sales have since bounced back strongly and as of September, are sitting slightly above year-ago levels.

Interestingly, EV sales have so far stood out as a bit of a bright spot, having generally been hit less hard than non-electric sales. This should perhaps not come as a surprise. The income shock resulting from the pandemic has been disproportionately felt by lower-income households. A recent study by the St. Louis Federal Reserve found that those who have either less than two-months of income in safe assets or debt payments exceeding 40% of their income are significantly more likely to become seriously delinquent on their debt during the pandemic. Meanwhile, higher-income earners have (so far) been far less financially impacted as many have been able to work-from-home and are also more likely to have some financial cushion saved. This is important from an EV standpoint, as US data has shown that sales in recent years have remained concentrated among higher-income earners. In fact, a 2019 Congressional Research Report showed that EV tax credits are overwhelmingly claimed by high income earners, with over 75% of claims made by individuals earning more than $100,000 per-year.

It is important to note that while the above Congressional Report was presented to Congress in 2019, the data being referenced in the report was from 2016. As we have already mentioned, significant innovations in EV technology have driven the average price down in recent years, making EVs somewhat more cost-effective and accessible to other income classes.

That being said, the longer the pandemic drags on, the less certain the economic recovery becomes. Any lasting income shock would almost certainly slow the pace of electrification over the coming years. As a result, public policy needs to play a proactive role in helping facilitate the continued rotation away from fossil fuel to more carbon-friendly vehicles. This has already been the case in China, where both the central and local governments quickly moved to implementing a range of new support measures which are intended to stimulate EV demand1. Similar initiatives have been implemented in France (up to €7,000 tax credit) and Italy (€10,000) as part of targeted fiscal response packages intended to support the respective automotive sectors and facilitate the continued rotation towards electrification. France has also taken it a step further, offering additional subsides for lower-income households who trade-in a gasoline powered vehicle for an EV.

Such simulative measures have so far been absent in the US. While a “Cash for Clunkers 2.0” program was floated when the CARES Act was first negotiated, considerations quickly faded as no bipartisan agreement on appropriate reductions to emission standards could be reached between the House and Senate. Moreover, the goal of the program wasn’t intended to specifically target the sale of electric vehicles, but rather meant to support the overall automotive industry – like the 2008/09 program.

However, with vehicle sales in the US having already recovered most of their respective pandemic losses, the associated cost of such a program far outweighs the benefits. More targeted approaches offering further tax credits or direct cash incentives for those trading-in for more efficient hybrids or pure electrics are likely to yield a more desirable outcome. Income testing recipients could be one approach for keeping program costs down, while also helping to facilitate sales of EVs across the income spectrum.

Investment from North American Automakers

While EV capital investment from the Big Three North American automakers has lagged European and Chinese manufactures, we have seen a big push more recently as EV popularity has grown. The recent announcement by GM is just the latest in a string of commitments, with the automaker investing $2.2B (a cumulative total of $4.5B invested since March 2019) in its US operations intended to increase EV production over the coming years. Chrysler has also made similar investments on both sides of the border, committing $4.5B to its US operations – intended to increase EV capacity at three of its production facilities – and more recently $1.2B to its Canadian production facility in Windsor, Ontario. Meanwhile, Ford has pledged to produce 40 hybrid and fully electric models by 2023 and has allocated $11B dollars in investments (to be used by 2022) to help achieve that goal. While the lion’s share will be directed towards enhancing US operations, Ford recently announced that it is committing over $1B to its Canadian facility, with the intended goal of producing purely electric vehicles by 2024. As part of the announcement, the federal and provincial governments jointly committed an additional $450M ($600M CAD) in subsidies to the automaker, in an attempt to incentivize further EV production in Canada.

The combined investments on both sides of the border will go a long way in improving not only North America’s competitiveness with producing electric vehicles but also the components. Currently, over 70% of battery production occurs in China. If recent year’s trade wars and the current pandemic have taught automakers anything, it’s having a globally integrated supply chain can leave manufacturers particularly vulnerable to any number of unforeseeable economic shocks. By devoting investment dollars to domestic battery production, North American automakers will not only help boost global supply but also help to minimize domestic production risk.

Does the Commercial Space Stand to Benefit?

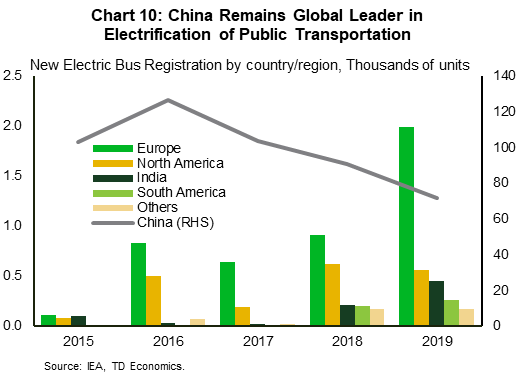

Much of the EV discussion to date has focused squarely on the passenger vehicle segment. However, thanks to battery advancements and tightening emission regulations, it is expected that electrification will soon extend into heavier applications. Perhaps the most obvious segue is to public transportation, particularly across urban centers. So far, most of the transition to public transport electrification has been concentrated in China, though Europe has made decent progress in recent years (Chart 10). That being said, commitments from some of the larger North American metros (e.g. New York, Los Angeles, San Francisco, Toronto and Montreal) to migrate their fleets to 100% emission free buses by 2040 has shown that commercial electrification is gaining increasingly more staying power.

Commercial delivery vans are also likely to see increased demand for electrification in the years to come, as strict air quality standards are making it increasingly more expensive to run diesel operated vehicles. Moreover, as more urban centers adopt “emission free zones”, companies will be forced to embrace electrification in order to service these areas. Even putting the regulation aspects aside, falling upfront costs and increased battery range should make electrification a genuine alternative. This is particularly true across urban centers, where driving mileage is very predictable for most delivery routes, hence making daily usage times easily forecastable. Moreover, charging stations can be easily installed at depots and warehouses, allowing for dependable recharging at the end of each shift. According to estimates by BloombergNEF, sales of electric light and medium commercial vehicles will account for nearly one-third of sales in this space by 2030 – well above its current share of just 2%.

On the other end of the spectrum are heavy-duty trucks. Adoption in this space has so far been very small relative to other commercial segments, catering to very specific purposes such as urban delivery and port transportation. However, much like commercial vans, a gradual movement towards low and/or zero-emission urban zones over the coming decades will lead to a stronger market penetration.

What Does This All Mean for EVs?

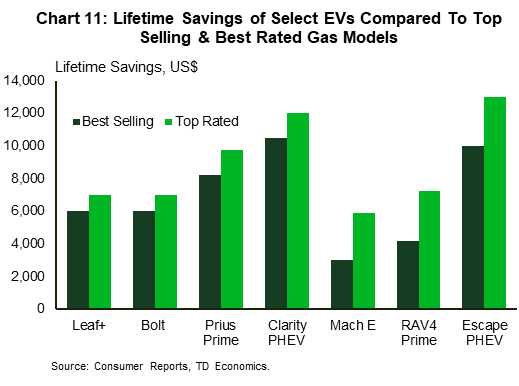

The outlook for EVs looks bright, though that doesn’t mean it comes without obstacles. Key among them is consumer education. History has shown that even though EV prices have fallen drastically in recent years, consumers remain hesitant given the additional upfront costs. However, studies have shown that those upfront costs more than pay for themselves over the lifetime of the vehicle, through both lower maintenance and fuel costs. In fact, Consumer Reports found that for both pure battery and plug-in hybrid vehicles, maintenance costs on average are 50% lower over the lifecycle of the vehicle. Depending on the specific model, fuel costs could be as much as 60% lower. The combined lifetime savings can amount to as much as $10,000, which in most cases, more than offsets the upfront price differential (Chart 11). Educating the consumer of these benefits will hopefully assuage buyer fears that the upfront cost isn’t just lost dollars going towards paying the “new product premium”. Moreover, as prices continue to fall alongside further technological advancements, the lifetime savings should become even more enticing to buyers.

As we have already noted, range anxiety is perhaps the other key concern among consumers. While lack of charging infrastructure is certainly to blame, EV owners have also complained of frustrating deficiencies across existing public charging stations. The most common issues include broken chargers and/or unreported downtime, tedious online registration forms that must be filled out before use, and longer than expected charge times. Outside of the infrastructure issues, battery life has also proven to be significantly reduced by cold weather – a serious issue for those living in either the Northeast or Midwest. At this point, automakers have largely shrugged of the issues, citing them as temporary setbacks that will gradually fade alongside further battery enhancements and increased infrastructure. However, until this occurs, EV popularity will remain somewhat uneven across the US.

A key example of this is California, who recently became the first state to announce that they will be banning the sale of all fossil fuel powered passenger vehicles by 2035. By in large part, California was able to make this commitment because of its already large network of charging infrastructure. Despite accounting for roughly 11% of annual vehicle sales, California is home to nearly a third of all US charging stations. The disparity speaks to the broader issue that while investment in charging infrastructure has been significant, it hasn’t necessarily been even. Concentrating future investment projects across other major urban centers will help diversify consumer interest outside of California, perhaps paving the way for other states to set target dates to exclusively sell zero-emission vehicles.

While sound in practice, it will take some time to implement. For that reason, it is assumed that over the coming years, the US will continue to fall behind other leading EV markets (i.e. China and Europe), before significantly narrowing the gap through the late 2020’s and into the next decade. BloombergNEF estimates that the share of EV sales could rise as high as 20% in the US by 2030, which would represent a nearly 10-fold increase in market share from today’s levels.

Conclusion

Electric vehicles have slowly been gaining global market share in recent years, and it is assumed that popularity will continue to grow as the price gap between comparable fossil fuel and electric models’ further narrows. Compared to other leading EV markets, uptake in the US has been slower, owing to a host of factors. Relatively less generous government subsides, lack of charging infrastructure and limited vehicle selection have perhaps been the biggest headwinds. However, commitments from the incoming government as well as automakers to not only boost infrastructure but also to produce vehicles and batteries in North America are notable steps in the right direction.

COVID-19 has taken a notable bite out of global 2020 auto sales, though the electric market has remained somewhat sheltered, owing largely to its consumer demographic. Moreover, we have seen governments in China, France and Italy include specific support measures in their respective fiscal packages offering targeted incentives to purchasing EVs. Such measures have so far been absent in the US fiscal stimulus announced to date, though perhaps should be considered in future support packages in order to support the continued rotation towards electrification. Under the right criteria (e.g. incentivize trade-ins of fossil fuel cars for ZEVs, income test recipients), the government would be able to support the automotive industry while also helping to facilitate the sale of EVs across the income spectrum.

Text Box: President Elect Biden Hopes To Jump-Start EV Market

Under Joe Biden’s Plan for a Clean Energy Revolution and Environmental Justice, a number of “Day 1” orders have been proposed. Key among them are:

- Rejoining the Paris Climate Agreement

- Developing methane pollution limits for oil & gas operations

- Creating efficiency standards for appliances & buildings

- Modifying the Clean Air Act’s (CAA) fuel emission standards to ensure 100% of newly sold light vehicles are electrified.

While Biden’s proposal stops short of setting a date by which all new vehicles sold in the US must be zero emission, it is generally agreed that it would likely be by 2035. The reasons are two-fold. First, it’s the date by which Biden’s climate plan calls for reaching 100% clean electricity. Second, it aligns to the timing of when California will ban the sale of all gasoline powered vehicles.

The Biden Administration would have two main channels through which it could establish a national policy on implementing a zero-emission vehicle: regulation or legislation. Legislation seems unlikely, particularly if the Republicans end up keeping control of the Senate.

This leaves regulation. Under the CAA, the Environmental Protection Agency (EPA) has the authority to set greenhouse gas emission standards. Therefore, President Elect Biden can direct the EPA to set a replacement rule whereby fuel efficiency standards become increasingly stringent over the next 15 years such that by 2035 the only vehicles that could comply would be zero-emission. This wouldn’t be the first time an incoming government directed the EPA to change existing standards. In fact, President Trump significantly rolled back emission standards put in place by the Obama Administration, as it was thought that the inherited standards were too punitive for automakers to achieve.

But it’s important to note that even the regulation channel could be met with opposition. The auto industry has a long history of challenging vehicle emission regulations in court, and the stringent measures required to eliminate the sale of fossil fuel passenger vehicles by 2035 would almost certainly be contested. Depending on the level of pushback, the Biden Administration may be willing to relax imposing a strict target date on imposing a ZEV standard, and rather make it a centerpiece of a clean vehicle initiative. Under such a plan, the government could provide additional subsidies for the purchase of EVs, grants for charging infrastructure as well as incentives for manufacturing EVs in the US.

Biden has also put forward other budget initiatives that would specifically target EVs, though these will require Senate approval, thus making them less likely should the Republicans maintain control of the Senate. Key among them is a commitment to permanently extending the $7,500 tax credit and eliminating the existing 200,000-unit manufacturer cap. This would mean that buyers of Tesla and GM electric cars would again be eligible to receive the $7,500 federal government subsidy. Tax credits would encourage the sale of US made electric vehicles, as imported EVs would not be eligible. Moreover, the scope of eligible recipients would also be somewhat narrowed, specifically targeting middle and low-income earners, with eligibility for those earning over $250,000 gradually phased-out.

End Notes

- Policy measures implemented by the central government are targeted to local governments and range from increased quotas for license plates, accelerated replacement of aging vehicles and shift policies from limiting car purchases to regulating usage, subsidize car purchases and facilitate the trade-in of aging vehicles, extended funding and purchase-tax rebates on new energy vehicles for another two years. The government has also encouraged financial institutions to reduce both down payments and interest rates on car loans, while also extending loan terms. Local governments have also committed to increasing construction of charging stations over the coming years in an effort to spur more EV sales.

References

Biden/Harris Campaign Platform: The Biden Plan to Build A Modern, Sustainable, Infrastructure & an Equitable Clean Energy Future.

Bloomberg: China is Trying to Salvage Its Bruised Electric Car Industry, May 31, 2020.

BloombergNEF: A Behind the Scenes Take on Lithium-ion Battery Prices, March 2019.

BloombergNEF: Electric Vehicle Outlook 2020, March 2020.

Congressional Research Report, The Plug-in Electric Vehicle Tax Credit, May 2019

Edmunds: Electric Vehicle Tax Credits: What You Need to Know, August 2020.

Geotab: Electric Vehicle Trends 20 Harto, C. Consumer Reports: Electric Vehicle Ownership Costs – Today’s Electric Vehicles Offer Big Savings for Consumers, October 2020.

International Energy Agency (IEA), Global EV Outlook, June 2020

International Energy Agency (IEA), Exploring the Impacts of the COVID-19 Pandemic on the Global Energy Markets, Energy Resilience, and Climate Change, July 2020

International Energy Agency (IEA), The COVID-19 Crisis and Clean Energy Progress, June 2020

Office of the Prime Minister --- Minister of Natural Resources Mandate Letter, December 2019.

Ricketts, L., & Boshara, R., Federal Reserve Bank of St. Louis: Which Families Are Most Vulnerable to an Income Shock Such as COVID-19?, May 2020

Disclaimer

This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Download

Share: